Industrial Catalysts Market Size and Forecast 2025 to 2034

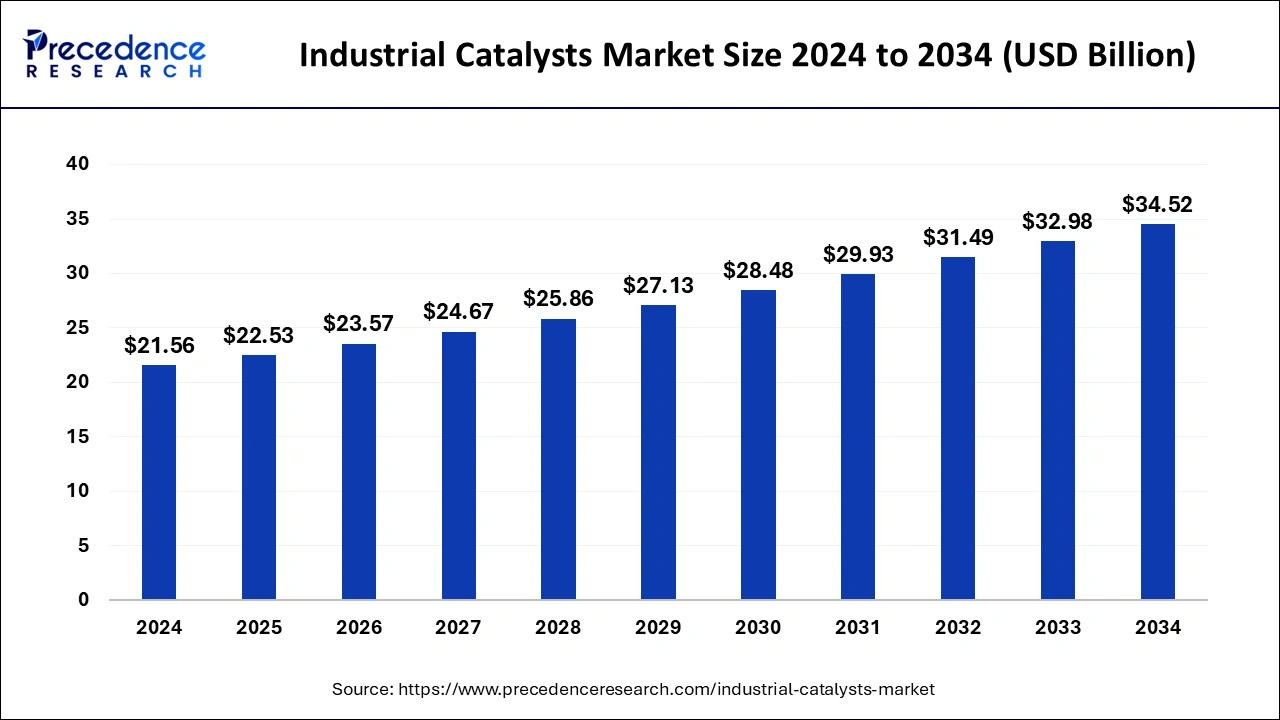

The global industrial catalysts market size accounted for USD 21.56 billion in 2024 and is expected to exceed around USD 34.52 billion by 2034, growing at a CAGR of 4.82% from 2025 to 2034.

Industrial Catalysts Market Key Takeaways

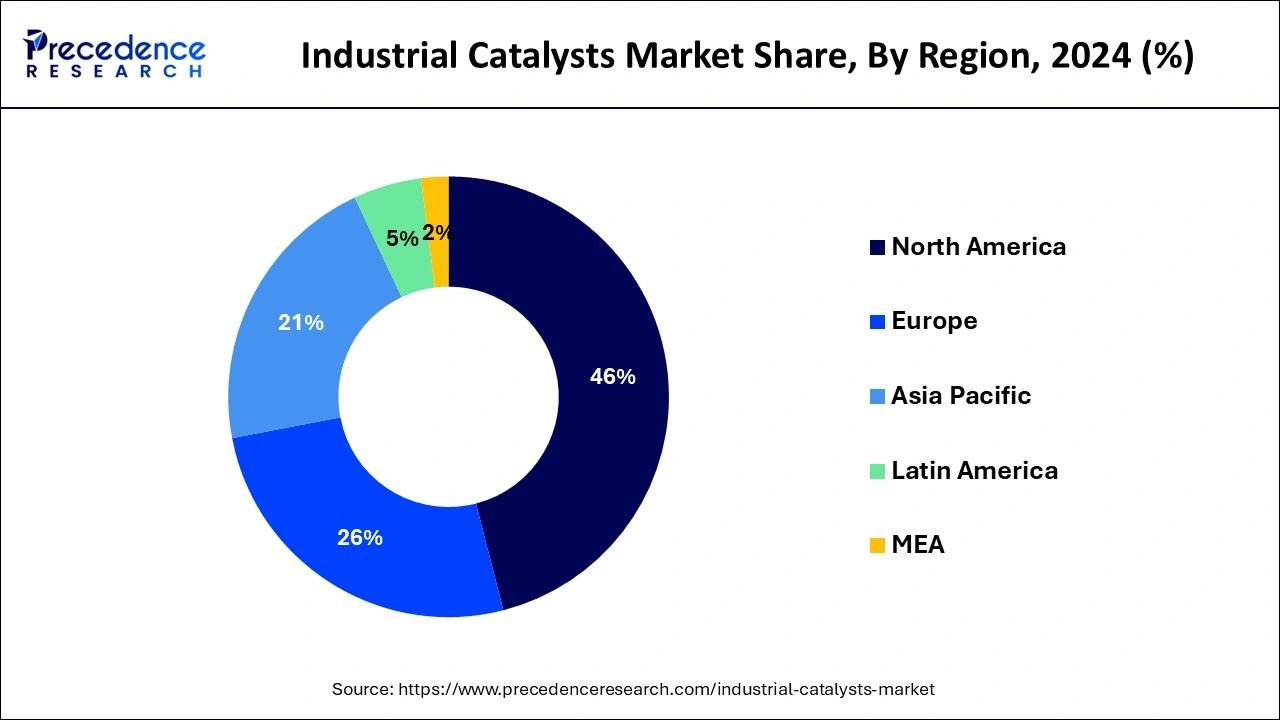

- The North America region contributed more than 46% of revenue share in 2024.

- Asia Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

- By material, the chemicals segment has held the largest market share of 62% in 2024.

- By material, the permanent magnet motor segment is anticipated to grow at a remarkable CAGR of 5.4% between 2025 and 2034.

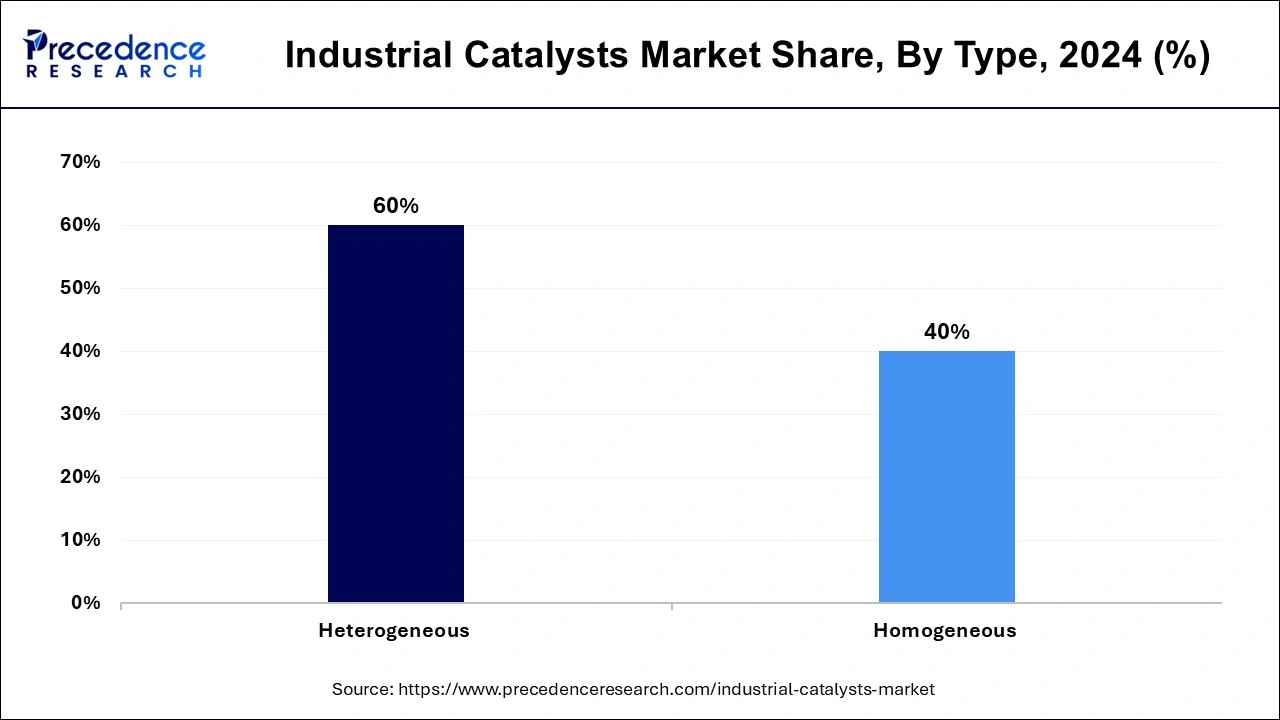

- By type, the heterogeneous catalyst segment generated over 60% of revenue share in 2024.

- By type, the homogeneous catalyst segment is expected to expand at the fastest CAGR over the projected period.

- By application, the chemical synthesis segment generated over 61% of revenue share in 2024.

- By application, the petrochemicals segment is expected to expand at the fastest CAGR over the projected period.

U.S. Industrial Catalysts Market Size and Growth 2025 to 2034

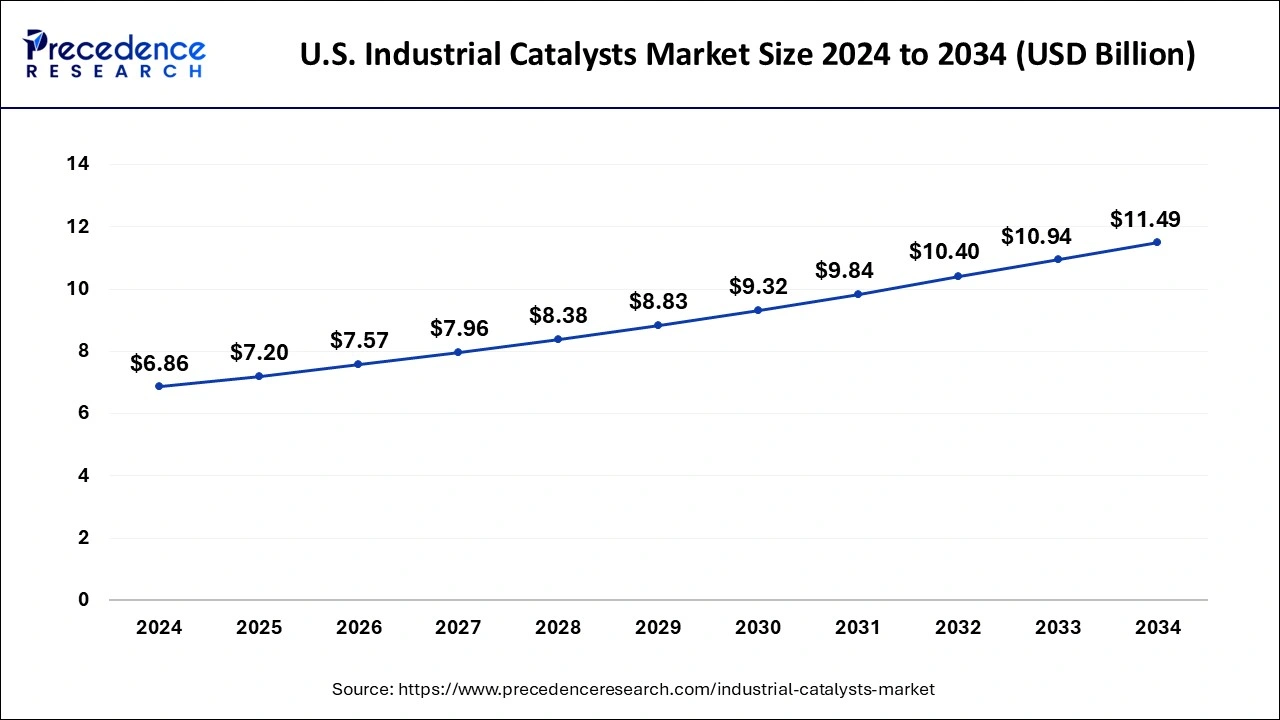

The U.S. industrial catalysts market was exhibited at USD 6.86 billion in 2024 and is projected to be worth around USD 11.49 billion by 2034, growing at a CAGR of 5.29% from 2025 to 2034.

North America has held the largest revenue share of 46% in 2024. North America holds a major share in the industrial catalysts market due to robust industrialization, a well-established petrochemical sector, and increasing investments in research and development. The region's focus on sustainable practices and stringent environmental regulations drives the demand for advanced catalyst technologies. Additionally, the presence of key market players and a high level of technological innovation contribute to North America's dominance. The demand for catalysts in applications like refining, chemicals, and automotive, coupled with a mature industrial landscape, solidifies the region's prominent position in the industrial catalysts market.

Asia Pacific is estimated to observe the fastest expansion. Asia Pacific dominates the industrial catalysts market due to robust industrialization, rising demand for petrochemicals, and a thriving manufacturing sector. The region's dynamic economic growth, particularly in countries like China and India, propels the demand for catalysts across diverse industries.

Additionally, favorable government initiatives, increasing investments in research and development, and the presence of key market players contribute to the region's major share. The evolving regulatory landscape and a focus on sustainable practices further drive the adoption of industrial catalysts, solidifying Asia-Pacific's leading position in the market.

Market Overview

Industrial catalysts are substances crucial to numerous chemical processes in industrial settings, expediting reactions by lowering the energy required for them. These catalysts are pivotal in enhancing the efficiency of processes such as petroleum refining, chemical production, and pharmaceutical synthesis. They function by providing an alternative reaction pathway with lower activation energy, making the processes more cost-effective and environmentally friendly.

Typical industrial catalysts include metals such as platinum, palladium, and nickel, as well as metal oxides and zeolites. In applications like petroleum refining, catalysts facilitate the transformation of complex hydrocarbons into valuable products like gasoline. Similarly, in chemical manufacturing, these catalysts are instrumental in producing essential compounds on a large scale. Ongoing research aims to enhance catalyst performance, durability, and environmental sustainability, driving advancements in industrial processes. The continuous development of industrial catalysts remains a key factor in optimizing the efficiency and sustainability of diverse chemical manufacturing processes on an industrial scale.

Industrial Catalysts Market Growth Factors

- Surging Petrochemical Needs: The rising global demand for materials like plastics is pushing the necessity for improved industrial catalysts in refining.

- Adherence to Environmental Standards: Strict environmental rules are steering the development of catalysts that make industrial processes cleaner and greener, aligning with regulatory requirements.

- Tech Upgrades: Continuous improvements in catalyst technology, including nanotech and new materials, are sparking innovation and enhancing the overall effectiveness of industrial catalysts.

- Coping with Energy Costs: Soaring energy prices are encouraging industries to adopt catalysts that streamline processes, cutting down on operational expenses.

- Pharmaceutical Boom: The expanding pharmaceutical sector is creating a need for specialized catalysts in the synthesis of medical compounds, contributing to market growth.

- Renewable Energy Emphasis: The push for renewable energy is propelling research in catalysts used for sustainable energy solutions, including biofuels.

- Growing Refinery Operations: Increased investments in oil and gas infrastructure are driving demand for catalysts in refining processes and hydroprocessing applications.

- Green Chemistry Adoption: The global shift towards sustainable manufacturing is boosting demand for eco-friendly catalysts, supporting environmentally responsible chemical production.

- Emerging Economy Industrialization: Rapid industrial growth in emerging economies is fueling catalyst demand across various manufacturing sectors.

- Automotive Industry Expansion: The growth of the automotive industry, especially in electric vehicles, is increasing the demand for catalysts used in catalytic converters and battery materials.

- Specialty Chemicals Surge: Increasing demand for specialty chemicals, crucial in electronics and pharmaceuticals, is contributing to the industrial catalysts market expansion.

- Advanced Catalyst Analysis: Enhanced methods for understanding catalyst behavior are aiding in the development of more efficient catalysts.

- Global Chemical Production: The globalization of chemical manufacturing is creating opportunities for catalyst suppliers to cater to diverse markets worldwide.

- Collaborative Innovations: Rising collaborations between catalyst manufacturers and research institutions are speeding up the development of new catalysts.

- High-Performance Catalysts: Industries are seeking catalysts with superior activity, selectivity, and durability to optimize production processes.

- Sustainable Packaging Focus: The emphasis on sustainable packaging is driving the demand for catalysts in the production of eco-friendly polymers and packaging solutions.

- Renewable Feedstock Use: Catalysts enabling the efficient use of renewable feedstocks in chemical processes are gaining importance.

- Chemical Process Complexity: The complexity of modern chemical processes is driving the need for sophisticated catalysts capable of handling intricate reaction pathways.

- Clean Fuel Demand: Global demand for cleaner fuels is boosting the need for catalysts in refining processes for environmentally friendly fuel production.

- Research Investment Surge: Increased investments in research and development are shaping the future of the industrial catalysts market, driving innovation and optimization.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 22.53 Billion |

| Market Size by 2034 | USD 34.52 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.82% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 To 2034 |

| Segments Covered | Type, Material, and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Growing demand for petrochemicals and rising energy costs

The increasing need for petrochemicals is a key factor boosting the industrial catalysts market. With a growing reliance on products like plastics globally, there's a heightened demand for efficient catalysts in refining processes. These catalysts play a crucial role in transforming raw materials in the petrochemical industry, improving production efficiency to meet the rising demand for essential materials. Simultaneously, the surge in energy costs further propels the market demand for industrial catalysts.

As industries face rising expenses in energy consumption, there is a heightened emphasis on adopting catalysts that optimize processes, reduce energy requirements, and consequently lower operational costs. Industrial catalysts contribute to energy efficiency, making them instrumental in addressing the economic challenges posed by escalating energy prices, thus driving their increased adoption across various sectors reliant on energy-intensive processes.

Restraint

Complexity in catalyst design

The complexity in catalyst design poses a significant restraint on the growth of the industrial catalysts market. Designing effective catalysts tailored to specific industrial processes involves intricate scientific and engineering considerations. The complexity arises from the need to optimize catalytic activity, selectivity, and stability while considering the unique requirements of diverse applications. This intricate design process requires specialized expertise and extensive research and development efforts, leading to prolonged timelines and increased costs.

Moreover, the intricate nature of catalyst design may hinder the scalability and widespread adoption of certain catalyst technologies. Industries seeking catalyst solutions often face challenges in understanding and implementing these complex designs, limiting the market's growth potential. Standardization and interoperability issues may further contribute to the hindrance, creating barriers to the seamless integration of advanced catalysts into various industrial processes. Overcoming these complexities requires collaborative efforts, innovative approaches, and industry-wide initiatives to streamline catalyst design processes and enhance their accessibility for broader industrial applications.

Opportunity

Rising focus on sustainable practices

The increasing emphasis on sustainable practices is a significant driver of opportunities in the industrial catalysts market. As industries globally prioritize environmental responsibility, there is a growing demand for catalysts that enable cleaner and greener manufacturing processes. Catalysts play a crucial role in promoting sustainable practices by facilitating processes that reduce energy consumption, minimize waste, and lower emissions. Opportunities arise for catalyst manufacturers to develop and market eco-friendly catalysts that align with stringent environmental standards. This includes catalysts for green chemistry applications, renewable energy production, and processes that contribute to a circular economy.

Additionally, industries seeking to enhance their sustainability profiles are actively exploring catalyst technologies that support their environmental goals. This trend not only fosters innovation in catalyst design but also positions the industrial catalysts market as a key contributor to the global shift towards sustainable industrial practices.

Material Insights

In 2024, the chemicals segment had the highest market share of 62% on the basis of the material. In the industrial catalysts market, the chemicals segment refers to catalysts used in chemical manufacturing processes. These catalysts play a vital role in enhancing reaction rates, selectivity, and overall efficiency in the production of various chemicals. Trends in this segment include the increasing demand for catalysts that enable sustainable and environmentally friendly chemical processes. There is also a growing focus on the development of specialty catalysts for fine chemicals and pharmaceutical production. Innovations in materials, such as nanostructured catalysts, are driving advancements in the chemicals segment of the industrial catalysts market.

The metals segment is anticipated to expand at a significant CAGR of 5.4% during the projected period. In the industrial catalysts market, the metals segment refers to catalysts predominantly composed of metallic elements such as platinum, palladium, and nickel. These metals act as active sites for catalyzing chemical reactions in various industrial processes. A notable trend in this segment involves the increasing utilization of nanostructured metals, enhancing catalytic performance. The demand for efficient and durable metal-based catalysts continues to rise, driven by applications in petrochemical refining, chemical synthesis, and environmental processes, contributing to the overall growth and advancement of the industrial catalysts market.

Type Insights

According to the type, the heterogeneous catalyst segment has held 60% revenue share in 2024. Heterogeneous catalysts, a pivotal segment in the industrial catalysts market, are substances that exist in a different phase from the reactants. Commonly used in gas or liquid-solid reactions, these catalysts promote chemical transformations at their surface. Trends in the heterogeneous catalyst segment include the development of advanced materials such as metal oxides and zeolites, as well as innovations in nanotechnology. These trends aim to enhance catalyst efficiency, selectivity, and durability, catering to the evolving needs of industries seeking sustainable and high-performance solutions.

The homogeneous catalyst segment is anticipated to expand fastest over the projected period. Homogeneous catalysts, a type within the industrial catalysts market, are defined by their ability to exist in the same phase as the reactants during a chemical reaction. These catalysts are typically soluble in the reaction medium, allowing for uniform distribution. A notable trend in the homogeneous catalyst segment involves advancements in catalyst design for improved selectivity and efficiency. Researchers are exploring new ligands and metal complexes, enhancing the performance of homogeneous catalysts in various chemical processes, and driving innovation within this segment.

Application Insights

According to the application, the petrochemicals segment has held a 61% revenue share in 2024.The petrochemicals segment in the industrial catalysts market focuses on catalyst applications within the production of chemicals derived from petroleum and natural gas. Catalysts play a pivotal role in refining processes, facilitating the conversion of raw materials into valuable products such as plastics and synthetic materials. A notable trend in this segment involves increasing research and development efforts to develop catalysts that enhance process efficiency, reduce energy consumption, and comply with stringent environmental regulations, aligning with the industry's shift towards sustainability and cleaner manufacturing practices.

The chemical synthesis segment is anticipated to expand fastest over the projected period. The chemical synthesis segment in the industrial catalysts market involves the use of catalysts to facilitate various chemical reactions, including the production of essential chemicals, pharmaceuticals, and specialty compounds. A trend in this segment includes a growing focus on eco-friendly catalysts that enable cleaner synthesis processes. Additionally, there is a heightened demand for catalysts that enhance selectivity, yield, and efficiency in chemical synthesis, reflecting the industry's commitment to sustainable and cost-effective manufacturing practices.

Recent Developments

- Albemarle Corporation's Ketjen Brand (January 2023): Albemarle Corporation's introduction of Ketjen, a specialized brand, emphasizes tailored catalyst solutions for petrochemical, refining, and specialty chemicals. This offering addresses the unique needs of these industries, reflecting a strategic move to provide advanced solutions in response to evolving market demands.

- Johnson Matthey and Hystar Strategic Supply Agreement (May 2023): The three-year strategic supply agreement between Johnson Matthey and Hystar focuses on renewable hydrogen production, utilizing catalysts in membrane electrode assemblies for electrolysis. This collaboration underscores the pivotal role of catalysts in driving sustainable practices and meeting the increasing demand for renewable energy solutions.

- BASF SE's X3DTM Technology (September 2022): BASF SE's groundbreaking X3DTM technology leverages 3D printing in catalyst manufacturing, introducing open-structure catalysts. This innovation aims to enhance reactor performance by reducing pressure drop, showcasing BASF's commitment to cutting-edge technology for improved catalyst design and manufacturing.

- BASF SE's CircleStar™ Catalyst (September 2022): BASF SE's CircleStar™ is an innovative dehydration catalyst designed for renewable feedstocks. Operating at lower temperatures, this catalyst significantly reduces the carbon footprint along the bio-ethylene value chain, demonstrating a commitment to sustainability and environmental responsibility in catalyst development.

- Axens' Symphony Catalyst Family Expansion (November 2021): Axens' introduction of the P/PR 200 Series to their Symphony catalyst family signifies a leap forward in catalyst technology. The series boasts enhanced activity, stability, and improved product selectivity, offering increased operational flexibility and improved unit economics for industry partners.

Industrial Catalysts Market Companies

- Albemarle Corporation

- Johnson Matthey

- BASF SE

- Axens

- Clariant AG

- W. R. Grace & Co.

- Evonik Industries AG

- Chevron Phillips Chemical Company

- Arkema SA

- ExxonMobil Corporation

- Shell Global Solutions

- Dow Inc.

- Honeywell International Inc.

- Solvay SA

- Zeolyst International

Segments Covered in the Report

By Type

- Homogenous

- Heterogenous

By Material

- Metals

- Chemical

- Organometallic

By Application

- Petroleum refining

- Chemical Manufacturing

- Environmental

- Food Processing

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting