Labeling Services Market Size and Forecast 2025 to 2034

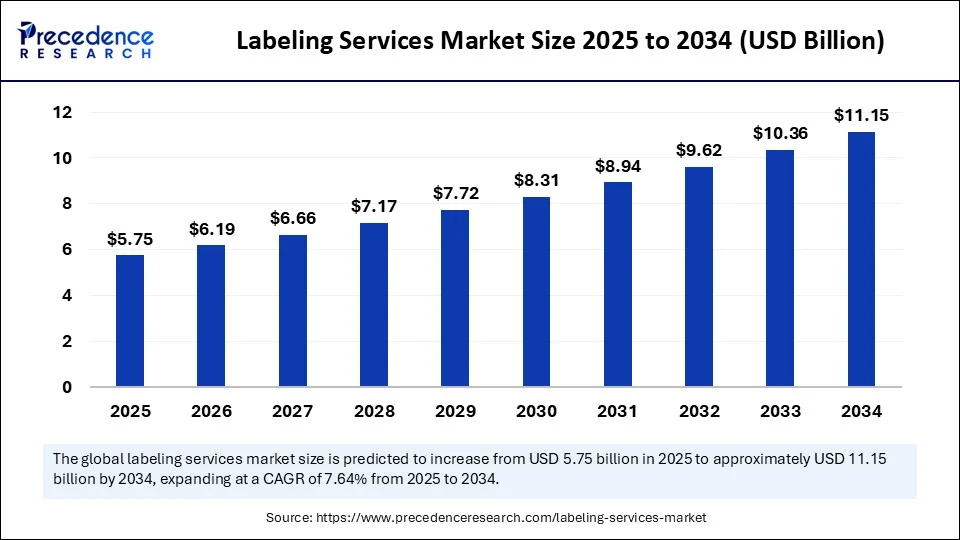

The global labeling services market size was calculated at USD 5.34 billion in 2024 and is predicted to increase from USD 5.75 billion in 2025 to approximately USD 11.15 billion by 2034, expanding at a CAGR of 7.64% from 2025 to 2034. The labeling services market is growing due to the rising demand for product information.

Labeling Services Market Key Takeaways

- In terms of revenue, the global labeling services market was valued at USD 5.34 billion in 2024.

- It is projected to reach USD 11.15 billion by 2034.

- The market is expected to grow at a CAGR of 7.64 % from 2025 to 2034.

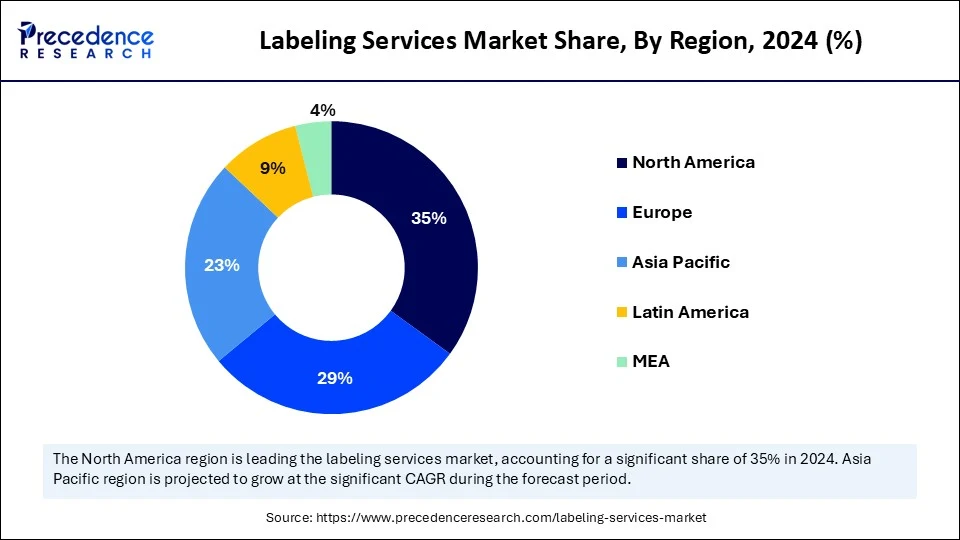

- North America dominated the labeling services market with the largest share of 35% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR during the forecast period.

- By service type, the custom labeling solutions segment led the market in 2024.

- By service type, the regulatory & compliance labeling segment is expected to grow at the fastest CAGR in the coming years.

- By end use, the food & beverages segment held the biggest market share in 2024.

- By end use, the pharmaceuticals segment is expected to expand at the fastest CAGR during the projection period.

How is Artificial Intelligence Transforming the Labeling Services Market?

The integration of AI in labeling services drives the market's growth, as AI-driven systems rapidly identify discrepancies and ensure that all labeling complies with modern regulations, thereby reducing the challenges of expensive recalls and compliance risks. AI is significantly speeding up the labeling process. AI-powered automation streamlines labeling processes, reducing human errors. AI automates various tasks in labeling processes, enabling the design, printing, and applying labels with minimal human intervention.

With the healthcare industry facing stringent regulatory requirements, AI-based solutions ensure that labels are not only accurate but also compliant with modern legal and marketing standards. This is particularly rigorous in sectors where labeling mistakes have serious implications for patient safety. AI-driven technology automates the artwork creation process, enabling the dynamic construction of labels by pre-approved content. This reduces the need for manual input, allowing designers to focus on creative aspects and thereby increase productivity. The rapid advancement of artificial intelligence (AI) is transforming various sectors, including the pharmaceutical regulatory labeling sector. As AI technologies become integrated into artwork and labeling management, they promise to improve efficiency, compliance, and accuracy in an industry where precision is paramount.

U.S. Labeling Services Market Size and Growth 2025 to 2034

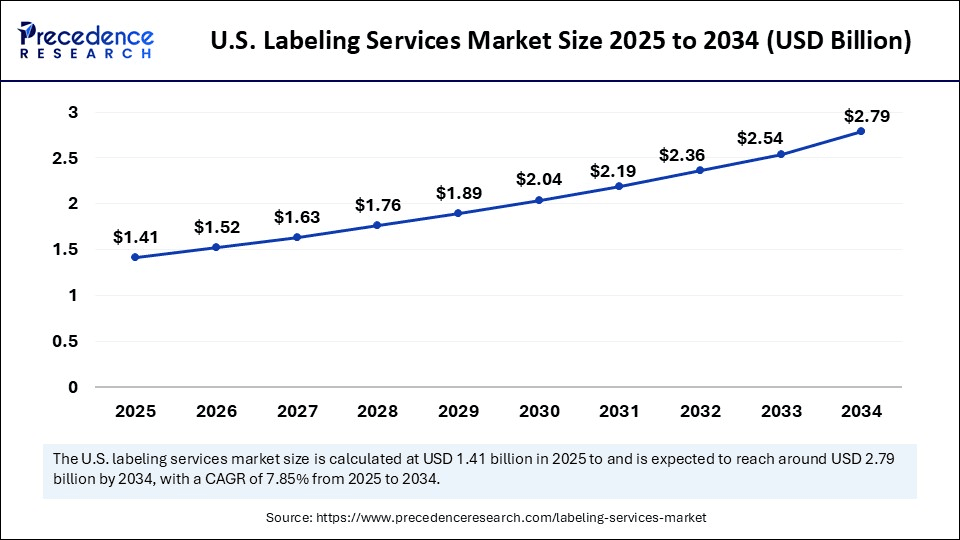

The U.S. labeling services market size was exhibited at USD 1.31 billion in 2024 and is projected to be worth around USD 2.79 billion by 2034, growing at a CAGR of 7.85% from 2025 to 2034.

What Made North America the Dominant Region in the Market?

North America dominated the labeling services market by capturing the largest share in 2024. This is mainly due to stringent regulations regarding the safety of consumer goods. The region has a strong manufacturing base across various industries, including food & beverages, pharmaceuticals, and consumer goods, which are investing heavily in labeling solutions due to stringent regulations. There is a strong emphasis on improving supply chain visibility and transparency, boosting the need for smart labels. The presence of major labeling service providers also strengthened the region's market position.

Why is Asia Pacific Emerging as the Fastest-Growing Market for Labeling Services?

Asia Pacific is expected to experience the fastest growth during the forecast period, driven by the increasing manufacturing of consumer goods, particularly in countries such as India and China. As people have become more aware of product safety, they are increasingly seeking clean-label products, encouraging various industries, especially consumer goods, pharmaceuticals, and food & beverages, to invest in labeling services. Moreover, the rising adoption of advanced labeling solutions like digital printing and RFID is likely to drive market growth.

- In January 2025, Avery Dennison South Asia, a global leader in materials science and packaging solutions, announced the launch of its Premium Labels range. This novel offering includes a portfolio of textured substrates for premium labeling, specifically designed to elevate consumer experiences with unique surface textures and patterns.

(Source: https://www.business-standard.com)

Market Overview

The labeling services market is experiencing rapid growth due to increasing regulatory requirements across various industries. Labeling provides critical information about the product, including its ingredients, expiration date, manufacturing date, usage instructions, nutritional value, and other relevant details. This data supports consumers in making well-versed decisions, particularly when they have dietary restrictions, allergies, or other health challenges. Labeling is a potent element in driving market success. Labeling communicates significant information about the product to the consumer, enhances awareness, and improves customer satisfaction.

What are the Major Factors Boosting the Growth of the Labeling Services Market?

- Technological innovations are boosting the growth of the market. Automation and AI-driven technology are revolutionizing the data labeling process by making it faster, more precise, and more affordable. AI-based annotation tools currently offer advanced features, such as pre-labeling, auto-labeling, and smart predictions, which potentially reduce the manual effort required for labeling complex datasets.

- Advancements in printing technology have made customized and on-demand labeling cost-effective and accessible. Digital printing offers superior flexibility in label design, enabling short runs and variable data printing, which drives market growth.

- The growth of the e-commerce sector and the growing need to improve supply chain transparency are boosting the growth of the market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 11.15 Billion |

| Market Size in 2025 | USD 5.75 Billion |

| Market Size in 2024 | USD 5.34 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.64% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, End Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Demand for Product Information

The rising demand for product information drives the growth of the labeling services market. Consumers are seeking comprehensive details about products, including ingredients, origin, and usage instructions, which must be accurately and legibly displayed on labels. This encourages businesses to invest in high-quality labeling solutions that can accommodate detailed information while maintaining visual appeal. Furthermore, stringent regulatory requirements across various industries necessitate precise and compliant labeling, driving demand for specialized labeling services. As consumers become more informed and regulations tighten, the need for professional labeling services will continue to grow, ensuring products meet both consumer expectations and legal standards.

Restraint

Challenges in Labeling Operations

Despite the growing demand for high-quality labeled data, several critical restraints challenge the scalability and efficiency of data labeling initiatives. Common challenges include ambiguity in annotations, high manual labor costs, and a shortage of domain-specific expertise. The absence of robust tools to handle large-scale labeling workflows further impedes progress. Moreover, regulatory compliance poses significant constraints on the labeling services market.

Opportunity

Rising Demand for Smart Labels

The rising demand for smart labels presents a substantial opportunity for the labeling services market, enhancing the way products communicate with consumers and healthcare providers. Smart labels, which incorporate technologies such as RFID and NFC, offer enhanced product tracking, authentication, and consumer engagement capabilities. As businesses strive to enhance supply chain visibility, combat counterfeiting, and deliver interactive experiences, the adoption of smart labels is increasing. As digital health solutions continue to gain momentum, smart labels offer a strategic advantage by enhancing patient adherence, promoting deeper engagement, and driving improved health outcomes, thereby positioning pharmaceutical organizations to lead in the evolving digital healthcare sector.

Service Type Insights

Why Did the Custom Labeling Solutions Segment Dominate the Labeling Services Market in 2024?

The custom labeling solutions segment dominated the market with the largest share in 2024. This is primarily due to the growing demand for personalized labeling solutions that meet specific customer needs and enhance brand differentiation. Using custom labels on products is a simple and affordable way to make them stand out. They're also great for branding, marketing, and advertising. The custom labels on products make it easy for customers to select what they choose. It gives consumers the independence to use whatever designs, text, and images they want. Custom labels are also important for branding purposes.

The regulatory & compliance labeling segment is expected to grow at a significant rate in the upcoming period due to stringnet regulations across various industries. This mandates precise labeling to ensure consumer safety. This is particularly important in avoiding costly penalties associated with non-compliance. Many patients experience adverse reactions or allergies to certain foods or cosmetics; therefore, labeling regulations are crucial for ensuring that individuals know what they are consuming and whether the products can be consumed safely.

End Use Insights

How Does the Food & Beverages Segment Dominate the Labeling Services Market in 2024?

The food & beverages segment dominated the market, holding the largest share in 2024, as accurate labeling is crucial for ensuring food compliance, safety, and brand differentiation. Labeling permits customers to know exactly what ingredients are in the food products they're buying. By integrating informational labels, beverage and food organizations can build trust with their consumers and distinguish themselves from competitors who do not prioritize transparency. Labels enable corporations to showcase the unique benefits and features of their products, such as sustainable sourcing or organic ingredients, which can help them stand out in a crowded marketplace.

The pharmaceutical segment is expected to grow at the fastest rate over the forecast period. This is mainly due to stringent regulations regarding the safety and efficacy of pharmaceutical products. This encourages the pharmaceutical industry to invest heavily in labeling solutions. Labeling also improves patient engagement and trust in products, encouraging repeat purchases. Digital labeling enables the easy accessibility of information to healthcare professionals, patients, and regulatory agencies. This accessibility can improve patient safety by providing accurate and up-to-date information about medications. Labeling allows better tracing and tracking of pharmaceutical products through the supply chain.

Labeling Services Market Companies

- Celegence

- Freyr Solutions

- TransPerfect

- FineLine

- Resource Label Group

- General Data Company, Inc.

- Arrow System Inc.

- Tailored Label Products, Inc

Recent Developments

- In May 2025, Loftware, announced the availability of their cloud-connected label printing solution for AEP-equipped SATO printers. This comes at a time when the adoption of cloud-based technologies is on the rise, with the Loftware/SATO partnership supporting this shift to streamline business processes and enhance supply chain agility.

(Source: https://www.loftware.com) - In April 2025, UPM Raflatac becomes the first labeling business to provide product footprints in consumer quotes. These product footprints, known as product passport prototypes (PPPs), provide label converters with transparent environmental data, supporting them to make informed material choices.

(Source: https://www.upmraflatac.com) - In October 2023, BNY Mellon announced the launch of LiquidityDirect's novel White Labeling service offering, providing financial institutions with a liquidity management solution for their end clients. Financial institutions seeking to include short-term funds in their suite of offerings currently leverage LiquidityDirect's services and technology to offer a seamless user experience through a single sign-on for their clients.

(Source: https://www.bny.com) - In May 2024, Omnia Technologies, a leading platform for automation and bottling technologies for the spirits, wine, beverage, dairy, and pharma industries, launched a novel high-speed beverage division focused on bottling-labeling-packaging tools through the acquisitions of ACMI, SACMI Beverage, and SACMI Labeling.

Segments Covered in the Report

By Service Type

- Custom Labeling Solutions

- Regulatory & Compliance Labeling

- Others

By End Use

- Food & Beverages

- Pharmaceuticals

- Consumer Goods

- Chemicals & Industrial

- Automotive & Electronics

- Others

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Get a Sample

Get a Sample

Table Of Content

Table Of Content