What is the CCTV Camera Market Size?

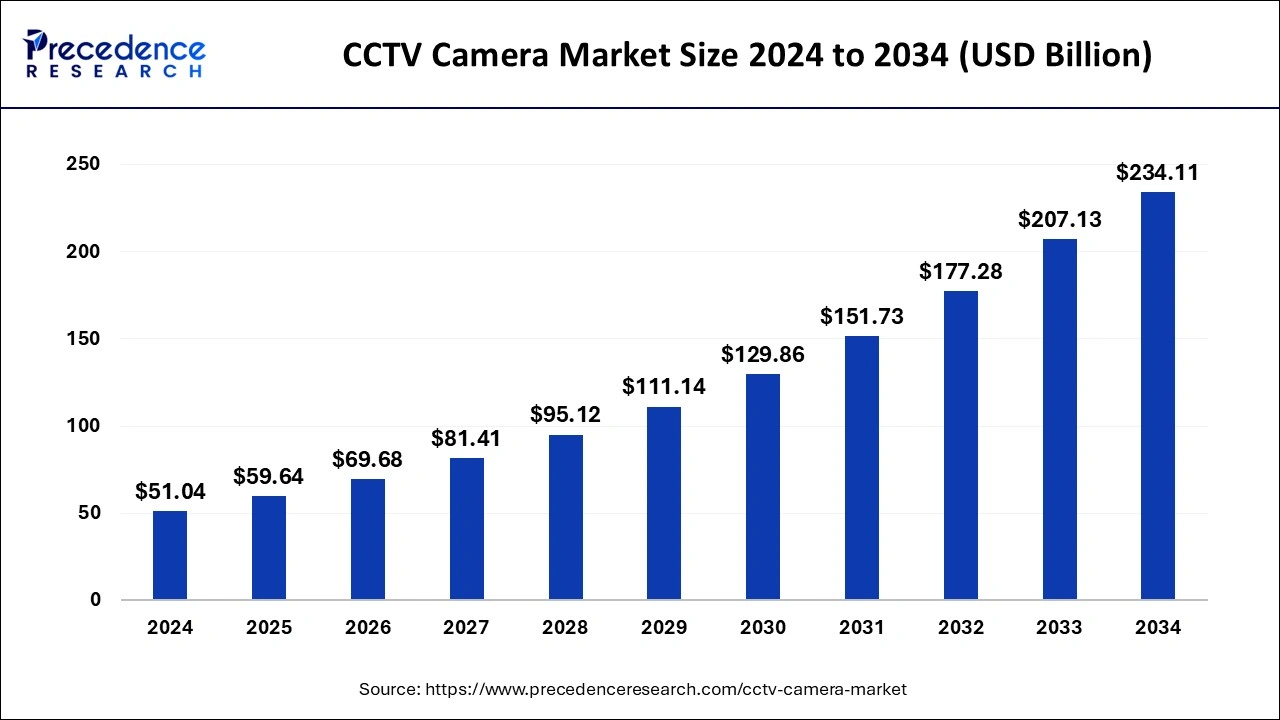

The global CCTV camera market size was estimated at USD 59.64 billion in 2025 and is predicted to increase from USD 69.68 billion in 2026 to approximately USD 263 billion by 2035, expanding at a CAGR of 16% from 2026 to 2035. The CCTV camera market is driven by the growing need for critical infrastructure security solutions.

Market Highlights

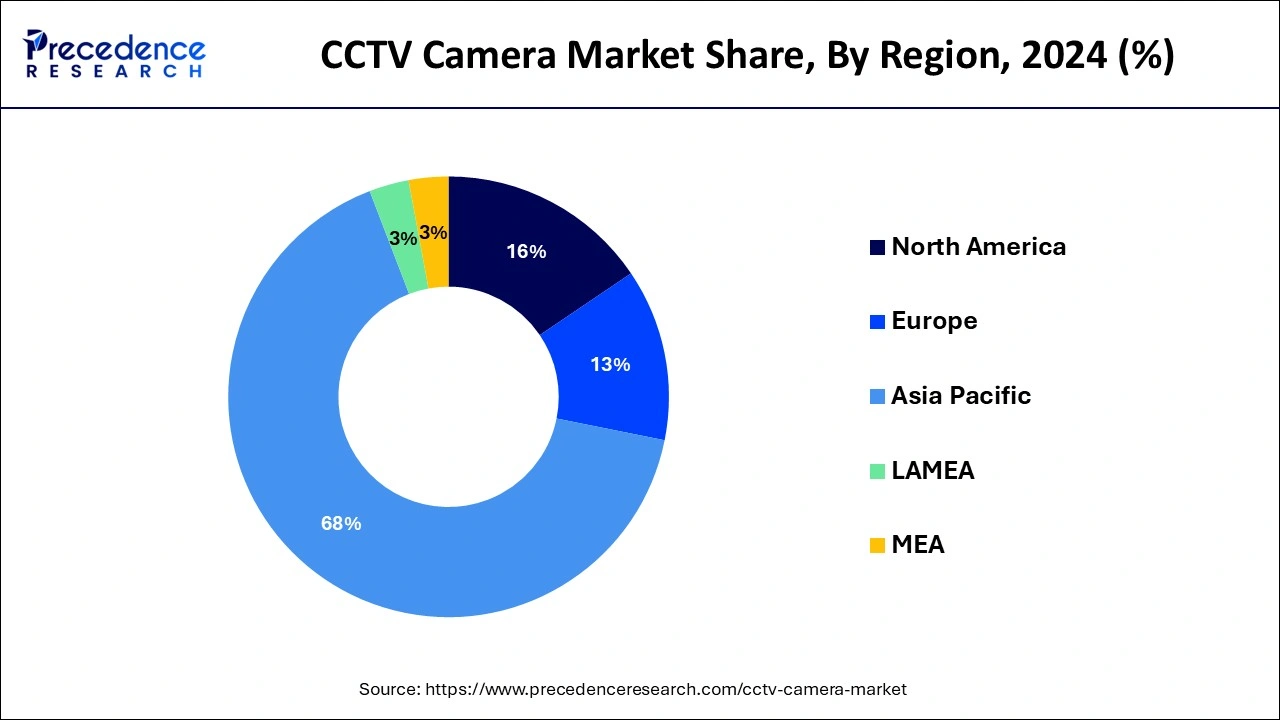

- Asia- Pacific dominated the CCTV camera market with revenue share of 68% in 2025.

- By camera type, the dome CCTV segment dominated the market in 2025.

- By technology, the IP camera segment dominated the market in 2025.

- By end-user, the BFSI segment dominated the CCTV camera market.

Market Size and Forecast

- Market Size in 2025: USD 59.64 Billion

- Market Size in 2026: USD 69.68 Billion

- Forecasted Market Size by 2035: USD 263Billion

- CAGR (2026-2035): 16%

- Largest Market in 2025: Asia Pacific

Market Overview

CCTV cameras improve security in several locations, such as residences, workplaces, public areas, and government buildings. They assist in real-time activity monitoring, serve as a deterrent to crime, and offer essential proof in the event of an occurrence. CCTV cameras also support public safety in public spaces such as streets, parks, and transportation hubs by keeping an eye out for suspicious activity, mishaps, or crises. They make it possible for authorities to guarantee the public's safety and react to situations quickly.

CCTV cameras are used in business environments for staff monitoring, internal theft prevention, and asset protection. They also support operations monitoring and guarantee that safety procedures and laws are followed. Rapid technical improvements in the CCTV market include machine learning capabilities, artificial intelligence (AI), higher-resolution cameras, and advanced analytics.

CCTV Camera Market Data and Statistics

- In November 2022, as an "unacceptable" threat to national security, the U.S. Federal Communications Commission (FCC) officially declared that it will no longer approve electronic equipment from Huawei, ZTE, Hytera, Hikvision, and Dahua.

- In July 2022, all bus queue shelters in the nation's capital will have high-resolution CCTV cameras installed by the Delhi Transport Department to replace manual monitoring and closely monitor bus lane discipline infractions. Over 1,000 civil defense volunteers have been stationed throughout the city to guarantee that buses operate on the far left and stop at the specified boxes. The Delhi transport department's enforcement team is currently watching for violations of the bus lane discipline.

CCTV Camera Market Growth Factors

- The need for surveillance systems in residences, workplaces, and public spaces is being driven by rising crime rates and terrorist concerns.

- Cloud-based CCTV systems improve security management by allowing remote monitoring of security feeds from any location.

- Companies employ video analytics to increase operational efficiency and learn more about the behavior of their customers.

- CCTV cameras are required by expanding security laws in many industries, which is driving up demand.

- Governments worldwide are funding smart city initiatives that use CCTV cameras to monitor the environment, control traffic, and ensure public safety.

CCTV camera market outlook

- Industry Growth Overview: Between 2025 and 2030, this market is expected to rise significantly due to the growing demand for animal-free products in the developed nations coupled with rapid government investment in the food and beverage industry.

- Major Investors: Several food ingredient companies and strategic investors are actively entering this market, drawn by partnerships, R&D and business expansion. Numerous ingredient manufacturers such as Impossible foods, Clara foods, Novozymes and some others have started investing rapidly for manufacturing high-quality ingredients for numerous industries.

- Startup Ecosystem: Various startup brands are engaged in developing fermented ingredients for end-user industries. The crucial startup companies dealing in precision fermentation ingredients comprises of Melt & Marble, ImaginDairy, Shiru, Inc. and some others.

Market Scope

| Report Coverage | Details |

| Global Market Size in 2025 | USD 59.64 Billion |

| Global Market Size in 2026 | USD 69.68 Billion |

| Global Market Size by 2035 | USD 263Billion |

| Growth Rate from 2026 to 2035 | CAGR of 16% |

| Largest Market | Asia-Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Camera Type, Technology, End-user, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising concerns about security

Due to shifting crime rates and complex criminal operations, people, companies, and governments are spending more on CCTV systems to help detect and apprehend criminals and discourage potential offenders. Visible CCTV cameras discourage would-be offenders and lessen the possibility of criminal activity. Businesses and households are investing in CCTV systems to protect their assets and homes. This is due to the growing awareness of security concerns and the necessity for ongoing monitoring. Broad surveillance coverage is now essential for everything from banks and retail outlets to apartment buildings and industrial operations. CCTV cameras provide continuous monitoring, enabling proactive threat detection and real-time surveillance.

Restraint

Raising concerns about privacy

Developments in CCTV technology, such as high-definition cameras, facial recognition software, and predictive analytics, raise more privacy concerns. Although these developments improve security, they also raise concerns about intrusive monitoring and widespread spying. Critics contend that face recognition technology in public places should be completely prohibited or subject to more stringent laws since they believe it seriously compromises people's civil rights and privacy.

Opportunity

Advancements in camera technology

CCTV systems that incorporate artificial intelligence (AI) algorithms and advanced analytics. These systems can automatically analyze real-time video feeds, which can then identify and notify users of any suspicious activity or anomalies. Artificial intelligence (AI)-powered features like object tracking, facial recognition, and behavioral analysis improve surveillance systems' capabilities and make them more proactive in identifying and responding to threats. Beyond typical security surveillance, new applications have also been made possible by advancements in camera technology. For example, high-resolution cameras equipped with panoramic or 360-degree viewing capabilities are employed in public areas and events to monitor crowds. Thermal imaging cameras identify any health hazards and screen temperature in public spaces and healthcare institutions.

Segment Insights

Camera Type Insights

The dome CCTV segment dominated the CCTV camera market in 2025. Dome cameras are distinguished by their small, discrete, and elegant design. Compared to other CCTV cameras, they are less threatening due to their dome-shaped housing. This design element not only improves the appearance but also acts as a deterrent to possible invaders because they might not be able to determine which way the camera is pointed. Many functions are available on modern dome cameras, including motion detection, pan-tilt-zoom (PTZ) capabilities, infrared night vision, high-definition video resolution, and two-way voice communication. These cutting-edge capabilities give consumers more flexibility and control over their security operations while improving monitoring systems' overall efficacy.

- In April 2024, Axis Communications unveiled the AXIS Q9307-LV Dome Camera, a multipurpose tool with integrated high-definition video, two-way audio, intelligent analytics, and visual warnings. This cutting-edge all-in-one solution improves operational productivity, safety, and security across various industries.

The C-mounted segment is the fastest growing in the CCTV camera market during the forecast period. C-mount cameras are becoming more affordable despite having better features and image quality, which opens more options for a broader spectrum of users. Because of the falling costs of camera components combined with manufacturing economies of scale, C-mount cameras are an appealing option for both cost-conscious consumers and enterprise clients wishing to implement scalable surveillance solutions.

Technology Insights

The IP camera segment dominated the CCTV camera market in 2025. IP cameras are an example of how surveillance technology has advanced. Instead of analog CCTV cameras, IP cameras digitize and process video data on-board. There are many benefits to using this digital method in terms of usefulness, resolution, and image quality. IP cameras transmit data over the internet or currently existing computer networks. Because of this connectedness, users can watch remotely from any location with an internet connection and view live or recorded video. Furthermore, IP cameras provide centralized monitoring and control when linked to more extensive security systems.

The wireless camera segment is the fastest growing in the CCTV camera market during the forecast period. Regarding ease and versatility, wireless cameras are superior to their tethered counterparts. They are simple to install in historic buildings, rental homes, or outdoor spaces where laying wires would be expensive or impossible. Wireless cameras are perfect for business and residential applications because of their versatility. Manufacturers can use economies of scale and lower production costs as the demand for wireless cameras increases. Due to this development, a broader spectrum of individuals and companies can now access more affordable wireless camera choices.

End-user Insights

The BFSI segment dominated the CCTV camera market in 2025. Significant technological breakthroughs in the CCTV camera industry have included the introduction of high-definition (HD) and ultra-high-definition (UHD) cameras, intelligent video analytics, facial recognition, and the ability to monitor remotely. BFSI firms use these cutting-edge surveillance technologies to strengthen security posture, boost situational awareness, and expedite security operations. BFSI institutions can increase their overall security efficacy by investing in state-of-the-art CCTV systems, providing better coverage, higher resolution images, and more sophisticated threat detection capabilities.

The residential segment is the fastest growing in the CCTV camera market during the forecast period. Homeowners are using CCTV cameras more frequently to monitor their properties as worries about safety and security at home grow. The necessity for surveillance has increased due to trespassing, vandalism, and burglaries. When a property has CCTV cameras installed, several insurance providers reduce the cost of the homeowners' insurance. To lower risks and save insurance costs, this financial incentive encourages homeowners to invest in surveillance systems.

- In July 2023, Home safety goods are now part of Versuni, formerly known as Philips domestic appliances. The most recent lineup includes three smart security cameras and a brand-new Home Safety app. According to the business, Philips Home Safety solutions integrate reliability, artificial intelligence, and ease of use. The newest security cameras from Philips will have intelligent features that can distinguish between people, motion, and noise.

The government segment shows notable growth in the CCTV camera market during the forecast period. Cities are growing denser due to fast urbanization and population increase, which raises security issues, including crime and civil unrest. Governments are spending money on monitoring systems to reduce these threats and guarantee the security of their inhabitants. Governments emphasize public safety programs and invest in surveillance technologies to effectively prevent and respond to security breaches in response to the growing threat of terrorism and organized crime. CCTV cameras are essential for monitoring high-risk locations and spotting possible security risks.

Regional Insights

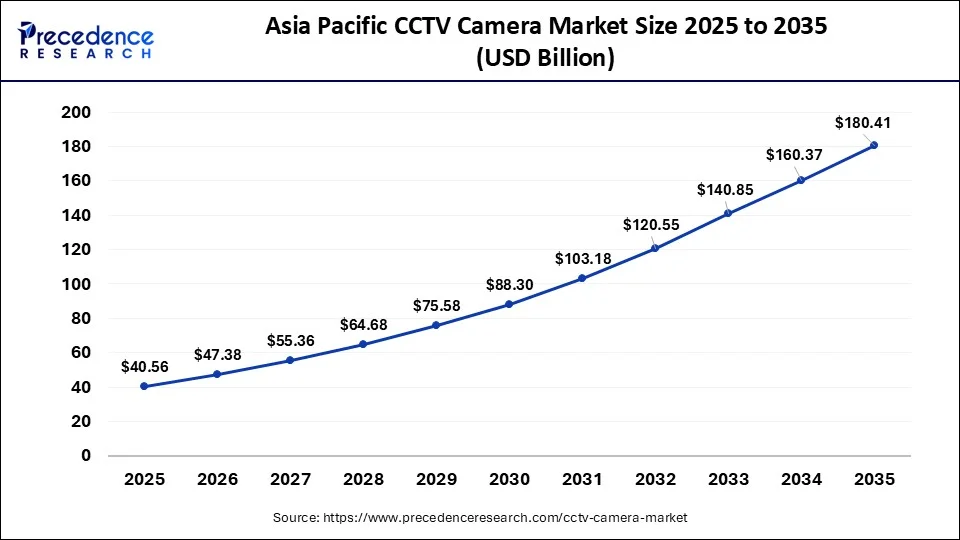

What is the Asia Pacific CCTV Camera Market Size?

The Asia Pacific CCTV camera market size is estimated at USD 40.56 billion in 2025 and is expected to be worth around USD 180.41 billion by 2035, at a CAGR of 16.10% from 2026 to 2035.

Asia-Pacific carried the largest share of the CCTV camera market, and the region is observed to sustain dominance throughout the predicted timeframe. A large amount of infrastructure has been developed due to many countries experiencing fast economic growth in the Asia-Pacific region. Building smart cities, transit systems, industrial zones, and business complexes are all included in this. CCTV cameras are in high demand due to significant infrastructure investments made by public and commercial organizations. These investments serve to maintain security and promote effective operations. Society expectations and cultural norms also influence the need for CCTV cameras. Community monitoring and communal security are highly valued in many Asian countries. The middle class's growing wealth has also led to more spending on personal safety and home security systems, driving up demand for CCTV cameras.

- In September 2022, the second iteration of World of Film, an endeavor to honor Sony's legacy and ongoing dedication to helping filmmakers realize their limitless creative potential, is proudly announced by Sony Electronics Asia Pacific.

China CCTV Camera Market Trends

China's market is experiencing robust expansion, driven by rising security concerns, rapid urbanization, and significant government investment in surveillance infrastructure. Advanced technologies such as AI-powered analytics, facial recognition, and cloud-based systems are increasingly integrated into new deployments, shifting demand from analog cameras to smart IP-based solutions. China remains a global leader in CCTV manufacturing and exports, with major domestic players driving innovation and large-scale production.

North America is the fastest growing CCTV camera market during the forecast period. Use of machine learning and artificial intelligence algorithms-powered video analytics systems drives the need for CCTV cameras. Due to these enhanced analytics capabilities, CCTV systems are now more proactive and effective in detecting and preventing security risks, allowing for real-time monitoring, predictive analysis, and automatic reactions.

U.S. CCTV Camera Market Trends

The U.S. market continues to grow as demand rises across commercial, residential, and public safety sectors, driven by heightened security concerns and smart city initiatives. Adoption of advanced technologies such as AI-powered video analytics, cloud storage, high-resolution imaging, and IP-based cameras is accelerating, enabling more accurate detection and real-time monitoring.

What are the Advancements in the CCTV Camera Industry in Europe?

Europe is expected to grow at a moderate rate during the forecast period. Advanced surveillance solutions in the public and private sectors are expected to drive the gradual growth. In major European countries like Germany, the U.K., and France, governments are supporting the use of smart surveillance to increase safety for the public and protect vital buildings and structures. Smart video surveillance supports European security initiatives related to fighting crime, terrorism, and ensuring safe cities.

Sustainability is playing a crucial role in the development of the European CCTV market. More consumers and businesses are choosing sustainable packaging and ways of producing items due to Europe's emphasis on protecting the environment. Therefore, security companies and service providers are now including completely encrypted systems with privacy features in their CCTVs.

The UK CCTV Camera Market Trends: The country's market landscape is developing due to governments and enterprises offering security using AI surveillance technology. Organizations in the region are actively improving their surveillance technologies in order to prevent robbers, monitor public spaces, and also improve police services. Government initiatives are also helping to promote high-definition surveillance adoption by integrating it with metropolitan infrastructures.

What are the Key Trends in the CCTV Camera Industry in Latin America?

Latin America held a considerable share of the industry. The growing adoption of AI-enabled CCTV cameras in numerous sectors including BFSI, homeland security, retail and some others has boosted the market expansion. Additionally, rapid investment by government for deploying CCTV cameras in the urban areas is expected to drive the growth of the CCTV camera market in this region.

Brazil CCTV Camera Market Trends: The use of surveillance cameras in city centers and high-traffic areas is driving market growth in the country. Major cities now have extensive networks of surveillance cameras in public squares, shopping areas, and transportation hubs, which helps to foster innovation and fuel market adoption.

How is the Middle East and Africa Region Growing in the CCTV Camera Market?

Middle East and Africa held a notable share of the market. The increasing sales of PTZ cameras and dome CCTV cameras in numerous countries such as UAE, Saudi Arabia, South Africa, Qatar and some others has driven the market growth. Also, partnerships among market players and construction sector to deploy advanced CCTV cameras in construction sites is expected to propel the growth of the CCTV camera market in this region.

Saudi Arabia CCTV Camera Market Trends: This country is seen investing heavily in smart city projects, which is thus encouraging the adoption of surveillance cameras for aspects like traffic control, urban development, and public safety. The integration of surveillance systems with Internet of Things (IoT) technology and cloud-driven solutions is also gaining traction in the market.

Value-Chain Analysis

- Raw Material Procurement: The raw materials used in the production of CCTV cameras consists of plastic, aluminum, steel, and some others.

Key Companies: Norsk Hydro, Alcoa, Austria Metall and others. - Testing and Quality Control: Testing and Quality Control (QC) for CCTV cameras involves verifying performance, ensuring security, and confirming durability through a series of checks and tests.

Key Companies: Intertek, Qualitest, Bureau veritas and others. - Distribution Channel: The distribution channels for CCTV cameras are primarily offline (via wholesalers, specialty stores, and independent retailers) and online (through e-commerce platforms and direct sales).

Key Companies: Ebay, Amazon, Walmart and others.

Key Players: Developing advanced solutions for strengthening security

- Bosch Security Systems Inc.: Bosch Security Systems Inc. is a global provider of electronic detection, communication, and security equipment, and is a subsidiary of the German company Robert Bosch GmbH. The company develops and sells a wide range of products including video surveillance, intrusion and fire alarm systems, access control, and conference systems for various sectors like commercial, industrial, government, and education.

- Honeywell Security Group: Honeywell Security Group is a provider of a wide range of security products and solutions for both commercial and residential markets, including integrated systems for video surveillance, access control, and intrusion management.

- Hangzhou Hikvision Digital Technology C0., Ltd.: Hangzhou Hikvision Digital Technology Co., Ltd. is a global provider of video surveillance products, solutions, and services, specializing in AIoT (AI-powered Internet of Things) technology. This company was founded in 2001 and headquartered in Hangzhou, China, the company develops and distributes a wide range of products including cameras, network video recorders, and enterprise storage.

- Axis Communications AB: Axis Communications AB is a Swedish multinational company, founded in 1984, that is a leader in network video solutions such as network cameras, access control, and network audio devices.

- Mobotix AG: Mobotix AG is a German company that designs, develops, and manufactures high-quality, intelligent IP video surveillance and security systems. This company was founded in 1999 and headquartered in Langmeil, Germany. It is known for its robust, decentralized systems that integrate AI and advanced video analytics for applications in industries such as manufacturing, retail, and logistics

- Zhejiang Dahua Technology Co., Ltd: Zhejiang Dahua Technology Co., Ltd. is a global provider of video-centric AIoT solutions and services that is headquartered in Hangzhou, China, and founded in 2001. It manufactures and distributes security products, including cameras, recorders, and video intercoms.

CCTV Camera Market Companies

- Bosch Security Systems Inc.

- Honeywell Security Group

- Hangzhou Hikvision Digital Technology C0., Ltd.

- Axis Communications AB

- Mobotix AG

- Zhejiang Dahua Technology Co., Ltd

- Panasonic System Networks Co., Ltd.

- Geovision Inc.

- Sony Electronics Ltd.

- FLIR Systems Inc.

Recent Developments

- In August 2025, Consistent launched Consistent 5MP AHD Dome and the Consistent 5MP AHD Bullet Camera. These cameras are designed for the residential and industrial sector.

(Source: https://channeltimes.com ) - In June 2025, Honeywell launched 50 Series line of CCTV products in India. These products are designed for numerous end-user sectors including government, healthcare, education, transport, commercial, real estate and some others.

(Source: https://www.honeywell.com ) - In May 2025, Hikvision launched a new range of video security products. These products are equipped with Wi-Fi 6 technology.

(Source: https://www.hikvision.com ) - In April 2025, Consistent (Consistent Infosystems) held its first online product launch event, where it revealed a number of new products and launched the New Gaming Cabinets and CCTV Cameras.

- In December 2024, Panasonic Life Solutions India (PLSIND) announced, while at IFSEC India 2024, South Asia's largest Security expo and conference in New Delhi, the launch of its two new revolutionary surveillance solutions, the AI-enabled High Zoom Bullet Camera and X-series Camera, that utilize AI-based on-site learning analytics, aimed at bringing the Indian market unparalleled ability to take advantage of the latest in surveillance capabilities.

- In March 2024, World Guardian Security Services, a leader in cybersecurity solutions, unveiled its new CCTV camera installation service to add to its offerings for 2024. The goal of World Guardian is to provide clients with physical security measures in addition to cybersecurity solutions.

Segments Covered in the Report

By Camera Type

- Box CCTV

- Bullet CCTV

- Dome CCTV

- C- Mounted

- PTZ Camera

- Others (Infrared Camera)

By Technology

- IP Camera

- Analog

- Others (Wireless Camera)

By End-user

- BFSI

- Homeland Security

- Retail

- Residential

- Logistics & Transportation

- Hospitality

- Government

- Commercial Spaces

- Others (Energy & Power)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting