What is the Industrial Insulation Market Size?

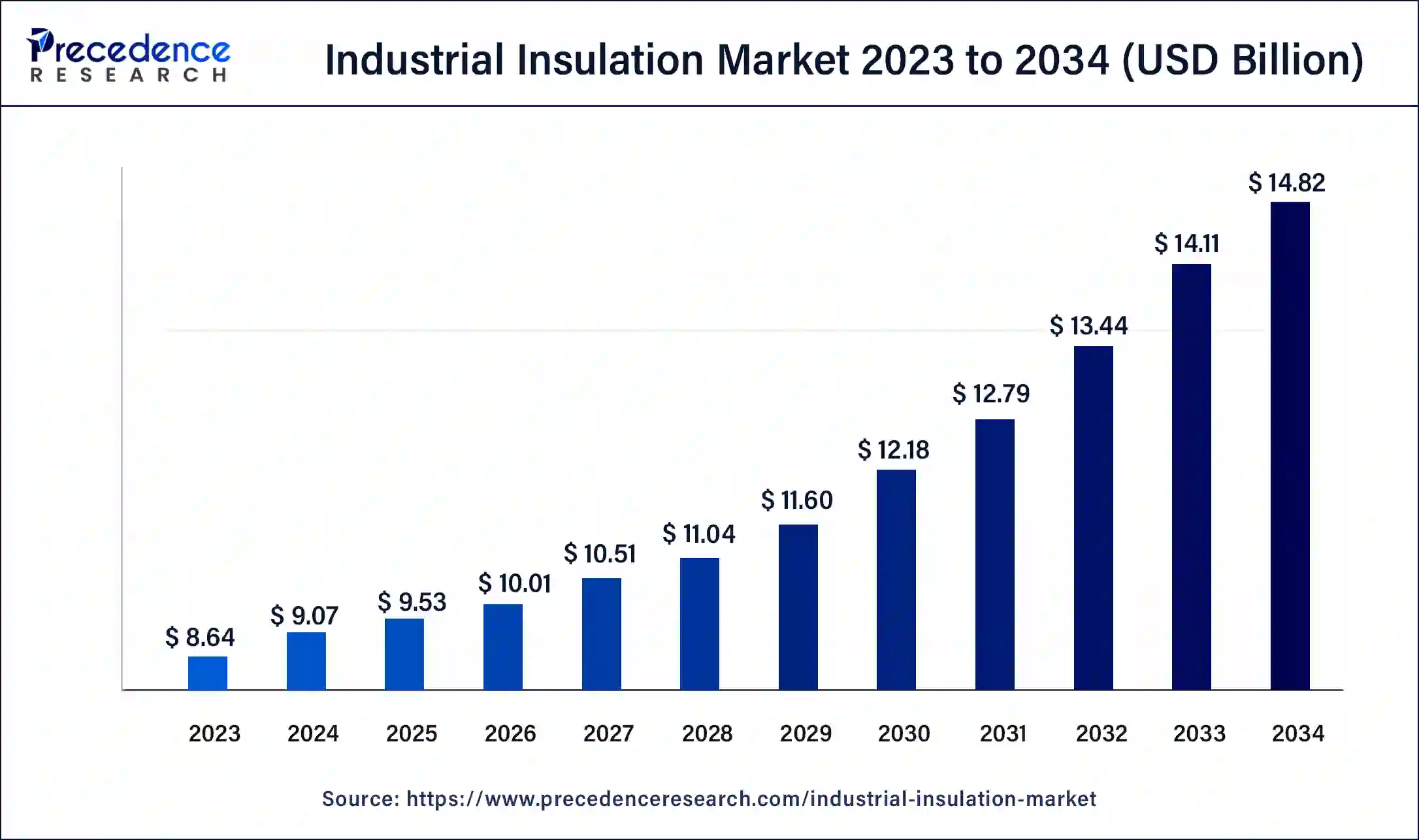

The global industrial insulation market size was estimated at USD 9.53 billion in 2025 and is predicted to increase from USD 10.01 billion in 2026 to approximately USD15.50 billion by 2035, expanding at a CAGR of4.98% from 2026 to 2035. Rising awareness about industrial safety and temperature control is driving the growth of the industrial insulation market

Industrial Insulation Market Key Takeaways

- In terms of revenue, the global industrial insulation market was valued at USD 9.07 billion in 2025.

- It is projected to reach USD 14.82 billion by 2035.

- The market is expected to grow at a CAGR of 5.03% from 2026 to 2035

- Asia Pacific dominated the industrial insulation market in 2025.

- North America is expected to witness significant growth in the market during the forecast period.

- By material, the stone wool segment dominated the market in 2025.

- By material, the CMS fibers segment is expected to witness notable growth in the market during the anticipated period.

- By product, the pipe insulation segment led the global market in 2025.

- By product, the board segment dominated the market in 2025.

- By application, the LPG/LNG segment captured a significant share of the market in 2025.

- By application, the petroleum & refineries segment is expected to witness significant growth in the market during the predicted period.

How Can AI Help the Industrial Insulation Market?

The integration of artificial intelligence in the industrial insulation market drives the enhancement of the insulation production process and brings sacral benefits associated with the production, such as significantly reducing the production time by 50%. It helps the factory to operate non-stop with 24/7 production capabilities. It ensures the reproducible chemical composition of insulation, enhanced performance standards, and real-time machine data analysis.

The integration consistently increases the productivity and demand for the insulation material. It provides real-time analysis that helps ensure the demand meets the specific requirements or criteria. AI continuously evolves new standards in the production capacity with more precision and consistent quality with the same chemical composition. AI helps save costs for thermal production isolation, promotes decision-making, and creates further opportunities for product development. Thus, the integration of AI into industrial insulation is increasing the productivity and operation of industrial insulation.

- 84% of companies use artificial intelligence in their daily operations and increase their investment in AI and data. AI enhances operational efficiency, helps in reducing carbon emissions and energy efficiency, supports clean technology, and addresses climate change.

- The consultant of BCG forecasted that $1.3 trillion to $2.6 trillion value could be generated by implementing AI in corporate sustainability efforts.

Market Overview

Industrial insulation is one of the essential part of the industries such as construction, manufacturing, power generation, and refineries plants. It is mainly focusing on the regularizing or controlling the temperature of the industrial applications. The industrial insulation is one of the essential way to save the cost of production and energy consumption. It used the available resources to conserver and save energy. Industrial insulation is used by the various manufacturing industries to maintain the internal temperature condition by reducing its operational energy load. It used modern insulation material in the industries that provide the improved energy efficiency.

There are several applications in the industrial insulation market, including tank and vessel insulation, pipe insulation, industrial ovens and kilns, acoustic insulation, HVAC systems, equipment insulation, and boiler insulation. The rising industrialization and the awareness regarding the energy efficiency is boosting the growth of the industrial insulation market.

Industrial Insulation Market Growth Factors

- Investment in the development of industrial infrastructure all across the world due to the rising demand for the manufacturing industries for consumer goods is driving the growth of the industrial insulation market.

- The increasing demand for power generation and the rising awareness about environmental pollution due to the higher use of energy consumption is driving the demand for an efficient system that can maintain the pollution and reduce the risk of potential accidents in the industries, boosting the growth of the industrial insulation market.

- The rising awareness about industrial insulation and the advantages related to its properties in several end-use industries in terms of cost and energy efficiency is driving the growth of the industrial insulation market.

- The rising demand for insulation systems in petroleum and oil refinery industries to improve operational work, enhance efficiency, reduce the risk of industrial damage and accidents, and reduce environmental pollution is accelerating the growth of the industrial insulation market.

- The rising adoption of new technologies in industrial applications and the ongoing research and development activities in the growth and development of thermal isolation technologies in various industries are driving the growth of the industrial insulation market.

Industrial Insulation Market Outlook

- Industry Growth Overview: Technological development in the area of insulation materials, e.g., aerogels, mineral wool, and environmentally friendly composites, contributes to the growth of the industry. Market expansion is also being increased by government regulation on energy conservation and safety in industries, and by increasing industrial infrastructure projects.

- Global Expansion: Asia-Pacific and North America are the regions of the world that will experience global expansion because of the rapid industrialization, urbanization, and growth of manufacturing activities. The firms are reinforcing the local production, distribution channels, and local solutions towards addressing varied industry needs.

- Major Investors: The major players in the industry of industrial insulation are Owens Corning, Saint-Gobain, Johns Manville, Rockwool, and Knauf Insulation. These players are investing in new products, long-lasting solutions, and global expansion initiatives.

- Start-up Ecosystem: Business enterprises that manufacture high-performance, energy-efficient, and environmentally friendly insulation materials also exist in the start-up environment. They include Aspen Aerogels, Thermablok, and Superwool, niche industrial solutions and sustainable solutions.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 15.50 Billion |

| Market Size in 2025 | USD 9.53 Billion |

| Market Size in 2026 | USD 10.51 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 4.98% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Material, Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Benefits associated with industrial insulation

There are several advantages associated with the insulation system in the various manufacturing plants, such as chemical, manufacturing, and processing plants, that are driving the growth of the market. It enables minimum operational cost and energy savings; it minimizes heating and cooling costs due to its temperature-controlling properties, which save additional infrastructural costs. The adoption of insulation increases safety in the working environment, though it maintains the temperature and reduces the potential risks of accidents. Insulation improves the soundproof system. The rising awareness regarding the safety of the workforce and energy efficiency is driving the growth of the industrial insulation market.

Restraint

Cost of the product

The cost of the product mainly depends upon the fluctuating availability and the price of raw materials used in the making of insulation. The fluctuation in the prices of plastic foams like polystyrene foams and polyethylene foam is major in limiting the production of insulation material and restraining the growth of the industrial insulation market.

Opportunity

Advancements in industrial insulation

The evolution in industrial insulation drives future opportunities for growth in the market. Advancements such as smart insulation help automate temperature control and humidity in buildings. Recyclability in insulation, the rising awareness about sustainability, and environmental awareness are driving the adoption of recyclable insulation. Further advancements like aerogel insulation and vacuum insulation panels are driving growth opportunities in the industrial insulation market.

Segment Insights

Material Insights

The stone wool segment dominated the industrial insulation market in 2024. The increasing adoption of stone wool as an insulation material by several manufacturing industries is due to its higher temperature resistance, fire resistance capacity, and lack of hazardous amounts of toxic gases and smoke. Stone wool insulation is made up of actual stone and minerals. Stone wool material is used in various end-use industries for different applications. Stone wool is specifically used as an industrial insulation material in industries such as industrial plants, building construction, and automotive applications. These types of materials are used to limit the fire spread in the building; they have an extremely high melting point of 1,800° F to 2,000° F. Thus, the higher temperature resistance and insulation properties make them ideal for industrial insulation material.

The CMS fibers segment is expected to witness notable growth in the industrial insulation market during the anticipated period. The growth of the segment is attributed to the increasing penetration of the CMS fibers in industrial insulation due to its higher resistance to chemical attacks, which boosts the adoption of the CMS fiber segment. CMS fibers are form body-fluid soluble, low bio-persistent (similar to glass), fiber blanket insulation, and non-ceramic. CMS fiber is used in a number of industrial applications due to its greener, safer asbestos-alternative properties, which fuel the adoption of the segment.

Product Insights

The pipe insulation segment led the global industrial insulation market in 2024. The rising adoption of pipe insulation in industries owing to helps prevent condensation, minimize heat loss or gain, increase fire safety, protect pipes from freezing, and reduce noise, driving the growth of the pipe insulation segment. These are used mainly in processing, such as steaming, hot and cold water, air conditioning, refrigeration, and heating. Pipe insulation has different properties like moisture resistance, thermal conductivity, durability, cost, and flexibility. There are a number of industries that use pipe insulation in manufacturing capacity.

The board segment dominated the industrial insulation market in 2024. The growth of the segment is attributed to its higher thermal performance, lower shrinkage at high temperatures, process, and power system. These type of product is used in the industries like construction sites, manufacturing facilities, and workshops.

Application Insights

The LPG/LNG segment captured a significant share of the industrial insulation market in 2024. The rising demand for insulation materials in LPG and LNG industries minimizes the risk of accidents and protects the high investment in the facilities. Insulation is essential for the engineering of LPG and LNG industries to improve performance; it fights against the two biggest enemies of industries: fire and moisture. The LPG/LNG industries are generally considered to be high-risk industries in terms of safety. These industrial products involved high risks associated with storage and transportation pipes. Thus, all these associated risks are accelerating the demand for industrial insulation in the LPG/LNG industries.

The petroleum & refineries segment is expected to witness significant growth in the industrial insulation market during the predicted period. The petroleum and refinery industries are among the industries in high demand, with the continuous production of natural gas and crude oil. The rising demand for efficient insulation material in industrial applications reduces the risk of processing and manufacturing. The continuous rise in the demand for petroleum and refineries in various end-use applications drives the growth of the market.

Regional Insights

Asia Pacific dominated the industrial insulation market in 2024. The rising demand for industrial insulation in the various end-use industries to reduce the risk of accidents and raise awareness about the cost of energy and energy efficiency is driving the growth of the market. The rising strict regulations regarding the rising awareness about energy efficiency are driving the adoption of industrial insulation. The rising investment in the industrial revolution is also fueling the growth of the industrial revolution market in the region.

North America is expected to witness significant growth in the industrial insulation market during the forecast period. The higher presence of the well-developed industrial infrastructure and the availability of the various manufacturing industries are driving the growth of the market. In the regional analysis, the United States led the market with the largest market share due to the developed industrial infrastructure and power generation sector. The region is also one of the largest consumers of energy due to the availability of advancement in the industrial sector, which boosts the growth of the industrial insulation market across the region.

- The insulation material manufacturer directly generates $24.9 billion in industrial shipments and is responsible for employing more than 40,000 workers in 45 states.

- The insulation manufacturing contributed $2.4 billion to state and local government and $3.3 billion in federal tax.

Why Is the European Industrial Insulation Market Experiencing Notable Growth?

The European market is recording a booming growth rate because of the demand for more energy-saving solutions in manufacturing, chemical, oil and gas, and power generation. Stricter laws that address energy-saving and emission of carbon dioxide are compelling industries to adopt newer insulation materials in the form of mineral wool, aerogels, and green composite insulators.

Germany Industrial Insulation Market Trends

Germany is the leading one due to the fact that it has a large industrial sector, stringent energy efficiency policies, and an effective automotive and chemical industry. The adoption of renewable energy and industrial modernization projects in France helps the country to grow, whereas the powerful manufacturing and energy efficiency approaches implemented by the government contribute to the growth of the UK.

Why Is the MEA Industrial Insulation Industry Gaining Momentum?

The MEA market is also on an upward trend as a result of the accelerated industrialization, growing oil and gas, petrochemical, and power generation industries, and growing emphasis on operational efficiency. The increasing cost of energy and the necessity to decrease heat loss in industrial processes are increasing the demand for advanced insulation materials. Any government efforts towards energy preservation, industrial safety, and environmental compliance also aid in market uptake.

Saudi Arabia & the UAE Industrial Insulation Market Trends

The MEA region markets are led by Saudi Arabia and the UAE have mega-projects in the refining sector, petrochemical, and power plant. Some other major contributors are Egypt and South Africa, which are motivated by the growth of industries and the building of infrastructure. The availability and use of contemporary insulation solutions are being enhanced by investments of an international manufacturing and technology insulation community.

These countries are all combined to develop the MEA market, turning it into a very competitive and technologically advanced market regarding energy-efficient industrial insulation.

Why Is the Latin American Industrial Insulation Industry Emerging Rapidly?

The Latin American market is growing fast, with the levels of industrialization, escalation of energy prices, and the market pressures to have manufacturing processes that are energy efficient. The growing industries of oil and gas, chemical processing, and power generation are also hastening the use of superior insulation materials. The government programs promoting energy efficiency and sustainable industrial practices are also increasing the pace of market growth.

Brazil Industrial Insulation Market Trends

Brazil leads in its large-scale industrial sector that includes oil refineries, chemical manufacturing plants, and power plants. Mexico is speedily developing in the automotive, energy, and manufacturing sectors, whereas Chile and Argentina are future markets because of the development of infrastructure and renewable energy projects. These nations are making Latin America a promising and emerging market for industrial insulation products.

Value Chain Analysis-Industrial Insulation Market

- Feedstock Procurement: Implicates provide raw materials such as fiberglass, mineral wool, aerogels, and chemical binders used in the production of insulation.

Key players: Owens Corning, Saint-Gobain, Johns Manville, Rockwool, Knauf Insulation - Quality Testing and Certification: Guarantees performance standards and thermal efficiency standards, and safety of the insulation.

Key players: TÜV Rheinland, Intertek, SGS, Bureau Veritas, Eurofins Scientific - Distribution to Industrial Users: Logistics, warehousing, and supply chain management cover to provide insulation to industrial establishments and construction projects.

Key players: W.W. Grainger, Rexel, Fastenal, Ferguson, Sonepar - Regulatory Compliance and Safety Monitoring: Complies with safety, environmental, and industry standards such as fire, thermal, and occupational safety standards of their products.

Key players: SGS, TÜV SÜD, Intertek, Bureau Veritas, UL Solutions

Industrial Insulation Market Companies

- Aspen Aerogels, Inc.

- Cabot Corporation

- Morgan Advanced Materials plc

- Unifrax LLC

- RATH Group

- IBIDEN Co., Ltd.

- Rockwool Insulation A/S

- Poroc Group Oy

- Knauf Insulation

- TechnoNICOL Corporation

- Anco Products, Inc.

- Armacell International

Recent Developments

- In November 2025, The Sarda Group presented the first rock mineral wool insulation in India, RHINO, which was made without using fossil fuels in an electric smelter. The product can be used in building, industrial, and marine applications and minimizes the CO2 emission by 65 percent.

(Source: https://b2bpurchase.com ) - In August 2024, PPG also launched PITT-THERM(r) 909, which is a silicone-based oil and gas, petrochemical, and infrastructure spray-on insulation coating. The coating improves the safety of the surface to touch and minimizes corrosion under insulation. (Source:https://investor.ppg.com )

- In February 2024, Aerogel Core Ltd, University of Bath spin-out Company launched the ultra-light ‘aerogels' the soundproofing and heat-shielding insulation materials for the automotive and aerospace industries.

- In October 2024, ALP Aeroflex (I) Pvt Ltd, a part of the Rs 2000 Cr ALP Group, launched the 'Aerocell Rail,' a superior brand that is fire rating approved, and the thermal insulation for the modern rail and metro rail coaches.

- In June 2024, Pearl Group, a leading provider of polyurethane (PU) solutions installed the real-time digital counter that saves CO2 with the use of innovative PU insulation systems.

- In October 2023, PENOPLEX, the environmentally friendly thermal insulation materials production plant, was inaugurated at the Hajigabul industrial quarter in the village of Atbulak, Republic of Azerbaijan. Having a capacity of 300,000 cubic meters of extruded polystyrene foam per year.

- In September 2023, Carlisle Spray Foam Insulation (CSFI), a leading producer of spray polyurethane foam insulation products in North America, introduces the Carlisle PRO Academy, it is the education, training, and certification program for spray foam professionals.

- In November 2023, Kingspan Group, a leading group in building envelopes, and high-performance insulation launched the HemKor, a first bio-based insulation material developed by the company majorly made by hemp.

- In June 2023, Hitachi Energy provided the cutting edge solution in thermal insulation with the innovation in the Transformers Insulation and Components.

- In March 2024, Fluke announced the launch of two portable and lightweight (1.3 kg) Insulation Resistance Testers that provide accurate, fast, and reliable testing up to 2500 V (DC).

Segment Covered in the Report

By Material

- Stone Wool

- Elastomeric Foam

- Micro Silica

- Glass Wool

- Composites

- CMS Fibers

- Calcium Silicate

- Cellular Glass

- Foamed Plastic

- Perlite

- Aerogel

- Cellulose

- Others

By Product

- Pipe

- Board

- Blanket

- Others

By Application

- Power Generation

- Petrochemical & Refineries

- EIP Industries

- LNG/LPG

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting