Modular Packaging Equipment Market Size and Forecast 2025 to 2034

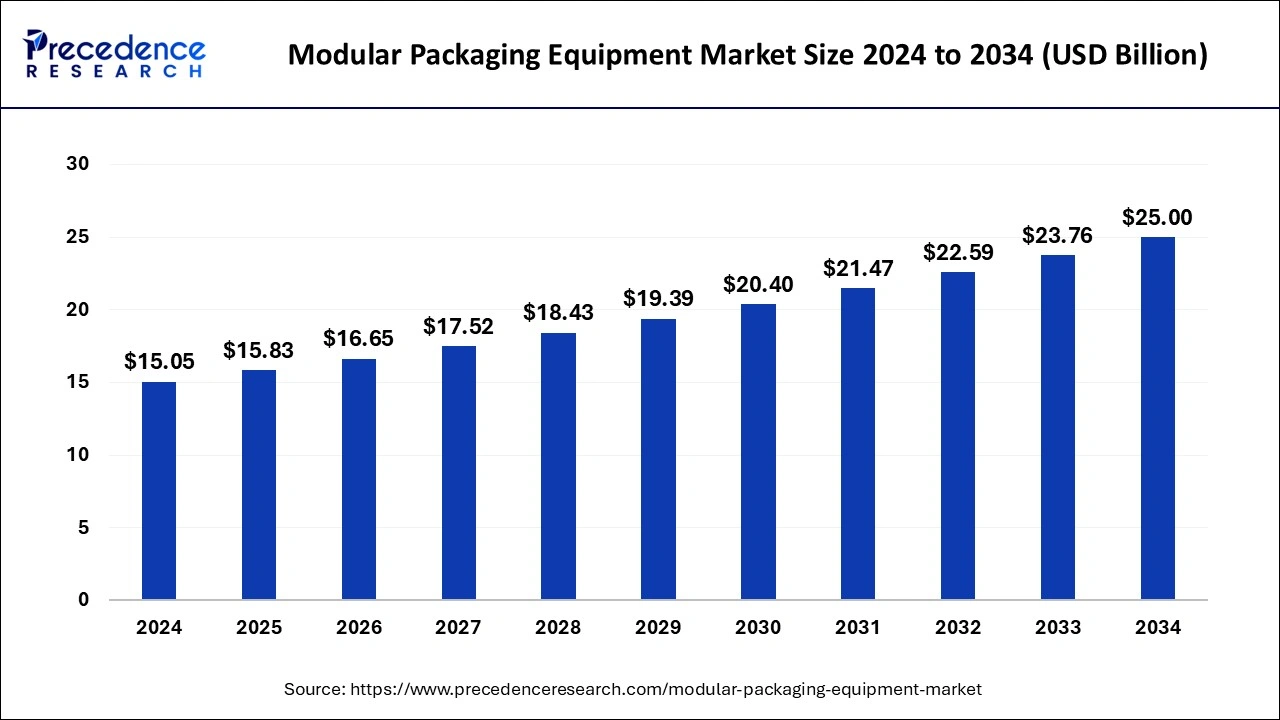

The global modular packaging equipment market size accounted for USD 15.05 billion in 2024 and is expected to exceed around USD 25.00 billion by 2034, growing at a CAGR of 5.21% from 2025 to 2034. The key factor driving the modular packaging equipment market growth is the rising focus on efficiency and flexibility in manufacturing processes. Also, advancements in technology coupled with the increasing emphasis on sustainability can fuel market growth soon.

Modular Packaging Equipment Key Takeaways

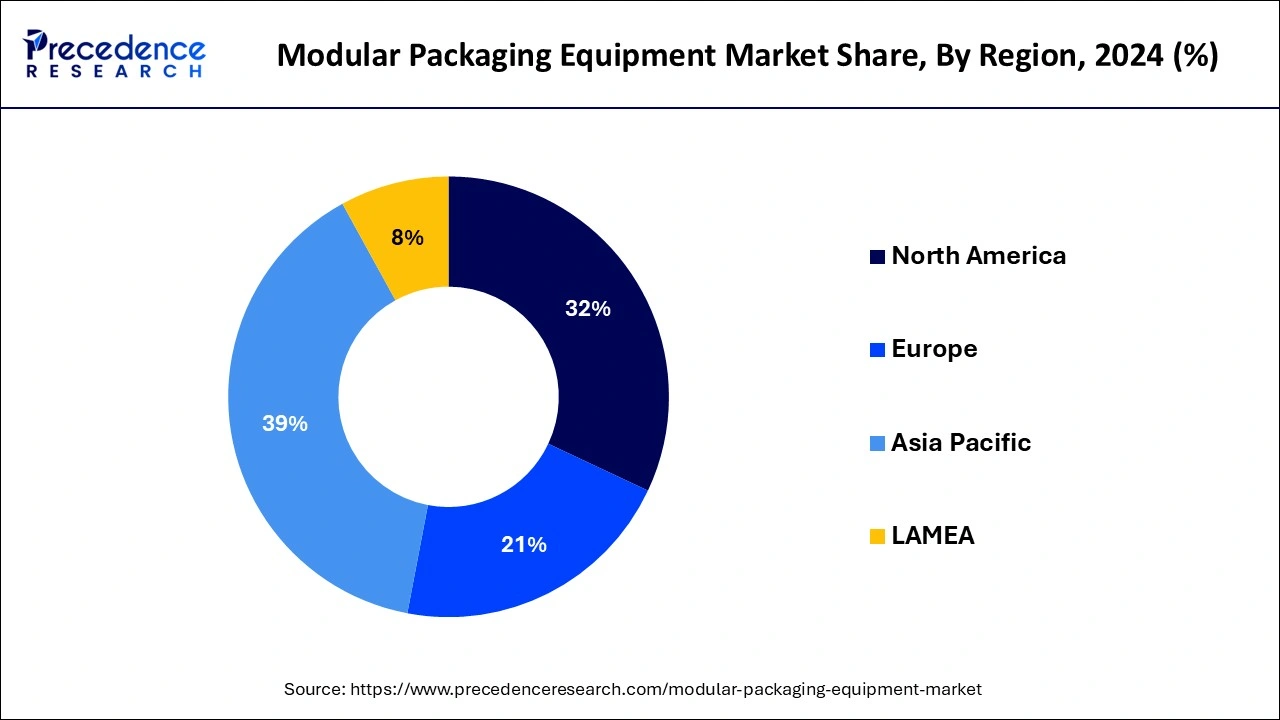

- Asia Pacific dominated the modular packaging equipment market with the largest market share of 32% in 2024.

- North America is expected to show the fastest growth over the studied period.

- By type, the primary packaging equipment segment contributed the highest market share of 60% in 2024.

- By type, the secondary packaging equipment segment is expected to grow at the fastest rate over the forecast period.

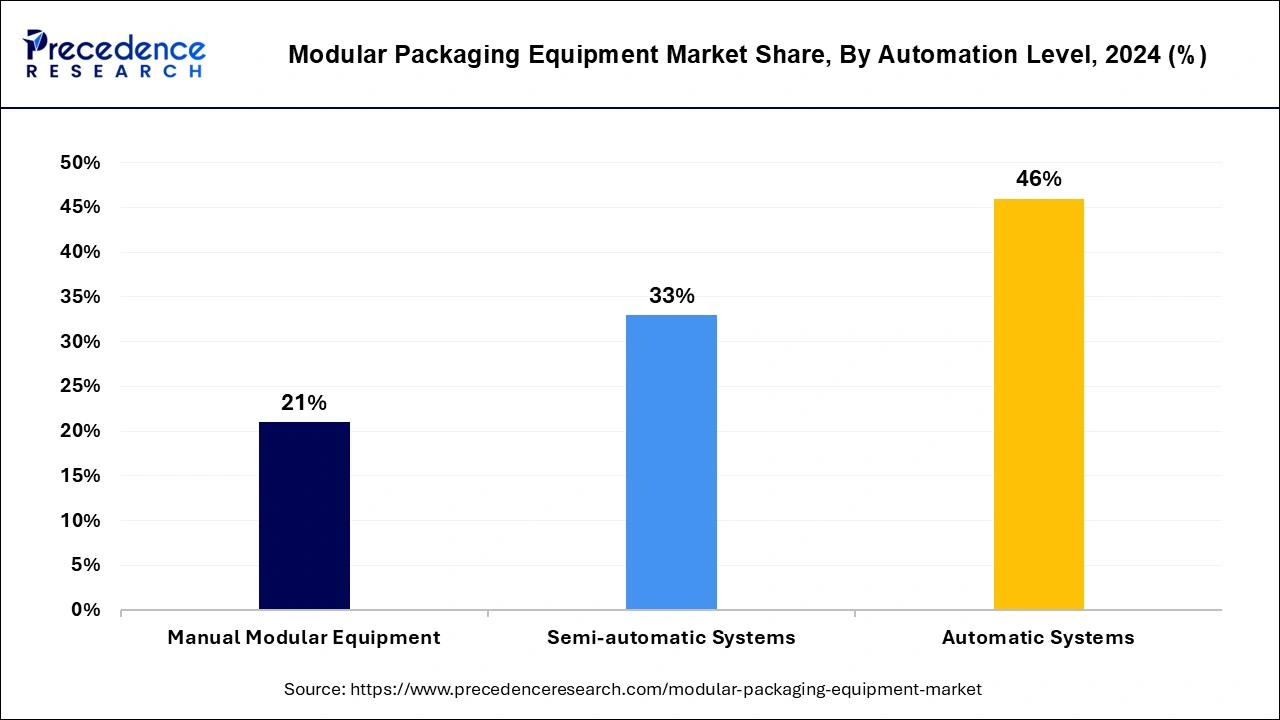

- By automation level, the automatic segment has held the major market share of 46% in 2024.

- By automation level, the semi-automatic segment is expected to grow at the fastest rate over the projected period.

Impact of Artificial Intelligence (AI) on the Modular Packaging Equipment Market

Artificial Intelligence is the authentic tech to guide the way for the new revolution in the modular packaging equipment market, from manufacturing to packaging to distribution. Rising industry demand for sustainable and paper-based packaging materials, along with eco-friendly consumer goods and services, are key contributors to the adoption of AI in this industry. Furthermore, AI can enhance business processes and workflows in no time.

- In February 2024, OSARO launched the Robotic Depalletization System, an AI-powered solution to enhance efficiency and safety in e-commerce fulfillment and warehousing operations. Designed to replace manual pallet unloading, this advanced warehouse automation system addresses the labor-intensive and hazardous task of unloading mixed-case pallets.

Asia Pacific Modular Packaging Equipment Market Size and Growth 2025 to 2034

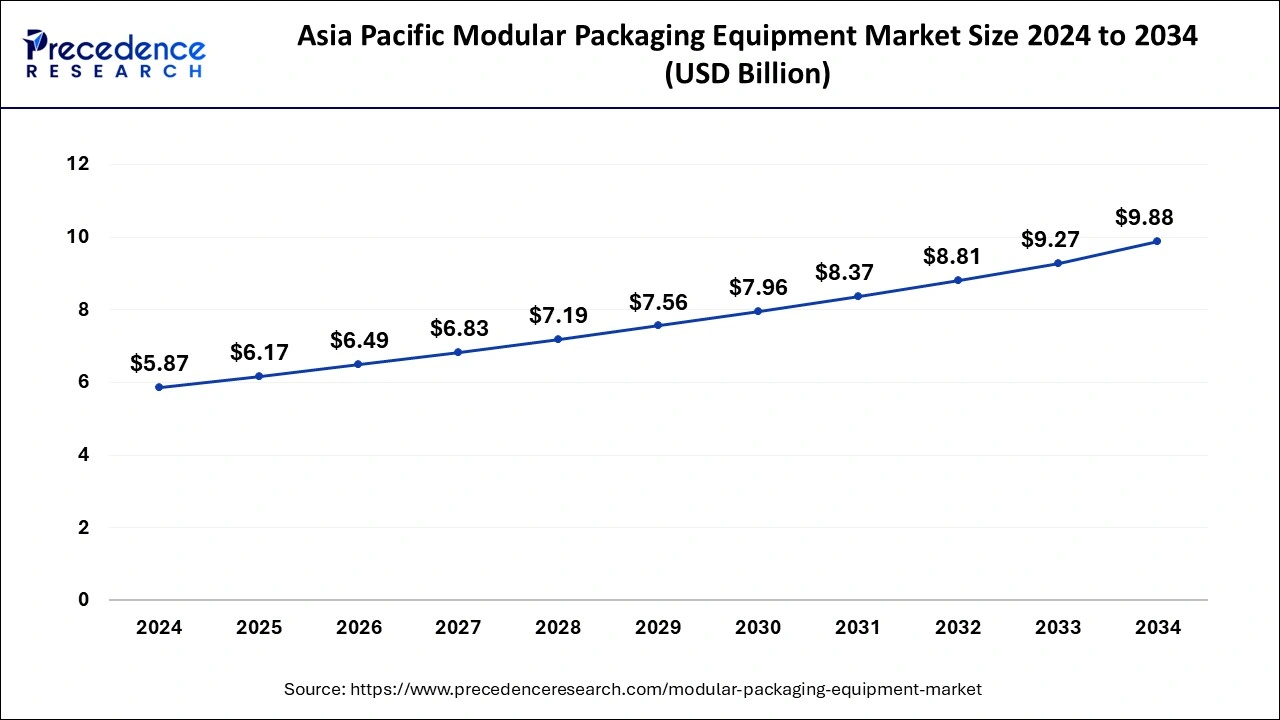

The Asia Pacific Modular Packaging Equipment market size was exhibited at USD 5.87 billion in 2024 and is projected to be worth around USD 9.88 billion by 2034, growing at a CAGR of 5.34% from 2025 to 2034.

Asia Pacific dominated the modular packaging equipment market in 2024. The growth of the region can be credited to the increasing population and rising consumer purchasing power owing to the high population. Furthermore, in North America, the U.S. led the market due to the strong presence of many multinational food processing companies, which in turn resulted in the growing demand for packaging machinery.

North America is expected to show the fastest growth over the studied period. The dominance of the region can be attributed to the surge in the growth of the e-commerce industry along with the growth in online shopping. Furthermore, companies are confronting growing pressure to fulfill the consumer demand for secure, fast, and cost-effective packaging. Hence, these packaging systems are important in fulfilling these demands as they provide flexibility to pack an extensive range of products.

- In June 2024, Cama Group launched a new top-loading packaging machine, which enhances productivity and reduces machinery footprint in the multipack market. The main motive behind launching this was to handle multiple food items in the food industry.

Market Overview

Modular systems are adaptable systems that enable organizations to rapidly reconfigure their lines of packaging to accommodate production volumes, package sizes, and different products. This factor is especially important for markets like pharmaceuticals, food and beverage, and personal care, where changes in consumer desire with rapid product launches need responses. The modular packaging equipment market offers high scalability, which enables producers to adjust to fluctuations in demand.

Modular Packaging Equipment Market Growth Factors

- Rising demand for packaging machinery is expected to boost market growth soon.

- The growing use of e-commerce platforms can propel modular packaging equipment market growth shortly.

- The increasing consumer demand for packaged goods will likely contribute to the market expansion over the forecast period.

Market Scope

| Report Coverage | Details |

| Market Size by 2024 | USD 15.05 Billion |

| Market Size in 2025 | USD 15.83 Billion |

| Market Size in 2034 | USD 25.00 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.21% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Automation level, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing incorporation of automated technologies

The packaging industry, especially food packaging, is bound to stringent government regulations to maintain a hygienic and safe environment in the food packaging process. Also, governments across the globe are deploying many strict laws and regulations regarding food equipment safety and hygiene because of the increasing issues of food-borne disorders. All these regulations will force modular packaging equipment market players to install safe and hygienic food equipment further.

- In July 2024, Cama Group launched a new top-loading packaging machine. A new top-loading packaging machine from Cama Group is increasing productivity and reducing machinery footprint in the multipack market. These machines can be built as a single unit, or as a fully integrated element of a complete production line.

Restraint

High initial cost

The high initial costs associated with innovative packaging machines are challenging for small market players to afford, which constrained the modular packaging equipment market growth. The rising competition among market players creates a harsh business scenario, which can impact the overall profit rate. Moreover, modular packaging equipmentmanufacturing requires a big factory setup that can further add to the market cost.

Opportunity

The surge in the number of e-commerce platforms

The tremendous growth of various e-commerce platforms is an important factor fuelling the requirement for the modular packaging equipment market. Online shopping practices are becoming pervasive, which results in the growing demand for packaging solutions that can safeguard products during transportation. Furthermore, automation within this modular packaging equipment optimizes the whole packaging process smoothly.

- In January 2025, JASA is set to launch the latest generation of vertical packaging machines at Fruit Logistica in Berlin. JASA offers the customer efficiency, ease of use, and service. The whole NXXT generation project is based on a modular concept, building with autonomous modules.

Type Insights

The primary packaging equipment segment dominated the modular packaging equipment market in 2024. The dominance of the segment can be attributed to the growing consumer preferences for individualized and advanced packaging solutions. As consumers are increasingly seeking personalized and unique products, market players are searching for new ways to provide a wide range of consumer-specific packaging solutions.

- In November 2024, IWK Packaging Systems, Inc., a manufacturer of premium cartoning and tube filling equipment for the pharmaceutical and health & beauty sectors, launched the CH 4, a modular, horizontal cartoning machine engineered to meet dramatically increased demand for the packaging of pre-filled syringes, vials, and other delicate pharma containers.

The secondary packaging equipment segment is expected to grow at the fastest rate in the modular packaging equipment market over the forecast period. The secondary packaging solutions safeguard the product during the transportation and distribution process. This packaging type enables easy stacking, handling, and storage of multiple units, which makes logistics and transportation more efficient and organized.

Automation Level Insights

The automatic segment led the global modular packaging equipment market in 2024. The dominance of the segment can be linked to the growing demand for automatic equipment in industries that require high-speed packaging and large-scale production. Industries such as pharmaceuticals, food and beverage, and consumer electronics need large-scale packaging solutions that can monitor huge quantities of products with less or no human intervention. Additionally, this system can substantially raise production speed, enabling efficient packaging operations that are important for mass production.

- In April 2024, Swiss technology group Bühler, in collaboration with leading Canadian packaging equipment manufacturer Premier Tech, announced the launch of the CHRONOS OMP-2090 B, a fully automatic bagging station. The new bagging station was developed for a wide range of powdery and other non-free-flowing products.

The semi-automatic segment is expected to grow at the fastest rate in the modular packaging equipment market over the projected period. The growth of the segment can be driven by fewer labor costs required to maintain high-quality output. This system is also less expensive to deploy as compared to other systems. However, a semi-automated system can decrease factory lead times offer faster ROI, and increase production output.

Modular Packaging Equipment Companies

- Bosch Packaging Technology

- Coesia

- Combi Packaging Systems

- IMA Group

- Krones

- Marchesini Group

- Marel

- Multivac

- NJM Packaging

- Packaging Automation

- ProMach

- Rockwell Automation

- Sidel Group

- Tetra Pak

- Unipak Machinery

Latest Announcement by Market Leaders

- In November 2024, Rockwell Automation, Inc., the world's largest company dedicated to industrial automation and digital transformation, announced it is integrating NVIDIA Omniverse application programming interfaces into its Emulate3D™ digital twin software to enhance factory operations through artificial intelligence and physics-based simulation technology. Blake Moret, Chairman and CEO of Rockwell Automation, said, "Our integration of Emulate3D with NVIDIA Omniverse marks a significant leap forward in bringing autonomous operations to life,"

Recent Developments

- In July 2024, Eliter Packaging Machinery unveiled its latest automatic sleeving machine, the Multi-Wrap C-80S. Capable of achieving speeds up to 80 wraps per minute, this machine adeptly organizes packaging containers—be it cans, bottles, cups, or pots—into configurations like 1x2x1 and 1x4x1, and even cluster-pack formats such as 2x2x1 and 2x3x1.

- In May 2024, Mackie's of Scotland invested £300,000 in a new ice packaging machine. The investment aims to enhance the production capabilities by three million bags annually, alongside its low-carbon refrigeration system.

- In March 2024, ATS Corporation agreed to acquire Paxiom Group, a packaging machine provider, integrating it into ATS' Products and Food Technology business post-acquisition, with completion expected in Q3 2024.

- In March 2023, Packaging machinery manufacturer Bosch Packaging Technology launched a new range of vertical form-fill-seal machines for the pharmaceutical industry.

- In February 2024, IMA Group announced two artificial intelligence (AI) solutions aiming to enhance the efficiency and effectiveness of services offered to customers. The IMA Sandbox solution is a collaborative, cloud-based platform for co-development and partnership in creating advanced algorithms, based on a shared and secure environment.

Segments Covered in the Report

By Type

- Primary Packaging Equipment

- Filling Machines

- Sealing Machines

- Labeling Machines

- Coding And Marking Equipment

- Secondary Packaging Equipment

- Cartoning Machines

- Case Packing Systems

- Shrink Wrapping Machines

- Palletizing Equipment

By Automation Level

- Manual Modular Equipment

- Semi-Automatic Systems

- Automatic Systems

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting