What is Micro Fulfillment Market Size?

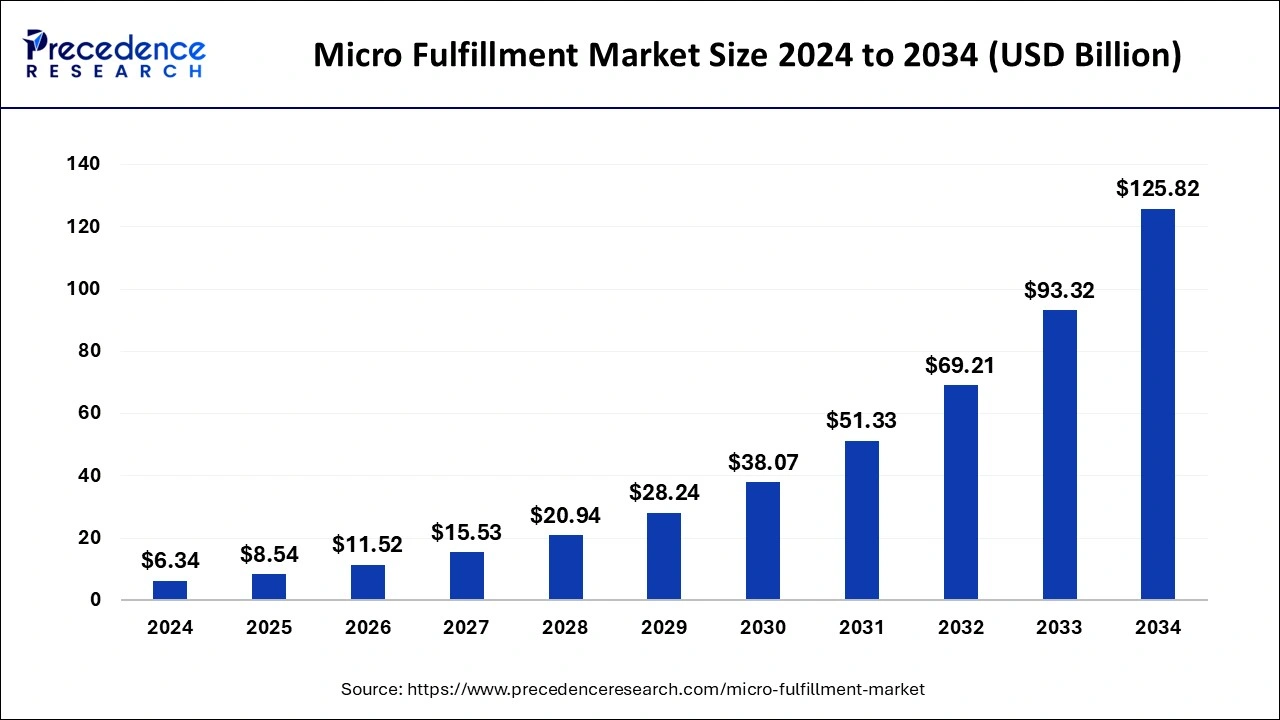

The global micro fulfillment market size was estimated at USD 8.54 billion in 2025 and is anticipated to reach around USD 125.82 billion by 2034, expanding at a CAGR of 34.83% from 2025 to 2034. the micro fulfillment market is witnessing a significant surge due to increasing demand for instant delivery for essential daily goods along with expansion of e-commerce, which is also backed by government subsidies, driving the market on a large scale.

Market Highlights

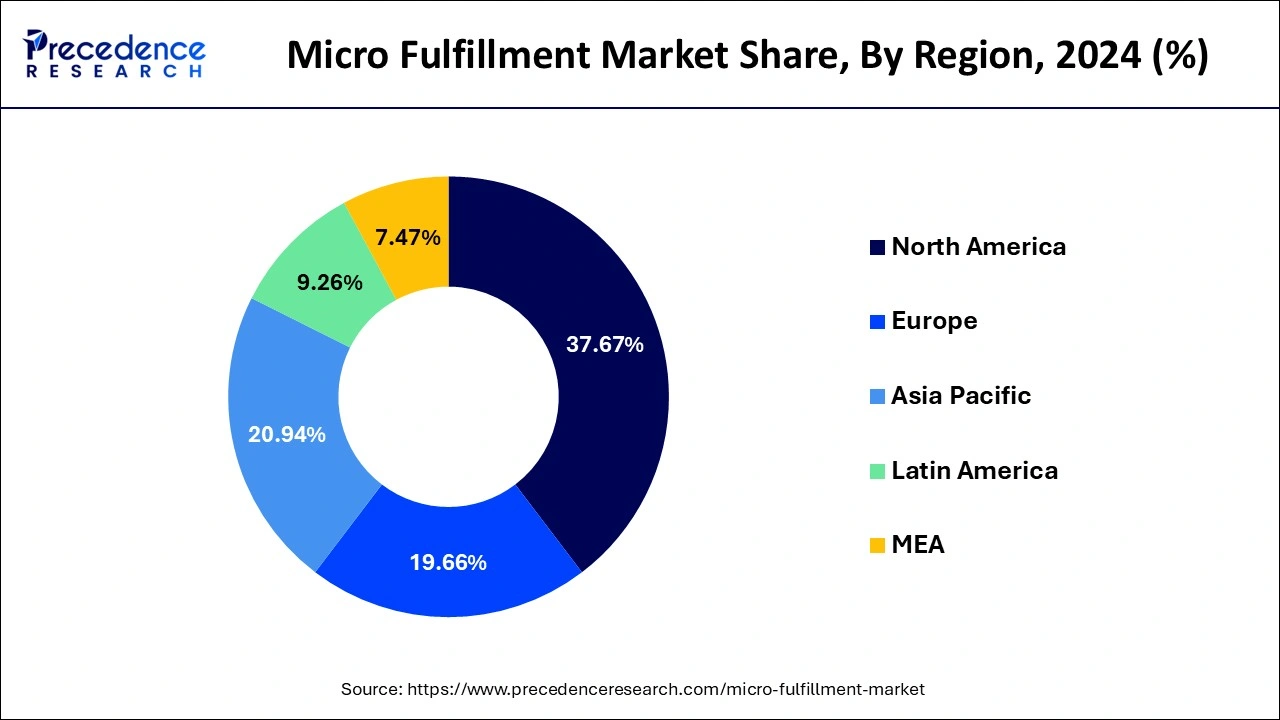

- North America dominated the global micro fulfillment market with the largest market share of 37.67% in 2024.

- Asia Pacific is projected to expand at the notable CAGR during the forecast period.

- By Warehouse size, the small size segment has held the largest market share in 2024.

Market Size and Forecast

- Market Size in 2025: USD 8.54 Billion

- Market Size in 2026: USD 11.52 Billion

- Forecasted Market Size by 2034: USD 125.82 Billion

- CAGR (2025-2034): 34.83%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

AI Impact on Micro Fulfillment Market

In today's fast paced world, AI has emerged as a cornerstone in every sector including the micro fulfillment market. Machine learning algorithms can be employed which further analyses consumers behavior and sales data, improving the accuracy rate for demand forecasting along with inventory management. Robotics and AI can work relentlessly to sort, dispatch and pack materials with less error as compared to human work.

In addition, predictive analytics can save past and present data and made patterns through it to forecast future demand by consumers, is an important factor fueling the AI integration in the micro fulfillment market. As AI models can continuously learn and improve to adapt with evolving trends it ensures accurate prediction.

Market Overview

A micro fulfillment canter (MFC) is a both small and large-scale storage facility which is used by almost every industry, e-commerce venture, and general stores to stock their material and inventory located near the end customer so they can save time and cost. These MFC warehouses are currently highly automated and supporting to grow operational efficiency in developed countries. These MFC centers are highly popular in e-commerce strategies, is a productive way to connect the developing geographical nature of e-commerce demand, rising volumes, and the increasing demand for the fastest delivery at the doorstep. A study found that the micro fulfillment market is expected to have a great opportunity worth USD 36 Bn in upcoming years by 2030 with an installed base of 6700 micro fulfillment canter if the advanced technology and concept remain permanent. Years 2022 and 2023 are yet to be the milestone for the micro fulfillment market touching a billion-dollar mark.

Micro Fulfillment Market Growth factors

- Increased urbanization rate across the globe has increased many residential complexes in different areas and regions, positively influenced the market.

- Government policies that support the e-commerce sector along with rising penetration of internet across the globe.

- The concept of small-scale warehousing is allowing a quick, profitable delivery system fueling the market's demand.

- To fulfill the needs of consumers, the micro-fulfillment market provides ranges of products with different brands and with a range of sizes to stay competitive in the market.

- Technological advancement that allows the improvement in material handling devices and robots are expected to amplify the markets graph.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 8.54 Billion |

| Market Size in 2026 | USD 11.52 Billion |

| Market Size by 2034 | USD 125.82 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 34.83% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technolgy, Warehouse Size, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing use of micro fulfillment centers in e-groceries driving the market growth.

The increasing use of micro fulfillment services e-Grocery companies driving market growth. The MFC centers are rapidly increasing in e-commerce and e-grocery strategies, the online e-grocery platforms provide their customers with the service of products and groceries with the help of small and medium-sized MFC centers which deliver the products to their doorstep these factors are expected to drive the micro fulfillment market. The market is driven by major e-commerce companies such as Amazon, Walmart, Kroger, Alibaba, and Ocado across the globe. Additionally, the end users like manufacturing industries, e-commerce platforms, and general stores are rapidly increasing their need for services from MFC which desires their safe, rapid, and in-time deliveries is driving the micro fulfillment market growth.

Restraint

The centers for fulfillment are situated far from the city

The current centers for fulfillment are located far from the main city which slightly hampers the micro fulfillment market; due to this the logistics and transportation have an extra additional cost as well as take more delivery time as compared to customers' expectations, especially in e-commerce, grocery and food and beverages industry. The fulfillment centers need large spaces to store materials of companies because there's not much space in residential areas so the warehouses are installed out of the city for operations, but this cost-consuming and time-consuming factor impacts the micro fulfillment market.

Opportunity

Technological advancement in micro fulfillment centers creating opportunities

The technological advancements in micro fulfillment centers such as automation and robotics utilization are creating ample opportunities for new players and the MFC market. An automated mobile robot is a type of robot that is programmed by algorithms that understand and move through its location without being overseen by an operator, and riches to the path. The micro fulfillment industry and logistic ventures are looking for new and innovative ways to increase their design, increase speed, and enhance speed and precision.

Many micro-fulfillment companies turn to AMRs for help. AMRs use a set of sensors, programs, algorithms, AI, and machine learning for path planning to navigate through the working place. A piece-picking robot is a type of robot which automatically picks and drops material from stock containers to an order collection conveyer. The piece-picking robots work on full automation which helps to save time and cost. The engineers are focusing to design more speedy and safe robots due to increased demand from warehouses. These opportune factors will rapidly drive the micro-fulfillment market across the globe.

Challenge

Labor challenges

A major obstacle to digital transformation and the accelerated adoption of automated warehouse procedures is the high turnover rates brought on by a lack of qualified employees and rising minimum salaries. Utilizing unique algorithms, labour management software may identify behaviors that can point to an employee who is on leave. Operators can then act to keep top players or proactively swap them with systems based on real-time labour optimization findings.

Technology Insights

Based on the technology, the global micro fulfillment services market is segmented into the traditional warehouse management system, mobile AMR (autonomous mobile robot), and piece-picking robots. Traditional warehouses i.e., standard everyone ones, are the facilities that everyone has been developing for many years. The traditional WMS works in a non-automated way, the entire operations of the company is done by the workers. For instance, the company has to recruit people and train them according to the work. On the other hand, rapid advancements in technology like artificial intelligence, automation, and robotics. An autonomous mobile robot is a type of robot programmed by algorithms that understand and move through its location without being overseen by an operator, and predetermined path. The micro fulfillment industry and logistic ventures are looking for new and innovative ways to increase its design, and enhance speed, and precision. Many micro-fulfillment companies are turning to AMRs for help. AMRs use a set of sensors, programs, algorithms, AI, and machine learning for path planning to navigate through the working place. A piece-picking robot is a type of robot that automatically picks and drops material from stock containers to and order collection conveyer. The piece-picking robots work on full automation which helps to save time and cost. The engineers are focusing to design more speedy and safe robots due to increased demand from warehouses.

Warehouse Size Insights

Based on Warehouse size, the global micro-fulfillment market is segmented into small size and large size warehouses. The small size of micro fulfillment warehouses makes them supreme for development in hubs like in Cities, suburban areas, and metropolitan places. This consumer's nearby location will support the center to reach faster to the end user. In small size warehouses more than 50% of micro fulfillment installations are targeted for centers having sizes between 5,000 square ft. to 10,000 sq. ft. these warehouse centers involve fully automated storage facilities nearby the end user. There are a lot of companies that are investing heavily in shipping infrastructure such as Walmart has opened over 5000 small stores in the U.S. to deliver orders more quickly. On the other hand, amazon invested billions in developing the infrastructure and USD 1.5 billion in a Kentucky air hub. On the other hand, the large size of warehouse centers contains more than 300, 00 square ft. range but it is larger depending on the size of the work. Large-size fulfillment centers have space to keep a huge number of materials and inventory, which might last for several years of operations and might not be filled up as often. For instance, Nike's fulfillment center is 2.8 million square ft. and amazon has 3.6 million square ft. in Tennessee. These large-sized fulfilments are installed far away from the residential areas.

End-User Insights

Based on End-User, the global micro-fulfillment market is segmented into E-Commerce sites, industrialists, and general stores. The e-commerce sector had the highest revenue share in 2021, and it is expected to dominate the market in the forecast period as the increasing use of E-commerce sites among people. Additionally, some of the major companies are highly investing in small warehouses such as Amazon, Walmart, and Alibaba. The pandemic surged the growth of e-commerce systems and micro-fulfillment warehouses also. On the other hand, industrialists are also turning towards micro fulfillment services as they need to store their materials and inventory. Industries are using large-scale warehouses as they have a lot of material but lack storing space. General stores are taking help of small warehouses to buy goods for that reason the micro fulfillment service provides the fastest in-time delivery to stores which helps to grow the store income.

Regional Insights

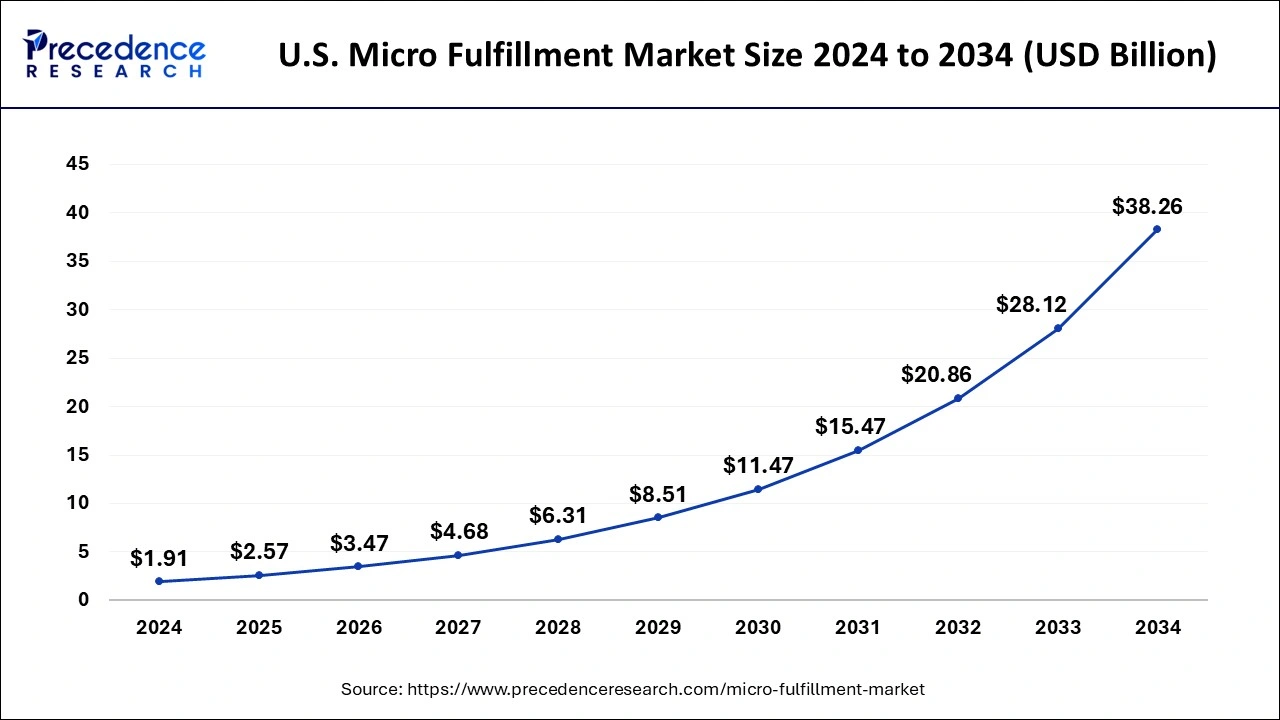

U.S. Micro Fulfillment Market Size and Growth 2025 to 2034

The U.S. micro fulfillment market size was evaluated at USD 2.57 billion in 2025 and is predicted to be worth around USD 38.26 billion by 2034, rising at a CAGR of 34.95% from 2025 to 2034.

North America dominated the global micro fulfillment market with the largest market share of 37.67% in 2024owing to its well-developed infrastructure and awareness of e-commerce among a large population. The regional market is also anticipated to be driven by the rising number of online buyers, fast services, and heavy investments by companies.

The rise in the number of e-commerce users, who are more likely to deliver quality products, doorstep delivery, refunds, discounts, and services is anticipated to hold a sizable revenue share throughout the forecast period. Micro fulfillment center installation will grow more than 10x by 2030 from the current installed year of 50 in 2021.

What factors drive the Asia Pacific's rapid micro fulfillment market growth from 2024 to 2032?

The Asia Pacific region is anticipated to hold the fastest CAGR from 2024 to 2032. Fuelled by the fast-paced urbanization processes, extensive use of e-commerce, and the rise in demand for last-mile delivery services. Due to the increasing urbanization, consumers demand a quicker delivery time, and that has compelled the development of new and better modes of delivery in the retail sector and also among the logistics providers. Some of the leaders of these innovations include Alibaba and Rakuten, e-commerce giants. Alibaba has also revealed plans to construct what they call Smart Warehouses in cities where there will be automation and artificial intelligence that will be used to manage the inventory and smooth the supply chain.

Asia Pacific is a region with enormous potential because of its huge population and e-commerce industry, which is booming in countries such as China, India. This growth is being aided by various measures, such as investment in infrastructure and technology-friendly government policies, which allow further micro-fulfillment centers to expand. This makes Asia Pacific one of the most active and fastest-moving markets in the micro-fulfillment sector globally.

Why is the European micro fulfillment market expected to witness significant growth?

The European micro fulfillment market is expected to witness significant growth over the forecast period. The dense city centers and lack of space in Europe have prompted operators to be creative and seek alternatives, which include turning unutilized parking garages into last-mile delivery stations. The urban micro-fulfillment nodes minimize the distance travelled by delivery vans, reducing emissions and congestion.

Sustainability is one of the core trends influencing the micro fulfillment industry in Europe. The carbon prices and harsh environmental standards are compelling retail workers towards electric delivery cars and energy-saving warehouses. Also, using automation, robotics, and AI in these centers helps to deliver even faster and has a lower environmental impact.

Micro Fulfillment Market Companies

- Dematic

- Get Fabric, Inc.

- Alert Innovation, Inc.

- Takeoff Technologies Inc.

- Exotec

- Attabotics

- Geekplus Technology Co., Ltd

- Ocado Group

- Auto Store

- TGW Logistic Group

Recent Developments

- In January 2025, ClickPost has launched its innovative returns and exchanges solutions which supports E-commerce platforms, particularly design to how e-commerce platform can efficiently manage R&E policy while prioritizing revenue retention, consumer satisfactions along with to keep up with brand value. ClickPost's R&E solutions showed a return rate of 54% on exchanges, of which 40% led to purchases of higher prices. The solution has improved user experience, minimized friction for customers, and is integrated with WhatsApp, SMS, and email, allowing access with basic connectivity. Another feature offered is real-time inventory updates, which keep the customer in the loop at all times.

- In February 2023, India's leading logistics company popularly known as, the Bobba Group has recently launched its new 75,000 square-foot tech-enabled warehouse facility located at Bengaluru, with temperature monitoring facility.it has complete provision to manage need-to-end supply chain needs to support micro fulfillment. The warehouse can store up to 452 pallets of inventory within its premises and is equipped with eight docking stations, as well as a state-of-the-art remote monitoring system. “Bobba group has been a pioneer in the aviation, airport cargo, and ground handling services for over 30 years. We have 500 employees managing air cargo terminals and providing ground and ramp handling services. The opening of our new warehouse is a significant milestone for the Bobba group,” said V. S. Bobba, Managing Director of Bobba Group.

Segments Covered in the Report

By Technology

- Traditional WMS

- Mobile AMR

- Piece picking robots

By Warehouse Size

- Small Size

- Large Size

By End-User

- E-Commerce

- Industries

- General Stores

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting