Healthcare payers are rapidly transforming from traditional claims processors into data-driven value orchestrators. Powered by AI, cloud, automation, and advanced analytics, rewired payers reduce administrative costs, improve health outcomes, and deliver personalized, transparent member experiences while keeping ethics and human empathy at the core.

The New Pulse of Healthcare Finance

The global healthcare economy is evolving faster than any payer can comfortably keep pace with. The combination of the increasing cost, complicated rules, and the aging population with a surge of digital innovation is altering the way care is provided and funded. Conventional payer organizations, which were designed with reliability but not speed, are now exposed to digital-native participants and consumer demands for transparency, immediacy, and personalization. The old systems that had ensured stability in operations are turning into bottlenecks to block development.

Healthcare payers must then transition from being claim processors to value orchestrators. The issue is not whether they need to digitize, but how far they must re-architect their core. The application of artificial intelligence, automation, and cloud computing has enabled a redesign of all the processes, including underwriting and engagement. However, it is not technology that can bring about change. It has to be inculcated with a new culture, new data ethics, and new methods of success measurement.

Precedence Research views this change as a rewiring rather than a technology upgrade. Our analysis indicates that those who will win here will be the ones who uproot administrative inertia through the application of algorithmic intelligence without losing the human empathy that healthcare is based on. The rewired payer will also think like a data company, behave like a consumer brand, and work like a clinical partner. This is not a far-fetched dream- it is the working requirement of the decade to come.

The Digital Deficit: Why Payers Lag Behind

The digital transformation of every payer begins with confronting its own legacy. In static environments, the core administration systems that were written decades ago were designed to monitor eligibility and reimbursements. Layers of manual workarounds and regulatory changes have made them, over the years, complex labyrinths of code. The combination of these systems and the current tools of the digital realm is comparable to connecting a supercomputer to a steam engine. Latency, limited visibility, and high cost of maintenance are the outcomes.

Compliance cultures have been developed within the payer organisations, and success was equated with minimum deviation. Reliability was guaranteed by that discipline, but it brought about resistance to change. Some employees who have dedicated their lives to mastering manual processes that are complex in nature tend to see automation as a curse and not a blessing. The solution to overcoming this fear is leadership that not only explains the mechanics of digital transformation but also the meaning of the change.

Modernisation, as Precedence Research emphasizes, must be approached as a phased evolution, not a single project. The best payers view legacy transformation as a never-ending process of simplification-finding redundant processes, automating high-impact workflows, and leveraging the data of one process to inform the next. Modernization as a rhythmic process instead of an event gives momentum and confidence to the organization. The inefficiency of analog infrastructure is being revealed by regulatory dictates of interoperability, cybersecurity, and outcome-based reimbursement.

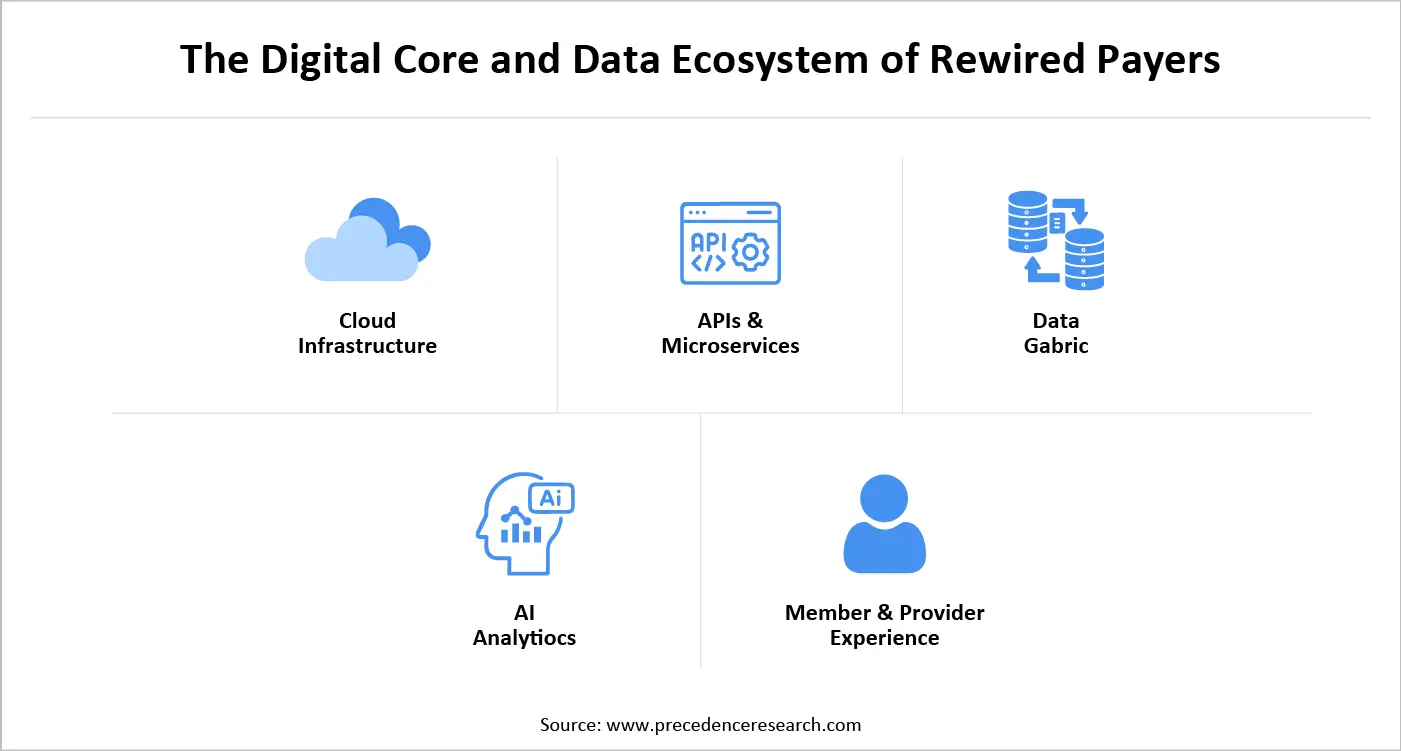

Designing the Digital Core

At the heart of any transformed payer lies a digital core, an integrated set of technologies, processes, and governance principles that enable real-time intelligence. This core starts with cloud migration, which enables switching to the next level, scalability, updates, and access to enhanced AI toolkits. However, cloud adoption is a continuing process rather than a destination. A digital core is a connector between front-end experience and back-end intelligence.

All that has to flow into analytics engines that learn with each interaction, feed member portals and mobile applications, as well as provider dashboards. This provides feedback loops in which claims information leads to care management, care management leads to pricing, and pricing leads to new product design. Every transaction will then become a data signal, which will enhance the overall intelligence of the organization. According to Precedence Research, this is the emergence of the so-called living payer platform, which is a system that evolves with the tempo of the ever-changing environment. It is designed in a modular architecture, which is based on APIs that enable internal teams and external partners to integrate into services without having to do complex re-coding.

Data: The New Currency Powering the Future of Care

Healthcare payers stand atop vast oceans of data, yet in many organizations, this information remains trapped in silos, underutilized, unexamined, and disconnected from its true potential. Data, such as claims, provider performance, clinical outcomes, and social determinants, all of which exist in dissimilar databases and are controlled by the various teams and are frequently stored on incompatible platforms.

Rewiring starts with changes to convert these disjointed datasets into an interoperable, coherent ecosystem. Highly developed analytics is able to identify arising tendencies of risks even before they occur in claims. The predictive models can also identify members who have a high risk of developing chronic conditions, and this can be intervened at an early stage. Procedural redundancy that pushes costs up and does not enhance outcomes can be detected through machine-learning algorithms. Precedence Research refers to this progression as the “data value decade.” Raw data generates descriptive analytics, predictive analytics, and prescriptive analytics. When integrated into daily operations, this intelligence shifts the payer’s orientation from hindsight to foresight.

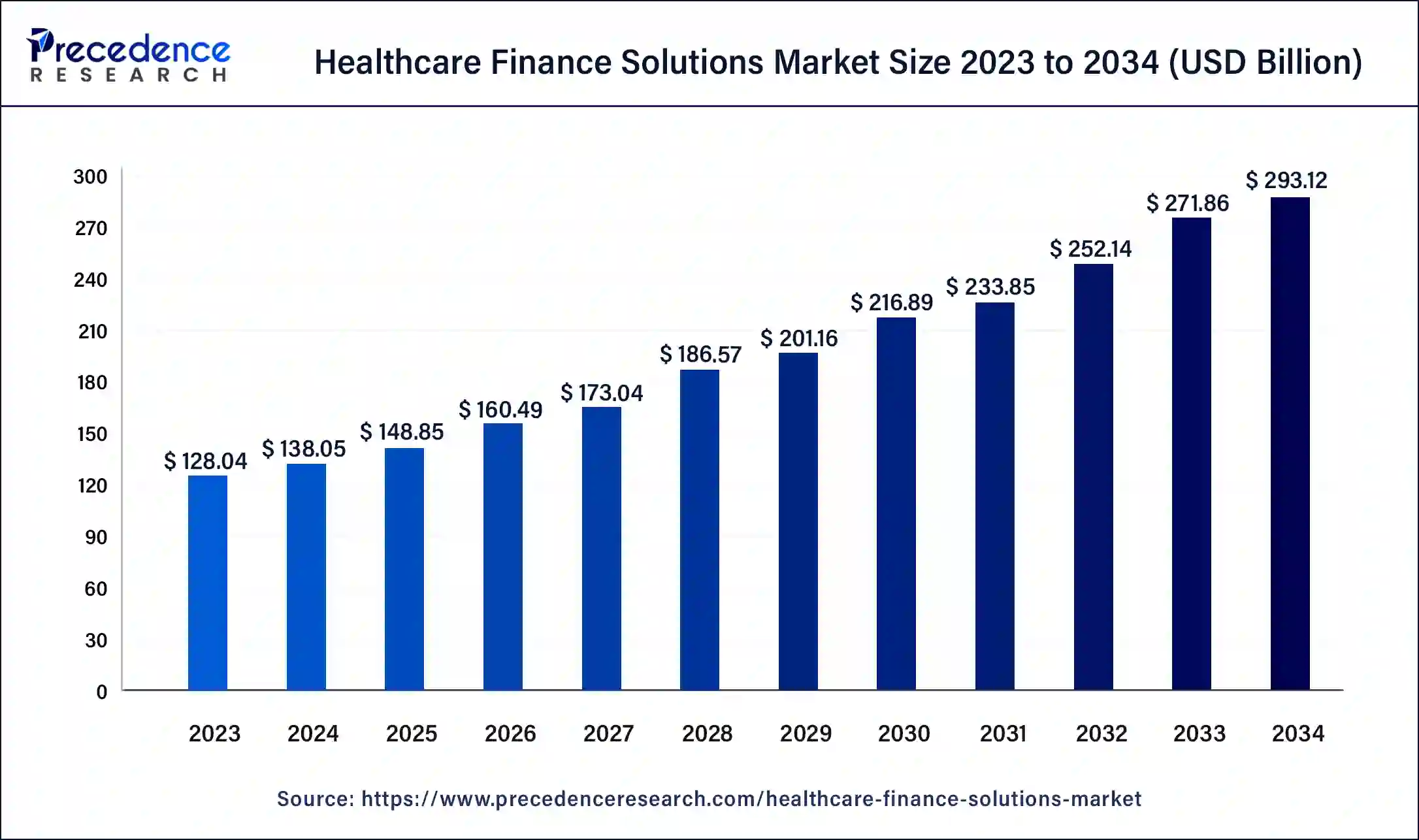

What is Healthcare Finance Solutions Market Size?

The global healthcare finance solutions market size is USD 148.85 billion in 2025, calculated at USD 160.49 billion in 2026 and is expected to reach around USD 293.12 billion by 2034, expanding at a CAGR of 7.82% from 2025 to 2034. The continuous need to improve processes and performance and the requirement for hi-tech equipment and technology are some of the factors driving the healthcare finance solutions market growth.

The healthcare finance solutions market encompass tools and strategies employed by healthcare organizations like hospitals and clinics to effectively manage their financial processes. These solutions streamline billing and payment procedures and ensure accurate billing for patients and insurance companies. They also aid in navigating intricate insurance reimbursement models and guaranteeing fair and timely payments.

Healthcare Finance Solutions Market Trends

- The increasing prevalence of chronic diseases is expected to fuel the healthcare finance solutions market growth in the upcoming years.

- Rising global geriatric population is contributing to the growth of the healthcare finance solutions market.

- Decreasing the cost of treatment facilitated by technological advancements can drive market growth further.

- Some key providers are providing great deals to support the healthcare sector, which can boost the healthcare finance solutions market growth shortly.

- AI & Predictive Analytics are being used to optimize billing, forecast payments, and reduce the risk of defaults.

- Flexible patient payment plans are becoming common, allowing patients to pay in installments for expensive treatments.

- Blockchain and secure digital platforms are being adopted to make billing and claims transparent and reduce fraud.

- Personalized insurance models are on the rise, using data to offer coverage tailored to individual risk and needs.

- Subscription and value-based payment models are emerging, linking payments to health outcomes or ongoing care.

- Cloud-based finance solutions help hospitals and clinics streamline billing, claims processing, and reporting.

- Rapid adoption in emerging markets is driven by growing healthcare infrastructure and financing needs.

- Regulatory and value-based care pressures are pushing providers to adopt smarter, more flexible financial solutions.

The Digital Core and Data Ecosystem of Rewired Payers

Artificial Intelligence: Powering the Rise of the Cognitive Enterprise

Artificial intelligence is no longer a futuristic experiment, as it is the operational engine of major payers. Machine learning automates the process of claim adjudication, and natural-language processing understands physician notes. These are not structured, and predictive models can predict utilization patterns several months before they happen. Every capability introduces accuracy to judgment that was previously reliant on hand examination.

AI-driven recommendation engines can analyze behavior patterns, lifestyle data, and clinical history to deliver tailored programs, from preventive screenings to comprehensive disease management plans. This interaction not only leads to better results but also builds loyalty, which is a rare asset as the cost of switching suppliers in the industry is reducing. Precedence Research identifies three maturity stages of AI integration. The first is automation, where algorithms replicate manual tasks.

The second is augmentation, where AI supports human judgment. The third is autonomy, where systems act within defined ethical parameters without human initiation. Most payers currently operate between automation and augmentation. Moving toward autonomy requires rigorous governance to ensure accountability. Payers should hence embrace clear model-validation and explainability in order to audit the decisions. There is a rapidly changing regulation, but proactive ethics will never remain behind compliance.

The Human Transformation in the Digital Era

Behind every digital dashboard are the people who must use it, and the human side of transformation remains both the most complex and the most overlooked aspect of change. New technologies succeed only when they are adopted, and adoption depends on belief. Employees should be made aware of the fact that digital tools are not aimed at taking away their professional knowledge but rather complementing it. Training programs must hence combine both the technical training with cultural orientation. When teams are made aware of the importance of change, not only to members but also to the mission, they will work with much more zeal.

Precedence Research emphasizes the importance of continuous learning ecosystems. The rate at which the digital world is advancing renders single training redundant. Adaptive competence is developed through internal academies, mentorship programs, and cross-functional rotations. Digital literacy also becomes embedded in the organizational DNA over time. Its final destination is psychological safety, the confidence to suggest ideas, challenge assumptions, and repeat without the fear of blame. Innovation thrives when there is safety and curiosity. The rewired payer is not only a digital organisation but a learning being.

Rewiring Governance in the Age of Algorithms

As digital operations expand, governance becomes increasingly complex and even more essential to sustaining trust and efficiency. The standard oversight frameworks of quarterly reviews and inflexible policies are unable to match the algorithmic decision-making cycles in milliseconds. The governance should change to be an ongoing assurance and not episodic auditing. Risk management and innovation enablement are combined in modern digital governance. Automated compliance software tracks transactions in real time, with suspicious transactions reported to humans. The ethics committees of data evaluate the fairness and transparency of algorithms. Cyber-resilience models use security as a collective responsibility among the IT, operations, and business departments.

Progress is also a measure of good governance. There will be key measures, such as the rate of adoption of new digital tools, the decrease in manual interventions, and better decision-making. These indicators hold transformation accountable to outcomes and not words. Its philosophy is not complicated, but rather deep, ruling must spur change, not hinder it. Risk is manageable, and innovation can be maintained when control is performed at the same speed as innovation.

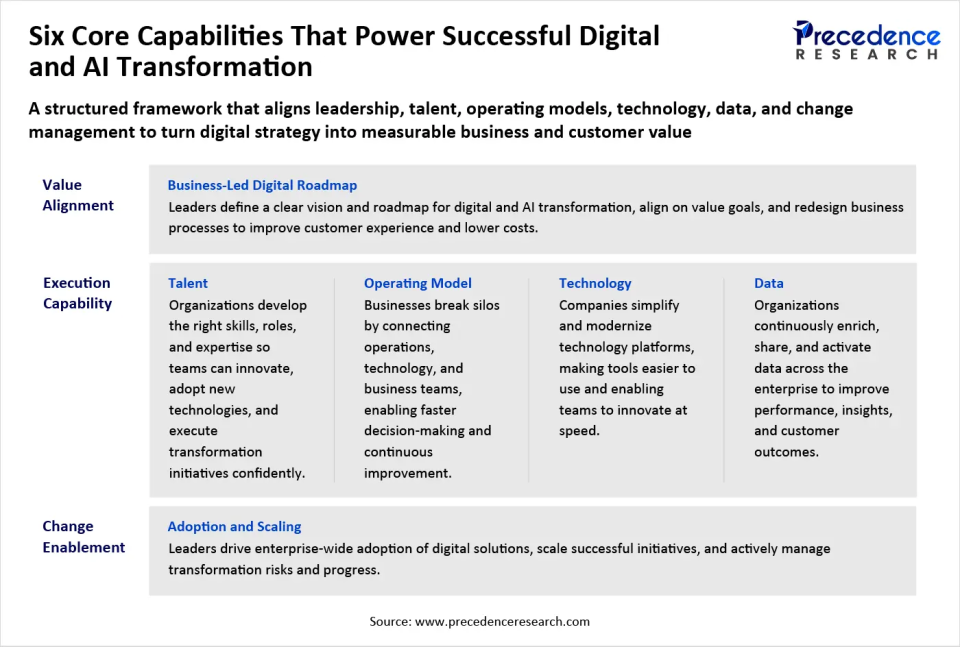

The Digital Strategy Imperative for Rewired Payers

Strategy is not about gradual improvement, it is about reinventing the very purpose for which a payer organization exists. Digital transformation should start with a vision that determines what value the payer wishes to bring to a connected health ecosystem. In the past, insurers focused on achieving efficiency in claims management, but now they must strive for efficiency in health itself. That is to take the place of reimbursement with prevention, volume with value, and opaque transactions with open experiences.

A digital strategy helps to define what is important amid the enormous opportunities of technology. The payer could emphasize automation to reduce administrative costs, focus on AI-driven care navigation to achieve better outcomes, or invest in analytics platforms to enhance underwriting accuracy. It will have to depend on the market position and preparedness of each payer. Precedence Research frames this as “purpose-driven digitalization.” It asserts that technology ought to be missionary and not a distraction from the mission.

The dominant actors are starting to combine purpose and profit by relating digital efforts to quantifiable health outcomes. New economic thinking is also required in the implementation of a coherent digital strategy. Payers are advised to treat data as a compound interest capital asset. Clean, interoperable data investment is beneficial in claims automation, fraud detection, and customer engagement. It is financially rational to think that a better quality of data will, in the long run, have a higher payback, the faster it is improved and the more continuous it is.

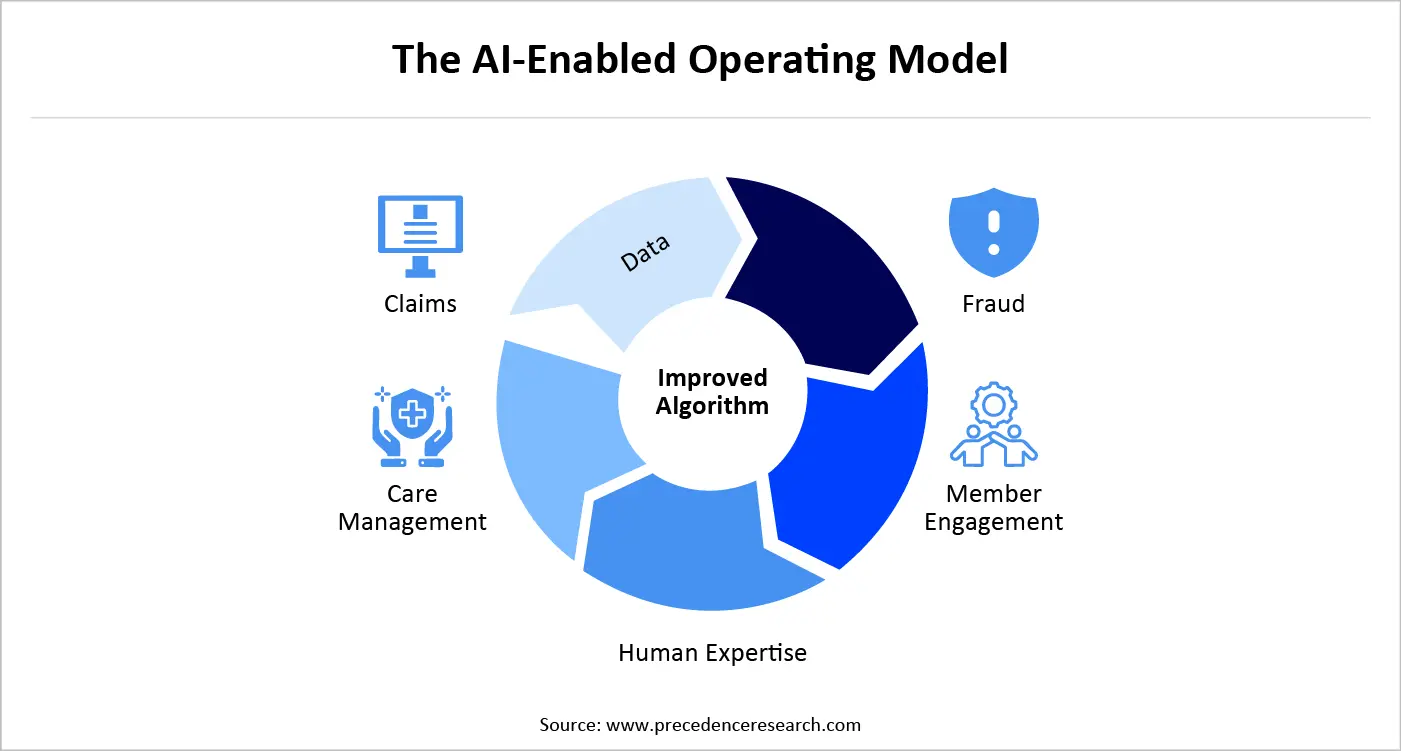

Building the AI Enabled Operating Model for Rewired Payers

A rewired payer does not simply add artificial intelligence to existing workflows, it rebuilds those workflows entirely around intelligence. The AI-controlled operating model combines data, algorithms, and human experience, and forms learning loops that remain constantly repeated. It is a chance to make better decisions in the future with every transaction.

Machine-learning systems that learn through historical adjudication are now capable of handling most simple claims automatically, which leaves the human expert to work on exceptions that are judgment-based. With time, the feedback provided by such specialists helps to improve the algorithm, and each time, it increases accuracy. Fraud detection, provider credentialing, and member support are all undergoing similar loops. Organizations that have attained full-loop learning capture up to five times more operational insight than organizations that have made use of stagnant analytics. However, insight will not necessarily lead to impact. The operating model should be reorganized in a way that knowledge is converted into action quickly. The mechanism of that translation is agile cross-functional teams.

These teams are comprised of a combination of technologists, clinicians, data scientists, and policy experts who have co-designed end-to-end solutions. They do not pass hand projects across departments, but rather repeat themselves constantly, controlled by real-time performance measures. This fluid form is a substitute for past vertical hierarchies with a lattice of collaboration. What used to take months to make can now be made in a few days.

In order to maintain agility, the governance should be lightweight and adaptive. An example is that budgeting no longer operates on an annual basis but is conducted on rolling investment pools to finance promising experiments. Projects that demonstrate traction attract additional resources, while those that stagnate are swiftly terminated. The field is a reflection of venture capital in a corporate setting. In the healthcare sector, where competitive advantage was formerly defined by information asymmetry, agility has become the new currency.

Unlocking the Economics of Digital Value for Rewired Payers

Digitalization reshapes the cost curve of the entire business, even though transforming a payer remains an expensive undertaking. Simplification alone by administration will be able to reduce costs that, in traditional terms, were eating up to a quarter of premiums. The automation, self-service portals, and processing straight-through minimise manual interventions and correction of errors. But the bigger reward is financial growth brought about by improved involvement and well-being outcomes.

Digital technology allows payers to create micro-segmented product offerings that are aligned to the lifestyle, occupation, or chronic-condition personalities of the members. Risk pricing that is more competitive and fairer is made possible by precision underwriting, which is an AI-driven tool fueled by real-time information about wearable devices. These inventions increase the market share of digital-first consumers who anticipate the same level of personalization by health insurers as they do streaming sites or banks.

According to the analysis conducted by Precedence Research, every digitisation maturity wave opens up a new economic sphere. The former one reduces cost, the second one brings efficiency, and the third brings completely new value propositions. The third wave, the payer utilises their data analytics to sell insights to providers, employers or policymakers, always within ethical and regulatory limits. Instead of developing all solutions in-house, progressive payers are investing in startup environments, data-exchange platforms, and joint R&D programs. The next phase of payer profitability will be collaborative economics, in which a variety of stakeholders jointly invest in digital transformation.

Redefining the Member Experience in a Rewired Healthcare Landscape

Digital transformation has fundamentally reshaped what members expect from their payers. Traditionally, there was only interaction in case something went wrong, a claim was denied, a bill was misleading, or the eligibility issue was raised. The rewired payer turns that casual relationship into an ongoing dialogue. The members are guided in time through omnichannel communication such as mobile applications, chatbots, wearables, and personalised dashboards before the problem can escalate.

Members no longer perceive their insurer as a means, as a bureaucratic entry point, but as a healthcare ally. Incentives could be provided to people to adhere to medication, screenings, or wellness by sending personalised nudges. Such communications are contextual, timely and in the right channel, and when they are communicated in this way, they create trust and not weariness.

Precedence Research refers to this strategy as empathetic intelligence. It combines human knowledge with fact-based information. As an illustration, AI can determine that a diabetic patient has been missing follow-up appointments regularly, whereas empathy will make the outreach less punitive and more supportive. The language, time and tone are equally important as the accuracy of algorithms.

Within the company, the payers should apply the same user-centric philosophy towards the employees. Claims processors, nurses, and call-centre agents should have access to digital tools that are as smooth just like what is being provided to the customers. As the experience of the employees increases, so does that of the members-two sides of the same coin in the rewired enterprise.

The AI-Enabled Operating Model

Evolving from Ecosystem to Platform in the Rewired Payer Economy

In the analog world, insurers operated as closed systems bound by bilateral agreements, but digitalization transforms them into dynamic, networks powered by a platform mindset. The payer platform is more of a marketplace, uniting the members with telemedicine providers, fitness programs, pharmacies, and wellness coaches instead of just handling claims. APIs enable the interchange of data in a secure way, thus third parties can develop complementary services. The larger the number of participants, the better the platform, a typical network effect.

This model is referred to by Precedence Research as the health value web. It contains payers that shift towards population health coordinators. They are also responsible for screening the partners, ensuring the integrity of data and aligning the incentives in such a manner that the best outcomes are available to all, including providers and patients.

Payers diversify their dependency by using external innovation instead of funding all development in-house. They are able to fly AI diagnostic tools or remote-monitoring solutions with limited integrations, and narrow only to value delivery. This scalability safeguards technological obsolescence. Simply put, the rewired payer is now infrastructure and also an innovator, a centre of trust within an ecosystem of intelligence. A radical redefinition of identity as a payer but a partner, an insurer but an integrator.

Governance, Risk, and the Ethics of Intelligence

Digital acceleration brings not only efficiency but also exposure, as every algorithm that touches a claim, diagnosis, or price point carries its own moral weight. To payers, governance thus turns into the immune system of the digital enterprise, a mechanism that remains continuously active and keeps innovation healthy without stifling it.

Conventional compliance was based on post-hoc inspection. In a knowledge-based organisation, control has to be done on the fly. Policy as code. This technique inserts regulatory requirements into software pipelines so that updates and releases are all automatically compliant. Dashboard continuously monitors and identifies abnormal data access or model operations before they become a problem. This change in convolutive auditing to anticipatory assurance is also reflective of the general shift from reactive to proactive healthcare.

Governance does not play the role of an adversary to innovation, but rather it facilitates it. Payers want to innovate without fear since they would have put the ethics codified in algorithms and code of compliance in place to liberate themselves. The organisations that achieve this Art will not be merely spared punishment; they will get reputational capital that in itself can become a competitive advantage.

The Future of Rewiring Healthcare: Keeping Humanity at the Core

Technology may rewire the infrastructure of healthcare, but humanity must remain the current that flows through it. As Precedence Research succinctly puts it, “To capture this value, companies will need to integrate innovation into the rhythm of their daily work.” The organisations that heed this guidance will set the standard for healthcare finance in the twenty-first century.

When data helps a chronically ill patient avoid hospitalisation, when automation frees a nurse to spend more time with people rather than paperwork, when AI guides a family through complex treatment options with clarity, that is transformation realised. The winners will be those who can harmonise intelligence and compassion, converting bytes into better lives. As the boundaries between technology and care dissolve, the true metric of success will be how seamlessly the system serves the person at its centre. The transformation has already begun; the question is who will lead it to its full potential.

About the Authors

Aditi Shivarkar

Aditi, Vice President at Precedence Research, brings over 15 years of expertise at the intersection of technology, innovation, and strategic market intelligence. A visionary leader, she excels in transforming complex data into actionable insights that empower businesses to thrive in dynamic markets. Her leadership combines analytical precision with forward-thinking strategy, driving measurable growth, competitive advantage, and lasting impact across industries.

Aman Singh

Aman Singh with over 13 years of progressive expertise at the intersection of technology, innovation, and strategic market intelligence, Aman Singh stands as a leading authority in global research and consulting. Renowned for his ability to decode complex technological transformations, he provides forward-looking insights that drive strategic decision-making. At Precedence Research, Aman leads a global team of analysts, fostering a culture of research excellence, analytical precision, and visionary thinking.

Piyush Pawar

Piyush Pawar brings over a decade of experience as Senior Manager, Sales & Business Growth, acting as the essential liaison between clients and our research authors. He translates sophisticated insights into practical strategies, ensuring client objectives are met with precision. Piyush’s expertise in market dynamics, relationship management, and strategic execution enables organizations to leverage intelligence effectively, achieving operational excellence, innovation, and sustained growth.

Request Consultation

Request Consultation