What is the Metal Casting Market Size?

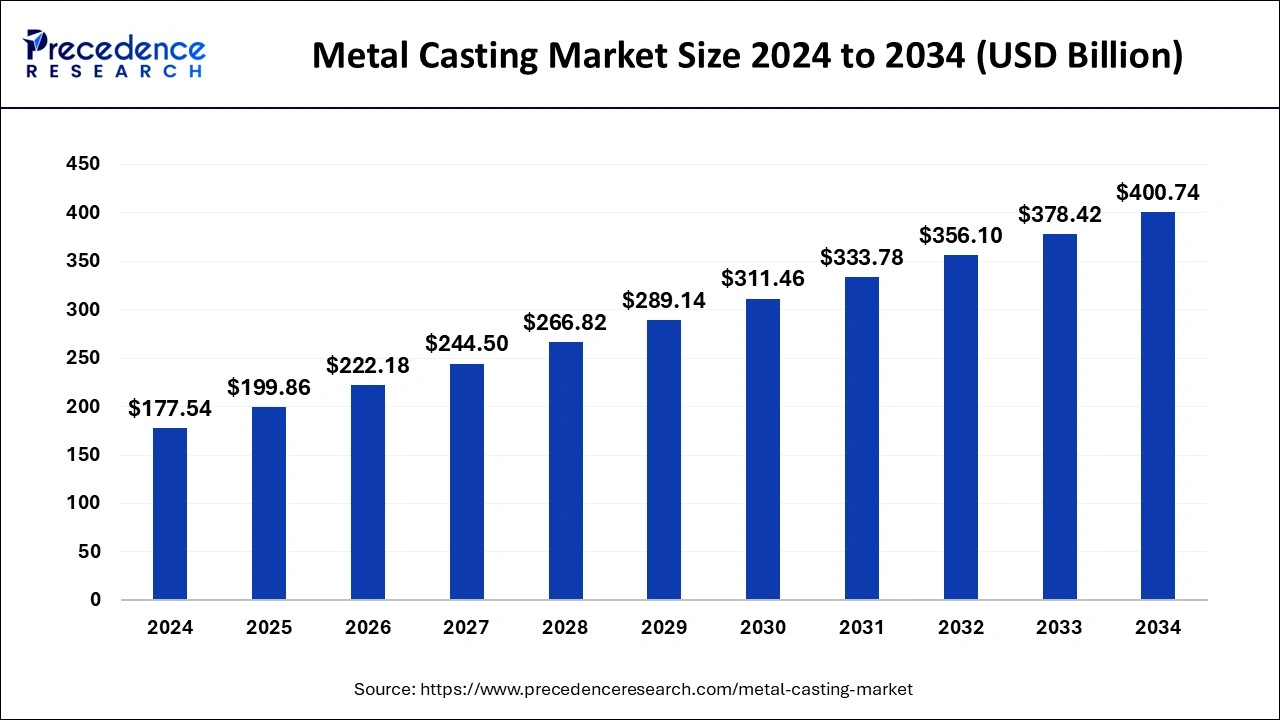

The global metal casting market size is accounted at USD 199.86 billion in 2025 and predicted to increase from USD 222.18 billion in 2026 to approximately USD 423.06 billion by 2035, expanding at a CAGR of 7.79% from 2026 to 2035.

Metal Casting Market Key Takeaways

- The global metal casting market was valued at USD 177.54 billion in 2025.

- It is projected to reach USD 423.06billion by 2035.

- The metal casting market is expected to grow at a CAGR of 7.79% from 2026 to 2035.

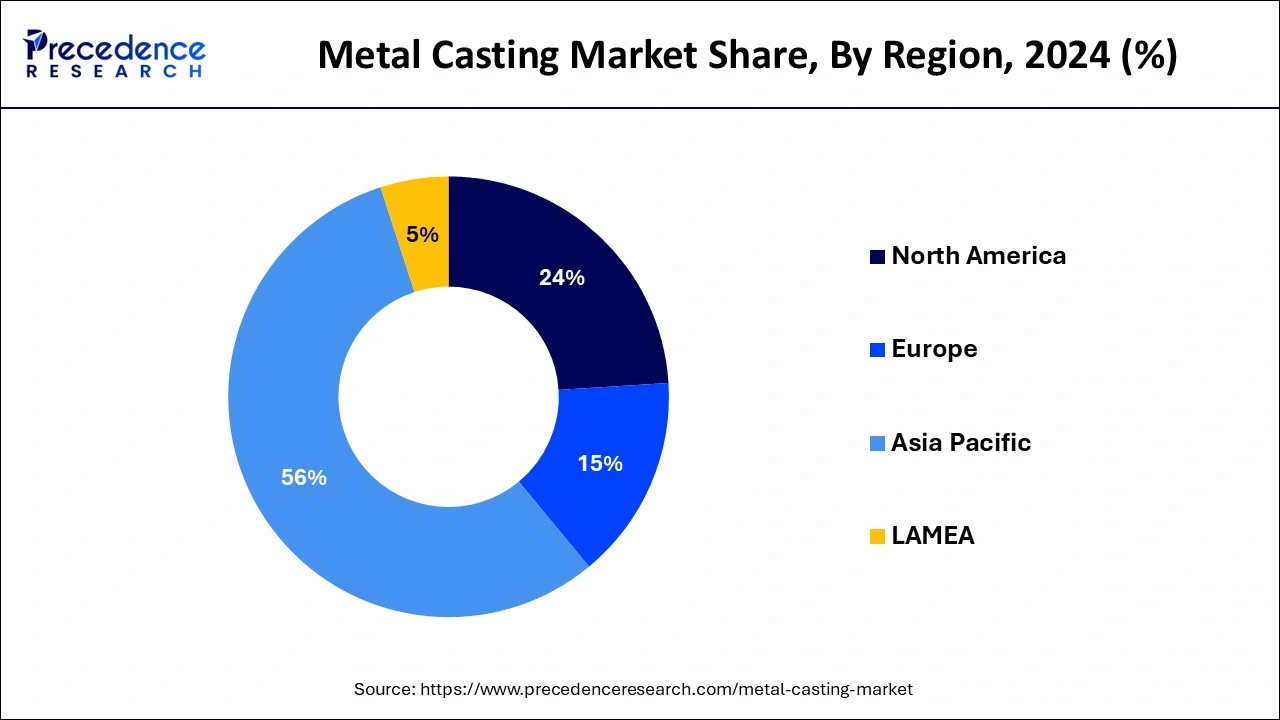

- Asia Pacific led the market with the biggest market share of 56% in 2025.

- North America is expected to witness the fastest rate of growth in the Metal Casting market during the forecast period.

- By material, the aluminum segment held the largest segment of the Metal Casting market in 2025.

- By material, the steel segment is expected to grow at a significant rate during the forecast period.

- By application, the automotive segment is expected to hold the dominating share of the market during the forecast period.

- By application, the industrial segment is expected to grow at a notable rate.

What is Metal Casting?

Metal casting is a manufacturing technique where molten metal is poured into a prepared mold to create a specific shape upon solidification. This time-tested process, utilized for centuries, is adept at crafting a diverse array of metal components, from intricate parts to sizable industrial elements. The method entails crafting a mold, often composed of sand or other materials, and then filling it with molten metal. As the metal cools and solidifies, the mold is removed, unveiling the final product. Metal casting finds widespread application in industries like automotive, aerospace, and construction due to its cost-effectiveness and efficiency in producing intricate metal forms at scale.

What is the Role of AI in the Metal Casting Industry?

AI significantly impacts the metallurgical industry and is beneficial for die casting companies. AI has wide applications in metal manufacturing, which include predictive maintenance, process optimization, automated quality control, energy efficiency, and advanced automation. AI solutions allow industries to optimize the use of raw materials, minimize energy consumption, and reduce carbon dioxide emissions.

What are the Growth Factors in the Metal Casting Market?

- The growth of the metal casting market is closely linked to industrialization trends. As industries expand globally, there is a rising demand for metal castings across various sectors, including automotive, aerospace, construction, and machinery.

- Ongoing technological advancements in metal casting processes contribute to the market's growth. Innovations in casting techniques, materials, and automation enhance efficiency, reduce production costs, and improve the overall quality of metal castings.

- The automotive industry is a major driver of the metal casting market. As the automotive sector expands globally, there is an increasing need for complex and lightweight metal components, which are often produced through casting processes.

- The focus on sustainable practices and environmental regulations is driving the adoption of eco-friendly casting processes. Metal casting companies that embrace cleaner and more sustainable methods are likely to experience growth as environmental concerns become more prominent.

- With the growing trend towards product customization, the metal casting market benefits from the ability to produce complex and customized components. This demand is particularly prevalent in industries like AE.

Metal Casting Market Outlook

- Industry Growth Overview: Between 2025 to 2030, the metal casting industry will experience steady growth based on increased demand from the automotive, construction industry and heavy machinery industry as a result of lightweight alloys as well as precision cast components that are beginning to be used throughout the world, particularly by the ASEAN and North American regions as they move towards the use of high-performance value-added applications for their products.

- Global Expansion: Many of the leading companies are ramping up capacity in areas such as Southeast Asia, Eastern Europe, and Latin America to be in proximity to automotive OEMs and benefit from the lower cost structure of those markets. Several global organizations have recently announced that they will be constructing additional facilities focused on aluminum and iron casting to supply the growing regional demand for Industrial and Mobility Applications.

- Major Investors: Private equity and strategic investors are rapidly becoming involved in the metal casting industry because there is a continuous demand, the availability of long-term contracts, and the opportunity for the modernization of the process. These investment firms are currently providing capital to businesses that manufacture high-precision aluminum castings, utilize green foundry technology, and provide advanced metallurgical solutions.

- Startup Ecosystem: Innovation in the additive-enabled casting industry, AI-based defect detection, and low-energy melting systems is gaining traction. Companies in the U.S., Germany, and India are attracting investments because they develop digital foundry tools, produce automated quality control technology, and provide clean metal recovery technologies.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 7.79% |

| Market Size in 2025 | USD 199.86 Billion |

| Market Size in 2026 | USD 222.18 Billion |

| Market Size by 2035 | USD 423.06Billion |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Material and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Infrastructure development boost

- The World Bank estimates that global infrastructure spending is expected to reach approximately USD 4.2 trillion per year by 2030, indicating a substantial demand for metal castings in construction projects.

Infrastructure development serves as a potent catalyst for the surge in market demand for the metal casting industry. As nations globally embark on ambitious infrastructure projects, the demand for diverse and specialized metal components escalates. Metal casting plays a pivotal role in providing essential parts for infrastructure projects such as bridges, pipelines, and power plants. The versatility of metal casting processes allows for the production of intricate and custom components that meet the stringent requirements of modern infrastructure.

The projected trillions of dollars in global infrastructure spending over the coming years, as estimated by the World Bank, underline the pivotal role of metal casting in shaping the future of construction and development. The reliability, durability, and scalability of metal casting make it an indispensable solution for the intricate and robust metal components essential to the success of large-scale infrastructure initiatives worldwide.

Restraint

Global supply chain disruptions

Global supply chain disruptions act as significant obstacles for the metal casting market, affecting both production and market demand. The metal casting industry heavily relies on a network of suppliers for crucial raw materials like metals and alloys. When disruptions occur in the global supply chain, be it due to geopolitical tensions, trade conflicts, or unforeseen events such as natural disasters, shortages, increased costs, and delays in production become prevalent. These uncertainties impede the ability of metal casting manufacturers to meet demand efficiently and in a timely manner. The interconnectedness of the global economy makes metal casting vulnerable to supply chain fluctuations.

When key raw material sources face interruptions, metal casting companies may experience challenges in maintaining consistent production levels and meeting contractual obligations. Consequently, these disruptions can create an atmosphere of uncertainty for consumers and manufacturers, impacting the overall demand for metal casting products in the market. Addressing these challenges requires strategic supply chain management, diversification of suppliers, and contingency planning to mitigate the impact of global disruptions on the metal casting industry.

Opportunity

Renewable energy targets

- According to a report published by India Brands Equity Foundation, the domestic automobile production increased by a compound annual growth rate (CAGR) of 2.36% from 2016 to 2020 with 26.36 million vehicles being manufactured in India in 2020.

The surge in original equipment manufacturers (OEMs) has created significant opportunities for the metal casting market. With the automotive sector witnessing substantial growth, metal castings play a crucial role in meeting the increased demand for precision-engineered components. OEMs rely on metal casting processes to produce a wide range of automotive parts, including under hood components, engine parts, and interiors. The versatility of metal casting allows for the creation of intricate and durable components that meet the stringent requirements of modern vehicles.

The expansion of OEMs into other sectors, such as aerospace and industrial machinery, further broadens the scope for metal casting applications. As original equipment manufacturers seek reliable and cost-effective solutions for producing complex components, the metal casting market stands poised to capitalize on these opportunities by providing essential manufacturing capabilities that contribute to the overall growth and innovation in various industries.

Sement Insights

Material Insights

The aluminum segment dominated the metal casting market in 2025; the segment is observed to continue the trend throughout the forecast period. Within the metal casting market, the aluminum segment pertains to utilizing aluminum alloys as the key material for casting processes. Aluminum's appeal lies in its lightweight properties, strong resistance to corrosion, and efficient thermal conductivity.

- As per the World Foundry Organization, the production volume of iron casting increased by 0.8% in 2017 compared to the previous year. It was 156.58 kilotons in 2017.

A noteworthy trend in metal casting involves the rising adoption of aluminum castings, particularly in the automotive and aerospace sectors. This preference is driven by the desire to reduce vehicle weight, improve fuel efficiency, and align with sustainable practices. The aluminum segment, thus, stands out as a favored choice in metal casting, meeting the evolving demands for lightweight, durable, and environmentally friendly components.

The steel segment is expected to grow at a significant rate throughout the forecast period. In the metal casting market, the steel segment refers to the production of metal components using various steel alloys. Steel, known for its strength and versatility, is a preferred material for manufacturing durable and high-performance castings. A prominent trend in the steel segment of the metal casting market is the increasing demand for specialized steel alloys, driven by the automotive and aerospace industries. These alloys offer enhanced properties, such as high strength-to-weight ratios, meeting the evolving needs of modern manufacturing and contributing to the overall growth of the metal casting market.

Application Insights

The automotive segment is observed to hold the dominating share of the metal casting market during the forecast period. In the metal casting market, the automotive segment pertains to the production of cast metal components used in vehicles. This includes under hood parts, engine components, interiors, and other critical automotive elements. A notable trend in the automotive segment of the metal casting market is the increasing demand for lightweight materials. As automotive manufacturers strive for fuel efficiency, metal casting processes are crucial in delivering high-strength yet lightweight components, contributing to the overall performance and sustainability goals of the automotive industry.

The industrial segment is expected to generate a notable revenue share in the market. In the metal casting market, the industrial segment encompasses the diverse applications of cast metal components across various industrial sectors. This includes the manufacturing of heavy machinery, equipment parts, and components for infrastructure projects. A notable trend in the industrial segment is the growing demand for precision-crafted metal castings to enhance the efficiency and reliability of industrial machinery. As industries worldwide invest in infrastructure development and machinery upgrades, the industrial application of metal casting continues to experience steady growth, driven by the need for durable and specialized components.

Regional Insights

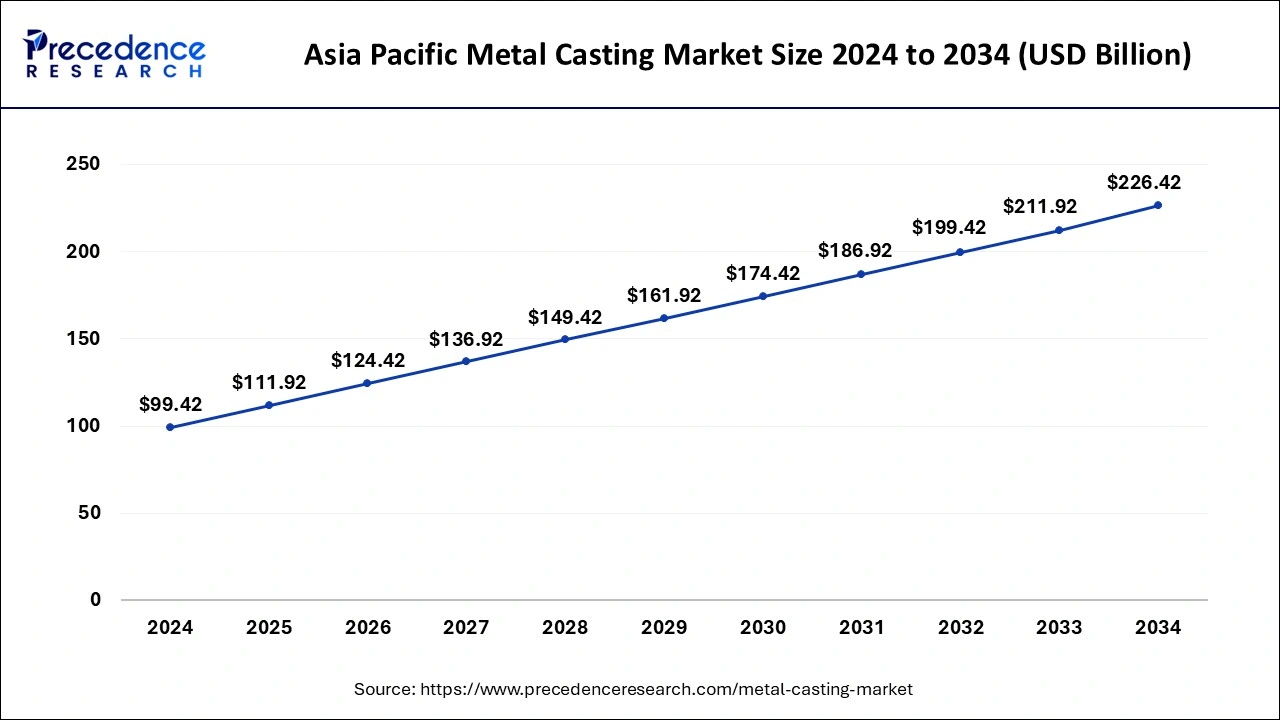

Asia PacificMetal Casting Market Size and Growth 2025 to 2034

The Asia Pacific metal casting market size is exhibited at USD 111.92 billion in 2025 and is projected to be worth around USD 239.59 billion by 2035, growing at a CAGR of 7.91% from 2026 to 2035.

How did Asia Pacific hold the Largest Revenue Share of the Metal Casting Market?

Asia Pacific had the largest market share of 56% in 2025 and will maintain its dominant position from 2026 to 2035. The metal casting market is due to robust industrialization, substantial automotive production, and rapid infrastructure development. The region's manufacturing prowess, particularly in countries like China and India, has fueled a high demand for metal castings across various sectors. Moreover, the growing emphasis on lightweight materials in automotive manufacturing further amplifies the significance of metal casting processes. The expanding industrial base, coupled with increasing investments in infrastructure, positions Asia-Pacific as a key player in the global metal casting market.

Europe is poised for rapid growth in the metal casting market, fueled by advancements in technology and increasing demand for lightweight materials.

- Europe has a presence of 4,500 metal casting firms, a major share of which are small businesses with less than 50 employees.

How did Europe reach rapid growth in the Metal Casting Market?

The European automotive sector, a significant consumer of metal castings, emphasizes fuel efficiency and sustainability, driving the adoption of innovative casting processes. The European Foundry Industry alone contributes over EUR 40 billion annually. Additionally, initiatives like the European Green Deal promote sustainable practices, creating opportunities for eco-friendly casting methods. With a strong industrial base and a focus on environmental responsibility, Europe is well-positioned for significant expansion in the metal casting market.

How is the Significant Expansion of the Metal Casting Market in North America?

North America is expected to grow at a significant rate in the market, owing to a shift in the automotive sector towards the production of electric and hybrid vehicles, and the adoption of Industry 4.0 technologies. The industry is also embracing sustainability, with increased use of recycled metal and energy-efficient production methods to meet environmental regulations. The American Foundry Society is dedicated to advancing the business climate for the $51 billion metal casting economy.

U.S. Metal Casting Market Trends

The U.S. market is showing steady growth as demand from key end-use sectors such as automotive, aerospace, and industrial machinery continues to expand, with lightweight aluminum and other non-ferrous castings increasingly used to meet efficiency and performance goals. Automation and advanced technologies, including robotics, digital monitoring, and additive manufacturing for mold making, are being adopted to improve precision, reduce defects, and shorten production cycles.

Why did Latin America grow at a considerable rate in the Metal Casting Market?

Expected growth for Latin America was solid due to the increase in manufacturing and demand for cast parts that are utilized in the construction and automotive industries. Many countries are making huge investments in new foundry technology and production methods. Some of the products that will be used from this growth will include mining equipment, farm machinery, and commercial vehicles.

Economic recovery and growth in the industrial sector led to growth in these segments, as did the government support the development of local production to decrease reliance on imported products.

Brazil Metal Casting Market Trends

Brazil was the largest market for casting products due to its strong industrial development and high levels of demand for casting products for various industries, including automotive, agricultural, and heavy machinery manufacturing. Foundries in Brazil have upgraded their production lines and implemented environmentally friendly technologies. Brazil has a large domestic market and many opportunities to export products throughout South America.

Why did the Middle East & Africa region grow at a considerable rate in the Metal Casting Market?

The Middle East & Africa region have been projected to grow significantly due to the growth of the construction, Infrastructure, and industrial sectors. As a result, demand has risen for steel and iron castings in pipelines, machinery, and building materials. Countries are now investing in the creation of new factories and in enhancing their casting technologies. There are substantial business opportunities in the fields of oil & gas equipment, mining machinery, and the development of public infrastructure.

The UAE Metal Casting Market Trends

The United Arab Emirates (UAE) has been leading the way in this region, as there has been a substantial investment in the construction, infrastructure, and industrial growth. Additionally, the UAE has made significant investments into modernizing manufacturing facilities and supporting the development of new foundry projects. Therefore, the demand for cast parts for use in building materials, machinery, and energy equipment has continued to grow.

The increased production capacity of the manufacturing sector has been aided by strong government policies, as well as an influx of foreign investments.

Value Chain Analysis of the Metal Casting Market

- Feedstock Procurement

This stage is transformed by scrap-first sourcing, energy savings, predictive analytics, supply chain traceability, and new alloys.

Key Players: Nucor Corporation, Tata Steel, Hindalco, Sims Limited, ArcelorMittal, Aurubis AG. - Waste Management and Recycling

This stage encompasses direct re-melting, AI-powered sorting, slag valorization, mechanical and thermal reclamation, and eco-friendly binders.

Key Players: Umicore, Sims Limited, Nucor Corporation, Dowa Holdings, CMR Green Technologies, and Baheti Recycling Industries. - Regulatory Compliance and Safety Monitoring

This stage is revolutionized by stricter air quality standards, hazard communication, heat stress prevention, IoT and real-time data, and automated inspections.

Key Players: Intertek Group PLC, TÜV SÜD AG, AECOM, VelocityEHS, ERM, GF Casting Solutions, Nemak.

Metal Casting Market Companies

- Alcoa Corporation

- ThyssenKrupp AG

- Bharat Forge Limited

- Norsk Hydro ASA

- Arconic Inc.

- Nemak

- Kobe Steel, Ltd.

- Georg Fischer AG

- Waupaca Foundry, Inc.

- Precision Castparts Corp. (PCC)

- Endurance Technologies Limited

- American Axle & Manufacturing Holdings, Inc.

- Zynq Foundry

- Aisin Seiki Co., Ltd.

- Bühler AG

Recent Developments

- In November 2022, POSCO declared that its steel plants in Pohang and Gwangyang received certification for their outstanding contributions to advancing sustainability in the steel industry. This significant achievement highlights the plants' unwavering dedication and effective management in promoting Environmental, Social, and Corporate Governance (ESG) objectives for a more sustainable future.

- In June 2020, Endurance Technologies Limited successfully concluded the acquisition of Grimeca Srl, an Italian automotive parts manufacturer. Endurance reported securing complete ownership, acquiring a 100% stake in Grimeca for 2.25 million Euros, approximately USD 2.45 million, as disclosed in a stock exchange filing.

Segments Covered in the Report

By Material

- Iron

- Steel

- Aluminum

- Others

By Application

- Automotive & Transportation

- Industrial

- Building & Construction

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content