IP Camera Market Size and Frecast 2025 to 2034

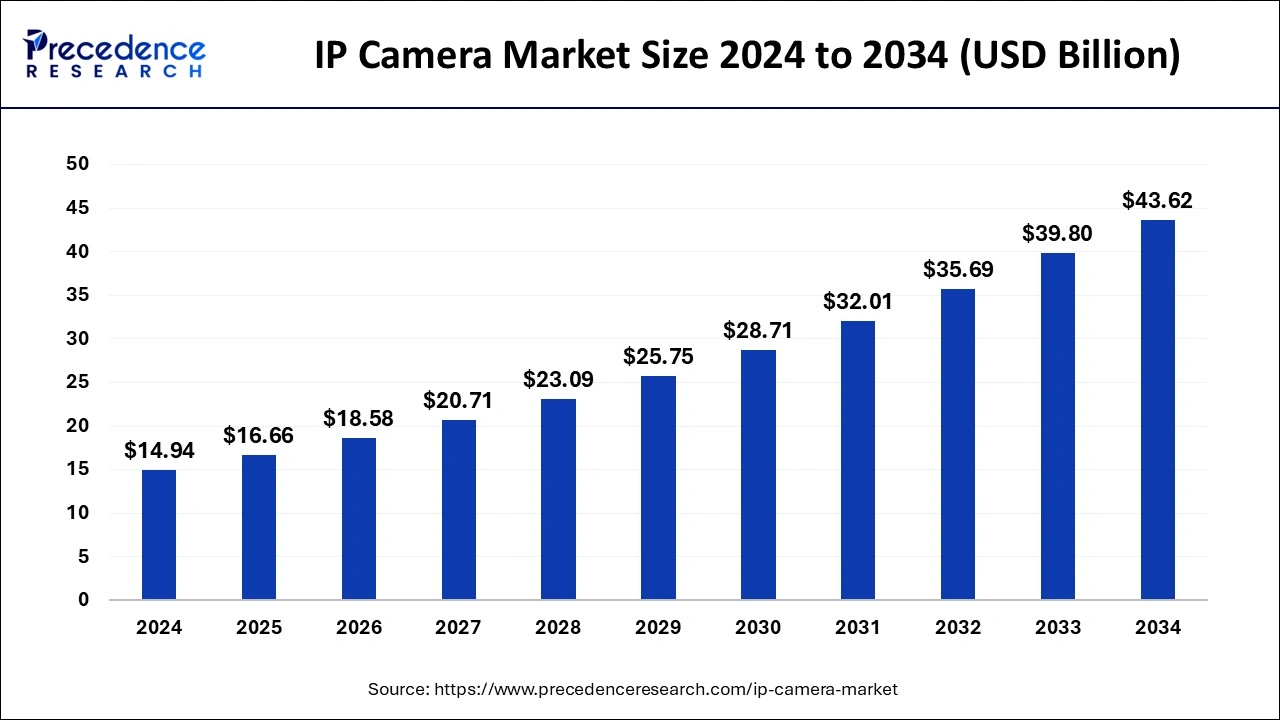

The global IP Camera market size was estimated at USD 14.94 billion in 2024 and is predicted to increase from USD 16.66 billion in 2025 to approximately USD 43.62 billion by 2034, expanding at a CAGR of 11.31% from 2025 to 2034. The rising demand for security surveillance has recently gained popularity due to the growing number of home burglaries and squatting; residential security has become the top priority of homeowners.

IP Camera MarketKey Takeaways

- The global IP Camera market was valued at USD 14.94 billion in 2024.

- It is projected to reach USD 43.62 billion by 2034.

- The IP Camera market is expected to grow at a CAGR of 11.31% from 2025 to 2034.

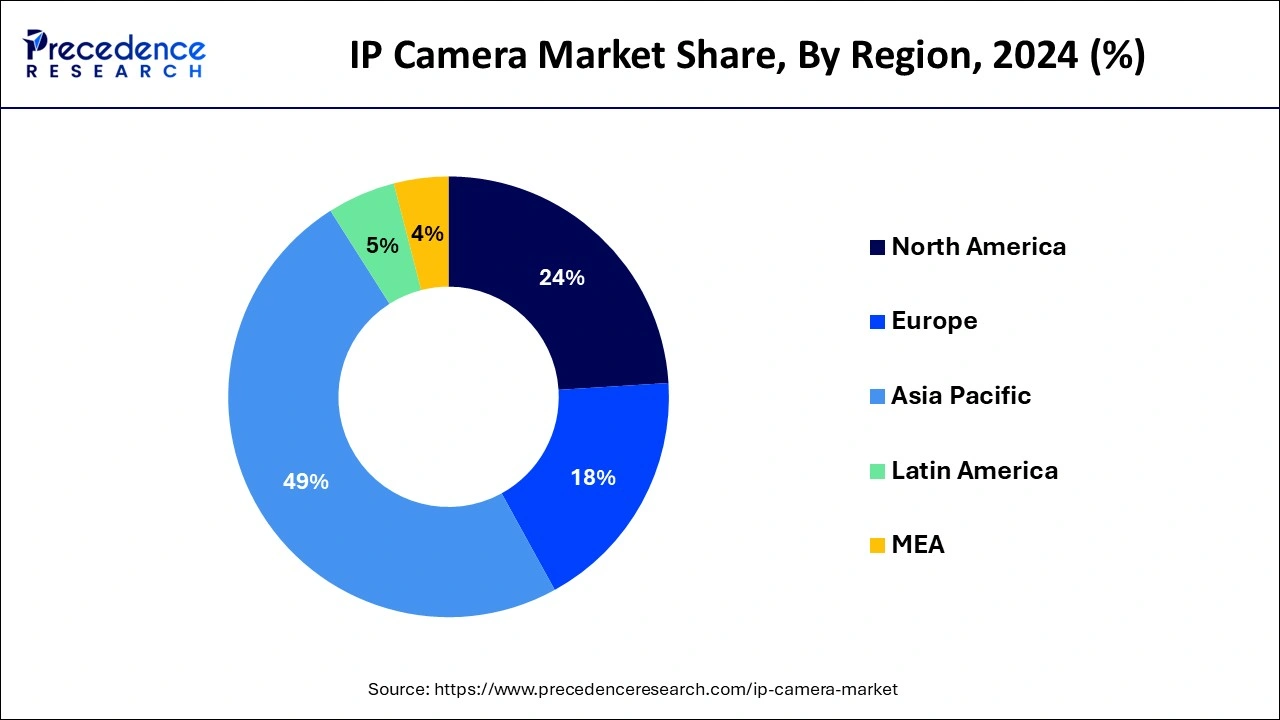

- Asia Pacific region has generated largest share of 49% in 2024.

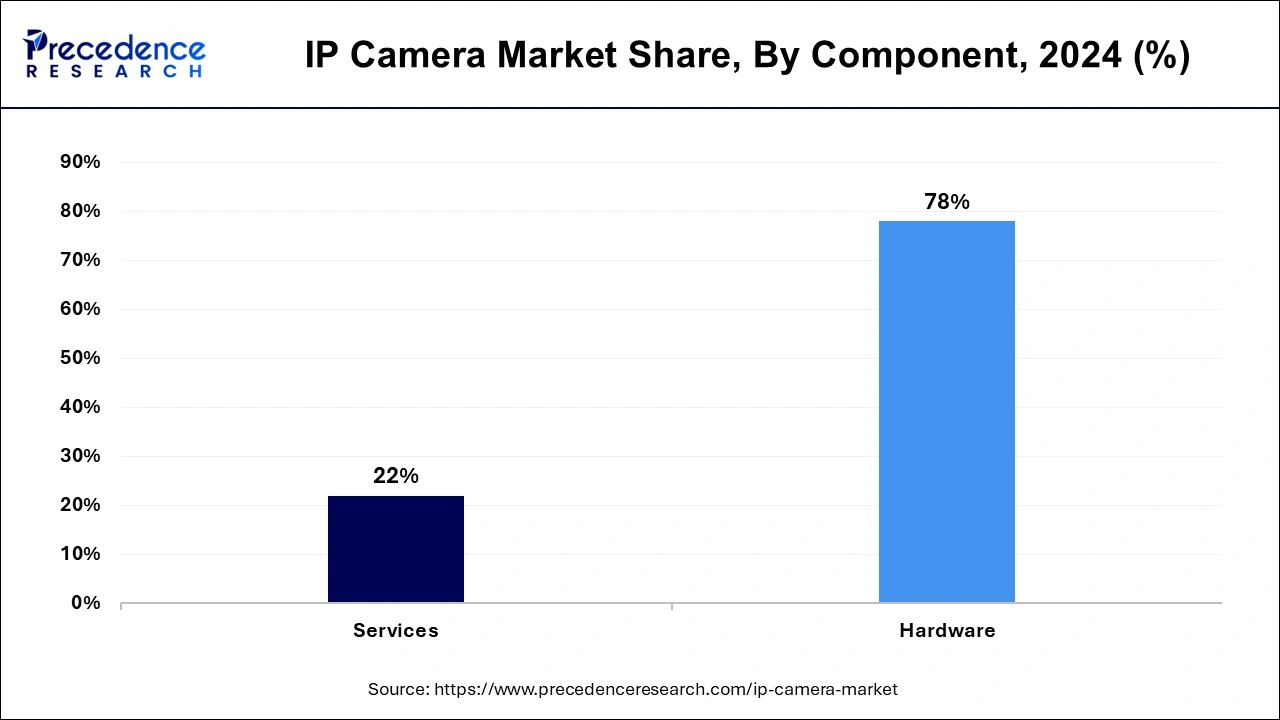

- By component, the hardware components segment has dominated the global market in 2024 with revenue share of 78%.

- By product, the infrared camera segment has held the largest share of 44% in 2024.

- By connection type, the consolidated segment dominated the market with revenue share of 75% in 2024.

- By end use, the commercial segment has captured market share of 67% in 2024.

Asia PacificIP Camera Market Size and Growth 2025 to 2034

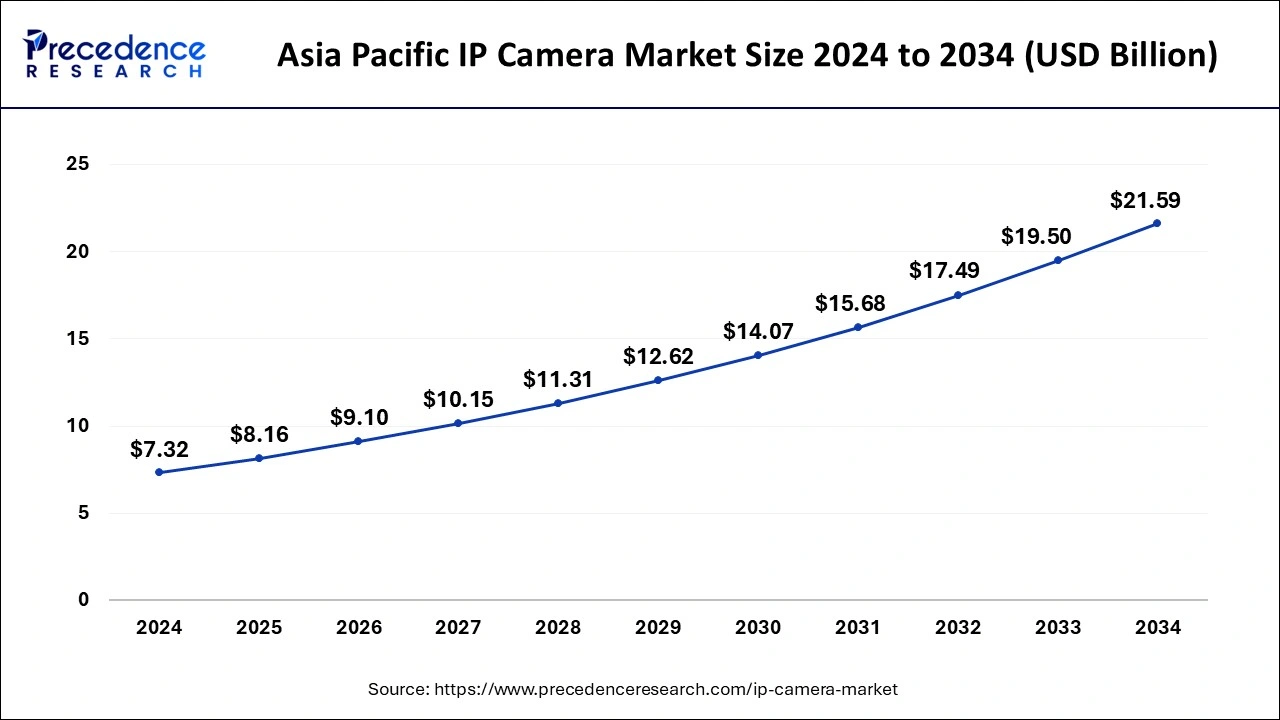

The Asia Pacific IP camera market size was estimated at USD 7.32 billion in 2024 and is projected to surpass around USD 21.59 billion by 2034 at a CAGR of 11.42% from 2025 to 2034.

Asia Pacific had the largest share of the IP camera market in 2024, and it's expected to maintain this lead in the coming years. This is because the region heavily relies on semiconductor devices and experiences a growing demand for security and surveillance systems. Factors like infrastructural development, industrialization, and increasing concerns about security threats and criminal activities contribute to this demand.

Awareness of the benefits of IP cameras is driving market growth. Additionally, the availability of affordable IP cameras from local manufacturers is encouraging their adoption by small and medium-sized businesses, which boosts market growth further in the region. China holds a significant portion of the market due to its access to high-end production units.

- In September 2023, Vivo V29 5G is tipped to launch globally this week with Snapdragon 778G, 50MP front camera. The device comes in four colorations for the global markets and a new monochrome sensor.

Latin America is projected to experience the fastest compound annual growth rate of during the forecast period. This growth is fueled by governments increasing their investments in public safety and security initiatives. Moreover, the emergence of smart city projects in the region is contributing to the expansion of the IP camera market.

- In October 2023, Latin America. Canon announced the CR-N100 4K PTZ camera. The camera is designed for indoor use and offers the excellent image quality and performance that Canon PTZ cameras are known for at a lower price.

Market Overview

An IP camera is a digital video camera that connects to an IP network to send and receive data. Unlike traditional CCTV cameras, which require a closed-circuit setup, IP cameras only need a local network connection. While they're commonly used for surveillance, they're also known as webcams or netcams when they're directly accessible over a network. Modern security cameras handle large amounts of data to identify potential risks and prevent them. They come with advanced features like video processing, motor control, and voice processing. These cameras are usually connected via wired Ethernet, WiFi, or HDBaseT, and they're often installed in challenging outdoor environments where energy efficiency is essential.

IP Camera MarketGrowth Factors

- Many homeowners are now adopting IoT technologies, which can drive the market for IP cameras.

- Increased use of IP cameras in commercial and residential buildings is expected to fuel market growth during the forecast period.

- Government initiatives regarding smart city projects in developing countries are anticipated to create market opportunities in the future.

- Continued research and development activities along with product launches by market players are one of the key contributors to the market expansion.

- The widespread utilization of cameras in various business sectors is estimated to boost the growth of the IP camera market shortly.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 11.31% |

| Market Size in 2025 | USD 16.66 Billion |

| Market Size by 2034 | USD 43.62 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Component, By Product, By Connection, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising security concerns and high need for IP cameras

IP cameras transmit and transfer data over computer networks and the internet, delivering high-quality video footage accessible via smartphones, tablets, and other devices. They offer features like motion detection, facial recognition, and remote monitoring, which makes them ideal for effective surveillance. With the increasing instances of data hacking and security breaches globally, there's a growing need for robust surveillance systems. This increased security concerns across.

The residential, public, commercial, and industrial sectors are expected to drive the demand for IP cameras and drive market growth. Additionally, the adoption of cloud-based video surveillance solutions is a significant growth driver for the IP camera market. Cloud-based systems also offer benefits such as remote access, scalability, cost-effectiveness, and easy management of video data.

- In March 2024, Iveda, the global solution for cloud-based AI, launched IvedaAI Cloud Subscription, a service that effectively makes innovative AI video services available for use cases from the consumer to the professional level. A powerful solution accessible to anyone with an IP camera, the IvedaAI Cloud Subscription can transform pre-existing cameras into smart cameras, all without the need for a large server or dedicated IT department.

Restraint

High cost of IP cameras and lack of awareness

Many businesses in developing regions are unaware of the possible uses of IP cameras, leading to limited application in these areas. Business owners are hesitant to invest in new technology due to uncertainty about potential profits. There is a lack of awareness about the benefits of IP cameras in government and residential applications in many developing countries, which further restricts market expansion. Additionally, the high cost of IP camera software installation has hindered the growth of the IP camera market, as increased efficiency often comes with a higher price tag. The capital requirement for IP cameras is significant, which makes them unaffordable for many medium and small-scale industries.

Opportunity

Adoption of artificial intelligence and deep learning

AI algorithms have the ability to analyze video footage in real-time, which enables IP cameras to detect and identify objects, faces, and events with high accuracy. With the help of deep learning algorithms, the reliability and precision of video analytics can be further improved, making IP cameras capable of providing intelligent insights and automating security processes. This technology has a wide range of applications, such as predictive analytics, anomaly detection, and automated threat response. As AI and deep learning technologies keep advancing, the demand for IP cameras with these capabilities is expected to increase significantly, leading to growth in the IP camera market.

Moreover, the growing deployment of IP cameras and the increasing volume of video data generated require efficient video data storage and management solutions. This presents a profitable opportunity for companies in this sector to take advantage of the growth prospects in the IP camera market.

- In November 2023, Dahua Technology, a world-leading video-centric AIoT solution and service provider, launched the Dahua Wireless Series at an online launch event. Featuring the Turret, Picoo, Bullet, and Hero series, this lineup is designed to provide smart and efficient security solutions for the day-to-day operations of small commercial establishments.

Component Insights

The hardware components segment dominated the global IP camera market in 2024. This is linked to the rising utilization of various types of lenses, camera mounting, cameras, and connectivity devices in the installation of the IP surveillance camera. Moreover, the growing demand for high-quality and trustworthy surveillance systems is likely to fuel segment growth shortly.

The service segment is the fastest-growing segment over the forecast period. This is because of the development and innovation done by IP camera market players and service providers in this sector. Manufacturers are also expanding their services to cope with the market demand for IP camera systems.

Product Type Insights

The infrared camera segment held the largest share of the IP camera market in 2024. It is also expected to continue growing significantly over the forecast period. Infrared cameras are excellent at capturing clear images even in low-light conditions. They have a wider range of applications such as perimeter security, protecting critical infrastructure, and border control. These cameras offer various benefits such as night vision, motion detection, and temperature measurement, which makes them well-suited for surveillance in diverse environments. The ongoing advancements in infrared technology, including thermal imaging and infrared fusion, are expected to further increase the demand for infrared cameras in the global market.

- In July 2023, Bosch launched new AUTODOME 7100i (IR) cameras with deep-learning video analytics. Bosch Video Analytics also helps security professionals to address a variety of challenges and delivers value beyond security.

During the forecast period, the pan-tilt-zoom (PTZ) product type is expected to experience the highest growth in the IP camera market. PTZ cameras allow for precise control over the field of view, with the ability to move from no pan/tilt to full 360-degree pan/180-degree tilt. They can complement stationary cameras to enhance monitoring capabilities. Additionally, PTZ cameras are equipped with optical and digital zoom functions, which are particularly useful for observing objects at long distances and focusing on crucial details for surveillance purposes.

- In October 2023, Canon India launched an innovative range of remote PTZ (pan-tilt-zoom) cameras in India. The new launches include the indoor CR-N100 remote PTZ camera and the outdoor, CR-X300 and CR-X500 remote PTZ cameras, featuring connectivity supporting a wide range of broadcasting avenues.

Connection Type Insights

The IP camera market was dominated by the consolidated segment in 2024. This type of product is expected to maintain a significant market share in 2024 because it operates with a central control server that stores all configuration data for the cameras, NVRs, and DVRs in the system, as well as all content for later access and analysis. In contrast, in a distributed architecture, the data is dispersed throughout the system, usually near where it is generated or used. The real benefits of IP-based surveillance are only realized if the solution is based on a distributed architecture.

The distributed segment is anticipated to experience the fastest growth in the IP camera market. This growth is attributed to the rising deployment of video surveillance solutions in various facilities. Distributed solutions come with built-in storage capabilities, enabling data to be saved on digital media storage devices like flash drives, SD cards, network-attached storage (NAS), or hard disc drives. This reduces the need for additional video recorders, thus cutting costs. Enterprises prefer decentralized solutions for their improved flexibility and reliability, especially in multi-server setups with only a few cameras.

End-use Insights

The commercial segment dominated the global IP camera market in 2024. this is due to the rise in demand for more innovative security technologies in banking sectors. The upsurge in retail theft encourages the implementation of contemporary video solutions that can inform and notify security staff about unlawful access to the premises. Many market players are now working on providing these advanced security solutions, especially for business use.

The residential segment is projected to see the fastest growth in the IP camera market. Residential applications are set to make a substantial impact on the market in the upcoming years. The growing integration of the Internet of Things (IoT) in smart homes is also contributing to market expansion. To bolster security on their properties, consumers are shifting away from traditional CCTV cameras and opting for IP cameras with advanced features. These innovative smart home security cameras give various benefits, which are driving their adoption in many households.

IP Camera Market Companies

- 3DEYE Inc

- Arecont Vision Costar LLC.

- Motorola Solutions, Inc.

- Belkin

- Bosch Sicherheitssysteme GmbH

- CAMERAFTP

- CAMCLOUD

- D-Link Corporation

- EOS Digital Services

- GEOVISION Inc.

- Hangzhou Hikvision Digital Technology Co. Ltd.

- Honeywell International Inc.

- Johnson Controls

- Kintronics Inc.

- Matrix Comsec.

- Panasonic

- PRO-VIGIL

- SAMSUNG

- Schneider Electric SE

- Sony Corporation

- Stealth Monitoring

- Johnson Controls.

- VIVOTEK Inc.

Recent Developments

- In July 2023, D-Link launched an indigenous array of surveillance products manufactured in India. The series intends to cater to Indian consumers' security concerns, and it includes a wide range of IP-based surveillance cameras and network video recorders (NVRs).

- In April 2023, 3dEYE Inc. added new features of cloud-based ALPR analytics to its existing IP cameras. The new features include scaling the analytics to existing IP cameras. It can detect authorized and unauthorized vehicle repeat offenders and enhance visitor management and access control without additional hardware investment or development.

- In March 2022, Hikvision introduced the 2nd Gen value IP camera series with enhanced motion detection and suspense technology. The new series of IP cameras from Hikvision offers several improvements over previous generations, such as enhanced motion detection and reduced false alarms. AcuSense technology can identify and classify people and vehicles, making searching for specific events in recorded footage easier.

Segments Covered in the Report

By Component

- Hardware

- Services

By Product

- Fixed

- Pan-tilt-zoom (PTZ)

- Infrared

By Connection

- Consolidated

- Distributed

By End-use

- Residential

- Commercial

- BFSI

- Education

- Healthcare

- Industrial

- Real estate

- Retail

- Transportation & Logistics

- Industrial

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content