What is the Isopropyl Alcohol Market Size?

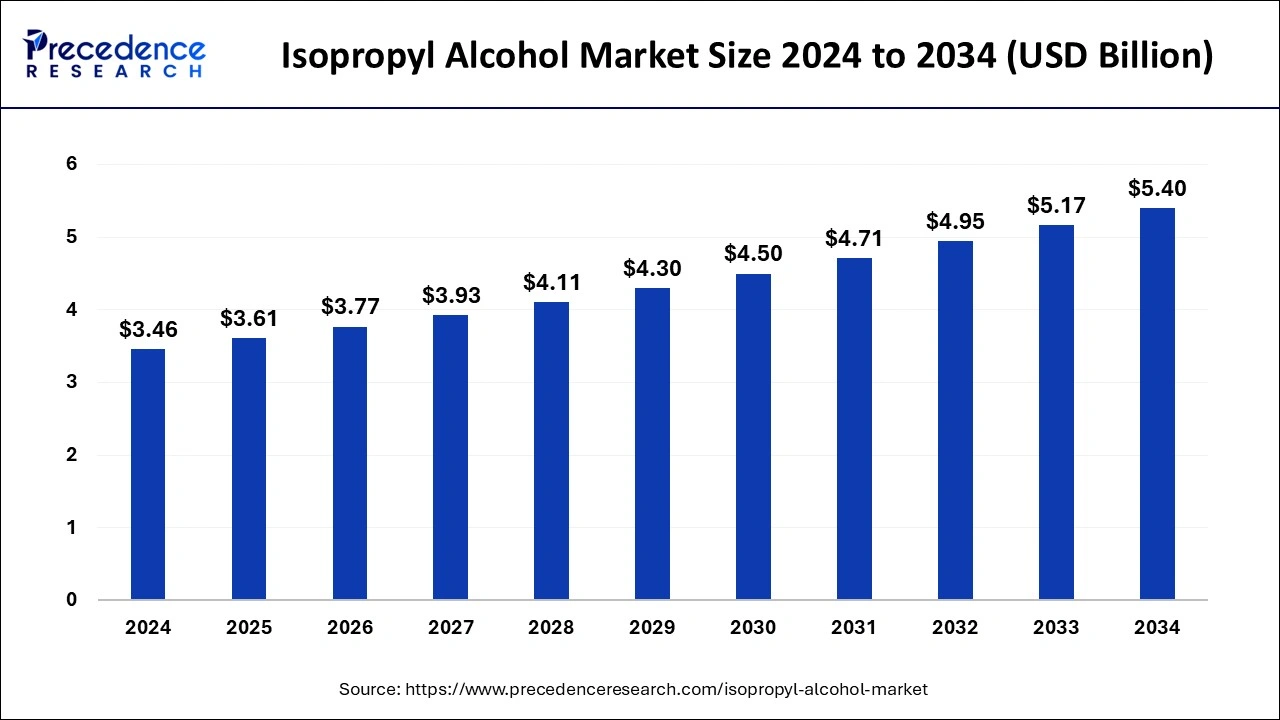

The global isopropyl alcohol market size was calculated at USD 3.61 billion in 2025 and is predicted to increase from USD 3.77 billion in 2026 to approximately USD 5.62 billion by 2035, expanding at a CAGR of 4.53% from 2026 to 2035.

Isopropyl Alcohol Market Key Takeaways

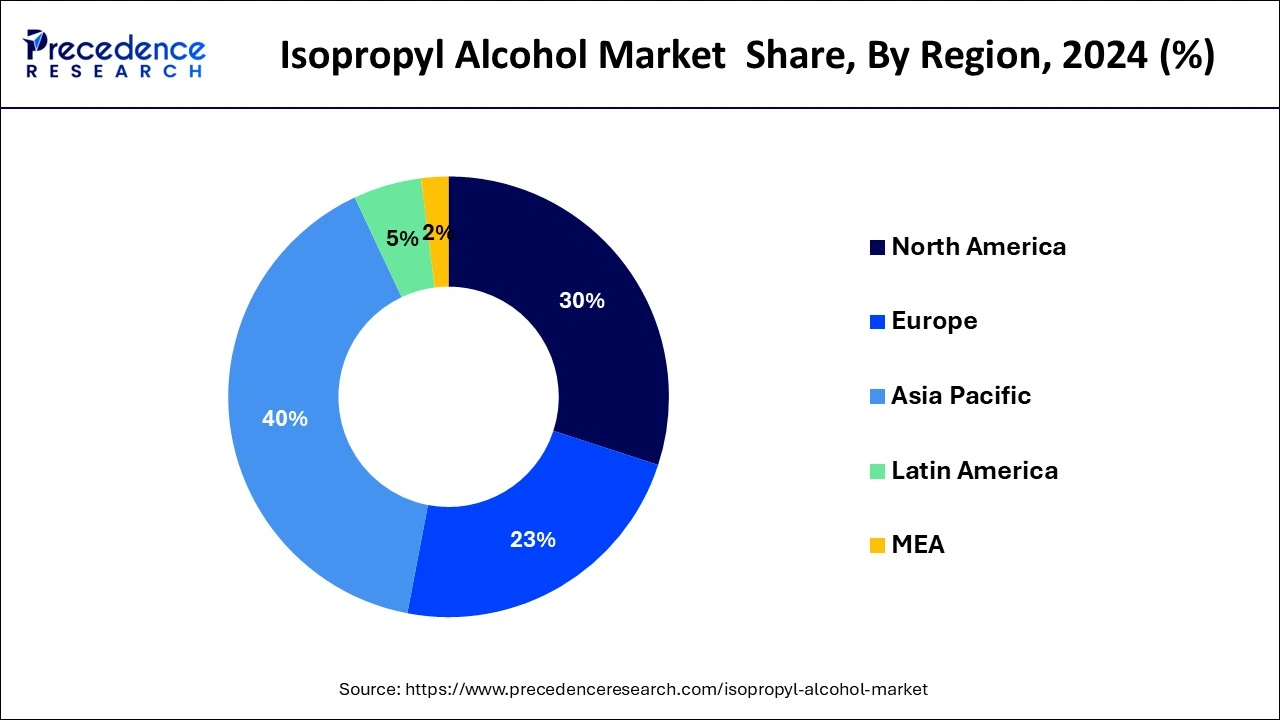

- Asia Pacific contributed more than 40% of revenue share in 2025.

- North America region is estimated to expand the fastest CAGR between 2026 to 2035.

- By Application, the process and preparation solvent segment has held the largest market share of 31% in 2025.

- By Application, the others applications segment is anticipated to grow at a remarkable CAGR of 5.8% between 2026 to 2035.

- By End-user industry, the cosmetics and personal care segment had the largest market share of 30% in 2025.

- By End-user industry, the other end-user industries metal segment is expected to expand at the fastest CAGR over the projected period.

What is Isopropyl Alcohol?

The global isopropyl alcohol (IPA) market is a dynamic and expansive realm, defined by the production and dissemination of isopropyl alcohol, a versatile chemical compound. IPA serves as a pivotal solvent, disinfectant, and intermediary component across multifarious industries. Its intrinsic value is manifest in pharmaceuticals, cosmetics, electronics, and cleaning agents. The marketplace experiences catalytic surges in response to unique catalysts, such as the heightened demand for sanitizing solutions during the COVID-19 pandemic. Within this sphere, leading entities comprise chemical manufacturers and distributors are tirelessly striving to cater to the diverse exigencies of both industrial and consumer segments.

Isopropyl Alcohol Market Growth Factors

- The increasing emphasis on health and hygiene has been a primary driver of the IPA market. The COVID-19 pandemic heightened awareness of the importance of hand sanitizers and disinfectants, leading to a surge in demand for IPA. People are now more vigilant about cleanliness and are expected to continue using IPA-based sanitizers and cleaning products, sustaining market growth.

- The pharmaceutical and medical sectors are major consumers of IPA. IPA is used in the manufacturing of various pharmaceutical products, including medications and disinfectants. With the continual advancement of the healthcare industry and the development of new drugs and therapies, the demand for IPA is expected to grow steadily.

- IPA is a critical component in the electronics and semiconductor industry for cleaning and removing contaminants from surfaces. As technology advances, the demand for smaller and more efficient electronic components is growing. This, in turn, fuels the need for high-purity IPA, supporting market expansion.

- IPA is an essential ingredient in cosmetics and personal care products, such as perfumes, deodorants, and hair sprays. As consumer preferences for grooming and personal hygiene evolve, the cosmetic industry continues to innovate. This innovation is likely to drive the demand for IPA in the formulation of new products.

- IPA serves as a versatile solvent and chemical intermediate in various manufacturing processes. With industries constantly seeking ways to improve efficiency and reduce costs, IPA plays a pivotal role in achieving these objectives. The growth of industries reliant on IPA as a key input will, in turn, drive market growth.

- As environmental awareness and sustainability initiatives gain traction, there is a shift toward eco-friendly and biodegradable products. This has spurred research into sustainable alternatives to IPA, such as bio-based or green solvents. The market will experience growth by adapting to these changing demands and developing eco-friendly IPA solutions.

- Ongoing research and development efforts are continuously uncovering new applications for IPA. Whether it's in the development of novel products or more efficient processes, the innovative use of IPA in various industries fuels market growth as businesses seek to stay competitive and meet evolving consumer demands.

- As businesses strive to optimize their supply chains and reduce production costs, IPA manufacturers are investing in process improvements and logistics to ensure a consistent and reliable supply of IPA. This focus on efficiency and reliability supports market growth by fostering trust among customers and stakeholders.

Market Outlook

- Industry Growth Overview: The isopropyl alcohol market is experiencing significant growth, as isopropyl alcohol is a standard choice for wiping down equipment, tools, and workstations in businesses such as automotive, electronics, and food processing.

- Global Expansion: The market expanded globally because isopropyl alcohol, like many high-proof ethanol products, is tremendously antimicrobial against bacteria. North America is dominant in the market due to great demand from advanced healthcare and pharmaceutical companies.

- Major investors: Major investors in the market include large chemical corporations that manage worldwide production, distribution, and research. It includes Dow Chemical Company, ExxonMobil Corporation, Royal Dutch Shell plc, INEOS Group Ltd., and LG Chem Ltd.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 4.53% |

| Market Size in 2025 | USD 3.61 Billion |

| Market Size in 2026 | USD 3.77 Billion |

| Market Size by 2035 | USD 5.62 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Application, End-user Industry and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Health and hygiene awareness

Elevated health and hygiene consciousness stands as a potent catalyst propelling the expansion of the isopropyl alcohol (IPA) market. The seismic impact of the COVID-19 pandemic has left an indelible imprint on our collective understanding of cleanliness and sanitation. Consequently, the demand for IPA-derived products, notably hand sanitizers and disinfectants, has experienced an extraordinary upsurge. People are now not only more vigilant but also more discerning in recognizing the pivotal role of IPA in upholding hygiene and curtailing the transmission of contagions. This heightened awareness has not merely ignited a momentary spike in IPA demand; it has ignited a sustained fervor.

Even as the pandemic subsides, consumers and businesses have internalized the indispensability of IPA in maintaining pristine environments and stemming the contagion tide. Moreover, IPA has been seamlessly woven into our daily routines, both in private sanctuaries and public arenas, imprinting itself as a societal staple.

Its efficacy in eradicating pathogens has etched it as the quintessential tool for personal and communal hygiene. Thus, the uptick in health and hygiene cognizance has not solely energized market expansion; it has fundamentally reshaped consumer behavior and industry conventions, cementing IPA's status as an enduring necessity in our progressively health-attuned world. The IPA market's horizon continues to gleam with promise as it unwaveringly serves an indispensable role in global health and sanitation.

Restraint

Supply chain disruptions

Supply chain disruptions present a significant restraint to the isopropyl alcohol (IPA) market's growth. The IPA market is intricately interconnected across global supply chains, and any disruption can have cascading effects. Natural disasters, geopolitical tensions, and transportation issues can disrupt the sourcing of raw materials, production, and distribution of IPA. These disruptions can lead to supply shortages, causing price volatility and instability in the market. Manufacturers may struggle to secure consistent and affordable sources of feedstock, impacting their cost structures and profitability.

Moreover, supply chain interruptions can result in delayed deliveries, affecting customers' production schedules and leading to dissatisfaction and potential shifts to alternative products or suppliers. In a market highly dependent on the timely availability of materials and finished products, such disruptions can hinder growth prospects and lead to uncertainty, making it imperative for industry players to invest in robust supply chain management strategies and contingency plans to mitigate these challenges.

Opportunity

Electronic and semiconductor advancements

Electronic and semiconductor advancements are fostering significant opportunities in the isopropyl alcohol (IPA) market. As technology continues to advance, electronic components are becoming increasingly miniaturized and intricate, demanding a higher level of purity and precision in cleaning processes. IPA, renowned for its effectiveness in removing contaminants from sensitive electronic surfaces, remains a critical solution in these industries.

The demand for high-purity IPA is thus on the rise, driven by the need for flawless manufacturing, reliable circuitry, and impeccable semiconductor production. IPA suppliers have the opportunity to cater to these evolving needs by offering specialized, ultra-high purity IPA formulations and innovative cleaning solutions. Moreover, as emerging technologies like 5G, Internet of Things (IoT), and electric vehicles become more prevalent, the demand for IPA in electronic and semiconductor applications is expected to further expand, presenting a fertile ground for market growth and development.

Impacts of COVID-19

- The COVID-19 pandemic triggered an unprecedented surge in demand for hand sanitizers and disinfectants, significantly impacting the isopropyl alcohol (IPA) market. IPA is a key ingredient in these products due to its strong disinfecting properties. Manufacturers had to ramp up IPA production to meet the skyrocketing demand, leading to supply shortages and price volatility. The market had to adapt quickly to ensure a consistent supply to healthcare, commercial, and household users.

- Many industries, including distilleries and chemical manufacturers, pivoted their operations to produce IPA during the pandemic. This sudden shift disrupted traditional supply chains and highlighted the need for increased flexibility in the IPA market. Companies had to navigate regulatory challenges, quality control, and distribution logistics to participate in the IPA production surge.

- The pandemic exposed vulnerabilities in global supply chains, affecting the IPA market. Disruptions in the supply of raw materials, transportation, and labor created challenges for IPA production and distribution. Manufacturers had to reevaluate and diversify their sourcing strategies to mitigate these disruptions.

- The need for IPA in hand sanitizers and disinfectants led to changes in regulations and compliance standards. Governments and health agencies introduced new guidelines to ensure the safety and quality of IPA-based products. Producers had to adapt to these evolving regulations, emphasizing the importance of quality control and regulatory compliance in the market.

Segment Insights

Application Insights

According to the application, the process and preparation solvent segment held a 31% revenue share in 2024. The zirconia segment's substantial market presence can be credited to its prevalence in various structural configurations and its extensive utility across multiple industries. Zirconia manifests in three primary crystal phases – monoclinic, tetragonal, and cubic – each endowed with distinctive attributes suited for a diverse array of industrial domains, encompassing ceramics, electronics, and healthcare.

Its malleability and versatility render it an appealing choice for applications spanning advanced ceramics, dental prosthetics, fuel cells, and electronic components. Given its ability to cater to the diverse requirements of different sectors, zirconia emerges as the favored option, securing a significant portion of the isopropyl alcohol market.

The other segment is anticipated to expand at a significant CAGR of 5.8% during the projected period. The segment commands a significant growth in the isopropyl alcohol market due to the diversity of sources from which isopropyl alcohol is extracted. While zircon, an isopropyl alcohol silicate mineral, represents a substantial portion, other minerals, such as baddeleyite and various industrial by-products, also contribute. This diverse range of sources ensures a stable and robust supply, reducing the market's vulnerability to disruptions from a single source. It provides a degree of flexibility and resilience, making it a pivotal component in meeting the varied and growing demand for isopropyl alcohol across multiple industries and applications.

End-user Industry Insights

Based on the end-user industry, cosmetics and personal care segment held the largest market share of 30% in 2024. The cosmetics and personal care sector exert a noteworthy influence on the isopropyl alcohol (IPA) market, primarily attributable to IPA's indispensable utility in these realms. IPA plays a multifaceted role as a versatile constituent in cosmetics and personal care merchandise, functioning as a reliable solvent for fragrances and aiding in formulation intricacies.

It contributes to product stability, improving the overall sensory experience and texture of a diverse array of cosmetic products. Furthermore, IPA's antimicrobial attributes are instrumental in upholding product integrity and ensuring hygiene. In light of the continual advancements within the beauty and personal care industry, the demand for IPA remains steadfast, cementing its prominence as a substantial segment within the broader IPA market landscape.

On the other hand, the other segment is projected to grow at the fastest rate over the projected period. The segment commands a substantial share in the isopropyl alcohol (IPA) market due to its diverse applications across various sectors. IPA's versatility makes it a valuable component in industries not specifically categorized, including printing, agriculture, adhesives, and specialty chemicals. Its use as a solvent, cleaner, and intermediate product serves a broad range of manufacturing and processing needs. This adaptability allows IPA to penetrate markets beyond well-defined sectors, contributing significantly to its overall market share, where specific end-use segments may not individually dominate but collectively establish its strong presence.

Regional Insights

What is the Asia Pacific Isopropyl Alcohol Market Size?

The Asia Pacific isopropyl alcohol market size was evaluated at USD 1.44 billion in 2025 and is projected to be worth around USD 2.29 billion by 2035, growing at a CAGR of 4.75% from 2026 to 2035.

Asia Pacific held the largest revenue share 40% in 2024. Asia-Pacific dominates the isopropyl alcohol (IPA) market due to a combination of factors. The region's robust industrialization, increasing population, and rapid urbanization have driven demand for IPA across various sectors, including electronics, pharmaceuticals, cosmetics, and cleaning products. Additionally, favorable government policies, lower production costs, and the presence of key IPA manufacturers have made Asia-Pacific a major IPA production hub. As a result, the region not only caters to its domestic demand but also exports IPA to other global markets, solidifying its prominent share in the IPA market.

China Isopropyl Alcohol Market Trends

Chinese isopropyl producers strengthen innovation, optimize manufacturing structure, and increase product quality and added value to achieve high-quality advancement. With a population growing to 1.4 billion and a rapidly ageing demographic, China is experiencing a rising demand for medical care services, pharmaceuticals, and medical tools, which drives the growth of the isopropyl alcohol market.

North America is estimated to observe the fastest expansion. North America's dominance in the isopropyl alcohol (IPA) market can be attributed to several factors. The region boasts a robust pharmaceutical and healthcare industry that relies on IPA for various applications. Additionally, the electronics and semiconductor sectors in North America contribute significantly to IPA demand. The awareness of hygiene and sanitization, especially during the COVID-19 pandemic, led to increased IPA consumption in the region. Moreover, a well-established manufacturing base and stringent quality standards have made North America a key IPA producer. This combination of diverse industrial demand and a strong manufacturing base consolidates North America's position as a major player in the global IPA market.

U.S. Isopropyl Alcohol Market Trends

In the U.S., has significance of medical care infrastructure is evident in its volume to save lives, lower suffering, and improve the health results of millions of people. Isopropyl alcohol provides the backbone for healthcare professionals to deliver timely and efficient treatment, allowing patients to lead healthier and more fulfilling lives. This drives high consumption of isopropyl alcohol.

Value Chain Analysis - Isopropyl Alcohol Market

- Raw Material:

The main raw materials for isopropyl alcohol (IPA) production are propylene and water for the hydration process, or acetone and hydrogen gas for the hydrogenation process.

Key Players: Linde and LG Chem - Production Processes:

Isopropyl alcohol (IPA) is significantly produced through two routes: hydration of propylene or catalytic hydrogenation of acetone.

Key Players: Shell and LyondellBasell - Recycling Management:

Isopropyl Alcohol (IPA) recycling management majorly focuses on solvent recovery via distillation, separating it from pollutants to enable reuse in applications such as cleaning, significantly reducing costs and waste.

Key Players: Dow and ExxonMobil

Isopropyl Alcohol Market Companies

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

United States |

Powerful financial strength and an advantaged low-cost asset portfolio |

In March 2025, Exxon Mobil spent $100 million to upgrade its Baton Rouge, Louisiana, chemical plant to produce a highly pure form of isopropyl alcohol that is used in the tech industry to clean and process microchips. |

|

|

United States |

world-leading proprietary polymer technologies |

In February 2025, Lyondell Chemical Company will implement price increases on Isopropyl Alcohol (IPA) products. These increases are significant for industries relying on IPA, particularly in producing pharmaceuticals. |

|

|

Shell Chemicals |

United States |

World-scale assets and advantaged feedstock access |

Shell is constantly listed as one of the leading global producers of isopropyl alcohol. |

|

Dow Chemical Company |

United States |

Highly diversified and integrated product portfolio |

Dow presented a novel line of bio-driven isopropyl alcohol products. |

|

Mitsui Chemicals |

Japan |

Presence of world-leading technology |

In May 2025, Mitsui Chemicals, Inc. began to consider splitting off its Basic & Green Materials business ("B&GM"), which is primarily engaged in petrochemicals, to transition to a more robust business structure and promote the shift to a green society. |

Other Major Key Players

- LCY Chemical Corp.

- Deepak Fertilisers and Petrochemicals Corporation Ltd.

- ISU Chemical Co., Ltd.

- Suzhou Jiutai Group

- Manali Petrochemicals Ltd.

- Perrigo Company plc

- KLK OLEO

- Tokuyama Corporation

- LG Chem

- Sasol Limited

Leaders' Announcements

- In March 2025, ExxonMobil announced expansion of its IPA production capabilities in the United States, with plans to invest in facilities including a unit for high-grade IPA for microchip manufacturing. While 99.9% purity IPA is great for hand sanitizers and household cleaning solutions, next-generation semiconductors need 99.999% pure IPA to avoid damaging delicate microchips. Advanced chip makers rely on this high-purity IPA to minimize defects in their sensitive circuitry by producing 99.999% purity IPA.

- In May 2023, Dowopens in a new tab and New Energy Blueopens in a new tab announced a long-term supply agreement in North America in which New Energy Blue will create bio-based ethylene from renewable agricultural residues. This bio-based ethylene reduces carbon emissions from plastic production and is used in recyclable applications across transportation, footwear, and packaging, and strengthens an ecosystem for diverse and renewable solutions.

- In May 2023, Mitsui Chemicals Inc. acquired certification for epoxy resins, part of the biomass phenol chain, under the International Sustainability and Carbon Certification (ISCC) PLUS system for certifying sustainable products. Also, Mitsui Chemicals intends to make further contributions to society's adoption of biomass products with the aim of biomass products utilizing the mass balance approach, picked up for widespread use throughout society.

Recent Developments

- In September 2024, Eastman launched elevated-grade isopropyl alcohol, added to the extensive range of EastaPureTM solvents, fulfilling requirements for semiconductor dependability and purity. These EastaPure IPAs work well for wafer fabrication and other stages of the semiconductor manufacturing process with these expert resources and internal manufacturing controls.

- In July 2022, INEOS OXIDE launched new Bio-Attributed Ethylene Oxide (EO), based on certified bio-based sources, which do not compete with food production. This new product reaffirms INEOS's commitment to developing more sustainable ways to produce the materials we use and rely on every day to significantly reduce their carbon footprint and offer innovative solutions.

- In September 2022, Exxon Mobil unveiled plans to broaden its healthcare solutions lineup, aligning with evolving medical requirements for safe and health-focused materials. The expanded portfolio encompasses ExxonMobil Isopropyl Alcohol (IPA) alongside an array of performance and specialty polymers. These versatile materials are designed for applications spanning medical equipment, infection control products, and pharmaceutical and laboratory supplies, catering to the ever-evolving healthcare landscape.

Segments Covered in the Report

By Application

- Process and Preparation Solvent

- Cleaning and Drying Agent

- Coating and Dye Solvent

- Intermediate

- Other Applications

By End-user Industry

- Cosmetics and Personal Care

- Pharmaceutical

- Electronics

- Paints and Coatings

- Chemicals

- Other End-user Industries

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting