Laser Welding Machine Market Size and Forecast 2025 to 2034

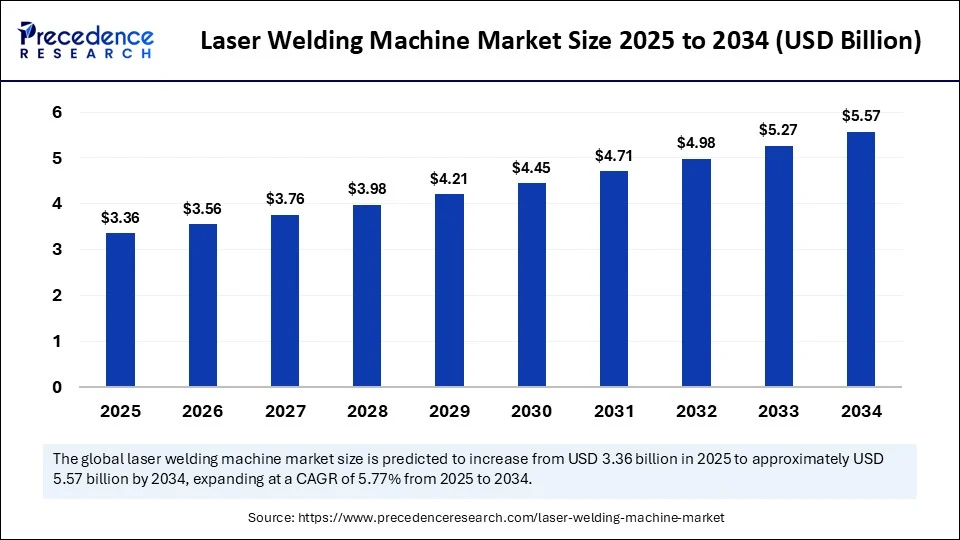

The global laser welding machine market size accounted for USD 3.18 billion in 2024 and is predicted to increase from USD 3.36 billion in 2025 to approximately USD 5.57 billion by 2034, expanding at a CAGR of 5.77% from 2025 to 2034.The market growth is attributed to increasing industrial automation, rising demand for precision welding in advanced manufacturing, and growing adoption of lightweight materials across end use industries.

Laser Welding Machine MarketKey Takeaways

- In terms of revenue, the global laser welding machine market was valued at USD 3.18 billion in 2024.

- It is projected to reach USD 5.57 billion by 2034.

- The market is expected to grow at a CAGR of 5.77% from 2025 to 2034

- Asia Pacific dominated the market with the largest share in 2024 and is expected to sustain its growth trajectory from 2025 to 2034.

- By laser type, the fiber laser segment held a major market share in 2024 and is projected to grow at a significant CAGR between 2025 and 2034.

- By operation mode, the automatic segment contributed the biggest market share in 2024.

- By technology, the keyhole welding segment dominated the market in 2024.

- By technology, the hybrid welding segment is expected to grow at a significant CAGR over the projected period.

- By application, seam welding segment dominated the market with the largest share in 2024.

- By application, hybrid welding segment is expected to grow at a significant CAGR from 2025 to 2034.

- By end-use industry, the automotive segment held the largest market share in 2024.

- By end-use industry, the electronics & semiconductor segment is projected to grow at the highest CAGR between 2025 and 2034.

- By power output, the 1 kW to 5 kW segment held a major market share in 2024.

- By power output, the above 5 kW segment is projected to grow at the fastest CAGR between 2025 and 2034.

- By machine type, the robotic laser welding segment contributed the biggest market share in 2024.

- By machine type, the handheld laser welding segment is expanding at a significant CAGR between 2025 and 2034.

- By sales channel, the direct sales (OEM) segment dominated the market in 2024.

- By sales channel, the online platforms segment is expected to grow at a significant CAGR over the projected period.

Impact of Artificial Intelligence on the Laser Welding Machine Market

Artificial intelligence (AI) is enhancing the capabilities of laser welding machines, making them more intelligent, efficient, and adaptive. Most manufacturing giants have enhanced these machines with AI-based sensors and vision systems, which enable them to monitor and self-correct in real-time during welding. AI offers the opportunity to dynamically adjust laser parameters, ensuring the consistency of weld quality and reducing defects. Furthermore, predictive maintenance also enhances equipment utilization life and minimizes operation costs by identifying any possible machine faults before they result in loss of plant operation.

Market Overview

The laser welding machine market refers to the global industry for machines that utilize a laser beam to join pieces of metal or thermoplastics with high precision and speed. These machines focus a highly concentrated heat source, allowing for deep, narrow welds and minimal thermal distortion. Laser welding is widely adopted in industries requiring high strength, precision, and automation, such as automotive, aerospace, electronics, medical devices, and heavy machinery.

Laser welding machines come in various configurations, including manual, semi-automatic, and fully automated systems, and operate with different laser sources such as fiber, COâ‚‚, and solid-state lasers. The increase in demand for automation in manufacturing is likely to have a significant impact on the use of laser welding machines across various industries. It is favorable in applications that demand precise joining under repeated conditions at the microscopic level.

In 2024, the International Federation of Robotics (IFR) announced that robot installations in industry increased globally by 7% compared to the previous year, with laser-based welding robots playing a key role in the automotive, electronics, and metalworking industries. Furthermore, the initiated localized production and digital industrial policies further boosted the demand for advanced laser-based systems.

(Source:https://ifr.org)

Laser Welding Machine MarketGrowth Factors

- Rising Demand for Battery Manufacturing Efficiency: Surging electric vehicle production is fueling the need for precise and high-speed laser welding in battery module and pack assembly.

- Boosting Integration with AI and IoT Technologies:The growing adoption of AI-driven process controls and Internet of Things-enabled monitoring systems is enhancing the efficiency and intelligence of laser welding operations.

- Growing Emphasis on Export-Oriented Manufacturing:Policy-driven industrial expansion in export-heavy economies is driving demand for high-throughput laser welding technologies.

- Increasing Demand for Wearable and Flexible Electronics: Rising production of compact and bendable electronic components is boosting the need for micro-precision welding capabilities.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 5.57 Billion |

| Market Size in 2025 | USD 3.36 Billion |

| Market Size in 2024 | USD 3.18 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.77% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Laser Type, Operation Mode, Technology, Application, End-Use Industry,Power Output, Machine Type, Sales Channel and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How is the Shift Toward Smart Automation Fueling the Adoption of Laser Welding Systems?

Increasing adoption of automation in manufacturing processes is expected to drive the market. Rising implementation of automation in industrial procedures is likely to spur the need for laser welding units. The automotive, electronic, and aerospace sectors are highly dependent on automation to improve production speed and consistency. Such automation requirements are met by laser welding machines that feature sophisticated integrated control systems, high welding speeds, zero contact, and reliable welds.

A global record of more than 4,281,585 units operating in factories worldwide was reported by the International Federation of Robotics (IFR) in 2024, and the number of robotic welding applications swelled in Asia, Europe, and North America. Major vendors, such as Trumpf or IPG Photonics, presented new laser welding systems with highly advanced AI features in 2024 that must be self-adjustable in real-time and also predict the condition of the laser welding process. Furthermore, the demand for laser-based automation solutions increased sharply due to the necessity of scalable precision processes in battery and electronic manufacturing, thus boosting the market.

- In April 2025, Bodor launched its ECO Series handheld laser welding machine, offering full-rated power, faster welding speeds, and up to 50% labor cost savings. Designed for smart, efficient, and automation-ready manufacturing.

(Source: https://ifr.org)

Restraint

High Initial Investment Requirements Limit Adoption Among Smaller Manufacturers

The high initial investment required for laser welding machines is expected to limit adoption among small and medium-scale manufacturers, thus hindering market growth. Initial capital expenditure for installing laser welding machines is high and includes high-precision laser creation, cooling, combined robotics, and safeguarded chambers. A limited budget and a lack of expected returns on investment cause many SMEs to avoid adopting modern welding methods. Moreover, the cost acts as a deterrent to mass rollout, especially in emerging nations where there is still little resource deployment, further hampering the market expansion.

Opportunity

Why are Fiber Lasers Emerging as a Game-Changer in Industrial Welding Applications?

A high focus on precision engineering and product miniaturization is likely to increase the deployment of laser-based joining techniques, further creating immense opportunities for the market in the coming years. The medical devices, consumer electronics, and semiconductor industries require welds that are micron-precise and have small heat-affected zones. These requirements are achieved using laser welding machines, especially those that have been combined with real-time monitoring and beam steering technologies.

By 2024, Fraunhofer ILT reported that in Germany, companies had adopted ultrafast pulsed lasers in micro-welding to facilitate assembly at the chip level in miniaturized devices. Furthermore, the spurring advancements in fiber laser technology are estimated to enhance system performance and fuel market expansion.

(Source: https://www.ilt.fraunhofer.de)

Laser Type Insights

Why Did the Fiber Laser Segment Lead the Market in 2024?

The fiber laser segment dominated the laser welding machine market in 2024 and is expected to sustain its upward trajectory during the forecast period. This is primarily due to its enhanced beam quality and energy efficiency, as well as its flexibility for use in various industrial processes. The automotive, electronics, and aerospace industries have found favor in fiber lasers as suppliers, as they are seeing a reduction in defects in the welding process due to their high precision and low distortion.

Fiber lasers are more cost-effective in the long term, as they require less maintenance and do not necessitate frequent adjustments, unlike CO2 or solid-state lasers. The Fraunhofer Institute for Laser Technology (ILT) industry reports forecast a significant shift in the direction of fiber lasers, driven by their compact size and ease of integration. Furthermore, the ongoing innovation in laser source technology and the need to adapt to Industry 4.0 practices further facilitate the segment's growth.

Operation Mode Insights

What Made Automatic Operation the Dominant Segment in the Laser Welding Machine Market in 2024?

The automatic segment dominated the market with the largest revenue share in 2024 and is likely to grow at the fastest rate in the upcoming period. This is mainly due to the increased dependency on precision-based and high-speed welding during mass production. Automotive, electronic, and metal fabrication manufacturers preferred fully automated laser welding systems, as they eliminated the potential for human error, ensured consistency, and achieved high throughput rates. Such systems were compatible with robotization and AI-based control units as per the expectations of a smart factory.

The International Federation of Robotics (IFR) report indicates that industrial automation applications reached new heights in 2024, with laser manufacturing being one of the most widely implemented processes in assembly-line automation upgrades. Automation companies, including FANUC, ABB, and Siemens, expanded their portfolios in this area, which endorsed the supremacy of automated systems in operations involving multiple welding tasks. Additionally, the growing demand for laser-welding machines is expected to drive error-free, scalable, and energy-efficient operations, further propelling the segment.

Technology Insights

How Does Keyhole Welding Become the Most Trusted Technique?

The keyhole welding segment dominated the laser welding machine market in 2024. Keyhole laser welding gained immense popularity in industries such as automotive, manufacturing, shipbuilding, and heavy machinery, as it is most suitable for joining thick metals that have high structural strength. The method formed a vapor hole, which enabled the laser beam to penetrate deeply into the material, resulting in strong welds in a few passes. Moreover, AWS also mentioned the higher usage of keyhole methods in EV chassis and structural frame assembly lines, thus boosting the segment.

The hybrid welding segment is expected to grow at the fastest rate in the coming years, owing to its precision and flexibility. Hybrid laser welding combines the deep penetration of laser beams and the filler of arc welding processes. This technology is used in complex joints and materials of different natures, as well as those members that have a greater opening tolerance. Moreover, the European Commission included hybrid welding R&D funding under its Horizon Europe program to focus on advanced manufacturing in the aerospace industry, thus further creating demand for the laser welding machine market.

Application Insights

Why Did the Seam Welding Segment Dominate Laser Welding Machine Market in 2024?

The seam welding segment held the largest revenue share in the laser welding machine market in 2024, primarily due to its key role in the continuous solid high-strength joining of long metal pieces, particularly in the automotive and battery manufacturing industries. Additionally, industry leaders such as Han Laser, IPG Photonics, and Bystronic have launched futuristic seam welds that utilize AI-driven path tracking, further fueling segment growth.

The hybrid welding segment is expected to grow at the fastest CAGR in the coming years, owing to its flexibility in handling a variety of materials and joint designs, as well as its ability to bridge large gaps with a high degree of tolerance. Hybrid welding combines high penetration and rapid laser welding capabilities with the filler metal of the arc welding process in various applications. Furthermore, the International Institute of Welding (IIW) noted that there has been further adoption of hybrid welding technologies in Europe and Asia to address joining and welding challenges in multi-metal and thick-section manufacturing.

End-Use Industry Insights

What Made the Automotive Industry the Major End-User of Laser Welding Machines?

The automotive segment dominated the laser welding machine market in 2024, driven by the increased demand for structural and safety-relevant parts in the automotive sector that are served by laser welding technology. Car manufacturers use laser welding to create lightweight structures, such as body frames, powertrain components, and battery housings, with high precision dimensional capability. The technology enabled high-speed, automated welding of new materials, such as aluminum and high-strength steels, which facilitated reduced vehicle weight while meeting crash performance requirements.

The International Institute of Welding (IIW) and VDMA reported that major OEMs and Tier 1 suppliers increased their laser welding capacity in 2024, particularly on electric vehicle platforms and modular production assembly lines. Integrated robotic laser welding system manufacturers, such as Mitsubishi Electric, Trumpf, and Panasonic, have launched their solutions in the automotive manufacturing sector, further strengthening the leading role of the segment.

The electronics & semiconductors segment is expected to grow at the fastest rate over the projection period. The segment growth is attributed to the increased requirements in the industry to eliminate welding tolerance at femto- and nano-levels in high-performance applications that are also of small size. Moreover, the Chips Act was released by the European Commission to increase local high-tech semiconductor production, which further strengthens the domestic demand for high-precision laser welding systems.

Power Output Insights

Why Did the 1 kW to 5 kW Segment Dominate the Market in 2024?

The 1 kW to 5 kW segment led the laser welding machine market in 2024, with the largest revenue share, as this range strikes a balance between power, efficiency, and versatility in medium-duty industrial applications. Such a range is the preferred option in industries where high precision and moderate penetration proficiency are of paramount importance. Furthermore, most installations of production lines that dealt with EV battery modules and consumer electronics casings were conducted in the range of 1 to 5 kW, thereby facilitating segment expansion.

The above 5 kW segment is expected to grow at the fastest CAGR in the coming years, owing to its applicability in deep-penetration and high-speed welding in heavy-duty systems. Demand in the shipbuilding, aerospace, and structural steel markets would drive this segment, especially thick-section welding, as higher energy density would yield stronger welds and shorten the cycle time. Additionally, the demand for high-power laser welding platforms is expected to meet stringent delivery deadlines and stronger infrastructure requirements, thereby driving the segment in the coming years.

Machine Type Insights

How Does the Robotic Laser Welding Segment Dominate the Laser Welding Machine Market in 2024?

The robotic laser welding segment dominated the market in 2024 due to the increased need for automation, precision, and repeatability in high-volume production facilities. Car, aircraft, and heavy equipment manufacturers are increasingly investing in robotic laser systems to perform faster cycle times and minimal defects. These robots were equipped with sophisticated weld trajectories and dynamic drive control and were ideal for participating in activities that required constant procedures throughout extended manufacturing processes.

The International Federation of Robotics (IFR) and VDMA reported the surge in robotic installations for welding in 2024, especially in European and Asian factories that produce EVs and metal body parts. Increasing adoption of robotic laser welders in U.S.-based automotive factories, especially for the welding of lightweight materials in the vehicles of electric vehicles. Furthermore, the increase in Japanese automotive exports with the inclusion of robot laser welds highlights the centrality of automation in competitiveness in the international market.

The handheld laser welding segment is expected to grow at the fastest CAGR in the coming years, owing to the growing popularity of mobile welding systems in small-scale manufacturing units and repair/maintenance facilities. Compared to fixed robotic systems, the handheld form enables on-site repairs, special metalworking, and mobile welding in inaccessible regions. Moreover, the growing adoption of handheld laser systems in small and medium-sized enterprises further fuels segment growth.

Sales Channel Insights

What Made Direct Sales the Dominant Segment in the Market?

The direct sales (OEM) segment dominated the market, accounting for the largest revenue share in 2024, driven by the increased popularity of customized solutions, technical consultations, and long-term service agreements. Manufacturers, such as Trumpf, Coherent, and AMADA, created global technical sales offices and demo centers regionally to support industrial clients on-site with testing and pre-installation. Direct sales enable manufacturers to expand their reach. Additionally, the improved after-sales services and extended cooperation in system improvements and process improvement further boost the utilization of OEM lease welding machines technology.

The online platforms segment is expected to grow at the fastest rate in the coming years due to the digitalization of industrial procurement and the increasing adoption of e-commerce in the exchange of capital equipment. In 2025, the World Economic Forum (WEF) also emphasized that the digital model of sales has a positive impact on market penetration for smaller producers and reduces distribution expenses. Additionally, the digital model of sales positively affects market penetration by smaller producers and reduces distribution expenses, thus further fueling the online channel segment.

(Source: https://www.weforum.org)

Regional Insights

Why is Asia Pacific Leading the Laser Welding Machine Market?

Asia Pacific dominated the laser welding machine market, capturing the largest revenue share in 2024, and is expected to sustain its leadership in the coming years. This is mainly due to its well-established manufacturing landscapes and long-term government investments in automation technology. Countries such as China, Japan, South Korea, and India have actively invested in the infrastructure of smart factories and precise metalworking processes, facilitating the widespread implementation of laser welding systems across numerous industries. The growing need for customized laser welding equipment further supports regional market growth.

Companies such as Han Laser, Mitsubishi Electric, and Trumpf China increased their local production and application centers accordingly. In 2024, the International Institute of Welding (IIW) and the German industry association VDMA reported that the Asia Pacific accounted for a significant share of new installations of robotic welding systems. This technology has been utilized to address the growing electric vehicle manufacturing sector and the increased capacity to produce semiconductors throughout China and Southeast Asia. Additionally, the region is expected to sustain the same market growth due to a combination of rising domestic consumption, export-oriented industry policies, and robust technology penetration in Industry 4.0.

(Source: https://ifr.org)

Laser Welding Machine Market Companies

- ALPHA LASER GmbH

- AMADA Co., Ltd.

- Bystronic Group

- Coherent Corp.

- DILAS Diode Laser, Inc.

- Emerson Electric Co.

- FANUC Corporation

- Han's Laser Technology Industry Group Co., Ltd.

- IPG Photonics Corporation

- Jenoptik AG

- LaserStar Technologies Corporation

- Miyachi Unitek Corporation (Amada Miyachi)

- Panasonic Corporation

- Precitec Group

- Rofin-Sinar Technologies Inc. (now part of Coherent)

- Sahajanand Laser Technology Ltd (SLTL)

- Scantech Laser Pvt Ltd.

- TLM Laser Ltd

- TRUMPF Group

- Wuhan Golden Laser Co., Ltd.

Recent Developments

- In May 2025, DMK Laser introduced its next-generation handheld laser welding machine, combining advanced performance with a bold, modern design. Featuring a vivid yellow casing, streamlined contours, and a compact form, the upgraded unit enhances weld quality while providing a more convenient and efficient experience for field professionals.

- In May 2024, Emerson unveiled the Branson GLX-1 Laser Welder, designed to address rising demand for intricate, small, or sensitive plastic components. Its compact footprint and modular structure support ISO-8 cleanroom use, while an integrated automation controller simplifies setup and compatibility with robotic production lines.

- In October 2024, Canada-based Laserax launched a new laser welding system for battery cells, developed using machine vision software from Germany's MVTec. The machine improves welding efficiency for current collectors and busbars in battery modules, supporting applications in EVs, AGVs, e-bikes, and power tools through high-speed, automated processes.

(Source: https://www.laserdmk.com)

(Source: https://www.thefabricator.com)

(Source: https://www.emerson.com)

(Source: https://chargedevs.com)

Latest Announcement by Industry Leader

- In April 2025, Bodor ECO Series launched handheld laser welding machine, which delivers full-rated power, increased welding speeds, and up to 50% savings in labor costs. Smart, efficient, and built for automation-driven next-gen manufacturing. Bodor Laser, a global leader in laser cutting and welding technologies, proudly introduces its newest advancement — the ECO Series Self-Cooling Handheld Laser Welding Machine. Developed to address the changing needs of advanced manufacturing, the ECO Series combines power, efficiency, and cost control, redefining industry benchmarks in laser welding. “At Bodor, we strive to equip our customers with intelligent, dependable, and future-ready laser technologies. The ECO Series reflects that mission by making top-tier welding simpler and more affordable for manufacturers across all scales,” said Patrick, Product Manager at Bodor Laser.

(Source: https://www.bodor.com)

Segments Covered in the Report

By Laser Type

- Fiber Laser

- COâ‚‚ Laser

- Solid-State Laser

- Diode Laser

- Others

By Operation Mode

- Manual

- Semi-Automatic

- Automatic

By Technology

- Conduction Welding

- Keyhole Welding

- Hybrid Welding

- Heat Conduction and Penetration Welding

By Application

- Spot Welding

- Seam Welding

- Deposition Welding

- Hybrid Welding

- Others

By End-Use Industry

- Automotive

- Aerospace & Defense

- Electronics & Semiconductor

- Medical Devices

- Heavy Machinery

- Energy & Power

- Jewelry & Art

- Others

By Power Output

- Below 1 kW

- 1 kW to 5 kW

- Above 5 kW

By Machine Type

- Handheld Laser Welding Machine

- Robotic Laser Welding Machine

- Fixed/Stationary Laser Welding Machine

- Portable Laser Welding Machine

By Sales Channel

- Direct Sales (OEM)

- Distributors / Integrators / VARs

- Online Platforms

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting