What is the Mezcal Market Size?

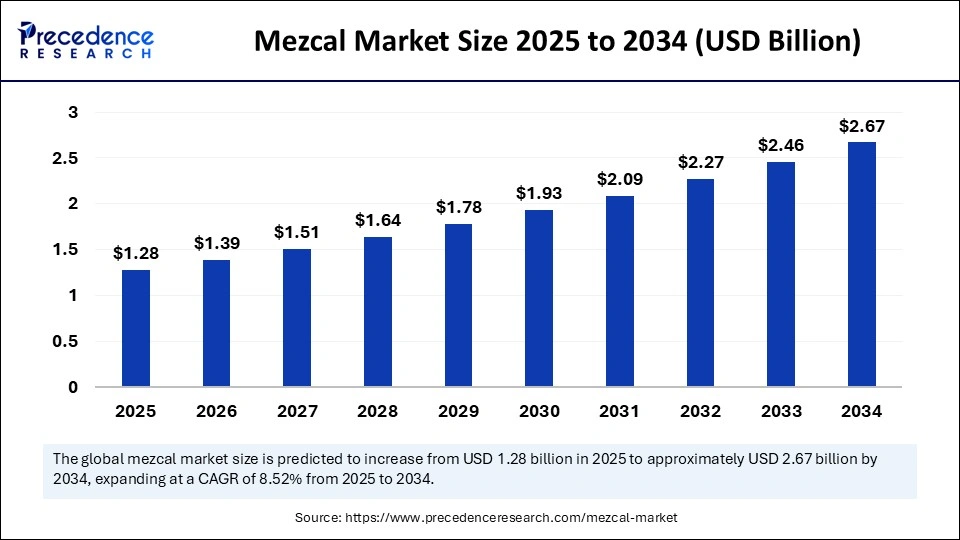

The global mezcal market size is accounted at USD 1.28 billion in 2025 and predicted to increase from USD 1.39 billion in 2026 to approximately USD 2.67 billion by 2034, expanding at a CAGR of 8.52% from 2025 to 2034. The market is experiencing rapid growth due to the rising consumer preference for premium alcoholic beverages. Furthermore, consumers are increasingly seeking unique beverages, which is boosting the preference for mezcal for its smoky flavor profile.

Mezcal Market Key Takeaways

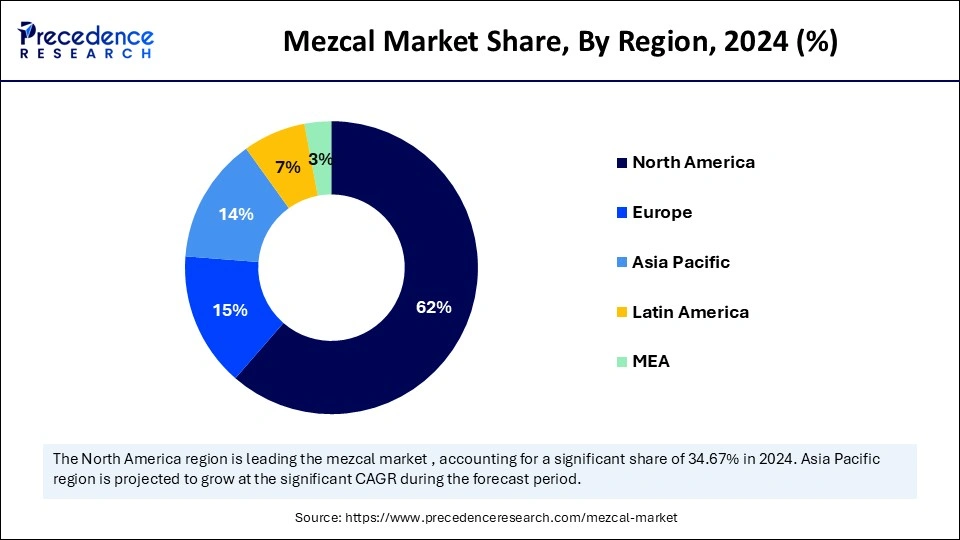

- North America dominated the mezcal market with the largest revenue share of 62% in 2024.

- Asia Pacific is projected to grow at a CAGR of 9.8% during the forecast period from 2025 to 2034.

- By product, the joven segment held the largest revenue share of 73% in 2024.

- By product, the añejo segment is expected to expand at the highest CAGR of 9.21% between 2025 and 2034.

- By formulation, the 100% agave segment dominated the market with the highest share in 2024.

- By formulation, the blend segment is projected to grow at a significant CAGR over the projection period.

- By distribution channel, the supermarkets and hypermarkets segment accounted for the biggest revenue share of 33% in 2024.

- By distribution channel, the specialty stores segment is projected to grow at a significant rate in the upcoming period from 2025 and 2034.

Artificial Intelligence: The Next Growth Catalyst in Mezcal

Artificial Intelligence (AI) is transforming the mezcal market by optimizing production, predicting consumer preferences, and enhancing supply chain management. AI can be utilized to refine agave growth and monitor fermentation and barrel aging in real-time by analyzing temperature, pH levels, and microbial activity, leading to more predictable and consistent outcomes while also personalizing the customer experience and ensuring a stable, high-quality agave yield. AI also helps improve product quality by identifying any deviation from the desired flavor profile.

Strategic Overview of the Global Mezcal Industry

The mezcal market is an industry that involves the production, distribution, and consumption of mezcal, a traditional Mexican spirit made from agave plants. Mezcal is produced by roasting and distilling agave plants, commonly using traditional methods like earthen pit cooking. The market is undergoing rapid growth, compelled by evolving consumer preferences for premium and artisanal spirits, which include unique flavor profiles and production methods of mezcal. Furthermore, celebrity endorsements and social media influencers are supporting the market's expansion.

What are the Key Trends in the Mezcal Market?

- Expansion of Cocktail Culture: Mezcal is gaining recognition as a popular ingredient in cocktails, increasing its accessibility in bars and restaurants worldwide.

- Sustainable Distillation Practices: Consumers are becoming increasingly aware of sustainable production methods, contributing to the need for mezcal produced with eco-friendly practices.

- Growing Tourism in Mexico: Increased tourism in Mexico exposes international consumers to mezcal, propelling global demand.

- Expansion of Distribution Channels: With the rapid expansion of retail and e-commerce channels, mezcal is becoming more accessible to consumers, which supports market growth.

Market Outlook:

- Market Growth Overview: The mezcal market is expected to grow significantly between 2025 and 2034, driven by growing demand for sustainability and authenticity, premiumization and artisanal appeal, and cocktail culture and mixology.

- Sustainability Trends: Sustainability trends involve agave conservation and biodiversity, responsible water and waste management, and ethical sourcing and fair trade.

- Major Investors: Major investors in the market include Diageo PLC, Bacardi Limited, Pernod Ricard SA, Becle SAB de CV, and William Grant & Sons Ltd.

- Startup Economy: The startup economy is focused on artisanal and niche products, venture capital involvement, and acquisition by incumbents.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 2.67 Billion |

| Market Size in 2025 | USD 1.28 Billion |

| Market Size in 2026 | USD 1.39 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.52% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Outlook,End-use Outlook, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Demand for Superior and Artisanal Spirits

The primary driver of the mezcal market is the growing demand for superior and artisanal spirits, especially among millennials and youngsters who are willing to invest more in high-end beverages, including mezcal, which aligns with their preference for quality and unique flavor profiles. This demand is further driven by the increased disposable income, rising travel and tourism, and the expansion of cocktail culture. Nowadays, consumers are increasingly looking for unique and authentic flavors, leading to the increased popularity of mezcal. Market players are continuously launching new products to meet consumers' varying demands, driving the growth of the market.

- In May 2025, Company B launched a spicy jalapeno-infused mezcal variety that appealed to consumers looking for a unique and bold flavor profile. This innovation attracted a new segment of customers and contributed to the growth of the brand in the market. (Source: https://essfeed.com)

Restraint

Higher Cost and Limited Availability

Prominent factors restraining the growth of the mezcal market are high costs and limited availability of raw materials, such as agave. This scarcity arises from the long growth cycles and high demand for agave, which, combined with their lengthy maturation periods, makes the raw material costly and restricts overall production. As a result, to take advantage of the scarcity and exclusivity of certain agave varieties, some brands are introducing limited-edition mezcals at elevated price points, which creates challenges in the market. Moreover, the availability of fake or poor-quality mezcal can damage the reputation of authentic brands, hampering the growth of the market.

Opportunity

Increasing Demand for Premium Spirits

Increasing demand for premium spirits creates immense opportunities in the mezcal market. More people are attracted to handcrafted, artisanal mezcal. This opportunity is further fueled by the rich cultural heritage and distinct flavors associated with the spirit, as consumers look for unique, authentic experiences, which is evident in markets like the U.S. Online platforms are also improving access to a wide variety of mezcal brands and allow for more convenient purchasing, contributing to the growth of online sales. Moreover, technological innovations in agave farming practices open new avenues for market growth.

- In April 2023, Diageo, producer of Don Julio and Casamigos tequilas, began the use of drones on its agave farms in Jalisco, Mexico, following a successful pilot conducted in 2022. These drones can detect stress in plants to address issues early by integrating more efficient farming practices and contributing to environmental benefits.

By Product Analysis

Why Did the Joven Segment Dominate the Mezcal Market in 2024?

The joven segment held the largest revneue share of 73% in 2024. This is primarily due to its pure agave flavor, greater affordability, and versatility in cocktails, making it more accessible to a broader consumer base, from mixologists to cocktail enthusiasts. This unaged or minimally aged mezcal is cheaper than other varieties like Reposado and añejo, as it does not require extended aging in barrels. Its fresh and vibrant flavors, along with adaptability in cocktails like Mezcal Margaritas and Palomas, further heightened its acceptance among younger consumers and bartenders.

The añejo segment is expected to expand at the highest CAGR of 9.21% during the forecast period, owing to increasing consumer demand for premium spirits, artisanal craftsmanship, and unique and complex flavor profiles. Additionally, the aging process in oak barrels gives añejo mezcal a distinct, smoother flavor profile, attracting more consumers seeking unique palates. The limited production of añejo mezcal adds to its exclusivity and desirability. Furthermore, its high-end positioning and suitability for fine dining and cocktails contribute to its higher demand in the luxury beverage category.

By Formulation Analysis

Why Did the 100% Agave Segment Lead the Mezcal Market in 2024?

The 100% agave segment dominated the mezcal market with the highest share in 2024. 100% agave mezcal is made solely from the agave plant, offering a pure and natural flavor profile and attracting consumers who value artisanal products and unique flavor profiles. Increased consumer awareness of the lower glycemic index of agave has boosted the demand for 100% agave mezcal. It is also a healthier alternative compared to other alcoholic beverages.

In April 2023, Mayenda Tequila Blanco was launched in the U.S. and Mexico. Mayenda's pioneering process adds two extra steps of craft and care to ensure the deep flavors and aromas of cooked agave; only the finest 100% Agave Azul is hand-harvested with a low-jima cut to remove harshness and bitterness, before embarking on the unique process with richer results and more elegant Blanco tequila ideal for sipping and savoring.

The blend segment is expected to grow at a significant CAGR over the projection period, driven by its affordability and accessibility as it combines agave with sugars or other ingredients during production, providing a more accessible price point, appealing to both casual drinkers and those new to mezcal. Furthermore, blended mezcal's lighter, more approachable flavor profile can be easygoing for consumers who may find the intense, smoky flavors of 100% agave mezcal overwhelming, making it an attractive entry point into the world of mezcal.

By Distribution Channel Analysis

Why Did Supermarkets and Hypermarkets Lead the Mezcal Market in 2024?

The supermarkets and hypermarkets segment contributed to the biggest revenue share of 33% in 2024. This is due to their convenience and wide product selection. These stores are often located in accessible areas, enabling them to be easily reachable for consumers by offering them a convenient and accessible choice. This segment's dominance is further strengthened by their ability to offer personalized shopping experiences and tastings. Moreover, these stores enable consumers to physically browse and examine mezcal bottles, receive recommendations from knowledgeable staff, and make immediate purchases.

The specialty stores segment is projected to grow at a significant rate in the upcoming period. This is due to the increasing demand for premium and artisanal spirits, the growing interest in Mexican culture and cuisine, and the personalized shopping experience offered by specialty stores. Additionally, the ability to facilitate a personalized and knowledgeable shopping experience and the opportunity to address the evolving challenges of consumers who are increasingly looking for unique and high-quality products contribute to segmental growth.

Regional Insights

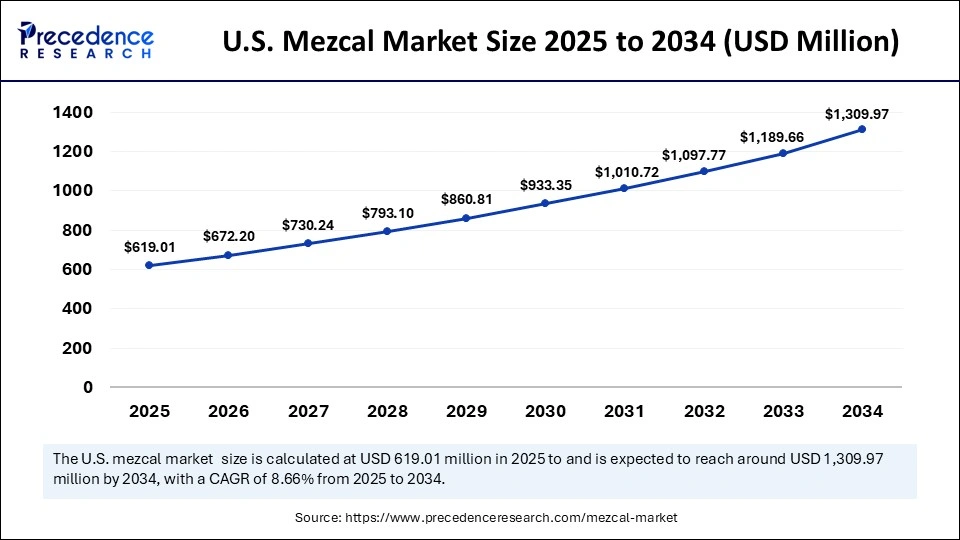

U.S. Mezcal Market Size and Growth 2025 to 2034

The U.S. mezcal market size is exhibited at USD 619.01 million in 2025 and is projected to be worth around USD 1,309.97 million by 2034, growing at a CAGR of 8.66% from 2025 to 2034.

What are the Major Factors Behind North America's Dominance?

North America dominated the mezcal market with the largest share in 2024 due to several factors. Firstly, there is a strong craft spirit culture in Mexico, the primary producer of mezcal. This facilitates immediate access and distribution of mezcal, contributing to its popularity in the region. Secondly, there is a growing cocktail culture and increasing consumer interest in artisanal beverages, which have boosted the demand for mezcal, particularly among millennials and youngsters who seek authentic and high-quality products. Moreover, collaborations between U.S. entrepreneurs and Mexican producers are on the rise, enhancing mezcal's visibility and availability through innovative marketing strategies that resonate with consumers.

- In December 2024, Blue Ridge announced that Republic National Distributing Company (RNDC), one of the largest distributors of wine and spirits in the U.S., had extended its investment in Blue Ridge for the foreseeable future to optimize inventory performance, streamline operations, and enhance overall customer satisfaction.

(Source: https://www.businesswire.com)

The U.S. Mezcal Market Trends

The U.S. plays a crucial role in the mezcal market. The rising demand for mezcal in the U.S. benefits Mexican producers, leading to increased exports and supporting traditional production methods. There is heightened adoption of artisanal and premium spirits, alongside a thriving cocktail culture. This creates immense opportunities for mezcal in the U.S.

Exploring the Asia Pacific's Growth Potential in the Market

Asia Pacific is projected to experience the fastest growth during the forecast period, driven by increasing disposable incomes, rapid urbanization, and a growing middle-class population in countries like China and India. This economic growth is spurring the demand for premium spirits and high-quality alcoholic beverages. The consumption of craft spirits and cocktails is rising in countries like China, India, Japan, and South Korea, which is likely to drive the growth of the market in the region.

Asia Pacific: China Mezcal Market Trends

China's growing consumer interest in premium and artisanal spirits, rising disposable incomes, and an expanding cocktail culture, particularly in urban centers. On-premise sales in bars and high-end restaurants are vital for building awareness and trial, while e-commerce expands its national reach. Brands are focusing on consumer education and strategic distribution to build market presence.

Europe: A Notable Region in the Mezcal Market

Europe is considered to be a significantly growing area. This is mainly due to the increasing popularity of premium spirits across the continent. Consumers in the region are attracted to traditional production methods and unique flavor profiles. Social media and the internet have played crucial roles in boosting awareness about mezcal. Key players in the European spirits industry also recognize the mezcal's unique flavor, boosting its demand.

- In July 2024, Artesario Distribution included dedicated web stores for six European countries. The new distribution network will make Mexican agave spirits more available across six European countries, such as Germany, Austria, France, Belgium, the Netherlands, and Denmark, to fortify the essence of traditional distilling by facilitating authentic, additive-free, small-batch Tequila and mezcal. (Source: https://www.thespiritsbusiness.com)

Europe: Germany Mezcal Market Trends

The German mezcal market is driven by an increasingly favor premium, artisanal, and authentic spirits over mass-produced options. The on-premise consumption in bars and restaurants, where mixologists introduce mezcal in innovative cocktails and educational promotions, builds brand awareness.

Value Chain Analysis of the Mezcal Market

- Inbound Logistics

This stage involves the meticulous cultivation and harvesting of agave plants, a process that can take six to twenty years. - Operations

Operations encompass the traditional, artisanal production process: roasting the agave in underground pits, crushing the cooked pinas, fermenting the pulp with natural yeasts, and distilling the resulting liquid, often twice. - Outbound Logistics

Outbound logistics involves the transportation of the finished mezcal from production sites in Mexico to distribution centers, importers, and eventually to retailers and bars worldwide. - Marketing and Sales

This stage focuses on promoting mezcal as a premium, authentic, and culturally rich spirit to consumers. - Service

The service stage involves providing support to both trade customers (bars, retailers) and final consumers.

Top Companies in the Mezcal Market & Their Offerings

- Pernod Ricard SA: These global spirits giant contributes by leveraging its vast distribution network to increase the global reach of its owned mezcal brands, such as Del Maguey Single Village Mezcal. Their investment in marketing and sales helps build brand awareness and consumer education worldwide.

- Ilegal Mezcal SA: A major contributor to the market, Ilegal Mezcal played a key role in making mezcal more mainstream by positioning it as an accessible, premium spirit ideal for cocktails. They focus heavily on brand identity, marketing, and on-premise placements in bars and restaurants.

- El Silencio Holdings Inc.: This company produces premium mezcal under the brand name Mezcal El Silencio, known for its sleek branding and strong market presence in the U.S. and beyond. Their focus is on the premium, modern consumer seeking a sophisticated sipping experience.

- Rey Campero: A well-respected, family-owned brand, Rey Campero contributes to the market by highlighting traditional production methods and the use of rare, wild agave species.

- Diageo PLC: As one of the world's largest spirits companies, Diageo contributes to the market through major investments and the acquisition of brands like Mezcal Unión, leveraging its extensive global distribution network to drive significant growth and mainstream adoption.

- Mezcal Vago: Mezcal Vago emphasizes transparency and the individual producers (mezcaleros) who make the spirit, contributing by building consumer trust and showcasing the diversity of mezcal production.

- Lágrimas de Dolores: This brand contributes by focusing on sustainable practices and the use of agave from their own fields (estate-grown), appealing to consumers who value environmental and ethical production methods.

- Bacardi Limited: Another major global spirits player, Bacardi contributes to the market through ownership of the mezcal brand Patrón, leveraging its vast resources to expand production and global distribution. They play a role in making agave spirits accessible to a broad international audience.

- Brown-Forman: Known for brands like Jack Daniel's, Brown-Forman has entered the mezcal market to diversify its portfolio, investing in or acquiring mezcal brands and using its established distribution channels to grow market share. Their contribution is in expanding the reach of mezcal to new consumer segments.

- Craft Distillers: This company focuses on producing and distributing artisanal, high-quality spirits, contributing to the mezcal market by nurturing smaller, authentic brands and educating consumers about their unique production stories. They often work closely with small-scale producers to bring products to market.

- Destileria Tlacolula: This is likely one of the numerous distilleries (palenques) in Oaxaca, Mexico, that produces mezcal for various brands. They are crucial to the value chain as the actual producers who employ traditional, artisanal methods.

- Familia Camarena: Primarily known for tequila production (Tequila Camarena), their family expertise in agave spirits contributes to the broader market by leveraging their extensive agave knowledge and production capabilities. Their main focus remains on the tequila market, however.

- MADRE Mezcal: MADRE Mezcal contributes by positioning itself as an accessible, craft brand with a focus on simple, natural ingredients and a unique bottle design, appealing to younger consumers and the cocktail market. They emphasize community and the experience of sharing mezcal.

- Banhez Spirits Company LLC: This company contributes by offering a high-quality, accessible espadín mezcal that is a cooperative effort of 80 families in Oaxaca. Their brand is often found at a more affordable price point, making authentic mezcal accessible to a wider consumer base.

- Becle SAB de CV (Jose Cuervo): As the largest tequila producer globally, Becle contributes to the mezcal market by using its immense resources to produce and distribute its mezcal offerings, such as Mezcal Creyente.

Mezcal Market Companies

- Pernod Ricard SA

- Ilegal Mezcal SA

- El Silencio Holdings INC

- Rey Campero

- Diageo PLC

- Mezcal Vago

- Lágrimas de Dolores

- Bacardi Limited

- Brown-Forman

- Craft Distillers

- Destileria Tlacolula

- Familia Camarena

- MADRE Mezcal

- Banhez Spirits Company LLC

- Becle SAB de CV (Jose Cuervo)

Industry Leader's Announcement

- In July 2024, AETHER Brand Group announced its strategic acquisition of Corte Vetusto Mezcal, the most awarded mezcal in the world. This acquisition boosts the capabilities of AETHER to increase and expand the distribution and outlet presence of the brand internationally and domestically. David Shepherd, co-founder and managing director at Corte Vetusto, said, “We are thrilled to be part of the AETHER Brand Group. The leadership team has an outstanding reputation in the consumer goods industry, with vast experience and success building and leading global brands across both developed and emerging markets. With this investment we'll continue to hand-craft world-class liquid, selectively expand our distribution and cement our position as a highly respected craft spirits brand.” (Source: https://www.bevnet.com)

Recent Developments

- In March 2025, Diageo-backed incubator Pronghorn invested in New York-based Doce Mezcal, marking its first foray into the category to elevate the drinking ritual through high-quality spirits. This backing encourages their dedication to amplifying underrepresented brands by leveraging their expertise, services, and support expanding Doce Mezcal's market share by heightening a lean capital round and executing a consumer-focused strategy. (Source: https://www.thespiritsbusiness.com)

- In November 2024, Maguey Imports, the U.S. distribution unit of Mexico's Maguey Spirits, bought Bozal Mezcal and Pasote Tequila from 3 Badge Beverage Corporation. This acquisition was a significant development in the agave spirits industry. This acquisition was fully integrated and ready to reach consumers with the same passion and quality, but with a deeper connection to their origins, intending to elevate the agave spirits heritage of Mexico. (Source: https://www.just-drinks.com)

- In September 2023, Bacardi Limited announced the completion of a transaction that makes the family-owned company the sole owner of ILEGAL Mezcal to accelerate brand growth within the fastest-growing super premium mezcal category. Bacardi and ILEGAL have a shared commitment to quality and environmental sustainability, building the future to maintain the legacy. (Source: https://www.bacardilimited.com)

Segments Covered in the Report

By Product

- Joven

- Reposado

- Añejo

- Others

By Formulation

- 100% Agave

- Blend

By Distribution

- Supermarkets & Hypermarkets

- Specialty Stores

- Online

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting