What is Minimally Invasive Medical Imaging Market Size?

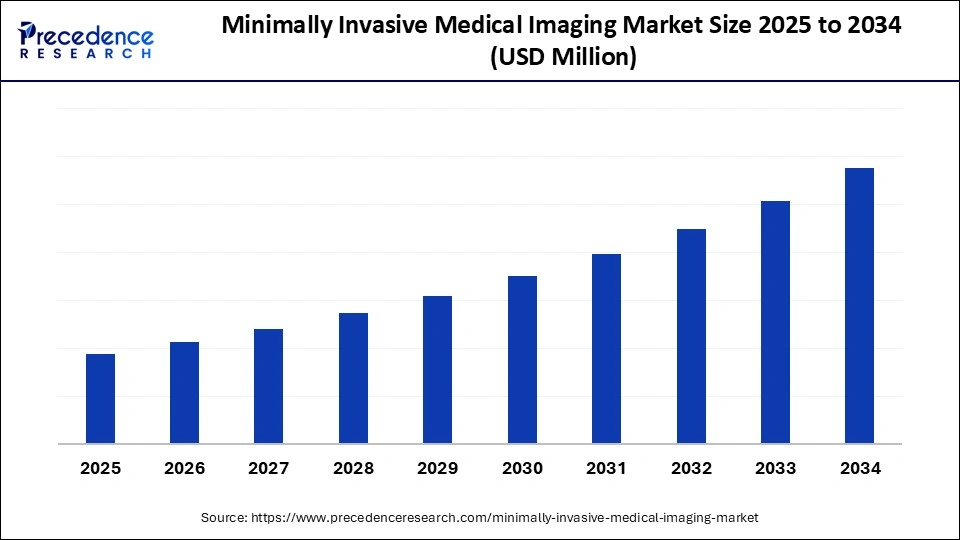

The global minimally invasive medical imaging market driven by rising chronic disease prevalence, technological innovations in ultrasound/CT/MRI and growing patient demand for less traumatic diagnostics. The minimally invasive medical imaging market growth is driven by the increasing preference for minimally invasive surgeries, technological advancements in imaging systems, and a rising demand for early and accurate diagnostics.

Market Highlights

- North America led the minimally invasive medical imaging market with 35% of share in the global market in 2024.

- Asia Pacific is estimated to expand the fastest CAGR in the market between 2025 and 2034.

- By modality, the x-ray imaging segment held the major market share of 25% in 2024.

- By modality, the MRI segment is anticipated to grow at a fastest CAGR between 2025 and 2034.

- By application, the oncology imaging segment captured 35% of market share in 2024.

- By application, the cardiovascular imaging segment is expected to expand at a notable CAGR over the projected period.

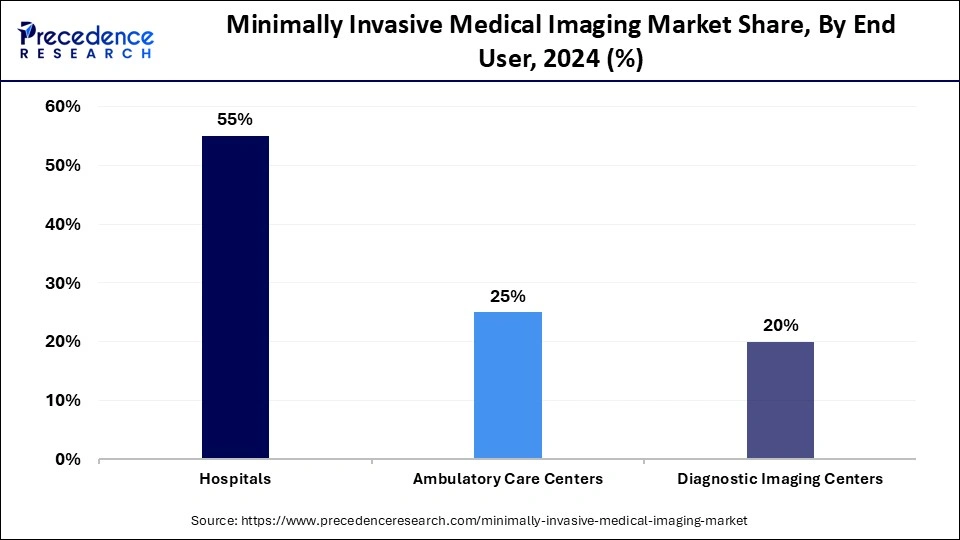

- By end-user, the hospitals segment captured more than 55% of market share in 2024.

- By end-user, the ambulatory care centers segment is expected to expand at a notable CAGR over the projected period.

Minimally Invasive Medical Imaging Market Overview

The minimal chances stimulating healthcare imaging market is propelled by the growing demand for early and accurate diagnosis with minimal trauma to the patient and a quicker recovery time. Minimal invasive medical imaging entails state of the art technologies including ultrasound, MRI, CT, and fluoroscopy imaging techniques that visualize internal organs to assist with procedures without the use of complicated surgical intervention.

These systems provide precision in diagnostics and treatments while minimizing hospital stay and post-operative complications. The continual increase in adoption of image guided surgeries, adoption of AI based imaging tools and technologies driven imaging tools from portable to team imaging continue to advance the market. This healthcare imaging market is not stagnant and is developing into more efficient means for faster, safer, and more patient-centric diagnostic imaging.

How is AI Changing the Paradigms of Today's Minimally Invasive Medical Imaging?

The application of Artificial Intelligence (AI) in minimally invasive medical imaging is creating new avenues for surgical precision, and increased patient safety. AI-enabled algorithms now offer the ability to enhance images in real time; enable 3D reconstructions; and provide predictive analytics that give clinicians improved neurosensory observations of anatomical structures.

- For instance, in 2025, SyncAR Spine received the FDA 510(k) marketing clearance for integrating Magnetic Resonance Imaging (MRI) and Computed Tomography (CT) imaging with AI-associated surgical navigation that aided in improving intraprocedure accuracy.(Source: https://www.prnewswire.com)

In addition, Intuitive's Ion system, more recently, adopted imaging capabilities, and built-in artificial intelligence for enhanced direction for lung biopsies, and ultimately streamlined decisions to be made during minimally invasive procedures. Taken together, these initiatives demonstrate how Artificial Intelligence is seamlessly marrying imaging and navigation to assist surgeons to complete complex and intense operations through smaller incisions, reduce adverse events, and provide a quicker recovery time for patient.* In summary, these are significant advancements to help support a shift to a smarter image-guided care.

Key Technological Shifts in Specialty Chemicals Market

Advances in imaging technologies, including MRI, CT, ultrasound, and fluoroscopy, are reshaping the landscape for minimally invasive imaging studies by providing increased accuracy, real-time imaging, and better diagnostic interpretation. The ability to provide superior imaging in 3D and 4D, new AI-generated imaging, and hybrid imaging systems allow clinicians to identify and navigate abnormalities more precisely and with lower radiation doses.

Hand-held and point-of-care ultrasound devices are now available for quicker bedside identification of possible abnormalities. Additionally, low dose CT and new MRI techniques can provide unparalleled soft tissue contrast and complexity of anatomy. Lastly, digital fluoroscopy measures continuous, real-time images during complex interventions that increase safety during procedures, leading to improved patient safety and outcomes across various procedures.

Minimally Invasive Medical Imaging Market Outlook

- Industry Growth Overview- The sector is growing steadily as public health organizations and academic institutions hasten the integration of image guided, low-trauma diagnostic and therapeutic processes. The NIH and EU initiatives stress the importance of safer, faster, and more accurate visualization technologies to be implemented in a clinical setting.

- Global Expansion- European and U.S. health authorities are developing global collaborations like the IMAGIO and FRONTIER initiatives bring hospitals, startups, and research institutes together to standardize minimally invasive imaging in cancer, cardiovascular, and inflammatory disease care around the world.

- Research and Development- The National Institutes of Health (NIH) in the U.S. has pledged in excess of $14 million through its NIOI initiative to develop new optical and molecular imaging devices to resolve tissue depth and resolution for improved precision in image guided minimally invasive interventions.

- Major Investors- The EU's Innovative Health Initiative and NIH's Common Fund serve as institutional primary investors; enabling significant grants and venture-style funding for accelerating commercialization of real-time imaging systems, optoacoustic platforms, and robotic guidance technologies for precision therapies.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Modality,Application,End User and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

What is driving the rise of minimally invasive medical imaging?

The growth of minimally invasive medical imaging is significantly driven by the adoption of AI-enabled image guidance, enabling procedures to become faster, safer, and more precise. Advanced artificial intelligence algorithms currently allow preoperative scans to be matched up with intraoperative images in real time to provide surgeons with navigational cues and decision support for more complex interventions.

- For example, in February 2025, Philips launched its SmartSpeed Precise AI module, which is used to speed up MRI scans while increasing the quality of the image, allowing for quicker and more confident minimally invasive treatments.

- In another example, in October 2025, MediView XR raised $24 million in Series A funding to develop its AR-centric visualization platform, which converts CT scans into interactive 3D models for surgical planning and AR-assisted procedures. These advances in artificial intelligence are accelerating the adoption and use of image-guided therapies in cardiology, oncology and neurology to make minimally invasive approaches more practical and routine. (Source: https://mediview.com)

Restraints

What technical limitations limit the uptake of minimally invasive medical imaging?

One of the main constraints that limit minimally invasive imaging systems, are the technical limitations inherent to those systems, including considering limitations attributed to field of view, manipulation, haptic feedback, and visualization limitations in less-than-ideal settings.

Recent report form NIH noted that surgeons spend approximatelty 40% of minimally invasive surgery (MIS) operating time managing suboptimal visualization (e.g. lens fogging, debris). One media reports the annual cost of that can exceed $2.2 billion per year in the United States including costs associated with lens cleaning and for those cases that have complications.Technical limitations also add time to a procedure, but especially when it comes to fatigue, advanced training, and considering patient safety - ultimately limiting uptake of minimally invasive imaging technologies.

Opportunity

What Advances in Immunomodulatory Encapsulation Are Creating New Opportunities?

A significant area of opportunity for cell encapsulation technology involves the integration of active immunomodulation into encapsulation systems. While immunosuppression is currently the standard of care for avoiding immune attack from grafts, encapsulation systems provides an avenue to avoid systemic immunosuppression. For example, in 2025 researchers at University College London (UCL) developed an encapsulation system using ultrapure alginate beads filled with tacrolimus-microparticles for the delivery of hiPSC-derived dopaminergic neuron progenitors (for Parkinson's disease). The system decreased T-cell activation by ~3-fold in vitro, maintained viability, and produced dopamine as the cells matured.

Similarly, advances in dual-porous immunoprotective membranes promote both prevention of T cell infiltration and enhanced vascularization in animal models, ensuring nutrient/oxygen flow while protecting cells from unwanted immune interactions.These developments decrease the need for lifelong immunosuppression and decrease the risk of immune-related side effects, while the effectiveness of encapsulated cell therapies will advance the acceptability for neurodegenerative and metabolic conditions.

Segment Insights

Modality Insights

What Modality Leads the Minimally Invasive Medical Imaging Market?

X-ray imaging dominated the market with 25% of the minimally invasive medical imaging market in 2024, remaining the primary modality due to its cost-effectiveness, speed, and accessibility. Advanced versions, including fluoroscopy and digital radiography, enable real-time visualization while improving surgical accuracy in orthopedic and cardiovascular interventions. The managed integration of X-ray imaging with a digital platform improves efficiency of workflow and is important across the hospital and outpatient environment.

Magnetic Resonance Imaging (MRI) is the fastest growing segment due to superior soft tissue imaging and lack of radiation exposure. High field MRI and open MRI, along with improvements in comfort and accuracy in detection of neurological and musculoskeletal disorders have increased usage. Additionally, improved facilities with image guided interventions continue to support this area of imaging. Lastly, developments with Artificial Intelligence to process images faster have competed and accelerated the growth of MRI imaging in minimally invasive diagnostics.

Application Insights

Why Oncology Segment Dominated the Market?

Oncology imaging leads the markeby capturing 35% of market share in 2024. The main factors are the increasing prevalence of cancer and the growing focus on early detection of cancer. Imaging modalities including PET, CT, and MRI are now highly utilized for detecting tumors and cancer staging. Companies are now shifting toward precision medicine and targeted therapies, increasing the need for imaging that provides accurate assessments of tumors in a timely manner.

Cardiovascular imaging is the second highest in market share at 20% and the fastest growing application segment, primarily driven by the growing burden of cardiac disease. The use of coronary artery imaging and cardiac perfusion modalities allows for early diagnosis and planning for minimally invasive treatment for patients. Advances in imaging modalities, including CT angiography and ultrasound, aid in imaging cardiac structures to provide faster interventions for cardiac care.

End User Insights

Which End User is dominates the Minimally Invasive Medical Imaging Market?

The dominant end user in the minimally invasive medical imaging sector is hospitals, with a 55% market share. Hospitals have advanced imaging facilities along with the overall infrastructure to support imaging technologies. They are the primary entity for procedures that require complex diagnostic imaging, as they are capable of employing multi-specialty, integrated diagnostic modalities, such as MRI, CT, and PET scans. Other considerations that further enhance hospitals' leadership role in minimally invasive medical imaging include the availability of the necessary personnel and the high volume of patients.

Ambulatory care centers are the fastest growing end user group during forecasted period. Ambulatory care centers continue to expand due to the growing demand for cost-effective, outpatient services. Ambulatory care centers employ advanced digital imaging and portable imaging systems. Ambulatory care centers are faster in terms of "turn-around" time and provide greater accessibility for patients. In addition, as we move towards decentralized health care, ambulatory care centers are becoming more prominent in the imaging healthcare ecosystem, with an increased focus on same-day diagnostic services.

Regional Insights

North America guides the charge because multiple factors established hospital networks, high intervention -procedure volume, and fast regulatory pathwaysall converge into more rapid commercialisation and clinician uptake of next-generation imaging systems. The recent institution of FDA clearances for example, a hands-free interventional X-ray system along with the ongoing approval of novel diagnostic agents, has driven workflow changes to procedural and diagnostic gain, thus reducing OR time and aiding throughput; a benefit to overall hospital purchasing and economics of implant/procedure.

U.S. Minimally Invasive Medical Imaging Market Analysis

The United States leads for regional demand because its large tertiary hospitals centralise complex interventional suites, image-guided therapy programs, and research/invitation-trials, thus boosting free-market adoption in its real-world settings. Activity at the regulatory level is very strong on-going listing and authorisation, by the FDA, of hundreds of AI-enabled radiology devices, as well as device clearances reduce time to market for innovations in imaging, and vendors can now spin these innovations into service contracts and subscription revenue. Clinical workflow benefits will lead to evident return on investments (ROI) for administrators thus supporting station budgetary and financing models.

- In September 2025, Olympus Corporation, announced the U.S. launch the VISERA™ S OTV-S500 imaging platform, which integrates advanced diagnostic capabilities for ear nose and throat (ENT) and urology applications. (Source: https://www.prnewswire.com)

Asia Pacific Minimally Invasive Medical Imaging Market Analysis

The Asia Pacific Region's rapid hospital expansion, public health screening initiatives, and burgeoning private provider networks are driving demand for minimally invasive imaging which shortens lengths of stay and increases throughput. Countries across the region continue to launch point-of-care ultrasound, vacuum-assisted biopsy suites, and image guided interventional services in tier-2/3 hospitals and cancer centers to address rising volumes quickly. Recent media coverage of initiatives in the region highlight new regional cultures of expanding minimally invasive diagnostics and robotic-assisted cardiac programs which illustrate capacity growth and technology diffusion beyond major metropolitan areas.

Which Country in Asia Pacific is Leading the Minimally Invasive Medical Imaging Market?

As an illustrative leader within APAC for rapid clinical uptake, India exemplifies most of the regional attributes tertiary hospitals are launching vacuum-assisted breast biopsy and robotic cardiac suites, enabling same-day procedures and broader screening efforts that drive up imaging procedure counts. Recent launches and local news indicate that public and private hospitals in India are investing in minimally invasive diagnostics, underlined by a policy perspective on early detection and on-site procedural ability.

In November 2024 Irillic Private Ltd. launched the Irillic L.nm, India's first true 4K NIR laparoscopic imaging system, advancing fluorescence imaging for minimally invasive surgery.

Top Key Players In Minimally Invasive Medical Imaging and Their Offering

- GE HealthCare- Provide and enhance minimally invasive procedures and surgeries, primarily through its Image Guided Systems (IGS) and Surgical Imaging (C-arm) platforms.

- Siemens Healthineers- Siemens Healthineers provides a comprehensive portfolio of minimally invasive medical imaging solutions, primarily through its Image Guided Therapy (IGT) systems.

- Philips Healthcare- Philips Azurion is a next-generation image-guided therapy platform used in cath labs, interventional radiology (IR) labs, and Hybrid ORs.

- Canon Medical Systems- Canon Medical Systems leverages high-resolution imaging technology, including its Alphenix interventional X-ray systems and non-contrast MRI techniques, to support minimally invasive procedures.

- Fujifilm Holdings Corporation- ELUXEO Surgical System provides high-definition (HD) and 4K UHD imaging, featuring advanced visualization modes like Linked Color Imaging (LCI) and Blue Light Imaging (BLI) to enhance observation and detection during procedures.

- Medtronic- O-arm™ Surgical Imaging System is an intraoperative 2D/3D imaging system that provides high-definition, 360° rotational imaging capability.

- Intuitive Surgical- Intuitive Surgical integrates advanced minimally invasive medical imaging technologies directly into its robotic surgical systems, to enhance a surgeon's visualization and control during procedures.

- Boston Scientific- SpyGlass™ DS system for visualizing and biopsying biliary ducts, and interventional radiology tools such as the EMBOLD™ Detachable Coil System.

- Stryker Corporation- 1788 Platform, Stryker's latest generation surgical camera system for minimally invasive surgery. It provides 4K resolution images, a wider color gamut, high dynamic range (HDR).

- Olympus Corporation- Systems like the EVIS X1 and VISERA ELITE III offer advanced imaging capabilities, including 4K and 3D visualization, which provide superior clarity an depth perception for surgeons.

Other Major Players

- Hologic, Inc.

- Esaote S.p.A.

- Hitachi Medical Corporation

- Johnson & Johnson (Ethicon)

- Samsung Medison

- Mindray Medical International

- Carestream Health

- Konica Minolta Healthcare

- Neusoft Medical Systems

- United Imaging Healthcar0065

Recent Developments

- In February 2024, Hologic announced FDA clearance for its Genius™ Digital Diagnostics System, making it the first and only FDA-cleared digital cytology platform. It combines deep-learning AI with volumetric imaging to detect precancerous cervical lesions more accurately. (Source: https://investors.hologic.com)

- In July 2025, Cook Medical launched a new interventional MRI (iMRI) division, appointing Peter Polverini as Vice President. The division aims to expand image-guided procedures in collaboration with hospitals and physicians.(Source: https://www.cookmedical.com)

- February 2025 Researchers at the Wyss Center developed a minimally invasive optical coherence tomography (OCT) imaging system for neurosurgery that visualizes neuroanatomy and blood flow in real time, improving precision in brain surgeries.(Source: https://www.indianchemicalnews.com)

- November 2024 Irillic launched L.nm, India's first true 4K near-infrared (NIR) laparoscopic imaging system. The platform offers fluorescence overlay and improved vascular/tissue visualization to enhance minimally invasive surgery outcomes.(Source: https://www.business-standard.com)

Experts Analysis

Experts anticipate that cell encapsulation technology develops alongside an increased clinical need for cell and gene therapies, further enabled by advancements in biomaterials, microfabrication, and immunomodulatory coatings. Growth will stem from translational innovation in islet replacement, neuroprotection, target-specific oncology, and investment in scalable manufacturing and processes.

Key challenges include chronic host response and device fibrosis, scalability, cost of goods, and regulatory uncertainty of combination products. There are partial opportunities for platform licensing, CDMO services, biodegradable hydrogels, and partnerships targeting metabolic and neurological indications. Trends include personalized matrices, off-the-shelf allogeneic constructs, encapsulation with controlled drug release, and commercialization.

Segments Covered in the Report

By Encapsulation Method

- Microencapsulation

- Nanoencapsulation

- Macroencapsulation

By Polymer Type

- Natural Polymers (e.g., alginate, chitosan)

- Synthetic Polymers (e.g., polyethylene glycol, polyacrylates)

By Application

- Drug Delivery

- Regenerative Medicine

- Cell Transplantation

- Research & Development

- Probiotics

By Technology

- Extrusion

- Electrostatic Dripping

- Rotating Disk Atomization

- Layer-by-Layer Coating

- Others

By End-User

- Pharmaceutical & Biotechnology Companies

- Contract Development and Manufacturing Organizations (CDMOs)

- Academic & Research Institutes

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content