What is the Inductor Market Size?

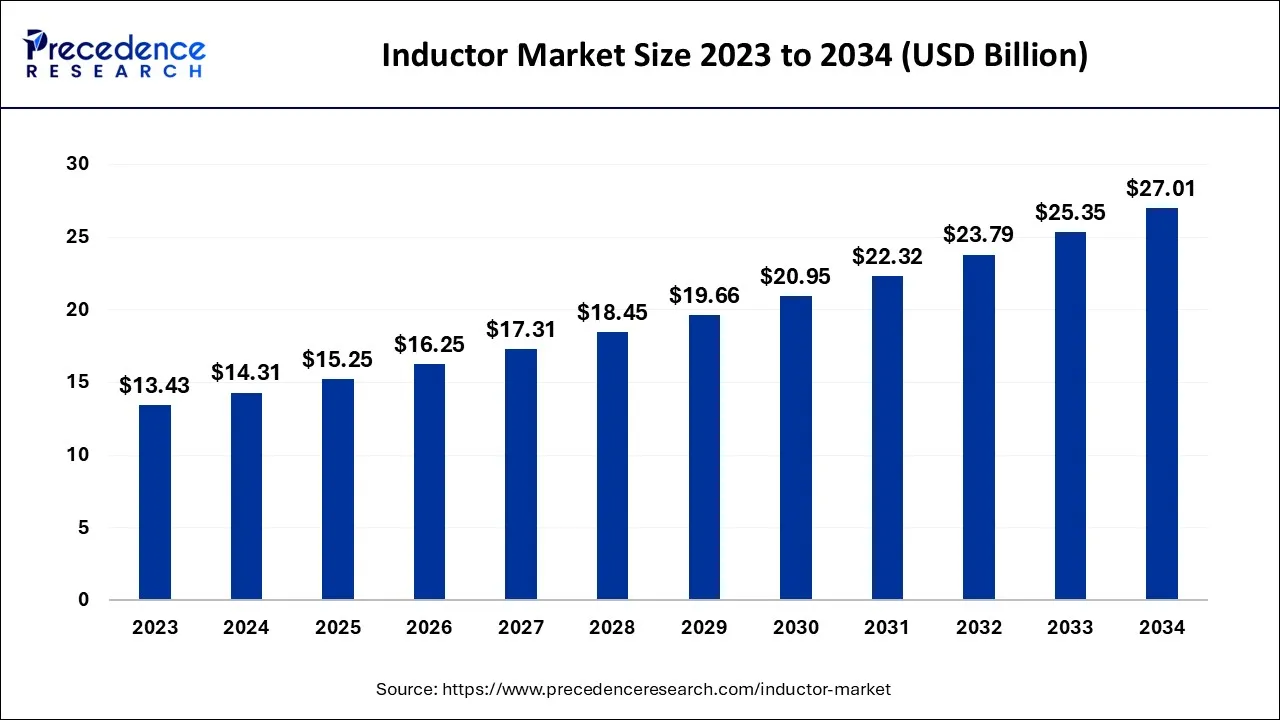

The global inductor market size is calculated at USD 15.25 billion in 2025 and is predicted to increase from USD 16.25 billion in 2026 to approximately USD 28.60 billion by 2035, expanding at a CAGR of 6.49% from 2026 to 2035.

Inductor Market Key Takeaways

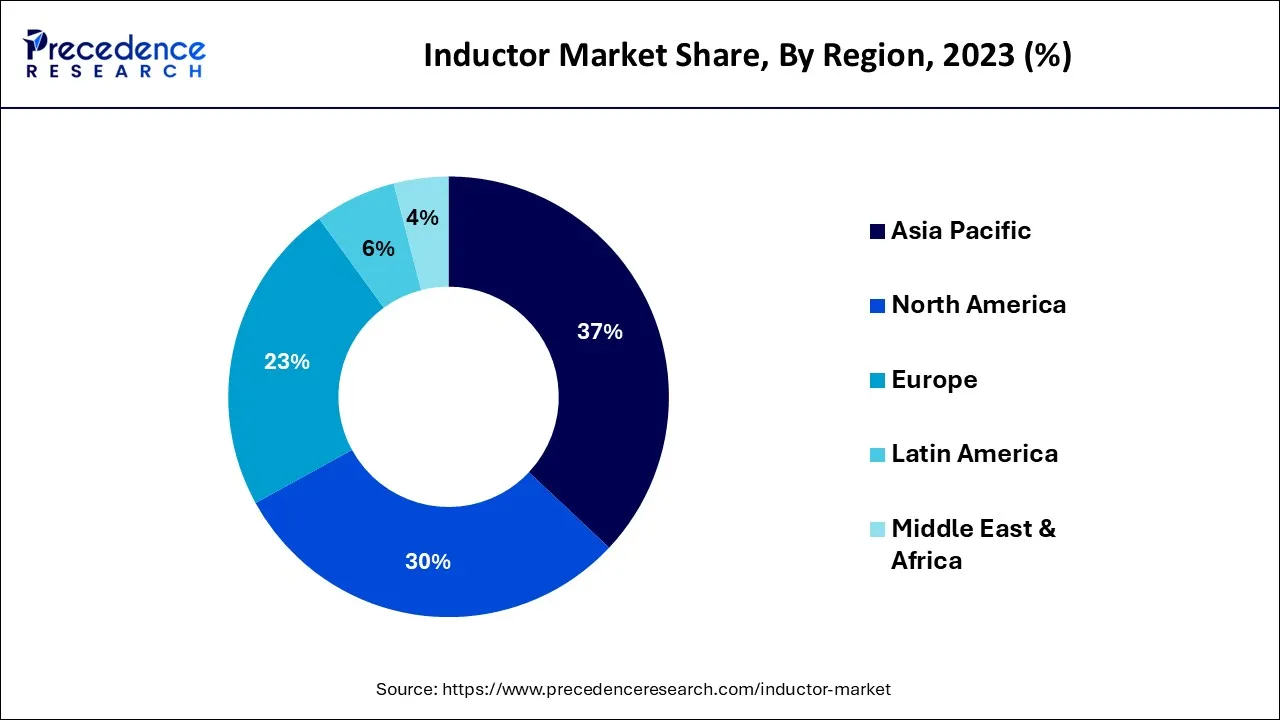

- Asia Pacific led the global market with the highest market share of 37% in 2025.

- By core type, the ferromagnetic Or ferrite core segment registered the maximum market share in 2025.

- By application, the power application segment has held the highest market share in 2025.

Strategic Overview of the Global Inductor Industry

Regional revenue generation consists of significant infrastructure, economic growth and financial development. Additionally, export and import, domestic production, and consumption patterns have aided market participants in identifying and seizing opportunities. The quantitative and qualitative parameters included in the report, with in-depth analysis, also highlight the market's motivating and inhibiting factors.

The increase in developments and innovations in consumer electronic products are significant factors anticipated to propel the expansion of the inductor market during the forecast period. Further expected growth drivers for the inductor market include the popularity of smart homes and smart city homes, which call for energy-efficient electronic and electrical systems. Additionally, it is predicted that advancements in telecommunication and chip integration will temper market growth for inductors. On the other hand, it is further anticipated that variations in the price of raw materials, particularly copper, will impede the expansion of the inductor market during the timeline period.

Additionally, as the demand for wireless and connected devices rises, there may be more chances for the inductor market to expand in the years to come. The future expansion of the inductor market, however, may be further hampered by the increased complexity brought on by inductors' miniaturization.

Artificial Intelligence: The Next Growth Catalyst in Inductor

Artificial Intelligence is fundamentally impacting the inductor industry by enabling predictive analytics, optimizing manufacturing processes, and enhancing product design through advanced simulation. AI-driven simulation tools help engineers explore vast design spaces and quickly identify optimal solutions that balance electrical performance, thermal stability, and size constraints, drastically reducing time-to-market and prototyping costs.

In manufacturing, AI and automation are crucial for smart factories, enhancing quality control, enabling predictive maintenance to minimize downtime, and optimizing supply chain logistics to meet fluctuating demands.

Market Outlook

- Market Growth Overview: The inductor market is expected to grow significantly between 2026 and 2035, driven by automotive electrification, 5G infrastructure and telecommunication, and a boom in demand for data centers and AI servers, for cloud computing and big data analytics, necessitating high-performance power inductors for power supply units and regulators.

- Sustainability Trends:Sustainability trends involve the use of recycled and eco-friendly materials, regulatory compliance, and green manufacturing practices.

- Major Investors: Major investors in the market include TKD Corporation, Murata Manufacturing Co., Ltd., Vishay Intertechnology, Inc., Taiyo Yuden Co., Ltd., and Chilisin Electronics Corp.

- Startup Economy:The startup economy is focused on innovative materials, advanced manufacturing processes, and specialized design software that addresses the complex needs of emerging technologies like electric vehicles, artificial intelligence, and 5G infrastructure.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 15.25 Billion |

| Market Size in 2026 | USD 16.25 Billion |

| Market Size by 2035 | USD 28.60 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 6.49% |

| Largest Market | Asia-Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type, By Inductance, By Core Type, By Application, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Consumer electronic products are developing and innovating more frequently.

Consumer electronics is a dynamic industry and is changing quickly, with increasing levels of market competitors in the market and game-changing technological advancements. The features and quality of buyer electronic device products are improving thanks to these technological advancements and innovations. Additionally, they are anticipated to increase the overall volume of inductors used in the consumer electronics sector.

Due to their small size, power inductors, high current capacity, and favourable DC characteristics are used more frequently in consumer electronics. The consumer electronics industry uses other inductor types, including air-core inductors, RF inductors, and multi-layered inductors. The adoption of inductors has been accelerated by manufacturers' increased focus on new technologies and the popularity of key emerging technologies like the Internet of Things (loT) and artificial intelligence (AI). The expansion of the inductor market has also been fueled by the incorporation of network technologies like GSM, LTE, 3G, 4G, and 5G in numerous electronic products.

Restraint

Raw materials' fluctuating costs, particularly those of copper

Due to characteristics like high electrical connectivity and significant power losses, inductors are typically constructed from iron, copper, and ferrite. Copper has excellent mechanical and thermal properties, which is why copper coils are used. The production of inductors frequently uses this as a raw material.

The copper line thickness must be kept to a minimum, and the metal pattern density must be as consistent as possible when producing inductors. Any hiccups in a region's mining operations can significantly impact copper prices worldwide. Landslides and other natural disasters are relatively common in mining regions, as are frequent mine worker strikes. Weather, season, political unrest, and transportation problems can reduce regional supplies and raise copper prices.

Opportunity

Increasing use of electric vehicles

The production of electric vehicles has increased significantly in recent years and is anticipated to do so even more in the years to come. The rate of electronic vehicle development has also increased considerably. Since more people are driving electric cars, advanced driver assistance systems and connected vehicles will become more common, expanding the usage of electronic components.

Many significant automakers and recently emerging automakers have increased the volume of electric vehicle production in response to increasingly stringent environmental regulations, which are anticipated to increase the requirement for passive components. These electric cars run on Al and loT and are outfitted with cutting-edge technology. In the upcoming years, it is anticipated that demand for inductors will rise as electric vehicles become more widely used.

Challenges

Growing complexity as a result of inductors' miniaturisation

The products' dimensions are shrinking steadily, and their corresponding functions are improving. The shape of mobile devices that offer sophisticated, complex processes is continuously decreasing. Reduced shape and thickness are required for these devices, including smartwatches, wristband-style wearables, and loT devices like sensor network devices. These devices also need highly efficient power supply circuits for longer operating times.

Wearables like smartwatches are becoming smaller and thinner, which has resulted in a rise in the usage of multi-core processors and faster processors for better performance. This makes it possible for all components, including inductors, to become smaller. Therefore, it is also necessary to reduce the size of multi-layered chip inductors while maintaining high Q ratings. However, keeping tolerances dimensional and long-term reliability gets more complicated as feature sizes decrease.

PDAs, Wireless handsets, and other portable electronic devices are continuously getting smaller and more complicated to use. As a result, they present design difficulties because the originally rated current and DC resistance must remain unchanged when an inductor's size is reduced.

However, it becomes more challenging to maintain long-term reliability and dimensional tolerances as feature sizes decrease.

Segment Insights

Type Insights

Many stacked coils that are wound around the core make up multilayer inductors. These inductors have a high inductance level because there are many layers of insulation separating them, which raises demand for the product based on different use cases and increases sales of the product.

Inductance Insights

Inductors will increasingly be used in automotive electronics, and demand for passive electronic components will rise quickly. On the other hand, this market will experience slow growth due to factors like inconsistent raw material price changes. Variable inductors' advantages of lightweight and compact size have increased their popularity inside TVs and radios, which has ultimately opened up a potential application for them and will create new market opportunities.

The Fixed Inductor is a passive electronic component for magnetic field-based energy storage. The turns are fixed in position for one another due to the way the coils are wound in the fixed inductor.

To separate different frequency signals, fixed inductors are used in electronic filters. They are also combined with capacitors to create tuned circuits that tune TV receivers and radios. These parts are widely used in many sectors, including the power, military & defence sector, automotive, consumer electronics, and Radio Frequency & telecommunication.

Core Type Insights

Iron core and air core inductors have the low-frequency operation, higher losses, and low inductance. However, they have high permeability, fixed value, and high inductance, ferrite core inductors. As a result, ferrite core inductors are widely used and regarded as a superior solution to overcome this issue.

Application Insights

The rise of hybrid and battery-powered technologies in the automotive sector can be used to justify the demand for power inductors because these advancements would necessitate more ECUs. The power inductors' excellent packaging and saturation properties are ideal for supplying the growing demand for powertrain technology. Computers, Mobile phones, and telecommunications equipment can all use the newly released power inductors from the Lmax series. The market for power inductors will increase due to their numerous applications across numerous industry sectors.

For general circuits, various kinds of inductors are utilised. Filters and oscillators are standard components in circuits. Car audio systems, Car navigation systems, and body control equipment like wipers and power windows are additional examples of general circuits. Analog circuit filters and signal processing filters are frequently made with inductors, resistors, and capacitors. An inductor alone can function as a low-pass filter because its impedance rises as a signal's frequency increases. Combining capacitors and inductors can be used to create oscillators. The LC oscillator is one of the most popular oscillator types, producing a continuous periodic waveform. Since they are simple to use and have excellent phase noise characteristics, LC oscillators are frequently utilised in radio-frequency circuits.

End User Insights

Automotive inductors are constructed from a coil winding with two terminals through which flux is passed. The inductive current is a function of the flux density through the coil. A current is induced in the coil by flux passing through it, causing a voltage drop around the coil. One of the key factors driving the market growth for automotive inductors is their current regulation feature, which stabilises the electric circuits in cars. The design of high-end inductors that function under harsh temperature conditions without suffering appreciable downtime represents an important development in the market for automotive inductors. As a result, the market for automotive grade induction will experience rapid growth. This raises the productivity level of the vehicle parts.

Regional Insights

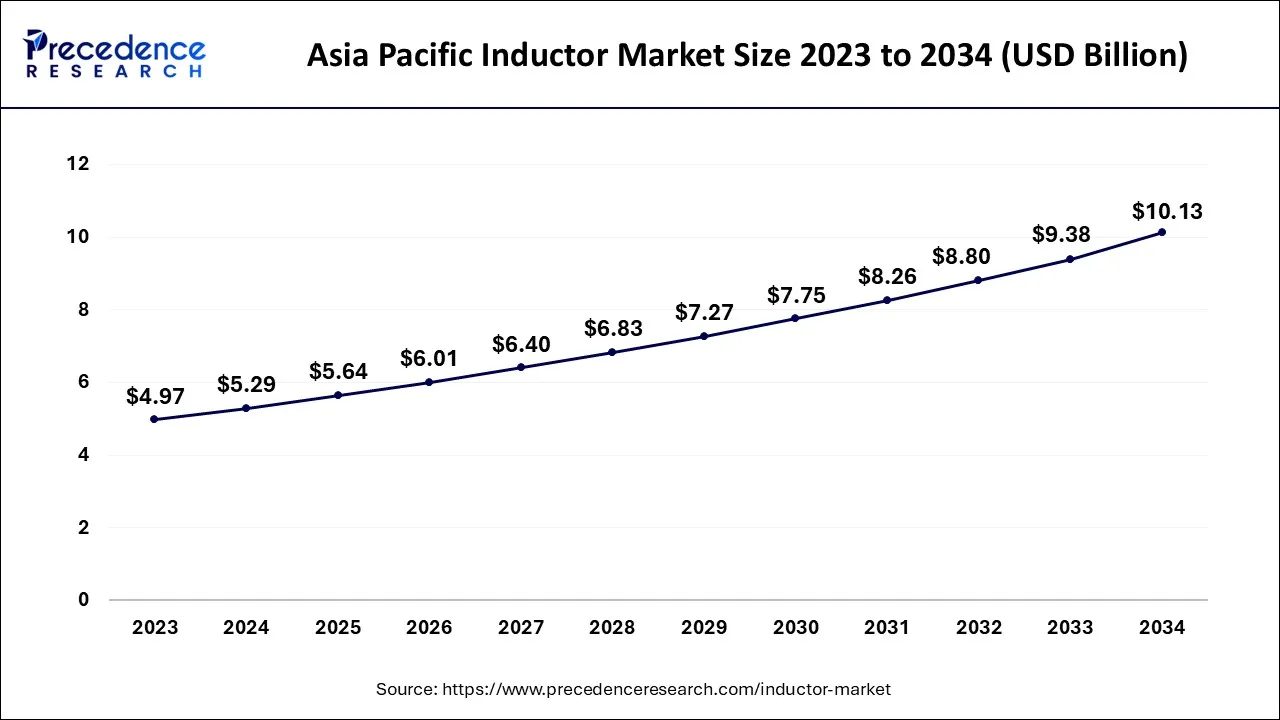

Asia Pacific Inductor Market Size and Growth 2026 to 2035

The Asia Pacific inductor market size is exhibited at USD 5.64 billion in 2025 and is projected to be worth around USD 10.77 billion by 2035, growing at a CAGR of 6.68% from 2026 to 2035.

Asia-Pacific accounted for a sizeable portion of the global market, roughly 37% in the regional analysis of the worldwide inductor market.Furthermore, it is anticipated that the Asian market will likely maintain its dominance for a predetermined amount of time. This area is renowned for housing a sizable concentration of consumer electronics producers.

China Inductor Market Trend

China's market is experiencing robust growth driven by massive domestic demand from the rapidly expanding EV and 5G infrastructure sectors. The market thrives on continuous technological innovation focused on miniaturization and high-performance components suitable for consumer electronics and automotive applications.

Additionally, these inductors are crucial in producing consumer devices and automobiles. Due to increased investment in the consumer automotive and electronics industries by nations like China, South Korea, India, and Japan, the inductor market in this region has seen a significant increase in demand for its products.

The North American inductor market, which accounts for roughly 28.93% of global sales, is the second-largest after the Asia-Pacific region.The rapid expansion of industrial automation, the rising adoption of smartphones and tablets & tablets, and the existence of an already well-established ICT industry are the main factors propelling the increase in the target market in this region.

U.S. Inductor Market Trend

In the U.S. market, there is high demand from the automotive electrification, 5G infrastructure, and AI data center sectors. This expansion is supported by continuous technological innovation focusing on component miniaturization and high performance. Government initiatives like the CHIPS Act are encouraging domestic production and nearshoring to mitigate supply chain volatility.

How did Europe gain a notable share in the Inductor Market?

Europe's strong automotive and industrial automation sectors which demand high-reliability and high-performance components for electrification and efficient power management. The region benefits from strong R&D capabilities in materials science, stringent environmental regulations, such as RoHS and WEEE, which further drive innovation towards sustainable and compliance, giving Europe a competitive edge in advanced inductor technology.

Germany Inductor Market Trends

Germany's market is driven by the automotive and industrial automation sectors, with a significant push for high-reliability components to support EV electrification and industrial modernization. The market prioritizes advanced, high-performance, and energy-efficient inductors, a result of strong domestic R&D and stringent quality standards.

Value Chain Analysis of the Inductor Market

Raw Material Sourcing & Processing (Inbound Logistics): This initial stage involves sourcing and processing fundamental raw materials such as copper wire, ferrite core materials, ceramic substrates, and other conductive and insulating materials.

Component Manufacturing & Production (Operations): This stage focuses on the core manufacturing processes, including winding wire onto cores, multilayer molding, thin-film deposition, and assembling the final inductor component using automated production lines and surface-mount technology (SMT).

- Key Players: TDK Corporation, Murata Manufacturing Co., Ltd., Taiyo Yuden Co., Ltd., Vishay Intertechnology, Inc., and Würth Elektronik GmbH.

Distribution & Sales (Outbound Logistics/Marketing & Sales): This stage involves marketing the inductors to original equipment manufacturers (OEMs) and managing the efficient logistics to ensure timely delivery to global production lines.

- Key Players: Arrow Electronics, Inc., Avnet, Inc., Future Electronics, TDK, and Vishay.

OEM Integration & Application (Service): Original equipment manufacturers integrate the inductors into their end products, such as smartphones, automotive systems, industrial equipment, and medical devices.

- Key Players: Apple, Samsung, Tesla, Bosch, and Siemens

Post-Sale Support & Life Cycle Management (Service): The final stage involves providing technical support, addressing quality issues, managing compliance with regulations (like RoHS), and handling end-of-life recycling and waste management.

Top Companies in the Inductor Market & Their Offerings

- Murata Manufacturing Co., Ltd.: A global leader in ceramic-based passive electronic components, Murata contributes by manufacturing miniaturized, high-frequency multilayer ceramic inductors crucial for smartphones, 5G devices, and automotive electronics.

- TDK Corporation:TDK is a dominant force in the market, offering a vast portfolio of products, including power inductors for automotive applications (via the acquired EPCOS brand), RF inductors for communication devices, and various ferrite components.

- SANYO Electric Co., Ltd.: While its component business has largely been absorbed by other entities (like Panasonic), Sanyo historically contributed to the market with various electronic components.

- Vishay Intertechnology, Inc.:Vishay contributes a broad range of inductor products, including wire-wound, power, and high-current inductors, catering to industrial, automotive, and medical applications.

- Chilisin Electronics Corp.: A major Taiwanese manufacturer, Chilisin specializes in magnetic components, contributing a wide variety of inductors, including high-current power chokes and chip inductors for consumer electronics, automotive, and networking applications.

- Houston Transformer Company, Ltd.:This company specializes in the design and manufacture of custom transformers and inductors, serving niche markets that require specialized, made-to-order components.

- Taiyo Yuden Co., Ltd.:Taiyo Yuden is a key player in high-frequency multilayer chip inductors, contributing essential components for smartphones, WiFi modules, and other high-frequency communication devices.

- TT Electronics:TT Electronics designs and manufactures a wide range of inductors and magnetic components for the defense, aerospace, medical, and industrial markets. Their contribution lies in providing highly reliable, customized solutions that meet rigorous safety and performance standards in specialized, mission-critical applications.

- Delta Electronics, Inc.:Delta is a major provider of power and thermal management solutions, contributing inductors that are part of their integrated power supply units for data centers, industrial systems, and automotive applications.

- ABC Taiwan Electronics Corporation: ABC Taiwan is a significant supplier of magnetic components, offering a variety of inductors for consumer electronics, networking, and industrial applications.

- Panasonic Corporation: Panasonic contributes to inductor with a strong focus on automotive applications and consumer electronics, offering power inductors, chip inductors, and specialized components.

- Coilcraft, Inc.: Coilcraft is a global leader in high-performance surface-mount and custom inductors, known for offering one of the industry's largest off-the-shelf component selections. Their contribution is centered on providing a wide range of precise, reliable components with rapid prototyping services for diverse customer needs.

- TOKIN Corporation (a Kemet Company, part of Yageo):TOKIN, now part of KEMET and the broader Yageo corporation, offers a range of magnetic components and inductors for IT, communication, and automotive applications.

- Pulse Electronics Corporation:Pulse Electronics, part of the OSE family, contributes a broad portfolio of magnetic components, including power inductors, current sense transformers, and RF components for networking, power management, and automotive applications. They specialize in high-volume, reliable components for complex electronic systems.

- Texas Instruments Incorporated: While primarily a semiconductor company, Texas Instruments contributes to inductor by designing power management integrated circuits (ICs) that are optimized to work with specific inductors.

- Shenzhen Sunlord Electronics Co., Ltd.:A major Chinese manufacturer, Sunlord contributes by providing a wide array of inductors and magnetic components for a rapidly growing domestic and international market, especially in consumer electronics, automotive, and telecommunications sectors.

- Sumida Corporation:Sumida is a global manufacturer of coil and magnetic components, contributing inductors for a wide range of applications, including automotive electronics, consumer devices, and industrial equipment. They are known for providing high-quality, customized solutions and extensive global manufacturing capabilities.

- Gowanda Electronics: Gowanda specializes in the design and manufacture of high-performance inductors and magnetic components for demanding markets such as aerospace, defense, medical, and test & measurement equipment.

- Ourns, Inc.: Ourns, also known as Ourns Enterprise, is a Taiwanese manufacturer of a variety of inductors, transformers, and magnetic components. They contribute by offering cost-effective and reliable components primarily for the consumer electronics and networking sectors.

- Ice Components, Inc.: Ice Components provides a range of inductors and transformers, focusing on offering standard components and custom magnetic solutions to industrial and electronics manufacturing customers.

- KEMET (part of Yageo): KEMET, a subsidiary of Yageo, contributes to inductor \ with a broad portfolio of components, including power inductors and filters for automotive, industrial, and consumer applications.

- AVX Corporation (part of Kyocera group): AVX, part of the Kyocera group, is a leading manufacturer of electronic components, contributing high-performance inductors for medical, aerospace, automotive, and industrial applications.

Recent Developments in the Inductor Industry

- In January 2025, Murata introduced the world's smallest 006003-inch size (0.16 mm x 0.08 mm) chip inductor, reducing the volume by 75% to support high-density mounting in mobile devices. Murata is making a consistent effort to reduce of chip sizes by integration of its proprietary core technologies. (Source: murata.com)

- In December 2025, TDK Corporation launched several new products for the automotive sector, including the CLT32 series for ADAS and EV power management, offering high current capability and a compact design. In December, the mass production of the product began. (Source: tdk.com)

- February 2022- With the addition of two new automotive-grade high current shielded inductors series, Bourns Inc. increased the mechanical resistance for challenging vibration application environments. Shielded inductors of the Model SRP1038WA and SRP1265WA series feature a wider side terminal lead frame that can withstand peak vibrations. The two series offered a small package, an extensive operating temperature range of -55 to + 165 °C, a high saturation current, a low buzz noise, a low DC, a low DC resistance, resistance, and excellent temperature stability. These inductors are perfect for power management and EMI filtering in a variety of consumer, automotive, industrial, and telecom electronics applications.

- August 2021- A brand-new line of chip inductors with a high Q value and a small size was unveiled by Bourns Inc. In comparison to multilayer or film technology, the CWF1610 and CWF2414 chip inductors' wire wound construction improved their performance characteristics for DC power line applications and RF signal processing.

- June 2020- In order to meet the high demand for inductor for notebooks and 5G smartphones, Chilisin Electronics Corp (VAGEO Corporation) increased capacity. With regard to small-size moulding chokes, the company has increased capacity to 600 million units, and also for large-size ones, to 300 million units. Additionally, the business intends to increase its monthly production of LTCC (Low Temperature Co-Fired Ceramic) components by half, to 200 million units.

Segments Covered in the Report

By Type

- Multilayered

- Film Type

- Molded

- Wire Wound

By Inductance

- Variable Inductors

- Fixed Inductors

By Core Type

- Iron Core

- Ferromagnetic Or Ferrite Core

- Air Core

By Application

- Power Applications

- General Circuits

- High-Frequency Applications

By End User

- Transmission And Distribution

- Automotive

- Military And Defense

- Consumer Electronics

- Industrial

- RF And Telecommunication

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting