What is Long Steel Products Market Size?

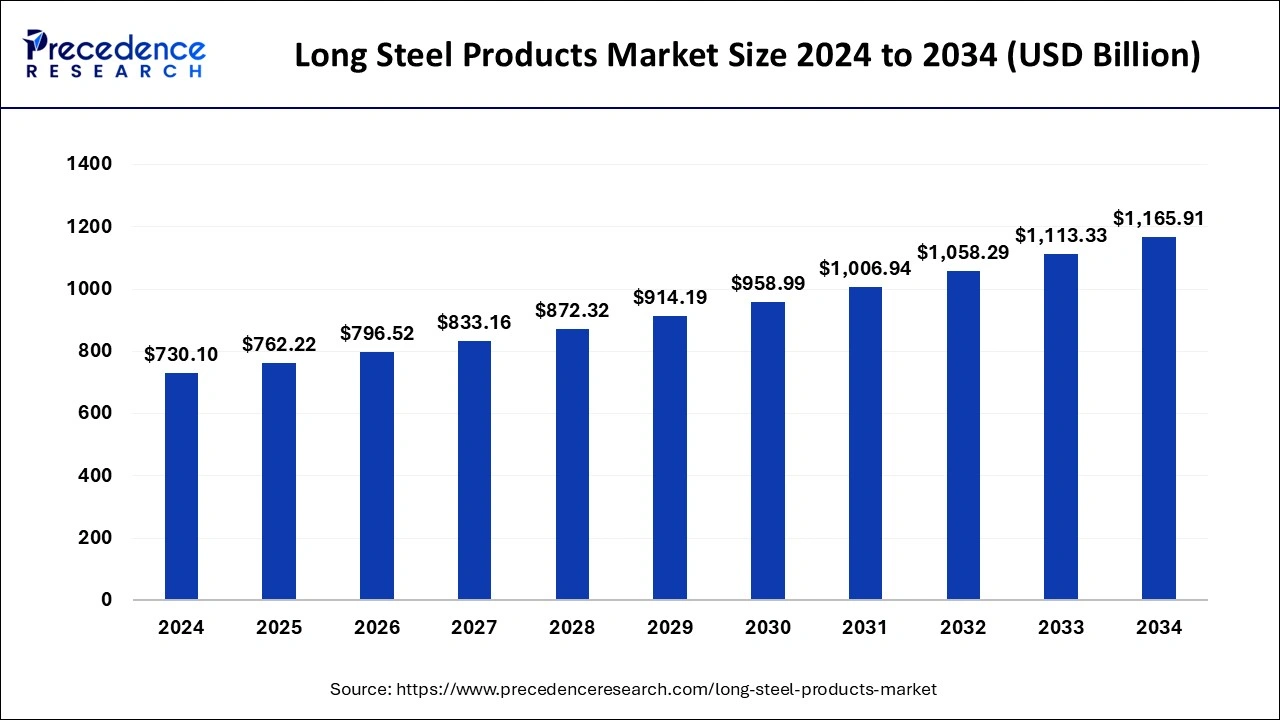

The global long steel products market size is estimated at USD 762.22 billion in 2025 and is predicted to increase from USD 796.52 billion in 2026 to approximately USD 1,165.91 billion by 2034, expanding at a CAGR of 4.79% from 2025 to 2034.

Market Highlights

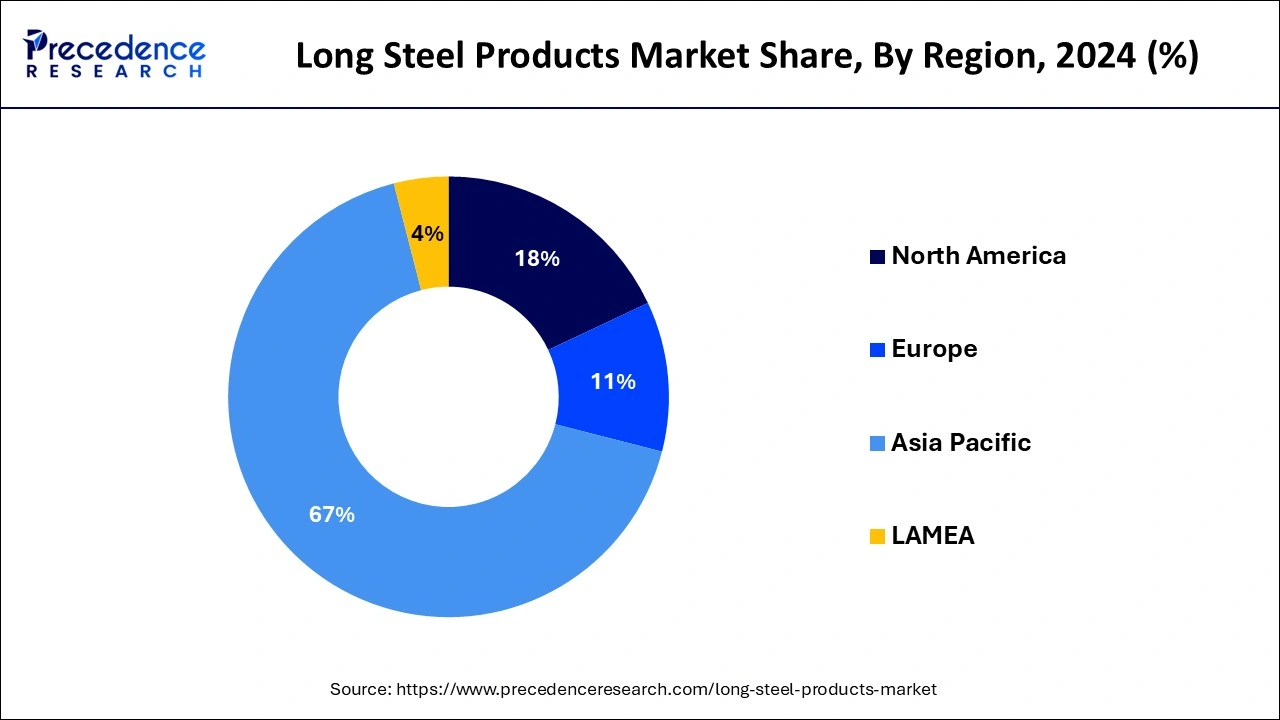

- Asia-Pacific contributed 67% of the market share in 2024.

- North America is estimated to expand the fastest CAGR between 2025 and 2034.

- By product, the rebars segment has held the largest market share of 35% in 2024.

- By product, the wire rods segment is anticipated to grow at a remarkable CAGR of 5.9% between 2025 and 2034.

- By end-use, the building and construction segment generated over 81% of the market share in 2024.

- By end-use, the automotive and aerospace segment is expected to expand at the fastest CAGR over the projected period.

Market Overview

Long steel products refer to a category of steel items characterized by their elongated shape, including items like bars, rods, and structural sections. These products find extensive use in construction and infrastructure projects due to their strength and durability. Common examples include reinforcement bars (rebar) used in concrete structures, steel beams for building frameworks, and wire rods for various industrial applications. Long steel products play a crucial role in supporting the construction industry and are essential for creating sturdy and reliable structures. Whether it's in the form of beams providing structural support or rods reinforcing concrete, these products contribute to the integrity and longevity of buildings and infrastructure projects, making them foundational elements in the world of construction and engineering.

Long Steel Products Market Data and Statistics

- In India, the government is actively implementing various social programs, such as the Pradhan Mantri Awas Yojana, aimed at developing new housing units to address the housing needs of the masses. As of February 2023, approximately 12.3 million houses have been approved for construction under the Pradhan Mantri Awas Yojana.

- According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), global vehicle production witnessed a 3.1% increase in 2021 compared to the previous year.

- In May 2022, the price of imported Hot Rolled Coils (HRC), Cost and Freight (CFR) at the main port in Northern Europe, ranged from EURO 850 to 920 (USD 891.20 to 964.59) per tonne. Some mills were considering reducing production to cope with the challenges posed by escalating input costs.

Long Steel Products MarketGrowth Factors

- The ongoing global trend of urbanization and the need for new infrastructure projects contribute significantly to the growth of the long steel products market. Rising populations and urban migration drive the demand for construction materials, including long steel products like beams, columns, and rebars.

- The construction industry's growth, particularly in emerging economies, is a key driver for long steel products. Increasing construction activities in residential, commercial, and industrial sectors boost the demand for structural steel, reinforcing bars, and other long steel products.

- The world's increasing population directly correlates with the demand for housing and infrastructure. As more people require housing and urban amenities, the construction industry relies on long steel products to meet these needs.

- Long steel products play a crucial role in the automotive industry, providing materials for components such as chassis, axles, and suspension systems. As the automotive sector expands globally, the demand for specialized long steel products continues to rise.

- The push for renewable energy sources, such as wind and solar power, involves the construction of large-scale projects that require substantial amounts of long steel products. Wind turbine towers and solar panel support structures are examples of items driving demand in this sector.

- Innovations in steel production processes, including advanced manufacturing technologies and sustainable practices, contribute to the growth of the long steel products market. The adoption of efficient and eco-friendly production methods enhances the industry's competitiveness.

Recent Trends

- Infrastructure and Construction Demand: Growth is driven by large infrastructure projects, commercial and residential construction, and urbanization, increasing the need for rebars, wire rods, sections, and tubes. This sustained demand is a direct result of ongoing global development and population growth, particularly in emerging economies.

- Sustainable Production Practices: Steel manufacturers are adopting greener processes, such as electric-arc furnaces, higher scrap usage, and advanced alloys, while producing stronger steel to reduce waste and carbon emissions. These practices are crucial for meeting stricter environmental regulations and consumer demand for eco-friendly products.

- Technological Advancements: New rolling, shaping, and alloying technologies are improving steel quality, performance, and durability, enabling applications in high-strength and specialized sectors. These innovations allow for the creation of lightweight yet strong steel products, which are essential for modern industries like automotive and aerospace.

- Global Expansion and Emerging Markets: Asia-Pacific leads due to rapid industrialization and infrastructure investment, while manufacturers are expanding globally to serve new markets and applications like automotive and renewable energy. This strategic expansion allows companies to diversify their customer base and capitalize on new growth opportunities.

- Focus on Circular Economy: Recycling of scrap steel and adoption of closed-loop production systems are helping companies minimize environmental impact and support sustainable growth across the supply chain. This approach not only conserves natural resources but also reduces energy consumption and the overall cost of production.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 762.22 Billion |

| Market Size in 2026 | USD 796.52 Billion |

| Market Size by 2034 | USD 1,165.91 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.79% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By End Use, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Global construction boom

- According to the Global Construction Perspectives and Oxford Economics, the global construction market is expected to reach $15.5 trillion by 2030.

The global construction boom has become a driving force behind the surge in market demand for long steel products. As countries worldwide experience rapid urbanization and a growing need for infrastructure, the construction industry is witnessing unprecedented growth. Long steel products, including beams, columns, and reinforcement bars, play a pivotal role in constructing sturdy buildings, bridges, and other essential structures. The increasing demand for new residential, commercial, and industrial spaces fuels the necessity for these durable and versatile steel products. Moreover, major infrastructure projects, such as roads, bridges, and energy facilities, require substantial amounts of long steel products. As a result, the global construction boom creates a robust market demand for long steel products, making them integral to the construction landscape and contributing significantly to the overall growth of the steel industry.

Restraint

Overcapacity in the steel industry

Overcapacity in the steel industry poses a significant restraint on the market demand for long steel products. When there is excess production capability in the industry, it leads to intensified competition among manufacturers, creating a scenario where supply surpasses demand. This surplus often exerts downward pressure on steel prices, affecting the overall profitability of long steel product manufacturers. The resultant price decline can discourage investments and limit the financial viability of expanding or upgrading production facilities.

Furthermore, the presence of overcapacity can contribute to a lack of pricing power for steel producers, making it challenging to maintain stable and favorable pricing structures. In such a competitive environment, manufacturers may struggle to recoup their production costs, impacting their ability to invest in research, development, and sustainable practices. This overcapacity dynamic not only affects the economic health of individual steel producers but also hampers the overall growth and dynamism of the long steel products market.

Opportunity

Strategic partnerships and collaborations

Strategic partnerships and collaborations play a pivotal role in creating opportunities for the long steel products market. By forming alliances with construction firms, architects, and engineering companies, long steel product manufacturers gain early involvement in major projects. This proactive engagement allows them to align their product offerings with specific project requirements, fostering a more streamlined and efficient supply chain. Moreover, such collaborations enable knowledge sharing, technological exchange, and joint research initiatives, promoting innovation in long steel product manufacturing. By leveraging the expertise of diverse stakeholders, manufacturers can adapt to emerging trends, address industry challenges, and position themselves as preferred partners for large-scale construction projects. Strategic partnerships not only enhance market presence but also open avenues for sustained growth and competitiveness in the dynamic landscape of the long steel products market.

Segment Insights

Product Insights

The rebars segment held the largest market share of 35% in 2024. Rebars, short for reinforcing bars, are a crucial segment in the long steel products market. These steel bars, commonly used in construction, provide strength and stability to reinforced concrete structures. The rebars segment is witnessing a trend towards increasing demand due to rising construction activities globally, particularly in infrastructure projects. As urbanization continues, the need for durable and resilient structures propels the use of rebars, reflecting a key trend in the long steel products market.

The wire rods segment is anticipated to witness rapid growth at a significant CAGR of 5.9% during the projected period. Wire rods are long steel products characterized by their round cross-section. Widely used in construction, automotive, and manufacturing, they serve as raw material for various applications like fencing, nails, and wire products. In the long steel products market, the wire rods segment is witnessing a trend towards increased demand driven by construction projects and industrial applications. As infrastructure development continues globally, the need for wire rods in creating durable and versatile products for diverse industries remains a prominent and growing aspect of the market.

End-Use Insights

The building and construction segment has held 81% market share in 2024. The building and construction segment in the long steel products market pertains to the use of steel in various structural applications, including beams, columns, and reinforcement bars. This segment is crucial for erecting residential, commercial, and industrial structures. Recent trends indicate a rising demand for long steel products in sustainable and energy-efficient construction practices. Additionally, the growth of urbanization, infrastructure projects, and the increasing popularity of steel-framed buildings contribute to the steady expansion of the building and construction segment in the long steel products market.

The automotive and aerospace segment is anticipated to witness rapid growth over the projected period. In the long steel products market, the automotive segment involves the use of steel in manufacturing components like chassis, axles, and suspension systems. Increasing demand for automobiles globally has spurred the need for high-quality, durable long steel products in this sector. In aerospace applications, long steel products contribute to the construction of aircraft components such as beams and structural elements. The aerospace segment is witnessing a trend towards lightweight, high-strength materials, driving innovations in the development and application of long steel products to meet stringent industry standards.

Regional Insights

Asia-PacificLong Steel Products Market Size and Growth 2025 To 2034

The Asia-Pacific long steel products market size is valued at USD 510.69 billion in 2025 and is expected to reach around USD 786.99 billion by 2034 with a CAGR of 4.87% from 2025 to 2034.

Asia-Pacific held the largest market share of 67% in 2024due to rapid urbanization, robust industrialization, and substantial infrastructure development in countries like China and India. The region's burgeoning construction sector, driven by population growth and economic expansion, significantly boosts the demand for long steel products. Moreover, Asia-Pacific's strong presence in industries like automotive and manufacturing further propels the market. With increasing investments in construction and infrastructure projects, the region remains a key player, driving the growth and dominance of the long steel products market.

North America is poised for rapid growth in the long steel products market due to robust construction activities, infrastructure investments, and a resurgence in manufacturing. The region's focus on upgrading and modernizing aging infrastructure, coupled with a strong demand for residential and commercial construction, creates a favorable environment. Additionally, initiatives supporting sustainable building practices and the adoption of advanced technologies contribute to the anticipated growth. These factors position North America as a promising market for long steel products, reflecting the region's economic momentum and development prospects.

Meanwhile, Europe is experiencing notable growth in the long steel products market due to robust construction activities and infrastructure development across the region. The demand for long steel products, including beams and reinforcement bars, has surged with increased urbanization and large-scale building projects. Additionally, the emphasis on sustainable construction practices and the implementation of stringent building standards contribute to the rising adoption of long steel products. These factors collectively propel the growth of the long steel products market in Europe, creating opportunities for manufacturers and suppliers in the steel industry.

Long Steel Products Market Companies

- ArcelorMittal

- Nippon Steel Corporation

- Tata Steel

- POSCO

- BHP Group

- Steel Authority of India Limited (SAIL)

- JFE Steel Corporation

- Celsa Group

- Gerdau S.A.

- Emirates Steel

- Mechel PAO

- Evraz plc

- Hyundai Steel Company

- Jindal Steel and Power Limited

- Thyssenkrupp AG

Recent Developments

- In March 2022, Schnitzer Steel Industries, Inc., the foremost producer and exporter of recycled metal products in North America, launched GRN SteelTM. This innovative line of net-zero carbon products originates from its Cascade Steel manufacturing facilities located in McMinnville, Oregon.

- Moving to September 2022, Nippon Steel, a prominent Japanese steel company, announced its plans to commence the sale of green steel products in the initial stages of the fiscal year 2023. Marketed under the trade name NS Carbolex Neutral, these steel products are designed to have reduced carbon emissions.

- In September 2022, Tata Steel approved the merger of seven subsidiaries, including Tata Steel Long Products, Tata Metaliks, The Tinplate Company of India, TRF Limited, Indian Steel & Wire Products, Tata Steel Mining, and S&T Mining. This strategic move aims to consolidate Tata Steel's subsidiary businesses, fostering management simplification and a more focused business approach. The anticipated net present value of synergies is expected to exceed Rs 1,000 crore, representing a substantial opportunity for value unlocking.

- In February 2022, Trimble, a global leader in construction technology, announced that Zamil Steel, the premier supplier of pre-engineered steel buildings and structural steel products in the Middle East, will utilize Tekla PowerFab's software to revolutionize steel fabrication in its factories across India, Saudi Arabia, Egypt, and Vietnam.

Segments Covered in the Report

By Product

- Rebars

- Wire Rods

- Sections

- Tubes

By End-use

- Building & Construction

- Automotive & Aerospace

- Railways & Highway

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting