IT Professional Services Market Size and Forecast 2025 to 2034

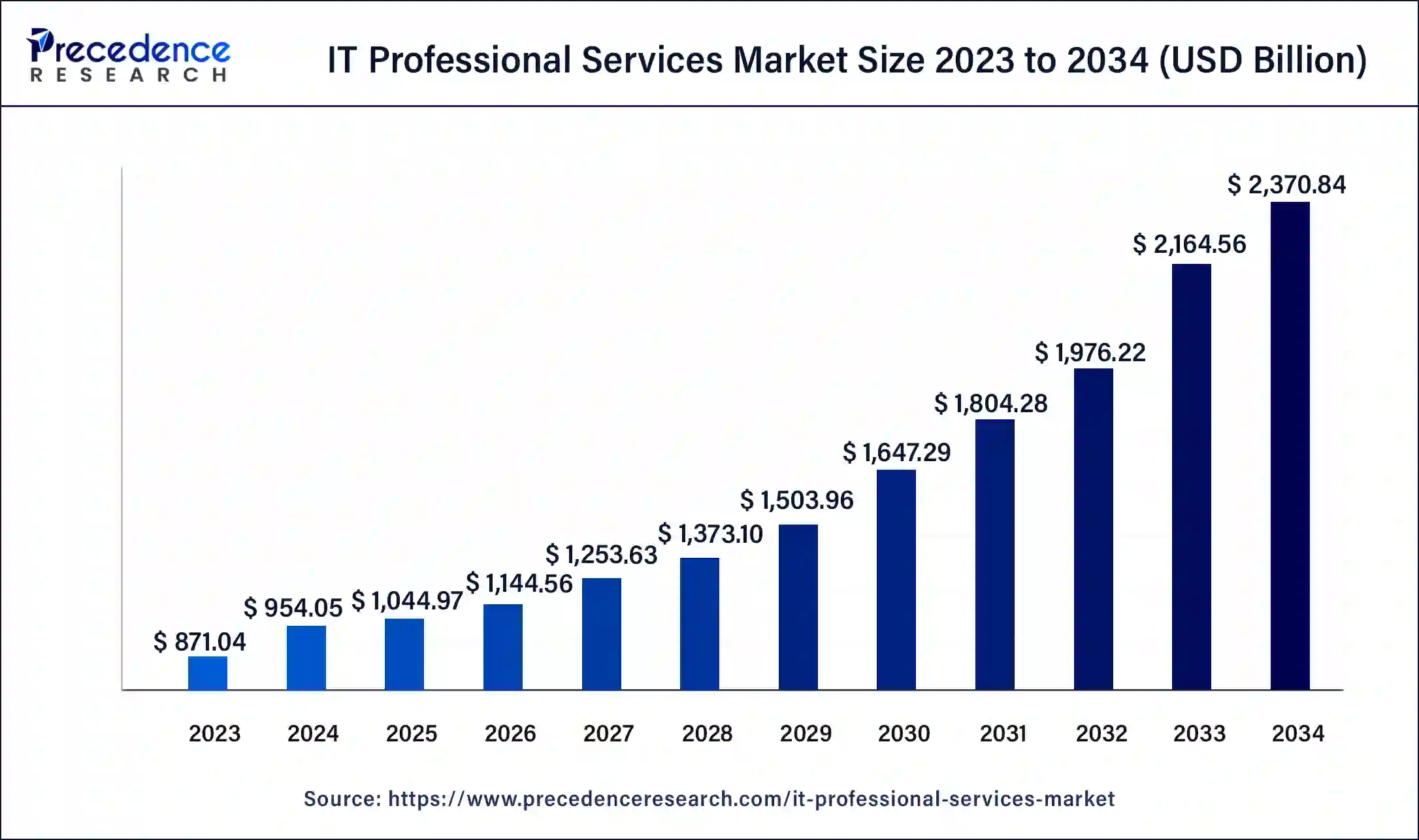

The global IT professional services market size was calculated at USD 954.05 billion in 2024 and is expected to reach around USD 2,370.84 billion by 2034. The market is expanding at a solid CAGR of 9.53% over the forecast period 2025 to 2034. The North America IT professional services market size reached USD 362.54 billion in 2024. The rise in automation for the elimination of everyday tasks and shift in customer demand, are key market drivers.

IT Professional Services Market Key Takeaways

- The global IT professional services market was valued at USD 954.05 billion in 2024.

- It is projected to reach USD 2,370.84 billion by 2034.

- The IT professional services market is expected to grow at a CAGR of 9.53% from 2025 to 2034.

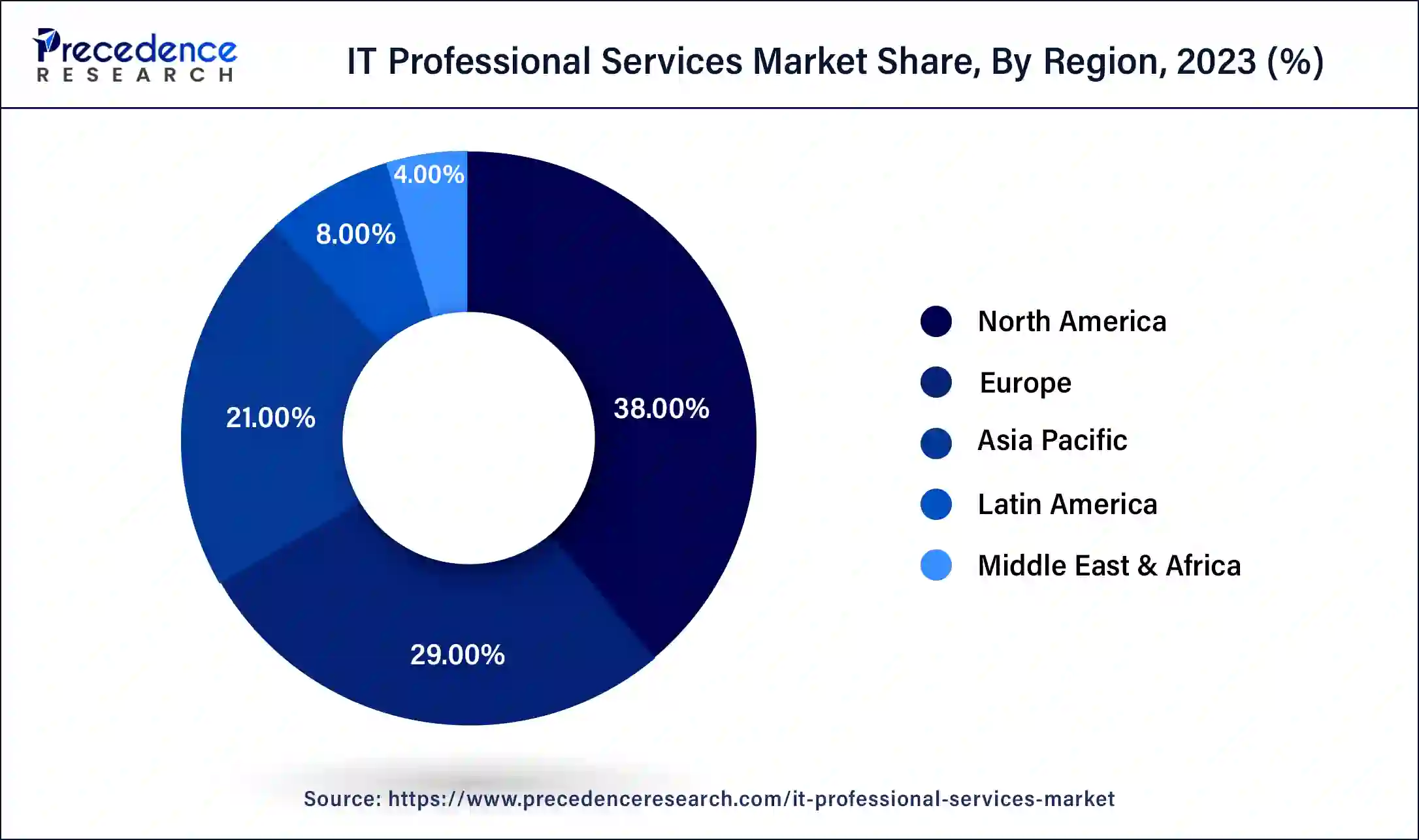

- North America led the global IT professional services market with the largest market share of 38% in 2024.

- Asia Pacific is projected to grow at a solid CAGR of 11.06% during the projected period.

- By type, the project-oriented services segment has contributed more than 38% of market share in 2024.

- By type, the information technology outsourcing (ITO) service segment is expected to grow at the notable CAGR of 10.31% over the forecast period.

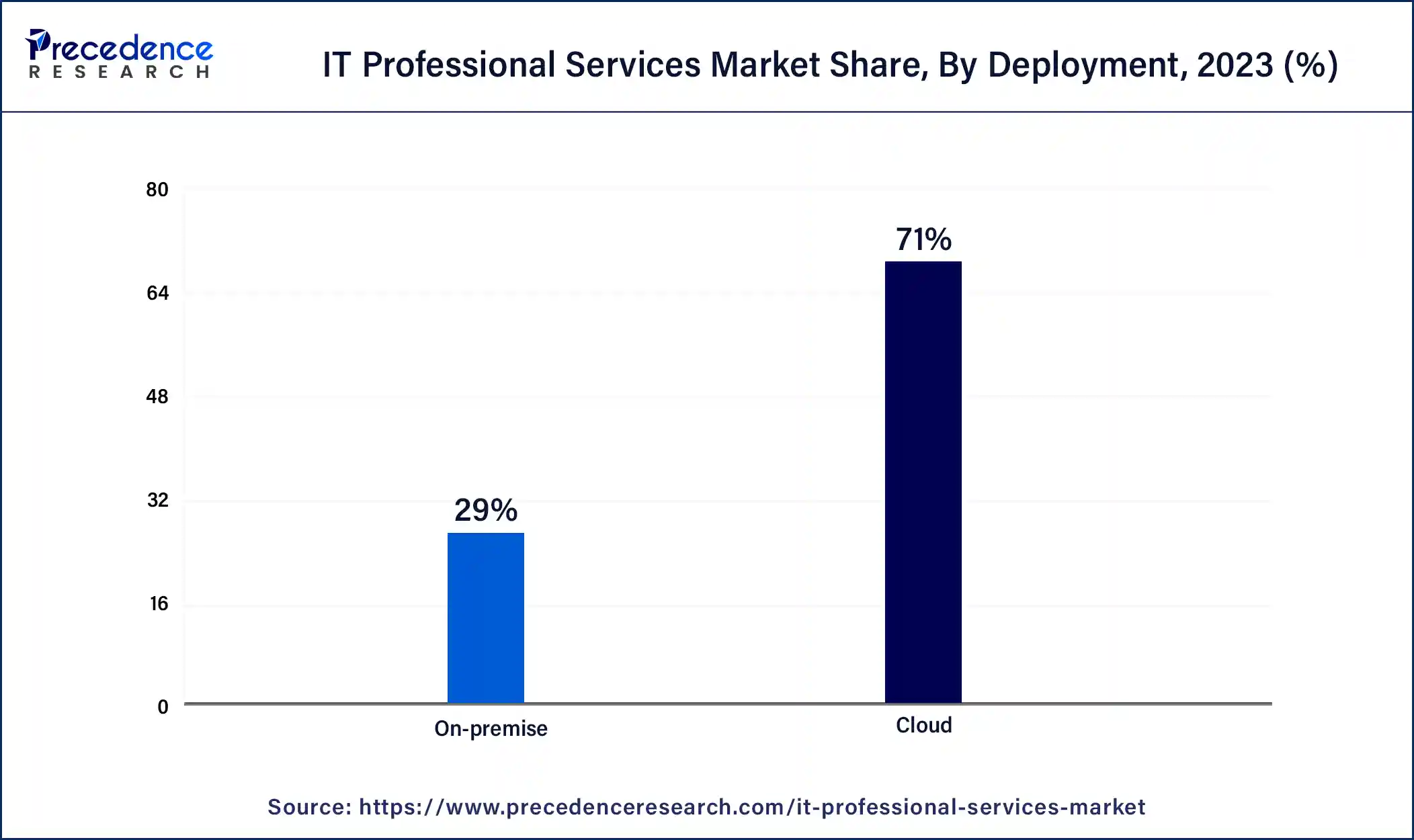

- By deployment, the cloud segment has continued more than 71% of market share in 2024.

- By deployment, the on-premise segment is projected to expand at a CAGR of 8.22% during the forecast period.

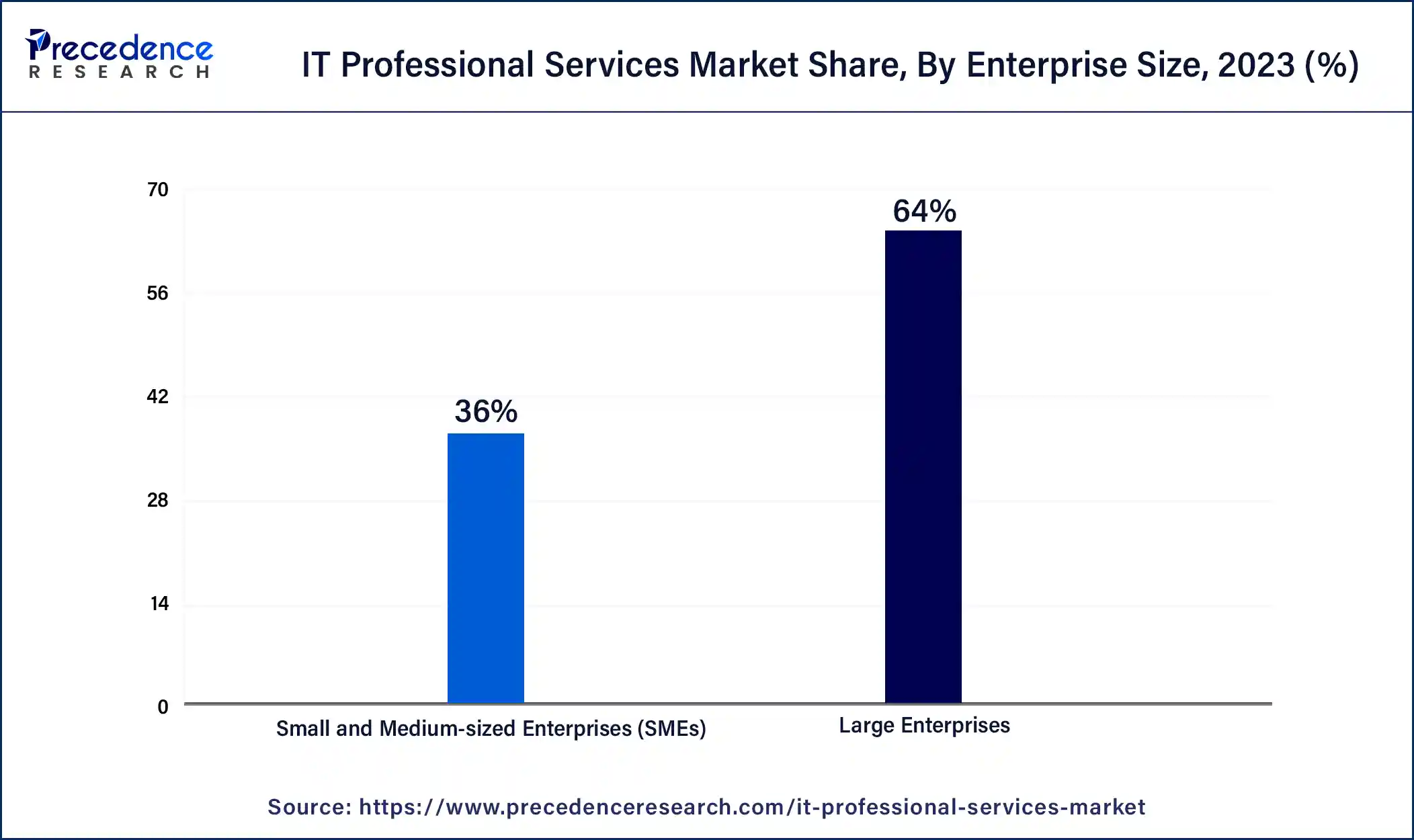

- By enterprise size, the large enterprises segment accounted for the biggest market share of 64% in 2024.

- By enterprise size, the small & medium enterprise (SMEs) segment is projected to show the fastest CAGR of 11.63% in the market during the forecast period.

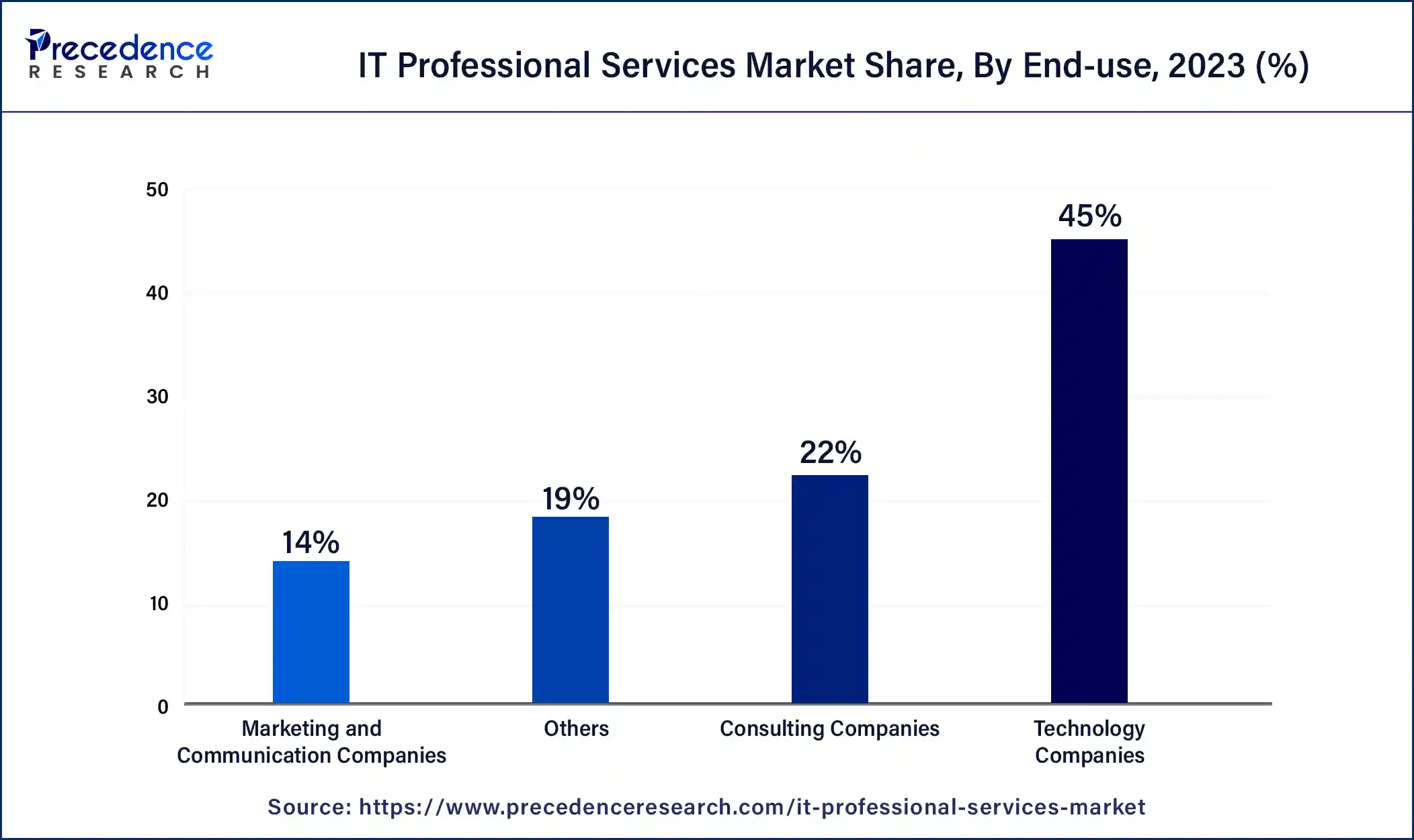

- By end-use, the technology companies segment has generated more than 64% of revenue share in 2024.

- By end-use, the marketing and communication companies segment is expected to expand at a solid CAGR of 11% during the forecast period.

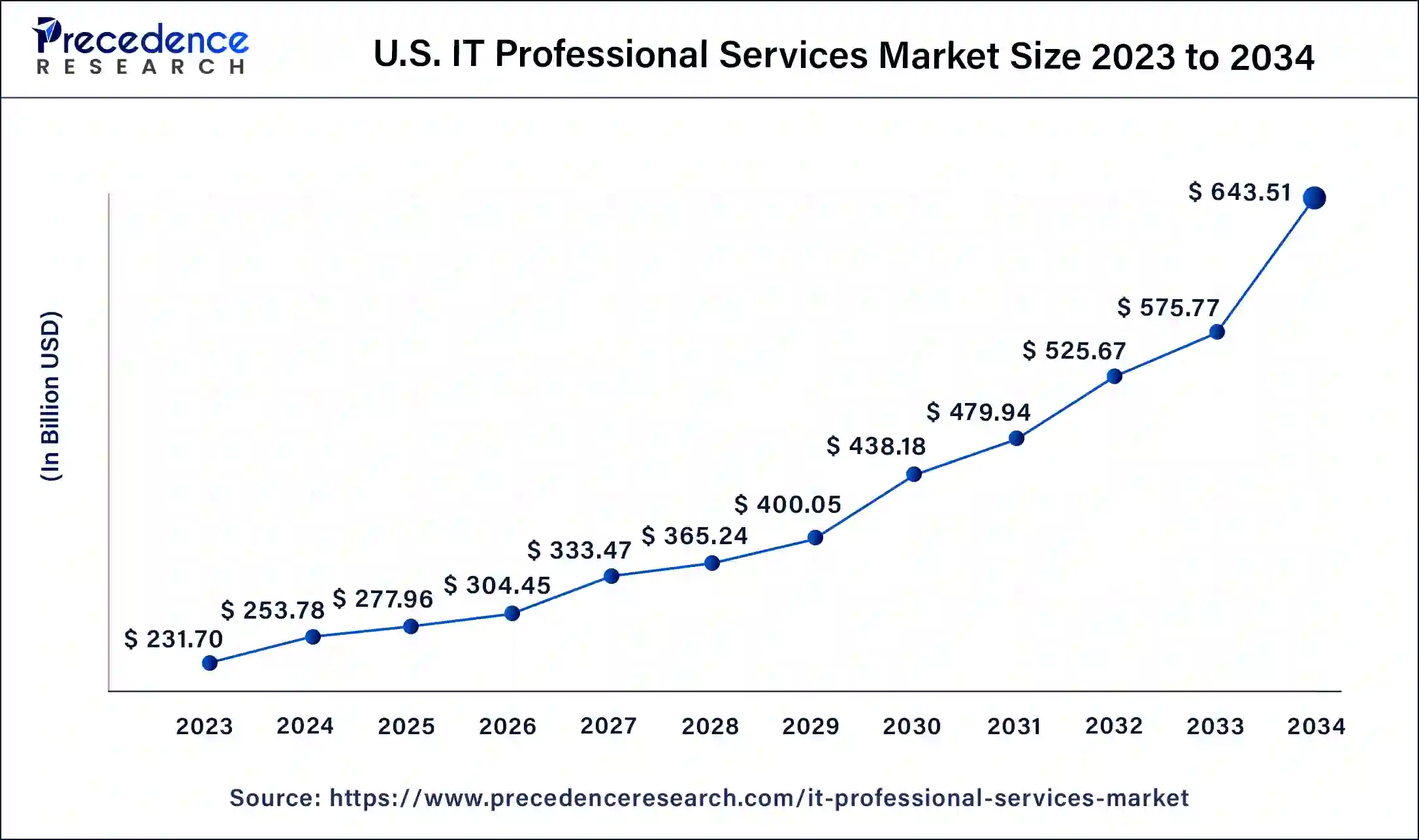

U.S. IT Professional Services Market Size and Growth 2025 to 2034

The U.S. IT professional services market size was exhibited at USD 253.78 billion in 2024 and is projected to be worth around USD 643.51 billion by 2034, poised to grow at a CAGR of 9.75% from 2025 to 2034.

North America led the global IT professional services market in 2024. North America has consistently been a lucrative market due to its early adoption of advanced technologies in the manufacturing, retail, and financial services industries. The region's market growth can be attributed to the significant presence and penetration of major industry players. Because of some of the world's largest economies, North America sees rising demand for data processing, outsourcing, Internet services, and infrastructure.

The U.S. IT professional services market will dominate North America by providing lucrative opportunities for services such as outsourcing and data processing. Additionally, the growing adoption of cloud-based services will further propel market growth.

- In February 2024, Capgemini and Unity, the world's leading platform for creating and growing real-time 3D (RT3D) content, announced an expansion of their strategic alliance that will see Capgemini take on Unity's Digital Twin Professional Services arm. As Per the agreement, Unity's Digital Twin Professional Services team will join and embed within Capgemini, forming one of the largest pools of Unity enterprise developers in the world.

Asia Pacific is projected to witness significant growth in the IT professional services market during the projected period. The demand for knowledge-based services in the region is projected to grow rapidly, particularly in the legal, advisory, and accounting sectors. This trend will drive regional growth throughout the forecast period. Similarly, APAC will experience significant benefits from the increasing emphasis on IT in emerging economies like India and China, creating numerous opportunities for IT professionals. Many SMEs in the Asia Pacific region depend on professional services to manage their daily operations.

- In April 2024, VaynerMedia unveiled its suite of consulting products in the Asia Pacific region, tailored to meet the dynamic needs of the marketplace. VaynerMedia Consulting will complement its existing professional services. These innovative offerings tap into the agency's disruptive thinking and profound cultural insights to revolutionize the way their clients market their brands.

Market Overview

IT professional services are intangible offerings provided to organizations or customers to manage specific business aspects. These services encompass a range of integrated solutions, including project-oriented services, IT outsourcing (ITO), IT support and training, and enterprise cloud computing. By implementing IT services such as business analytics and cloud-based solutions, companies can optimize their operations and boost revenue. The global deployment of the IT professional services market is increasing as businesses automate routine tasks and respond to evolving customer demand for personalized pricing and it improved customer experiences.

IT Professional Services Market Growth Factors

- The rising adoption of IT professional services in organizations is expected to fuel market growth soon.

- Increasing IT services through cloud computing technology is also boosting the IT professional services market growth.

- The regulations implied for ensuring data security can drive the IT professional services market growth further.

- The players are actively focusing on new product innovations that can contribute to the IT professional services market expansion.

IT Professional Services Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 2,370.84 Billion |

| Market Size in 2025 | USD 1044.97 Billion |

| Market Size in 2024 | USD 954.05 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.53% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Deployment, Enterprise-size, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Services provided by IT firms

In the IT professional services market, companies are reshaping their business models to adapt to the evolving environment and prepare for potential challenges. IT professional services play an important role in helping organizations identify cost-saving opportunities. They also provide numerous other advantages, such as business intelligence (BI), reduced resource usage, improved operations, and precise forecasting. Moreover, many companies are leveraging IT services to accelerate business growth in the post-pandemic era. Professional service firms provide various services, including consulting, auditing, accounting, and implementation support, along with financial risk mitigation. These firms also deliver business information management and analytic capabilities.

- In May 2024, ZS, a Chicago-headquartered management and technology consulting firm, announced the launch of a platform and products business unit. The new unit which will be led by chairman Jaideep Bajaj aims to accelerate the expansion of ZS' software-as-a-service offerings. Though the firm introduced its first SaaS product over a decade ago, the new business unit represents the latest in a series of investments in the SaaS market.

Restraint

Security concerns

Concerns about security related to cloud-based professional services and the inability to promptly address consumer demands are anticipated to impede the IT professional services market growth. Additionally, the market can be greatly affected by regulations initially aimed at ensuring data security, which influences service delivery models and shapes industry standards. Companies must adhere to the General Data Protection Regulation (GDPR), the NIST Cybersecurity Framework, and various industry-specific regulations, among others.

Opportunity

Rising adoption of hybrid and multi-cloud environments

A major trend in the IT professional services market is the increasing adoption of hybrid and multi-cloud environments. Driven by the need for flexibility, scalability, and optimized resource allocation, there has been a general shift toward embracing hybrid and multi-cloud solutions. Furthermore, one of the primary benefits of these environments is their ability to provide organizations with the flexibility to select the most appropriate cloud solutions for their specific needs. By adopting a hybrid or multi-cloud strategy, organizations can choose the optimal solution for any given workload or application.

- In December 2023, Lenovo announced significant enhancements to its hybrid cloud platform, elevating its capabilities for AI applications. This includes new Think Agile hyper-converged solutions and Think System servers that deliver accelerated performance, management, and efficiency capabilities, powered by the next generation of Intel Xeon Scalable Processors.

Type Insights

The project-oriented services segment dominated the IT professional services market in 2024. Project-oriented services encompass timely maintenance, modernization, project installation, and decommissioning. Often customized to address the client's unique requirements, these services help maximize operational efficiency and ensure projects are completed on time and within budget. Organizations gain numerous advantages from project-oriented services, including revenue management, scope management, the preparation of improved quotations, resource management, and effective project delivery. These factors are the main drivers of demand in this segment.

The information technology outsourcing (ITO) service segment is expected to grow fastest in the IT professional services market. These services also offer a broad spectrum of resources to help achieve a robust return on investment (ROI), effectively bridging the gap between legacy IT systems and innovation. ITO services provide organizations with access to technical expertise, automation, and cost reduction by choosing the appropriate delivery model. The growth of ITO services is anticipated due to their ability to deliver high-performance computing, compliance, security, and scalability.

- In April 2022, Accenture was positioned as a leader in the IDC MarketScape analysis of life science sales and marketing IT outsourcing services in 2022. 11 service providers offering IT outsourcing (ITO) solutions for sales and marketing processes in the life science industry. It reviews both quantitative and qualitative characteristics that define current market demands and expected buyer needs.

Deployment Insights

The cloud segment led the global IT professional services market in 2024. Cloud computing is gaining momentum due to various benefits, including enhanced accessibility, reduced technology infrastructure expenses, and lower implementation costs. Additionally, the improved infrastructure for Internet services is accelerating the adoption of cloud-based solutions. Increasing competition across various end-use industries is compelling companies to reduce spending, hence driving the demand for cost-effective services. These features and capabilities are expected to boost the growth of the further segment during the forecast period.

The on-premise segment is projected to show the fastest growth in the IT professional services market during the forecast period. Organizations choose on-premise deployment because it allows for greater control over their IT infrastructure and the flexibility to tailor it to their specific needs. Moreover, this approach is also appealing due to its reduced reliance on internet connectivity, ensuring that employees can access data even during network outages. These advantages are expected to drive the demand for on-premise deployment.

Enterprise-Size Insights

The large enterprises segment dominated the IT professional services market in 2024. This can be attributed to enhanced customer experience, improved team collaboration, reduced operating costs, and lowered workforce expenses; these organizations are significant users of IT professional service solutions. To minimize software costs and ensure their employees quickly become proficient with various IT professional services, these enterprises often enter into long-term agreements with IT professional services software providers.

The small & medium enterprise (SMEs) segment is projected to show the fastest growth in the IT professional services market during the forecast period. The SME sector, recognized as an untapped market, has garnered attention from industry players. According to the World Bank, SMBs constitute 95% of all businesses. The demand for cloud-based IT professional services tools in the SME sector is expected to increase due to their affordability.

- In April 2024, Codebase Technologies, a UAE homegrown FinTech platform, has launched its Digibanc SME Financing platform to address the needs of underserved MSME's across MENA and APAC. Through the new launch, the UAE-based FinTech, with offices across MENA, Africa, and APAC, will provide financial institutions with a tailor-made platform to launch a variety of SME financing products and services.

End-use Insights

The technology companies segment led the IT professional services market in 2024. IT professional services play a crucial role for companies leveraging data analytics. With technology constantly advancing, many firms, particularly those in Technology as a Service (TaaS), opt for IT professional services to support their business operations. This adoption has driven significant shifts in work cultures, such as remote work and IT infrastructure maintenance. Together, These factors contribute to the growth of the IT services market and segment.

The marketing & communication companies segment is projected to show the fastest growth in the IT professional services market during the forecast period. These companies rely on comprehensive market research, website analysis, budget management, and reputation management, all of which can be facilitated by professional IT services. Furthermore, the increasing prominence of digital media and the focus on improving customer experience is expected to further drive the growth of this segment.

IT Professional Services Market Companies

- VMware Inc.

- Accenture Plc

- Capgemini SE

- IBM Corporation

- Fujitsu Limited

- Hewlett Packard Enterprise Development LP

- Microsoft Corporation

- Oracle Corporation

- Other Key Players

Recent Developments

- In February 2024, Skyhigh Security announced the addition of managed & professional IT services to its Altitude Partner Program. With these professional services offered, companies can complete their product development and resell SkyHigh Security solutions.

- In August 2023, Rackspace Technology announced a professional services collaboration with Google Cloud to help accelerate VM migrations. This collaboration will migrate virtual machines to Google Cloud, helping to provide efficient and innovative solutions to businesses.

- In August 2023, HCLTech signed an agreement with TIBCO Solutions, a cloud software group. Under this agreement, HCLTech will help implement, modernize, upgrade, and provide services for TIBCO products globally, helping strengthen HCL's professional services portfolio.

Segments Covered in the Report

By Type

- Project-oriented Services

- ITO Services

- IT Support & Training Services

- Enterprise Cloud Computing Services

By Deployment

- On-premise

- Cloud

By Enterprise-size

- Small & Medium-sized Enterprises (SMEs)

- Large Enterprises

By End-use

- Technology Companies

- Consulting Companies

- Marketing & Communication Companies

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting