What is the Japan Data Center Market Size?

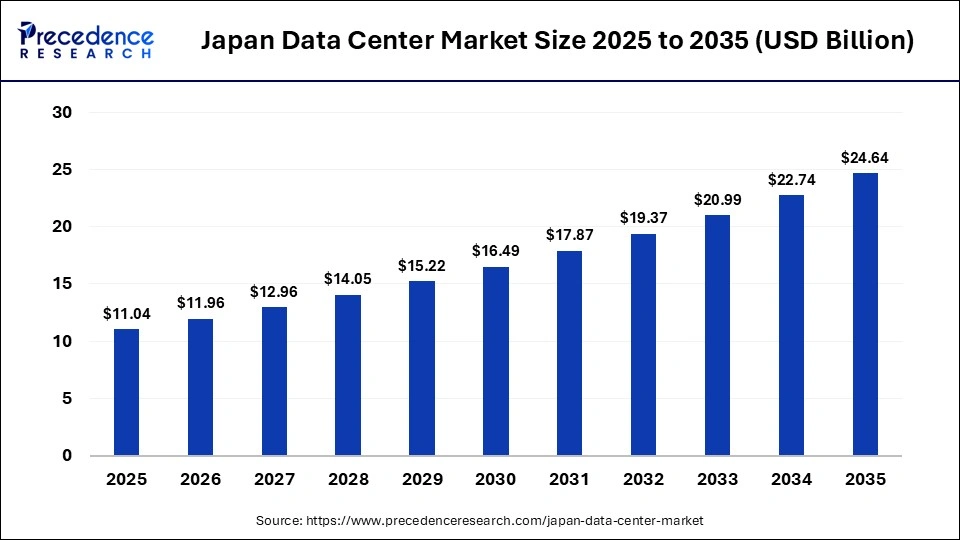

The Japan data center market size was calculated at USD 11.04 billion in 2025 and is predicted to increase from USD 11.96 billion in 2026 to approximately USD 24.64 billion by 2035, expanding at a CAGR of 8.36% from 2026 to 2035. The market is driven by strong demand for cloud services, digital transformation, and advanced technologies like AI and IoT.

Market Highlights

- By data center size, the large segment dominated the Japan data center market in 2025.

- By data center size, the medium segment is expected to grow at the fastest rate over the forecast period.

- By data center type, the colocation segment dominated the market in 2025.

- By data center type, the hyperscale / self-built segment is expected to grow at a significant CAGR in the upcoming period.

- By end user, the IT and ITES segment dominated the market in 2025.

- By end user, the BFSI segment is expected to grow at a significant rate in the coming years.

Market Overview

The Japan data center market is growing due to the country's rapid digitalization across government, corporate, and industrial sectors, which requires robust infrastructure to support cloud computing, AI, and big data. Government mandates for cloud adoption and increasing investments from hyperscale operators like AWS and Microsoft are driving further demand for localized facilities. Additionally, the rise of 5G networks and IoT technologies is creating a need for low-latency processing, spurring the development of edge and medium-scale data centers. Strict data residency and security regulations also promote the growth of local data centers that comply with Japan's privacy laws, positioning domestic providers to capitalize on these trends.

Japan Data Center Market Trends

- IoT and 5G Development: The expansion of IoT devices and the rollout of 5G networks demand low-latency processing, which is driving the need for edge data centers located closer to end-users. This improves performance and supports real-time applications in various industries like manufacturing, healthcare, and logistics.

- Green Technologies: To meet Japan's sustainability goals and comply with environmental regulations, data centers are increasingly adopting green technologies. This includes using renewable energy sources, efficient cooling systems, and low-carbon infrastructure, helping reduce their carbon footprint while supporting corporate Environmental, Social, and Governance (ESG) initiatives.

- AI Optimization:Smart AI applications are revolutionizing the data center sector by optimizing operations, predicting maintenance needs, and improving energy management. These technologies enhance operational reliability, reduce costs, and increase the overall efficiency of data center facilities, making them more competitive.

- Colocation and Shared Facilities: Companies are increasingly turning to colocation and shared data centers to avoid the high capital costs and operational complexities of running their own facilities. This allows them to access cutting-edge infrastructure and services with greater flexibility and scalability while focusing on their core business operations.

How is AI Transforming the Japan Data Center Market?

Artificial Intelligenceis transforming the Japan data center market by improving the efficiency, reliability, and scalability of operations of data centers. Hi-tech AI-intensive surveillance systems predict maintainability, identify possible equipment malfunctions before their development, minimize downtime, and lower the operation expenses. Additionally, AI-driven smart energy control systems optimize power consumption and cooling processes, significantly lowering energy use and enhancing sustainability. On the security front, AI-based solutions improve threat detection, anomaly identification, and real-time responses, providing stronger defenses for sensitive enterprises and customer data against cyber threats.

What Regulations are Impacting the Japan Data Center Market?

Several key regulations are shaping the Japan data center market, primarily focusing on data privacy, security, and sustainability. These include:

- Act on the Protection of Personal Information (APPI): Japan's data privacy laws, particularly the APPI, regulate how personal data is collected, stored, and processed. This law emphasizes the protection of personal data, imposing strict requirements on data controllers, especially for businesses that handle sensitive information.

- Data Residency and Sovereignty Requirements: Japan has strict data residency laws that require certain types of data, particularly personal and sensitive data, to be stored within the country. Data centers must comply with these regulations to meet legal requirements for local data storage, especially for industries like finance, healthcare, and government.

- Cybersecurity Regulations (NISC Framework): Japan's National Information Security Center (NISC) sets guidelines for the cybersecurity of critical infrastructure, including data centers. The NISC framework mandates that data centers implement robust security measures to protect against cyber threats, ensuring that data is safeguarded from breaches and other risks.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 11.04 Billion |

| Market Size in 2026 | USD 11.96 Billion |

| Market Size by 2035 | USD 24.64 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 8.36% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Data Center Size,Data Center Type,End User |

Segment Outlook

Data Center Size Insights

Why Did the Large Segment Dominate the Japan Data Center Market?

The large segment dominated the market with the largest share in 2025. This is primarily due to the ability of large-scale facilities to handle high-density computing, cloud platforms, and enterprise-level digital workloads. These facilities are equipped with superior power and cooling systems, along with high-performance network connectivity, making them ideal for hyperscale cloud services, AI training, and critical enterprise applications.

The rise of Japanese public-sector cloud initiatives and growing demands for sovereign cloud infrastructure have further driven the development of large data center campuses that meet stringent security and compliance requirements. Additionally, these large facilities benefit from centralized management, automation, and energy optimization technologies, which enhance operational efficiency. Multinational corporations (MNCs) and global cloud providers are increasingly relying on large data centers to centralize their workloads and reduce latency, solidifying the importance of these expansive infrastructures.

The medium segment is expected to grow at the fastest rate during the projection period, driven by the increasing demand for edge computing and data processing. The rollout of 5G networks, the adoption of IoT in the manufacturing sector, and the growth of smart-city projects are all fueling the need for localized data centers that can handle low-latency processing.

Medium-sized data centers strike a balance between capacity and deployment flexibility, enabling operators to place infrastructure closer to population hubs and industrial zones. These facilities require less initial capital investment compared to large campuses, yet still provide enough power density to support enterprise applications and AI inference workloads. The rise in demand from local businesses, healthcare organizations, and regional cloud providers further accelerates the growth of medium-sized data centers in Japan.

Data Center Type Insights

What Made Colocation the Leading Segment in the Japan Data Center Market?

The colocation segment led the market in 2025 because it is cost-effective, scalable, and does not violate regulations. Enterprises are increasingly drawn to colocation services as a way to avoid the high capital costs associated with building and maintaining their own data centers, particularly in urban areas where land is limited. Colocation providers offer a secure environment, high-availability infrastructure, and ensure compliance with Japan's stringent data residency and cybersecurity regulations, making them appealing to both domestic and international companies.

Additionally, the Japanese public sector's cloud initiatives have driven demand for certified local colocation providers, ensuring the sovereign control of data. The ability to scale capacity easily, access a variety of network carriers, and minimize operational complexity further boosts the appeal of colocation, making it a compelling choice for enterprises looking to optimize their infrastructure while reducing costs and risk.

The hyperscale / self-built segment is expected to expand at a significant rate in the coming years. This is due to the increasing demand for high-capacity infrastructure to support AI workloads, cloud computing, and big data analytics. Global cloud providers and large domestic tech companies are localizing their data centers to comply with Japan's strict data sovereignty laws, ensuring data residency and security.

These self-built facilities also reduce latency by being closer to enterprise clients, enhancing performance for real-time applications. Additionally, government incentives for digital infrastructure development and the integration of renewable energy sources make it more attractive for companies to invest in large, scalable, and sustainable hyperscale data centers outside overcrowded urban locations.

End User Insights

Why Did the IT & ITES Segment Dominate the Japan Data Center Market?

The IT & ITES segment dominated the market by holding a significant share in 2025 because of its heavy reliance on cloud computing, application hosting, and the delivery of digital services. Software companies, managed service providers, and outsourcing firms require highly available infrastructure to support enterprise platforms, cybersecurity services, and large-scale data processing. Japan's growing digital transformation across industries like manufacturing, healthcare, and government further boosts the demand for IT-driven data centers. Additionally, continuous innovation in SaaS platforms, fintech solutions, and e-commerce technologies drives a sustained need for robust infrastructure to meet the evolving requirements of this sector.

The BFSI segment is expected to grow at the fastest rate throughout the forecast period due to the increasing adoption of cloud-based solutions in areas like mobile banking, electronic payments, fraud detection, and risk analytics. Regulatory demands for data security, disaster recovery, and business continuity have further fueled the need for investment in high-quality data center infrastructure.

The integration of AI for tasks such as credit scoring, customer service automation, and algorithmic trading has significantly boosted the demand for high-performance computing. Additionally, the rise of open banking systems and fintech partnerships has increased the need for secure data transfer systems, driving the requirement for domestic data centers that comply with strict regulatory standards.

Geographical Insights

What Makes Tokyo the Leading Area in the Market?

Tokyo dominated the Japan data center market while holding the largest share in 2025. This is mainly due to its role as the country's financial and business hub, housing numerous multinational companies and tech giants that drive high demand for data services. The city offers exceptional connectivity, with access to major fiber-optic networks, high-speed internet, and multiple telecom providers, ensuring low-latency and reliable communication. Additionally, Tokyo's infrastructure meets Japan's strict data residency and cybersecurity regulations, making it a prime location for both domestic and international data centers. Its strategic position as a gateway to the Asia-Pacific region further strengthens its status as the key market hub for data center operations in Japan.

Why is Osaka Considered the Fastest-Growing Area in the Market?

Osaka is considered the fastest-growing area in the Japan data center market due to its strategic location as a key commercial and industrial hub in the Kansai region. The city's proximity to major manufacturing centers and its role as a business center for industries like automotive, healthcare, and logistics drive significant demand for data processing, especially in edge computing and localized services. Additionally, Osaka offers lower land and operational costs compared to Tokyo, making it an attractive option for data center operators seeking scalability without the high costs of urban locations. With continued investments in digital infrastructure and growing demand from both domestic businesses and international companies, Osaka is rapidly emerging as a crucial player in Japan's data center landscape.

Who are the Major Players in the Japan Data Center Market ?

The major players in the Japan Data Center Market include NTT Global Data Centers, KDDI Corporation, Fujitsu, NEC Corporation, Hitachi Systems, Sakura Internet, Internet Initiative Japan (IIJ), SCSK Corporation, Tokai Communications, MC Digital Realty (Mitsubishi Corporation subsidiary), Telehouse Japan (KDDI subsidiary), GMO Internet Group, SOFTBANK Corp, IDC Frontier (Yahoo Japan / SoftBank group), Canon IT Solutions, and Itochu Techno-Solutions (CTC)

Recent Developments

- In September 2025, OPTAGE improved the connectivity of its data center in Osaka Sonezaki and stated that it would have a Japan-Singapore submarine cable. The cable, which is supposed to be live in FY 2028, will be based on dedicated 100 Gbps and 400 Gbps circuits.(Source: https://optage.co.jp)

- In June 2025,ARTERIA Networks was incorporated in the Japan-Korea submarine-optical-cable consortium with Microsoft, Amazon Web Services, and Dreamline. The route between Fukuoka and Busan will begin operation in Q3 2027. (Source:https://www.arteria-net.com)

- In April 2025,Gaw Capital Partners and GDS collaborated to build a 40 M carrier-neutral campus in Fuchu Intelligent Park in the west of Tokyo. The plant is expected to start at the end of 2026. (Source:https://www.gawcapital.com)

Segments Covered in the Report

By Data Center Size

- Large

- Massive

- Medium

- Mega

- Small

By Data Center Type

- Hyperscale / Self-built

- Enterprise / Edge

- Colocation

- Non-Utilized

- Utilized

- Retail Colocation

- Wholesale Colocation

By End User

- BFSI

- IT and ITES

- E-Commerce

- Government

- Manufacturing

- Media and Entertainment

- Telecom

- Other End Users

By Geography

- Osaka City

- Takamatsu

- Tokyo

- Rest of Japan

Get a Sample

Get a Sample

Table Of Content

Table Of Content