Medical Foods Market Size and Growth 2025 to 2034

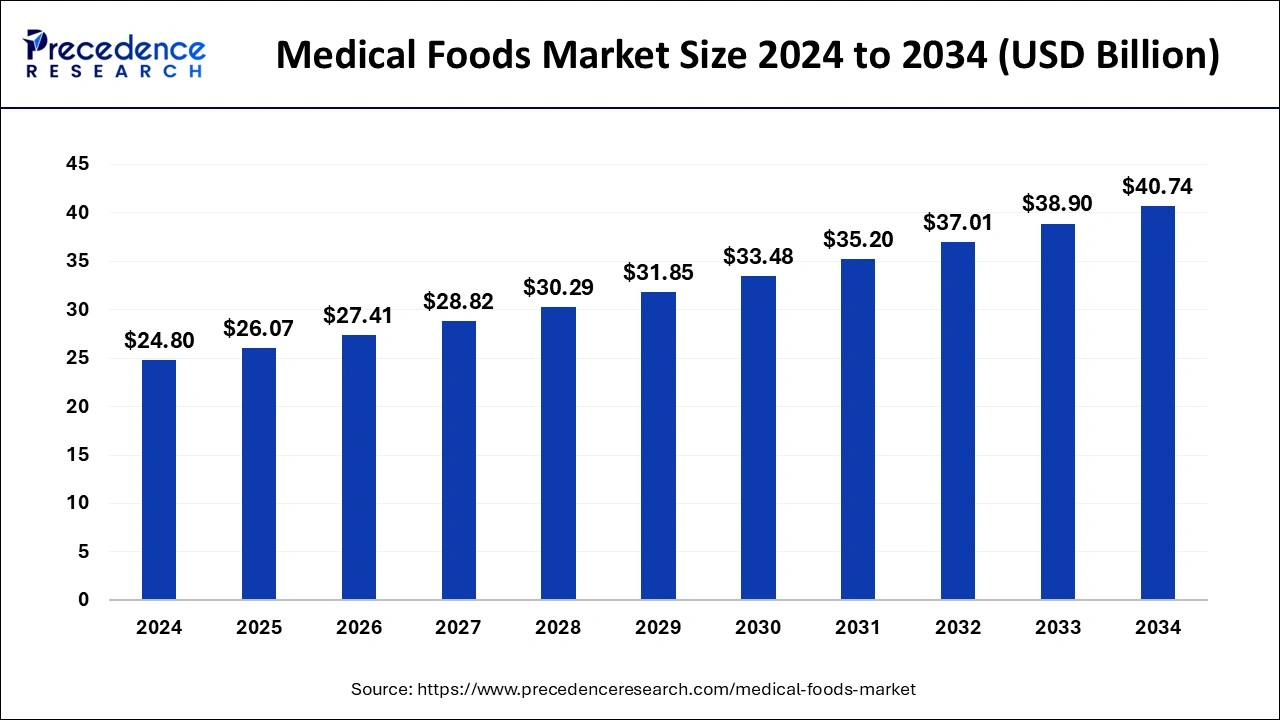

The global medical foods market size was estimated at USD 24.80 billion in 2024 and is predicted to increase from USD 26.07 billion in 2025 to approximately USD 40.74 billion by 2034, expanding at a CAGR of 5.09% from 2025 to 2034. The primary reasons behind the growth of this market are a rise in the number of chronic diseases and the geriatric population.

Medical Foods Market Key Takeaways

- The global medical foods market was valued at USD 24.80 billion in 2024.

- It is projected to reach USD 40.74 billion by 2034.

- The market is expected to grow at a CAGR of 5.09% from 2025 to 2034.

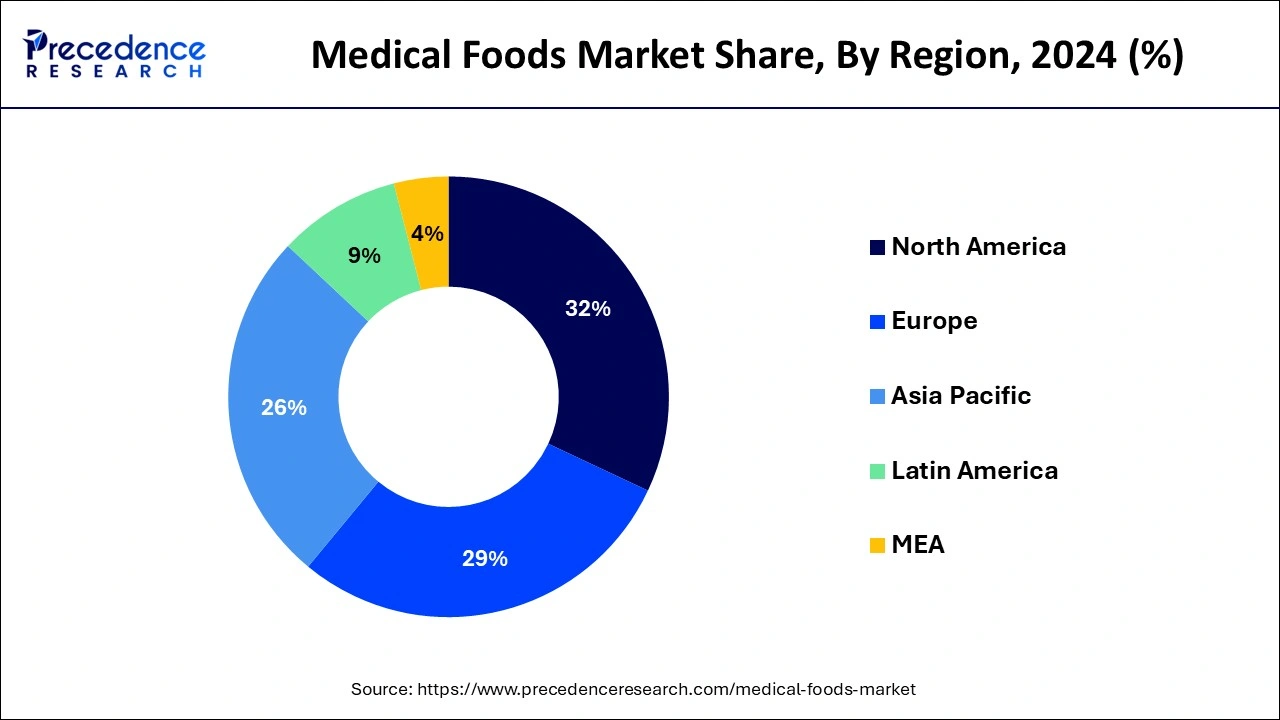

- North America led the global market with a major market share of 32% in 2024.

- Asia Pacific will be the fastest-growing region in the global market during the projected period.

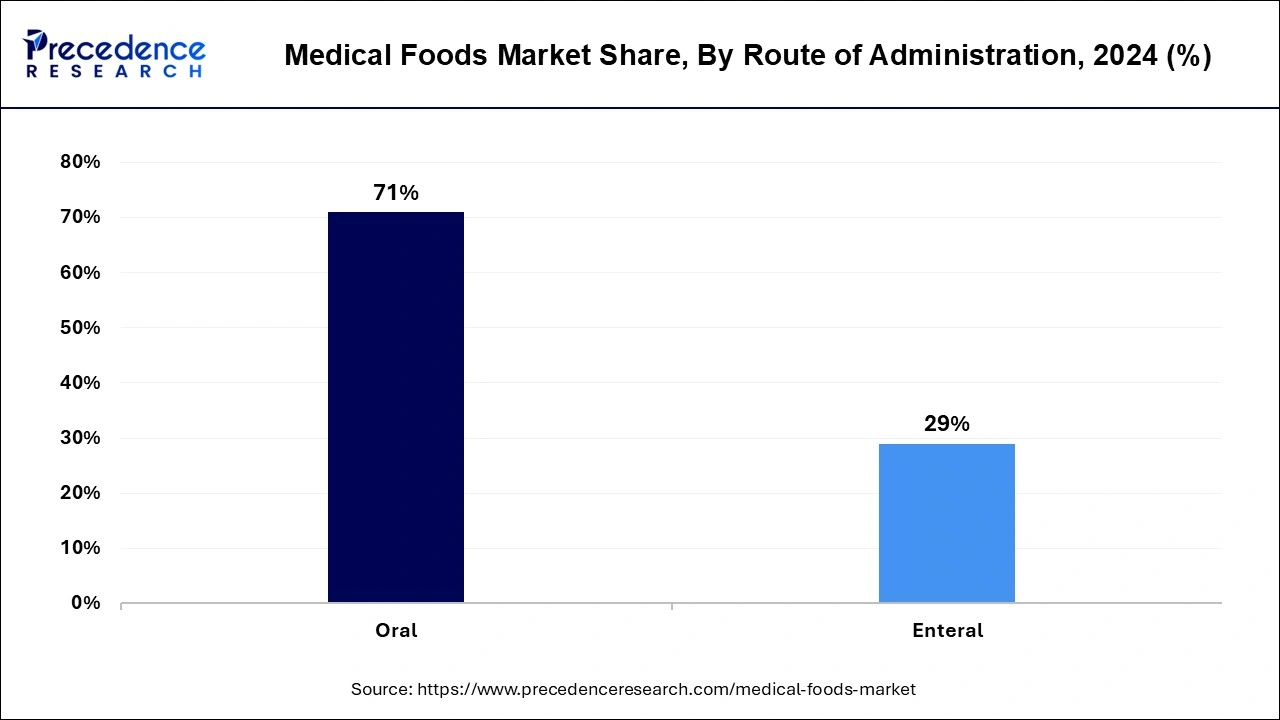

- By route of administration, the oral segment has generated more than 71% of market share in 2024.

- By route of administration, the enteral segment is expected to witness the fastest growth over the forecast years.

- By product type, the powder segment accounted for the largest market share in 2024.

- By product type, the liquid segment is anticipated to grow at the fastest rate during the forecast period.

- By application, the cancer segment has held the largest market share in 2024.

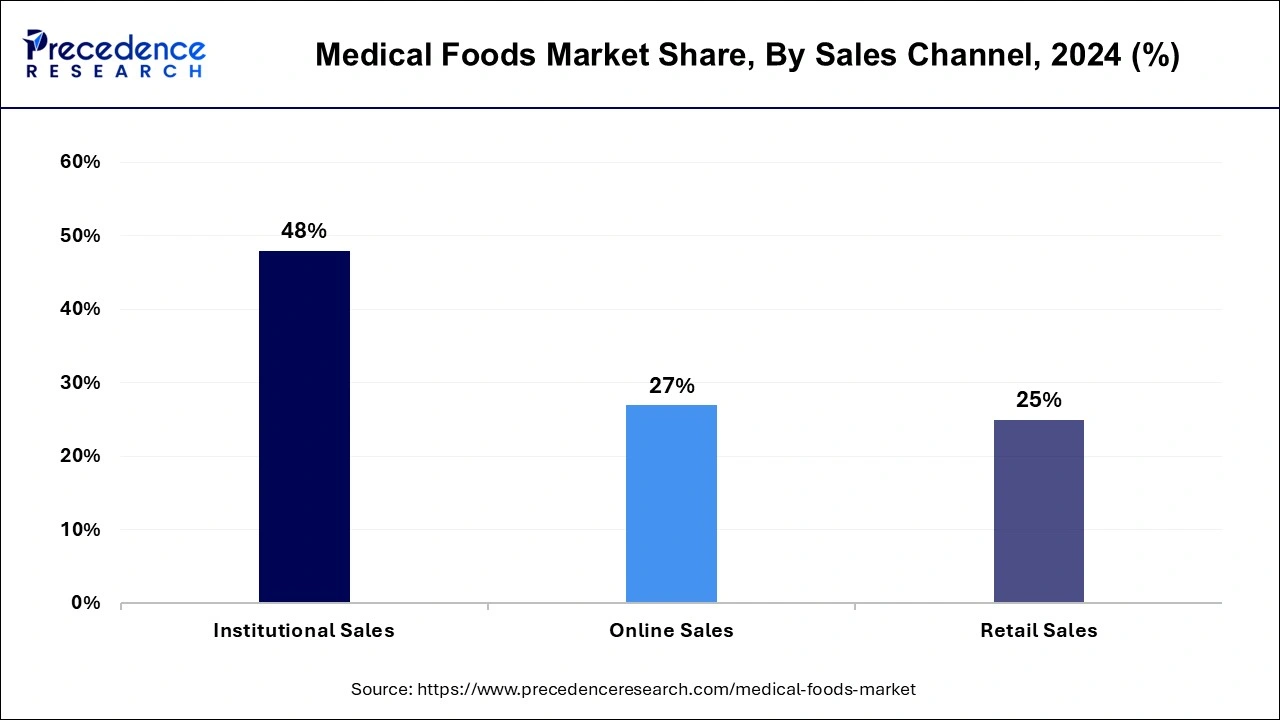

- By sales channels, the institutional sales channel segment has captured more By sales channels, the online sales segment will be the fastest-growing segment during the forecast period.

U.S.Medical Foods Market Size and Growth 2025 to 2034

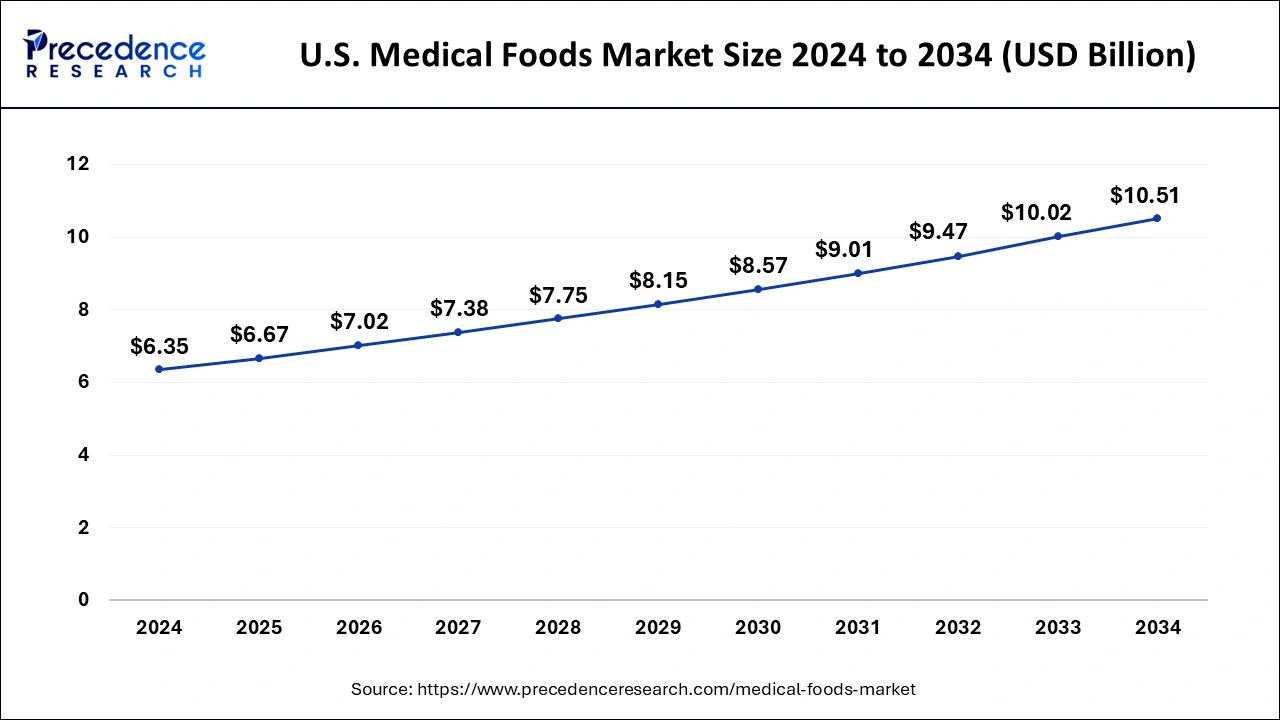

The U.S. medical foods market size reached USD 6.35 billion in 2024 and is predicted to be worth around USD 10.51 billion by 2034, at a CAGR of 5.17% from 2025 to 2034.

North America dominated the global medical foods market in 2024. The reason behind the dominance of North America is an increased geriatric population suffering from chronic diseases. A large number of people show their dependency on medical foods. There is a rise in the number of infants, too. It is anticipated that there will be a significant growth in population in the coming years. Chronic diseases in a large population are also showing nutritional deficiencies. Several people are suffering from neural disorders. Due to this, there will be a growth in the North American medical foods market.

Asia Pacific will be the fastest-growing region in the global medical foods market during the projected period. There are increasing cases of cancer and diabetes, and the government is introducing many policies to develop the healthcare sector. There is a constantly growing geriatric population that is becoming more susceptible to diseases. People have caught a sedentary lifestyle because of joining corporate jobs. There is an awareness about health at the same time, and people are taking steps towards a healthier lifestyle. Medical foods are not only used for curing diseases but also to prevent them. There is strong competition among the local players, and this is leading to growth in the market.

Market Overview

When a person catches some disease, the disease demands certain nutritional requirements. The nutritional requirements might not be fulfilled by a normal diet. Hence, to fulfill these requirements, it is important to consume medical foods that have the necessary nutrition. Medical foods are orally ingested or fed using a tube. They are labeled for fulfilling the dietary requirements for specific diseases or conditions. They are only consumed under medical supervision.

Medical foods can be thought to be a hybrid of drugs and dietary supplements that are given in a regulated manner. Medical foods are labeled for specific medical conditions like Alzheimer's, Parkinson's, etc. Medical foods are useful in treating chronic diseases and help manage nutrition. Doctors can recommend medical foods after checking the overall nutritional intake and health of the patient. The main difference between nutritional supplements and medical foods is that medical foods need to undergo different phases of trials for pharmaceutical drugs. The disease or condition for which the foods are designed should be addressed properly in the case of medical foods.

Medical Foods Market Growth Factors

- A rising number of chronic illnesses

- Growing population, along with a high number of geriatric population.

- Health awareness among people.

- Improved quality of medical foods and enhanced nutritional quality in medical foods.

- Advancements in the healthcare sector.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.09% |

| Global Market Size in 2025 | USD 26.07 Billion |

| Global Market Size by 2034 | USD 40.74 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Route of Administration, By Product, By Application, and By Sales Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising prevalence of chronic diseases

The primary drivers behind the medical foods market are a rising number of diseases and chronic disorders. Due to an unhealthy lifestyle, a huge population is ignoring their health today. Due to this, there are several patients struggling with diabetes, cancer, cardiovascular diseases, etc. There is a growing geriatric population, and with rising age, immunity gets reduced, and a person becomes more susceptible to diseases. For such a susceptible population, there have been several advancements in healthcare facilities. Awareness of health has increased among the population, and there is an increased market demand for nutritional products. There are more advancements in medicines, and people are aware of diet, too.

Restraint

Challenges with clinical trials and maintaining nutritional quality

There are strict regulatory requirements and standards that have to be followed while manufacturing hinders the growth of the medical foods market. Preparing foods targeted to combat a particular disease and regulating the proper proportion of components accordingly can be challenging. There is limited awareness among people regarding medical foods, and many people, even in urban areas, don't have much knowledge about them. Medical foods have a higher price because the preparation methods involve precisely monitored and tailored formulations of the foods. This makes the foods costly because they are formulated and tested by experts. However, high costs make them look like a luxury. There are other pharmaceutical alternatives that can create competition in the medical foods market. In many diseases, patients lose their taste and can find the food to be unappealing. However, not eating food might also not be good for one's health. So, the foods also need to be given a proper taste using proper flavors while keeping in mind that the flavors are not causing any harm to the patient's health.

Opportunity

Patients can ‘enjoy' having their medicines.

Medical foods are a very effective way of treating the diseases. Many patients hate the taste of medicines, or taking too many medicines sounds daunting. In such cases, medical foods can help such patients by being medicines in disguise. This is particularly helpful for kids who don't take their medicines, and such medical foods can also be helpful for pets. Medical food companies can add good flavors to the food and make it tastier and healthier for patients who have lost their appetite. The market can be expanded to different countries where the economies are flourishing, and people can afford high-quality healthcare.

Route of Administration Insights

According to the route of administration, the oral segment led the medical foods market in 2024 and is projected to maintain its position throughout the forecast period. In many cases, oral intake is functional in a patient, and it gives a feeling of ‘having eaten' something. It also gives the patients the feeling that their condition is not that bad. Many times, the mental state of a patient helps them fight a disease. Medical foods can nourish the body well, and food absorption happens through the natural route. Oral intake is completely noninvasive, and hence, it is favored a lot. Oral medical foods are cost-effective as well.

According to the route of administration, the enteral segment is expected to witness the fastest growth in the medical foods market over the forecast years. The enteral route is for patients with serious health issues who have completely lost the ability to consume food orally. Patients lose the sense of appetite when sick, and in such cases where oral intake is impossible, food has to be provided through the enteral route.

Product Type Insights

According to product type, the powder segment accounted for the largest revenue share of the medical foods market in 2024. Powdered foods are easy to consume and can be mixed with warm water and eaten. This is helpful for the elderly population or infants who lack teeth. Powdered foods are also helpful because they can be digested easily and absorbed into the body effectively. They allow different formulations and innovations. More taste can be added to them in order to make the patients like these foods. Powdered foods are dry in nature and can remain fresh for a long time, making them easier to store and consume. Powdered foods are available in metal or plastic containers and can be found in many medical stores, too. Powdered foods cater to the needs of the patients, but they can also be made gluten-free and vegan in order to ensure that the patients don't catch allergies.

According to product type, the liquid segment is anticipated to grow at the fastest rate in the medical foods market during the forecast period. This is because of a rising geriatric population and infants. Digestion might be affected in these age groups, and there is less control over the bowels. Liquids are easy to consume and can pass easily from urine. Intake of solids can be difficult if a patient has difficulty in swallowing due to severe accidents. In such cases, liquid foods can be extremely helpful. Liquid foods can be highly effective because of the low effort needed to digest them, and the body can absorb them extremely efficiently. The nutrient content, vitamins, and minerals are packed precisely in these foods to meet specific dietary requirements. Liquid foods also provide convenience to caregivers, as the food is generally excreted in the form of urine and less through stools. Liquid diets can be added with tasty fruit flavors to give it a taste of energy drinks.

Application Insights

According to the application, the cancer segment dominated the medical foods market in 2024. Cancer is a disease in which the patient can face severe weight loss, malnutrition, and side effects because of chemotherapy and other medications. There is a loss of appetite, and the body shows poor digestion and absorption of food. Medical foods are easy to absorb in the body and to control weight. Cancer patients at a serious stage of chemo lose a lot of energy and cannot digest heavy food. Medical foods are easy to digest and provide adequate nutrition and hydration to the patient. Medical foods are also given by the enteral routes using pipes, and nutrients are directly provided into the intestinal tract.

Sales Channels Insights

According to sales channels, the institutional sales channel segment held the largest share of the medical foods market in 2024. Institutional sales consist of making sales to hospitals, institutes, or clinics and not directly to the patients. This means that patients get a proper prescription from doctors, and then they can get the medicines. The reason behind the dominance of institutional sales channels is that patients get an assurance from the doctors, as trusted professionals should be a reliable choice when it comes to medicines. Hospitals purchase bulk medical foods at a reasonable price. Many hospitals or clinics have tie-ups with medical food manufacturers.

According to sales channels, the online sales segment will be the fastest-growing segment in the medical foods market during the forecast period. Several medical foods are available on websites where one can order medicines online. Online channels provide the luxury of delivery at the doorstep while ensuring the proper quality of the product. Because of online sales, there are no geographical limitations for delivering any product, and a large region can be covered. Online sales are available at any time of the day, and one just has to go on the website to order medical foods. Online sales channels are cheaper and, at the same time, offer a wider reach. Nowadays, online shopping has become very convenient, too, because of the ratings and reviews that people can leave for a product.

Medical Foods Market Companies

- Danone

- Nestlé

- Abbott

- Targeted Medical Pharma Inc.

- Primus Pharmaceuticals Inc.

- Fresenius Kabi AG

- Mead Johnson & Company, LLC

Recent Strategic Initiatives for Medical Foods

The Food is Medicine initiative healthful food choices are provided to patients diagnosed with particular chronic diseases. This initiative contains three main programs which consist of medically tailored meal delivery (MTMs) and medically tailored grocery service (MTGs) alongside produce prescription services. The designed programs work to lower diet-linked medical conditions and fight food scarcity while improving dietary wellness for susceptible groups of people.

Government Announcements

- In August 2024, the BioE3 Policy, which is approved, aims to encourage high-performance biomanufacturing in India and specifically focuses on medical foods and functional foods. The GFRS 2.0 probably refers to Guidelines for Regulatory Framework for Services (GFRS), which may be the updated version, related to biotechnology and biomanufacturing, and the regulation and approval process.

Recent Developments

- In September 2024, Dutch Medical Food decided to launch its Indian market entrance through a strategic partnership with Pristine Pearl Pharma Pvt. Ltd. The newly launched product line uses an approach to treat disease-associated malnutrition throughout both pediatric and adult patient groups.

- In November 2023, Danone an announced the launch of its first medical nutrition product Fortimel for adults in China under foods for special medical purposes. The launch is a key part of Danone's strategy in China linking its scientific capability at all life stages and encouraging the growth of the adult medical nutrition segment.

- In March 2023, French food group Danone acquired ProMedica, a Poland-based company specializing in providing care services for patients at home. This acquisition supports Danone's lucrative specialized nutrition market.

Segments Covered in the Report

By Route of Administration

- Oral

- Enteral

By Product

- Powder

- Pills

- Liquid

- Other

By Application

- Chronic Kidney Disease

- Minimal Hepatic Encephalopathy

- Chemotherapy-induced Diarrhoea

- Pathogen-related Infections

- Diabetic Neuropathy

- Adhd

- Depression

- Alzheimer's Disease

- Nutritional Deficiency

- Orphan Diseases

- Tyrosinemia

- Eosinophilic esophagitis

- Fpies

- Phenylketonuria

- Msud

- Homocystinuria

- Others

- Wound Healing

- Chronic Diarrhea

- Constipation Relief

- Protein Booster

- Dysphagia

- Pain Management

- Parkinson's Disease

- Epilepsy

- Other cancer-related Treatments

- Severe protein Allergy

- Cancer

- Cachexia

- Other

By Sales Channel

- Online Sales

- Retail Sales

- Institutional Sales

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting