What is the Diagnostic Tools Market Size?

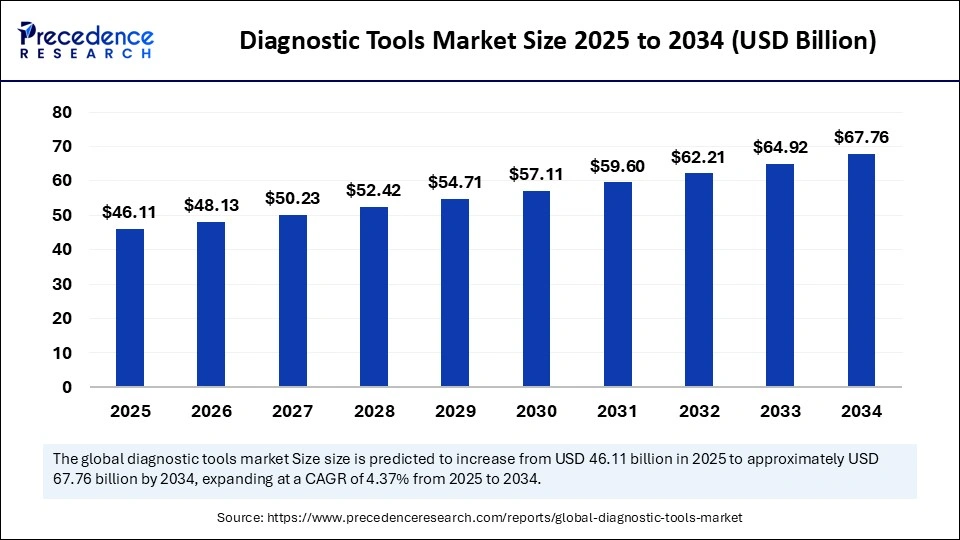

The global diagnostic tools market size accounted for USD 46.11 billion in 2025 and is predicted to increase from USD 48.13 billion in 2026 to approximately USD 67.76 billion by 2034, expanding at a CAGR of 4.37% from 2025 to 2034. This market is growing due to rising demand for early, accurate, and rapid disease detection, driven by the rise in chronic illnesses and advancements in healthcare technologies.

Market Highlights

- North America dominated the market by holding the largest market share in 2024.

- The Asia Pacific is expected to grow at the fastest CAGR between 2025 and 2034.

- By type, the X-ray segment has contributed the highest market share in 2024.

- By type, the computed tomography (CT) scanners segment will grow at a notable CAGR between 2025 and 2034.

- By application, the hospitals segment held the major market share in 2024.

- By application, the diagnostic center segment is growing at a notable CAGR between 2025 and 2034.

Market Overview

Transforming Healthcare Through Next-Gen Diagnostic Innovation

Quicker, more precise disease detection is a top priority for healthcare systems. Hospitals and diagnostic laboratories are under pressure to shorten turnaround times, improve accuracy, and support early screening programs for chronic and infectious diseases. These needs are driving strong interest in tools that can process samples faster and provide reliable results at the first point of contact with patients.

Demand is rising due to growing patient awareness and technological advancements such as portable testing devices and AI-driven diagnostics. Patients are increasingly familiar with rapid tests, wearable devices, and digital health tools that enable early symptom detection and continuous monitoring. AI-assisted diagnostic platforms also help clinicians interpret complex data more accurately, reducing misdiagnosis and supporting better treatment planning.

Growing investments in digital diagnostic platforms and point-of-care solutions are bolstering market adoption in clinicals, hospitals, and home care settings. Health systems are expanding the use of handheld analyzers, mobile diagnostic kits, and cloud-connected reporting systems to support decentralized testing. These investments strengthen operational capacity and allow healthcare providers to deliver faster, more accessible diagnostic services across urban and rural environments.

Case Study: Roche Boosts Diagnostic Precision with AI Platform

In 2025, Roche advanced the diagnostic tools market with its AI-based InsightDX Platform, which unified imaging, molecular testing, and patient data into one digital system. The platform enabled faster disease detection and reduced diagnostic turnaround times by over 30% by integrating real-time analytics and automated reporting. Roche improved clinical accuracy and strengthened decision-making across hospitals and labs.

Diagnostic Tools Market Outlook

As healthcare providers move toward precision medicine and quicker patient screening, the diagnostic tools market is growing rapidly. Efficiency and accuracy are increasing through developments in imaging, molecular diagnostics, and AI-enabled platforms. Growing numbers of chronic illnesses and increased access to healthcare in developing nations are driving market demand.

The market for diagnostic tools is being shaped by sustainability through energy-efficient instruments, less biomedical waste, and environmentally friendly device designs. Manufacturers are using long-lasting parts to reduce replacement cycles, recyclable materials, and digital reporting to reduce paper use. Carbon-neutral projects and green manufacturing certifications are also becoming industry norms.

Innovations in point-of-care testing. AI-based disease detection and portable home diagnostic devices are driving the growth of the diagnostic technology startup ecosystem. Due to their unmet diagnostic gaps and quick product scalability, emerging companies are attracting significant investor interest. With their innovative cloud-based diagnostic platforms, faster workflows, and cost-effective solutions, these startups are accelerating market disruption.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 46.11 Billion |

| Market Size in 2026 | USD 48.13 Billion |

| Market Size by 2034 | USD 67.76 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.37% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Emerging Opportunities in the Diagnostic Tools Market

| Opportunity | Insights |

| AI diagnostics | Faster, more accurate image and data interpretation using automation |

| Point of care testing | High demand for portable devices that deliver quick results anywhere |

| Remote & Digital Diagnostics | Telehealth growth is boosting cloud-based and app-enabled testing solutions |

| Molecular Testing | Personalized medicine is driving the uptake of genetic and molecular diagnostics |

| Wearable Health Tech | Smart wearables enable continuous monitoring and early risk detection. |

| Low-Cost Test Kits | Affordable solutions are gaining traction in emerging and rural healthcare markets |

Diagnostic Tools Market Segmental Insights

Type Insights

X-Ray Systems: This segment dominated the diagnostic tools market in 2024 due to its broad clinical applicability and its crucial role in initial diagnostic screening. Demand is high and growing due to their widespread use in orthopedics, dental imaging, emergency care, and routine health assessments. Digital radiography, low-dose imaging, and AI-supported interpretation are examples of technological advancements that have increased in hospitals and diagnostic centers.

Computed Tomography (CT) Scanners: This segment is expected to be the fastest-growing, driven by the growing need for sophisticated cross-sectional imaging in neurological, cardiovascular, trauma, and oncology assessments. In crucial, complex cases, their ability to provide rapid, highly accurate diagnostic insights has made them essential. Investment in this field is increasing due to innovations such as ultra-low-dose CT spectral imaging and AI-enhanced detection.

Cardiovascular Monitoring and Diagnostic Devices: This segment is gaining significant momentum as the prevalence of heart disease rises worldwide, and continuous preventive cardiac care becomes more common. For early detection, remote monitoring, and post-treatment management, devices such as wearable cardiac sensors, Holter monitors, and ECGs are being widely used. Their clinical value is being further enhanced by the integration of real-time analytics with digital health platforms.

Application Insights

Hospitals: This segment dominates the diagnostic tools market with the largest market share, because they manage the largest patient volumes and need a wide range of imaging and diagnostic systems for inpatient emergency and specialty care. Strong investments in X-ray, CT, MRI, ultrasound, and cutting-edge laboratory systems are supported by their sizable budgets, highly qualified workforce, and requirement for integrated diagnostic ecosystems. Hospitals are the foundation of market demand due to their extensive diagnostic workflows.

Diagnostic Centers: This segment is the fastest-growing in the diagnostic tools sector, driven by growing patient demand for specialized, faster, and less expensive testing services. To provide fast turnaround times and reasonably priced diagnostics, these facilities are investing more and more in high-precision imaging systems, automated lab analyzers, and digital reporting tools. Increased health consciousness and the quick increase in preventive health screenings also contribute to their growth.

Diagnostic Tools Market Regional Insights

North America dominated the diagnostic tools market in 2024 due to its highly advanced healthcare systems, widespread use of cutting-edge imaging technologies, and significant suppliers of diagnostic solutions. Major hospital systems such as Mayo Clinic, Cleveland Clinic, Johns Hopkins, and Kaiser Permanente operate multi-hospital imaging networks that purchase and pilot new devices from vendors like GE HealthCare, Siemens Healthineers, Philips, and Canon Medical. These networks use enterprise PACS, vendor-neutral archives, and cloud imaging platforms to scale CT, MRI, and PET capacity across regional systems, which directly increases procurement of diagnostic hardware and integrated software suites.

The area gains from high awareness of early disease detection, structured reimbursement models, and significant investment in AI-enhanced diagnostics. Medicare and private payers maintain established CPT and HCPCS coverage pathways for many imaging and laboratory procedures, while CMS innovation pilots and Medicare Advantage programs help de-risk deployments of new diagnostic workflows. Federal and private research funding from NIH, NCI, and BARDA, together with venture capital into firms such as Guardant Health, Exact Sciences, and Tempus, supports liquid biopsy, next-generation sequencing assays, and AI-enabled interpretation tools.

The U.S. remains one of the most advanced markets backed by widespread use of AI-enabled imaging and laboratory systems, robust R&D investment, and high technology adoption. To improve clinical accuracy and patient outcomes, hospitals and diagnostic networks regularly upgrade to state-of-the-art X-ray, CT, MRI, and molecular testing platforms. The nations leadership in the diagnostic tools sector is further strengthened by the ongoing emphasis ondigital transformation, precision diagnostics, and preventive healthcare.

Asia Pacific is the fastest-growing region, driven by the need for early and accurate disease detection, rapid healthcare modernization, and the expansion of diagnostic infrastructure. Investments in digital health platforms, automated laboratory systems, and imaging equipment are rising in the region. The burden of chronic illnesses is increasing, private healthcare spending is rising, and preventive diagnostics is receiving more attention, all of which are driving market expansion.

India Diagnostic Tools Market Trends

India is witnessing strong growth in the diagnostic tools market due to the rising burden of chronic illness, rapid expansion of healthcare, and the need for affordable imaging and laboratory services. To enable quicker and more precise testing, private hospitals and diagnostic chains are making significant investments in digital X-ray systems, CT scanners, and automated analyzers. Modern diagnostic technologies are being adopted more quickly in urban and tier-2 cities, driven by government-led screening programs and rising health consciousness.

The Middle Eastern diagnostic tools market is gaining momentum as healthcare providers implement automated testing platforms, AI-driven imaging, and infrastructure upgrades. Major hospital groups such as SEHA in the UAE, Hamad Medical Corporation in Qatar, and the Ministry of Health facilities in Saudi Arabia are integrating high-throughput analyzers, digital pathology systems, and cloud-based radiology networks. Regional procurement programs linked to Saudi Vision 2030 and the UAEs National Strategy for Artificial Intelligence are accelerating the adoption of AI-assisted CT, MRI, and emergency care triage tools across tertiary hospitals.

Consistent demand is driven by rising investments in smart hospitals, the growing burden of chronic diseases, and a greater emphasis on preventive healthcare. Smart hospital projects like Riyadhs King Faisal Specialist Hospital upgrades and Abu Dhabis digital command center initiatives rely on automated diagnostic workflows for cardiology, oncology, and infectious disease management. The regions high prevalence of diabetes, cardiovascular disease, and obesity also drives sustained use of HbA1c analyzers, cardiac biomarker testing, and digital screening programs designed for early detection.

UAE Diagnostic Tools Market Trends

The UAE diagnostic tools market is experiencing rapid growth as hospitals and private practices invest in cutting-edge imaging and point-of-care technologies. Modern X-ray CT and molecular testing systems are in high demand due to the governments strong emphasis on digital health, AI-enabled diagnostics, and early disease detection. The UAE is emerging as a major hub for high-precision diagnostic solutions in the region, driven by rising rates of lifestyle diseases andmedical tourism.

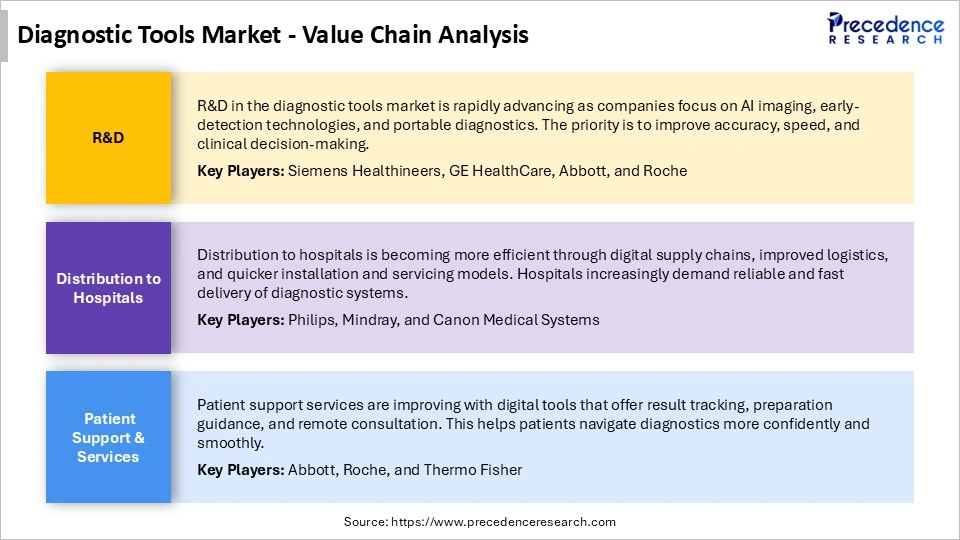

Diagnostic Tools Market Value Chain

Diagnostic Tools Market Companies

A global healthcare company providing a wide portfolio of diagnostic instruments, rapid tests, immunoassays, and molecular diagnostics. Abbott is known for its point-of-care platforms and infectious disease testing solutions used worldwide.

A world leader in in vitro diagnostics offering clinical solutions for infectious diseases, antimicrobial resistance, and sepsis. The company also supplies industrial microbiology tools for food, cosmetics, and pharmaceutical safety testing.

A major provider of diagnostic imaging systems, including CT, MRI, ultrasound, and X-ray technologies. The company focuses on high-resolution imaging and AI-enhanced diagnostic platforms.

Operates multiple diagnostic brands such as Beckman Coulter, Cepheid, and Radiometer. Danaher provides immunoassay systems, molecular diagnostics, automation platforms, and clinical chemistry instruments for hospitals and labs.

Offers a broad healthcare portfolio including diagnostic imaging, ultrasound, endoscopy, and advanced IVD systems. The company combines imaging expertise with digital diagnostics for clinical applications.

A global leader in medical technology providing CT, MRI, ultrasound, and molecular imaging systems. GE HealthCare also offers clinical analytics, monitoring tools, and lab workflow solutions.

Specializes in diagnostic technologies for womens health, including breast imaging, cervical cancer screening, and molecular infectious disease testing. The company focuses on high-sensitivity assays and imaging innovations.

A major provider of in vitro diagnostics systems, reagents, and digital lab solutions. Roche leads in immunoassays, molecular diagnostics, and data-driven clinical platforms for hospitals and laboratories.

A global leader in next-generation sequencing (NGS) instruments, consumables, and genomic data analysis. Illuminas platforms are widely used in oncology, rare disease diagnostics, and large-scale genetic research.

A diversified health technology company offering diagnostic imaging systems such as MRI, CT, and ultrasound, along with image-guided therapy solutions. Philips integrates AI and digital workflows for precision diagnostics.

Provides medical devices across patient monitoring, in vitro diagnostics, hematology, and medical imaging. Mindray delivers cost-effective, scalable diagnostic solutions for global healthcare markets.

Recent Developments

- In April 2025, Abbott Laboratories announced $500 million investment in new U.S. manufacturing and R&D facilities. This expansion is aimed at boosting capacity for diagnostics and medical devices. It reflects Abbotts long-term plan to localize production and accelerate innovation.(Source:https://www.reuters.com)

- In August 2025, Abbott Laboratories announced a new cardiovascular-device manufacturing plant in Georgia. The facility will support the growing demand for heart-care technologies and strengthen Abbotts U.S. production network. Construction is expected to be completed by 2028.(Source:https://www.abbott.com)

Diagnostic Tools MarketSegments Covered in the Report

By Type

- X-Ray Systems

- Ultrasound Systems

- Computed Tomography (CT) Scanners

- Magnetic Resonance Imaging Systems

- Cardiovascular Monitoring and Diagnostic Devices

- Nuclear Imaging Device

By Application

- Hospitals

- Diagnostic Centers

- Other

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting