What is the Insurance Third Party Administration Market Size?

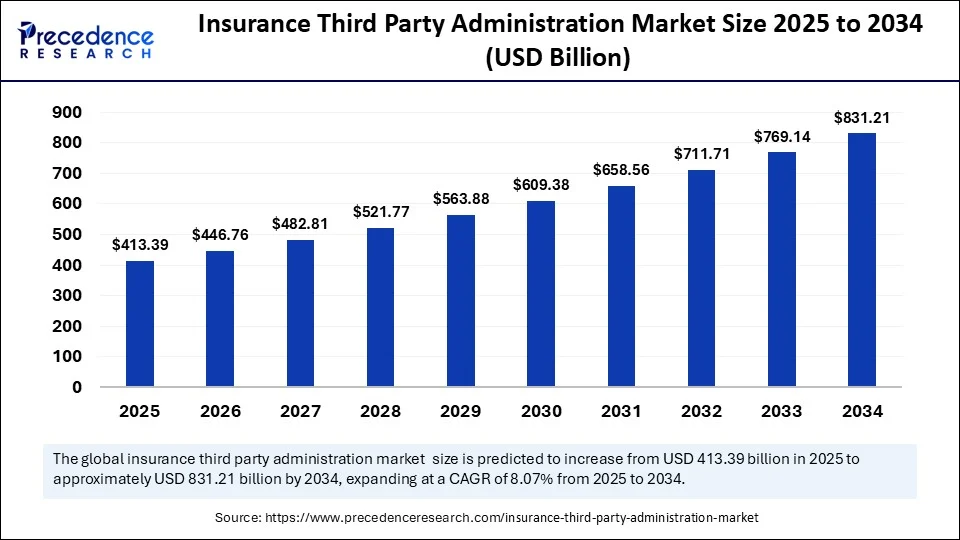

The global insurance third party administration market size is calculated at USD 413.39 billion in 2025 and is predicted to increase from USD 446.76 billion in 2026 to approximately USD 831.21 billion by 2034, expanding at a CAGR of 8.07% from 2025 to 2034. The market growth is attributed to increasing insurer reliance on specialized third-party administrators to streamline complex claims processing, ensure regulatory compliance, and enhance operational efficiency.

Insurance Third Party Administration Market Key Takeaways

- In terms of revenue, the global insurance third party administration market was valued at USD 382.52 billion in 2024.

- It is projected to reach USD 831.21 billion by 2034.

- The market is expected to grow at a CAGR of 8.07% from 2025 to 2034.

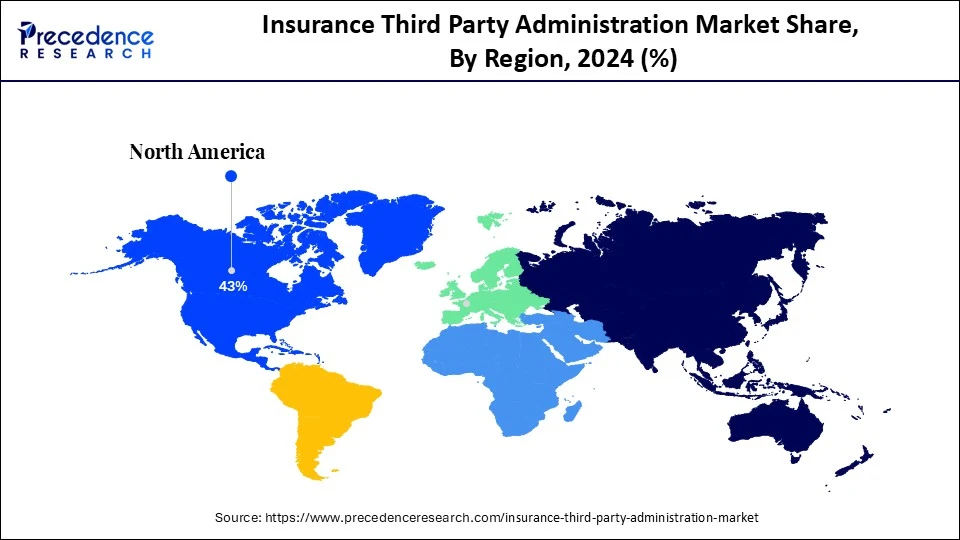

- North America dominated the insurance third party administration market with the largest share of 43% in 2024.

- Asia Pacific is expected to grow at a notable CAGR from 2025 to 2034.

- By business, the life health insurance segment held the major market share in 2024.

- By business, the travel insurance segment is projected to grow at a significant CAGR in between 2025 and 2034.

- By service type, the claims management segment contributed the biggest market share in 2024.

- By service type, the policy administration segment is expanding at a significant CAGR in between 2025 and 2034.

- By technology, the cloud based segment led the market in 2024.

- By technology, the on-premises segment is expected to grow at a remarkable CAGR over the projected period.

- By deployment model, outsourced captured the market with the largest share in 2024.

- By deployment model, in-house segment is expected to grow at a notable CAGR from 2025 to 2034.

- By end-use, insurance companies segment generated the highest market share in 2024.

- By end-use, reinsurance companies is expected to grow at a notable CAGR from 20245 to 2034.

Artificial Intelligence: The Next Growth Catalyst in Insurance Third Party Administration

Artificial Intelligence (AI) is still transforming the third-party administration market in insurance since it has made it easier to process claims, detect fraud, and deliver efficient customer service. Firms have started using sophisticated interrupt machine learning models to process huge volumes of data in real-time. This allows them to make decisions quicker and assess risks more accurately. Moreover, predictive analytics also be used to predict the trend of claims, and as a result, it enables administrators to use resources more effectively and reduce delays.

Strategic Overview of the Global Insurance Third Party Administration Industry

Increased complexity in the operations of insurance and the increased focus on the compliance with regulations are the main factors leading to the growth of the insurance third party administration (TPA) Market. TPAs are the experts whose services are used to perform some important administrative tasks, such as management of claims, policy servicing, enrollment, billing, and customer services. They work on behalf of the insurers and thus enabling the insurers to concentrate on business functions and also achieve efficiency in operations. In Europe, during 2024, the European Insurance and Occupational Pensions Authority (EIOPA) concluded that the outsourcing of administrative services to TPAs enhanced the Solvency II reporting and the consumer experience, insurers. Furthermore, the insurance third party administration model is being changed by cloud computing and API-based integration that allows real-time claims adjudication further fuelling the market.

(Source: https://www.gao.gov)

Insurance Third Party Administration Market Growth Factors

- Rising Complexity of Insurance Products: Diversified policy structures across health, life, and travel domains are driving insurer demand for specialized third-party expertise.

- Growing Regulatory Stringency: Expanding global compliance mandates are fuelling the outsourcing of administrative tasks to ensure audit readiness and avoid penalties.

- Boost in Employer-Sponsored Health Plans: Increasing corporate healthcare benefits is propelling the need for efficient claim adjudication and member services through TPAs.

- Surge in Healthcare Utilization Rates: Higher medical service usage, especially post-pandemic, is accelerating third-party involvement to manage healthcare claims volume.

- Digital Transformation Across Insurance Ecosystems:Rising integration of cloud platforms and AI tools is boosting third-party platforms that support seamless digital servicing.

- Expansion of Cross-Border Insurance Services: Globalization of coverage options is driving insurance third party administration use to handle multi-jurisdictional claims and policy administration efficiently.

- Growing Demand for Real-Time Claims Resolution: Consumer expectations for faster settlements and transparency are fuelling adoption of agile, tech-enabled third-party solutions.

Market Outlook:

- Market Growth Overview: The insurance third party administration market is expected to grow significantly between 2025 and 2034, driven by increasing insurance penetration, digital transformation, and rising healthcare costs.

- Sustainability Trends: Sustainability trends involve digitalization and automation, ESG integration in risk management, workforce transformation and social responsibility, and support for sustainable insurance products.

- Major Investors: Major investors in the market include BlackRock, Inc., Vanguard Group Inc., JPMorgan Chase & Co., and State Street Corp.

- Startup Economy: The startup economy is focused on insurTech, specialized platforms, and API-First and cloud-native.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 831.21 Billion |

| Market Size in 2025 | USD 413.39 Billion |

| Market Size in 2026 | USD 446.76 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.07% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Business Segment, Service Type, Technology, Deployment Model, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Is the Increasing Demand for Cost-Effective Insurance Operations Accelerating the Growth of the Insurance Third Party Administration Market?

Increasing demand for cost-effective insurance operations is expected to accelerate the third-party administration services market. The growing need to achieve cost-effectiveness in the operations of insurance is likely to boost the rate of adoption of the third-party administration services. Insurers are now eager in decreasing administrative overheads or operational costs by means of outsourcing non core activities, such as policy claims processing, service, and bills. insurance third party administrations give companies both the large insurance and small insurance providers an opportunity of using scalable solutions that reduce overhead costs without compromising the quality of service provision. In 2024, the European Insurance and Occupational Pensions Authority (EIOPA) noted that there is an increased interest of European Insurance companies to contract with third parties vendors. This expected to help them deal with policy services smarter as there is increasing tightening of the regulation. Furthermore, the utilize TPAs to facilitate group benefits administration because of cost efficiency and continuity of service, thus further fuelling the market.

(Source: https://www.eiopa.europa.eu)

Restraint

Lack of Standardized Performance Metrics Projected to Undermine Insurer Confidence in TPAs

Lack of standardization in service quality and performance benchmarks is projected to hinder the market. Prevent absence of standardization in service quality and performance benchmarks is expected to influence the trust of the insurers on third-party administrators. Claim handling time, error rates or customer service quality differences lead to unpredictability in the policyholder experience. Furthermore, the Such inconsistency lowers the incentive of the providers to outsource high value or customer facing services especially in competitive insurance markets whereby customer retention depends on delivery of the services rendered.

Opportunity

How Is the Surging Adoption of Digital Technologies Projected to Reshape the Insurance Third Party Administration Market?

Surging adoption of digital technologies is projected to create immense opportunities for the players competing TPAs market in modern insurance ecosystems. The exponentially growing trend of the adoption of digital technologies is set to reinforce the role played by the TPAs in the contemporary insurance ecosystems. Insurers prefer digital-first partners that be in line with the commission changes and the expectations of customers. Advanced technologies used by insurance third party administrations make them superior to in-house traditional models, which may not be this innovative and technically advanced. In 2024, the International Association of Insurance Supervisors (IAIS) focused on digital transformation in facilitating interoperability of insurance services across borders, especially by using real-time regulatory data tools. Furthermore, the governance was presented by the European Insurance and Occupational Pensions Authority (EIOPA), which aimed at promoting more transparency regarding third-party data processing, thus further fuelling the market.

(Source: https://www.iais.org)

Business Insights

Which Segment Led the Insurance Third Party Administration Market in 2024?

The life health insurance segment dominated the market with the largest share in 2024, as the complexity of healthcare claims, the volume of policies, and regulatory compliance requirements are growing. TPAs help insurers address the expansive administrative processes and efforts, such as coordination of benefits, adjustment of claims, and medical necessity reviews. Furthermore, the growth of chronic diseases, an aging population, and employer-based health plans have also increased insurers' workload in life and healthcare insurance, which further fuels the segment.

The travel insurance segment is projected to grow at a CAGR in the future years, owing to the rising travel and tourism activities, health-related traveling claims, and consumer awareness. Pandemic-related disruptions led to a shift in the insurance structure. Travel TPAs offer services that include 24/7 support in multiple languages, real-time claim confirmation, and area-based organization of services, which both insurers and travelers find appealing.

In 2024, the OECD observed a significant revival in international travel and noted increased demand for the further development of digitally enhanced travel insurance services. Global insurers were increasingly outsourcing the processing of travel claims to TPAs to achieve greater efficiency during busy travel periods. Moreover, new guidelines were issued by the Insurance Regulatory and Development Authority of India (IRDAI) in 2024, which promote the integration of travel insurers with digital TPAs.

(Source:https://www.oecd.org)

Service Type Insights

What Made Claims Management the Dominant Segment in the Market?

The claims management segment dominated the insurance third party administration market with a major revenue share in 2024 due to the increasing insurance claims getting complex and the need to ensure proper and timely processing of the insurance. Insurance companies were relying so much on TPAs to provide end-to-end claim service, such as verifications, adjudications, documentation, and settlement.

In 2024, the National Association of Insurance Commissioners (NAIC) reported that claims handling delays and inaccuracies were one of the greatest concerns of policyholders. TPAs have addressed this challenge by introducing automation tools and artificial intelligence-based fraud detection. Furthermore, the increased efficiency of third-party insurance administrations and higher consumer satisfaction ratings, particularly in the areas of health, auto, and workers' compensation insurance policies, are expected to fuel the market.

(Source:https://content.naic.org)

The policy administration segment is expected to expand at a significant CAGR in the coming years, driven by the growing demand for digital transformation to onboard customers, bill premiums, and renew policies. It is believed that insurers increasingly direct their attention to enhancing customer retention and personalization, and therefore. They rely more on TPAs to outsource lifecycle policy activities to a multi-channel platform. TPAs with fluid functionality, in the form of cloud platforms and API platforms, were popular among providers seeking to reduce excessive administrative costs, which further drives the market.

Technology Insights

Why Did the Cloud Based Segment Dominate the Market in 2024?

The cloud based segment dominated the insurance third party administration market in 2024. This is primarily due to the increased demand for flexibility, scalability, and real-time global data transmission. Insurers are becoming increasingly inclined to use cloud platforms to automate processes across multiple locations, facilitate better collaboration with third-party partners, and expedite claims processing on their cloud platforms. Moreover, insurers implementing cloud-based TPA systems have become more operationally agile and resilient during claim surges, thus further fueling the market in the coming years.

The on-premises segment is expected to grow at a significant CAGR over the projected period since the insurance industry has always been dependent on legacy infrastructure and its own control over sensitive insurance data. The majority of the insurers were mainly those that were in highly regulated environments, such as those in health and life insurance, and on-premise systems were more welcome due to perceived data security and compliance reliability. Furthermore, the insurers utilizing on-premise TPAs achieved a stronger level of integration between themselves and internal IT systems, which further fuels the segment.

Deployment Model Insights

How Does the Outsourced Deployment Segment Dominate the Market in 2024?

The outsourced deployment segment dominated the insurance third party administration market with the largest revenue share in 2024 due to the increased demand for expertise, scalability, and cost-effective administration. Insurance companies in different geographies are pursuing third-party alliances to streamline claims processing, policy servicing, and regulatory reporting. At the same time, they internalize their resources toward product development and customer attraction. Furthermore, the increased popularity of outsourcing among mid-range insurers, which sought to update their systems without investing heavily in infrastructure, thus further fueled the segment.

(Source: https://www.iais.org)

The in-house segment is expected to grow at a notable CAGR during the forecast period, owing to the rising need for direct control and appropriate management of proprietary systems and data-controlling within organizations. Most giants in the industry had in-house administrative departments that coordinated activities to align operational processes with internal guidelines. This ensures that sensitive client and policyholder information remains confidential. In 2024, the Canadian Life and Health Insurance Association (CLHIA) also noted that insurers that retain in-house insurance third-party administration activities experience shorter integration procedures and easier internal communication flows. Furthermore, the health insurance providers still depended on in-house maintained platforms to comply with privacy and provincial regulatory legalities, thus further boosting the market.

(Source: https://www.clhia.ca)

End-user Insights

Why Did the Insurance Companies Segment Dominate the Insurance Third Party Administration Market in 2024?

The insurance companies segment dominated the market in 2024. This is mainly due to the increased pressure to reduce administrative overhead, accelerate claim turnaround, and the emerging sophistication of regulatory rules. These insurance companies have collaborated with TPAs to outsource non-core processes, such as paying claims, billing, servicing members, and policy administration.

The U.S. leveraged third-party administrators to ensure a desirable service level as the number of claims was increasing, but it was not feasible to scale up their internal structure. In 2024, a Centers for Medicare & Medicaid Services (CMS) bulletin highlighted the increasing use of outsourcing among Medicare Advantage providers as a response to delays in prior authorization and the accessibility of documentation standards. Additionally, the TPAs enabled insurers to meet the increasing demand among customers for 24-hour service, creating a demand for these services in the sector.

(Source: https://www.cms.gov)

The reinsurance companies segment is expected to grow at a notable CAGR in the coming years, owing to rising global risk exposure, fluid cross-border agreements, and the desire for improved claims evaluation and reporting. In retrocession, reinsurers, to a great extent, are likely to collaborate with TPAs so that region-specific expertise is tapped, overflow claims are cleared, and claims are promptly settled. Additionally, the TPAs were very resourceful in handling the quick claims, post-event loss adjudication, and regulatory reporting, thus further fuelling the market in these companies.

Regional Insights

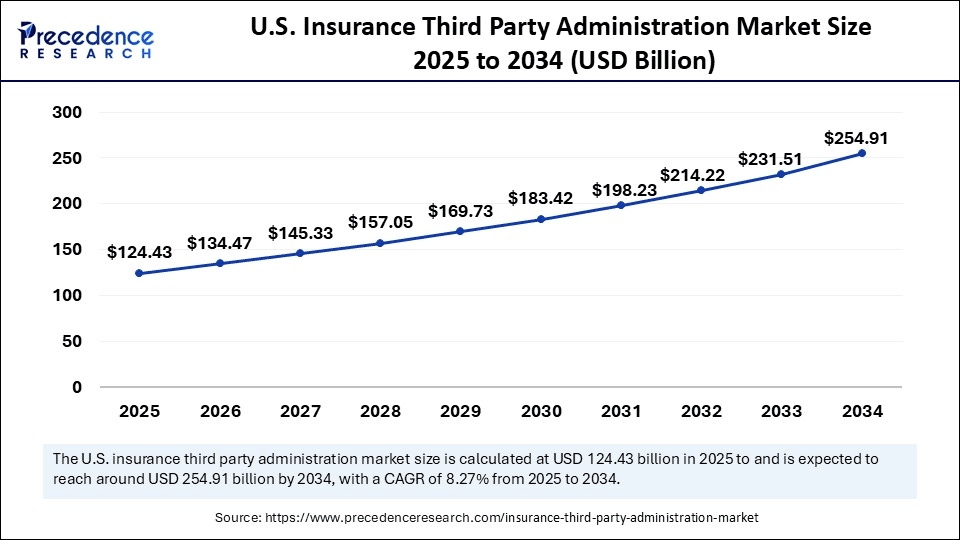

U.S. Insurance Third Party Administration Market Size and Growth 2025 to 2034

The U.S. insurance third party administration market size is exhibited at USD 124.43 billion in 2025 and is projected to be worth around USD 254.91 billion by 2034, growing at a CAGR of 8.27% from 2025 to 2034.

Why Did North America Lead the Insurance Third Party Administration in 2024?

North America led the insurance third party administration market, capturing the largest revenue share in 2024. Due to the facts that North America has a mature insurance sector, advanced regulatory environment, and has achieved a high percentage of outsourcing in health, life insurance. Insurers in the United States became partners of TPAs to not only combat exploding claim numbers, to reconcile legacy systems and ensure compliance with confusing state and federal regulations

There is also the fact that the group health plans have improved ERISA compliance monitoring due to the external administrators that were identified by the Employee Benefits Security Administration (EBSA). Furthermore, the increased use of advanced analytics are bound to build on its dominance regarding TPA adoption in different insurance spheres in this region.

North America: U.S. Insurance Third Party Administration Market Trends

U.S. growth is driven by increased outsourcing and the need for specialized services in complex insurance sectors. The widespread adoption of AI, automation, and cloud-based platforms is being used to boost operational efficiency, detect fraud, and enhance customer service.

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period, owing to the high growth of the insurance business, the changes of the regulation system, and the increase of demands in digital administrative tools. Insurance Regulatory and Development Authority of India (IRDAI) came up with new operational guidelines of TPAs in health insurance whereby more partnership between domestic insurance companies and third party administrators developed. The National Health Authority (NHA) explained that the emergence of Ayushman Bharat and other public-private schemes in India had created an additional demand for scalable third-party service providers to handle claim logistics, eligibility verification, and benefits disbursing.

Asia Pacific: China Insurance Third Party Administration Market Trends

The Chinese insurance third-party administration (TPA) market is growing rapidly due to the need for specialized services in complex insurance sectors and strong technological adoption. The heavy investment in AI and cloud-based platforms to boost efficiency and support a mobile-first consumer base.

Similar activity was noted in China, where the China Banking and Insurance Regulatory Commission (CBIRC) indicated the activity among banks and insurers in an effort to respond to the growing number of policyholders. The OECD Health Statistics report of 2024 highlighted the increasing digital health ecosystem in Asia, especially in Japan and South Korea, as the driver towards the proliferation of TPA-led service delivery. Furthermore, the TPAs' adoption of API based platforms and cloud-based infrastructure to accommodate aging populations, along with long-term care coverage, further propels the market in this region.

(Source: https://www.oecd.org)

The Middle East and Africa region is expected to hold a notable revenue share of the market, due to the growing health insurance requirement, widening foreign investments in the insurance industry, and growing digitization among emerging economies. In 2024, the World Health Organization (WHO) also explained why the region requires scalable administrative framework to meet the objectives of Universal Health Coverage (UHC), namely Saudi Arabia, the United Arab Emirates, Kenya, and South Africa. Furthermore, the trends are estimated to fuel the TPA market in Middle East and Africa, especially in the health and travel insurance with increased focus on improving the infrastructure and implementing regulatory requirements.

(Source: https://www.who.int)

Middle East & Africa: Saudi Arabia Insurance Third Party Administration Market Trends

Saudi Arabia's market growth is driven by digitization initiatives, government interest in healthcare infrastructure, and compulsory health insurance regulations. Both nations benefit from robust healthcare infrastructure and high per capita incomes, creating fertile ground for TPA market expansion.

Value Chain Analysis of the Insurance Third Party Administration Market

- Inbound Logistics

This stage involves the handling and processing of vast amounts of raw data from insurers, policyholders, medical providers, and other third parties.

Key Players: Sedgwick and Broadspire - Operations

Operations encompass the core services of a TPA, including claims adjudication, policy administration, customer service via contact centers, and fraud detection.

Key Players: UnitedHealth Group (through its Optum division) and CGI Inc. - Outbound Logistics

This stage involves the distribution of information, payments, and reports to relevant stakeholders, including insurers, policyholders, and healthcare providers. - Marketing and Sales

This stage focuses on attracting new insurer clients and policyholders by highlighting the TPA's value proposition: cost savings, specialized expertise (e.g., in workers' compensation), and technological efficiency.

Key Players: Aon plc and Marsh McLennan - Service

The service stage involves ongoing customer support, training for clients on TPA systems, dispute resolution, and continuous compliance monitoring as regulations evolve.

Key Players: WebTPA

Top Companies in the Insurance Third Party Administration Market & Their Offerings

- AmWINS Group: As a leading wholesale insurance broker and MGA, AmWINS contributes to the market by facilitating complex specialty risk placements, often requiring intricate administration that their services support.

- Aon: A global professional services firm, Aon provides a variety of risk, retirement, and health solutions, including robust administration and outsourcing services that function as TPA offerings.

- Arthur J. Gallagher Co.: This global insurance brokerage offers a wide range of risk management, consulting, and TPA services, particularly in areas like property/casualty and benefits administration.

- Boll Branch: Boll Branch is a luxury bedding company and is not an insurance-related company. Therefore, it does not contribute to the insurance third-party administration market.

- Brown & Brown: As a large insurance brokerage firm, Brown & Brown offers some administrative services; however, its primary contribution to the broader market is through insurance placement and consulting, not as a core TPA provider. They provide risk management and employee benefits solutions to their clients.

- Gallagher: See Arthur J. Gallagher Co. They contribute through an extensive portfolio of TPA and risk management services, leveraging global reach and scale to manage complex claims for a variety of clients. They focus on minimizing clients' total cost of risk.

- HUB International: A global insurance broker, HUB provides TPA services through its benefits and risk management practices, helping businesses manage administrative functions efficiently. Their focus is on delivering comprehensive insurance and consulting solutions.

- Lockton: As the world's largest independent insurance broker, Lockton offers a range of services that include benefits administration and risk management, which can involve TPA functions.

- Marsh McLennan Companies: A global professional services firm, Marsh McLennan (and its subsidiaries like Mercer) offers significant TPA capabilities through its administration services for health and benefits programs.

- NFP: NFP provides benefits consulting, wealth management, and retirement services, which include robust TPA and administration solutions for employee benefits programs.

- Sedgwick: Sedgwick is a leading global TPA, making significant contributions as a core provider of tech-enabled claims and productivity management solutions across property, casualty, and health lines.

- USI Insurance Services: A major insurance brokerage and consulting firm, USI offers administrative and TPA services as part of its broad range of property & casualty, employee benefits, and risk management solutions.

- Willis Towers Watson (WTW): WTW is a major global advisory and solutions company that provides extensive TPA services for pension, health & welfare, and insurance programs.

- WTW: See Willis Towers Watson. They provide TPA solutions integrated with their broader HR and risk management consulting services, leveraging global scale and deep expertise to help companies manage their benefits and administrative needs.

Insurance Third Party Administration Market Companies

- AmWins Group

- Aon

- Arthur J. Gallagher Co.

- Boll Branch

- Brown Brown

- Gallagher

- HUB International

- Lockton

- Marsh McLennan Companies

- NFP

- Sedgwick

- USI Insurance Services

- Willis Towers Watson

- WTW

Recent Development

- In August 2024, Policybazaar for Business, the corporate arm of Policybazaar Insurance Brokers Private Ltd, has announced a strategic partnership with Paramount Health TPA and various insurance providers to introduce the '15-Minute Express Discharge' service. Designed specifically for employee health insurance cashless claims, the new offering significantly shortens hospital discharge times. Traditionally, patients face delays of up to four hours post-doctor approval, owing to interdepartmental coordination at hospitals. The Express Discharge service streamlines this process, aiming to enhance patient experience by enabling quicker exits upon medical clearance.

- In November 2024, the Reinsurance Group of America has launched Aspire, a new licensed third-party administrator in the United Arab Emirates (UAE). Developed in partnership with health-tech company CarePay, Aspire features a cutting-edge digital platform that modernizes health insurance portfolio management for insurers. The platform offers real-time data exchange and communication with robust adherence to GDPR-compliant security standards. Through Aspire, insurers in the UAE are expected to benefit from faster claims processing, increased operational efficiency, and enhanced service delivery to insured members.

(Source: https://www.cnbctv18.com)

(Source: https://www.businesswire.com)

Latest Announcement by Industry Leader

- In June 2025, Accenture, through Accenture Ventures, has invested in Reserv, an insurance claims processing firm that merges extensive claims knowledge with cutting-edge AI-powered solutions. This investment will also allow both companies to co-develop offerings that boost accuracy and efficiency across the claims landscape, supporting underwriters and claims handlers in delivering improved outcomes and service quality for claimants. Reserv, acting as a third-party administrator (TPA), offers claims services for property & casualty (P&C) insurers throughout the U.S. and the U.K. The company leverages a data warehouse, analytics, and generative AI to automate backend tasks and improve responsiveness, enabling claims professionals to prioritize precision and enhance customer satisfaction. Kenneth Saldanha, senior managing director and Accenture's North America Insurance lead, stated: “Insurance claims processing is central to the customer commitment and poised for comprehensive reinvention and innovation. Reserv's AI-first servicing platform enables insurers to leverage detailed claims data for increased accuracy and operational efficiency, supporting faster resolution and a superior claimant experience. The data feedback into risk evaluation fosters stronger resilience and helps sharpen competitive pricing strategies.”

(Source: https://newsroom.accenture.com)

Segments Covered in the Report

By Business Segment

- Life Health Insurance

- Property Casualty Insurance

- Travel Insurance

By Service Type

- Claims Management

- Customer Service

- Policy Administration

- Underwriting Services

By Technology

- Cloud-based

- Hybrid

- On-Premise

By Deployment Model

- Co-sourced

- In-house

- Outsourced

By End-User

- Insurance Companies

- Managing General Agents

- Reinsurance Companies

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting