What is the Infusion Catheter Market Size?

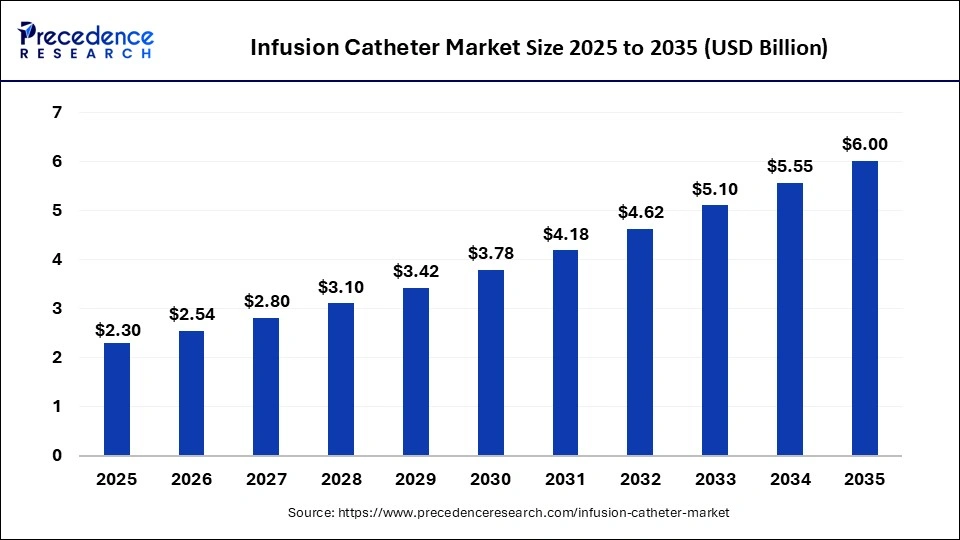

The global infusion catheter market size is valued at USD 2.30 billion in 2025 and is predicted to increase from USD 2.54 billion in 2026 to approximately USD 6.00 billion by 2035, expanding at a CAGR of 10.06% from 2026 to 2035.

Infusion Catheter Market Key Takeaways

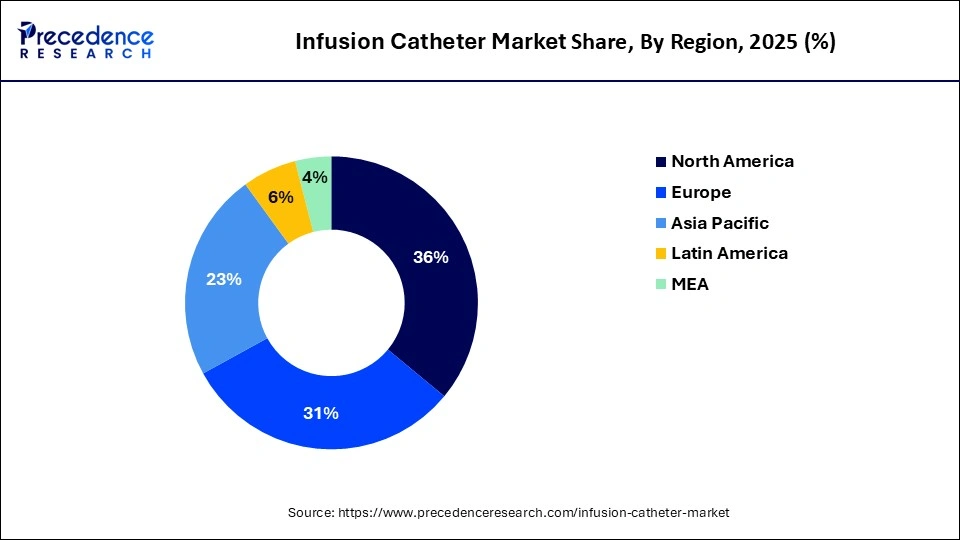

- North America contributed more than 36% of revenue share in 2025.

- Asia-Pacific is estimated to expand the fastest CAGR between 2026 and 2035.

- By type, the thermodilution catheter segment has held the largest market share of 31% in 2025.

- By type, the anesthesia catheter segment is anticipated to grow at a remarkable CAGR of 11.4% between 2026 and 2035.

- By application, the hospital segment generated over 48% of revenue share in 2025.

- By application, the clinic segment is expected to expand at the fastest CAGR over the projected period.

Market Overview

An infusion catheter stands out as a specialized tool in the medical field, purpose-built for the meticulous and targeted delivery of fluids or medications directly into the bloodstream or specific body tissues. Crafted with finesse, it features a slender, flexible tube equipped with a needle or catheter tip, allowing for its adept insertion into veins, arteries, or other designated anatomical sites. The primary function of this catheter is to serve as a conduit, facilitating the precise administration of therapeutic substances be it medications, nutrients, or blood products directly into the body's circulatory system.

Widely embraced in hospitals and clinics, these catheters take center stage in administering treatments like chemotherapy, pain management medications, or nutritional support. Tailored to diverse needs, some infusion catheters are engineered for prolonged usage, while others are designed for short-term requirements. The adoption of infusion catheters empowers healthcare practitioners, offering them the ability to exercise meticulous control over dosage and infusion rates. This not only elevates the effectiveness and safety of medical interventions but also minimizes potential side effects.

Infusion Catheter Market Growth Factors

- Increasing Incidence of Chronic Diseases: The rising prevalence of chronic conditions, such as cardiovascular diseases and cancer, is propelling the demand for infusion catheters in targeted therapies and long-term treatments.

- Advancements in Technology: Ongoing technological innovations, including the development of smart catheters and improved materials, are enhancing the performance and capabilities of infusion catheters.

- Aging Population: As the global population ages, there is a growing need for infusion catheters to address age-related health issues, contributing to market expansion.

- Rising Surgical Procedures: The surge in surgical interventions, particularly in specialties like oncology and pain management, is driving the utilization of infusion catheters for precise drug delivery.

- Increasing Healthcare Expenditure: Higher healthcare spending, especially in emerging economies, is supporting the adoption of advanced medical devices, including infusion catheters.

- Expansion of Ambulatory Care Settings: The trend toward outpatient care and ambulatory surgical centers is creating new avenues for infusion catheter use in more diverse medical settings.

- Patient Preference for Home Healthcare: The growing preference for home-based treatments is fostering the demand for infusion catheters that facilitate the self-administration of medications.

- Rising Awareness about Minimally Invasive Procedures: Increased awareness and acceptance of minimally invasive procedures are boosting the demand for catheters for their role in less intrusive medical interventions.

- Government Initiatives for Healthcare Infrastructure: Supportive government policies and investments in healthcare infrastructure are contributing to the accessibility and adoption of infusion catheters.

- Growing Focus on Personalized Medicine: The trend toward personalized medicine is creating opportunities for infusion catheters tailored to specific patient needs and treatment regimens.

- Expanding Applications in Pediatric Care: The versatility of infusion catheters is leading to their increased use in pediatric care, addressing unique medical requirements in children.

- Strategic Collaborations and Partnerships: Collaborations between medical device manufacturers and healthcare providers are fostering innovation and the development of more efficient infusion catheter solutions.

- Increasing Prevalence of Infectious Diseases: The global impact of infectious diseases is fueling the demand for infusion catheters in the administration of antibiotics and antiviral medications.

- Emphasis on Home Infusion Therapy: With the emphasis on home-based healthcare solutions, infusion catheters are playing a crucial role in facilitating effective and safe home infusion therapy.

- Expanding Geriatric Patient Population: The expanding geriatric demographic is creating a sustained demand for infusion catheters to address the unique healthcare needs of the elderly.

- Rise in Lifestyle-Related Diseases: The increase in lifestyle-related diseases, such as diabetes and obesity, is contributing to the demand for infusion catheters for chronic disease management.

- Globalization of the Healthcare Industry: The globalization of healthcare services is driving the standardization and adoption of infusion catheters across different regions.

- Increasing Awareness of Pain Management Therapies: The awareness and recognition of effective pain management solutions are boosting the use of infusion catheters for targeted pain relief.

- Focus on Outcomes-Based Healthcare: The shift towards outcomes-based healthcare is encouraging the development of infusion catheters that contribute to improved patient outcomes and reduced hospital stays.

- Demand for Biocompatible Materials: Growing concerns about compatibility and safety are leading to increased demand for infusion catheters made from biocompatible materials, minimizing the risk of adverse reactions.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 10.06% |

| Market Size in 2025 | USD 2.30 Billion |

| Market Size in 2026 | USD 2.54 Billion |

| Market Size by 2035 | USD 6.00 Billion |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing surgical procedures and expanding ambulatory care

The surge in surgical procedures and the expansion of ambulatory care settings are driving significant demand for infusion catheters in the medical market. Increasing surgical interventions, especially in fields like oncology and pain management, necessitate precise drug delivery during and after procedures. Infusion catheters play a pivotal role in ensuring controlled and targeted administration of medications, contributing to enhanced postoperative care and recovery.

Additionally, the growing prominence of ambulatory care, where patients receive treatments in outpatient settings, underscores the need for efficient and portable infusion solutions. Infusion catheters offer a convenient means to administer medications outside traditional hospital environments, aligning with the trend towards patient-centric, accessible healthcare. The flexibility and versatility of infusion catheters make them vital components in addressing the evolving landscape of modern medical practices, accommodating the demand for effective and minimally invasive solutions in both surgical and ambulatory care scenarios.

Restraint

Infection risks and stringent regulatory approval

Infection risks and stringent regulatory approval processes significantly impede the market demand for infusion catheters. Concerns about catheter-related infections, especially during prolonged use, pose a substantial barrier to widespread adoption. The potential for infections not only raises patient safety apprehensions but also prompts healthcare providers to explore alternative, less risky drug delivery methods. Moreover, stringent regulatory approval requirements contribute to a prolonged time-to-market for new infusion catheter products.

The rigorous evaluation and approval processes may delay product launches, hindering the timely introduction of innovative catheter technologies into the market. This delay not only restricts industry innovation but also limits the availability of advanced catheters for healthcare professionals and patients seeking more efficient and safer treatment options. The demanding regulatory landscape adds a layer of complexity to the development and commercialization of infusion catheters, with manufacturers grappling with extensive documentation, testing, and compliance measures.

As a consequence, these challenges can impede market access for both established companies and new entrants, leading to a constrained market environment that may struggle to meet the dynamic demands of modern healthcare. The industry must navigate these hurdles collaboratively to address infection risks and streamline regulatory processes, ensuring that infusion catheters can realize their full potential as safe and effective medical devices.

Opportunity

Home healthcare expansion and emerging markets

The expanding landscape of home healthcare and the exploration of emerging markets present significant opportunities for the infusion catheter market. As the healthcare industry increasingly shifts towards decentralized and patient-centric models, infusion catheters designed for home use are becoming pivotal. These catheters offer patients the flexibility to self-administer medications in the comfort of their homes, promoting convenience and potentially reducing healthcare costs associated with in-patient treatments.

The ability to adapt infusion catheter designs to suit home environments and patient preferences positions manufacturers to tap into a rapidly growing market segment, meeting the rising demand for personalized and accessible healthcare solutions.

Moreover, the exploration of emerging markets, particularly in developing economies, opens up new frontiers for the infusion catheter market. Adapting to the unique healthcare landscapes in these regions and tailoring catheter designs to suit diverse needs can create opportunities for market expansion. Manufacturers that strategically navigate these opportunities stand to benefit from increased market share, revenue growth, and the ability to address unmet healthcare needs in previously underserved populations.

Type Insights

In 2025, the thermodilution catheter segment had the highest market share of 31% based on the type. Thermodilution catheters are a type of infusion catheter designed for measuring cardiac output by utilizing the principle of thermodilution. These catheters introduce a known volume of cold saline into the bloodstream, allowing for the calculation of cardiac output based on temperature changes.

A trend in the infusion catheter market is the increasing adoption of thermodilution catheters for real-time hemodynamic monitoring during critical care scenarios, providing healthcare professionals with valuable insights into a patient's cardiovascular status, guiding treatment decisions, and improving overall patient outcomes.

The anesthesia catheter segment is anticipated to expand at a significant CAGR of 11.4% during the projected period. The anesthesia catheter segment in the infusion catheter market refers to specialized catheters designed for the administration of anesthesia during medical procedures. These catheters facilitate precise and controlled delivery of anesthetic agents, ensuring patient comfort and safety.

A notable trend in this segment involves the integration of advanced materials and technology to enhance catheter performance, minimize discomfort, and improve overall efficiency. As medical procedures continue to evolve, the demand for anesthesia catheters that offer optimal anesthesia management and patient experience is expected to rise, driving innovation in this specific category.

Application Insights

According to the application, the hospital segment has held 48% revenue share in 2025. In the context of infusion catheters, the hospital segment refers to the application of these devices within traditional healthcare settings. Hospitals utilize infusion catheters for a diverse range of medical procedures, including surgical interventions, chemotherapy, and pain management.

A prominent trend in this segment involves the integration of advanced technologies into catheter designs, improving precision and monitoring capabilities. Additionally, the adoption of infusion catheters in outpatient settings within hospitals reflects a growing emphasis on providing efficient and targeted treatments while minimizing patient hospitalization periods.

The clinic segment is anticipated to expand fastest over the projected period. In the infusion catheter market, the clinic segment refers to the use of catheters in outpatient clinic settings. Clinics employ infusion catheters for various medical applications, including chemotherapy, pain management, and antibiotic administration.

A notable trend in this segment involves the increasing adoption of ambulatory care, where clinics offer infusion services outside traditional hospital settings. This trend aligns with the broader movement towards patient-centric care, providing a more convenient and accessible environment for individuals to receive infusion therapies in specialized clinic settings.

Regional Insights

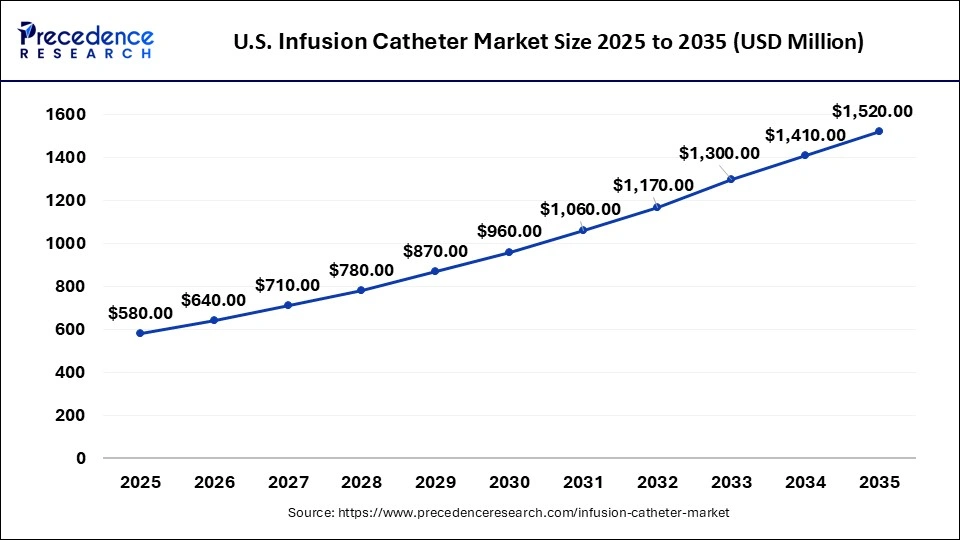

U.S. Infusion Catheter Market Size and Growth 2026 To 2035

The U.S. infusion catheter market size is valued at USD 580 million in 2025 and is expected to be worth around USD 1,520 million by 2035, rising at a CAGR of 10.11% from 2026 to 2035.

North America has held the largest revenue share of 36% in 2025. North America dominates the infusioncatheter market due to robust healthcare infrastructure, a high prevalence of chronic diseases, and strong investments in research and development. The region's advanced medical facilities facilitate the widespread adoption of infusion catheters, particularly in the context of an aging population requiring long-term treatments. Additionally, favorable reimbursement policies, a proactive regulatory environment, and a focus on technological advancements contribute to North America's significant market share, making it a key player in the global infusion catheter market.

U.S. Market Trends

The infusion catheter market in the U.S. is growing due to an aging population and rising prevalence of chronic diseases that require long-term therapy. Technological advancements, such as antimicrobial coatings, smart devices, and integration with programmable infusion pumps, are enhancing safety, automated dosing, and remote monitoring. Additionally, increased use of PICC and CVC lines in home healthcare and a strong focus on reducing catheter-related infections are further driving market growth.

Canada Market Trends

The infusion catheter market in Canada is growing due to increasing chronic diseases, an aging population, and technological innovations like antimicrobial coatings and smart pumps. Improved placement guidance enhances safety and reduces infections, while rising demand for central venous and PICC lines in long-term and home care settings further supports market expansion.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia-Pacific is estimated to observe the fastest expansion. Asia-Pacific commands a significant share of the infusion catheter market due to several factors. The region's robust economic growth, coupled with a rising aging population, has led to an increased prevalence of chronic diseases requiring long-term treatments. Additionally, expanding healthcare infrastructure, growing awareness, and government initiatives contribute to the widespread adoption of infusion catheters. Moreover, the infusion catheter market in Asia-Pacific benefits from the presence of key players, strategic collaborations, and a proactive approach to technological advancements, solidifying the region's prominence in the global market.

India Market Trends

Rising cases of cancer, diabetes, and cardiovascular diseases, which necessitate long-term infusions, are boosting the market in India. Growing acceptance of home-based care for chronic conditions is driving the demand for disposable catheters. Moreover, increasing government initiatives to boost the domestic production of medical devices contribute to market growth.

What Makes Europe a Notably Growing Region in the Infusion Catheter Market?

Europe is expected to grow at a notable rate over the forecast period due to the increasing prevalence of chronic diseases, an aging population, and rising demand for advanced intravenous therapies. Adoption of innovative technologies, such as antimicrobial coatings, smart catheters, and integration with automated infusion pumps, enhances safety and reduces catheter-related infections, further driving market growth across hospitals, clinics, and home healthcare settings. The UK is a major contributor to the European market due to the increasing prevalence of diabetes, cancer, and cardiovascular diseases, which directly drive the demand for infusion therapies.

How is the Opportunistic Rise of Latin America in the Infusion Catheter Market?

Latin America is growing at a robust rate in the market due to increasing rates of chronic diseases, an aging population requiring frequent IV therapies, and growing healthcare investments. The shift toward home healthcare, adoption of smart or digital catheters, and use of sustainable materials are enhancing patient safety, convenience, and data management. Additionally, trends like wellness IV therapies and disparities between public and private healthcare systems are boosting demand for both basic and advanced infusion catheters across the region.

What Opportunities Exist in the Middle East & Africa for the Market?

The Middle East & Africa (MEA) presents immense opportunities for the infusion catheter market. These opportunities arise from the rising cases of chronic diseases, expanding healthcare infrastructure, and growing demand for safer, cost-effective vascular access solutions. Initiatives like Saudi Arabia's Vision 2030 are driving the adoption of advanced technologies, including smart infusion pumps, telemedicine, and data analytics, enhancing patient care. Additionally, the focus on antimicrobial coatings, infection prevention, and adherence to international standards creates opportunities for specialty and technologically advanced catheters across the region.

Infusion Catheter Market Companies

- Medtronic

- B. Braun Melsungen AG

- Terumo Corporation

- Johnson & Johnson

- Becton, Dickinson and Company

- Teleflex Incorporated

- Smiths Medical

- Nipro Corporation

- C.R. Bard (acquired by Becton, Dickinson and Company)

- AngioDynamics, Inc.

- Cook Medical

- ICU Medical, Inc.

- Vygon SA

- Fresenius Kabi AG

- Merit Medical Systems, Inc.

Recent Developments

- In March 2021, Medtronic introduced the Chameleon Percutaneous Transluminal Angioplasty (PTA) balloon catheter in select European and African countries, including Germany, Portugal, Italy, South Africa, Turkey, and Spain. This innovative catheter is designed for use in a range of arterial applications, including femoral, iliac, and renal arteries, as well as both native and synthetic arteriovenous dialysis fistulas. The system's approval underscores its versatility and suitability for various vascular interventions, offering healthcare professionals a reliable and effective tool for angioplasty procedures. Medtronic's expansion of its product portfolio reflects ongoing efforts to address diverse clinical needs and enhance treatment options in the field of interventional cardiology and vascular care.

Segments Covered in the Report

By Type

- Thermodilution Catheter

- Pressure Monitoring Catheter

- Central Venous Catheter

- Anesthesia Catheter

- Others

By Application

- Hospital

- Clinic

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting