Precision Diagnostics Market Size and Forecast 2025 to 2034

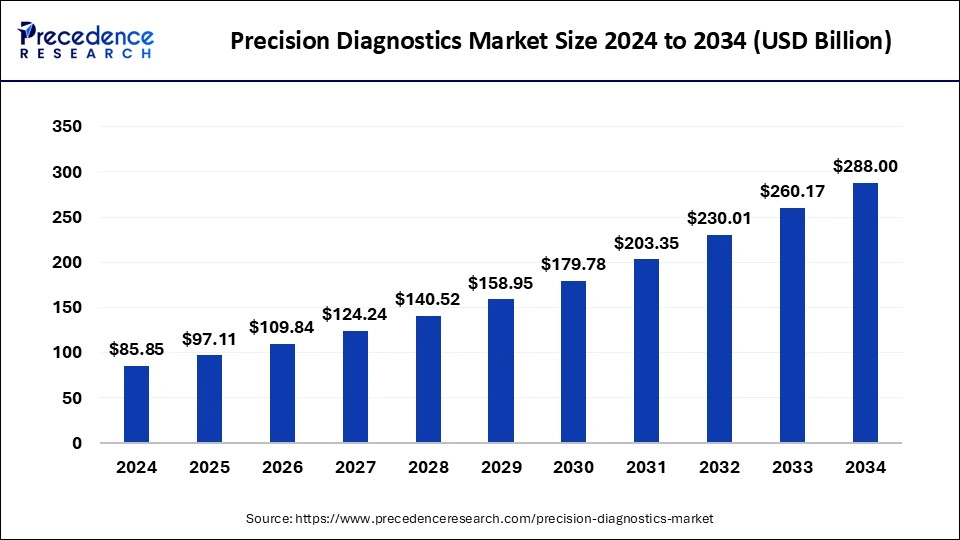

The global precision diagnostics market size was estimated at USD 85.85 billion in 2024 and is predicted to increase from USD 97.11 billion in 2025 to approximately USD 288.00 billion by 2034, expanding at a CAGR of 12.87% from 2025 to 2034. Rising of digital pathology can boost the precision diagnostics market.

Precision Diagnostics Market Key Takeaways

- In terms of revenue, the global precision diagnostics market was valued at USD 85.85 billion in 2024.

- It is projected to reach USD 288.00 billion by 2034.

- The market is expected to grow at a CAGR of 12.87% from 2025 to 2034.

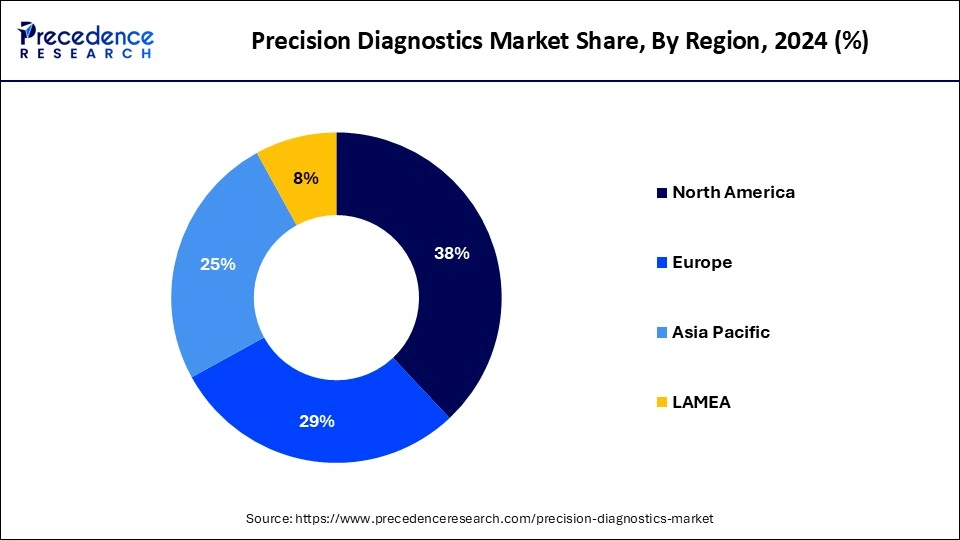

- North America dominated the market with the largest revenue share of 38% in 2024.

- By type, the genetic tests segment has held a major revenue share of 48% in 2024.

- By type, the esoteric tests segment is expected to grow at the highest CAGR during the forecast period.

- By application, the oncology segment dominated the market in 2024 and is expected to grow at the fastest CAGR during the forecast period.

- By end-user, the clinical laboratories segment dominated the market in 2024.

- By end-user, the hospital segment is expected to grow at the highest CAGR in the market during the forecast period.

U.S. Precision Diagnostics Market Size and Growth 2025 to 2034

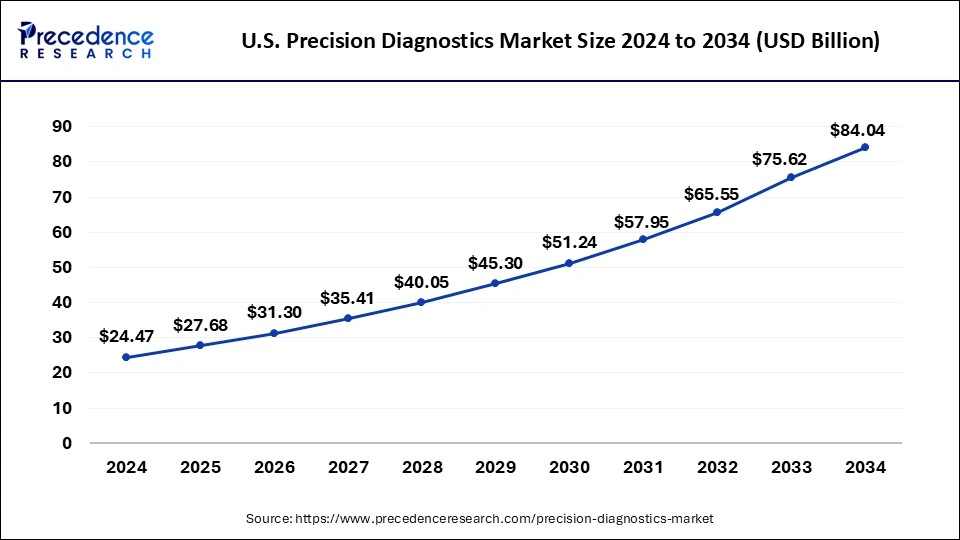

The U.S. precision diagnostics market size was exhibited at USD 24.47 billion in 2024 and is projected to be worth around USD 84.04 billion by 2034, poised to grow at a CAGR of 13.33% from 2025 to 2034.

North America dominated the precision diagnostics market in 2024. The United States and other countries in North America have created healthcare infrastructures that facilitate the integration and uptake of cutting-edge diagnostic technology. Modern diagnostic equipment and a wide variety of precision tests are available in hospitals and clinics. Both the governmental and corporate sectors make significant expenditures in research and development that benefit the area. This funding stimulates innovation in precision diagnostics, resulting in the creation and marketing of state-of-the-art diagnostic instruments and methods. Many of the world's top biotechnology and medical device businesses are based in North America. These businesses are at the forefront of creating cutting-edge diagnostic technologies, and their wide distribution networks help them break into new markets.

Europe held the second-largest share of the precision diagnostics market in 2024. The infrastructure and technology investments in healthcare are rising dramatically in European nations. Precision diagnostics is expanding due in part to this investment, which aims to improve healthcare outcomes and diagnostic skills. Personalized medicine is becoming more and more important throughout Europe. Because they enable customized treatment regimens based on unique patient profiles and improve treatment results, precision diagnostics are essential to personalized medicine. Precision diagnostics are receiving more and more regulatory backing in Europe. The new diagnostic technologies can be used more quickly if clearance procedures are streamlined and clear recommendations are provided by regulatory authorities like the European Medicines Agency (EMA) and others.

Market Overview

The precision diagnostics market refers to precision diagnostics pertains to the application of sophisticated diagnostic instruments and methodologies to detect certain molecular, genetic, or cellular indicators inside a patient's anatomy. The disease's nature, course, and potential response to different therapies may all be fully understood by looking at these indicators. Precision diagnostics aims to improve medical care by diagnosing and treating patients based on their unique traits, hence enabling more accurate, tailored, and effective care. Precision diagnostics, which aims to enhance diagnosis, treatment, and patient outcomes by utilizing cutting-edge technology and a greater understanding of human biology, reflects a trend towards more exact, accurate, and customized healthcare.

Precision Diagnostics Market Growth Factors

- Rising demand for personalized medicines can grow the precision diagnostics market.

- Rising demand for early detection and accurate diagnosis can boost the precision diagnostics market.

- The increasing prevalence of chronic conditions and old age increases the need for precision diagnostics.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 288 Billion |

| Market Size in 2025 | USD 97.11 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 12.87% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising prevalence of chronic diseases

The rising prevalence of chronic diseases can boost the precision diagnostics market. The requirement for early, accurate, and customized diagnostic tools is being driven by the increasing prevalence of chronic illnesses, which is propelling the precision diagnostics market. Precision diagnostics are essential in tackling the rising burden of chronic illnesses because of their capacity to offer in-depth insights, direct focused medicines, and enhance disease management results.

Restraint

High cost associated with advanced precision diagnostics

The high cost associated with advanced precision diagnostics may slow down the precision diagnostics market. Precision diagnostics can be expensive to produce and use up front, which might prevent patients and healthcare professionals from using them, particularly in areas with little financial resources. This restricts the use of precision diagnostics and impedes the expansion of the precision diagnostics market.

Opportunity

Increasing healthcare spending

The increasing healthcare spending can be the opportunity to boost the precision diagnostics market. The increasing healthcare spending makes it possible to invest in infrastructure, technology, research, and education, which in turn fosters the expansion of the precision diagnostics industry. Additionally, it encourages the execution of beneficial laws and public health campaigns, which eventually propels the uptake and incorporation of precision diagnostics into accepted medical procedures.

Type Insights

The genetic tests segment dominated the precision diagnostics market by type in 2024. Genetic testing has benefited greatly from significant technology breakthroughs like next-generation sequencing (NGS) and CRISPR, which have increased test accuracy, speed, and affordability. With the use of these technologies, genetic material may be thoroughly analyzed to find a wide range of genetic mutations and variations that are linked to different diseases. Personalized medicine, which adjusts medical care to each patient's unique traits, depends heavily on genetic testing.

Healthcare professionals can create individualized treatment strategies that are more successful and have fewer negative effects by knowing a patient's genetic composition. The need for genetic diagnostics is being driven by this emphasis on individualized care. Genetic abnormalities and chronic illnesses, including diabetes, cancer, and cardiovascular disease, are becoming more common. Genetic tests are widely used since they are critical for the early diagnosis, treatment, and detection of many illnesses.

The esoteric tests segment is expected to grow at the highest CAGR in the precision diagnostics market by type during the forecast period. Rapid technological improvements are helping esoteric diagnostics, which comprise very difficult and specialized diagnostic examinations. Advances in fields like proteomics, metabolomics, and genomes are propelling the creation of novel and complex esoteric assays that provide enhanced precision and comprehensive understanding. The rich data that esoteric testing gives is crucial to personalized therapy.

By identifying certain genetic, molecular, and biochemical markers, these tests enable customized therapy regimens that enhance patient outcomes. The need for esoteric diagnostics is rising due to the growing trend towards individualized care. Advanced diagnostic techniques are required due to the growth in chronic and complicated illnesses, including cancer, cardiovascular diseases, and uncommon genetic abnormalities. Esoteric testing leads to greater usage since it offers in-depth analysis that is essential for treating and diagnosing these illnesses.

Application Insights

The oncology segment dominated the precision diagnostics market in 2024 and is expected to grow with the fastest CAGR during the forecast period. Globally, cancer continues to be one of the primary causes of illness and mortality. The need for precision diagnostics is driven by the growing incidence and prevalence of different forms of cancer, which aims to enhance early detection, precise diagnosis, and efficient treatment planning. Precision diagnostics in oncology mostly depend on genetic and molecular testing to find particular mutations and biomarkers linked to certain tumors.

Technological innovations like liquid biopsies and next-generation sequencing (NGS) have transformed cancer diagnosis by enabling less intrusive and more accurate testing. With the use of precision diagnostics, treatment regimens may be customized to each patient's unique tumor's genetic makeup. In cancer, this individualized approach quickly takes the place of standard therapy, improving treatment results and minimizing side effects.

End-user Insights

The clinical laboratories segment dominated the precision diagnostics market by end-users in 2024. The clinical laboratories are equipped with the necessary resources to efficiently and accurately conduct a large number of tests. They are the best option for precision diagnostics because of their centralized structure, which enables economies of scale. The clinical laboratories are manned by highly qualified specialists and furnished with cutting-edge diagnostic equipment. Precision diagnostics depends on the accuracy and dependability of the diagnostic outcomes, which is ensured by this competence. A wide variety of diagnostic tests, such as genetic, molecular, and biomarker testing, are available in clinical laboratories. This extensive test menu meets a wide range of medical demands, including sophisticated illness diagnoses and regular screenings.

The hospitals segment is expected to grow at the highest CAGR in the precision diagnostics market by end-users during the forecast period. The hospitals serve as the main hubs for patient care and are in close proximity to the patients. The incorporation of precision diagnostics into hospital environments improves the capacity to offer thorough, instantaneous, and instantly actionable diagnostic services, leading to better patient outcomes.

Molecular diagnostics, sophisticated imaging, and next-generation sequencing are just a few of the cutting-edge diagnostic technologies that hospitals are progressively using. Precision diagnostics depend on these technologies to provide more precise and individualized patient treatment. In order to deliver quick and accurate test results, many hospitals are investing in internal diagnostic laboratories. This decreases reliance on other laboratories and speeds up the diagnostic result turnaround, both of which are necessary for prompt treatment choices.

Precision Diagnostics Market Companies

- Abbott Laboratories

- Bayer AG

- Koninklijke Philips N.V.

- Lantheus Holdings Inc.

- Novartis AG

- Qiagen N.V.

- Quest Diagnostics Incorporated

- Sanofi

- Swiss Precision Diagnostics GmbH (Procter & Gamble)

Recent Developments

- In May 2024, Karolinska Institutet and Karolinska University Hospital partnered with Elekta to initiate a new tripartite relationship. The goal is to collaborate in the field of cancer research, with a particular emphasis on precision medicine and radiation treatment. For almost 50 years, the involved parties have collaborated in the identification and management of brain disorders and cancer.

- In January 2024, At IISc Bangalore, the Siemens Healthineers-Computational Data Sciences (CDS) Collaborative Laboratory for AI in Precision Medicine was opened by Siemens Healthineers and the Indian Institute of Science (IISc). Siemens Healthineers Chief Technology Officer Peter Schardt officially opened this cutting-edge lab. In order to effectively diagnose neurological disorders and analyze their clinical manifestations, the CDS joint laboratory will create open-source AI-based tools to precisely automate the segmentation of abnormal findings in neuroimaging data.

- In January 2024, Epredia, a leader in the world of precision cancer diagnostics, announced the entry of SlideMateTM Laser into the United States market. SlideMate printers are used in pathology labs for tissue sample identification and tracking. SlideMate Laser was created by Epredia to enhance sample traceability in clinical laboratories of all sizes. By enabling laboratories to print additional identifying information directly on the tab of the slides that pathologists utilize in the cancer detection workflow, SlideMate Laser offers high-resolution, 600 dpi laser printing on microscope slides.

- In October 2023, ahead of Biosciences with Cell-Free Genomic Diagnostic for Precision Medicine and Drug Development Under the leadership of CEO Rehan Verjee, the Boston-based firm comes out of stealth with a genome-wide platform that provides insight into the dynamic activation of genes and pathways in sick tissues by profiling circulating chromatin and the DNA methylome.

Segment Covered in the Report

By Type

- Genetic Tests

- Esoteric Tests

- Others

By Application

- Oncology

- Cardiovascular

- Neurology

- Others

By End-user

- Hospitals

- Clinical laboratories

- Homecare

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting