What is Implantable Insulin Pumps Market Size?

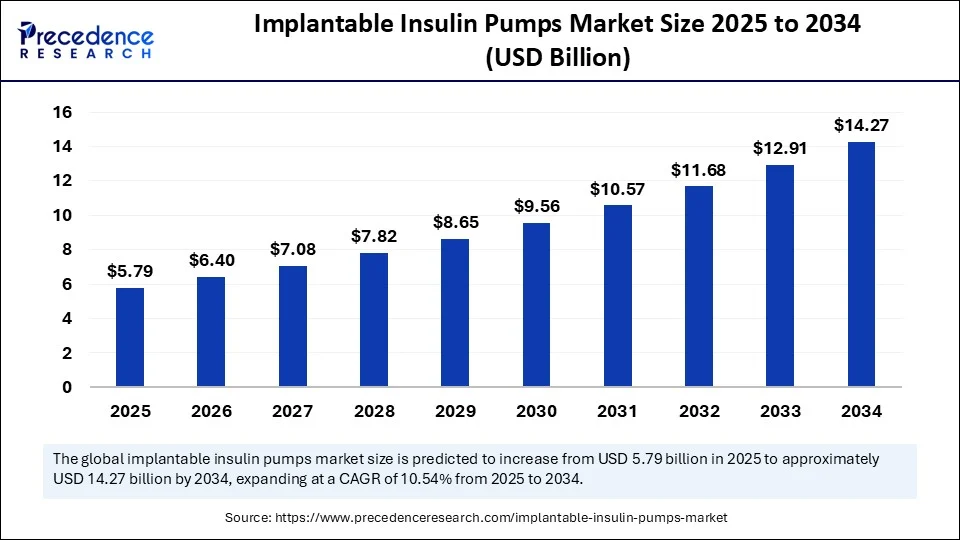

The global implantable insulin pumps market size is estimated at USD 5.79 billion in 2025 and is predicted to increase from USD 6.40 billion in 2026 to approximately USD 14.27 billion by 2034, expanding at a CAGR of 10.54% from 2025 to 2034. The market for implantable insulin pumps is experiencing substantial growth, driven by the increasing prevalence of diabetes and the demand for precise continuous insulin delivery. Advancements in drug delivery systems and a growing preference for minimally invasive procedures and long-term treatment options are likely to contribute to market growth.

Market Highlights

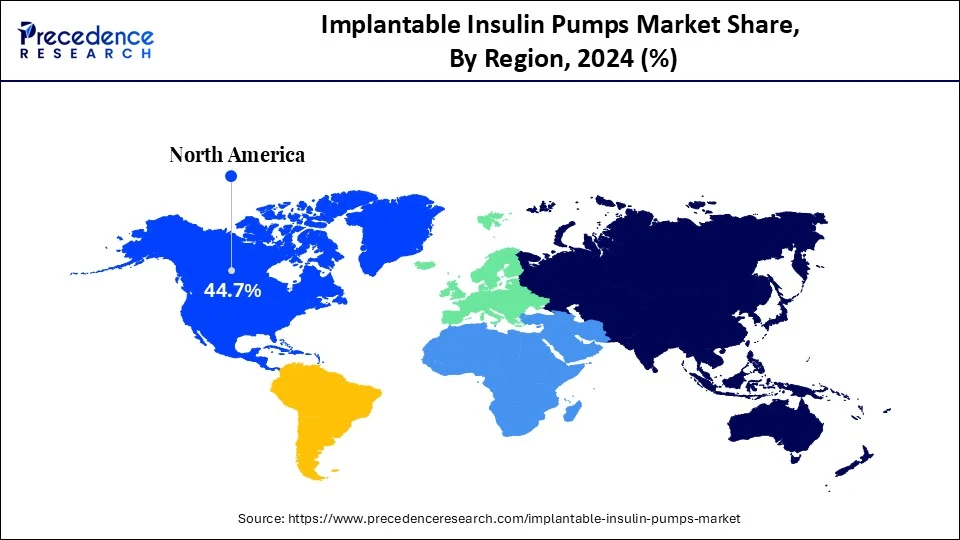

- North America dominated the implantable insulin pumps market with the largest share of 44.7% in 2024.

- Asia Pacific is expected to grow at the highest CAGR from 2025 to 2034.

- By pump type, the programmable implantable pumps segment led the market with a 52.4% share in 2024 and is expected to sustain its position in the coming years.

- By reservoir size, the medium volume (10-20 ml) segment captured the biggest market share of 39.1% in 2024.

- By reservoir size, the large volume (>20 ml) segment is expected to grow at a significant CAGR over the projected period.

- By delivery mode, the combined basal-bolus delivery segment contributed the highest market share of 46.8% in 2024.

- By delivery mode, the continuous basal delivery segment is anticipated to grow at a significant CAGR from 2025 to 2034.

- By end user, the hospitals segment held the biggest market share of 41.3% in 2024.

- By end user, the homecare segment is expected to grow at the fastest CAGR from 2025 to 2034.

- By age group, the adults (18–64 years) segment generated the major market share of 54.2% in 2024.

- By age group, the pediatrics segment (≤17 years) is projected to grow at a significant CAGR between 2025 and 2034.

- By indication, the type 1 diabetes mellitus (T1DM) segment accounted for significant market share of 62.9% in 2024.

- By indication, the type 2 diabetes mellitus (T2DM) segment is expected to experience rapid growth during the forecast period.

- By distribution channel, the direct hospital procurement segment held a remarkeble market share of 47.5% in 2024.

- By distribution channel, the online pharmacy segment is expected to grow at a significant CAGR from 2025 to 2034.

How is AI Impacting the Implantable Insulin Pumps Market?

Artificial intelligence (AI) is transforming the implantable insulin pumps market. AI enables the creation of automated insulin delivery (AID) systems that utilize AI-based algorithms for enhanced glycemic management. AI systems combine data from continuous glucose monitoring with insulin pumps, predicting potential risks and modify insulin delivery accordingly, potentially lessening the management burden and enhancing patient outcomes. AI can forecast future glucose levels, enable proactive insulin adjustments, and possibly prevent hypoglycemic or hyperglycemic episodes. AI algorithms analyze large datasets more quickly and accurately than humans, resulting in more precise and efficient insulin delivery.

What are the Diverse Advantages of Implantable Insulin Pumps?

The implantable insulin pumps market refers to the global industry focused on designing, developing, producing, and selling medical devices that are surgically implanted into the body to deliver continuous, controlled doses of insulin directly into the peritoneal cavity for patients with diabetes, especially those with Type 1 Diabetes Mellitus (T1DM). These devices are designed to reduce glucose fluctuations, improve glycemic control, and lessen the burden of frequent subcutaneous injections or external pumps. Unlike external insulin pumps, implantable versions are less visible, have lower infection risks, and support better patient compliance over longer periods. The rising prevalence of diabetes and advancements in insulin delivery technology drives the market.

What Are the Key Trends in the Implantable Insulin Pumps Market?

- Implantable Insulin Pumps Market Growing Awareness:There is an increasing awareness among patients and healthcare professionals regarding the benefits of insulin pump therapy, which include improved blood sugar control, greater convenience, enhanced flexibility, and a reduction in complications. This awareness is driving the adoption of these devices.

- Increased Focus on Personalized Medicine and Data-Driven Therapeutics: The vast amount of data generated by connected pumps and continuous glucose monitoring systems is paving the way for individualized treatment plans that can predict blood sugar fluctuations, customize insulin dosages, and identify early warning signs. This leads to a more proactive and preventive approach to diabetes care.

- Rising Preference: Patients with diabetes often prefer implantable insulin pumps over multiple daily injections due to their convenience and precision. They report improvements in their overall well-being and clinical outcomes.

- Technological Advancements: The development of closed-loop systems (artificial pancreases) and the integration of AI and ML into insulin delivery are boosting market growth. These technologies help reduce manual intervention and mitigate the risks of hypoglycemia and hyperglycemia. Moreover, technological advances led to the development of smart and automated insulin delivery systems.

Implantable Insulin Pumps Market Outlook:

- Global Expansion: The possession of robust supportive government policies, reimbursement programs, and the probable of escalated outcomes in patients are impacting the prospective progression.

- Major Investor: For innovative products, Medtronic, Insulet Corporation, Tandem Diabetes Care, and Abbott Laboratories are increasingly investing in these pumps and other technologies.

- Industry Overview: The market is promoting integrated AI/ML, the development of more user-friendly, tubeless, and smart devices, and robust expansion in both home and hospital settings.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 5.79 Billion |

| Market Size in 2026 | USD 6.40 Billion |

| Market Size by 2034 | USD 14.27 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.54% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Pump Type, Reservoir Size, Delivery Mode, End User, Age Group, Indication, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Prevalence of Diabetes and Improvements in Pump Technology

A key factor driving the growth of the implantable insulin pumps market is the growing prevalence of diabetes, particularly type 1 diabetes. This significantly boosts the demand for advanced diabetes management solutions. Implantable insulin pumps offer more precise insulin delivery, leading to better control of blood sugar levels. The market is also driven by the rising demand for continuous glucose monitoring and automated insulin pumps, which allow real-time glucose supervision and automatic insulin adjustments, leading to better glycemic control and fewer complications. Moreover, improvements in pump technology, such as smaller, more discreet pumps and user-friendly interfaces, increase patient convenience and encourage adoption.

Restraint

Higher Cost and Limited Reimbursement Options

Implantable insulin pumps are significantly more expensive than traditional methods like injections or external pumps. This challenge is compounded by the technical complexity and the need for specialized training for proper use and upkeep. This creates barriers for patients with low-income levels and hinders adoption. Limited reimbursement options also make them unreachable for many patients. Moreover, patients require regular follow-up for pump maintenance and insulin refills, discouraging patients from adopting them, especially those looking for convenient options.

Opportunity

Development of Automated Insulin Delivery Systems

A key future opportunity in the implantable insulin pumps market lies in the development of automated insulin delivery systems, also called closed-loop systems. These systems combine continuous glucose monitors, insulin pumps, and advanced algorithms to adjust insulin levels based on real-time glucose data automatically, minimizing manual interventions and improving overall glycemic control. Automating insulin delivery eases the daily management of diabetes for users, allowing for more flexibility. Advances in miniaturization, ease of use, and cost-efficiency are making AID systems accessible to more individuals with diabetes, further expanding their potential.

Segment Insights

Pump Type Insights

What Made Programmable Implantable Pumps the Dominant Segment in the Implantable Insulin Pumps Market in 2024?

The programmable implantable pumps segment dominated the market in 2024 and is expected to continue its growth trajectory during the forecast period. The dominance of programmable implantable pumps is attributed to their ability to deliver insulin more accurately and flexibly than non-programmable pumps, which supports personalized diabetes management. These pumps feature adjustable basal rates and bolus doses, essential for mimicking the body's natural insulin response and achieving better glycemic control. These pumps can fine-tune insulin delivery, reducing the risks of high and low blood sugars. The closed-loop pumps are gaining traction, which automatically adjust insulin based on real-time glucose data, improve glycemic control, and lessen the management burden, ultimately enhancing quality of life by minimizing manual insulin adjustments.

Reservoir Size Insights

How Did the Medium Volume (10-20 mL) Segment Lead the Implantable Insulin Pumps Market in 2024?

The medium volume (10-20 mL) segment led the market in 2024. This is mainly due to the ability of medium volume pumps to provide optimal balance between insulin capacity and pump size. This size provides a reasonable duration between refills while being manageable for implantation and comfortable for the patient. A 10-20 mL reservoir allows for a practical period between refills, which helps with patient adherence and convenience. This volume range generally results in a pump size that is not too large for implantation, reducing surgical complexity and discomfort. While highly concentrated insulin formulations can extend refill intervals, they pose challenges related to precipitation and stability in the pump reservoir. Medium volume pumps can use less concentrated insulin, reducing these risks.

The large volume (>20 mL) segment is expected to experience rapid growth in the upcoming period. The growth of the segment is primarily driven by the rising number of diabetes cases, especially among the elderly and obese populations, along with a desire for longer intervals between refills and less maintenance. Larger volume pumps can deliver insulin more consistently and accurately, potentially improving blood sugar control and reducing complications related to diabetes. Larger reservoirs mean fewer refills, less frequent maintenance, and greater ease of use, which can boost adherence. Continuous innovation in pump technology, including smaller, more efficient devices with larger reservoirs, further supports the growth of this segment. These pumps offer greater convenience and the potential for better glycemic management by enabling larger insulin reservoirs and fewer refills.

Delivery Mode Insights

Why Did the Combined Basal-Bolus Delivery Segment Dominate the Market in 2024?

The combined basal-bolus delivery segment dominated the implantable insulin pumps market in 2024. This is because of its ability to replicate the body's natural insulin release, offering a more flexible and personalized approach to diabetes management compared to traditional methods. This approach offers a continuous background insulin level (basal) and on-demand insulin delivery (bolus) to cover meals and correct high blood sugar levels. Studies demonstrate that coordinated basal-bolus delivery results in better postprandial glucose control, fewer glycemic fluctuations, and overall improved glycemic management compared to multiple daily injections. Additionally, optimizing basal rates and providing precise boluses can reduce the risk of hypoglycemic episodes.

The continuous basal delivery segment is expected to grow at the highest CAGR during the projection period. The growth of this segment is attributed to its ability to mimic natural insulin release and provide greater flexibility and better control compared to other methods, such as continuous subcutaneous insulin infusion. This reduces the burden of frequent injections and blood glucose monitoring, enhancing overall quality of life for people with diabetes, especially those with type 1 diabetes. It allows users to adjust insulin based on activity levels, meal times, and other factors, offering more convenience and adaptability than traditional methods.

End User Insights

What Made Hospitals the Dominant Segment in the Implantable Insulin Pumps Market in 2024?

The hospitals segment dominated the market in 2024. This is mainly because they serve as primary care settings for managing the high burden of diabetes, especially for patients needing advanced management strategies. Hospitals often are the first point of contact for new users, providing vital assessments, device setup, and training by specialists. They frequently purchase insulin pumps in bulk for clinics, training, and research purposes, making them a significant market segment. Hospitals also play a key role in evaluating new insulin pump technologies and treatment protocols that meet strict regulatory standards, ensuring accurate dosing and reducing risks, which further encourages adoption.

The homecare settings segment is expected to expand at the fastest rate in the coming years. This growth is driven by an increased focus on patient-centered care, technological improvements in insulin delivery devices, and the rising prevalence of diabetes. The global rise in diabetes cases demands more effective and convenient insulin delivery options, with home care settings offering a practical solution. Moving treatment to home settings can cut hospital visits and related costs, making insulin pump therapy more accessible. Awareness campaigns and educational programs are highlighting the benefits of insulin pump therapy and its suitability for home care settings. Moreover, there is a high demand for home treatments, as diabetes, particularly type 1 diabetes, often requires regular insulin for diabetes management.

Age Group Insights

Why Did the Adults (18–64 Years) Segment Dominate the Implantable Insulin Pumps Market in 2024?

The adults (18–64 years) segment dominated the market in 2024. This is due to the higher incidence of type 1 and type 2 diabetes in this age group, along with a greater willingness to adopt advanced technologies like insulin pumps for better blood sugar control and quality of life. Since many adults in this group lead active lifestyles, insulin pumps provide more flexibility and freedom compared to multiple daily injections, helping manage blood sugar during physical activities. Additionally, this age group tends to be more tech-savvy and open to using features like continuous glucose monitoring and automated insulin delivery, which enhance their health and well-being.

The pediatrics segment (≤17 years) is expected to grow at a rapid pace over the projection period. This is due to the increasing number of children with type 1 diabetes. Parents have become more aware of the benefits of insulin pump therapy in managing the disease, and technological advances that make pumps easier for young patients and their families to use are also boosting the segmental growth. Insulin pumps offer a more flexible and convenient way to control diabetes than multiple daily injections, especially for children needing precise, continuous insulin delivery to reduce the frequency of injections, improve blood sugar regulation, and lessen the risk of long-term complications. New technology also enables remote monitoring of glucose levels and pump settings, allowing for therapy adjustments from afar, which is helpful for families with young children.

Indication Insights

Why Did the Type 1 Diabetes Mellitus (T1DM) Segment Contribute Major Revenue in 2024?

The type 1 diabetes mellitus (T1DM) segment dominated the implantable insulin pumps market while holding a 62.9% share in 2024. This is mainly because of the urgent need for accurate insulin delivery to manage this autoimmune disease. Patients with type 1 diabetes require constant, near-natural insulin replacement, which can be provided by insulin pumps, including implantable devices, unlike type 2 diabetes (T2DM), where other treatments are often used. Implantable insulin pumps can mimic the body's natural insulin release, offering more precise and steady delivery than multiple daily injections. When combined with continuous glucose monitoring, these pumps help patients achieve better blood sugar control and lower the risk of long-term health problems. Growing awareness about the benefits of insulin pump therapy and ongoing technological improvements are fueling their adoption.

The type 2 diabetes mellitus (T2DM) segment is expected to register the highest CAGR during the forecast period. This is mainly due to the increasing number of cases of type 2 diabetes, driven by rising obesity rates and sedentary lifestyles. People have become more aware of the advantages of pump therapy over traditional methods for managing blood sugar. Insulin pumps provide improved glycemic control and lower hypoglycemia risk compared to multiple daily injections, making them an attractive option for T2DM management. Innovations like patch pumps and integration with continuous glucose monitoring systems are making insulin pump therapy more convenient, user-friendly, and personalized for T2DM patients, thus boosting adoption.

Distribution Channel Insights

Why Did the Direct Hospital Procurement Segment Dominate the Implantable Insulin Pumps Market in 2024?

The direct hospital procurement segment dominated the market for implantable insulin pumps because of these devices' specialized nature, which requires skilled expertise in implanting and managing. Implantable insulin pumps require surgery and ongoing management by trained healthcare providers, making hospitals the key centers for procedures and follow-up care. Many hospitals have dedicated diabetes centers and specialized teams, making them the main buyers and managers of these devices. Reimbursement policies often favor hospital-based treatments for complex medical devices, encouraging direct hospital purchases.

The online pharmacies segment is expected to grow at a significant CAGR in the upcoming period due to the convenience, accessibility, and rising preference for online shopping. Online platforms offer a discreet and efficient way for individuals to buy insulin pumps and supplies, especially for those managing chronic conditions diabetes. The growing awareness and acceptance of digital healthcare solutions are driving the growth of online pharmacies. These pharmacies provide accessibility to a wide range of products, enabling patients to choose products based on their needs. Furthermore, the rise of healthcare e-commerce and digital healthcare solutions is supporting segmental growth.

Regional Insights

U.S. Implantable Insulin Pumps Market Size and Growth 2025 to 2034

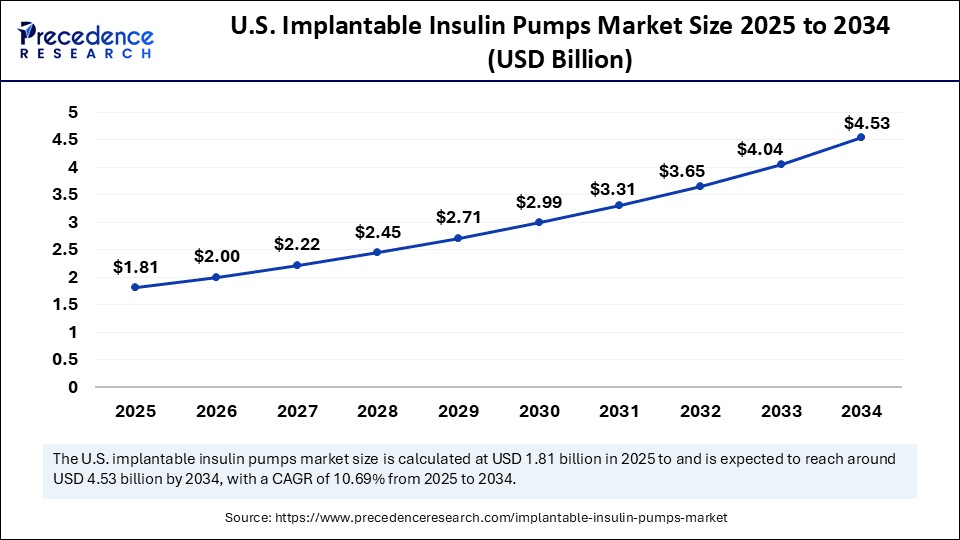

The U.S. implantable insulin pumps market size is exhibited at USD 1.81 billion in 2025 and is projected to be worth around USD 4.53 billion by 2034, growing at a CAGR of 10.69% from 2025 to 2034.

What Made North America the Dominant Region in the Implantable Insulin Pumps Market in 2024?

North America dominated the implantable insulin pumps market in 2024. This dominance is primarily attributed to the high prevalence of diabetes, a well-developed healthcare infrastructure, positive reimbursement policies, and strong market leadership by companies in the region. These factors contribute to increased adoption of insulin pumps and ongoing advancements in technology. Major insulin pump manufacturers, such as Insulet, Medtronic, and Tandem Diabetes Care, are based in North America, leading to significant investments in research and development that drive technological advancements. The focus on developing advanced features, such as wireless insulin delivery, data logging and analytics, integration with health management apps, and user-friendly interfaces, further enhances the appeal of insulin pumps in the region.

U.S. Implantable Insulin Pumps Market Trends

The U.S. is a major contributor to the market in North America due to its substantial diabetic population, advanced healthcare infrastructure, and consistent technological innovation. Furthermore, the country is a hub for research and development, particularly in areas like closed-loop systems and integration with continuous glucose monitoring devices. The FDA's regulatory processes and expanded insurance coverage for insulin pumps have further facilitated market growth and improved patient access to these life-changing technologies.

What Makes Asia Pacific the Fastest-Growing Region in the Implantable Insulin Pumps Market?

Asia Pacific is experiencing the fastest growth in the market. This growth is driven by a high prevalence of diabetes, increasing awareness of advanced diabetes management solutions, and supportive government initiatives. Enhanced patient education and awareness campaigns are encouraging the use of advanced insulin delivery systems, including implantable pumps, as convenient and effective ways to manage diabetes. Government initiatives to combat diabetes, paired with favorable reimbursement policies for insulin delivery devices, are further accelerating market growth. Increased investments in healthcare infrastructure and better access to healthcare services in developing countries are making advanced devices, such as implantable insulin pumps, more readily available.

China Implantable Insulin Pumps Market Trends

China plays a major role in the market due to its large diabetic population, growing demand for advanced diabetes management technologies, supportive government policies, and a focus on domestic manufacturing and innovation. With the world's largest diabetic population, China presents a substantial market opportunity for both local and international companies in the insulin pump sector. As a manufacturing hub for medical devices, China aims to enhance domestic production, reduce reliance on foreign brands, and promote innovation in AI and 3D bioprinting for medical devices.

Why is Europe Considered a Notable Region in the Implantable Insulin Pumps Market?

Europe is a notable region in the market due to the high prevalence of diabetes, supportive government initiatives, and advancements in technology. The region's robust healthcare infrastructure, along with increasing awareness and adoption of insulin pumps, is driving this trend. Several European countries have implemented programs and policies to improve diabetes care, including initiatives that subsidize insulin infusion technologies and enhance accessibility. These policies help reduce the financial burden on patients and encourage the adoption of insulin pumps. Europe benefits from a well-developed healthcare system and insurance coverage that often covers the costs of insulin pumps for eligible patients, further facilitating access to these devices.

What Opportunities Exist in Latin America?

Latin America is emerging as a major player in the market, primarily due to rising healthcare expenditures and supportive government initiatives. Factors such as a growing geriatric population, advancements in insulin delivery technology, and improved access to healthcare centers are boosting this expansion. Innovations in insulin pump technology, such as continuous glucose monitoring integration, wireless connectivity, and user-friendly interfaces, are making insulin pumps more attractive and effective. While Brazil and Mexico are key markets, other countries in the region are also witnessing increased adoption. Additionally, improvements in healthcare infrastructure, such as the availability of specialized clinics and access to telemedicine, are facilitating the adoption of insulin pumps.

What Factors Influence the Implantable Insulin Pumps Market in the Middle East & Africa?

The market in the Middle East & Africa is expected to grow due to a high prevalence of diabetes and increasing awareness of advanced diabetes management solutions. Governments in several countries, like Saudi Arabia, the UAE, and Egypt, are implementing initiatives to improve diabetes care and expand access to advanced treatments like insulin pumps. Increased private sector investment in healthcare infrastructure and technologies is also contributing to the growth of the market. Continuous innovation in insulin pump technology, leading to more user-friendly and feature-rich devices, is further driving adoption.

Immersive "Artificial Pancreas" Research: German Market Trend

Nowadays, numerous German researchers and institutions are actively exploring research on artificial pancreas systems, such as the possibility of prospective, fully implantable, self-regulating systems that could resolve the requirement for persistent monitoring and manual inputs.

Establishment of Cost-effective Pump: Brazilian Market Trend

Substantial efforts by researchers at the Federal University of São Paulo and other institutions are being made on the development of a low-cost insulin infusion pump prototype intended to be inexpensive for the Brazilian public. This further comprises the evolution of a software simulator for the prototype, which underwent usability testing with potential users.

Adoption of Hybrid Closed-Loop Systems: UAE Market Trend

Several hospitals in the UAE, like the Sheikh Shakhbout Medical City (SSMC) in Abu Dhabi and Al Qassimi Women's & Children's Hospital, unveiled advanced hybrid closed-loop systems, such as the Medtronic MiniMed 780G system, which automatically adjusts insulin delivery and corrects high glucose levels every five minutes.

Implantable Insulin Pumps Market: Value Chain Analysis

- R&D

Researchers are emphasizing conceptual design, engineering, and material selection, non-clinical and preclinical testing, clinical trials, regulatory approval, and manufacturing.

Key Players: Insulet Corporation, Tandem Diabetes Care, Johnson & Johnson, etc. - Clinical Trials & Regulatory Approvals

Trials are usually conducted for their safety and efficacy in specific patient populations, mainly those with brittle type 1 diabetes who experience frequent, unexplained severe hypoglycemia or hyperglycemia.

Key Players: Medtronic Diabetes, Sanofi, Medical Research Foundation, The Netherlands, etc. - Patient Support & Services

Giant firms are providing a 24-hour technical support line and assistance for ordering supplies, resources, and a consumer guide for diabetes management and pump information.

Key Players: Roche, Beta Bionics, Tandem Diabetes Care, etc.

Key Players in Implantable Insulin Pumps Market and Their offerings

- Medtronic plc- A significant company provides research and development of next-generation implantable pumps.

- Insulet Corporation- It unveiled the Omnipod 5 Automated Insulin Delivery System.

- Tandem Diabetes Care Inc.- It prominently leverages external, tubed, and tubeless insulin pumps, including the t: slim X2 and Tandem Mobi systems.

- Roche Diabetes Care- A vital leader offers tube-free patch pumps like the Accu-Chek Solo micropump system.

- SOOIL Development Co., Ltd.- It is emphasizing external, subcutaneous insulin pumps under the DANA Diabecare brand.

Recent Developments

- In April 2025, Medtronic plc announced that it had applied for FDA clearance for an interoperable insulin pump that integrates with Abbott's continuous glucose monitoring (CGM) platform, thereby enhancing treatment options for people with diabetes. The application includes submissions for the MiniMed™ 780G as an ACE pump and the SmartGuard™ algorithm as an automated glycemic controller. Medtronic's partnership with Abbott aims to deliver innovative solutions for diabetes management.(Source: https://www.prnewswire.com)

- In June 2024, Arecor Therapeutics partnered with Medtronic to develop a high-concentration, thermostable insulin formulation for next-generation implantable pumps. Using Arecor's Arestat™ technology, this new formulation seeks to improve treatment options for patients who require stable insulin, potentially lowering healthcare costs and enhancing care quality. This collaboration aims to transform treatment for a vulnerable patient population and expresses hope for future partnerships that will further enhance the benefits of next-generation devices.(Source: https://synapse.patsnap.com)

- In September 2024, Senseonics Holdings, Inc. and Ascensia Diabetes Care announced that the FDA cleared the next-generation Eversense 365 system for adults with Type 1 and Type 2 diabetes. This new continuous glucose monitoring (CGM) system is the world's first one-year sensor, improving sensor longevity, connectivity, and accuracy to help patients maintain desired glucose levels and lower A1c, marking a significant step forward in diabetes management.

(Source: https://www.senseonics.com) - In March 2024, the Twiist AID system became the first insulin pump integrated with Tidepool Loop, providing precise microdosing and customizable bolusing based on food types. Developed by Sequel Med Tech, this innovative system measures volume and flow for personalized insulin dosing. It is also the first FDA-approved insulin pump that can be controlled via Apple Watch. Dr. Natalie Bellini praised this groundbreaking option for diabetes management.

(Source: https://diatribe.org)

Segments Covered in the Report

By Pump Type

- Programmable Implantable Pumps

- Closed-loop Pumps

- Open-loop Pumps

- Non-programmable Implantable Pumps

- Others (Hybrid Delivery Systems)

By Reservoir Size

- Small Volume (≤10 mL)

- Medium Volume (10–20 mL)

- Large Volume (>20 mL)

- Others

By Delivery Mode

- Continuous Basal Delivery

- Bolus Delivery

- Combined Basal-Bolus Delivery

- Others

By End User

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Diabetes Clinics

- Homecare Settings

- Others (Military, Research)

By Age Group

- Pediatric (≤17 years)

- Adults (18–64 years)

- Geriatric (≥65 years)

By Indication

- Type 1 Diabetes Mellitus (T1DM)

- Type 2 Diabetes Mellitus (T2DM)

- Others (e.g., LADA, MODY)

By Distribution Channel

- Direct Hospital Procurement

- Retail Pharmacies

- Online Pharmacies

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting