What is the Marine Scrubber Market Size?

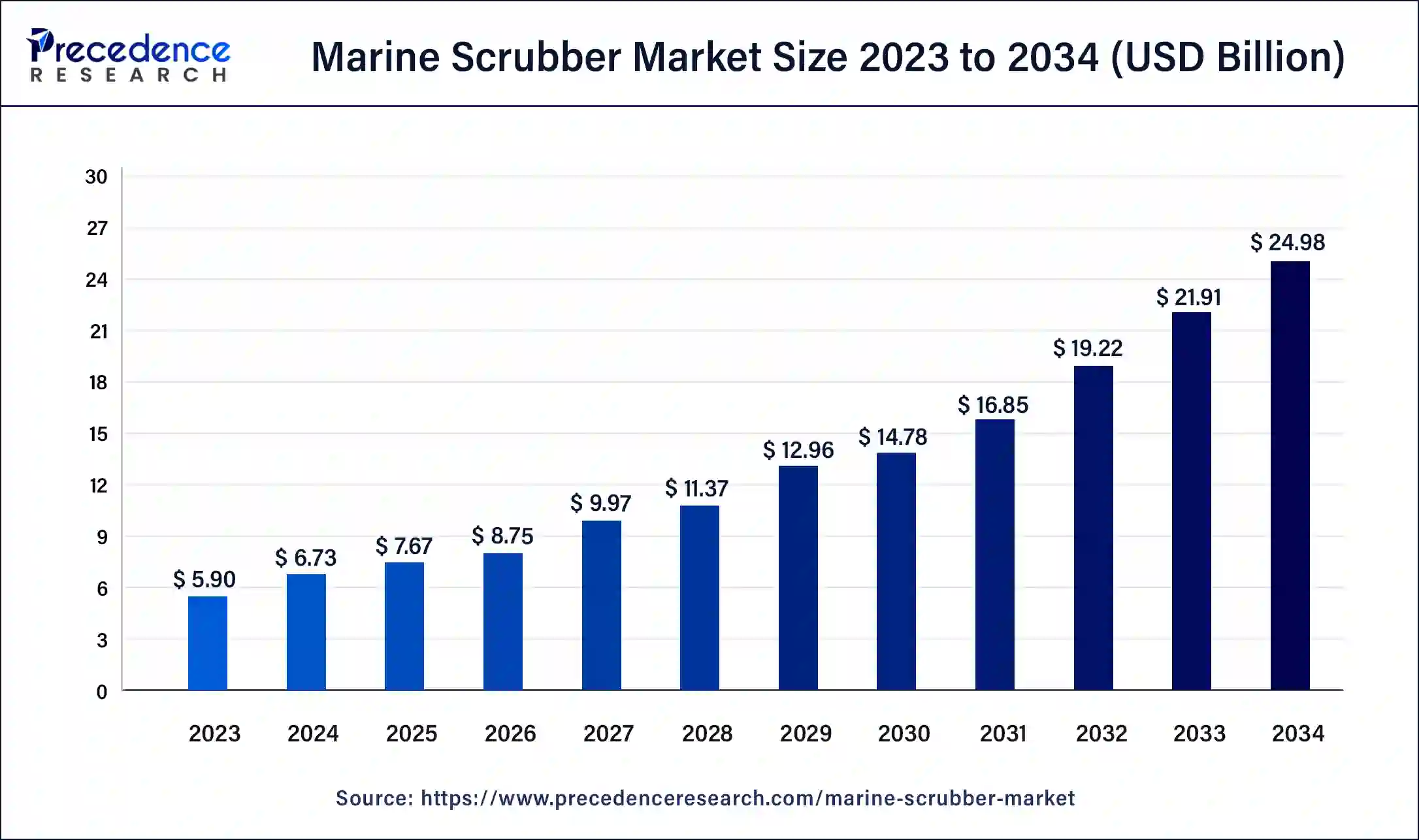

The global marine scrubber market size is accounted at USD 7.67 billion in 2025 and predicted to increase from USD 8.75 billion in 2026 to approximately USD 24.98 billion by 2034, growing at a solid CAGR of 14.01% over the forecast period 2025 to 2034. The marine scrubber market is driven by the implementation of stricter environmental regulations.

Marine Scrubber Market Key Takeaways

- The global marine scrubber market was valued at USD 6.73 billion in 2024.

- It is projected to reach USD 24.98 billion by 2034.

- The marine scrubber market is expected to grow at a CAGR of 14.01% from 2025 to 2034.

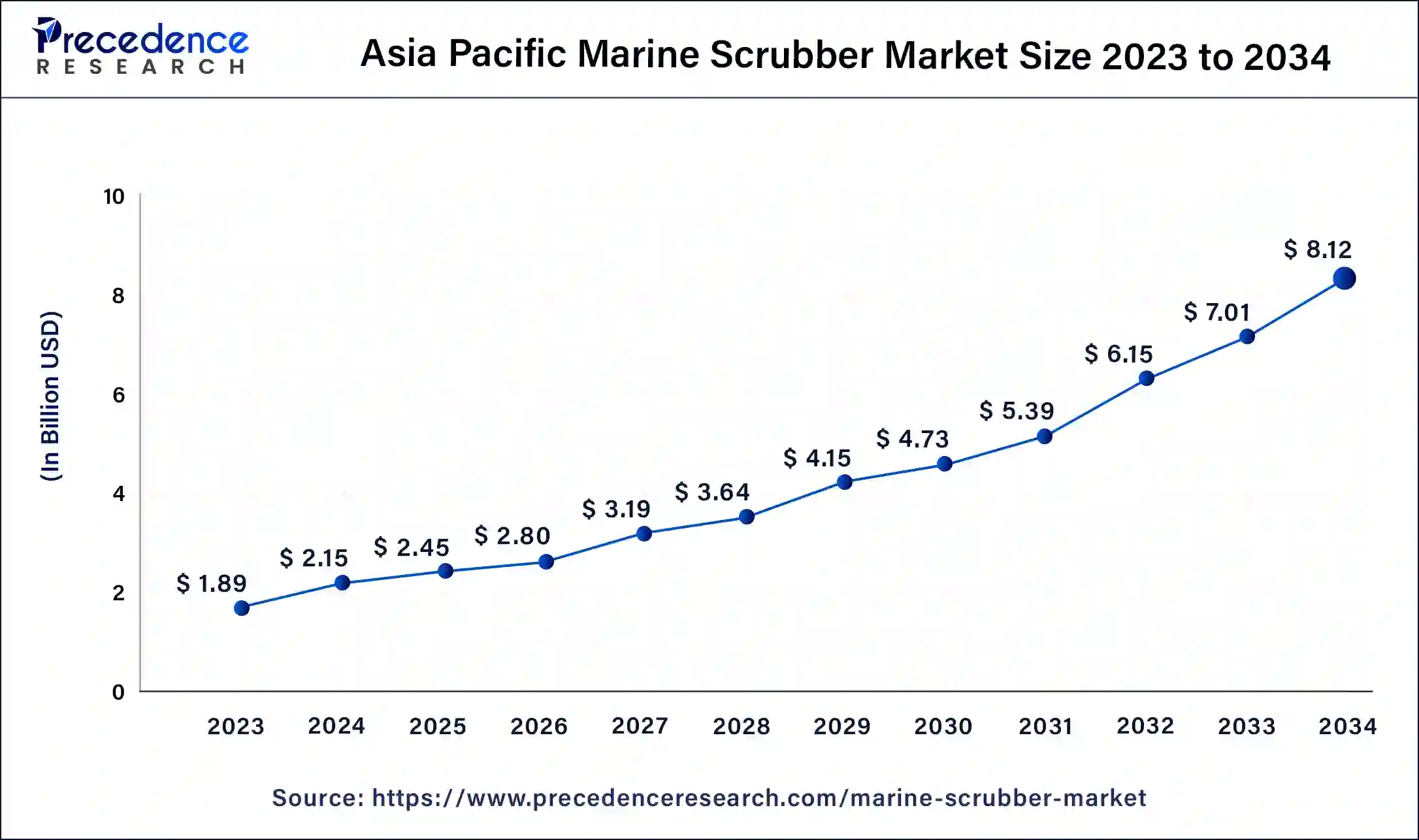

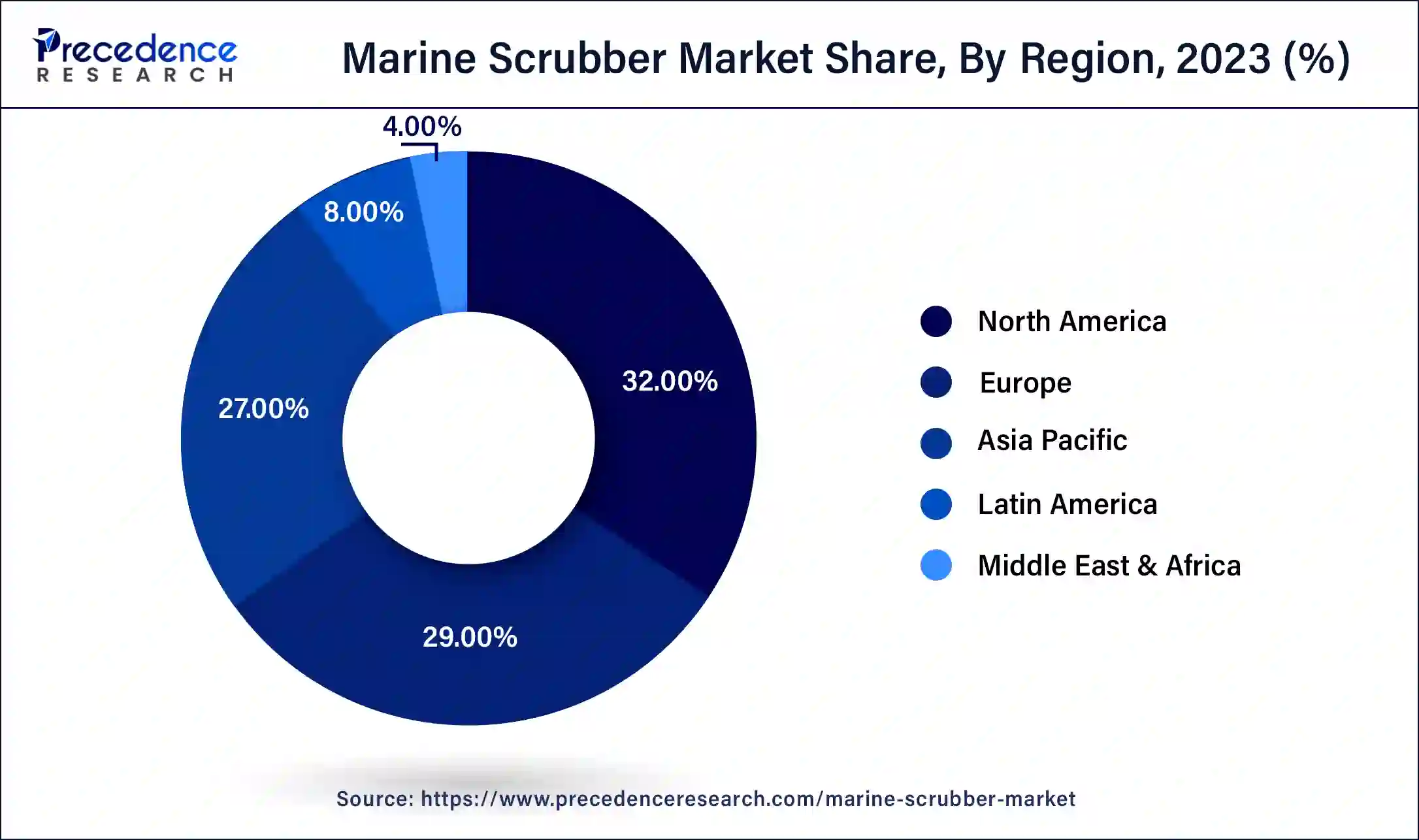

- Asia-Pacific dominated the marine scrubber market with the largest market share of 32% in 2024.

- North America shows a significant growth in the marine scrubber market during the forecast period.

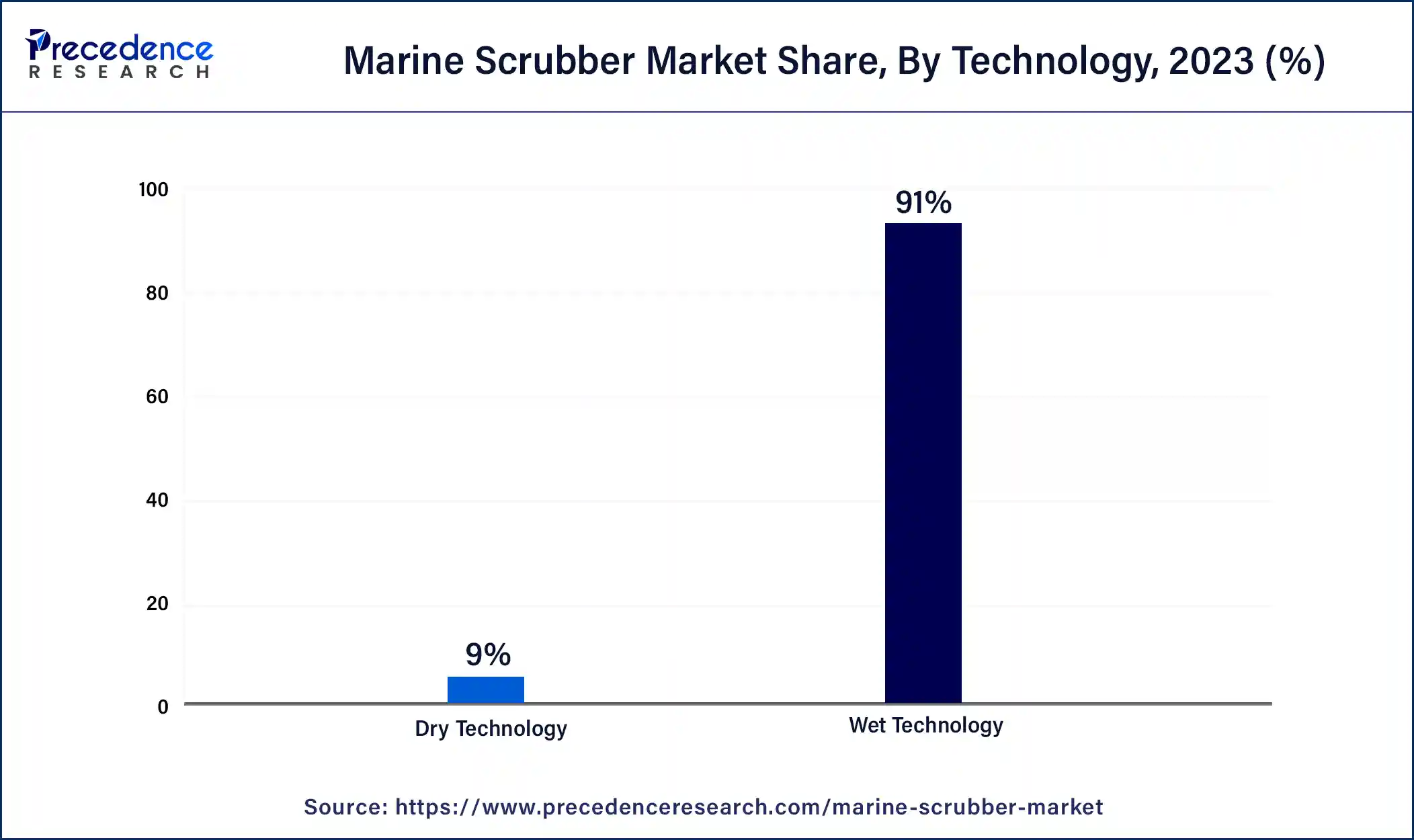

- By technology, the wet technology segment generated the biggest market share of 91% in 2024.

- By technology, the dry technology segment shows a significant growth in the market during the forecast period.

- By application, the bulk carriers segment recorded the highest market share of 33% in 2024.

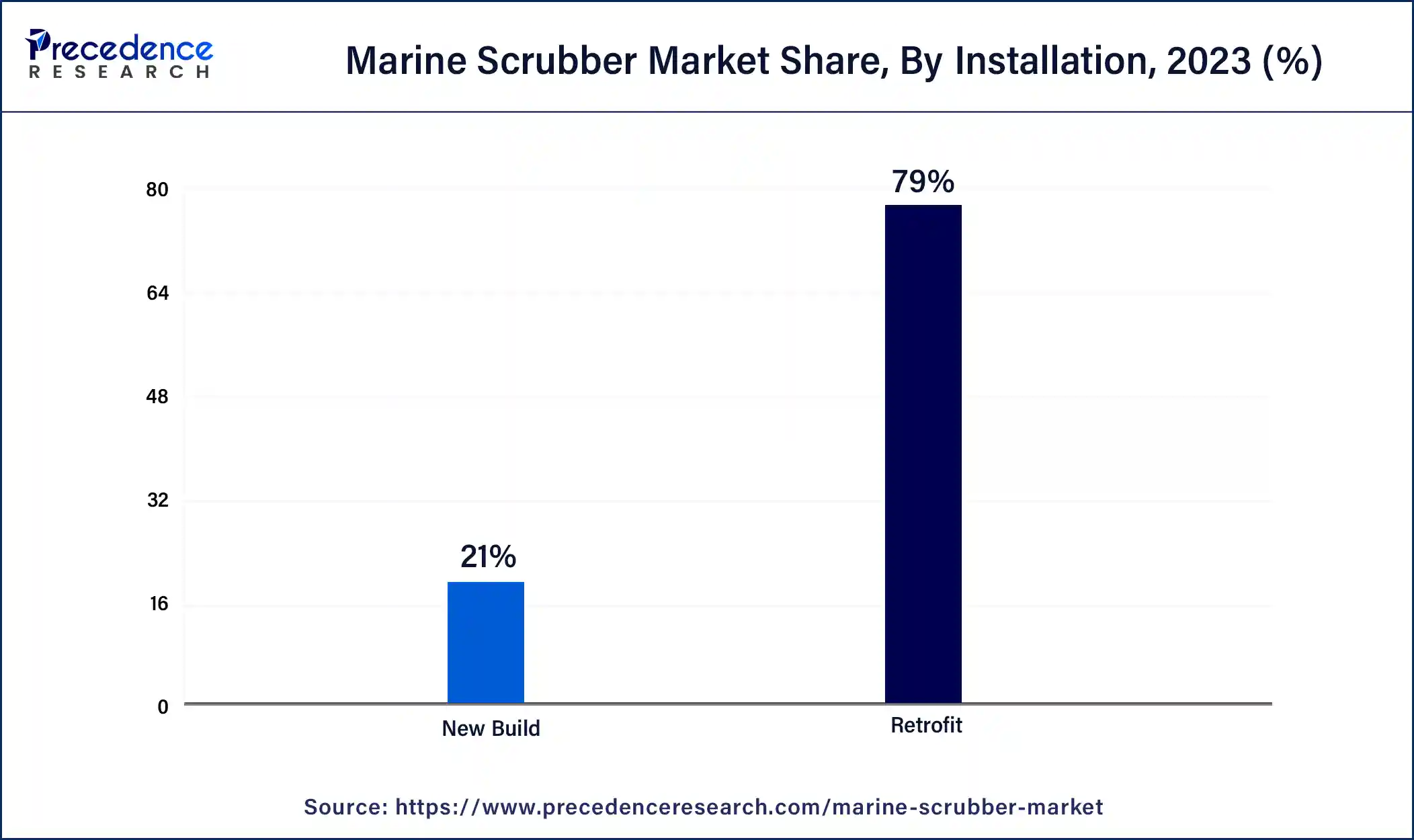

- By installation, the retrofit segment contributed the biggest market share of 79% in 2024.

- By installation, the new build segment shows a significant growth in the marine scrubber market during the forecast period.

How is AI helping the marine scrubber market growth?

Artificial intelligence contributes to scrubber system optimization through real-time operation adjustments, increased fuel economy, and reduced energy usage. AI-powered algorithms ensure the scrubber runs as efficiently as possible while generating the least waste by monitoring and adjusting parameters like temperature, chemical usage, and water flow rates. AI makes it possible to remotely monitor and manage scrubber systems. Fleet managers may now oversee numerous boats from one place, which enhances operational management. Faster reaction times to anomalies or inefficiencies are also made possible by real-time data and AI-driven analysis.

What is a Marine Scrubber?

An exhaust gas cleaning system, a scrubber, removes particulate matter and dangerous compounds from ship exhaust gas streams, including nitrogen oxide (NOx) and sulfur oxide (SOx). Before the shipping industry implemented exhaust gas cleaning systems, all exhaust was released into the atmosphere, seriously endangering human health and the environment. Scrubbers, on the other hand, may remove up to 98% of the SOx emissions. China, Greece, India, Japan, Singapore, South Korea, Norway, and the United Kingdom are the top nations for maritime travel.

- In August 2024, twelve large gas carriers (VLGCs), four of which are dual fuel, will be purchased by Singapore-based BW LPG, the owner and operator of LPG boats, from Norwegian shipping company Avance Gas.

The new IQ Series exhaust gas treatment system from W�rtsil� was created by its Moss, Norway-based Exhaust Treatment business unit. The most recent development in maritime exhaust gas treatment technology is the IQ Series. It has several enhancements that make it particularly suitable for container ships and meet the growing demand for scrubbers as a compliance alternative from the container market segment.

What are the Growth Factors in the Marine Scrubber Market?

- Scrubber technology is constantly evolving, creating more eco-friendly and efficient systems, making them a more appealing choice for the maritime sector.

- Marine scrubbers enable ships to use more affordable, higher-sulfur fuels, which can help reduce fuel use. This financial benefit is a big motivator for shipping businesses.

- A larger fleet of ships due to increased international trade has raised the need for marine scrubbers to comply with pollution laws.

- Government subsidies and incentives are provided in some areas to promote the use of marine scrubbers, which propels industry expansion.

Marine Scrubber Market Outlook

- Industry Growth Overview: Between 2025 and 2030, steady growth is expected in the marine scrubber market, as shipping firms continue their pursuit of more economical systems for sulfur compliance. Increases were sharp in demand for marine scrubbers for deep-sea vessels, particularly in the Asia-Pacific region and North America. The major factor driving this demand increase was the International Maritime Organization (IMO), which was rolling out compliance regulations, as well as increased global trade activity.

- Global Expansion: Leading manufacturers in marine scrubbers continued their expansion in Southeast Asia, the Middle East, and Northern Europe to service fleet size, and new partnerships were established with shipyards. Companies sought to expand the scale of their installation and retrofit installation capacities in proximity to major ports of call to strengthen service and regulatory compliance.

- Major Investors: Private equity firms are becoming increasingly interested as a result of the long-term demand for compliance, predictable revenues associated with installations, and higher technical barriers to entry in the supply chain. The idea is for investors to back companies selling modular systems and lifecycle services where rapid and substantial returns on their investment are enabled through regulations.

- Startup Ecosystem: A growing base of startups has emerged, centered around compact scrubber designs, digital monitoring, and zero-liquid-emission technology. Startups gained traction by offering cost-effective retrofits to the current scrubber systems and real-time, monitored emissions data, with further support from VCs in Europe and Asia.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 24.98 Billion |

| Market Size in 2025 | USD 7.67 Billion |

| Market Size in 2026 | USD 8.75 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.01% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Application, Installation, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Growing maritime trade

The construction and development of critical commercial routes, such as the Suez Canal, Panama Canal, and Arctic shipping lanes, also influence the growth of marine trade. Because these routes are essential to international supply networks, more ships are operating in these areas due to the increased use of these routes. Aside from following the law, increasing pressure from stakeholders, the public, and environmental organizations has led many shipping businesses to switch to more environmentally friendly operations. In the interim, marine scrubbers are thought to help reduce emissions; longer-term options, such as alternative fuels (like LNG and hydrogen), are still being developed.

Restraint

High installation costs

Scrubber retrofitting is a costly and technically difficult process for already-built boats. The ship's construction frequently needs to be altered to install the scrubber system. This may entail rearranging the engine room, cutting and rewelding portions of the ship, and strengthening other locations. These adjustments must be made precisely to guarantee that the scrubber interfaces with the vessel's current systems without generating operational concerns. Because of this, ship owners must pay more for labor, engineering, and occasionally dry-docking the vessel, which drives up the installation's entire cost.

Opportunity

Growth of green shipping initiatives

Scrubber technology innovation is growing along with green shipping initiatives. The marine scrubber industry is seeing a rise in the development of more adaptable and efficient systems that can handle a range of ship sizes and kinds while maintaining compatibility with varied exhaust systems. This versatility further accelerates scrubber adoption, providing shipowners with tailored solutions that meet their unique operational requirements. In the context of green shipping aims, technological advancements also improve scrubber operational efficiency, lowering maintenance costs, extending their lifespan, and increasing ship operators' return on investment (ROI).

Technology Insights

The wet technology segment dominated the marine scrubber market in 2024. One of the most well-known and tested methods for cleaning exhaust gases in various industrial settings, including maritime ones, is wet scrubbers. Historically, the shipping sector has chosen established technologies that have undergone considerable testing and shown to be reliable over an extended period. Because of their operational efficacy, wet scrubber systems have gained widespread adoption and are the preferred option for maritime firms.

The dry technology segment shows a significant growth in the marine scrubber market during the forecast period. Dry scrubbers use solid absorbent materials like lime or sodium bicarbonate to remove sulfur and other contaminants from exhaust gases. Dry scrubbers use fewer resources than wet scrubbers, which need sophisticated wastewater treatment facilities and water. Lower operational costs, including lower energy use and maintenance expenditures, result from this. Dry scrubbers simplify operation and minimize maintenance downtime because they do not require handling significant volumes of water, eliminating the need for complex pumps or wastewater management systems. Dry scrubbers are becoming increasingly popular in the market. They save shipping firms money by eliminating the need to manage tainted water systems.

Application Insights

The bulk carriers segment dominated the marine scrubber market in 2024. Large ships make up bulk carriers, some of which are among the most significant ship classes in the world (such as Panamax and Capesize vessels). The larger the ship, the more fuel it consumes. Larger ships with scrubbers may burn HSFO for less money, which accelerates the return on investment (ROI) for installing scrubbers when compared to smaller vessels with lower fuel use. The segment's dominance in the marine scrubber industry has been further cemented in recent years with the inclusion of scrubbers in the design of many new bulk carrier purchases.

Installation Insights

The retrofit segment dominated the marine scrubber market in 2024. Due to shipyard backlogs, building new vessels might take many years, particularly if demand spikes suddenly following IMO regulations. Refitting already-built ships offered ship owners a quicker way to comply with laws and avoid fines for fuel-related delays or outages. Retrofitting makes sense for older ships with a good amount of operating life left. It allows ship owners to keep making money from aging ships without buying new tonnage or decommissioning them early.

The new build segment shows a significant growth in the marine scrubber market during the forecast period. Pressure from shipping companies to use greener technologies to cut emissions is growing. Scrubber integration into new constructions guarantees adherence to both present and future laws. Additionally, it increases the vessels' appeal to operators and charterers who value sustainability highly. Scrubber-equipped vessels are in high demand as a result of this. The need for additional ships is rising as the world's shipping sector develops. Additionally, more contemporary, energy-efficient ships are replacing outdated fleets. Scrubbers installed during the building phase ensure that these new ships, frequently intended to meet the highest environmental compliance standards, are future proof against growing legislation.

Regional Insights

Asia Pacific Marine Scrubber Market Size and Growth 2025 to 2034

The Asia Pacific marine scrubber market size is exhibited at USD 2.45 billion in 2025 and is projected to be worth around USD 8.12 billion by 2034, poised to grow at a CAGR of 14.21% from 2025 to 2034.

Asia-Pacific dominated the marine scrubber market in 2024. Asia-Pacific nations, especially South Korea and China, are renowned for their efficient supply chains and industries. As a result, the region has become a competitive market for manufacturing and installing marine scrubbers, lowering the overall manufacturing cost. The financial benefit of marine scrubbers over low-sulfur fuel (LSFO) is one of the main arguments in favor of their use. Because high-sulfur fuel oil (HSFO) and low-sulfur fuel oil (LSFO) are so expensive in Asia-Pacific, scrubbers are a financially viable choice for shipowners.

Asia Pacific: China Marine Scrubber Market Trends

In China, the market is booming, driven by strict emission control areas (ECAs) around major ports like Shanghai and Shenzhen that force shipowners to install scrubbers to comply with sulfur regulations. The IMO 2020 sulfur cap continues to fuel retrofits and investments in scrubber systems, especially on newbuilds from China's massive shipbuilding sector. To meet this demand, hybrid and dry scrubber technologies are seeing growing adoption, offering flexibility and better environmental performance.

North America shows a significant growth in the marine scrubber market during the forecast period. It has been demonstrated that ship owners, especially those involved in long-haul transportation, can quickly recoup their investment in marine scrubbers. High-sulfur fuel is typically much less expensive than low-sulfur substitutes. Because of this financial advantage, scrubbers are becoming increasingly popular among North American shipping corporations. The region has made significant investments in studying and creating cutting-edge marine scrubber systems, especially those that lower emissions of sulfur dioxide, particulate matter, and other dangerous pollutants.

North America: U.S. Marine Scrubber Market Trends

In the U.S., the market is growing rapidly as shipowners turn to exhaust gas cleaning systems to comply with strict sulfur emission regulations, especially in designated emission control areas. The retrofit demand remains strong because installing scrubbers lets vessels continue using cheaper high-sulfur fuel while meeting environmental rules.

Why did Europe experience steady growth in the marine scrubber market?

There was steady growth in Europe due to its stringent emission control areas and very strict environmental laws. Broadly, ship owners made extensive use of scrubbers, enabling them to sail the Baltic and North Sea areas without needing to switch to costly low-sulfur fuel. While there were various opportunities in cruise ships, ferries, and cargo fleets, there was also strong technological expertise in the region, and government involvement supported further adoption. Many manufacturers were developing energy-efficient scrubbers, enabling Europe to maintain strong and steady market growth.

Germany Marine Scrubber Market Trends

Germany was a significant market, given the size of its shipping industry and its strict environmental policies. Vessels operating in the North Sea and Baltic Sea require scrubbers to comply with regional sulfur limits. Shipowners operating in Germany needed to upgrade their fleets to stay competitive. Various advanced engineering firms in Germany developed high-quality scrubber systems. Ports such as Hamburg and Bremen also supported retrofitting of ships with scrubber systems, all contributing to Germany being a significant player in terms of marine emission-control systems in Europe.

Why did Latin America experience steady growth in the marine scrubber market?

The gradual growth of Latin America correlates with the continued increase in maritime commerce, increased port infrastructure, and a rising awareness of emission requirements. The seaborne fleets in many countries were being improved and refurbished to meet the new global sulfur regulations. There were opportunities in bulk carriers, oil tankers, and cargo vessels.

Gradually growing regulatory developments, increased trade with North America and Asia, and ship owners' willingness to spend on scrubbers to reduce their fuel costs also showed the gradual yet very strong growth potential for the region.

Brazil Marine Scrubber Market Trends

Brazil had the most significant impact or influence due to large export amounts in oil, minerals, and agriculture, and ships regularly move along major trade corridors, installing scrubbers to comply with IMO limits and save on fuel costs. Ports in Brazil were significantly increasing their capacity for repairs and retrofitting, enabling the retrofitting of scrubbers. Growth trends were noted in the long-haul and tanker categories. In addition, governmental efforts to modernize fleets also pushed demand for clean vessel technologies along major coastal regions.

Why did the Middle East & Africa experience steady growth in the marine scrubber market?

The Middle East & Africa demonstrated steady, if gradual development as major shipping routes moved through the region. Tanker fleets, LNG carriers, and cargo vessels adopted scrubbers in preparation for new sulfur limits. The region capitalised on potential new port developments, offshore projects, and long-distance shipping. Trade with Europe and Asia increased demand for upgraded vessels. Regulations had not come through as fast as in other regions, but the demand for compliance internationally continued to penetrate.

The UAE Marine Scrubber Market Trends

The UAE continued to be the driving nation in the region, supported by the main ports of Dubai and Abu Dhabi, which accounted for heavy levels of global shipping traffic. Shipowners adopted scrubbers to meet international requirements for sulphur content and also to reduce operating costs. The UAE has also invested heavily in modern repair yards and maritime hubs that facilitated vessel scrubber installations.

The largest growth came from oil tankers, container ships, and offshore vessels. Finally, the UAE logistics infrastructure made it an important marine scrubber service market.

Marine Scrubber Market Companies

- ALFA LAVAL

- ANDRITZ

- Fuji Electric Co., Ltd.

- KWANG SUNG

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- Drizgas Tech

- CR Ocean Engineering

- Pacific Green (Pacific Green Group of companies)

- Valmet

- W�rtsil�

- Yara (Okapi Energy Group)

Recent Developments

- In July 2024, W�rtsil� and Nautica Ship Management, a Malaysian company, inked a six-year Lifecycle Agreement. The MTT Saisunee and MTT Senari are the two ships covered by the agreement, which guarantees the effective operation of the exhaust gas treatment equipment on board. These are feeder container vessels with hybrid scrubber systems made by W�rtsil�. In Q2 2024, W�rtsil� placed the order.

- In January 2024, the first ammonia-fueled medium gas carrier (AFMGC) with Japanese-made engines will be built by four Japanese businesses: Nippon Yusen Kabushiki Kaisha (NYK), IHI Power Systems, Japan Engine Corporation, and Nihon Shipyard. These companies signed several contracts for the project.

Segments Covered in the Report

By Technology

- Wet Technology

- Open Loop

- Closed Loop

- Hybrid

- Dry Technology

By Application

- Bulk Carriers

- Container Ships

- Oil Tankers

- Chemical Tankers

- Cruises

- Others

By Installation

- New Build

- Retrofit

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting