Japan Video Streaming Market Size and Forecast 2025 to 2034

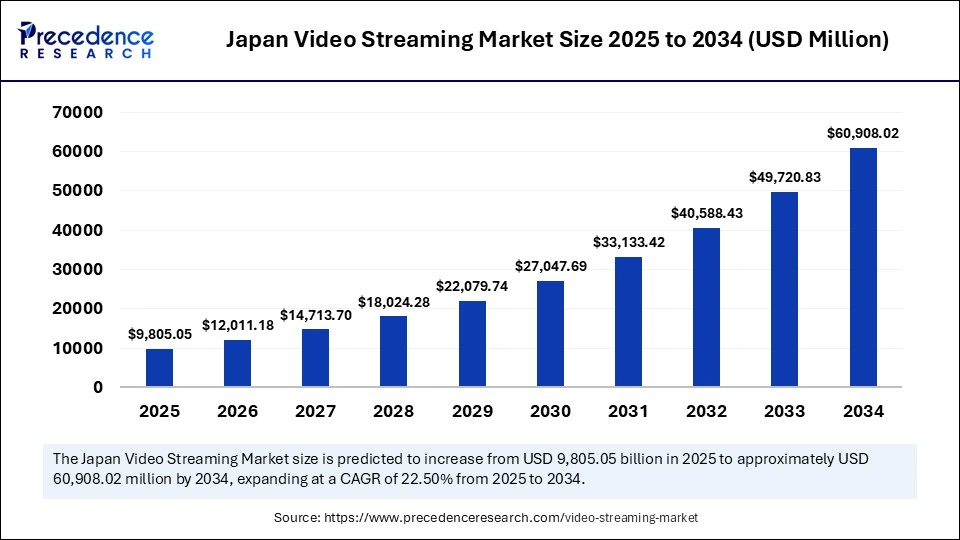

The Japan video streaming market size accounted for USD 8,004.12 million in 2024 and is predicted to increase from USD 9,805.05 million in 2025 to approximately USD 60,908.02 million by 2034, expanding at a CAGR of 22.50% from 2025 to 2034. The market growth is attributed to increasing consumer demand for high-quality and personalized video streaming experiences.

Japan Video Streaming Market Key Takeaways

- In terms of revenue, the Japan video streaming market is valued at $9,805.05 million in 2025.

- It is projected to reach $60,908.02 million by 2034.

- The market is expected to grow at a CAGR of 22.50% from 2025 to 2034.

- By streaming type, the live video streaming segment held the largest revenue share in 2024.

- By streaming type, the non-liner video streaming segment is expected to grow at the fastest CAGR during the forecast period.

- By component, the content delivery services segment dominated the market in 2024.

- By component, the software segment is expected to grow at the highest CAGR in the coming years.

- By solution, the over-the-top (OTT) segment led the market in 2024.

- By solution, the pay-TV segment is expected to expand rapidly in the upcoming period.

- By platform, the smartphones & tablets segment dominated the market in 2024.

- By platform, the smart TV segment is expected to grow at the fastest CAGR between 2025 and 2034.

- By service, the managed services segment dominated the Japan video streaming market in 2024.

- By service, the training & support segment is expected to register the highest CAGR in the future years.

- By revenue model, the subscription segment held the largest revenue share in 2024.

- By revenue model, the advertising segment is expected to grow at the fastest CAGR during the forecast period.

- By deployment type, the cloud segment held a dominant revenue share of the market in 2024.

- By deployment type, the on-premises segment is expected to grow at the fastest CAGR in the upcoming period.

- By end-user, the consumer segment accounted for a considerable share of the market in 2024.

- By end-user, the enterprises segment is expected to grow at the highest CAGR over the studied years.

Impact of Artificial Intelligence on the Japan Video Streaming Market

Artificial Intelligence (AI) is revolutionizing the market for video streaming within Japan by bringing new solutions for content delivery, user engagement, and operational efficiency. Streaming service providers in Japan are using AI technologies to analyze viewer preferences. AI enables personalized content recommendation that boosts watch time and subscriber loyalty. Furthermore, companies use AI-driven tools to automate the process of creating subtitles and voice dubbing, allowing them to localize international content into the Japanese language.

Market Overview

The rapid expansion of 5G infrastructure in Japan is expected to enhance the quality and availability of video streaming services. By the end of 2024, Japan had achieved the largest population coverage of 5G, driven by major carriers, including NTT Docomo, KDDI, and SoftBank. This nationwide adoption of 5G enables fast, low-latency connections, offering a smooth streaming experience for all nationwide users. According to a report published by the International Trade Administration, SoftBank is Japan's third-largest mobile carrier.

The company plans to spend more than USD 1.9 billion to expand its network to roughly 64% of the populated areas of the country by 2025. It plans to install 7,355 base stations in the 3.7GHz and 4.5GHz spectrum bands and 3,855 base stations in the 28GHz band to drive technological innovation and economic growth. The expansion of 5G technology is expected to contribute to the growth of both the live and non-linear video streaming sectors, driven by the increase in consumer demand for high-quality, on-demand, and real-time services. Furthermore, around 48 million Japanese subscribers subscribed to video streaming content in 2022, bolstered the growth of the market.

Japan Video Streaming MarketGrowth Factors

- Increasing demand for personalized content recommendations is expected to enhance user engagement and retention on streaming platforms, supporting the growth of the Japan video streaming market.

- The rising adoption of artificial intelligence and machine learning technologies is projected to optimize content delivery and improve the viewer experience.

- Expanding broadband internet coverage across urban and rural areas is likely to facilitate access to high-quality video streaming services.

- Growing preference for on-demand content over traditional broadcast TV is anticipated to drive subscription-based streaming services.

- Surging interest in interactive and social viewing experiences is expected to encourage innovation in platform features.

- Increasing collaborations between content creators and streaming providers are projected to diversify available programming.

- Rising consumer spending on digital entertainment is likely to fuel investments in exclusive and premium video content.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 60,908.02 Million |

| Market Size in 2025 | USD 9,805.05 Million |

| Market Size in 2024 | USD 8,004.12 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 22.50% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Authentication, Component,Deployment, Application, and Region |

Market Dynamics

Drivers

Is Japan's Anime Boom Powering the Rise of Niche Streaming Platforms?

The anime boom in Japan is driving the growth of the Japan video streaming market by influencing the rise of niche streaming platforms. High engagement with anime and manga-based content is anticipated to fuel market growth. Japan continues to be a leader in the world of anime productions, with genre-specific platforms experiencing rapid growth when it comes to the number of subscribers. Services, such as Crunchyroll, dAnime Store, and Netflix Japan, are increasingly focusing on licensing or co-production of exclusive anime titles for highly passionate fan communities. This genre-specific loyalty provides continuity in viewers and money-making prospects for streaming services. According to The Association of Japanese Animations' 2024 report, the Japanese anime industry reached around 3347 Billion Yen in 2023. This expanding content further creates the need for supportive video streaming solutions, thus boosting market growth.

Restraint

Strict Copyright Regulations Hamper Platform Scalability and Operations

Platform scalability and strict copyright regulations are likely to create operational challenges, thus further hindering the growth of the Japan video streaming market. Japan has strict content protection laws, leading to high compliance costs for both domestic and international providers. These legal frameworks restrict the ways that companies license, translate, and redistribute content, especially anime and other traditional media. This makes the platforms negotiate complicated rights deals, which take time and are expensive. Preventing piracy also requires advanced digital rights management systems, which reduces interoperability between devices. Furthermore, such legal complexities deter smaller players from entering the market or expanding their libraries.

Opportunity

High Demand for Multilingual Content

Growing demand for multilingual content is anticipated to expand platform reach across international and expatriate audiences, further creating immense opportunities for the growth of the Japan video streaming market. Increasing calls for multilingual content is expected to increase platforms' reach across the country among international and expatriate populations. The estimation of record-breaking influx of 36.9 million international visitors (Japan National Tourism Organization) to Japan in 2024 made clear the world's appeal to the country and the need for entertainment to be available to all people. Streaming platforms are reacting by improving the sub-title, dubbing support across key genres, such as anime and J-drama, as well as documentaries, and by creating multi-language interfaces to accommodate non-native viewers. Such an initiative contributes to inclusivity and also increases cross-border appeal, widening the pool of monetization for streaming services. Furthermore, Netflix in Japan has over 10 million subscribers by 2024 and both Japanese and English programs were performing well, implying a growing demand for video streaming solutions.

(Source: https://www.nippon.com)

(Source: https://about.netflix.com)

Streaming Type Insights

What Made Live Video the Dominant Segment in 2024?

The live video streaming segment dominated the Japan video streaming market with the largest revenue share in 2024. This is due to the increased live content consumption, driven by increase in participation in real-time events, esports, concerts, and interactive broadcasting. Japanese consumers, in particular, are seeking more immersive and communal viewing experiences, prompting content providers to expand their live offerings, including simulcasting popular anime and sports. This shift toward live streaming is poised to reshape content strategies and drive market expansion, supported by government initiatives aimed at fostering digital innovation and media technology.

The non-linear video streaming segment is expected to grow at the fastest CAGR in the coming years, as on-demand content consumption becomes increasingly prevalent in households. Viewers' preference for flexibility and convenience is driving the shift towards watching content at their own pace, moving away from traditional broadcast schedules. Enhanced user interfaces, personalized content recommendations, and cross-device compatibility further contribute to the appeal of non-linear streams, thereby boosting the segment's growth.

Component Insights

Why did the Content Delivery Services Segment Dominate the Market in 2024?

The content delivery services segment dominated the Japan video streaming market with the largest revenue share in 2024, driven by the demand for seamless, high-quality streaming, supported by the country's robust digital infrastructure. Major platforms like Netflix and Amazon Prime Video, along with Japanese services such as U-NEXT and dTV, have invested heavily in Content Delivery Networks (CDNs) to ensure faster and more reliable content delivery. As on-demand services and live event viewership surged, the importance of robust content delivery services increased, solidifying this segment's leadership.

The software segment is expected to expand at the fastest rate in the coming years, fueled by the increasing adoption of video streaming software enhanced with AI-driven advanced technology. The growing use of AI-based streaming is expected to create superior, safer, and more engaging content experiences for viewers. Moreover, support for various devices and formats, including 4K, VR, and AR, is projected to increase the demand for advanced video processing and playback software. These advancements are poised to make the software sub-segment a key contributor to the growth of Japan's dynamic streaming industry.

Solution Insights

How does the OTT Segment Dominate the Japan Video Streaming Market?

The over-the-top (OTT) segment dominated the market by holding the major revenue share in 2024 due to the increased preference for digital content. There has been a rapid shift from standard broadcast services to on-demand online movies and TV shows via platforms like Netflix, Hulu Japan, Amazon Prime Video, and AbemaTV is on the rise. The increased use of mobile videos and the expansion of 5G coverage have driven the segment's growth by enabling streaming across various devices. Additionally, the COVID-19 pandemic significantly boosted online video streaming among the Japanese, leading many to favor OTT platforms over traditional television.

The pay-TV segment is expected to grow at a significant rate in the upcoming period. Hybrid offerings that combine pay-TV with OTT services are expected to retain their customer base, primarily among older demographics and those in rural areas. The utilization of premium sports channels, exclusive live broadcasts, and bundled services, including broadband, phone, and television, are anticipated to support this segment. Furthermore, as companies like J:COM and SkyPerfecTV aim to offer up-to-date services, they are likely to invest in high-quality HD, 4K, interactive, and cloud DVR technology, further fueling the market in this region.

Platform Insights

What Factors Contribute to Smartphones & Tablets Segment in 2024?

The smartphones & tablets segment registered dominance with the largest share in 2024. This is mainly due to the strong mobile internet access and the country's modern consumer habits. According to the Ministry of Internal Affairs and Communications, Japan had over 100 million mobile internet users in 2023, highlighting the reliance on mobile devices for video content. Platforms like Netflix, TVer, AbemaTV, and Paravi have made it easier for mobile users to access and enjoy their programs. Moreover, Japan is recognized as one of the world's top five countries for mobile broadband quality, indicating reliable mobile connections that support high-bandwidth activities like video streaming.

The smart TV segment is projected to experience rapid growth during the forecast period, primarily due to the increasing number of people choosing to watch movies and TV at home on high-resolution displays and with smart home devices. Leading Japanese electronics brands, including Sony and Panasonic, are introducing more smart TV models, enabling direct access to platforms like Hulu Japan, U-NEXT, and Amazon Prime Video through their built-in operating systems. Japanese consumers are increasingly setting up voice-controlled TVs and dashboards in their homes, which is expected to boost smart TV usage and further drive market growth in the coming years.

Service Insights

How did the Managed Services Segment Dominate the Japan Video Streaming Market?

The managed services segment dominated the market in 2024. This is due to the increased demand from media and telecom firms for comprehensive, seamless streaming technology. Japanese companies have begun outsourcing content management, network oversight, encoding, and digital rights management to specialists to ensure optimal performance and scalability. Managed service providers offer cloud-powered CDN integration, consistent technical support, and user interfaces tailored for the diverse Japanese population. Furthermore, the segment growth is reinforced by Japan's rapid 5G deployment and the adoption of edge computing, creating a more favorable environment for outsourced video systems.

The training & support segment is expected to grow at a significant CAGR during the forecast period, driven by the expanding array of digital media platforms and heightened competition in the streaming landscape. Organizational leaders are prioritizing increased employee training, particularly in OTT platform management, audience monitoring, content enhancement, and cyber security. This segment is expected to benefit from Japan's national initiatives to improve digital job skills under the "Digital Garden City Nation" plan by the Digital Agency. Moreover, service providers are ensuring the availability of Japanese language support for technical training and platform onboarding.

Revenue Model Insights

What Made Subscription the Dominant Segment in the Market in 2024?

The subscription segment dominated the Japan video streaming market with the biggest revenue share in 2024. This is due to the increased consumer preference for continuous access and ad-free experiences. Netflix, U-NEXT, Hulu Japan, and Amazon Prime Video gained subscribers by offering both international and domestic content, along with added incentives. The Japanese population demonstrated a willingness to pay a premium for uninterrupted access to their preferred content. Moreover, the segment saw further growth through multi-user family accounts and subscription plans tailored for mobile services.

The advertising segment is projected to experience the highest CAGR in the coming years, fueled by the proliferation of free ad-supported streaming TV (FAST) platforms and hybrid monetization strategies. Platforms like TVer and AbemaTV are anticipated to attract a larger audience through their localized content offerings and free access, with ads targeted at specific consumer segments. Advancements in programmatic advertising and enhanced data analytics in Japan are expected to increase the relevance and effectiveness of advertisements, leading to increased investment by brands in digital media. Video platforms are favored by many advertisers for their reach among younger demographics who may have limited engagement with traditional television. Additionally, interactive formats, such as shoppable videos and ads with clickable overlays, are being integrated into smart TVs and mobile applications, enabling advertisers to maximize the return on their investments.

Deployment Type Insights

What Made Cloud the Dominant Segment in the Japan Video Streaming Market?

The cloud segment dominated the market in 2024, driven by the surge in digital content and the demand for scalable, efficient, and fast technology. Cloud computing enabled major streaming services in Japan, such as Hulu Japan, Netflix, and U-NEXT, to manage the significant increase in users. Cloud-native architecture facilitated real-time analytics, adaptive bitrate streaming, and reduced latency, enhancing user satisfaction. Furthermore, collaborations between Japanese broadcasters and Amazon Web Services and Google Cloud accelerated the segment's growth.

The on-premises segment is projected to experience rapid growth in the coming years. Industries like education and government media, which must adhere to specific regulations, increasingly favor on-premises deployment due to its emphasis on internal control. A recommended strategy involves content studios using on-premises solutions for editing and archiving while leveraging the cloud for distribution. Preference for self-reliance and stringent policies may drive the adoption of on-premises solutions, particularly in specialized scenarios, thereby supporting market growth. Moreover, on-premises deployment enables service providers to have foll control and provide enhanced security.

End-User Insights

Why did the Consumer Segment Dominate the Market?

The consumer segment dominated the Japan video streaming market in 2024, fueled by the rise of digital media consumption and the strong demand for mobile entertainment. Netflix, TVer, Amazon Prime Video, and U-NEXT gained many users by offering extensive libraries of anime, J-dramas, and international content tailored for Asian markets. According to the Ministry, 92% of Japanese internet users accessed video websites weekly in 2023. Moreover, the growing adoption of smart TVs and mobile devices has made them the primary way for people in Japan to consume media at home.

(Source: https://santandertrade.com)

The enterprises segment is expected to grow at a significant CAGR during the projection period, driven by the increasing use of video streaming in business communication, training, advertising, and events. Japanese businesses are likely to adopt advanced video technology for meetings, online product launches, and customer engagement as the hybrid working model gains traction. Across education, healthcare, and retail sectors, companies are planning to use reliable and scalable streaming services to broaden their reach. Japanese companies operating internationally are expected to adopt cloud solutions that offer analytics, real-time communication, and multilingual capabilities.

Geographical Insights

Kanto led the japan video streaming market, capturing the largest revenue share in 2024, due to its high population, advanced technology, and major city centers like Tokyo and Yokohama. The region's tech-savvy population frequently uses both paid and free online video platforms. Providers prioritized Kanto for the launch of new high-speed internet and 5G, ensuring seamless, high-quality video streaming across all devices.

Kansai is expected to grow at the fastest rate in the market during the forecast period, driven by a high number of people using digital media and ongoing city development projects. Improvements in new technology for delivering content are benefiting Osaka, Kyoto, and Kobe. The presence of numerous major universities and a large youth population is expected to increase demand for entertainment and educational content in local languages. Providers are planning to invest more in server nodes, enhance CDN performance, and offer regional language support to better serve Kansai users, further boosting market growth in this region.

Japan Video Streaming Market Companies

- Amazon Prime Video

- AbemaTV

- BANDAI NAMCO Arts

- dTV

- Gyazo

- Hulu

- LINE LIVE

- Netflix

- TVer

- Twitch

- Rakuten TV

- Niconico

- Paravi

- YouTube

Latest Announcement by Industry Leader

- In April 2025, Apple TV+ is now available in Japan and the Netherlands through Prime Video as an add-on subscription, expanding access to Apple's premium content library via Amazon's popular streaming platform. Until April 24, new and eligible returning customers can subscribe to Apple TV+ for a promotional rate of JPY 200 (€1.25) per month for the first three months. “We're delighted to continue the rollout of Apple TV+ on Prime Video, with the launches in Japan, India, and the Netherlands, bringing Prime Video customers an even greater selection of TV shows and films, all in one app experience,” said Kelly Day, Vice President of International at Prime Video. Keisuke Oishi, Country Manager of Prime Video Japan, added, “We are super excited to welcome Apple TV+ and its stellar content to Prime Video's extensive library in Japan. Prime members in Japan can now access Apple Originals through a simple add-on subscription, benefiting from streamlined content discovery, unified watchlists, and centralized billing.” He further emphasized Prime Video's evolution in Japan as a leading entertainment destination, highlighting its offering of local and international Originals, anime, movies, and a robust lineup of live sports programming.

(Source: https://www.advanced-television.com)

Recent Developments

- In April 2025, Paramount+, the international streaming platform from Paramount Global, expanded its footprint in Japan through a new partnership with Lemino, the streaming service operated by NTT Docomo. Under this agreement, Japanese consumers can now access Paramount+ via the Lemino Channel as an à la carte subscription, priced at JPY 770 ($5.40) per month. This initiative marks another strategic move by Paramount+ to strengthen its presence in the Japanese market. Previous partnerships include deals with J:COM, WOWOW Inc., and availability through Prime Video Channels. In addition, the company has recently secured a content licensing arrangement with Japan Airlines, allowing passengers to enjoy a curated selection of Paramount+ titles as part of the airline's in-flight entertainment offerings. (Source: https://www.mediaplaynews.com)

- In June 2024, Rakuten Group, Inc. unveiled Rakuten PLAY, a new content discovery platform designed to aggregate and recommend video content from Rakuten TV and other major video-on-demand services across Japan. Rakuten PLAY, offered as a free service, helps users explore a broad selection of content, including movies, dramas, and anime, through editorial recommendations and an Overall Content Ranking system derived from user surveys. Subscribers who sign up for paid streaming services via Rakuten PLAY also receive Rakuten Points as part of a loyalty rewards program, further enhancing user engagement. (Source: https://global.rakuten.com)

Also in June 2024, Brightcove Inc., a global leader in streaming technology, announced a new partnership with JCOM Co., Ltd., Japan's largest cable television provider. Under this collaboration, Brightcove powers Ikimono Watch (“Animal Watch”), JCOM's latest streaming initiative featuring content from zoos and aquariums throughout Japan. Brightcove's streaming platform was selected for its scalability, reliability, and security, positioning it as a key technology partner for JCOM's expanding digital offerings. (Source: https://www.brightcove.com)

Segments Covered in the Report

By Streaming Type

- Live Video Streaming

- Non-Linear Video Streaming

By Component (USD)

- Software

- Content Delivery Services

By Solutions

- Internet Protocol TV

- Over-the-Top (OTT)

- Cable TV

- Pay-TV

By Platform

- Gaming Consoles

- Laptops & Desktops

- Smartphones & Tablets

- Smart TV

By Service

- Consulting

- Managed Services

- Training & Support

By Revenue Model

- Advertising

- Rental

- Subscription

By Deployment Type

- Cloud

- On-Premises

By End User

- Enterprise

- Consumer

Get a Sample

Get a Sample

Table Of Content

Table Of Content