IR Camera Market Size and Forecast 2025 to 2034

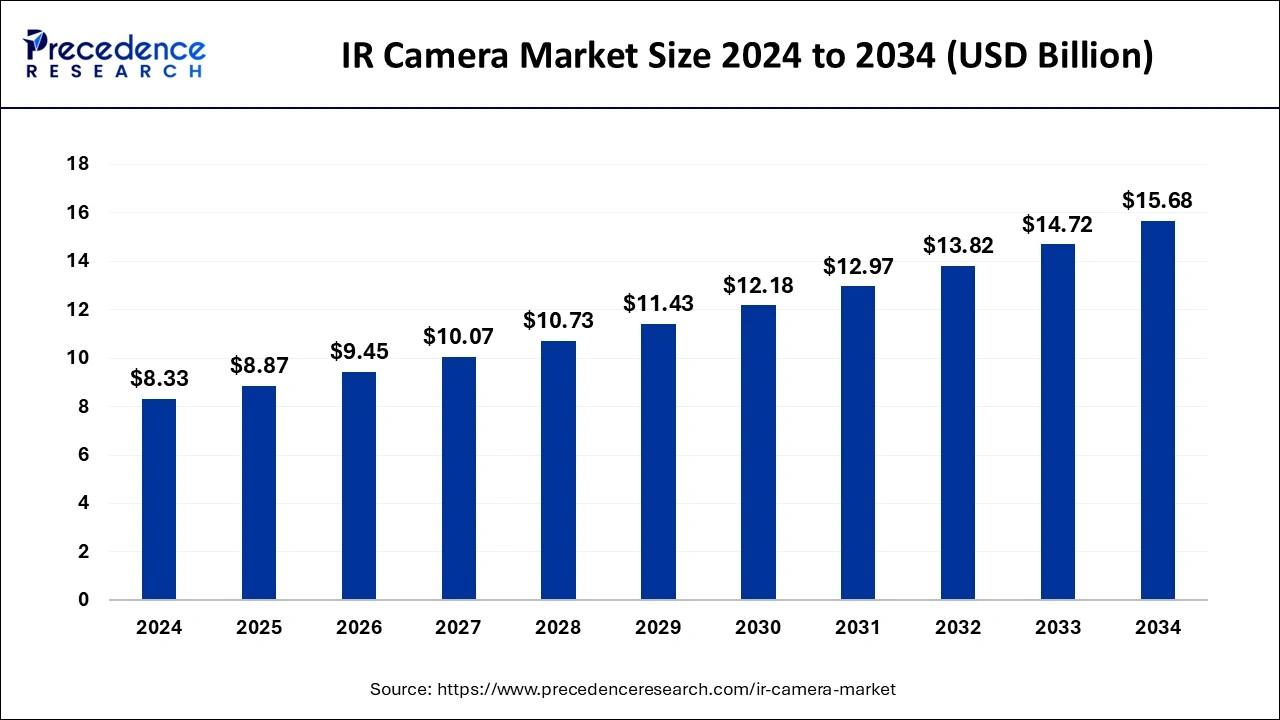

The global IR camera market size was accounted for USD 8.33 billion in 2024 and is expected to exceed around USD 15.68 billion by 2034, growing at a CAGR of 6.53% from 2025 to 2034. Ongoing advancements in detector technology are the key factor driving the growth of the market. Also, increasing investments by homeowners and the government coupled with the high image quality given by these cameras can fuel the IR camera market growth soon.

IR Camera Market Key Takeaways

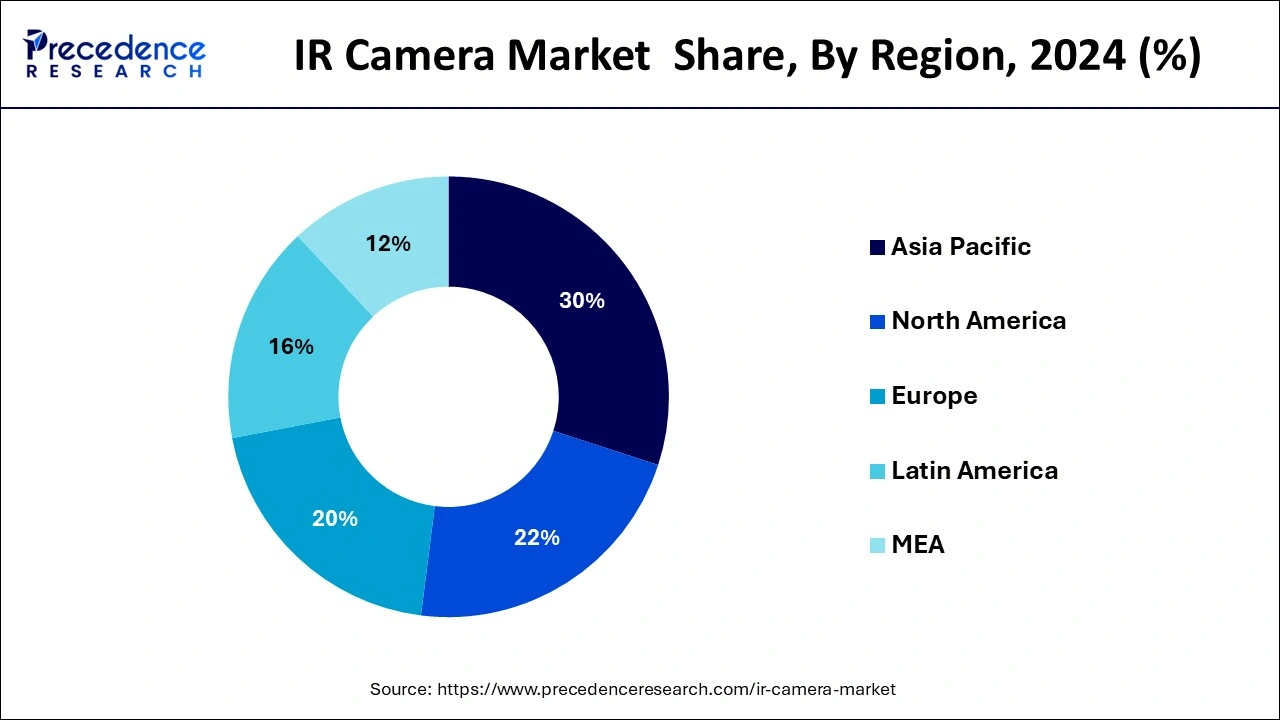

- Asia Pacific dominated the global market with the largest market share of 30% in 2024.

- North America is expected to show the fastest growth during the forecast period.

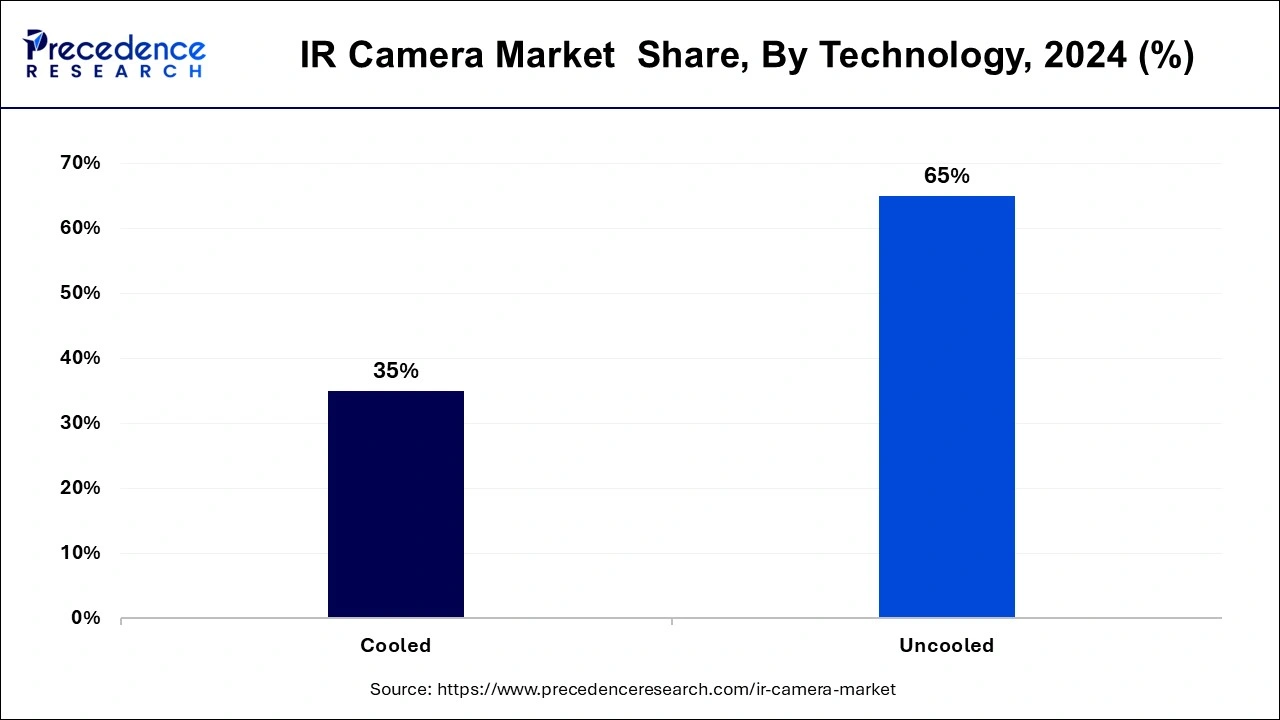

- By technology, the uncooled IR cameras segment contributed the highest market share of 65% in 2024.

- By technology, the cooled IR cameras segment is expected to grow at the fastest CAGR during the forecast period.

- By material, the Germanium segment captured the biggest market share in 2024.

- By material, the sapphire segment is anticipated to grow at the fastest CAGR over the forecast period.

- By type, the near and short-wavelength IR segment generated the major market share in 2024.

- By type, the Long-wavelength IR-type segment shows the fastest growth during the projected period.

- By application, the commercial segment has held the largest market share in 2024.

- By application, the industrial sector is expected to grow at the fastest CAGR during the studied period.

Impact of Artificial Intelligence (AI) on the IR Camera Market

The integration of artificial intelligence is transforming the IR camera market significantly. Algorithms enhance the whole image processing abilities, enabling more precise predictive analytics and temperature measurements. Furthermore, AI in IR imaging enabled innovative pattern recognition and defect detection, which is necessary for measuring optimal performance and avoiding equipment failures.

- In September 2024, Artificial Intelligence Technology Solutions, Inc., announced the launch of RADCam™, a groundbreaking residential security product from its subsidiary Robotic Assistance Devices Residential, Inc. (RAD-R). RADCam revolutionizes the concept of residential security by introducing what the company sees as the world's first AI-powered, purpose-built 'Talking Security Camera'.

Asia Pacific IR Camera Market Size and Growth 2025 to 2034

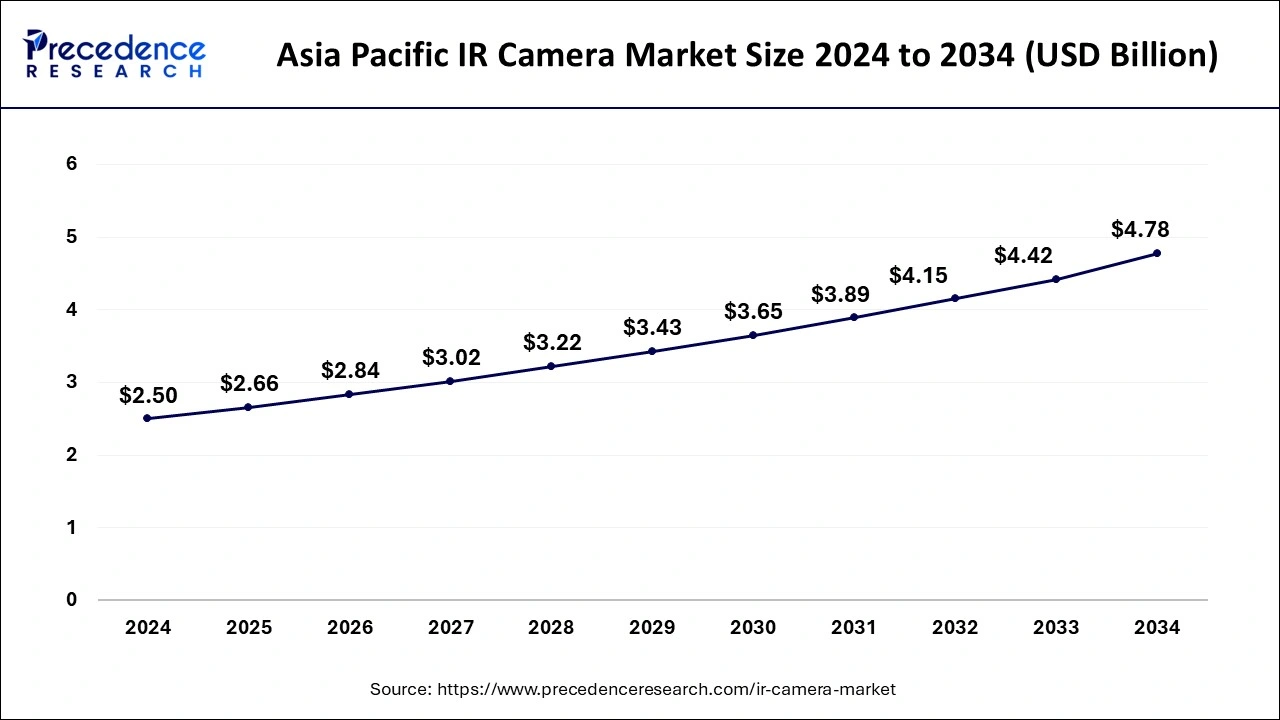

The Asia Pacific IR camera market size was exhibited at USD 2.50 billion in 2024 and is projected to be worth around USD 4.78 billion by 2034, growing at a CAGR of 6.70% from 2025 to 2034.

Asia Pacific dominated the global IR camera market in 2024. This dominance can be attributed to the region's technological advancements and developments in infrared imaging technologies, including innovative image processing algorithms. Moreover, in Asia Pacific, India is showing rapid growth owing to increasing population densities and expanding urban areas.

- In April 2023, Teledyne FLIR announced the expansion of its Boson+ thermal camera module product line to include 24 compact models with a resolution of 320 x 256. Boson+ is a line of longwave infrared (LWIR) cameras that can be integrated into unmanned aircraft systems (UAS) and utilized for various purposes.

North America is expected to show the fastest growth in the IR camera market over the studied period. The growth of the region can be linked to the increase in the application of IR cameras in industrial, residential, and commercial applications. In North America, the U.S. led the market due to a surge in the semiconductor industry and advancements in power transfer and data processing.

Market Overview

Infrared cameras identify infrared radiation and transform it into an electronic signal. Later, this signal is used to create a thermal image on the monitor. The thermal energy sensed by IR cameras is then quantified and measured to manage heat performance and detect heat-related problems. The latest industry trends are ongoing innovations in detector technology and the addition of built-in visual imaging technology.

IR Camera Market Growth Factors

- A rise in strategic collaborations between major market players across the globe is expected to boost IR camera market growth soon.

- Increasing utilization of hybrid printing technology using Silicon Infrared (IR) Camera can propel market growth shortly.

- Growth in commercialization due to the innovations in microbolometer technology will likely contribute to the market expansion over the forecast period.

Market Scope

| Report Coverage | Details |

| Market Size by 2024 | USD 8.33 Billion |

| Market Size in 2025 | USD 8.87 Billion |

| Market Size in 2034 | USD 15.68 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.53% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Material, Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing adoption of IR cameras in quality control and inspection

The IR camera market is gaining traction in process control and quality assurance monitoring. Process control measures the accurate temperature data and decides the product's shape on a manufacturing line. In addition, this data enhances and controls the process so that product shapes and temperatures are desired to meet the specifications. Also, various automobile manufacturers are utilizing IR for quality control.

- In September 2024, Leopard Imaging Inc., a global leader in intelligent vision solutions, launched its next-generation stereo camera, Eagle1, powered by the NVIDIA Jetson Orin platform for edge AI and robotics, at Vision Stuttgart 2024. This streamlined camera is designed to meet the growing demand for high-performance and high-resolution IR cameras.

Restraint

High maintenance cost

The high cost of IR cameras and lack of accuracy are the major factors that constrain the IR camera market growth. IR cameras are costly, particularly in developing nations. However, the installation, and monitoring of these cameras are generally high, impacting the overall technology's cost.

Opportunity

Rising demand for surveillance

The demand for the IR camera market in surveillance has grown across different applications, such as military, energy, defense, and commercial spaces. An increasing need for continual and rigorous surveillance in the military is anticipated to expand the market. Furthermore, rising investment in the designing of high-performance IR cameras and the rising utilization of these cameras for object identification.

- In October 2024, e-con Systems announced the launch of its latest innovation, See3CAM_CU83 – a 4K RGB-IR superspeed USB Camera featuring Onsemi's AR0830 sensor. This RGB-IR camera provides promising performance for a wide range of applications, including biometric access control and in-cabin monitoring.

Technology Insights

The uncooled IR cameras segment led the IR camera market in 2024. The dominance of the segment can be attributed to the increasing adoption of this camera across various sectors. These cameras use microbolometer sensors which don't need any cryogenic cooling like traditional cooled IR cameras. Additionally, these sensors are more reliable and efficient, hence they enable the development of high-performance IR cameras.

The cooled IR cameras segment is expected to grow at the fastest rate in the IR camera market over the forecast period. The growth of the segment can be linked to their ability to decrease the temperature of the infrared detectors, substantially improving their image and sensitivity quality. Also, these cameras are necessary for challenging military operations, such as surveillance, reconnaissance, and acquisition.

- In October 2024, Imperx launched a new high-sensitivity, thermoelectrically cooled camera, the CLF-C13K0-T, the latest addition to its Cheetah industrial camera line. The new camera is based on the Sony Pregius IMX661 global shutter sensor and comes in color and monochrome options.

Material Insights

The Germanium segment dominated the IR camera IR camera market in 2024. The dominance of the segment can be driven by the high transmission capabilities of the germanium in the IR spectrum. Germanium is a crucial material for IR camera optical components and lenses. In addition, it has low absorption rates and a high refractive index which helps it to produce high-quality thermal images.

The sapphire segment is anticipated to grow at the fastest rate over the forecast period. The growth of the segment is due to the superior qualities of sapphire, including hardness, excellent IR transmission rate, and high thermal conductivity, especially in the short-wave infrared (SWIR) spectrum. Sapphire windows and lenses provide exceptional IR light transmission.

Type Insights

- In 2023, the near and short-wavelength IR segment dominated the global IR camera market. The dominance of the segment is because of their capability to catch detailed images of objects depending on their reflectance properties and thermal signatures which makes them crucial in the agriculture, manufacturing, and electronics industries.

The long-wavelength IR-type segment shows the fastest growth during the projected period. The growth of the segment is linked to the increasing use of LWIR cameras in defense and military sectors. LWIR cameras are specially used to detect heat signatures in a dark environment and through obscurants such as fog, smoke, and dust. This makes it important for civilian security and military operations.

- In June 2024, Lynred, a leading global provider of high-quality infrared sensors for aerospace, announced the launch of ATI640, its plug-and-play, longwave infrared (LWIR) thermal imaging module with VGA resolution, for new market players seeking easier access to infrared (IR) technologies.

Application Insights

The commercial segment led the global IR camera market in 2024. The dominance of the segment is due to the increasing investment by organizations and businesses in efficient security systems to safeguard assets and protect property from future threats. Furthermore, with the growing instances of theft, retail environments, commercial properties, and office buildings need improved security measures.

The industrial sector is expected to grow at the fastest rate during the studied period. The growth of the segment can be credited to the growing adoption of IR cameras in industries to detect heat anomalies, including mechanical wear, electrical faults, and overheating components. Also, IR cameras can significantly reduce maintenance costs, expand equipment lifespan, and minimize downtime.

IR Camera Market Companies

- Teledyne FLIR LLC

- SPI Corp.

- OPGAL Optronic Industries Ltd.

- Raytheon Company

- Seek Thermal Inc.

- Fluke Corporation

- Leonardo DRS

- Axis Communication AB

- Xenics nv

- L3Harris Technologies Inc.

Recent Developments

- In November 2023, Sierra-Olympia introduced the Ventus Compact MK2, a state-of-the-art infrared camera. This advanced device is tailored for compact integration in applications with limited space, such as airborne, handheld, and other low-SWaP scenarios.

- In March 2023, Z3 Technology, LLC, a prominent provider of video encoding systems, introduced a new AI-capable, low-latency dual Camera Encoder compatible with SDI and IR Cameras. This H.265/H.264 encoder simultaneously transmits and records 3G-SDI or HD-SDI video and long-range thermal cameras.

Segments Covered in the Report

By Technology

- Cooled

- Uncooled

By Material

- Germanium

- Silicon

- Sapphire

- Others

By Type

- Near and Short-Wavelength IR

- Medium-Wavelength IR

- Long-Wavelength IR

By Application

- Military and Defense

- Automotive

- Industrial

- Commercial

- Residential

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting