AI is shifting from a testing tool to a core business engine. Companies that scale it well gain faster growth, lower costs, and smarter decisions, while others fall behind. Success now depends less on technology and more on leadership, data use, and responsible integration.

Artificial Intelligence at Scale: How AI Is Reshaping Global Industries in the Decade Ahead

Artificial Intelligence (AI) has moved decisively beyond experimentation. Across industries, enterprises are shifting from fragmented pilots to scaled deployments that directly influence revenue growth, cost efficiency, customer experience, and risk management. Global spending on AI is projected to exceed USD 500 billion by 2027, growing at a CAGR of over 20%, yet fewer than 30% of organizations report achieving enterprise-wide value from AI today.

Global AI investment now runs into hundreds of billions of dollars annually, yet the returns remain uneven. While some organizations are reporting double-digit productivity gains and material revenue uplift, many others remain stuck in pilot mode, unable to translate technical success into business outcomes. This divergence is not accidental. It reflects fundamental differences in industry structure, data maturity, operating models, and leadership intent.

The Global State of AI Adoption: From Momentum to Maturity

| Metric (Global) | 2023 | 2025 |

| % of enterprises using AI in some form | 55% | 75% |

| % running AI at scale across functions | 18% | 35% |

| % reporting “significant financial impact” | 12% | 28% |

| Avg. AI ROI timeline | 18–24 months | 12–18 months |

The New Reality of AI Adoption: Scale, Not Sophistication, Determines Winners

Across industries, AI capabilities have become increasingly commoditized. Advanced algorithms, foundation models, and open-source frameworks are widely accessible. Yet performance outcomes vary dramatically. The reason is simple: AI advantage no longer comes from building better models, but from integrating AI into the core of how organizations operate.

In 2024, more than 70% of large enterprises reported using AI in at least one function. However, fewer than 30% had deployed AI across multiple business-critical workflows, and less than 15% reported enterprise-level financial impact. This gap highlights a shift underway: AI success is becoming less about experimentation and more about organizational discipline, governance, and execution at scale.

Industries with standardized processes, high data volumes, and clear performance metrics are progressing faster. Others, constrained by regulation, legacy infrastructure, or fragmented value chains, are moving more cautiously, but not standing still.

Artificial Intelligence (AI) Market Size and Growth 2025 to 2034

The global artificial intelligence (AI) market size was USD 638.23 billion in 2024, calculated at USD 638.23 billion in 2025 and is expected to reach around USD 3,680.47 billion by 2034, expanding at a CAGR of 19.20% from 2025 to 2034.

Market Highlights

- North America accounted for the largest market share, at 36.92%, in 2024.

- The Asia Pacific region is expected to grow at a notable CAGR of 19.8% from 2025 to 2034.

- By solution, the software segment held the biggest market share of 51.40% in 2024.

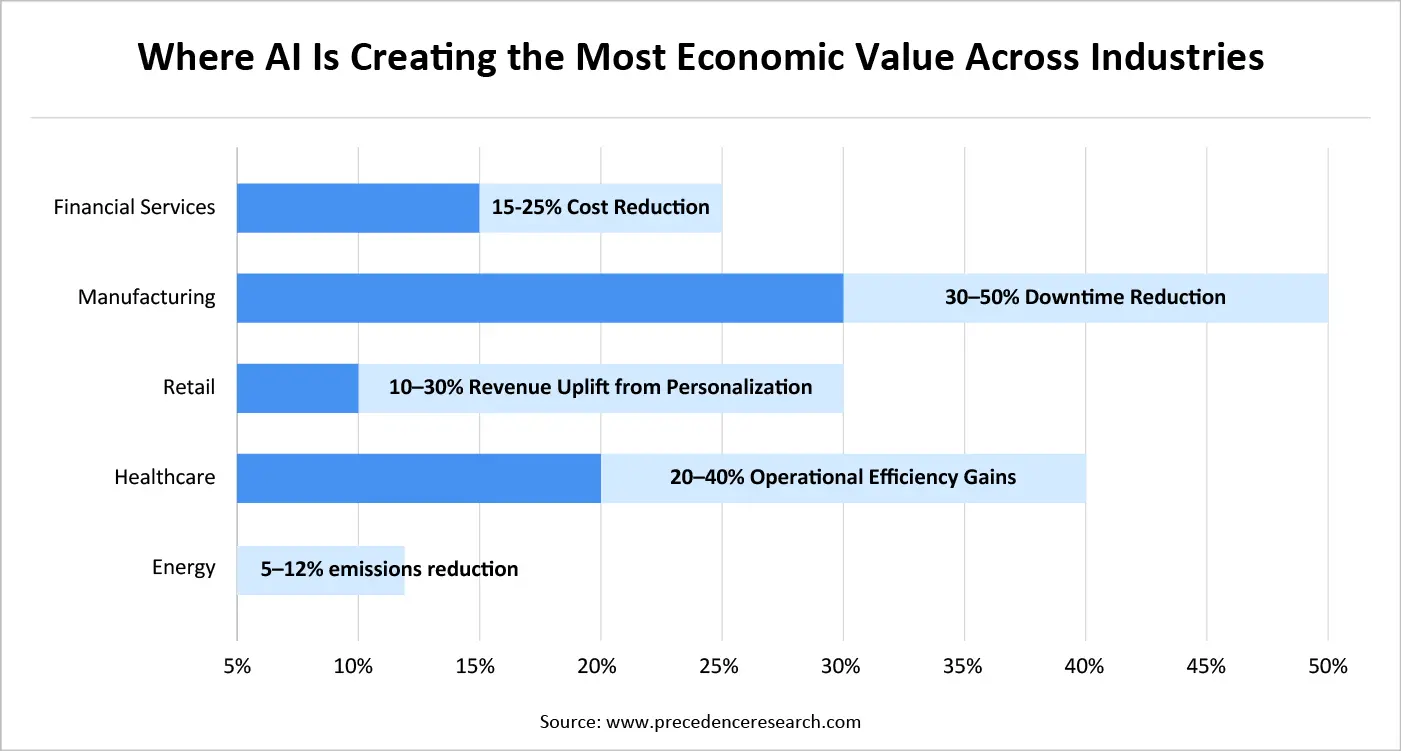

Where AI Is Creating the Most Economic Value Across Industries

Suggested Visuals:

- Heat map comparing industries vs. value drivers (cost reduction, revenue growth, risk mitigation)

- Data points:

- Financial Services: 15–25% cost reduction

- Manufacturing: 30–50% downtime reduction

- Retail: 10–30% revenue uplift from personalization

- Healthcare: 20–40% operational efficiency gains

- Energy: 5–12% emissions reduction

Financial Services: AI as the Invisible Operating System of Modern Finance

No industry illustrates the evolution of AI more clearly than financial services. Banks, insurers, and capital market firms were early adopters, initially using AI to automate narrow tasks such as fraud detection or credit scoring. Today, AI increasingly functions as an invisible operating layer that shapes decision-making across the enterprise.

In retail banking, AI-driven fraud detection systems now analyze transactions in real time, reducing fraud losses by 30–50% while simultaneously lowering false positives that frustrate customers. Credit underwriting models incorporate thousands of variables, improving risk prediction accuracy by 20–25% compared to traditional scorecards. Meanwhile, conversational AI handles the majority of routine service requests, allowing human agents to focus on higher-value interactions.

What is changing now is the emergence of agentic AI systems capable of orchestrating entire workflows. In leading institutions, AI agents can approve loans end-to-end, monitor compliance continuously, and dynamically adjust pricing based on market conditions. These capabilities are reducing operating costs by 15–25% while enabling faster product innovation.

However, financial services also illustrate the limits of unchecked AI. Regulatory scrutiny, explainability requirements, and systemic risk considerations mean that governance is as critical as innovation. The institutions pulling ahead are those that embed responsible AI controls directly into their operating models rather than treating them as afterthoughts.

Healthcare and Life Sciences: Precision at Scale, With Trust as the Constraint

Healthcare represents one of the most transformative, but also most complex AI frontiers. The promise is immense: earlier diagnosis, personalized treatment, faster drug discovery, and more efficient health systems. The reality is nuanced, shaped by regulation, ethics, and human trust.

AI-powered diagnostic tools now match or exceed clinician-level accuracy in areas such as radiology, dermatology, and pathology, with accuracy rates exceeding 90% in several standardized tests. In drug discovery, AI-enabled molecular modeling has reduced early-stage development timelines by 30–50%, significantly lowering R&D costs.

Operationally, hospitals are using predictive analytics to forecast patient admissions, optimize staffing, and reduce readmissions by 15–25%. These improvements directly address long-standing inefficiencies that strain healthcare systems globally.

Yet adoption remains uneven. Clinical workflows are complex, data is fragmented, and explainability is non-negotiable. Successful healthcare AI programs share a common trait: they are designed with clinicians, not just for them. AI systems that augment decision-making, rather than attempt to replace it are the ones achieving sustained adoption.

Manufacturing and Industrial Operations: AI as the Engine of the Smart Enterprise

In manufacturing, AI’s value proposition is deeply economic. Thin margins, volatile supply chains, and aging workforces have forced industrial firms to rethink how productivity is achieved. AI, combined with sensors and industrial IoT, is becoming the backbone of the “smart factory.”

Predictive maintenance is among the most mature use cases. By analyzing equipment data in real time, AI systems can predict failures weeks in advance, reducing unplanned downtime by 30–50%. Computer vision systems now inspect products at speeds and accuracy levels unattainable by human inspectors, cutting defect rates by up to 90%.

Beyond individual use cases, manufacturers are deploying digital twins AI-powered simulations of physical assets and processes. These models allow companies to test production scenarios, optimize energy usage, and redesign workflows virtually before implementing changes on the factory floor.

The strategic shift underway is from automation to autonomous optimization. Leading manufacturers are building systems that continuously learn, adapt, and optimize across the entire value chain, from procurement to distribution.

Retail and Consumer Goods: From Mass Markets to Markets of One

Retail AI adoption has accelerated as consumer expectations reset around speed, personalization, and convenience. Recommendation engines now influence a significant share of online revenue, with personalized experiences driving 10–30% higher conversion rates.

AI-driven demand forecasting improves inventory accuracy, reducing stockouts by 20–40% while minimizing overstock. Dynamic pricing systems continuously adjust prices based on demand signals, competitor behavior, and inventory levels, improving margins by 5–10%.

However, retail also highlights the ethical dimension of AI at scale. Consumers are increasingly sensitive to data usage, algorithmic bias, and manipulative personalization. The most successful retailers balance advanced analytics with transparency and trust, positioning AI as a service enabler rather than a surveillance tool.

Energy, Utilities, and Sustainability: AI as a Catalyst for the Transition Economy

Few sectors face transformation as profound as energy and utilities. The transition to renewables, decentralized generation, and stricter emissions targets has created unprecedented complexity. AI is emerging as a critical enabler of this transition.

AI-powered forecasting models improve renewable energy integration by 20–30%, helping grid operators manage variability in solar and wind generation. Predictive maintenance reduces failures in aging infrastructure by 25–40%, while optimization algorithms cut emissions by 5–12% through smarter asset utilization.

Cross-Industry Insight: The AI Maturity Gap Is an Operating Model Problem

Across sectors, a clear pattern emerges. AI leaders are not those with the most advanced technology, but those with the most coherent operating models.

| AI Maturity Level | Characteristics |

| Experimentation | Isolated pilots, unclear ownership |

| Functional Scaling | Department-level deployment |

| Enterprise Integration | Shared platforms, governance |

| Autonomous Operations | AI-managed workflows |

The Workforce Reset: Why AI Favors Generalists Over Specialists

AI is fundamentally reshaping work. While automation will replace certain tasks, it is also increasing demand for AI-literate generalists, professionals who understand business context, data, and human judgment.

By 2030, up to 40% of current tasks may be automated in some form. At the same time, new roles are emerging in AI governance, orchestration, and human-AI collaboration. Organizations that invest in reskilling and cultural adaptation are seeing faster AI adoption and higher employee engagement.

Responsible AI: From Statements to Systems

Responsible AI has moved from ethics statements to operational necessity. Regulatory pressure, reputational risk, and stakeholder expectations demand transparency and accountability.

Yet fewer than one in four organizations have embedded responsible AI into daily operations. Leaders are implementing governance frameworks that integrate bias testing, explainability, and human oversight directly into AI workflows, turning responsibility into a competitive advantage rather than a constraint.

Why Value Is Concentrating Among Fewer Players

As AI adoption matures, a striking economic pattern is emerging across industries: value is concentrating, not distributing evenly. Early expectations assumed AI would act as a democratizing force, lifting productivity broadly across sectors. In reality, AI is behaving more like previous general-purpose technologies, electricity, computing, the internet where early leaders pull away rapidly.

Organizations that successfully scale AI report 2–3x higher returns on digital investments compared to peers. These gains compound over time. AI systems improve with usage, data feedback loops strengthen, and marginal costs decline. As a result, leading firms reinvest gains into further AI capability, widening the performance gap.

This phenomenon is particularly visible in industries with network effects. In financial services, large institutions benefit from superior data breadth, enabling more accurate models. In retail, companies with higher transaction volumes generate richer behavioral data, reinforcing personalization engines. In manufacturing, scale enables investment in digital twins and autonomous systems that smaller players struggle to afford.

The implication is clear: AI is becoming a competitive accelerant, not a leveling force. For lagging organizations, incremental adoption will not be enough. Closing the gap requires structural change in how decisions are made, how data flows across the enterprise, and how leadership prioritizes AI investments.

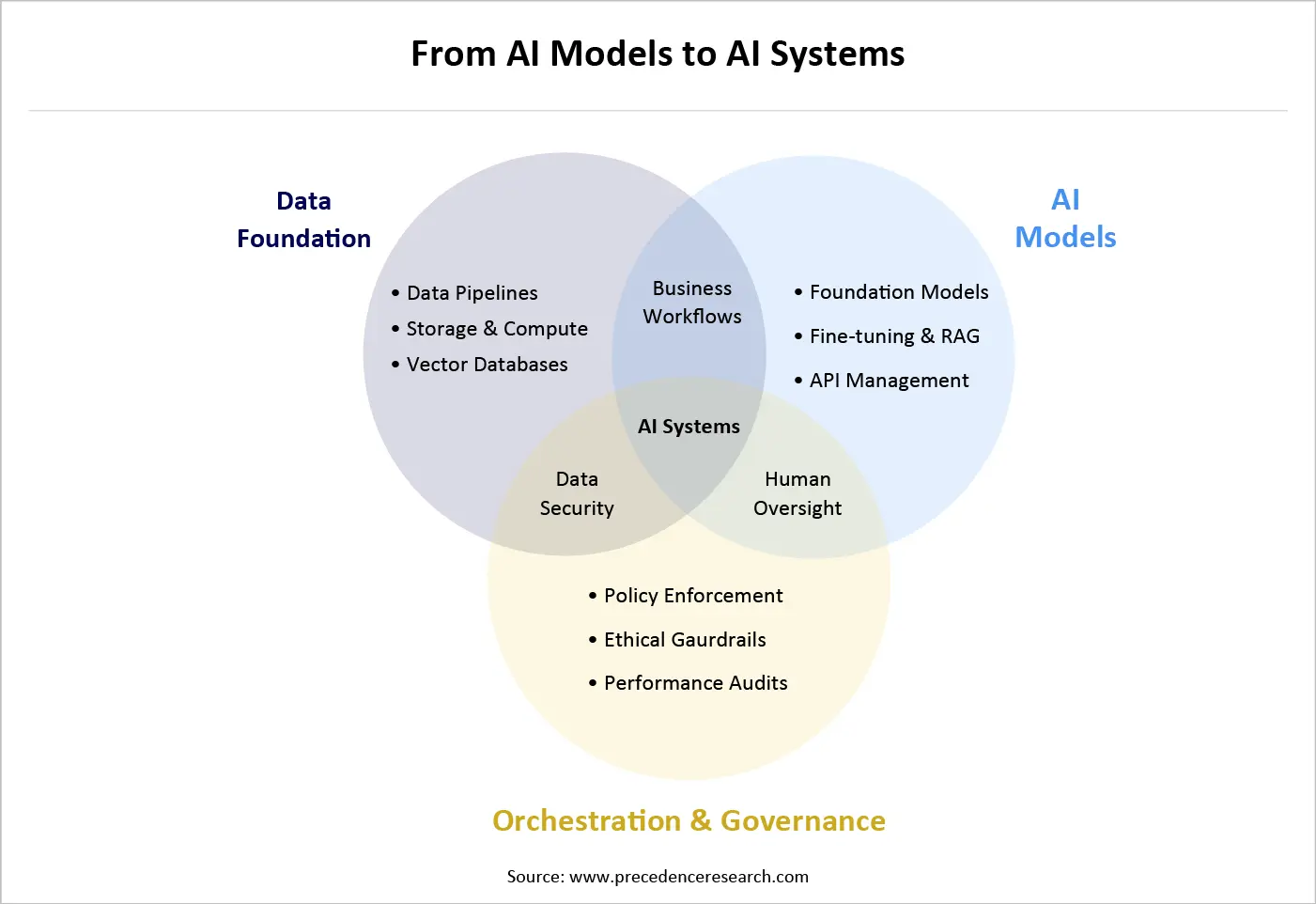

The Hidden Layer Separating Pilots from Performance

One of the least discussed, but most critical, elements of enterprise AI success is orchestration. While much attention is paid to models and tools, the true challenge lies in coordinating AI systems across functions, data sources, and human workflows. As organizations scale AI, complexity increases rapidly. Models interact with other models. Outputs trigger downstream decisions. Errors propagate if left unchecked. Without orchestration, AI ecosystems become fragile, opaque, and difficult to govern.

From AI Models to AI Systems

- Layered architecture diagram:

- Data foundation

- AI models

- Orchestration & governance layer

- Business workflows

- Human oversight

As artificial intelligence capabilities continue to advance, industries are entering a phase that looks fundamentally different from the experimentation and early scaling of the past decade. The next wave of AI adoption will not be defined by incremental efficiency gains or isolated automation wins. Instead, it will be characterized by structural shifts in how decisions are made, how value chains are connected, and how enterprises balance innovation with responsibility.

At the center of this evolution is a simple but powerful reality: AI is becoming less of a tool and more of a decision-making infrastructure. As organizations deploy increasingly autonomous systems, the emphasis is shifting from what AI can do to how AI should be allowed to act within enterprise boundaries.

Greater Autonomy in Decision-Making: From Assisted Intelligence to Delegated Authority

The next phase of industry AI will see a meaningful transition from AI that supports human decisions to AI that executes decisions within predefined limits. In many sectors, this shift is already underway. Pricing engines adjust rates in real time, supply chain systems reroute shipments autonomously, and credit engines approve or decline applications without human intervention.

What changes now is scope and confidence. Rather than handling narrow, low-risk tasks, AI systems are increasingly entrusted with decisions that have direct financial, operational, and reputational consequences. By the end of the decade, it is expected that 30–40% of routine enterprise decisions, particularly in areas such as operations, procurement, customer engagement, and risk management will be handled autonomously.

How the Next Phase of AI Differs from Today

| Dimension | Current Phase of AI | Next Phase of Industry AI |

| Decision Role | Decision support and recommendations | Delegated, semi-autonomous decision-making |

| Scope of Deployment | Function-level optimization | End-to-end value chain integration |

| Governance Focus | Model accuracy and performance | Trust, accountability, and explainability |

| Regulatory Posture | Reactive compliance | Proactive, design-led governance |

| Sustainability Impact | Secondary or indirect benefit | Core value driver and investment rationale |

| Competitive Advantage | Tool adoption and speed | System-level integration and discipline |

Artificial intelligence is no longer an experiment layered onto existing structures. It is a force that challenges how organizations think, decide, and operate. Across industries, AI is amplifying strengths, exposing weaknesses, and accelerating divergence between leaders and laggards.

The question facing enterprises is no longer whether AI will reshape their industry, but whether they are prepared to reshape themselves in response. Those that approach AI with strategic intent, operational rigor, and human-centered design will not merely adapt, they will define the next era of industry leadership.

About the Authors

Aditi Shivarkar

Aditi, Vice President at Precedence Research, brings over 15 years of expertise at the intersection of technology, innovation, and strategic market intelligence. A visionary leader, she excels in transforming complex data into actionable insights that empower businesses to thrive in dynamic markets. Her leadership combines analytical precision with forward-thinking strategy, driving measurable growth, competitive advantage, and lasting impact across industries.

Aman Singh

Aman Singh with over 13 years of progressive expertise at the intersection of technology, innovation, and strategic market intelligence, Aman Singh stands as a leading authority in global research and consulting. Renowned for his ability to decode complex technological transformations, he provides forward-looking insights that drive strategic decision-making. At Precedence Research, Aman leads a global team of analysts, fostering a culture of research excellence, analytical precision, and visionary thinking.

Piyush Pawar

Piyush Pawar brings over a decade of experience as Senior Manager, Sales & Business Growth, acting as the essential liaison between clients and our research authors. He translates sophisticated insights into practical strategies, ensuring client objectives are met with precision. Piyush’s expertise in market dynamics, relationship management, and strategic execution enables organizations to leverage intelligence effectively, achieving operational excellence, innovation, and sustained growth.

Request Consultation

Request Consultation