What is the Minimally Invasive Medical Robots Market Size?

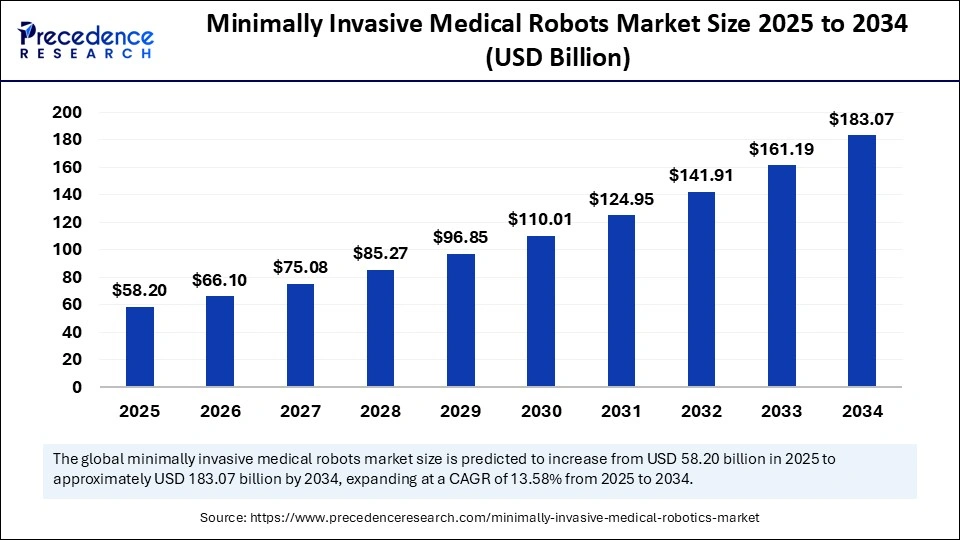

The global minimally invasive medical robots market size accounted for USD 58.20 billion in 2025 and is predicted to increase from USD 66.10 billion in 2026 to approximately USD 183.07 billion by 2034, expanding at a CAGR of 13.58% from 2025 to 2034. The market is driven by rising demand for precise, less invasive surgeries and advancements in robotics technology.

Market Highlights

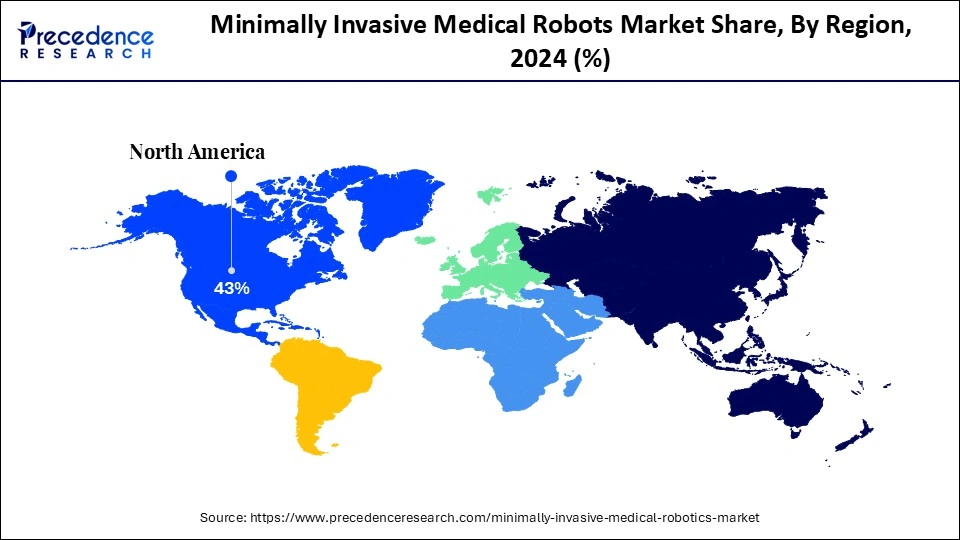

- North America accounted for the largest market share of 43% in 2024.

- The Asia Pacific is expected to witness the fastest growth during the forecasted years.

- By product type, the surgical robots segment held a significant share in 2024.

- By product type, the non-surgical robots segment is expected to grow at the fastest rate in the market over the forecast period.

- By application, the orthopedics segment held a major share of the market in 2024.

- By end user, the hospitals segment held the largest market share in 2024.

- By end user, the ambulatory surgical centers segment is expected to grow at the fastest CAGR over the forecast period.

Defining Robotic-Assisted Minimally Invasive Surgery

Minimally invasive medical robots are advanced machines designed to assist surgeons in performing complex surgical procedures with greater precision, control, and flexibility through small incisions, unlike traditional open surgeries. These robots incorporate imaging, navigation, and computer-assisted technologies to enable surgeons to execute highly delicate procedures accurately. The growing use of robotic-assisted surgery has revolutionized healthcare by increasing surgical accuracy, reducing surgeon fatigue, and improving overall patient outcomes.

The main driving force behind minimally invasive medical robots is the global trend of favoring minimally invasive surgery over traditional procedures. Adoption is also propelled by technological advancements such as artificial intelligence, 3D visualization, improved haptic feedback, and smaller instruments. Additionally, the increasing prevalence of chronic diseases requiring surgical treatment, the aging population, and rising healthcare costs are boosting market growth. Surgical centers and hospitals are heavily investing in robotic systems to enhance surgical care, reduce errors, and improve operational efficiency.

Technology Shifts Driving Next-Gen Surgical Robotics

With the emergence of artificial intelligence, the minimally invasive medical robot market is evolving to improve precision, decision-making, and surgical results. AI offers an opportunity to analyze data in real-time, recognize objects through imaging, and create predictive models, enabling surgeons to make more accurate movements and identify potential issues during surgery. Machine learning algorithms can be used to continually enhance robot performance based on previous surgeries, movements, and error reduction. AI-powered imaging and navigation systems complement visualization techniques, providing a clearer understanding of anatomical structures during complex surgeries. Since medical facilities began adopting AI-driven robotic systems, the field has experienced rapid technological advancements in autopilot systems, making minimally invasive procedures more accurate, efficient, and focused on outcomes.

What Factors are Boosting the Growth of the Minimally Invasive Medical Robots Market?

- Increased demand for Minimally Invasive Surgeries: Minimally invasive procedures are more preferred by patients and healthcare providers because of quick recovery, pain, and lower chances of infection; thus, robotic-assisted surgeries are becoming more popular and are more likely to be used to achieve more precise outcomes and positive patient outcomes.

- Robotic Technological Breakthroughs: Recurrent advances in the field of robotics, like artificial intelligence integration, improved imaging, 3D visualization, and haptic feedback, have enabled robots to be more precise, efficient, and dependable, thus pushing them to be utilized in challenging surgical interventions across specialties.

- Healthcare Investment Upsurge: Supported by the positive changes in healthcare funding and modernization efforts, hospitals and surgical centers are investing in the new advanced robotic platforms to increase the precision of surgery and minimize errors, as well as improve patient care.

- Favorable Regulatory Concessions: More positive regulatory approvals and government assistance to advanced medical technologies are hastening the commercialization and clinical application of minimally invasive robotic systems in healthcare institutions.

Minimally Invasive Medical Robots Market outlook

The minimally invasive medical robots industry is expected to grow rapidly from 2025 to 2034, driven by technological advancements and the need for accurate surgeries and better patient outcomes. Increasing investments in healthcare and the growing use of robotic-assisted operations are driving market growth worldwide.

There is strong potential for market expansion in regions such as Europe, Latin America, and Asia-Pacific, driven by improvements in healthcare facilities, increased numbers of surgical procedures, and greater accessibility to advanced robotic technology in the developing world.

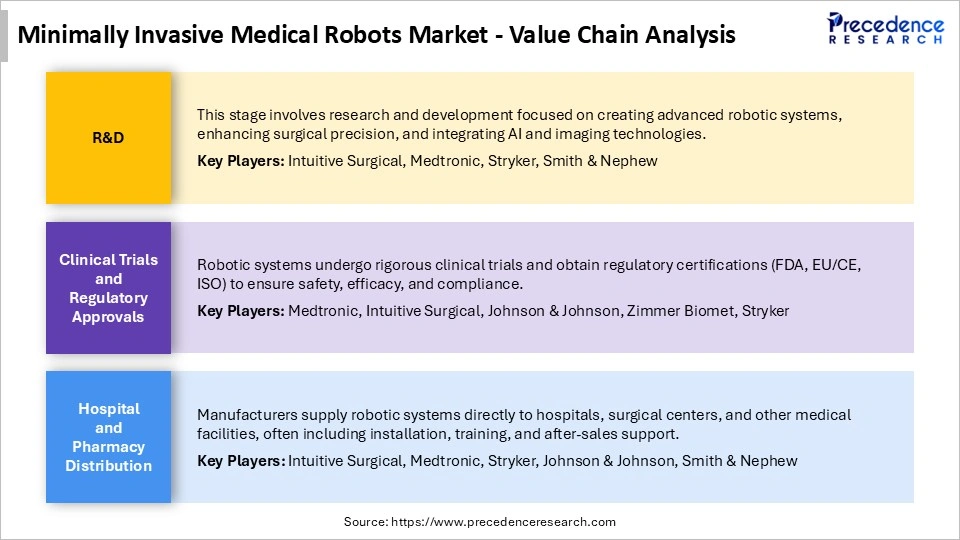

Leading players, including Intuitive Surgical, Medtronic, Stryker, and Johnson & Johnson, are heavily investing in R&D to optimize robotic platforms, expand clinical applications, and consolidate market presence. Simultaneously, startups are innovating with compact, AI-enabled, and cost-effective solutions, attracting significant venture capital to accelerate the commercialization of next-generation surgical robotics.

Startups are making attempts to create AI-based, small, and affordable robotic systems. Surgical precision, automation, and real-time analytics are new areas of venture capital, fast-tracking the commercialization of next-generation robotic technologies.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 58.20 Billion |

| Market Size in 2026 | USD 66.10 Billion |

| Market Size by 2034 | USD 183.07 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 13.58% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Application, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Minimally Invasive Medical Robots MarketSegment Insights

Product Type Insights

The surgical robots segment dominated the market with the largest revenue share in 2024. This is mainly because of their high accuracy, control, and visualization capabilities during surgery, which enable surgeons to perform complex procedures with minimal invasiveness. Laparoscopic, orthopedic, and cardiovascular surgeries are primarily performed using surgical robots. Laparoscopic robots, including the da Vinci Surgical System, are widely used for procedures such as prostatectomy, cholecystectomy, and hysterectomy, offering better precision and quicker recovery times. The increasing incidence of chronic diseases like cancer and heart disease is driving up the costs of major surgical procedures. Additionally, the rising demand from patients and healthcare providers for less invasive surgeries, along with continuous advancements in robotic technologies, such as 3D visualization and AI-guided navigation, continues to propel market growth.

The non-surgical robots segment is expected to grow significantly during the forecast period. These robots are intended to support non-invasive surgeries, which offer better accuracy, consistency, and patient care. Robotic systems are also being used in physical rehabilitation, drug delivery, and medical imaging. For example, robotic exoskeletons are transforming rehabilitation therapy by helping mobility-impaired patients regain movement and strength, while robotic drug delivery systems ensure accurate and precise medication administration, reducing side effects. Additionally, imaging robots can improve diagnostic accuracy through high-resolution visuals and minimally invasive scanning. The rising incidence of chronic and neurological diseases, along with an aging population needing rehabilitation assistance, further drives the demand for these systems.

Application Insights

The orthopedics segment contributed the largest revenue share in 2024 and is expected to maintain its growth throughout the forecast period. This is mainly due to the increasing rates of musculoskeletal disorders, bone fractures, arthritis, and other orthopedic conditions, which drive the need for accurate and minimally invasive surgical procedures. Robotic-assisted orthopedic surgeries (such as joint replacements and spinal procedures) enable better precision in implant placement, cause less tissue damage, and allow for quicker patient recovery. Smart robots assist surgeons in performing complex operations with high accuracy, improving patient outcomes and reducing the risk of postsurgery complications. The aging population, being more susceptible to orthopedic issues, further fuels demand for robotic-assisted solutions. Additionally, growing awareness among patients and healthcare providers about the benefits of robotic orthopedic surgery, such as shorter hospital stays, less pain, and greater mobility, has led to increased adoption.

End User Insights

The hospitals segment held the largest share of the minimally invasive medical robots market in 2024, driven by the presence of skilled surgeons, advanced infrastructure, and high surgical volumes across specialties such as orthopedics, cardiology, urology, and general surgery. Growing demand for minimally invasive procedures from both patients and healthcare providers has further increased the adoption of robotic systems. Hospitals are also investing heavily in next-generation surgical robots to enhance procedural accuracy, reduce complications, and improve patient outcomes, a trend likely to be sustained by ongoing technological advancements and rising medical expenditure.

The ambulatory surgical centers (ASCs) segment is expected to register significant growth in the coming period, driven by the rising preference for outpatient procedures characterized by lower costs, faster recovery, and reduced infection risks. Increasing global proliferation of ASCs and their adoption of robotic-assisted surgeries enhance procedural precision, reduce postoperative complications, and improve patient satisfaction. With the continued advancement of robotic technologies and the growing demand for minimally invasive surgeries, ASCs are poised to become an increasingly important venue for implementing and leveraging medical robotic systems.

Minimally Invasive Medical Robots MarketRegional Insights

The North America minimally invasive medical robots market size is expected to be worth USD 79.64 billion by 2034, increasing from USD 25.03 billion by 2025, growing at a CAGR of 13.71% from 2025 to 2034.

North America dominated the minimally invasive medical robots market in 2024, driven by the presence of leading market players, widespread adoption of advanced robotic technologies, and well-established healthcare systems capable of supporting complex surgical procedures. The region's growth is further fueled by rising healthcare expenditure, favorable government policies promoting robotic-assisted surgery, and robust R&D initiatives by major medical equipment manufacturers. Strong infrastructure, a skilled medical workforce, and supportive regulatory frameworks position North America as a key hub for investment, development, and deployment of minimally invasive medical robots.

U.S. Market Analysis

In 2024, the U.S. held a dominant position in the minimally invasive medical robots market and is expected to continue playing a significant role throughout the forecast period. Its dominance is supported by key market players like Intuitive Surgical, Medtronic, and Stryker, who continually develop and expand robotic surgical systems. The widespread adoption of robotic-assisted surgery is driven by high-tech technologies, a highly developed healthcare sector, and a skilled surgical workforce. Additionally, favorable reimbursement policies, rising healthcare spending, and government initiatives promoting minimally invasive surgeries further propel market growth. Ongoing investments in the development of AI, imaging, and surgical robots ensure the continued growth and dominance of the U.S. market.

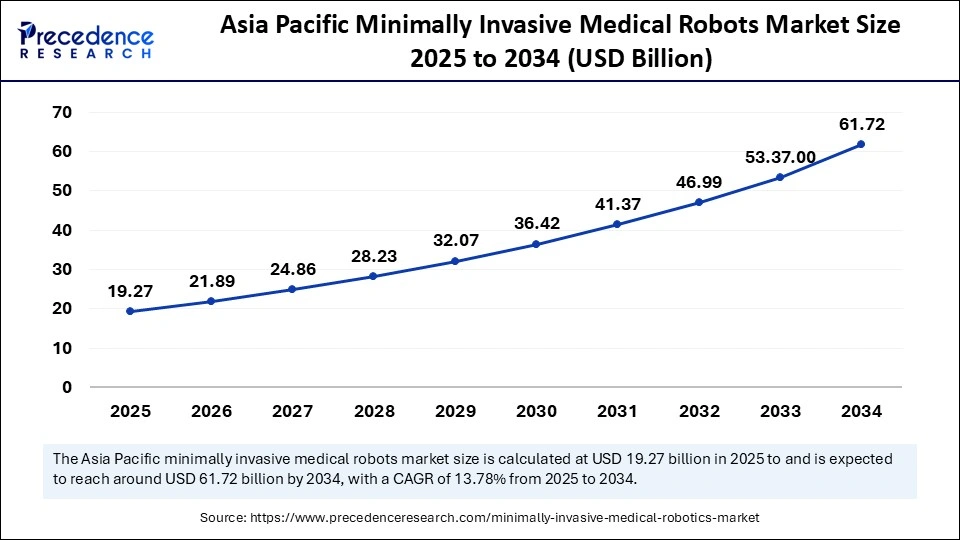

The Asia Pacific minimally invasive medical robots market size has grown strongly in recent years. It will grow from USD 19.27 billion in 2025 to USD 61.72 billion in 2034, expanding at a compound annual growth rate (CAGR) of 13.78% between 2025 and 2034.

Asia Pacific is expected to experience the fastest growth during the forecast period due to the expansion of healthcare infrastructure, increased patient awareness, and the demand for advanced medical technologies. Rapid economic growth in countries like China, Japan, and India has led to significant investments in healthcare centers, new surgical equipment, and robotics. Robotic-assisted surgical systems are gaining popularity in hospitals and surgical facilities in these countries to enhance procedural precision, reduce complications, and improve patient outcomes. Additionally, government programs supporting high-tech medical technologies and the growth of private medical services are further driving market acceptance.

China Minimally Invasive Medical Robots Market Analysis

The growing patient population and rising prevalence of chronic diseases such as cancer and cardiovascular conditions in China are driving the demand for robotic-assisted surgeries. In India, the adoption of cost-efficient minimally invasive surgical solutions is fueled by increasing patient awareness and improved accessibility to healthcare services. China's advanced healthcare infrastructure, combined with an aging population, is accelerating robotic-assisted procedures, particularly in orthopedics and neurosurgery, while the expansion of ambulatory surgical centers, private hospital chains, and collaborations between local healthcare providers and international medical device companies is further enhancing market penetration.

The European minimally invasive medical robots market is poised for notable growth in the coming years, driven by strong research and development capabilities, government support, and private investments that facilitate the development and adoption of advanced robotic surgical systems. Increasing healthcare expenditure, well-established medical infrastructure, and skilled healthcare professionals further enable widespread deployment of robotic-assisted surgeries. Rising patient demand and clinician adoption are fueled by the benefits of enhanced surgical precision, reduced postoperative complications, shorter hospital stays, and improved clinical outcomes.

Germany Minimally Invasive Medical Robots Market Analysis

Germany represents one of the most significant markets for minimally invasive medical robots in Europe, owing to its advanced healthcare infrastructure and strong technological focus. Hospitals and surgical centers are increasingly adopting robotic-assisted systems across orthopedics, urology, cardiology, and general surgery. Supportive government policies, substantial healthcare investments, and favorable reimbursement frameworks further drive adoption, while robust research and development and collaborations between medical device companies and healthcare facilities continuously fuel innovation in robotic surgical platforms.

Minimally Invasive Medical Robots Market Value Chain

Minimally Invasive Medical Robots Market Companies

| Tier | Companies | Rationale / Roles | Estimated Cumulative Share |

| Tier I Major Players | Intuitive Surgical; Medtronic; Stryker; Johnson & Johnson; Zimmer Biomet | These companies dominate the global market with extensive product portfolios, advanced robotic platforms, and strong global distribution networks. They lead in R&D, regulatory approvals, and high-volume adoption across multiple surgical specialties. | 45-50% |

| Tier II Established Players | CMR Surgical; Asensus Surgical; TransEnterix; Medtronic Hugo system (regional focus); Smith & Nephew | These companies are significant competitors with strong regional presence or niche specialties. They focus on modular or AI-enhanced robotic systems and have steadily growing adoption in specific markets or procedures. | 30% |

| Tier III Emerging / Niche Plaers | Titan Medical; Hansen Medical; Medtech S.A.; Verb Surgical (early-stage); Auris Health | These are smaller or emerging firms focusing on single-port, procedure-specific, or early-stage robotic technologies. They contribute meaningful revenue but lack the scale and reach of Tier I/II players. | 20-25% |

Recent Developments

- In September 2025, the Advanced SSI Mantra Surgical Robot was introduced in Sector 8, Faridabad, Sarvodaya Hospital, and its deployment can perform minimally invasive surgery across various disciplines. This adoption of the robots marks a major step toward the hospital integrating robotic technology to deliver high-quality surgical care.(Source: https://www.expresshealthcare.in)

- In December 2024, Fortis Escorts introduced the first second-generation surgical robot, which enables minimally invasive surgery, promotes quick recovery, reduces the risk of complications, and improves patient outcomes. It represents a significant breakthrough in robotic surgery.(Source: https://www.healthcareradius.in)

- In November 2023, the J&J MONARCH Platform became the first approved and widely applicable minimally invasive, robotic-assisted technology to perform bronchoscopy in China, addressing the high lung cancer burden. This underscores the growing need to utilize advanced robotic surgical instruments in oncology.(Source: https://www.jnj.com)

Exclusive Analysis

The global minimally invasive medical robots market is positioned for robust expansion, driven by the convergence of technological sophistication in robotic systems and escalating demand for precision-driven surgical interventions. Increasing adoption of robotic-assisted procedures across orthopedics, urology, cardiology, and general surgery is underpinned by hospitals' emphasis on operational efficiency, improved clinical outcomes, and patient-centric care. The integration of AI, advanced imaging modalities, and haptic feedback systems is creating differentiated product offerings, establishing new avenues for value capture in high-margin surgical robotics segments.

Geographically, North America retains market primacy owing to its mature healthcare infrastructure, early technology adoption, and sustained R&D investments by key players such as Intuitive Surgical, Medtronic, and Stryker. However, Asia-Pacific represents the fastest-growing opportunity, fueled by expanding healthcare access, rising surgical volumes, and increasing penetration of cost-efficient, next-generation robotic platforms in emerging economies like China and India. Concurrently, Europe is witnessing steady growth supported by government-backed innovation, favorable reimbursement policies, and the adoption of robotic systems in high-volume, high-precision surgical applications.

Strategic opportunities abound in the development of compact, AI-enabled, and procedure-specific robotic systems that can address operational constraints in ambulatory surgical centers and emerging markets. Moreover, the growing demand for minimally invasive surgeries coupled with evolving regulatory frameworks and clinical evidence is expected to accelerate capital deployment, partnership formations, and venture-backed innovations in surgical robotics, positioning the market for sustained double-digit growth over the medium term.

Minimally Invasive Medical Robots MarketSegments Covered in the Report

By Product Type

- Surgical Robots

- Non-Surgical Robots

By Application

- Cardiology

- Neurology

- Orthopedics

- Gastroenterology

- Urology

- Gynecology

- Others

By End User

- Hospitals

- Ambulatory Surgical Centers

- Specialty Clinics

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting