What is the MRI Safe Implantable Defibrillator Devices Market Size?

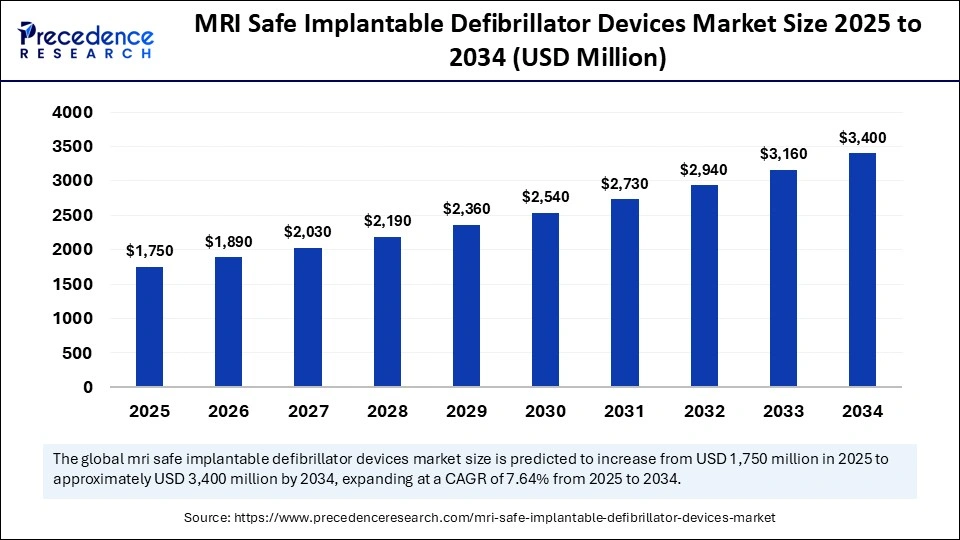

The global MRI safe implantable defibrillator devices market size accounted for USD 1,750 million in 2025 and is predicted to increase from USD 1,890 million in 2026 to approximately USD 3,400 million by 2034, expanding at a CAGR of 7.64% from 2025 to 2034. The market for MRI safe implantable defibrillator devices is driven by rising cardiac disorders, increasing MRI procedures, and technological advancements in safer, more efficient implantable devices.

Market Highlights

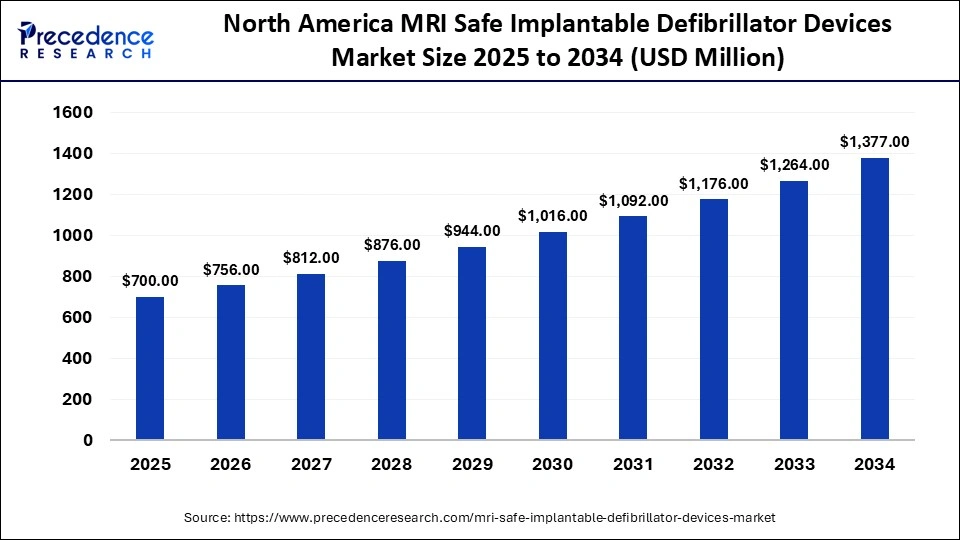

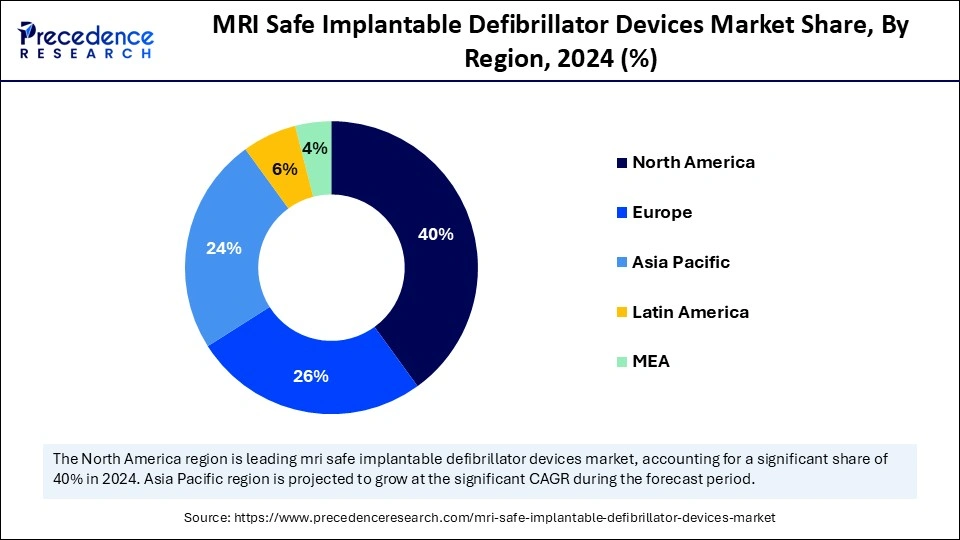

- North America led the MRI safe implantable defibrillator devices market with around 40% of share in 2024.

- The Asia Pacific is expected to grow the fastest CAGR between 2025 and 2034.

- By product type, the single-chamber ICDs segment accounted for the highest market share of 35% in 2024.

- By product type, the biventricular / CRT-D ICDs segment is growing at a fastest CAGR between 2025 and 2034.

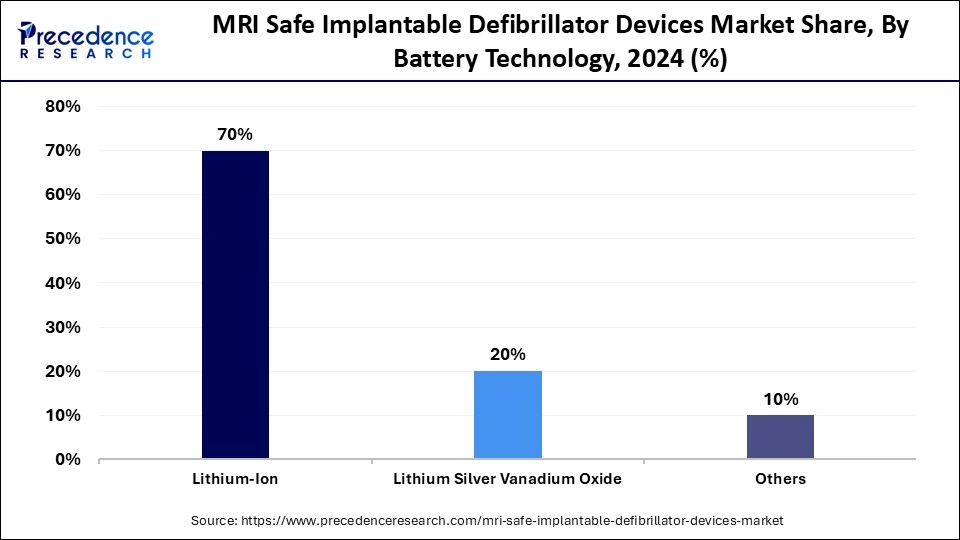

- By battery technology, the lithium-ion segment captured approximately 70% of the market share in 2024.

- By battery technology, the lithium silver vanadium oxide segment is growing at the fastest CAGR from 2025 to 2034.

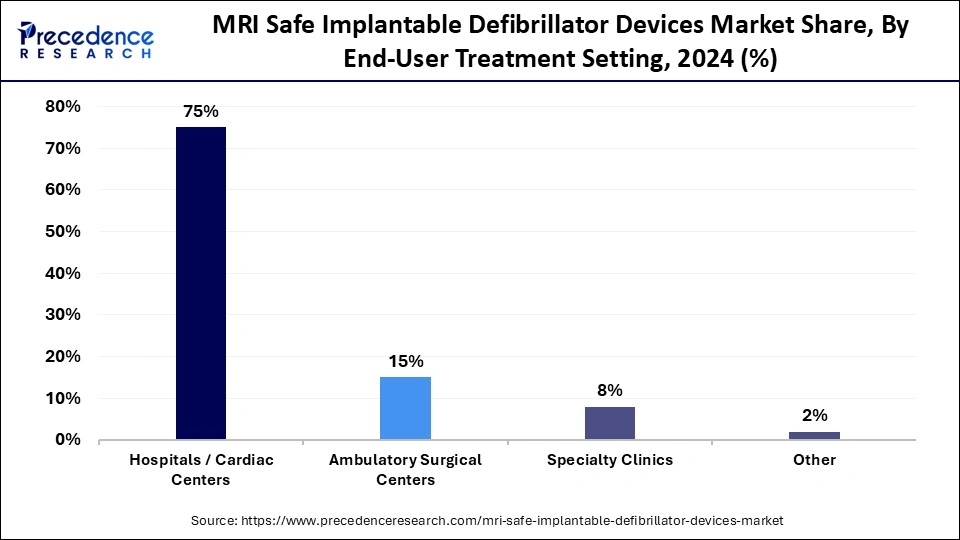

- By end-user/treatment setting, the hospitals / cardiac centers segment captured approximately 41.6% of market share in 2024.

- By end-user/treatment setting, the specialty clinics segment is expanding at a notable CAGR between 2025 and 2034.

Drive for MRI-Compatible Defibrillators by Safer Heart Solutions

The rising cases of patients with cardiovascular diseases, as well as the increasing demand for imaging procedures with compatibility considerations, continue to drive demand for MRI safe implantable defibrillator devices that detect and correct abnormal heart rhythms and can be safely used in patients who may undergo magnetic resonance imaging. MRI-conditional defibrillators are similar to standard defibrillator devices but utilize unique circuit and material designs that limit electromagnetic interference with imaging.

Demand for MRI safe defibrillator devices is gaining traction among cardiac care centers adopting these devices, as well as among developers of miniaturized devices, and among post-approval health systems favoring devices with supportive uses. Given patient safety concerns and diagnostic accuracy, manufacturers are working to develop exciting innovations that deliver therapeutic efficacy and MRI compatibility, thereby creating an important reference point for the development of cardiac rhythm management technology.

AI and Digital Innovation Transforming Medical Device Development

The MRI safe implantable defibrillator market is flourishing as manufacturers integrate advanced biocompatible materials, miniaturized circuitry, and improved shielding techniques for better stability in powerful magnetic fields. The development toward leadless and subcutaneously positioned devices presents less risk for infection and fewer complications during procedures. In improving device battery chemistry and power management, improved safety and reliability, and longevity leave the indwelling defibrillator caring for the patient longer with more dependability.

Systems based on AI-generated diagnostics enable personalized therapy adaptation, improving both patient safety with issues related to delivery and therapy accuracy. These advancements in device technology lead to increased use of MRI compatible devices for either preventative therapy or post-cardiac event treatment - either close to the implant site or remote from the implant site allowing for better imaging diagnostics without sacrificing device performance. On-going Research and Development efforts in material science to mitigate electromagnetic interference will continue to develop new designs in cardiac implant technology.

- In March 2025, Medtronic Japan Co., Ltd. announced the official approval and launch of the Aurora EV ICD MRI system, with the Epsila EV MRI Lead, in Japan, an extravascular, implantable cardioverter-defibrillator with MRI compatibility at both 1.5 T and 3 T.

Five Healthcare Trends Shaping 2025 and Beyond

- Increasing Trend of MRI-Compatible Cardiac Devices: Manufacturers are prioritizing MRI safe defibrillators in response to the increasing demand for safer imaging protocols in patients with heart disease. The healthcare system is conducting more MRI procedures in patients with heart disease, and the technology for shielding devices has also advanced.

- Convergence of Remote Monitoring with AI-Driven Diagnostics: Next-generation MRI safe defibrillators utilize AI-driven algorithms and remote patient monitoring capabilities. These capabilities support clinical decision-making, detect arrhythmias, and enhance progress and outcomes with patient-reported real-time cardiac data.

- Storage Minimization and Longer Battery Life: Manufacturers are focusing on minimizing the design of devices to conserve battery life. Reducing storage minimizes replacements, enhances comfort for patients, and improves MRI device compatibility with minimal impact on functionality.

- Increased Clinical Adoption in Aging Populations: Increased incidence and prevalence of cardiovascular diseases among older patients are contributing to a rise in demand for MRI safe implantable defibrillators. Hospitals are embracing MRI-capable systems as part of comprehensive cardiac care protocols in geriatric populations.

MRI Safe Implantable Defibrillator Devices Market Outlook

With the increasing prevalence of ventricular arrhythmias and a bunch of patients requiring both ICDs and diagnostic MRI scans, manufacturers want to provide MRI-conditional defibrillators that provide access to imaging while preserving life-saving therapy.

Emerging healthcare systems in Asia-Pacific and Latin America have been modernizing their infrastructure for cardiac care and the development of imaging capacity. This creates space to market MRI-compatible ICDs, particularly where there is an uptick in MRI usage but legacy devices prevent the delivery of imaging capabilities.

Device manufacturers have been investing in advanced lead materials, enhancing EMI shielding, and improving thermal-safety modelling (RF-induced heating) with the goal of meeting regulatory demand for safety to allow for MRI use in implanted defibrillators.

The track of patient need for diagnostic imaging, supported by the ongoing regulatory and institutional approval for MRI diagnostic imaging, coupled with the increase of patients requiring MRIs while implanted with cardiac devices (ICDs), is a driver for replacement of older systems for newer MRI-conditional ICDs, leading to some momentum in the market.

Sustaining and operating a functional business for development and distribution involves constant high costs of development, manufacturing and regulatory, as many markets do not reimburse for MRI compatible defibrillator use.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1,750 Million |

| Market Size in 2026 | USD 1,750 Million |

| Market Size by 2034 | USD 3,400 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.64% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Battery Technology, End-User/Treatment Setting, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

MRI Safe Implantable Defibrillator Devices Market Segment Insights

Product Type Insights

Single-chamber ICDs are the dominant product type in the MRI safe implantable defibrillator market, with approximately 35% share. These devices are widely used for ventricular pacing and defibrillation and represent a straightforward and effective option for patients who are at risk of potentially lethal arrhythmias. Their small size, lower complication rates, and improved compatibility with MRI makes them very popular in clinical practice.

Biventricular (or CRT-D) ICDs, which are the fastest-growing segment in the MRI safe implantable defibrillator market, can provide both cardiac resynchronization therapy and defibrillation. These needs are becoming increasingly significant in the advanced heart failure population in an effort to optimize cardiac function and minimize all-cause mortality. Recent developments, such as MRI conditional CRT-Ds with more leads that are MRI compatible and real-time monitoring, have driven up demand among cardiologists and hospitals.

Dual-chamber ICDs represent an important distinction, representing approximately 28% share of the market, and they provide an important balance between pacing and defibrillation. These devices provide atrial and ventricular pacing, which improve rhythm control and patient outcomes, especially in patients with conduction disease. These devices are increasing being adopted in hospitals, because of increased comprehensive arrhythmia management, and their smoother transition to MRI-compatible.

Battery Technology Insights

Lithium-ion batteries have a dominant share of 70% of the MRI safe implantable defibrillator devices market due to their high energy density, small size, and long life span. Lithium-ion batteries allow for reliable and consistent energy over a significant duration, which enhances device reliability and safety for the patient.

Lithium silver vanadium oxide (Li-SVO) batteries are the most rapidly growing segment and are known for voltage stability and high pulse power that is necessary during defibrillation. This chemistry is one that allows energy to be rapidly discharged without reliability issues, thus making it an ideal candidate for use in next-generation ICD systems.

Other battery chemistries, including hybrid lithium and solid-state systems, are slowly beginning to be examined for improved biocompatibility and energy efficiencies. These approximately new systems are targeted at reducing the frequency of battery replacement, while simultaneously improving the overall comfort of the patient and future-proof devices by being smaller, safer, and longer-lasting.

End-User/Treatment Setting Insights

Hospitals and cardiac centers represent the largest user group, holding overall a 75% share of the MRI safe implantable defibrillator market, due to advance infrastructure and specialized units focused on cardiac care. These centers manage complex implantations of devices and post-operative follow-up monitoring with the highest efficacy. The availability of diagnostic imaging systems which is compatible with MRI, as well as skilled electro physiologists, minimizes risk while implanting the devices and managing the follow-up.

Ambulatory surgical centers (ASCs) are beginning to show rapid growth, catering to the demand for cost-effective, minimally invasive implantations, with less recovery time. The outpatient preference for cardiac procedures is increasing, and compact designs of MRI safe defibrillators are paving the way for ASCs to cater for safely and efficiently implanting devices and managing follow-ups, in the right environment.

Because they focus on long-term patient management, the programming of devices, and regular follow-up care, specialty clinics have a distinct role to play. Specialty clinics provide personalized care and remote monitoring if needed, and they are able to provide the necessary care to help patient continuous optimal performance of their devices. They utilize telehealth systems to allow for improved accessibility to decrease delays in care delivery and promote on-going patient engagement in management of cardiac health.

MRI Safe Implantable Defibrillator Devices Market Regional Insights

The North America MRI safe implantable defibrillator device market size is estimated at USD 700 million in 2025 and is projected to reach approximately USD 1,377 million by 2034, with a 7.76% CAGR from 2025 to 2034.

Why does North America lead in the regions in the MRI safe implantable defibrillator device market?

North America is the dominant region in the MRI safe implantable defibrillator market, has established strong clinical adoption, regulatory clarity, and high MRI capacity for MRI-conditional/MRI safe ICDs. Hospitals in the U.S. and Canada are firmly established in electrophysiology programs, with a high volume of referrals for advanced cardiac imaging and clear device to MRI protocols that minimize procedural friction for gaining access to MRIs in CIED patients. Payers and health systems trend toward clinical access to diagnostic imaging for complex comorbid patients (those who are older or have cancer or neurological disease) with ICDs, which makes hospitals opt toward the MRI-conditional system as standard. Current guidelines and consensus statements from cardiology societies, both published and pending publication, have lowered barriers to MRI for device patients and have increased the selection of devices toward MRI-compatible devices in the implanting center.

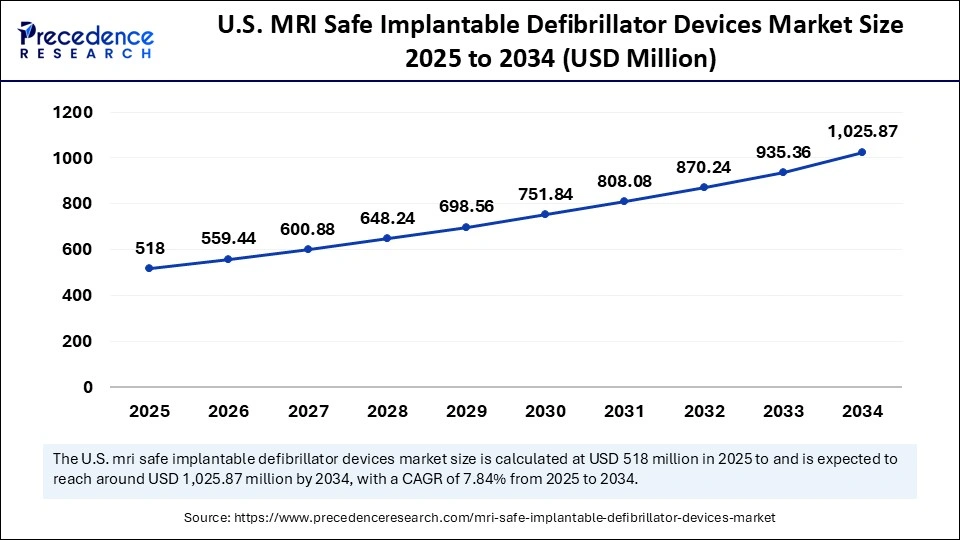

The U.S. MRI safe implantable defibrillator device market size is calculated at USD 518.00 million in 2025 and is expected to reach nearly USD 1,025.87 million in 2034, accelerating at a strong CAGR of 7.84% between 2025 and 2034.

U.S. MRI Safe Implantable Defibrillator Devices Market Trends

The U.S. accounts for the highest installed base of MRI scanners per capita among high-income countries and has very strong electrophysiology referral networks that hospitals follow via evidence-based protocols for obtaining MRIs in patients with a CIED. Its the combination of regulatory precedent, the approvals of early MR-conditional devices and the wide availability of advanced tertiary centers with the proper capacity to deliver advanced medical care to complex cardiac patients that makes the U.S. the default leading marketplace for MRI safe ICDs.

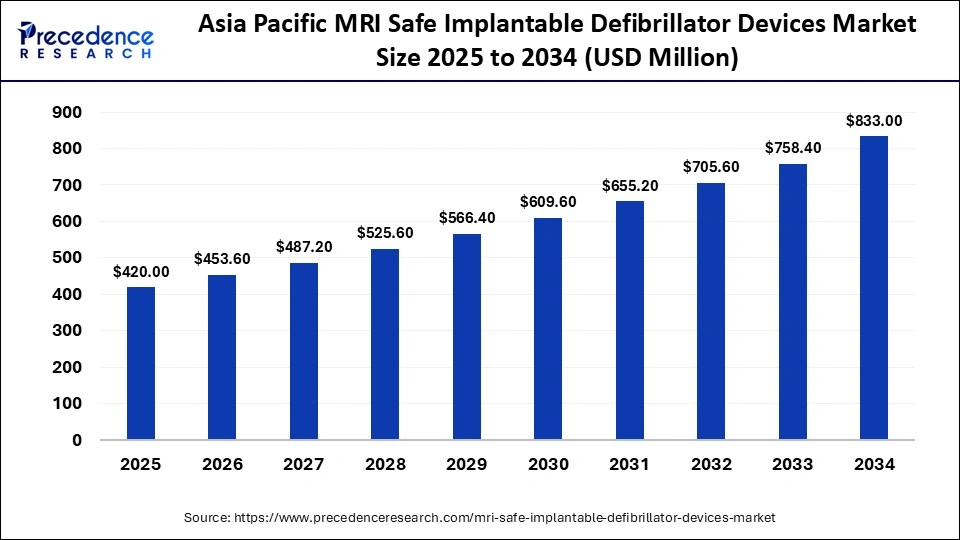

The Asia Pacific MRI safe implantable defibrillator Device market size is expected to be worth USD 833.00 million by 2034, increasing from USD 420.00 million by 2025, growing at a CAGR of 7.85% from 2025 to 2034.

What Is Driving Asia Pacific To Be The Fastest Growing MRI Safe Implantable Defibrillator Devices Market Region?

Asia Pacific growth in the MRI safe implantable defibrillator market is supported by both rapidly increasing diagnostic imaging capacity, rising prevalence of cardiovascular disease and older adults in large markets, and increasing expenditure on hospital infrastructure. There is significant activity in health systems replacing aging imaging fleets and building tertiary cardiac centers, which enhances demand for devices that facilitate future access to MRI. In addition to older device distributors, local hospital groups and health systems increasingly list MRI conditional options to meet demands of clinicians, and concurrent increased uses of cross specialty imaging in their markets enhances value and build demand for MRI conditional ICDs.

Furthermore, the regulatory pathways in many countries in APAC have become more favorable in recent years to allow manufacturers to negotiate their MRI compatible portfolios more regionally.

India MRI Safe Implantable Defibrillator Devices Market Trends

India growing private hospital network and corresponding investment in imaging, both concerted acquisitions of MR systems, and newer installations of localized imaging for 1.5 - 3T systems are providing a commercial pull for MRI conditional devices at tertiary medical centers. This is compounded by referral networks for the indication of cardiac electrophysiology that predominantly operate in metro hospitals and tertiary referral centers that need to have product choices for ICDs that will allow the potential for future access to MRI. Subsequently, both manufacturers and distributors are viewing these Metro hospital hives as primary locations to debut model launches and new education.

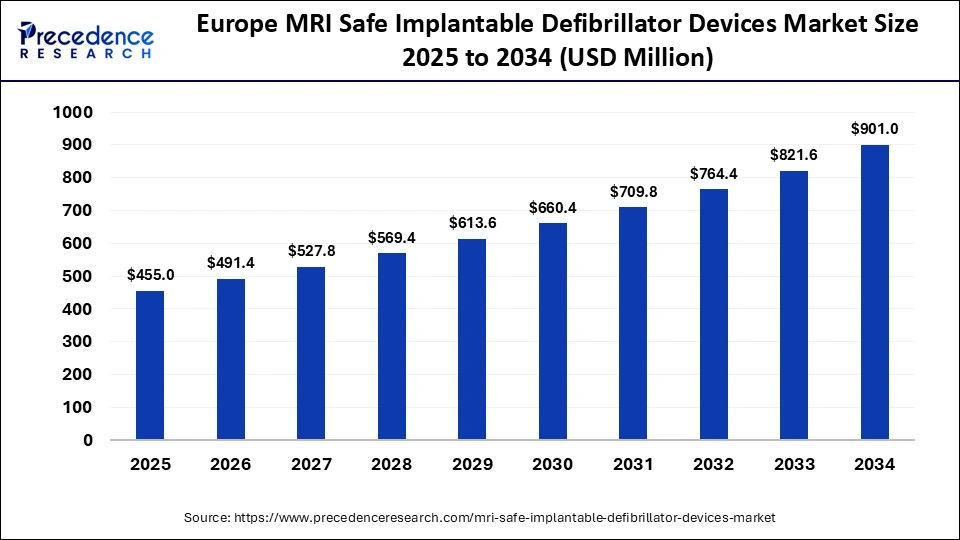

The Europe MRI safe implantable defibrillator Device market size has grown strongly in recent years. It will grow from USD 455 million in 2025 to USD 901 million in 2034, expanding at a compound annual growth rate (CAGR) of 7.83% between 2025 and 2034.

Why is Europe Showing Growth in the MRI safe implantable defibrillator market?

Europe growth trend is supported by advanced hospital networks, a significant proportion of advanced imaging capacity at tertiary cardiology centers, and appetence from European cardiology societies driving strong clinical guidance for safe MRI access for patients with cardiac implantable electronic devices (CIEDs). The reimbursement models, coupled with some centralized hospital procurements, are creating settings where prominent hospitals can readily accommodate MRI-conditional systems as the standard of care for implantations. Manufacturers and hospital systems are aligning on training, MRI-scanning protocols, and remote programming support, to reduce the operational burden across the continent.

Germany MRI Safe Implantable Defibrillator Devices Market Trends

Germanys combination of high hospital density, leading cardiac centers, and broad access to MRI establishes a natural market potential for MRI safe implantable cardioverter defibrillators. Tertiary care centers perform high procedural volume and, to support device patients access to MRI, install access pathways and communication mechanisms, creating a favorable environment for implanting cardiologists to implant devices with no change to the patients future access to MRI. Soon, centralized procurements from large hospital groups and reporting clinical practice guidelines will accelerate acceptance and implementation.

Latin America is a growth region for the MRI safe implantable defibrillator market based on an increasing absolute burden of cardiovascular disease and increasing investment in tertiary cardiology services and imaging infrastructure in major countries. Although per-capita MRI capacity remains lower in Latin America when compared to high-income regions, urban referral centers that are somewhat constrained in capacity to deliver a large presence of imaging services, especially those that examine electrophysiology, are beginning to enhance imaging and electrophysiology services to meet increased demand for diagnostic imaging services and advanced cardiac care. Investment in clinician training, device follow-up programs and an MRI Safety Protocol will determine how fast the adoption of MRI safe devices moves out of the major metropolitan centers.

Brazil MRI Safe Implantable Defibrillator Devices Trends

Brazil has a large population, and the major cities have a concentration of tertiary cardiac hospitals which results in the most ICD implants in Latin America. Analysis of hospitalizations and outcomes from cardiovascular disease indicates that substantial absolute volumes of ischemic heart disease and heart-failure hospitalizations occur. The urban hospitals will respond by implementing new imaging technology and upgrading electrophysiology programs to allow them to manage patients with devices that may require MRI.

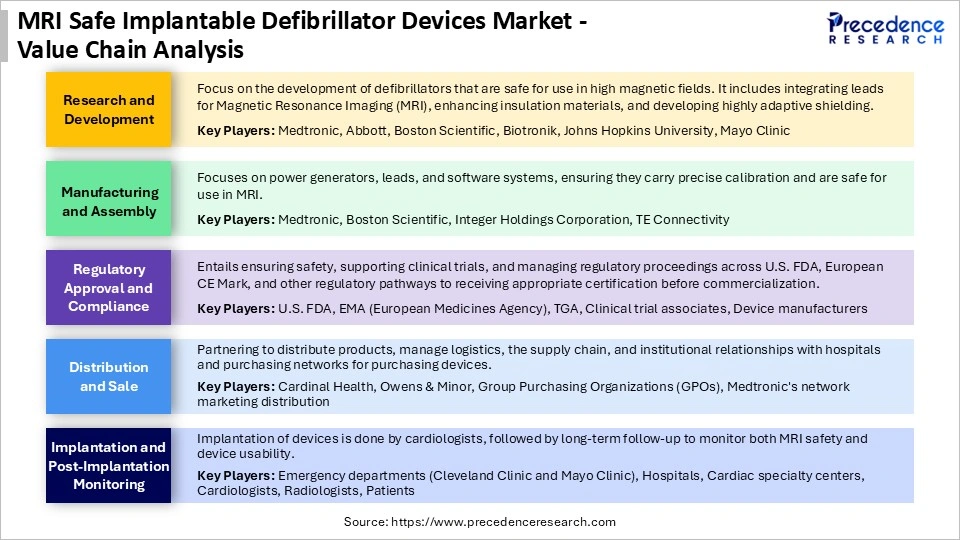

MRI Safe Implantable Defibrillator Devices Market Value Chain

MRI Safe Implantable Defibrillator Devices Market Companies

A global leader in cardiac rhythm management, offering MRI-safe implantable cardioverter defibrillators (ICDs) with advanced pacing, arrhythmia detection, and shock-delivery technologies designed for full-body MRI compatibility.

Provides MRI-conditional ICDs featuring advanced sensing algorithms, remote monitoring, and high-performance leads for improved patient safety and long-term device reliability.

Manufactures MRI-safe ICDs with innovative therapies for ventricular arrhythmias, long battery life, and compatibility with contemporary MRI scanning protocols.

Offers MRI-conditional ICDs incorporating advanced home monitoring, robust leads, and proprietary arrhythmia detection algorithms engineered for precision and durability.

Supplies MRI-safe cardiac rhythm management systems with a focus on reliable pacing and defibrillation technologies tailored for long-term cardiovascular care.

Known for external defibrillation and cardiac monitoring technologies while also offering specialized implantable solutions designed to support MRI safety standards.

Provides MRI-conditional ICDs, including systems acquired from the former Sorin Group, featuring high-performance leads and patient-centric monitoring capabilities.

Offers complementary cardiac care technologies—including imaging and monitoring systems—that integrate with MRI-safe ICD workflows and clinical environments.

Produces advanced electrophysiology and cardiac monitoring technologies that support the broader use of MRI-compatible ICD therapies.

An Italian manufacturer offering pacemakers and ICD systems with MRI-conditional features and a focus on compact device design.

Recent Developments

- In December 2024, Philips announced its initiative to advance cardiac MRI technology through AI-driven research, focusing on enhancing image clarity, diagnostic accuracy, and workflow efficiency to improve cardiovascular care and accessibility for patients worldwide.(Source: https://www.usa.philips.com)

- January 2025, Researchers from Brown University conducted a study on Transvenous implantable cardioverter-defibrillators (ICDs), highlighting their effectiveness in preventing sudden cardiac death and comparing their safety and performance with emerging extravascular ICD systems.(Source: https://www.acc.org)

Exclusive Insights

From an analysts perspective, the market for MRI safe implantable defibrillators has a strong growth opportunity, supported by three impactful trends: an increased incidence of cardiac arrhythmias and SCA in aging populations, increasing MRI diagnostic use and acceptance in cardiac care, and the technical need to ensure that implantable supports their use in imaging. From an opportunity perspective with MRI safe devices, business participants can access higher priced product tiers and new geographic markets where MRI imaging growth is occurring. However, there are some potential pitfalls, regulatory and reimbursement challenges, costs for devices that may limit adoption in price sensitive conditions, and clinician continued concerns over lead-heating/artefact during MRI scanning.

Importantly, the market should continue to chase three trends: integration of remote monitoring into MRI safe ICDs, partnerships between device companies and radiology/imaging centers, and movement away from basic implantable model towards more differentiated devices within MRI safe segment. Overall, from a business /market perspective, companies that receive regulatory approval, build irons an efficient cost model for manufacturing MRI compatible products, and align efforts with imaging workflow stakeholders, should be well positioned to access this premium niche of the broader implantable defibrillator market.

MRI Safe Implantable Defibrillator Devices MarketSegments Covered in the Report

By Product Type

- Single-Chamber ICDs

- Ventricular pacing & defibrillation

- Dual-Chamber ICDs

- Atrial + ventricular pacing

- Biventricular/CRT-D ICDs

- Cardiac resynchronization therapy + defibrillation

- Subcutaneous ICDs (S-ICD)

- Non-transvenous implantation

- Others (specialty/pediatric ICDs)

By Battery Technology

- Lithium-Ion

- Lithium Silver Vanadium Oxide

- Others

By End-User/Treatment Setting

- Hospitals/Cardiac Centers

- Ambulatory Surgical Centers

- Specialty Clinics

- Other

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting