What is Elastomeric Infusion Pumps Market Size?

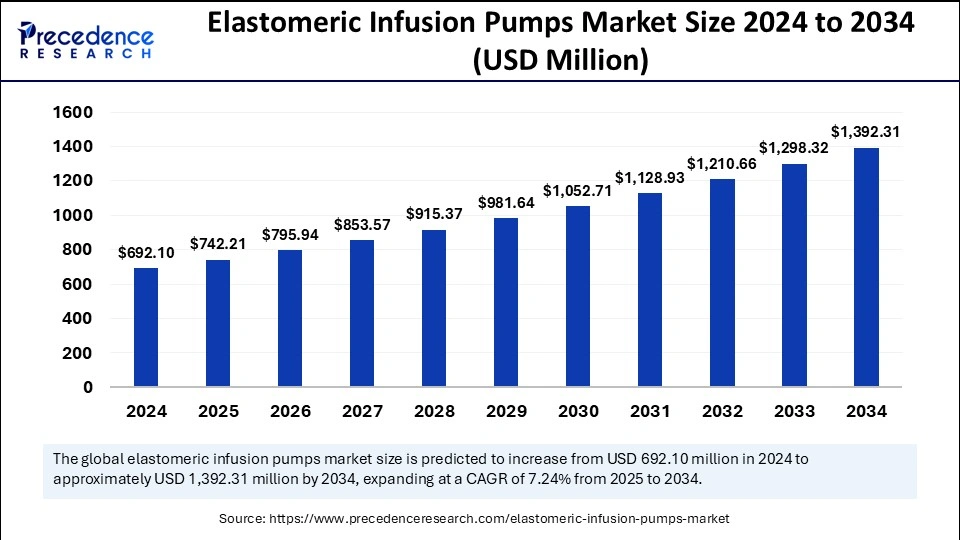

The global elastomeric infusion pumps market size accounted for USD 742.21 million in 2025 and is predicted to increase from USD 795.94 million in 2026 to approximately USD 1,392.31 million by 2034, expanding at a CAGR of 7.24% from 2025 to 2034. The surging prevalence of chronic diseases like diabetes, cancer, and cardiovascular disorders is a key factor driving the growth of the market. Also, the increasing demand for home healthcare solutions, coupled with the innovations in pump design and user interfaces, can fuel market growth soon.

Market Highlights

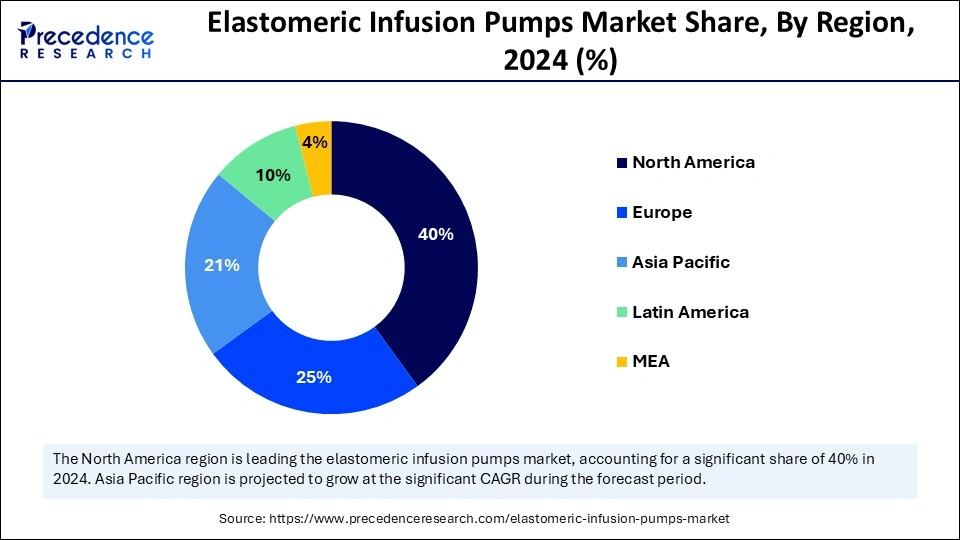

- North America dominated the market with the largest market share of 40% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR of 8.9% during the period.

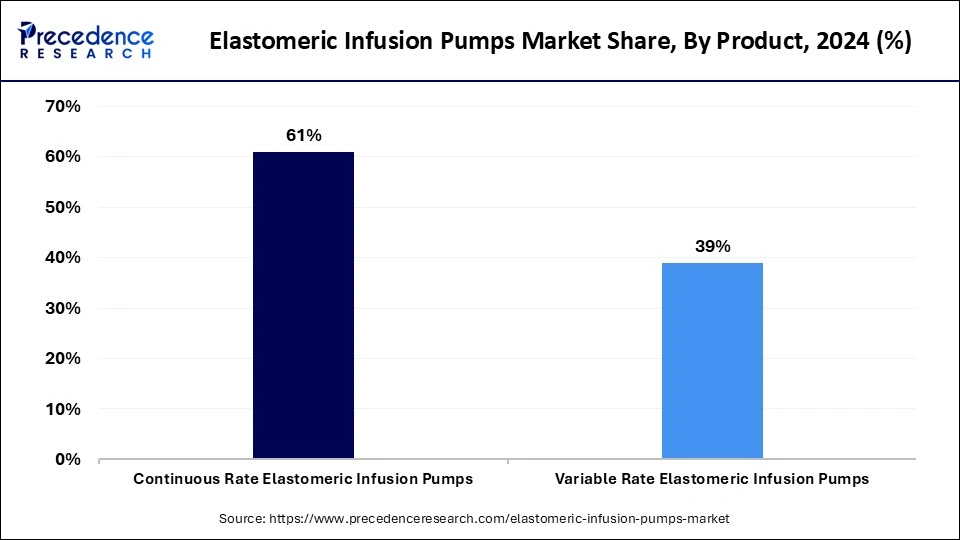

- By product, the continuous rate elastomeric infusion pumps segment held the biggest market share of 61% in 2024.

- By product, the variable rate elastomeric infusion pumps segment is expected to grow at the fastest rate over the forecast period.

- By application, the pain management segment contributed the major market share of 38% in 2024.

- By application, the antibiotic/antiviral therapy segment is anticipated to grow rapidly during the forecast period.

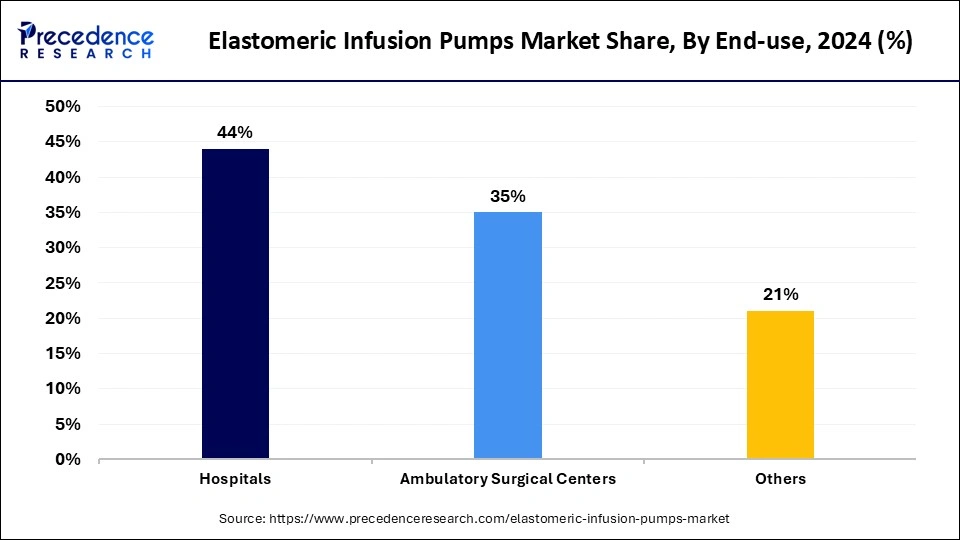

- By end use, the hospital segment contributed the biggest market share of 44% in 2024.

- By end use, the ambulatory surgical centers (ASCs) segment is expected to show the fastest growth over the projected period.

How are the Elastomeric Infusion Pumps Transforming?

The elastomeric infusion pumps market covers the world demand for medical devices, known as balloon pumps, utilized for the monitored delivery of fluids or medication over a desired period, especially valued for their portability, simplicity, and ease of use in home care and hospital settings. Infusion pumps provide substantial benefits over a direct administration of fluid, such as the capability to deliver fluids in smaller volumes with precise measurements.

The Impact of AI on Improving the Elastomer Infusion Pumps Market

The integration of artificial intelligence (AI) in the elastomeric infusion pumps market is transforming the landscape of medication management and patient care. AI-powered algorithms can improve infusion precision, decrease human error, and facilitate personalized medication dosage by processing patient data. Furthermore, AI in elastomer infusion pumps optimizes the overall process from prescription to administration, reducing manual intervention and increasing efficiency

Elastomeric Infusion Pumps Market Growth Factors

- The growing number of surgeries, along with the requirement for post-operative pain management, is expected to boost the elastomeric infusion pumps market.

- The ongoing surge in mergers and acquisitions among major market players can propel market expansion shortly.

- Market players are focusing on improving their value proposition through various strategies, like quality, customer service, and pricing, which will likely contribute to market growth.

Elastomeric Infusion Pumps Market Outlook:

- Global Expansion: Current progression is fueled by implementing integration of smart sensors and digital connectivity to optimise accuracy and allow remote monitoring.

- Major Investor: A huge healthcare corporation, such as Baxter International Inc., B. Braun SE, is actively investing in R&D, manufacturing, and distribution of a diverse range of medical devices.

- Industry Overview: It is expanding its applications in pain management, oncology, and post-surgery care, with its benefits, like portability, ease of use, and affordability.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 742.21 Million |

| Market Size in 2026 | USD 795.94 Million |

| Market Size by 2034 | USD 1,392.31 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.24% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Increasing emphasis on R&D and innovation

Growing investment in research and development (R&D) and advancements is a major trend driving the elastomeric infusion pumps market growth. Market players are dedicating resources to creating technologically advanced devices that possess ergonomic designs, advanced materials, and integrated digital features. In addition, these advancements enhance the safety and accuracy of pumps, which makes them convenient to use. Improved R&D efforts are also facilitating quick regulatory approvals.

- In July 2023, BD (Becton, Dickinson and Company), a leading global medical technology company, announced that the updated BD Alaris™ Infusion System has received 510(k) clearance from the U.S. Food and Drug Administration (FDA), which enables both remediation and a return to full commercial operations for the most comprehensive infusion system available in the United States.

Restraints

Side-effects of elastomeric pumps system

The number of risks and other complications related to these pumps, along with the requirement for surgical intervention to tackle some of them, are anticipated to hinder the market growth. Moreover, the treatment cost for a longer duration is relatively expensive for a middle-income person to afford. This increasing cost is a key concern constraining the market expansion.

Opportunities

Raised adoption of ambulatory pumps in home care facilities

Infusion pumps are generally utilized in clinical settings like nursing homes, hospitals, and in-home care settings. Due to rising funding for hospitalization and the rise in the incidence of chronic diseases, implementing ambulatory infusion pumps has been raised significantly. Furthermore, ambulatory infusion pumps are an important route of drug delivery in an extensive range of clinical disorders such as TPN infusion, chemotherapy, pain control medication, etc.

- In November 2024, Avanos Medical, Inc. announced that the Centers for Medicare and Medicaid Services (CMS) had issued its final Medicare Hospital Outpatient Prospective Payment System (OPPS) and Medicare Ambulatory Surgical Center (ASC) Payment System rule for 2025.

Segment Insights

Product Insights

The continuous rate elastomeric infusion pumps segment dominated the elastomeric infusion pumps market in 2024. The dominance of the segment can be attributed to its provision of steady, controlled medication delivery along with the reliability, simplicity, and suitability for treatments. Additionally, they are extensively utilized for a number of treatments such as pain management, antibiotic therapies, chemotherapy, etc. The segment growth is further driven by rising demand for continuous-rate pumps and their extensive utilization in chronic disease treatment.

The variable rate elastomeric infusion pumps segment is expected to grow at the fastest rate over the forecast period. The growth of the segment can be credited to the surge in demand for personalized and flexible drug delivery solutions across most medical settings. Also, variable rate pumps have the ability to deliver medications at different flow rates, making them suitable for more customized or complex infusion profiles.

Application Insights

The pain management segment held the largest elastomeric infusion pumps market share in 2024. The dominance of the segment can be linked to the rising incidence of chronic pain conditions across the globe, which leads to an increasing need for sophisticated e-pain management solutions. In addition, advancements in pain management technologies, like innovative drug delivery systems, nerve stimulators, and minimally invasive surgical operations, are improving the overall treatment options.

- In September 2024, Mankind Pharma, one of India's leading pharmaceutical companies, announced its entry into the topical analgesic market through its consumer business division. According to the company's press statement, the company is introducing Nimulid Strong, a revolutionary gel and spray formulation specifically designed to address neck pain, a condition that significantly impacts overall body function.

The antibiotic/antiviral therapy segment is anticipated to grow at the fastest rate during the forecast period. The growth of the segment can be driven by increasing demand for convenient and effective delivery of antiviral and antibiotic medications coupled with the rising incidence of infectious diseases. Moreover, hematopoietic growth factors, like granulocyte colony-stimulating factor (G-CSF) and erythropoietin (rHuEPO), can be utilized to tackle the side effects of these medications.

- In June 2024, Chennai-based Orchid Pharma, the only Indian pharmaceutical company to have ever invented a New Chemical Entity (NCE), announced the launch of its new drug - Cefepime-Enmetazobactam, which has been approved for the treatment of complicated urinary tract infections (cUTI), hospital-acquired pneumonia (HAP), and ventilator-associated pneumonia (VAP) indications.

End-Use Insights

In 2024, the hospital segment led the global elastomeric infusion pumps market. The dominance of the segment is owing to the extensive adoption of these pumps in different hospital facilities, including intensive care units, surgical wards, and oncology departments. Furthermore, there is a growing need for accurate and reliable drug delivery solutions in numerous hospital settings. These pumps provide persistent medication delivery, which is important for effective patient care.

The ambulatory surgical centers (ASCs) segment is expected to show the fastest growth over the projected period. The growth of the segment is due to the increasing inclination toward minimally invasive procedures, which fuels the adoption of elastomeric pumps. These facilities also offer cost-effective and more convenient alternatives to conventional hospital settings, further impacting the positive segment's growth.

Regional Insights

U.S. Elastomeric Infusion Pumps Market Size and Growth 2025 to 2034

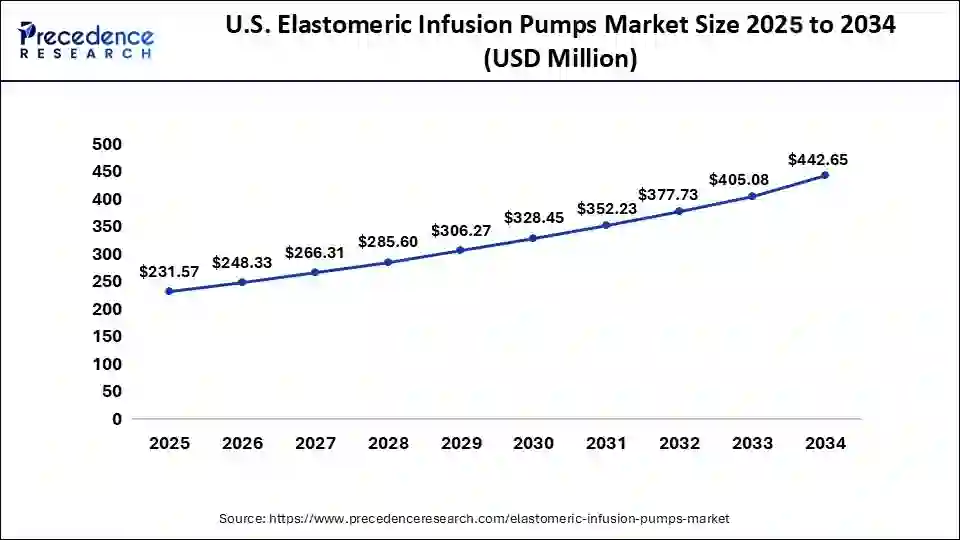

The U.S. elastomeric infusion pumps market size is exhibited at USD 231.57 million in 2025 and is projected to be worth around USD 442.65 million by 2034, growing at a CAGR of 7.44% from 2025 to 2034.

How did North America Dominate the Market in 2024?

North America held the largest elastomeric infusion pumps market share in 2024. The dominance of the region can be attributed to the increasing demand for home healthcare services, coupled with the rising incidence of chronic diseases. Moreover, the increasing elderly population in the region is propelling the demand for infusion pumps, such as elastomeric pumps. There is also an increasing demand for portable home healthcare services, which will impact market growth positively soon.

In North America, the U.S. led the elastomeric infusion pumps market owing to favorable reimbursement policies, strong healthcare infrastructure, and the presence of major market players in the country. Also, the FDA has implemented strict laws to ensure the efficacy and safety of infusion pumps, which can lead to the development of advanced products.

- In January 2024, a new elastomeric pump method was introduced by the East and North Hertfordshire NHS Trust, which could enable nurses to deliver antibiotics to clients in less time with one visit a day while reducing the number of visits required from nurses.

Developments in Medical Treatments are Bolstering the Asia Pacific

Asia Pacific is expected to witness the fastest growth in the elastomeric infusion pumps market during the period studied. The growth of the region can be credited to the rising disposable income levels, rapidly evolving healthcare infrastructure, and increasing advanced medical treatments. Furthermore, the growing population, raised healthcare awareness, and the surge in the health sector will likely contribute to market growth soon.

Focus on Quality Healthcare: Impacts the Chinese Market

China dominated the elastomeric infusion pumps market. The dominance of the country can be linked to the increasing emphasis on quality healthcare and the rise in the middle class. Also, the demand for efficient drug delivery systems, such as elastomeric infusion pumps, is anticipated to rise in the foreseeable future.

Ongoing Breakthroughs in Materials and Design are Fueling Europe

Europe is experiencing a significant expansion in the elastomeric infusion pumps. This is mainly leveraged by numerous producers who are employing sophisticated materials to expand the durability and reliability of pumps. Also, they are promoting the development of ergonomic, user-friendly, and lightweight designs to escalate patient comfort and compliance, mainly for home-based care.

Improvements in Infusion Periods & Applications: Spurs the UK Market

The leading UK players are focusing on raising the period of new-generation pumps for up to one week, with accelerated treatment convenience and potentially lowering the frequency of nurse visits or hospital trips. Besides this, they are exploring the wider applications in different settings, like in acute settings, including in hospitals, for short-term therapies.

Stepping Towards Variable Rate Pumps is Encouraging Latin America

A rise in demand for variable rate elastomeric pumps, with increased flexibility for tailored drug delivery, especially in pain management and chemotherapy. Such as many vital hospitals in Brazil, Mexico, and Peru are widely using Alaris smart pumps with wireless drug library updates and Dose Error Reduction Software (DERS) to raise patient safety.

Rigorous Regulatory Upgrades: Assists the Mexican Market

Specifically, Mexico's health regulatory agency, COFEPRIS, is integrating its medical device regulations more closely with international standards (such as FDA and EMA approvals) to simplify approvals and accelerate market safety and quality. This regulatory climate offers the entry and use of advanced medical devices.

Elastomeric Infusion Pumps Market: Value Chain Analysis

- R&D It covers a structured product development lifecycle that consists of concept generation, design, validation, and post-market surveillance.

Key Players: Melsungen AG, Fresenius Kabi AG, Smiths Medical, etc. - Clinical Trials & Regulatory Approvals These pumps are specifically regulated as Class II medical devices by the US FDA and further need study of safety and efficiency for market authorization, often via a 510(k) premarket notification.

Key Players: USFDA, EMA, Stuart Bond, Yonsei University, etc. - Patient Support & Services Organisations are offering comprehensive patient education and training, access to home healthcare services, and 24/7 clinical support for troubleshooting and emergencies.

Key Players: Avanos Medical, Inc., NIPRO Corporation, Vygon Group, etc.

Key Players in Elastomeric Infusion Pumps Market and Their Offerings

- Baxter offers a wide range of pumps for oncology, pain management, and home healthcare, with recent innovations in smart technology like the Novum IQ system to enhance patient safety and workflow efficiency.

- Fresenius Kabi AG focuses on integrated solutions and supply-chain resilience, offering diverse infusion therapy products and leveraging digitalization to improve interoperability and address specific clinical needs.

- B. Braun SE provides extensive infusion therapy solutions, emphasizing patient-centric care and chronic illness management, utilizing digital health capabilities and an expansive global presence for market reach.

- Ambu A/S contributes with innovation in single-use devices, including pain management solutions, adapting quickly to market needs with cost-effective, specialized equipment for a variety of applications.

- Leventon, S.A.U. (Werfenlife SA) specializes in specific, economically viable solutions that meet regional demands, utilizing strategies like distribution agreements to expand its market presence.

Latest Announcements by Market Leaders

- In October 2024, Nipro PharmaPackaging, a specialist in glass tubing, glass primary packaging, and medical devices, announced the launch of its innovative D2F (Direct-to-Fill) glass vials. These vials, featuring Stevanato Group's advanced EZ-fill technology, offer a high-quality ready-to-use (RTU) solution designed to meet the rigorous standards and increasing requirements of the pharmaceutical industry.

- In December 2024, Terumo Health Outcomes (THO), a division of Terumo Interventional Systems (TIS), and Medis Medical Imaging, a leading cardiac imaging software company, announced that they have entered into a strategic partnership, in the United States, to enhance cardiovascular care through the utilization of both ePRISM.

Recent Developments

- In January 2024, Hospital at Home launched a new elastomeric pump pathway for heart failure patients in East and North Hertfordshire. This initiative enables earlier hospital discharge and reduces admissions by allowing continuous treatment at home.

- In August 2024, the U.S. Food and Drug Administration (FDA) revealed that Smiths Medical is performing a corrective recall of its CADD-Solis Ambulatory Infusion Pump due to various concerns linked to obsolete software. According to the FDA, this recall focuses on remedying certain devices without removing them from operation or sale.

- In October 2023, China's National Medical Product Administration approved 221 medical device products, consisting of one from Hong Kong, Macau, or Taiwan, 176 Class III domestically produced devices, 28 Class III imported products, and 16 Class II imported products.

Segments Covered in the Report

By Product

- Continuous Rate Elastomeric Infusion Pumps

- Variable Rate Elastomeric Infusion Pumps

By Application

- Pain Management

- Chemotherapy

- Antibiotic/Antiviral Therapy

- Others

By End-use

- Hospitals

- Ambulatory Surgical Centers

- Others

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting