What is the Medical X-ray Market Size?

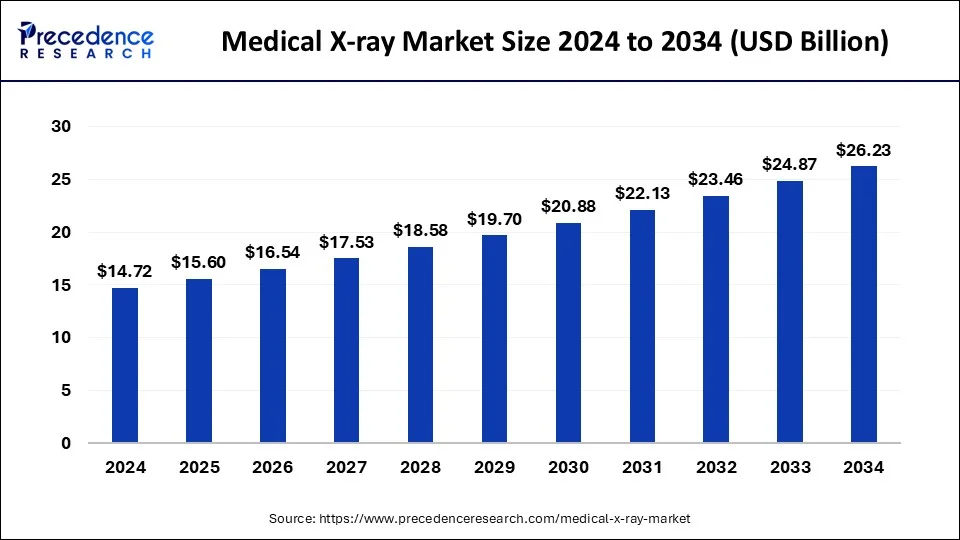

The global medical X-ray market size was estimated at USD 15.60 billion in 2025 and is predicted to increase from USD 16.54 billion in 2026 to approximately USD 27.62 billion by 2035, expanding at a CAGR of 5.88% from 2026 to 2035.

Medical X-ray Market Key Takeaways

- The global medical X-ray market was valued at USD 15.60billion in 2025.

- It is projected to reach USD 27.62billion by 2035.

- The medical X-ray market is expected to grow at a CAGR of 5.88% from 2026 to 2035.

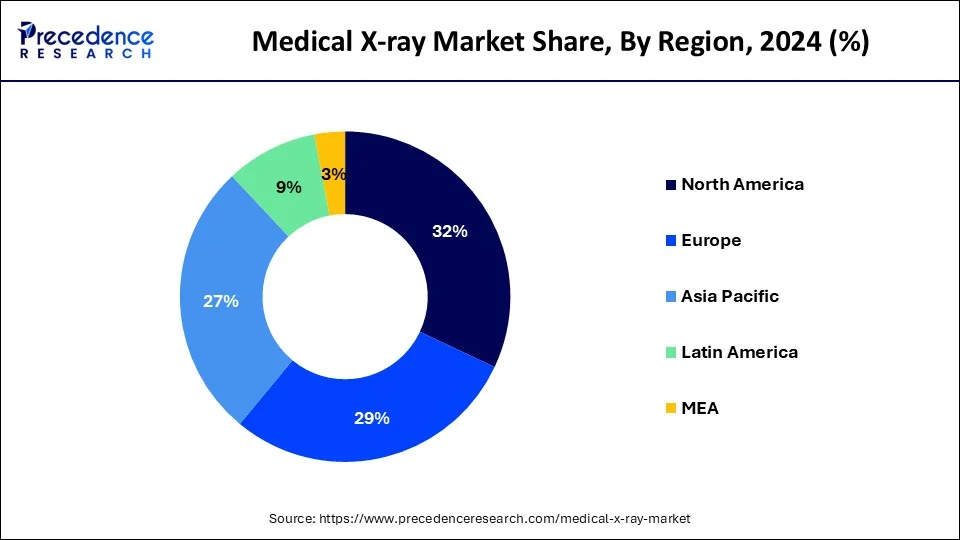

- North America dominated the global market with the largest market share of 32% in 2025.

- By type, the digital segment held the largest share of the market in 2025.

- By portability, the fixed system segment held the biggest market share in 2025.

- By portability, the portable segment is expected to gain significant traction in the market in the upcoming years.

- By application, the chest segment captured the biggest market share in 2025.

Market Overview

X-ray technology, discovered in the late 1800s during the era of electricity experimentation, has evolved into a vital tool for medical diagnosis and industrial inspection. X-rays, a form of ionizing radiation, penetrate through objects, including the human body, allowing for noninvasive imaging of internal structures. This low-cost and powerful technology has seen extensive use in medical diagnostics and industrial nondestructive inspection.

Advances in X-ray detectors and imaging applications continue to enhance their technological importance and effectiveness in various fields. Natural background radiation sources, including extraterrestrial and terrestrial origins, contribute to the overall radiation exposure, but medical X-ray machines emit controlled radiation for specific purposes, with proper precautions to minimize risks associated with genetic damage.

Recent Trends in the Medical X-Ray Market

The increasing rate of global population along with a huge demographic shift, which shows, growing old age population who are prone to many chronic diseases and illnesses, which require various diagnostic processes to confirm the exact medical condition, is a major driver of the medical X-ray market.

Another propelling factor for the market includes reimbursement of medical treatment, which includes x-rays as well, further accelerating the market growth as the x-ray option becomes affordable to perform within the group of people who claim to have reimbursement of medical treatments. Government, private marketers, and insurance companies are also supporting medical treatment by covering x-ray services and their expenses.

Medical X-ray Market Growth Factors

- Medical X-rays are the leading contributor to man-made radiation exposure. Despite awareness of potential risks, there's a prevalent tendency to overuse X-rays, leading to a growing demand for diagnostic imaging services.

- X-rays play a crucial role in diagnosing conditions like bone fractures, ensuring accurate realignment to prevent complications such as malposition and arthrosis. This necessity drives the expansion of the medical X-ray market as it addresses critical healthcare needs.

- Specialized procedures like computed tomography (CT) for head injuries provide vital insights, enabling timely surgical interventions or avoiding unnecessary operations. This demand for specialized diagnostic capabilities fosters market growth.

- Medical X-rays facilitate early detection of diseases such as breast cancer and vascular narrowing, enhancing patient outcomes. The emphasis on preventive healthcare drives the expansion of the medical X-ray market through increased screening initiatives.

- Awareness of radiation risks during pregnancy prompts the adoption of alternative imaging modalities or postponement of X-ray procedures, spurring the demand for non-ionizing imaging technologies and specialized prenatal care.

- While conventional radiography involves low radiation doses, procedures like X-ray fluoroscopy and CT scanning entail higher doses. The diverse requirements for diagnostic accuracy drive the medical X-ray market as healthcare providers seek optimal imaging solutions with minimal radiation exposure.

- Integration of digital X-ray imaging with artificial intelligence (AI) enables Computer-Aided Diagnosis (CAD) systems. These intelligent algorithms enhance diagnostic accuracy and efficiency, contributing to market expansion through improved diagnostic capabilities.

- Advancements in digital X-ray technology have led to the development of portable and mobile devices, revolutionizing medical imaging by bringing imaging capabilities directly to the point of care. The increased accessibility and convenience drive the growth of the medical X-ray market by expanding imaging opportunities beyond traditional settings.

Market Scope

| Report Coverage | Details |

| Global Market Size in 2025 | USD 15.60 Billion |

| Global Market Size in 2026 | USD 16.54 Billion |

| Global Market Size by 2035 | USD 27.62 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.88% |

| Dominated Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type, By Portability, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Advanced imaging technology

The integration of traditional X-ray technology with computer processing, as seen in computed tomography (CT), is a significant driver of growth in the medical X-ray market. CT imaging surpasses plain radiography by providing highly detailed cross-sectional images of the body, offering doctors the ability to visualize internal structures from multiple perspectives.

Advanced imaging technological advancement enhances diagnostic capabilities, allowing for more accurate and comprehensive assessments of various medical conditions. As healthcare providers increasingly prioritize advanced imaging modalities for improved patient care and treatment outcomes, the demand for CT scans continues to fuel the expansion of the medical X-ray market.

- In February 2023, Lantheus acquired Cerveau Technologies, Inc., expanding its imaging pipeline into Alzheimer's Disease.

- In September 2023, Align Technology, Inc. unveiled new software innovations to accelerate digital practice transformation.

Enhanced diagnostic capabilities through fluoroscopy and mammography

The utilization of advanced techniques such as fluoroscopy and mammography significantly propels the growth of the medical X-ray market. Mammography, utilizing X-rays, provides essential tools for cancer detection and diagnosis by identifying irregular-shaped masses and microcalcifications, aiding in early detection and treatment planning.

Fluoroscopy, which combines X-rays with a fluorescent screen, enables real-time imaging of bodily movements and diagnostic processes, such as tracking contrast agents through blood vessels and organs. This technology is vital in minimally invasive procedures like cardiac angioplasty, enhancing precision and effectiveness while fostering the expansion of the medical X-ray market through improved diagnostic capabilities and treatment outcomes.

- In November 2023, Nagarro and Radiometer affirmed a strong and ongoing partnership in advancing medical technology.

- In November 2023, Fremman Capital acquired a majority stake in HT Médica, a leading Spanish provider of radiology and diagnostic imaging services, in partnership with the Luna Family.

Restraints

Potential health risks associated with ionizing radiation

Despite their diagnostic benefits, the medical X-ray market faces a restraint due to the potential health risks associated with ionizing radiation. While X-ray scans are a vital part of the diagnostic processes of life-threatening conditions such as bone cancer, blocked blood vessels, and infections, cumulative exposure to ionizing radiation poses a risk to living tissue. Although the risk of developing cancer from radiation exposure is generally small, the concern over long-term health implications limits the widespread adoption of X-ray procedures, leading to cautious utilization and potentially constraining market growth.

Concerns over radiation exposure in vulnerable populations

A significant restraint in the medical X-ray market arises from concerns over radiation exposure, particularly in vulnerable populations such as pregnant women and children. While X-rays are generally considered safe for pregnant women if the imaging area excludes the abdomen or pelvis, doctors prioritize non-radiation imaging modalities like MRI or ultrasound whenever possible. However, in emergencies or when time constraints exist, x-rays may be used as an alternative.

Children, being more sensitive to ionizing radiation and having a longer life expectancy, face a higher relative risk of developing cancer from radiation exposure. Parents may hesitate to opt for X-ray imaging unless assured that the equipment settings are adjusted for pediatric patients, thus limiting the adoption of X-ray procedures and potentially constraining market growth.

Opportunities

Advancements in X-ray imaging driving multifaceted applications

The continual advancements in X-ray imaging present significant opportunities for the medical X-ray market. With its exceptional penetration ability, X-ray imaging has become a powerful modality for medical diagnostics, enabling detailed visualization of skeletal structures, fractures, bone diseases, and foreign objects. This imaging data plays a crucial role in guiding surgical interventions and enhancing patient care and treatment outcomes. Moreover, beyond medical applications, X-ray imaging finds extensive use in non-destructive industrial and safety inspections, further expanding its utility across diverse sectors.

The continuous development of X-ray imaging technologies over the past century has not only revolutionized medical diagnostics but also contributed to advancements in various disciplines, ranging from fundamental research to practical applications. This interdisciplinary synergy creates opportunities for innovation and growth in the medical X-ray market, driving the evolution of diagnostic radiography and expanding its impact across multiple domains.

- In January 2024, Canon Medical Systems and Olympus announced a business alliance regarding Endoscopic Ultrasound Systems.

- In November 2023, Bracco revealed a long-term strategic partnership with Ulrich Medical.

Advancements in digital X-ray imaging enhance diagnostic capabilities

The transition from traditional film-based X-rays to digital X-ray imaging represents a significant opportunity for the medical X-ray market. Digital X-ray systems, leveraging flat-panel detectors or charged-coupled devices (CCDs), deliver substantially improved image quality characterized by superior clarity, resolution, and contrast. This enhanced clarity enables healthcare professionals to discern even the smallest anatomical details with precision, facilitating more accurate diagnoses and optimal treatment planning.

Superior quality of digital images facilitates the early detection of diseases and abnormalities, potentially leading to life-saving interventions. The seamless integration of digital X-ray imaging with Picture Archiving and Communication Systems (PACS) further enhances opportunities by providing a comprehensive database for storing and sharing medical images and patient data across healthcare facilities or departments. This integration streamlines workflow promotes collaboration among healthcare providers, and ultimately improves patient care, driving the growth and adoption of digital X-ray technology in the medical X-ray market.

- In January 2023, Bayer acquired Blackford Analysis Ltd., reinforcing the company's position in Digital Medical Imaging.

Segment Insights

Type Insights

The digital segment stood as a cornerstone in the medical X-ray market in 2025, driving significant advancements through its transformative capabilities. One of the major breakthroughs of digital technology lies in its ability to facilitate the electronic transfer of images to any location, offering unparalleled convenience and accessibility. Digital X-ray systems deliver detailed images with remarkable efficiency by leveraging a combination of software and hardware. The system's sensors swiftly process and transmit pictures to a monitor within seconds, providing physicians with quick and clear insights into the patient's condition.

This timely production and transmission of images not only expedites diagnosis but also enhances collaboration and consultation among healthcare professionals. The option for remote interpretation of images holds immense potential in alleviating the workload of radiology departments, particularly during peak hours or in understaffed facilities. Images captured in one location can be swiftly analyzed and reported by fully staffed departments elsewhere, optimizing resource utilization and improving patient care.

Digital radiology represents a monumental leap forward in medical imaging, potentially rendering traditional radiographic films obsolete in the near future. Analogous to the transition from film cameras to digital cameras, digital X-ray technology enables immediate image acquisition, editing, and sharing across a network of computers. This transformative shift not only enhances workflow efficiency but also enhances diagnostic accuracy and patient outcomes, positioning digital X-rays as a cornerstone of modern healthcare imaging practices.

Portability Insight

The fixed systems segment emerged as the dominant segment within the medical X-ray market in 2025, primarily due to their ability to streamline workflow for technologists, enhance consistency, boost diagnostic confidence, and minimize errors. Designed to keep radiology departments running smoothly and profitably, fixed X-ray systems are equipped with features aimed at simplifying operations and ensuring optimal performance.

Conventional radiography machines, a subset of fixed X-ray systems, are widely prevalent in hospitals and medical facilities. These machines, comprising an X-ray tube, flat detector, or film cassette, excel at capturing static two-dimensional images, making them well-suited for imaging bones, joints, and the chest. Conventional radiography plays a crucial role in diagnosing fractures, dislocations, and lung infections and evaluating bone health, among other applications.

In the market, the portable systems segment is expected to gain significant traction in the upcoming years. While fixed X-ray systems offer unmatched reliability and efficiency, the rising demand for portability in medical imaging presents a notable consideration. Portable X-ray systems provide flexibility and accessibility, allowing healthcare professionals to conduct imaging studies at the point of care, such as bedside examinations or in emergency situations. The portability of X-ray systems enables enhanced patient care and facilitates timely diagnoses, particularly in scenarios where mobility is essential or traditional imaging facilities are inaccessible.

Application Insights

The chest segment captured the biggest market share in 2025, owing to its widespread application and diagnostic efficacy. Utilizing a minimal dose of ionizing radiation, chest X-rays generate comprehensive images of the heart, lungs, airways, blood vessels, and spinal and chest bones, making it the most commonly performed diagnostic X-ray examination.

This imaging modality plays a pivotal role in diagnosing and treating various medical conditions by providing crucial insights into internal anatomy and pathology. By exposing patients to a small dose of ionizing radiation, chest X-rays aid healthcare professionals in diagnosing conditions such as shortness of breath, persistent cough, fever, chest pain, or injury. Moreover, they facilitate the evaluation and monitoring of lung-related ailments, including pneumonia, emphysema, and cancer.

As the oldest and most frequently utilized form of medical imaging, chest X-rays offer a fast and convenient diagnostic solution, particularly in emergency settings. Their rapid acquisition and ease of interpretation make them invaluable tools for swift diagnosis and treatment planning, enhancing patient care outcomes, and optimizing healthcare delivery.

Regional Insights

What is the U.S. Medical X-ray Market Size?

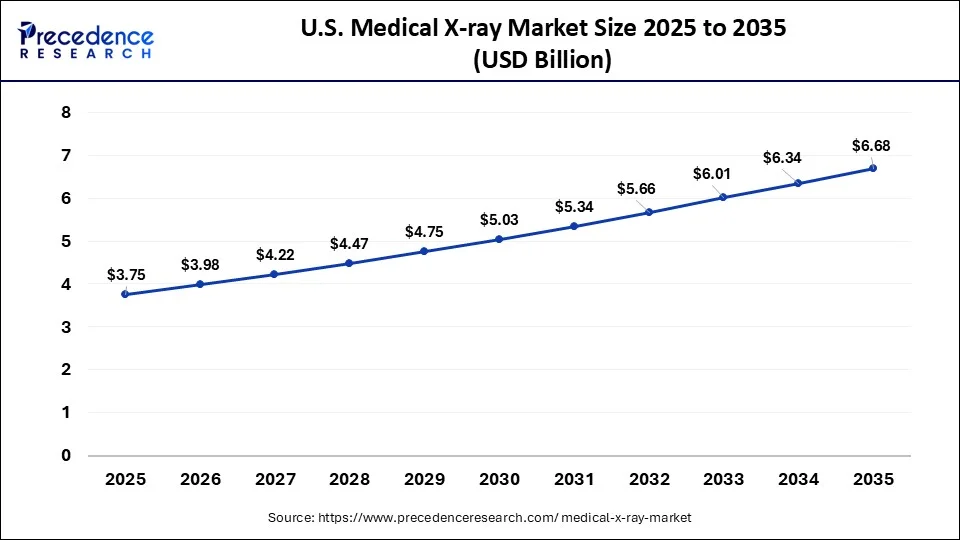

The U.S. medical X-ray market size was estimated at USD 3.75 billion in 2025 and is predicted to be worth around USD 6.68 billion by 2035 at a CAGR of 5.94% from 2026 to 2035.

North America held the largest market share of 32% in 2025, leveraging advanced technology and robust healthcare infrastructure. Medical X-rays play a pivotal role in diagnostic imaging, allowing healthcare professionals to visualize internal structures and detect abnormalities within the body.

- The Radiological Society of North America (RSNA), boasting over 54,000 members, underscored the region's leadership in radiological advancements and research.

X-ray technology, whether projected onto film or transmitted digitally to computers, enables comprehensive imaging of internal organs, tissues, and bones. The dense nature of bones results in their appearance as white on X-ray images, while less dense tissues appear dark as the radiation passes through them. Medical X-rays facilitate the detection of broken bones, tumors, and foreign objects, enhancing diagnostic accuracy and treatment planning.

The region's commitment to leveraging medical X-ray technology extends beyond traditional X-ray examinations to encompass a spectrum of imaging modalities, including CT scans, mammograms, and fluoroscopy. This comprehensive approach to diagnostic imaging underscores North America's position as a global leader in healthcare innovation, driving continued growth and advancement in the medical X-ray market.

- In February 2024, IBA completed the acquisition of Radcal Corporation, aimed at enhancing its Medical Imaging Quality Assurance portfolio and solidifying its presence in the United States.

- In January 2024, Orthofix announced a commercial partnership with MRIguidance.

- In February 2024, RadNet entered the Houston, Texas, market through the platform acquisition of Houston Medical Imaging.

What are the Advancements in the Medical X-ray Industry in Europe?

Europe is expected to witness significant growth in the market, fueled by increased investments in research and development from the public and private sectors. Moreover, the escalating demand for healthcare equipment and the prevalence of chronic and pain-related conditions in the region are expected to further boost market expansion even more. Furthermore, the region also benefits from efficient reimbursement policies. Countries like Germany, France, and the UK are leading players.

Germany Medical X-ray Market Trends: Germany is expected to expand significantly in the forecast period due to a rapidly aging population, the growing prevalence of chronic diseases, the presence of a sophisticated healthcare system, and high healthcare spending.

What are the Key Trends in the Medical X-ray Market in Latin America?

Latin America is expected to witness a substantial amount of growth in the market. This growth is due to various factors, such as the increasing awareness in the region about chronic disease and a rising number of diagnosed cases, thus boosting market demand. Furthermore, clinical education through conferences, symposiums, and webinars is becoming vital for improving the adoption rates. Countries like Brazil and Mexico are leading players.

Brazil Medical X-ray Market Trends: The country's market landscape is driven by increasing diagnostic imaging procedures and the need for efficient image storage, retrieval, and analysis systems, to boost innovations and adoption of medical X-rays. Healthcare providers are also seen modernizing in radiology and cardiology IT infrastructure.

How is the Middle East and Africa Region Growing in the Medical X-ray Industry?

The Middle East and Africa are expected to witness steady growth throughout the forecast years, due to rapid technological innovation and an increasing focus on healthcare infrastructure. The region is seen actively focusing on the digitalization of healthcare by leveraging innovative technologies, such as AI, big data, and cloud computing. Such advancements are driving the demand. Countries like the UAE, Saudi Arabia, and Kuwait are leading players in the region.

Saudi Arabia Medical X-ray Market Trends:

The Saudi Arabian market is growing steadily as healthcare modernization under Vision 2030 drives investment in advanced diagnostic imaging infrastructure and replaces older analog systems with digital radiography that offers higher image quality and efficiency. Increased prevalence of chronic diseases such as diabetes, cardiovascular conditions, and cancer is boosting demand for X-ray diagnostics to support early detection and routine screening across hospitals, clinics, and diagnostic centers.

Medical X-ray Market Companies

- Koninklijke Philips N.V.

- Siemens Healthineers AG

- GE Healthcare

- Canon Medical Systems

- Shimadzu Corporation

- FUJIFILM SonoSite, Inc.

- Carestream

- Mindray Medical International Limited

- Hologic, Inc

- New Medical Imaging

- AGFA

Recent Developments

- In July 2024, GE Healthcare Technologies announced the acquisition of the clinical artificial intelligence software business of Intelligent Ultrasound Group PLC, as per the estimated value of USD 51 million. The company has aim to incorporate these solutions into their ultrasound portfolio, which further strengthens their capabilities with technology design to enhance their workflow that positively impacts clinicians and patients by mitigating mundane, repetitive tasks. (Source: https://www.gehealthcare.com)

- In June 2024, a leading radiology solutions provider in Peru, renowned as Distribudora Diagnostica Medica SAC, made an agreement with the company named Carestream Health, aiming to convert consumers of DMD and offer a base for products of CareStream. As per the terms of the agreement, DMD will help CareStream to distribute the products in the region.

- (Source: https://www.carestream.com)

- In April 2024, a subsidiary of Japan's Shimadzu corporation, known as Shimadzu Medical System, U.S., announced that it acquired California X-ray Imaging Services, Inc. to expand its portfolio in the North American region while offering services as per consumers' demand. (Source: https://www.prnewswire.com)

- In August 2023, Union Minister Dr. Jitendra Singh inaugurated India's inaugural, domestically crafted, cost-effective, lightweight, ultrafast, High Field (1.5 Tesla), Next Generation Magnetic Resonance Imaging (MRI) Scanner in New Delhi.

- In July 2022, Siemens Healthineers introduced the new Mobilett Impact, a mobile X-ray system.

- In November 2022, MediView partnered with GE Healthcare to introduce Augmented Reality Solutions to Medical Imaging for the Interventional Space.

- In October 2022, Samsung introduced the AccE Glass-Free Detector for X-Ray Imaging.

- In July 2022, Siemens Healthineers expanded access to care with the launch of the new affordable X-ray system Multix Impact.

- In December 2023, Probo Medical finalized the acquisition of Alpha Source Group.

- In January 2023, Radon Medical Imaging announced the acquisition of Premier Imaging Medical Systems.

Segments Covered in the Report

By Type

- Digital

- Analog

By Portability

- Fixed Systems

- Portable Systems

By Application

- Dental

- Intraoral Imaging

- Extraoral Imaging

- Veterinary

- Oncology

- Orthopedics

- Cardiology

- Neurology

- Others

- Mammography

- Chest

- Cardiovascular

- Orthopedics

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting