What is Individual Health Insurance Market Size?

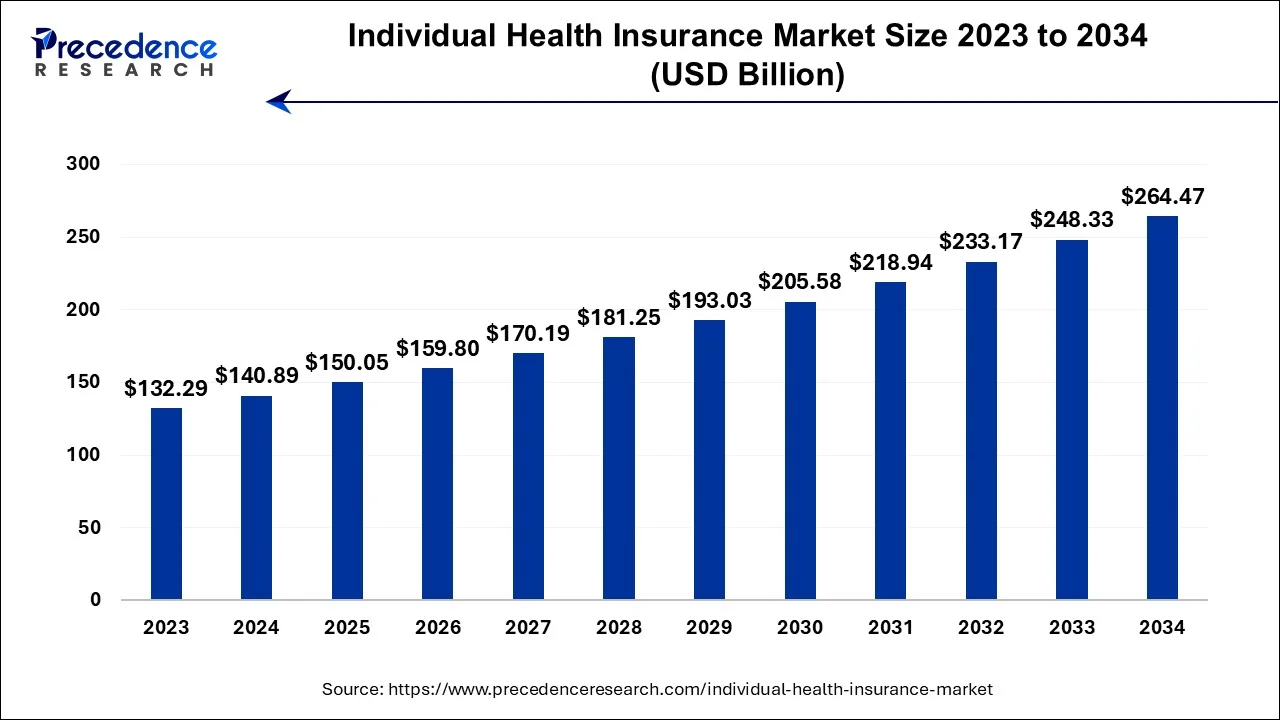

The global individual health insurance market size accounted for USD 150.05 billion in 2025 and is anticipated to reach around USD 279.95 billion by 2035, expanding at a CAGR of 6.43% between 2026 to 2035.

Market Highlights

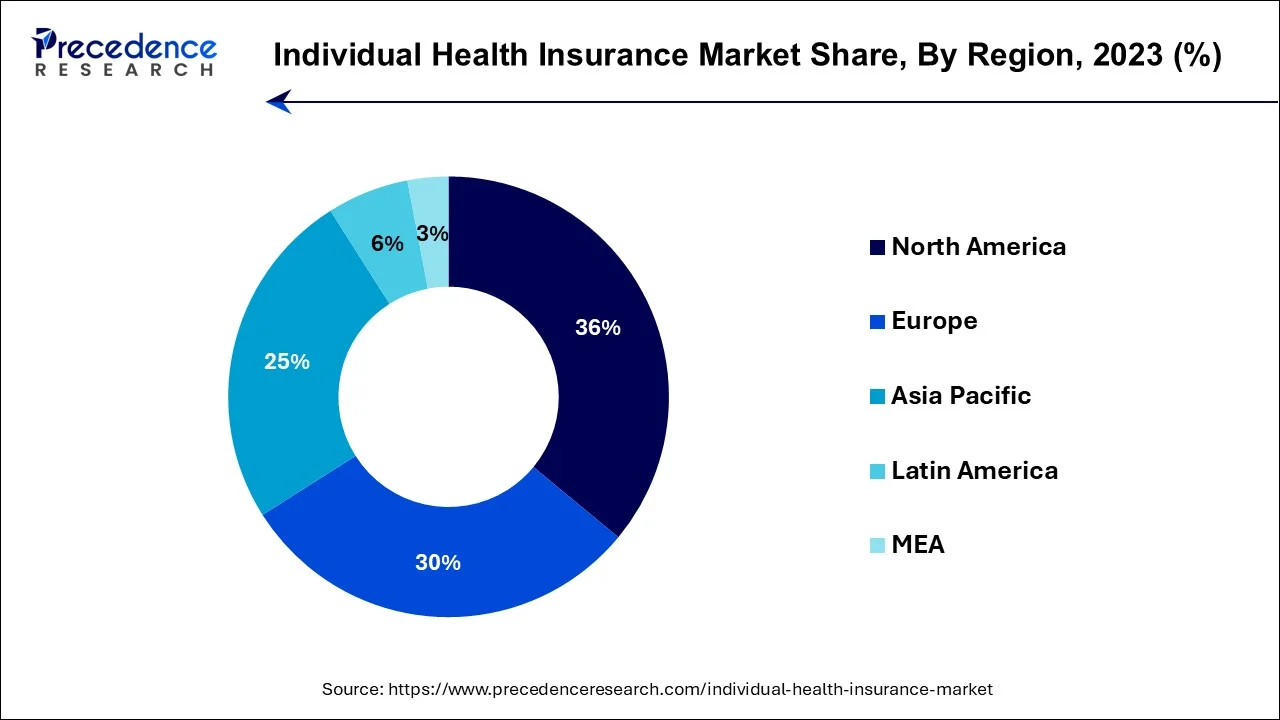

- North America contributed more than 36% of the revenue share in 2025.

- Asia Pacific is estimated to expand the fastest CAGR between 2026 to 2035

- By Type, the health maintenance organization (HMO) segment has held the largest market share of 44% in 2025.

- By Type, the preferred provider Organization (PPO) segment is anticipated to grow at a remarkable CAGR of 8.5% between 2026 and 2035.

- By Application, the individual coverage segment generated over 39% of revenue share in 2025.

- By Application, the student health insurance segment is expected to expand at the fastest CAGR over the projected period.

- By Policy, the basic health policies segment had the largest market share of 48% in 2025.

- By Policy, the comprehensive health policies segment is expected to expand at the fastest CAGR over the projected period.

Individual Health Insurance: Personalized Protection for Medical Expenses and Peace of Mind

Individualhealth insuranceis a personal insurance policy that people buy to safeguard themselves against medical costs. Unlike group plans provided by employers, individuals directly purchase this coverage. It usually includes doctor visits, hospital stays, prescription medications, and preventive care.

Policyholders pay monthly premiums and may face deductibles, copayments, and coinsurance. It's crucial for self-employed individuals or those ineligible for employer-based plans, to offer financial protection and healthcare access as needed. It usually includes doctor visits, hospital stays, prescription medications, and preventive care. Policyholders pay monthly premiums and may face deductibles, copayments, and coinsurance.

Individual Health Insurance Market Growth Factors

- The Individual health insurance market offers personalized medical coverage for individuals, safeguarding them from healthcare expenses.

- It is distinct from group insurance plans and is directly purchased by policyholders.

- Coverage typically includes doctor visits, hospital stays, prescription drugs, and preventive care.

- Policyholders pay monthly premiums and may encounter deductibles, copayments, and coinsurance.

- Growth drivers include a rising number of self-employed individuals, increasing healthcare costs, and demand for personalized healthcare.

- Industry trends include the expansion of coverage to include dental, vision, and maternity benefits for more comprehensive healthcare solutions.

- Challenges in the industry involve regulatory changes, premium affordability, and market competition.

- Business opportunities lie in innovative product development, such as incorporating digital health services and wellness programs.

- Adapting to changing consumer preferences and regulatory complexities is crucial for individual health insurance providers to meet the evolving demands of policyholders.

- Market Expansion: The individual health insurance market has witnessed expansion as more individuals seek coverage due to the changing landscape of healthcare and the need for protection against medical expenses.

- Technological Advancements: With the integration of technology, there is a growing opportunity for insurers to enhance customer experiences through digital platforms, telehealth services, and data-driven insights, thereby improving service efficiency and customer satisfaction.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 150.05 Billion |

| Market Size in 2026 | USD 159.80 Billion |

| Market Size by 2035 | USD 279.95 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 6.43% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increased self-employment and consumer awareness

Increased self-employment has significantly contributed to the surge in demand for individual health insurance. As the gig economy and freelance work continue to grow, more people find themselves without employer-sponsored health plans. In response, they turn to individual health insurance to secure their healthcare needs. This trend is further amplified by the COVID-19 pandemic, which prompted a wave of job losses and spurred many individuals to pursue self-employment or freelance work. This shift in employment dynamics underscores the crucial role of individual health insurance in ensuring access to healthcare services and protecting against unexpected medical expenses.

Consumer awareness is another potent driver. Individuals are becoming increasingly conscious of the financial vulnerabilities associated with unforeseen healthcare costs. The COVID-19 pandemic heightened this awareness, as it underscored the importance of having reliable health insurance coverage. This awareness prompts more individuals to actively seek out and purchase individual health insurance policies to safeguard their financial well-being and ensure access to quality healthcare. The synergy between increased self-employment and rising consumer awareness fuels the growth of the individual health insurance market as more people recognize the necessity of having personal coverage in today's dynamic employment landscape.

Restraint

Pre-existing conditions and limited coverage options

Pre-existing conditions and limited coverage options present significant restraints to the market demand for individual health insurance. These conditions refer to health issues or ailments that individuals have before seeking insurance. Many insurance providers may either deny coverage or impose high premiums on individuals with pre-existing conditions, discouraging potential policyholders and limiting their access to essential healthcare protection. This exclusion can be particularly burdensome for individuals who require ongoing medical care, as it may leave them with limited or unaffordable insurance options, hindering market growth.

Additionally, the limited coverage options available in the individual health insurance market can deter potential buyers. Some plans may lack comprehensive coverage, leaving individuals with gaps in their healthcare protection. This limited scope may not meet the diverse and evolving healthcare needs of policyholders, further reducing the appeal of individual health insurance. As a result, addressing these challenges, such as finding ways to provide affordable coverage for those with pre-existing conditions and expanding comprehensive coverage options, is essential to foster market demand and ensure individuals have access to vital healthcare protection.

Opportunity

Digital health integration and wellness programs

The integration of digital health solutions and wellness programs is revolutionizing the individual health insurance market, significantly boosting market demand. The integration of digital health, such as telehealth services, mobile health apps, and wearable devices, offers policyholders convenient access to healthcare resources. This improves the overall customer experience and appeals to tech-savvy individuals, motivating them to invest in health insurance that aligns with their preference for accessible and technology-driven healthcare solutions.

Furthermore, wellness programs integrated into insurance policies incentivize healthier lifestyles and preventive care. Insurers frequently provide incentives such as discounts, rewards, or lower premiums to policyholders who actively participate in wellness activities, such as exercise routines, dietary plans, or regular health check-ups. This not only promotes a healthier and proactive approach to healthcare but also attracts more individuals to enroll in health insurance, lured by the potential financial advantages. As a result, the integration of digital health tools and wellness programs transforms individual health insurance from a reactive safety net into a proactive, holistic healthcare solution, thus surging market demand by appealing to a broader consumer base.

Segment Insights

Type Insights

According to the type, the health maintenance organization (HMO) segment has held 44% revenue share in 2025. A health maintenance organization (HMO) is a type of health insurance plan that emphasizes cost-effective healthcare delivery. HMO policyholders are required to select a primary care physician (PCP) and typically need referrals from the PCP to access specialist care. These plans often have lower premiums and out-of-pocket costs, making them attractive to budget-conscious individuals. A trend in the individual health insurance market concerning HMOs is their continued popularity due to affordability and controlled costs. However, some individuals are seeking greater flexibility, which has led to the emergence of more versatile plan options.

The Exclusive Provider Organization (EPO) segment is anticipated to expand at a significant CAGR of 8.5% during the projected period. An exclusive provider organization (EPO) is a type of individual health insurance plan that offers coverage exclusively within a network of healthcare providers. EPO policies do not require policyholders to choose a primary care physician or obtain referrals for specialist care. These plans provide flexibility in terms of where and how individuals receive healthcare while still offering cost savings when using in-network providers. In the individual health insurance market, EPOs have gained traction as they strike a balance between affordability and choice, allowing policyholders to access a wide range of healthcare services within the network without a primary care gatekeeper. However, consumers must remain mindful of staying within the defined network to maximize cost benefits.

Application Insights

Based on application, the individual coverage segment held the largest market share of 39% in 2023.Individual coverage in the individual health insurance market refers to policies designed for individuals and often their families. It offers personal medical protection, including doctor visits, hospital stays, prescription drugs, and preventive care. A trend in this segment involves the customization of coverage, allowing individuals to select plans that suit their unique healthcare needs and budgets. It also includes increased integration of digital health services to enhance the customer experience and improve accessibility to healthcare resources.

On the other hand, the student health insurance segment is projected to grow at the fastest rate over the projected period. Student health insurance focuses on providing coverage to students, often those pursuing higher education. These policies cater to the specific healthcare needs of students, offering coverage for illnesses, accidents, and preventive care. A trend in student health insurance is the inclusion of mental health services, recognizing the importance of addressing students' mental well-being. Additionally, universities and educational institutions increasingly offer these plans as part of their student services, expanding the reach of student health insurance in the market.

Policy Insights

In 2025, the basic health policies segment had the highest market share of 48% on the basis of the policy. Basic health policies in the individual health insurance market provide essential coverage, typically including hospital stays, doctor visits, and necessary medical treatments. These policies are suitable for individuals seeking fundamental protection at a lower cost. A trend in this category is the inclusion of telehealth services and prescription drug coverage to meet evolving healthcare needs. Basic policies are also experiencing greater consumer interest, especially among younger, healthier individuals looking for affordable options.

The comprehensive health policies segment is anticipated to expand fastest over the projected period. Comprehensive health policies, on the other hand, offer more extensive coverage, including additional services like dental, vision, and maternity benefits. These policies cater to individuals who want a broader array of healthcare services and are willing to pay higher premiums for comprehensive protection. A trend in comprehensive policies is the focus on preventative care and wellness programs, aligning with the growing importance of proactive health management in the insurance industry. Overall, the individual health insurance market continues to offer a range of policy options to accommodate diverse healthcare needs and preferences.

Regional Insights

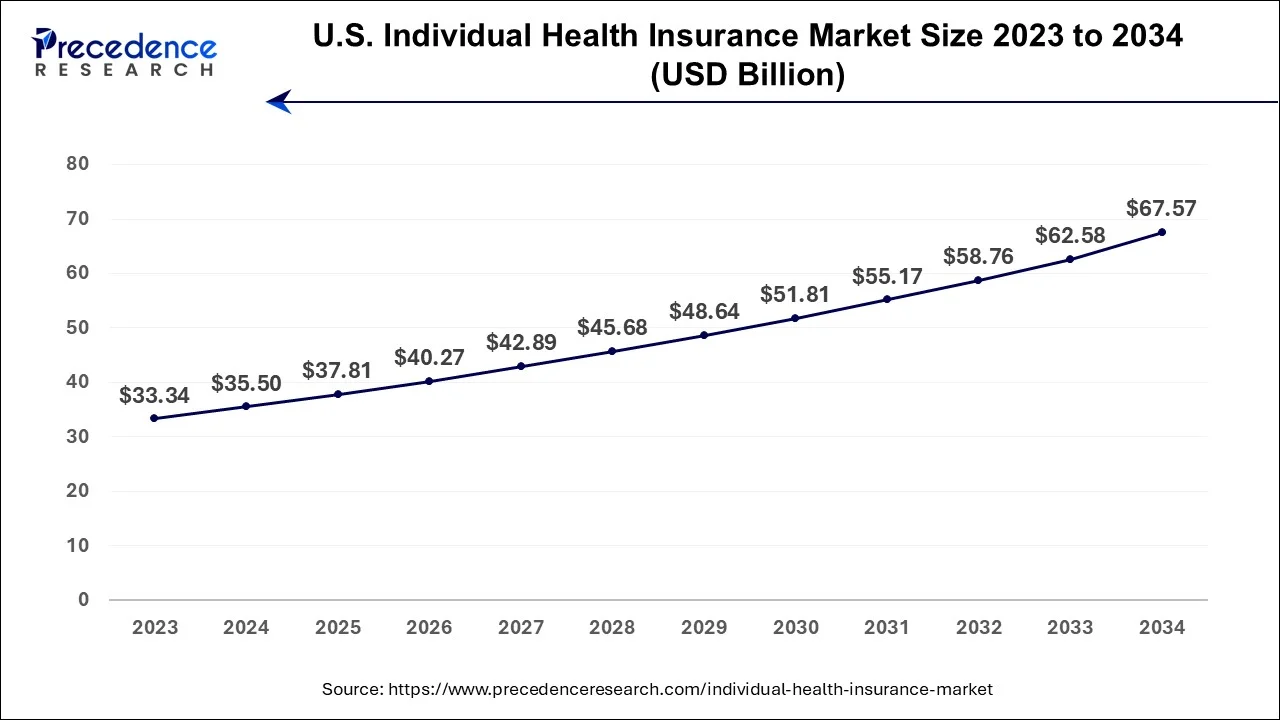

U.S. Individual Health Insurance Market Size and Growth 2026 to 2035

The U.S. individual health insurance market size ie estimated at USD 37.81 billion in 2025 and is expected to be worth around USD 71.78 billion by 2035, registering a CAGR of 6.62% between 2026 to 2035

North America has held the largest revenue share 36% in 2025. In North America, the individual health insurance market has witnessed a growing demand for innovative insurance solutions. Telehealth adoption has surged, making healthcare more accessible and driving insurers to provide digital health integration. Additionally, the pandemic has underscored the importance of comprehensive coverage, with individuals seeking plans that include COVID-19-related expenses. Regulatory changes have facilitated access to coverage during economic uncertainties. The market in North America continues to evolve with a focus on technology-driven services and adaptable insurance products.

Why is Asia Pacific Growing at the Fastest Rate in the Market?

Asia-Pacific is estimated to observe the fastest expansion. In the Asia-Pacific region, individual health insurance has experienced increasing popularity due to rising healthcare costs and an expanding middle class. There's a growing trend toward customizing policies to suit specific healthcare needs. Moreover, digital health solutions, including mobile apps and telemedicine, have gained prominence. As the region becomes more urbanized and health-conscious, insurers are tapping into this market by offering comprehensive coverage and wellness programs. Regulatory changes and a shift toward preventive healthcare measures are shaping the Asia-Pacific Individual Health Insurance market.

Why is Europe Considered a Significant Region?

In Europe, the individual health insurance market reflects a diverse landscape with variations in regulatory frameworks across countries. The market emphasizes comprehensive coverage, including pandemic-related expenses. Digital health integration and telemedicine services have gained traction, enhancing healthcare accessibility. The region's commitment to universal healthcare systems influences individual insurance preferences, with many opting for supplementary coverage. Europe's Individual Health Insurance market exhibits adaptability in response to shifting healthcare needs and regulatory nuances.

U.S. Individual Health Insurance Market Analysis

The U.S. market is growing due to rising healthcare costs, increased demand for personalized and comprehensive coverage, and greater awareness of preventive care. Telehealth adoption, pandemic-related healthcare needs, and supportive regulatory changes also drive market expansion. Moreover, there is a rising demand for flexible plans that address evolving health concerns and financial protection, which contribute to market growth.

India Individual Health Insurance Market Analysis

India's market is expanding due to rising healthcare costs, increasing health awareness, and a growing middle-class population. The demand for personalized and comprehensive coverage, digital health solutions, and telemedicine services is rising, leading to an increased need for comprehensive coverage. Government initiatives, regulatory reforms, and the need for financial protection against medical expenses further fuel the market's growth.

UK Individual Health Insurance Market Analysis

The UK market is expanding due to rising demand for private healthcare access, increasing awareness of preventive care, and the need for quicker treatment options beyond the public healthcare system. Growing adoption of digital health services and telemedicine, along with flexible and comprehensive insurance plans, is further supporting market growth. In addition, a supportive regulatory environment is encouraging the expansion of individual health insurance across the region.

Top Companies in the Market & Their Offerings

- Aetna: Provides comprehensive individual and family health insurance, including medical, dental, and wellness programs, focusing on preventive care and personalized healthcare solutions.

- Humana Inc.: Offers individual health plans, Medicare Advantage, and wellness programs, emphasizing chronic disease management, preventive care, and digital health services.

- Cigna Corporation: Delivers individual health insurance, global medical coverage, and wellness solutions, integrating telehealth, preventive care, and personalized support.

- Kaiser Permanente: Provides integrated healthcare and insurance plans, combining medical services, preventive care, and digital health tools for a seamless patient experience.

- Blue Cross Blue Shield Association: Offers a network of individual health insurance plans, covering medical, dental, and wellness programs, focusing on accessibility and preventive care.

- WellCare Health Plans: Specializes in individual and Medicare health plans, emphasizing affordable coverage, preventive services, and chronic condition management.

- Centene Corporation: Provides individual and government-sponsored health insurance, including Medicaid and Medicare plans, with a focus on affordable, accessible, and comprehensive healthcare solutions.

Other Individual Health Insurance Market Companies

- UnitedHealth Group

- Anthem, Inc.

- Molina Healthcare

- Health Care Service Corporation (HCSC)

- Highmark Inc.

- Independence Blue Cross

- Regence BlueCross BlueShield

- Ambetter

Recent Developments

- In March 2025, Prudential Group Holdings (UK) and Vama Sundari Investments (Delhi) Pvt. Ltd., an HCL Group promoter, formed a joint venture to launch a standalone health insurance business in India, targeting the country's expanding market and supporting the government's “Insurance for All by 2047” initiative (Source: https://www.prudentialplc.com)

- In February 2025, Bajaj Allianz introduced HERizon Care, India's first comprehensive women-focused health insurance plan, offering specialized benefits through two main covers: Vita Shield and Cradle Care, addressing women's unique healthcare needs in a single policy.(Source:https://bfsi.economictimes.indiatimes.com)

- In 2023, WTW unveiled Neuron, a high-tech digital insurance platform. Neuron enhances connectivity between underwriters and brokers, streamlining operations through digitization, automation, and data optimization, thereby expediting processes and reducing costs in the insurance industry.

- In 2023, Adobe collaborated with Hong Kong's leading digital life insurer, Blue Insurance Limited, to elevate digital customer experiences in the insurance industry. Blue will leverage Adobe's Experience Cloud, including RT-CDP and CJA, to foster engaging and personalized interactions with a holistic view of customers.

- In 2023, Microsoft and Majesco formed a strategic alliance to enable insurers to undergo digital transformation. Using Microsoft Cloud and Analytics, this partnership provides a secure, scalable, and intelligent cloud ecosystem for customers.

- In 2023, DXC Technology partnered with Polo Managing Agency (PMA) in the Lloyd's insurance market. PMA will adopt DXC Assure Commercial and Specialty, leveraging DXC's AI and ML-powered insurance platform for enhanced capabilities and efficiency.

Segments Covered in the Report

By Type

- Health Maintenance Organization (HMO)

- Preferred Provider Organization (PPO)

- Exclusive Provider Organization (EPO)

- High Deductible Health Plan (HDHP)

- Others

By Application

- Individual Coverage

- Family Coverage

- Senior Coverage

- Student Health Insurance

- Others

By Policy

- Basic Health Policies

- Comprehensive Health Policies

- Short-term Health Policies

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting