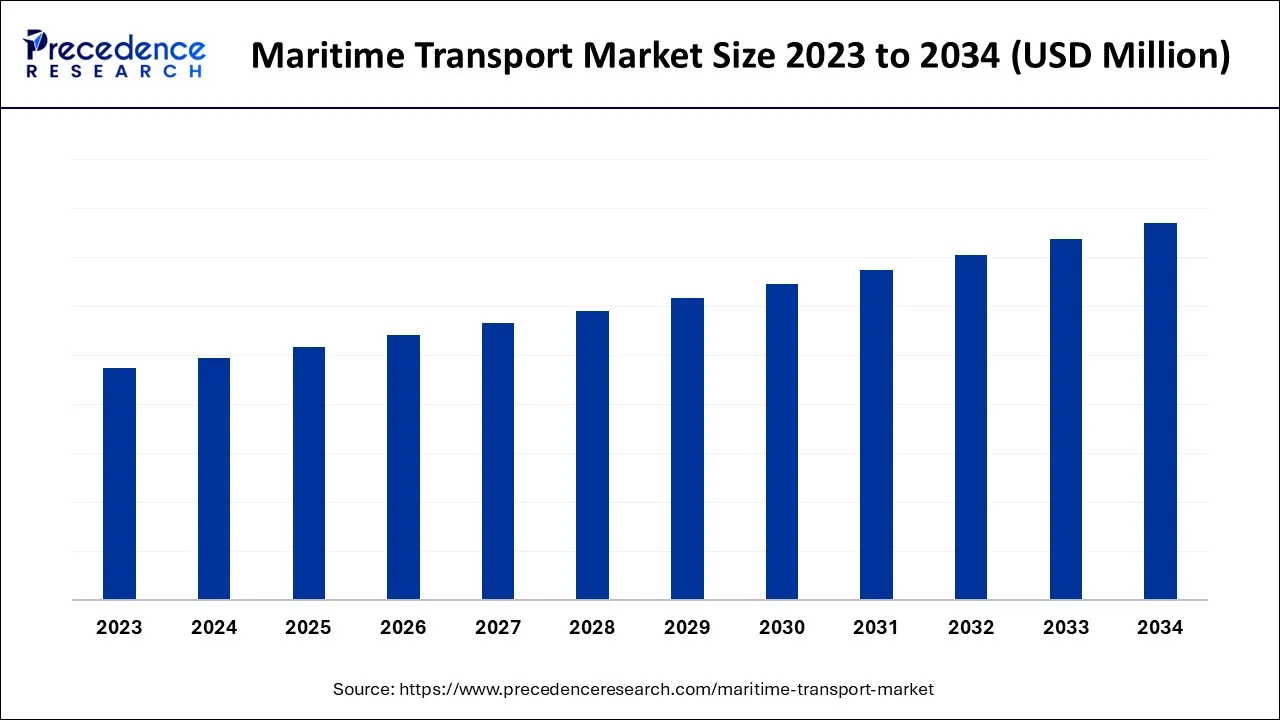

What is the Maritime Transport Market Size?

The global maritime transport market from 2026 to 2035, provides a comprehensive overview of the industry, market segmentation based on a variety of criteria, and the current vendor landscape.

Market Overview

The global trade industry heavily relies on maritime transport to move goods across borders. This market has seen significant growth due to the rise of emerging economies like China and India. The introduction of containerization has greatly improved the efficiency of handling goods. To achieve cost savings, larger vessels and mega-container ships are now being utilized. In response to environmental regulations, the industry has shifted towards cleaner fuels and sustainable practices. The implementation of digitalization and automation has further optimized operations, and initiatives like China's Belt and Road Initiative have enhanced connectivity. However, challenges such as geopolitical factors, infrastructure limitations, and fluctuating freight rates still exist. In summary, the maritime transport market is currently focused on improving efficiency, and sustainability, and embracing digital transformation.

The global trade industry relies heavily on the maritime transport market to move goods and commodities across borders. This market includes shipping, port operations, and logistics services, and is crucial for connecting countries, regions, and continents. The growth of global trade greatly impacts maritime transport. As economies expand and international trade volumes increase, there is a higher demand for shipping services. This demand has been driven by emerging markets like China, India, and Southeast Asian countries.

Maritime Transport Market Growth Factor

The container shipping industry is a key growth sector in the maritime transport market. Containerization has revolutionized global trade by making the transportation of goods efficient and cost-effective. As international trade and e-commerce continue to rise, the demand for container shipping services is expanding. This is particularly evident in emerging economies in Asia and Africa, where rapid industrialization and urbanization are driving increased import and export volumes. Furthermore, there are new opportunities for maritime transport providers in specialized cargo sectors such as refrigerated goods, pharmaceuticals, and hazardous materials. The integration of digital technologies and automation in container handling operations is also expected to enhance efficiency and stimulate market growth.

Market Scope

| Report Coverage | Details |

| Largest Market | Europe |

| Second Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Cargo Type and By Vessel Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growth of E-commerce

The growth of e-commerce has become a strong force in the maritime transport market, changing the way global trade and supply chains work. The popularity of online shopping and e-commerce platforms has transformed the buying and selling of goods, which means there is a need for a reliable and efficient logistics infrastructure to meet the increasing demand.

E-commerce companies face the challenge of fulfilling orders from all over the world, and they heavily rely on maritime transportation to move goods in a cost-effective and reliable way. Maritime transport is ideal for transporting a wide range of products, from electronics to clothing to household goods, because it can handle large volumes of cargo in containerized shipments.

Maritime transport has an extensive network of shipping routes that connect manufacturing centers with consumer markets worldwide. This allows for the smooth movement of goods across continents, and ships can access various ports and terminals, making it possible for e-commerce companies to reach customers in even the most remote locations.

The adoption of containerization in the industry has further boosted the growth of maritime transport in the e-commerce sector. Standardized cargo handling practices have made supply chain operations more efficient, reducing transit times and overall transportation costs. Containerization also ensures that goods are well-protected during transit, minimizing the risk of damage and optimizing efficiency throughout the logistics process.

Restraints

Volatility in fuel prices

Volatility in fuel prices is a major challenge for the maritime transport industry. Fluctuations, especially in marine fuel oil (MFO) prices, can have a significant impact on the operating costs of shipping companies. Since fuel costs make up a large portion of their expenses, sudden price increases can quickly reduce profit margins and negatively affect the financial viability of shipping operations.

When fuel prices rise sharply, shipping companies face a dilemma: either absorb the increased costs or pass them on to customers by raising freight rates. Both options have disadvantages. Absorbing the higher costs can strain finances, while passing them on to customers may make shipping services less competitive and potentially reduce demand. On the other hand, when fuel prices are low, shipping companies may benefit from lower operating costs. However, this situation can discourage investments in cleaner and more efficient technologies that aim to reduce emissions and improve sustainability. With lower fuel costs, there is less incentive to adopt alternative fuels or invest in fuel-efficient vessels, which hinders progress toward a greener maritime industry. According to times now news, the cost of marine fuel 'Low Sulphur High Flash High-Speed Diesel' has increased to Rs 1,21,000 per kilolitre from Rs 76,000 earlier. Similarly, the cost of 'Very Low Sulphur Fuel Oil' has increased to Rs 80,917 per kilolitre from Rs 40,608. Effectively the rise is more than 40 percent.

Opportunities

Increasing globalization and international trade

The maritime transport market is benefiting greatly from increasing globalization and international trade. As economies worldwide grow and develop, the demand for goods and commodities continues to rise. To meet this demand, efficient and reliable transportation services are necessary, making maritime transport a crucial part of the global supply chain.

Maritime transport plays a vital role in international trade by enabling the movement of goods in large quantities over long distances. It offers cost-effective solutions for transporting various types of cargo, including raw materials, manufactured goods, and energy resources. The extensive network of shipping routes connects ports all around the world, facilitating the flow of goods between different countries and continents.

As emerging economies undergo rapid industrialization and urbanization, their demand for imported goods and raw materials increases. Maritime transport provides the capacity and efficiency required to handle these growing trade volumes. Furthermore, maritime transport offers economies of scale, allowing for the transportation of large quantities of goods in a single voyage. This efficiency reduces transportation costs, making goods more affordable for both consumers and businesses. The ability to transport goods in bulk also meets the demands of industries like mining, agriculture, and manufacturing that rely on a steady supply of raw materials and components.

Segment Insights

Cargo Type Insights

Dry bulk cargo refers to goods that are not packaged and are transported in large quantities. This category includes commodities like coal, iron ore, grains, and minerals. The growth of the dry bulk cargo segment is mainly driven by the demand for raw materials in industries such as construction, manufacturing, and agriculture. As economies grow and infrastructural development continues, there is an increased need for transporting bulk materials by sea, which in turn boosts the demand for dry bulk shipping services.

Containerized cargo, on the other hand, refers to packaged goods that are loaded into standardized shipping containers. This type of cargo includes a wide range of products, from electronics and clothing to consumer goods and machinery. The expansion of global trade, particularly in the e-commerce sector, has led to an increased demand for containerized cargo transport. As more businesses adopt e-commerce and supply chains become more interconnected across borders, maritime transport plays a crucial role in efficiently moving containerized goods between manufacturing centers and consumer markets.

Liquid bulk cargo consists of liquids or gases transported in large quantities, such as oil, liquefied natural gas (LNG), chemicals, and edible oils. The growth of the liquid bulk cargo segment is influenced by the energy sector's demand for oil and gas, as well as the chemical and food industries' need for bulk liquid transportation. International trade in energy resources and the increasing globalization of the chemical and food industries have contributed to the steady expansion of the liquid bulk cargo market.

Vessel Type Insights

Ro-Ro ships, also known as Roll-on/Roll-off ships, are specifically designed to transport vehicles such as cars, trucks, and heavy machinery. These ships are equipped with ramps or doors that make it easy for vehicles to be driven onto and off the vessel.

LNG carriers, on the other hand, are specialized vessels used for transporting liquefied natural gas. These ships are built with advanced insulation and containment systems to maintain the cargo at extremely low temperatures. Similarly, LPG carriers are designed to transport liquefied gases like propane and butane. These ships have specialized tanks and safety features to handle these volatile cargoes.

The offshore support vessels play a crucial role in providing logistics and support services to offshore oil and gas platforms. These vessels include supply vessels, anchor-handling tugs, and accommodation barges, among others.

Regional Insights

What Made Europe the Dominant Region in the Maritime Transport Market?

Europe dominated the market by capturing the largest share in 2024. This is due to its extensive coastline, dense network of major ports, and long-standing maritime trade heritage. The region benefits from advanced port infrastructure, strong logistics connectivity, and strict regulatory standards that enhance operational efficiency and safety. Additionally, Europe's focus on sustainable shipping practices and technological innovation further strengthens its leadership in the global maritime transport sector.

Germany Market Trends

The market in Germany is growing due to its strong industrial base, high export activity, and well-developed port infrastructure, including major hubs such as Hamburg and Bremen. Increasing investments in digitalization, port automation, and sustainable maritime solutions further support growth, while Germany's central role in European logistics strengthens demand for efficient maritime transport services.

What Makes Asia Pacific the Fastest-Growing Region in the Maritime Transport Market?

Asia Pacific is expected to grow at the fastest rate during the projection period due to rapid industrialization, expanding international trade, and strong growth in manufacturing and export-oriented economies such as China, India, and Southeast Asian countries. The region is also witnessing significant investments in port infrastructure, shipping fleets, and logistics modernization, which improve capacity and efficiency. Additionally, rising energy demand and increasing seaborne trade of raw materials and consumer goods continue to accelerate maritime transport growth across Asia Pacific.

Singapore Market Trends

Singapore is considered one of the major players in the Asia Pacific maritime transport market, as it boasts the world's largest fully automated port, called Tuas Port, through the combined operations & exploring technology. Also, the country is emphasizing developing1,000 new jobs by 2025 in high-tech maritime roles, led by the Maritime Industry Transformation Tripartite Committee (MITTC).

What Makes North America a Significant Region in the Market?

North America is a significant region in the market due to its well-developed port infrastructure, strong trade links, and high volume of imports and exports. The region also benefits from advanced logistics networks, technological adoption in port operations, and investments in sustainable and efficient shipping practices, which support steady growth and competitiveness.

New York Market Trends

The maritime transport market in New York is increasingly adopting cleaner fuels such as LNG, methanol, and ammonia to support greener operations, with ports like NY/NJ acting as key hubs for this transition. In addition, industry players are exploring battery-powered ferries and hybrid tugs around the harbor to reduce emissions, supported by advancements in electric vessel technology.

How is the Opportunistic Rise of Latin America in the Maritime Transport Market?

Latin America is experiencing an opportunistic rise in the market driven by growing export activity in commodities such as agricultural products, minerals, and energy resources. Increasing investments in port modernization, logistics infrastructure, and trade connectivity, along with expanding regional and international trade partnerships, are creating new growth opportunities. Additionally, the region's strategic coastal access and efforts to improve operational efficiency and sustainability are strengthening its position in global maritime transport.

What Opportunities Exist in the Middle East & Africa for the Market?

The Middle East & Africa (MEA) presents immense opportunities in the maritime transport market due to its strategic geographic location along major global trade routes and the presence of key ports linking Asia, Europe, and Africa. Growing investments in port expansion, logistics hubs, and maritime infrastructure, along with rising energy exports and regional trade, are creating favorable conditions for market growth. Additionally, initiatives focused on port automation and sustainable shipping solutions further enhance long-term opportunities in the region.

Maritime Transport Market Companies

- Maersk: It offers end-to-end solutions, from ocean freight (FCL/LCL) and inland logistics, such as truck, rail, and barge, to united services, including customs, air freight, contract logistics (warehousing), and digital platforms (Maersk Spot, Maersk Go).

- COSCO Shipping: It specializes in large vessels, alongside bulk, tanker, and specialized cargo transport.

- AP Moller: It offers global container shipping with huge ocean networks, integrated with rigorous inland logistics (truck, rail, barge), customs services, warehousing, and value-added solutions.

- Mediterranean Shipping Company S.A. (MSC): The company usually provides comprehensive global maritime transport through vast container shipping.

- CMA-CGM: It offers various container types like specialized reefers, high cubes, and bamboo floors, and value-added services, such as security (Barlock), cold treatment, etc.v

Other Major Key Players

- China Ocean Shipping (Group) Company (COSCO)

- Hapag-Lloyd

- ONE - Ocean Network Express

- Evergreen Line

- HMM Co.

Recent Developments

- In December 2025, Contemporary Amperex Technology Co., Limited (CATL) launched the world's first and only “ship-shore-cloud” zero-carbon shipping and smart port integrated solution.(Source- https://emobilityplus.com/)

- In December 2025, the V.O. Chidambaranar (VoC) Port unveiled a Green Hydrogen Pilot Project focused on developing a bunkering facility for green hydrogen and its derivatives. (Source- https://solarquarter.com/)

- In September 2025, Dubai's Roads and Transport Authority (RTA) announced the rollout of the Dubai Autonomous Zone (DAZ), a 15-kilometre dedicated corridor for driverless vehicles and marine transport, set to become active in early 2026.(Source- https://www.newsonair.gov.in/)

- The International Maritime Organization (IMO) has introduced new regulations, known as IMO 2020, which will take effectin January 2020. These regulations aim to decrease the amount of sulfur oxide emissions produced by ships. To comply with the regulations, ships will be required to either use fuels that have a lower sulfur content or implement technologies that reduce emissions.

- June 2023 The world's largest container shipping company, Maersk, has announced that it will invest $1 billion in sustainable shipping solutions. This includes the development of new ships that run on alternative fuels, such as methanol and ammonia.

Segments Covered in the Report

By Cargo Type

- Dry bulk (e.g., coal, iron ore, grains)

- Liquid bulk (e.g., oil, liquefied natural gas)

- Containerized goods

- General cargo (e.g., machinery, vehicles)

By Vessel Type

- Container ships

- Bulk carriers

- Tankers (crude oil, product, chemical)

- Ro-Ro (Roll-on/Roll-off) vessels

- LNG/LPG carriers

- Offshore support vessels

- Cruise ships

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting