Load Break Switch Market Size and Forecast 2025 to 2034

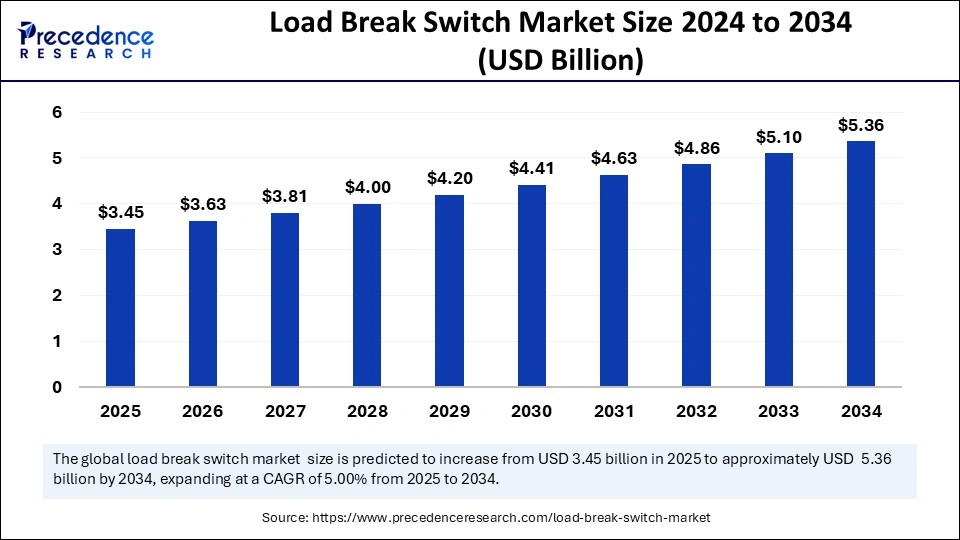

The global load break switch market size accounted for USD 3.29 billion in 2024 and is predicted to increase from USD 3.45 billion in 2025 to approximately USD 5.36 billion by 2034, expanding at a CAGR of 5% from 2025 to 2034. Rapid infrastructure development across the globe is the key factor driving the growth of the market. Also, the expansion of smart grid technology, coupled with the growing shift towards renewable energy sources, can fuel market growth further.

Load Break Switch Market Key Takeaways

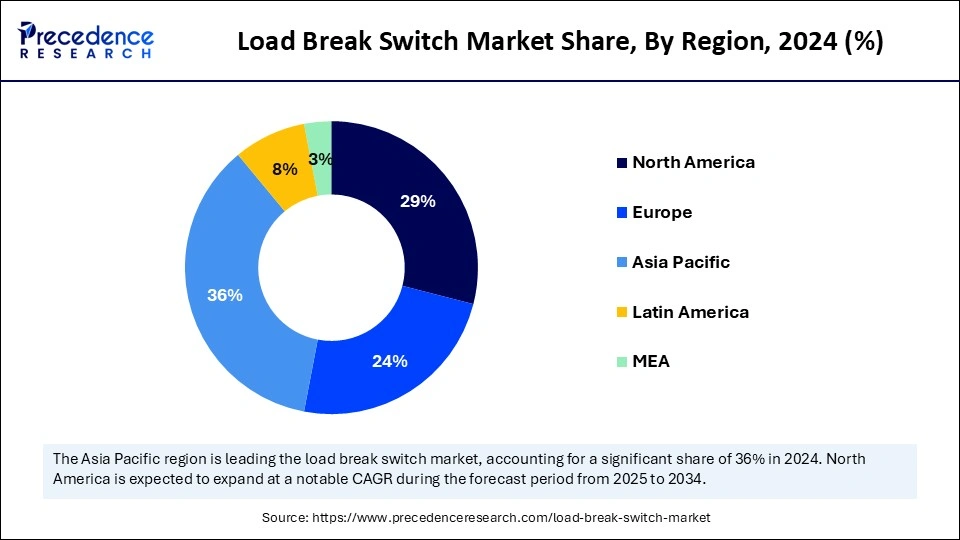

- Asia Pacific dominated the global market with the largest market share of 37% in 2024.

- North America is expected to grow at the fastest CAGR over the period studied.

- By type, the gas-insulated segment dominated the market in 2024.

- By type, the air-insulated segment is anticipated to grow at the fastest rate over the forecast period.

- By voltage, the 11-33 kV segment led the global market in 2024.

- By voltage, the 33-60 kV segment is anticipated to grow at the fastest rate over the forecast period.

- By installation, the outdoor segment held the largest share of the market in 2024.

- By installation, the indoor segment is estimated to grow at the fastest rate over the forecast period.

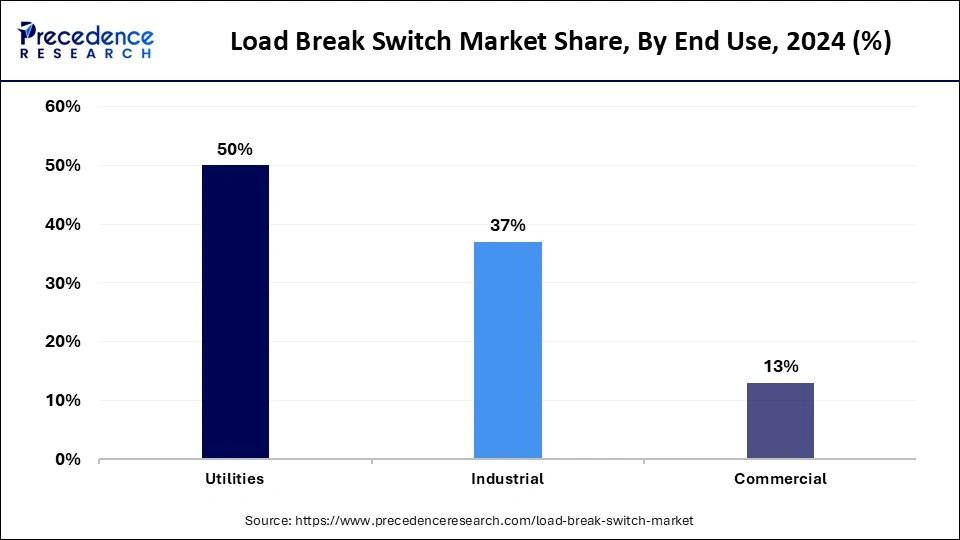

- By end use, the utilities segment accounted for the largest market share of 50% in 2024.

- By end use, the industrial segment is projected to grow at the fastest rate over the period studied.

Artificial Intelligence (AI) in Improving Load Break Switches

Artificial Intelligence is playing a transformative role in the load break switch market by improving the performance, efficiency, and reliability of the essential power grid components. AI-driven solutions can enhance predictive maintenance, bolster the development of new switch designs, and optimize grid operations, which can lead to a more efficient and resilient power grid. Furthermore, the growing digitalization of the power grid is fueling the adoption of AI-driven solutions for load break switches.

In November 2024, Hitachi Energy launched an AI tool to revolutionize renewable energy forecasting. Hitachi Energy's tool integrates grid performance data, market forecasts, and asset monitoring, all powered by machine learning to provide reliable forecasts.

Asia Pacific Load Break Switch Market Size and Growth 2025 to 2034

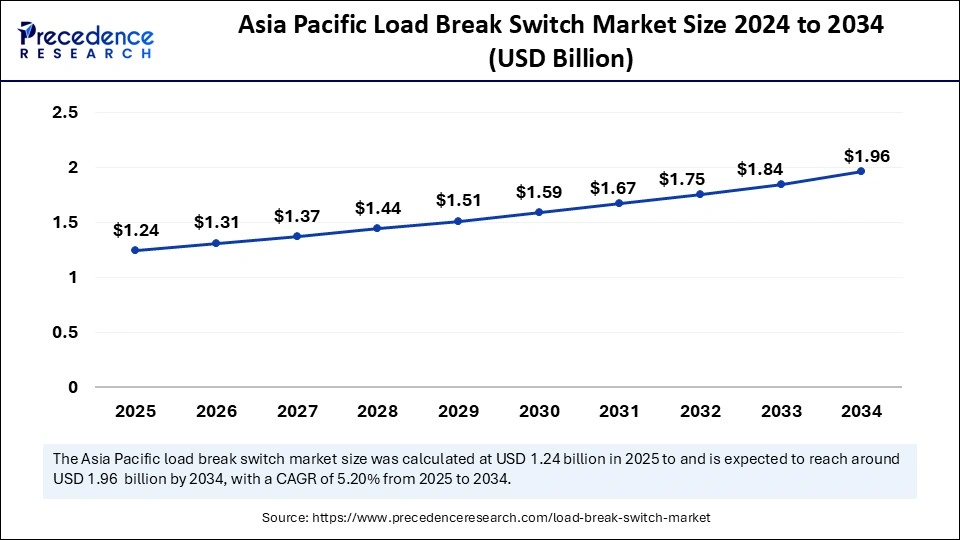

The Asia Pacific load break switch market size was exhibited at USD 1.18 billion in 2024 and is projected to be worth around USD 1.96 billion by 2034, growing at a CAGR of 5.20% from 2025 to 2034.

Asia Pacific dominated the load break switch market in 2024. The dominance of the region can be credited to the increasing demand for electricity and the rapid growth of power distribution networks. Furthermore, emerging economies such as China, Japan, and South Korea are substantially investing in renewable energy projects and infrastructure development. The surge in industrialization and rapid urbanization in the country are major factors for regional market growth.

In Asia Pacific, China dominated the load break switch market in 2024. The dominance of the region can be driven by a surge in population growth and expanding urban areas in the country. Moreover, China is heavily investing in power infrastructure development to fulfill the escalating demand for electricity.

North America is seen to grow at the fastest rate in the load break switch market during the forecast period. The growth of the region can be attributed to the increasing renewable energy adoption, coupled with grid modernization and the expansion of electric vehicle charging infrastructure. Moreover, regulatory mandates for enhanced safety standards and energy efficiency further boost the demand for these switches.

- In April 2024, Schneider Electric launched the EasySet MV switchgear, a compact, modular solution for medium-voltage distribution, designed for efficiency and flexibility.

In North America, the U.S. is a major contributor to the market owing to the strong emphasis on innovating the national grid and combining renewable energy sources. Also, government initiatives, like rural electrification projects, electrification programs, and grid modernization efforts, are fueling the market demand in the country.

Market Overview

A load break switch is capable of creating and breaking electrical connections while the current is passing, enabling reliable and safe switching under load conditions. The load break switch market focuses on the manufacturing and sale of electrical devices built to switch electrical circuits on and off, particularly for high and medium-voltage systems. These switches are important for separating and controlling electrical power in different applications such as industrial facilities, utilities, and renewable energy sectors.

Load Break Switch Market Growth Factors

- Ongoing government initiatives for power grid modernization are expected to boost the load break switch market growth shortly.

- The increasing need for efficient and compact switches in numerous applications can propel market growth further.

- The surge in investment in power distribution grids will likely contribute to the market expansion soon.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 5.36 Billion |

| Market Size in 2025 | USD 3.45 Billion |

| Market Size in 2024 | USD 3.29 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Voltage, Installation, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Increasing demand for industrial power

The growing need for effective, reliable, and efficient power distribution systems, particularly in commercial, industrial, and utility sector applications, is the major factor driving market growth. In addition, the expansion of infrastructure development along with the integration of renewable energy are impacting positive market growth. Utility companies across the globe are focusing on grid modernization projects, which can directly affect the deployment of innovative switchgear solutions.

- In April 2024, the Energy Management and Automation Group, Schneider Electric, launched two new entry-level market products – the GoPact Moulded Case Circuit Breaker (MCCB) and the Manual Transfer Switch (MTS). The products have been designed with the basic entry level of the market in mind, which requires robustness and reliability.

Restraint

Regulatory pressure

Governments across the globe are implementing stringent regulatory standards to promote electrical safety and energy efficiency, which affects the load break switch market growth negatively. However, these regulations also require the use of standard LBS to ensure reliable and safe power distribution. The market is also prone to logistics and supply chain issues, which negatively impact the availability and cost of finished products.

Opportunity

Government policies to innovate power distribution facilities

The Governments in various countries have launched many initiatives to innovate the country's power distribution infrastructure, hence creating lucrative opportunities in the market. Furthermore, the government's focus on reducing AT&C losses and improving overall operational efficiency has facilitated higher investments in the current infrastructure. The emphasis of the government on attaining an operationally efficient and financially viable distribution sector offers a necessary platform for market expansion.

Type Insights

The gas-insulated segment dominated the load break switch market in 2024. The dominance of the segment can be attributed to the superior performance and innovative features offered by this segment. Additionally, the increasing need for efficient, compact, and reliable power distribution options in industrial and urban settings where space is short is driving the segment's growth further. The government also focuses on upgrading current infrastructure to optimize modern systems.

- In March 2025, GE Vernova announced plans to expand its GE Saudi Advanced Turbines (GESAT) facility in Dammam to locally manufacture high-voltage gas-insulated switch gears.

The event coincided with GE Vernova's Global Supplier Partnership Summit, which convened more than 300 supplier organizations to strengthen supply chain resilience.

The air-insulated segment is anticipated to grow at the fastest rate over the forecast period. The growth of the segment can be credited to its environmentally friendly properties and low cost. These switches are becoming more popular because market players are increasingly focusing on sustainable solutions in industries. Also, their unique design and fewer maintenance requirements make them well-suited for industrial sites.

Voltage Insights

The 11-33 kV segment led the load break switch market in 2024. The dominance of the segment can be linked to the growing penetration of high voltage levels in industrial applications, power distribution networks, and commercial buildings. Moreover, a rising need for smart grids coupled with the integration of renewable fuels, the demand for 11-33 kV switches, particularly in semi-urban and urban areas, where control mechanisms are necessary.

The 33-60 kV segment is anticipated to grow at the fastest rate over the forecast period. The growth of the segment can be driven by increasing industrial demand for high-voltage transmission solutions. The increasing use of high-voltage substations, renewable energy sources, and smart grid technologies has raised the demand for the device in the foreseeable future.

Installation Insights

The outdoor segment led the load break switch market in 2024. The dominance of the segment is due to the growing need for reliable and robust electrical infrastructure in difficult environmental conditions. However, outdoor load break switches are important for grid reliability and resilience, used in substations, generally at remote load centers or high-voltage transmission lines, particularly in developing regions.

The indoor segment is estimated to grow at the fastest rate over the forecast period. The growth of the segment is owing to the increasing need for limited space power distribution & alternative current in industrial, commercial, and metropolitan infrastructure. Furthermore, the rising demand for smart energy management systems and sustainable building designs is further propelling segment growth.

End Use Insights

In 2024, the utilities segment dominated the load break switch market by holding the largest share. The dominance of the segment can be linked to the ongoing integration of renewable energy sources into the grid. The surge in demand for electricity leads to heavy investments in the current infrastructure to improve efficiency, reliability, and safety.Additionally, government initiatives and regulatory mandates aimed at enhancing energy efficiency and decreasing carbon emissions further boost segment growth.

The industrial segment is projected to grow at the fastest rate over the period studied. The growth of the segment can be driven by the increasing shift towards Industry 4.0, along with the rising adoption of smart manufacturing practices that need innovative electrical components that can facilitate operational safety and uninterrupted power supply. Hence, the need for load break and robust switches becomes more crucial, contributing to overall segment growth.

- In January 2025, Broadcom Inc. announced the availability of the Brocade G710 24-port 64G switch, the industry's most responsive and efficient top-of-rack SAN switch. Brocade Gen 7 Fibre Channel combines cyber-resilient and autonomous SAN technology into this cost-effective platform that seamlessly integrates into rack-based storage solutions.

Load Break Switch Market Companies

- Schneider Electric

- ABB

- Fuji Electric FA Components & Systems Co., Ltd.

- SOCOMEC

- Rockwell Automation

- ENSTO

- Lucy Group Ltd.

- Safvolt

- KATKO Oy

- Powell Industries

Latest Announcement by Market Leaders

- In February 2025, Energy management and automation major Schneider Electric announced plans to open three more manufacturing plants in India. The company currently has 31 manufacturing plants in the country. The three new plants will come up at Kolkata, Hyderabad, and Ahmednagar, he said at the event organized by industry body IEEMA in Greater Noida.

- In December 2024, Rockwell Automation, Inc., and Microsoft Corp., a leading global technology company, announced an expanded strategic collaboration aimed at revolutionizing industrial transformation. Together, the companies will provide manufacturing customers with advanced cloud and AI solutions that deliver powerful data insights.

Recent Developments

- In February 2025, Socomec introduced new solutions for power management, such as advanced UPS products, power quality meters, and energy storage fuses, to ELECRAMA 2025. Socomec further displayed its modular UPS, auto transfer switches, ATS controllers, manual transfer switches, load break switches, and DC switch disconnectors for the PV segment.

- In August 2024, the 2nd Safe City and Intelligent Mobility India 2024 conference was organized in New Delhi, centering on intelligent grid integration and urbanization. The conference promoted the contribution of state-of-the-art power infrastructure in city resilience, demanding solid electrical devices such as load break switches (LBS).

- In August 2024, Hitachi Energy showcased its 550 kV SF₆-free Gas Insulated Switchgear (GIS), utilizing EconiQ™ gas to reduce environmental impact.

Segments Covered in the Report

By Type

- Gas-insulated

- Vacuum-insulated

- Air-insulated

- Oil-immersed

By Voltage

- Below 11 kV

- 11-33 kV

- 33-60 kV

By Installation

- Outdoor

- Indoor

By End Use

- Utilities

- Industrial

- Commercial

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting