Intellectual and Development Disability Care Market Size and Forecast 2025 to 2034

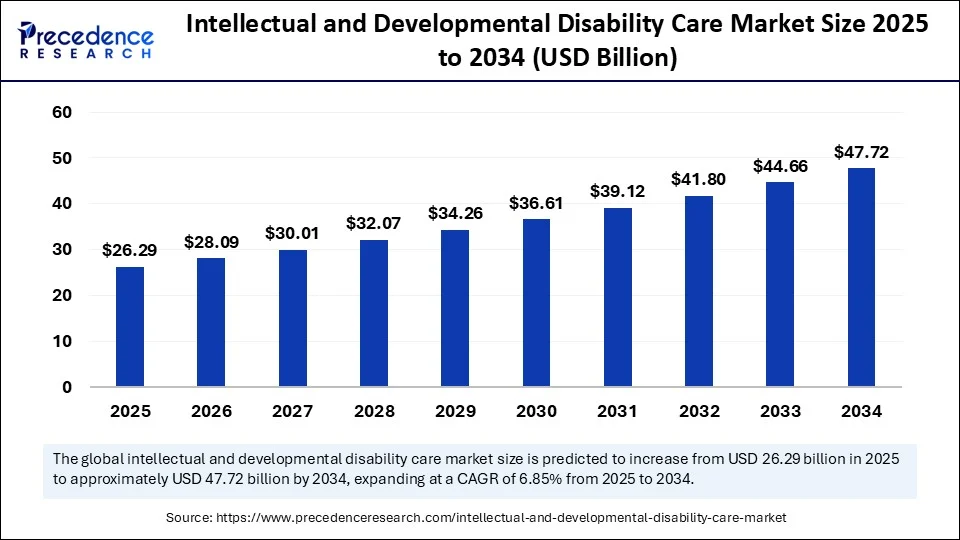

The global intellectual and development disability care market size was estimated at USD 24.60 billion in 2024 and is predicted to increase from USD 26.29 billion in 2025 to approximately USD 47.72 billion by 2034, expanding at a CAGR of 6.85% from 2025 to 2034. The market is growing steadily as healthcare systems place a greater emphasis on inclusivity, personalized care, and long-term support services.

Intellectual and Development Disability Care Market Key Takeaways

- In terms of revenue, the global intellectual and development disability care market was valued at USD 24.60 billion in 2024.

- It is projected to reach USD 47.72 billion by 2034.

- The market is expected to grow at a CAGR of 6.85% from 2025 to 2034.

- North America dominated the intellectual and development disability care market in 2024.

- Asia Pacific is expected to be the fastest-growing region in the upcoming years.

- By service type, the residential care services segment held the maximum revenue share in 2024.

- By service type, the non-residential care services segment is expected to witness the fastest growth over the forecast period.

- By funding source type, the public funding segment led the market in 2024.

- By funding source type, the hybrid models segment is expected to witness the fastest growth over the forecast period.

- By age group type, the children (0–17 years) segment held the biggest revenue share in 2024.

- By age group type, the adults (18–64 years) segment is expected to witness the fastest growth over the forecast period.

- By end-user, the rehabilitation centers segment generated the major revenue share in 2024.

- By end-user, the home-based care settings segment is expected to witness the fastest growth over the forecast period.

HowAI Has Impacted the Intellectual and Development Disability Care Market?

AI is transforming the intellectual and development disability care market by introducing personalized therapy plans, predictive health monitoring, and adaptive learning tools. Machine learning algorithms analyze patient progress, enabling caregivers to adjust interventions for better outcomes. AI-powered speech and communication devices are giving individuals with IDD a stronger voice in their daily lives. Virtual assistants and smart home systems are also being integrated to enhance independent living for people with disabilities. Predictive analytics helps identify potential health complications early, reducing hospitalizations and improving quality of life. Overall, AI is not replacing human caregivers but augmenting their capacity to deliver more tailored and effective support.

Caring Beyond Barriers

The intellectual and development disability care market encompasses services, programs, and solutions designed to support individuals with intellectual disabilities (such as Down syndrome, Fragile X syndrome) and developmental disabilities (including autism spectrum disorder, cerebral palsy, and other cognitive/physical impairments that occur during developmental years). The market includes residential, non-residential, therapeutic, educational, and vocational care services aimed at improving the quality of life, promoting independence, and ensuring health and social integration. Care delivery spans public, private, and non-profit organizations, often supported by government funding, insurance coverage, and community-based programs.

Growing awareness about intellectual disabilities, combined with rising demand for structured community care programs, is fueling the sector's growth. Governments and non-profits are working alongside private players to provide holistic support, including residential care, early intervention therapies, and assistive technologies. The market is shaped not only by medical services but also by vocational training and life skills programs. With a growing population requiring specialized care, stakeholders are investing in infrastructure and innovative solutions. This creates a dynamic ecosystem that balances medical, social, and emotional needs for individuals with intellectual or developmental disability (IDD).

Market Key Trends

- Shift from institutionalized care to community-based programs.

- Expansion of telehealth and remote monitoring in IDD services.

- Rising adoption of assistive and adaptive technologies.

- Stronger emphasis on family and caregiver training programs.

- Growth of public-private partnerships for inclusive healthcare.

- Increasing focus on integrated mental health support for individuals with intellectual or developmental disability.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 47.72 Billion |

| Market Size in 2025 | USD 26.29 Billion |

| Market Size in 2024 | USD 24.60 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.85% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, Funding Source, Age Group, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Markets Dynamics

Drivers

The Push for Inclusive Healthcare

A major driver of the intellectual and development disability care market is the growing global focus on inclusive healthcare and equal rights for people with disabilities. Supportive government policies, funding initiatives, and advocacy movements have created a strong foundation for structured IDD care programs. Parents and caregivers are increasingly demanding comprehensive services that cover both health and developmental aspects. The rising prevalence of developmental disorders such as autism is further driving the demand for early intervention and long-term care. In addition, the expansion of health insurance coverage for disability services is enabling more families to access quality care. Collectively, these factors are propelling the market forward.

Opportunity

Unlocking the Potential Through Innovation

The biggest opportunity lies in leveraging technology and personalized care models to improve outcomes for individuals with intellectual or developmental disability. Digital platforms that combine therapy, education, and progress tracking are opening new possibilities for integrated care delivery. Emerging markets present untapped potential, as awareness and infrastructure for disability care are still developing. Collaboration between tech firms and healthcare providers can accelerate innovations like AI-based learning tools and robotic assistance. Additionally, workforce training programs can expand the pool of skilled caregivers, addressing global shortages. This convergence of innovation and inclusivity creates a wide space for market growth.

Restraint

Barriers Still Exist

Despite progress, the intellectual and development disability care market faces challenges such as limited funding in low-and low-income regions. A shortage of trained professionals, including therapists and specialized caregivers, remains a critical barrier. High costs of advanced assistive technologies make them inaccessible for many families. Social stigma and lack of awareness in certain regions further delay diagnosis and treatment. Inconsistent government policies and fragmented service delivery models also create hurdles. These constraints highlight the need for stronger advocacy and sustainable solutions to ensure equitable care.

Service Type Insights

Why Are Residential Care Services Dominating the Intellectual and Development Disability Care Market?

The residential care services segment has become a dominant force in the intellectual and development disability care market, offering comprehensive, round-the-clock assistance for individuals requiring structured living environments. These facilities often include therapeutic, medical, and social support, making them an essential part of long-term care strategies. Families prefer residential options when independent living is not feasible, ensuring safety and holistic development. Moreover, government funding and nonprofit involvement strongly back residential care due to its structured approach. The demand is further sustained by increasing awareness about the benefits of tailored living arrangements. This makes residential care the backbone of the market, combining medical oversight with supportive community living.

Residential care's dominance also stems from the ability to handle complex medical and behavioral needs effectively. They serve as trusted hubs for specialized professionals, ranging from therapists to healthcare providers. Their capacity to scale with patient volumes makes them a sustainable option. Additionally, they provide caregivers' relief while ensuring consistent, high-quality care. Families increasingly value the integrated ecosystem offered in these settings. As a result, residential care continues to secure its leadership in the spectrum of IDD care services.

The non-residential care services segment has become the fastest-growing in the intellectual and development disability care market, due to these services' focus on targeted interventions like occupational therapy, behavioral therapy, and educational support tailored to individual needs. As early diagnosis improves, families seek more personalized care solutions to enhance developmental outcomes. This trend is fueled by advances in therapies designed to boost independence and integration into mainstream society. Additionally, the demand is increasing due to a growing emphasis on individualized, outcome-based programs. The availability of advanced therapeutic tools is also pushing this segment forward.

Growth in specialized services is also supported by the rising adoption of technology-enabled care models, including AI-driven assessments and digital therapy platforms. These interventions allow greater customization and measurable progress tracking. Families are increasingly willing to invest in therapies that promise long-term improvements. Insurance companies and governments are beginning to support targeted therapies, further expanding accessibility. With a focus on empowerment rather than only assistance, specialized therapeutic services are becoming the fastest-evolving segment. This growth is reshaping the IDD care landscape into a more outcome-oriented market.

Funding Source Insights

Why Public Funding Is Dominating the Intellectual and Development Disability Care Market?

The public funding segment has become a dominant force in the intellectual and development disability care market. Government programs ensure accessibility for families unable to afford high-cost care. Subsidies, Medicaid support (in the U.S.), and other regional initiatives guarantee equitable care delivery. These funds support both residential and non-residential models. Additionally, public backing has made it possible for large-scale infrastructure development. This widespread reliance highlights the critical role of governments in sustaining the sector.

The dominance of public funding is further tied to the policy push for inclusive care. Governments recognize intellectual and development disability care as a social responsibility, ensuring dedicated budget allocations. With rising prevalence, public investments continue to expand across regions. Such funding ensures both stability and affordability for end users. Moreover, government oversight enhances transparency and standardization in care. As a result, public funding remains the cornerstone of this market.

The hybrid models segment has become the fastest-growing segment in the intellectual and development disability care market. This approach allows broader service expansion while reducing reliance on government resources. Families often opt for hybrid options to access premium services not fully covered by public funding. The model creates room for innovation in therapies, infrastructure, and technology adoption. Additionally, it appeals to private investors seeking impact-driven opportunities. The growing popularity of public-private partnerships is also fuelling this growth.

Hybrid models are gaining traction as they balance affordability with quality enhancement. Insurance providers are increasingly collaborating with public systems to cover specialized services. This trend widens choices for families while improving the sustainability of care ecosystems. It also fosters competition among providers, resulting in better standards of care. As IDD care evolves, hybrid funding is reshaping financing frameworks. This segment is poised to redefine long-term market sustainability.

Age Group Insights

Why Are Children (0–17 Years) Dominating the Intellectual and Development Disability Care Market?

The children (0-17 Years) segment has become a dominant force in the intellectual and development disability care market. Early diagnosis and intervention programs are heavily targeted toward this group. Families and governments prioritize pediatric developmental support to improve long-term outcomes. Schools and therapy centres play a central role in care delivery for this demographic. Programs focusing on learning, behaviour, and physical skills further reinforce dominance. Parents' growing awareness of the benefits of early intervention sustains demand.

This dominance is also supported by extensive government initiatives promoting inclusive education. Pediatric specialists, therapists, and nonprofit organizations ensure a steady ecosystem of services. Funding allocations often prioritize children, recognizing the life-long benefits of early care. Moreover, families are increasingly open to advanced therapies and digital support tools. Children remain the focal point of developmental disability strategies globally. Their central role ensures the continuity of demand across the care ecosystem.

The adults (18–64 years) segment has become the fastest-growing segment in the intellectual and development disability care market, while children dominate in numbers, adults require extended support as they transition into independent living. Growing emphasis on employment support, community integration, and assisted living fuels demand. With life expectancy rising, adults are spending more years in care programs. Additionally, employers and governments are introducing inclusive workplace initiatives. This significantly broadens the scope of adult-focused services.

The growth of adult care is also tied to innovations in residential and home-based care models. Adults are seeking environments that balance autonomy with necessary support. The rise of adult rehabilitation centers and skill-building programs contributes further. Moreover, private investment in adult care facilities is gaining momentum. This segment highlights the evolving landscape of IDD care, where lifelong support is prioritized. The trend cements adults as the fastest-growing age group in the market.

End User Insights

Why Rehabilitation Centers Are Dominating the Intellectual and Development Disability Care Market?

The rehabilitation Centers segment has become a dominant force in the intellectual and development disability care market. These centers are specialized hubs offering multidisciplinary therapies under one roof. Families prefer them due to the availability of medical, behavioral, and social care professionals. Their structured programs enhance both developmental and social outcomes. They serve as trusted institutions for children and adults alike. Government and nonprofit support also strengthen their dominant role.

Rehabilitation centers maintain dominance by offering advanced infrastructure and continuous innovation. They provide intensive therapy programs that smaller facilities cannot match. These centers are also crucial in training caregivers and professionals. Their role as referral hubs in care networks ensures steady demand. Additionally, they benefit from significant government and insurance backing. This makes them central to the IDD care delivery ecosystem.

The home-based care settings segment has become the fastest-growing segment in the intellectual and development disability care market. Families increasingly value care provided in familiar environments for comfort and personalization. Advances in digital health, remote monitoring, and AI-driven care tools make home-based support more feasible. These models reduce costs while improving flexibility. Caregivers also benefit from professional guidance delivered at home. The growing trend of aging in place further accelerates this segment.

Additionally, home-based models align with the global shift toward patient-centric care. They allow customization of therapy schedules and environments. Insurance providers are beginning to expand coverage for home care. This option is particularly attractive for adults seeking independence with minimal disruption. As digital tools become more sophisticated, home-based care is poised to expand rapidly. This makes it the most dynamic segment in the evolving IDD care market.

Regional Insights

Why Does North America Lead the Way in IDD Care?

North America continues to dominate the intellectual and development disability care market because they have implemented robust policies that emphasize inclusivity, rights-based approaches, and integration into mainstream society. Federal and state-level funding programs support early intervention, residential services, and vocational training. The widespread adoption of telehealth and assistive technologies is further boosting the sector's growth. North America also benefits from strong advocacy networks that promote from strong advocacy networks that promote awareness and drive legislative reforms. Together, these factors make the region the most mature and developed intellectual and development disability care market globally.

In addition, continuous investment in research and technology ensures that advanced therapies and innovative solutions are accessible to individuals with IDD. Collaborations between healthcare providers, tech companies, and government bodies have created a dynamic ecosystem that fosters both growth and inclusivity. The insurance framework also plays a crucial role by making IDD services more affordable for families. Rising demand for personalized care models is shaping the future of the market in the region. Workforce development programs are helping address caregiver shortages, ensuring sustainability. This positions North America as a global benchmark for IDD care excellence.

Why Is the Asia Pacific the Fastest-Growing Intellectual and Development Disability Care Market?

Asia Pacific is the fastest-growing region in the intellectual and development disability care market, driven by rising awareness and expanding healthcare investments. Countries like India, China, and Japan are seeing an increase in early diagnosis and structured care programs for intellectual disabilities. Governments are introducing new policies to improve inclusivity and access to disability services. Growing disposable incomes and urbanization are also fueling demand for professional care services. The expansion of digital healthcare platforms is bridging gaps in regions with limited physical infrastructure. This growing momentum makes the Asia Pacific the fastest-expanding intellectual and development disability care market.

Alongside government initiatives, private players and non-profits are actively investing in creating sustainable care models. Community-based rehabilitation programs are becoming more common, especially in rural and semi-urban areas. The demand for assistive technologies is rising, with local innovation helping reduce costs. Education and vocational training centers are expanding, aiming to provide individuals with IDD more independence and life opportunities. Despite challenges like caregiver shortages, the region's youthful population presents opportunities for workforce training. Together, these dynamics position the Asia Pacific as the most promising region for future market expansion.

Intellectual and Development Disability Care Market – Value Chain Analysis

- Clinical Trials and Regulatory Approvals: Clinical trials in intellectual and developmental disability care focus on carefully designed research to test and validate new therapies and interventions. Regulatory approvals play a vital role by ensuring that these treatments meet safety and efficacy standards before they can be widely implemented.

Intellectual and Development Disability Care Market Companies

- The MENTOR Network

- Sevita

- BrightSpring Health Services

- NHS England

- Mosaic

- Elwyn

- Compass Group Canada (Affinity Services)

- Devereux Advanced Behavioral Health

- Camphill Communities

- Life Without Barriers

- KeyRing Living Support Networks

- Achieve Australia

- ResCare, Inc.

- Bancroft Neurohealth

- Lutheran Social Service of Minnesota

- YAI (Seeing Beyond Disability)

- Volunteers of America

- Community Living, Inc.

- Hope Services

- St. John of God Health Care

Recent Developments

- In August 2025, Dementia is becoming an increasingly pressing issue, especially in countries like India with rapidly ageing populations. Despite this, awareness, timely diagnosis, and access to proper care remain limited. Experts believe digital and assistive technologies hold significant promise, but affordability for patients remains a major challenge. According to the World Health Organization (WHO), more than 55 million people worldwide currently live with dementia, with nearly 10 million new cases each year. Alzheimer's disease is the most common type, accounting for 60–70% of cases. The burden is particularly heavy in low- and middle-income countries like India, where dementia prevalence is projected to triple by 2050 as populations continue to age.(Source: https://www.thehindu.com)

Segments Covered in the Report

By Service Type

- Residential Care Services

- Group Homes

- Assisted Living Facilities

- Institutional Care

- Others

- Non-Residential Care Services

- Day Programs & Community Participation

- Vocational Training & Employment Support

- Respite Care

- Personal Assistance Services

- Others

- Therapeutic Services

- Behavioral Therapy

- Occupational Therapy

- Speech & Language Therapy

- Physical Therapy

- Others

- Educational & Skill Development Services

- Special Education Programs

- Life Skills Training

- Digital Learning Platforms for IDD

- Others

- Healthcare Services

- Primary & Preventive Care

- Mental Health Services

- Dental & Specialized Medical Care

- Others

By Funding Source

- Public Funding

- Private Funding

- Non-Profit & Charity Funding

- Hybrid Models

- Others

By Age Group

- Children (0–17 years)

- adults (18–64 years)

- Seniors (65+ years)

By End User

- Individuals & Families

- Rehabilitation Centers

- Community Centers

- Home-based Care Settings

- Educational Institutions

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting