Monk Fruit Sweetener Market Size and Forecast 2025 to 2034

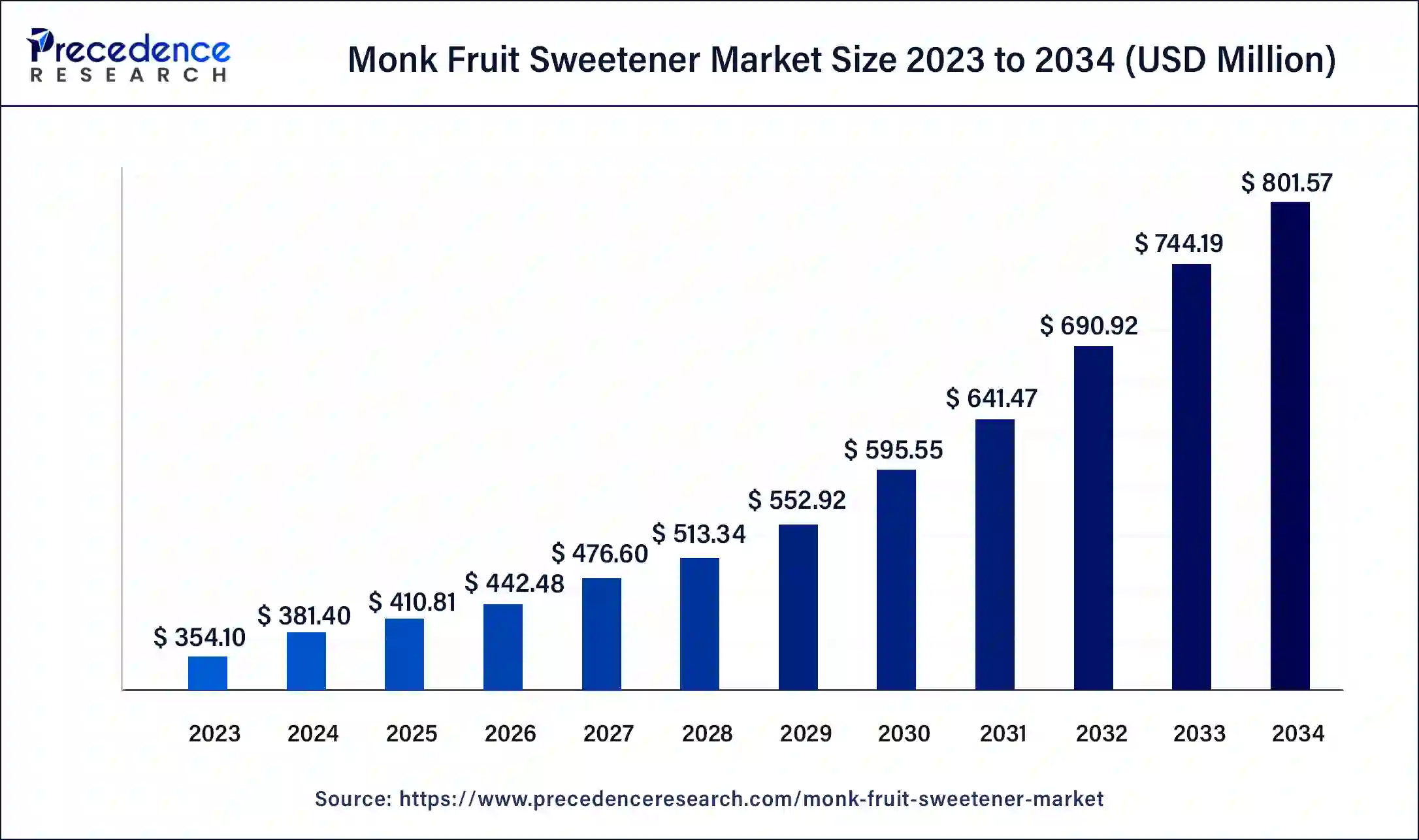

The global monk fruit sweetener market size is projected to be worth around USD 801.57 million by 2034 from USD 381.40 million in 2024, at a CAGR of 7.71% from 2025 to 2034. The increasing awareness regarding the health benefits of the product is helping to increase its demand in the food and beverage industry. Additionally, the increasing demand for monk fruit sweeteners for bakery items like cake drives the monk fruit sweetener market growth.

Monk Fruit Sweetener Market Key Takeaways

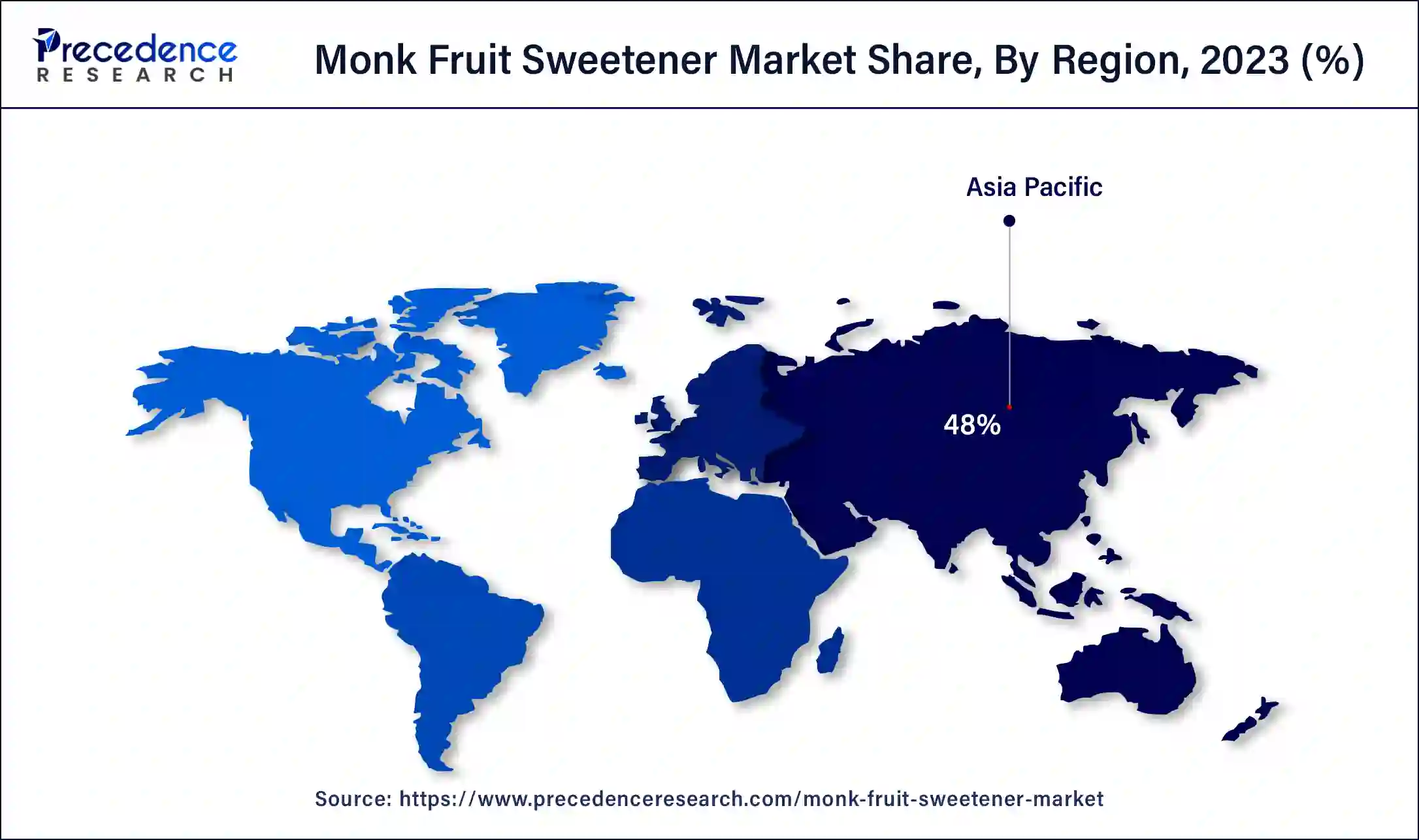

- Asia Pacific dominated the global monk fruit sweetener market with the largest market share of 48% in 2024.

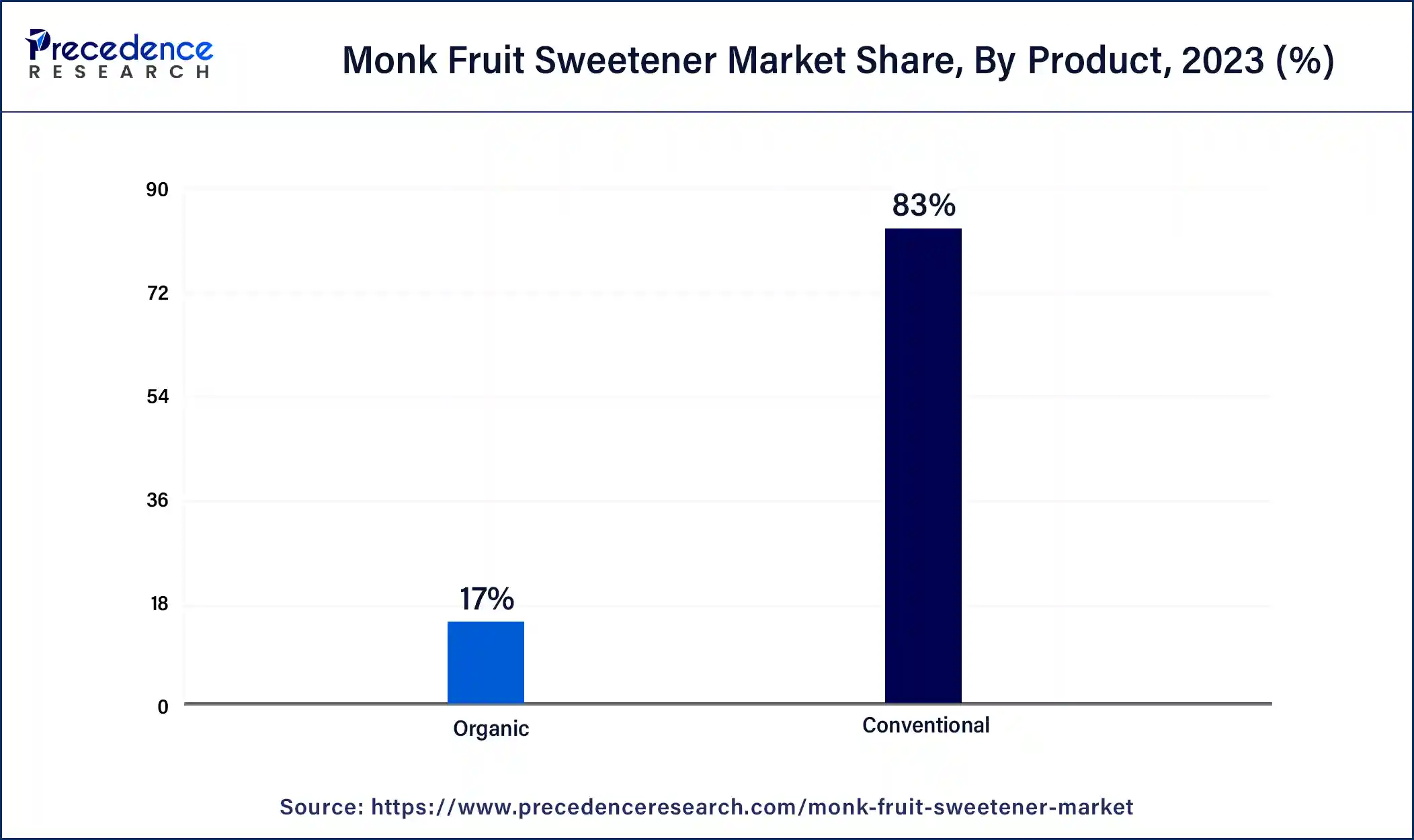

- By product, the conventional segment contributed more than 83% of market share in 2024.

- By product, the organic segment is anticipated to register the fastest growth in the market during the forecast period of 2025 to 2034.

- By form, the solid segment accounted for the largest market share of 74% in 2024.

- By form, the liquid segment is expected to grow at the fastest rate in the market during the forecast period.

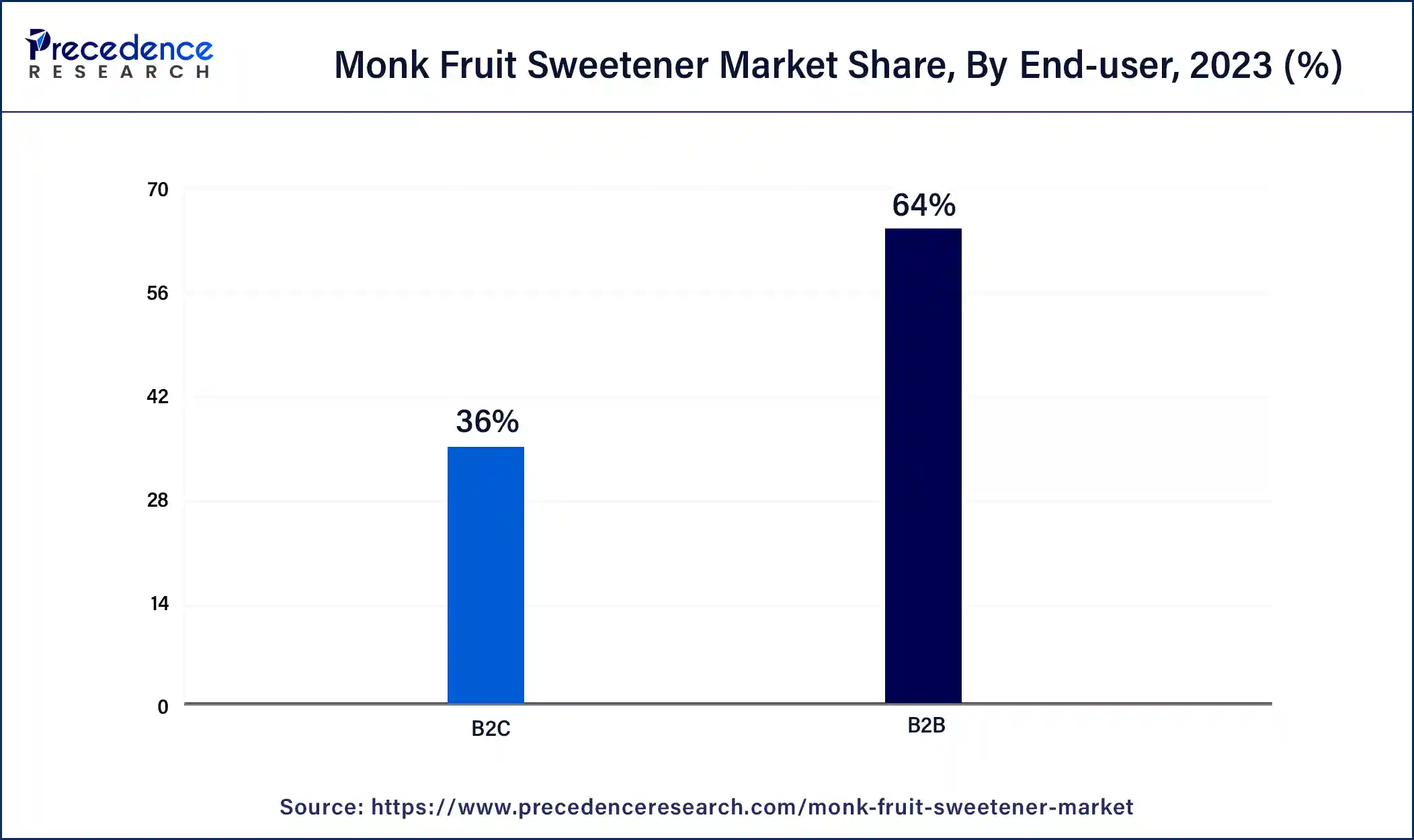

- By end-user, the B2B segment generated the highest market share of 64% in 2024.

- By end-user, the B2C segment is expected to register significant growth in the market during the forecast period.

What is the Role of AI in the Monk Fruit Sweetener Market?

AI has been constantly playing a vital role in the development of the food and beverage industry. The emergence of AI has helped enhance the agricultural sector by helping farmers make yield predictions, optimizing water usage, and monitoring crop health. This helps the farmers in the monk fruit sweetener market in ensuring higher quality standards in monk fruit harvesting. A good quality monk fruit is crucial for converting it into an organic sweetener.

Additionally, AI can help in innovation and product development by suggesting the use of monk fruit sweeteners in different beverages. AI also analyzes the use of monk fruit sweeteners and their sales, which will help emerging market companies to invest accordingly. Many companies in the monk fruit sweetener market are adopting the use of AI in their setups, which is enhancing their business ideas.

Asia Pacific Monk Fruit Sweetener Market Size and Growth 2025 to 2034

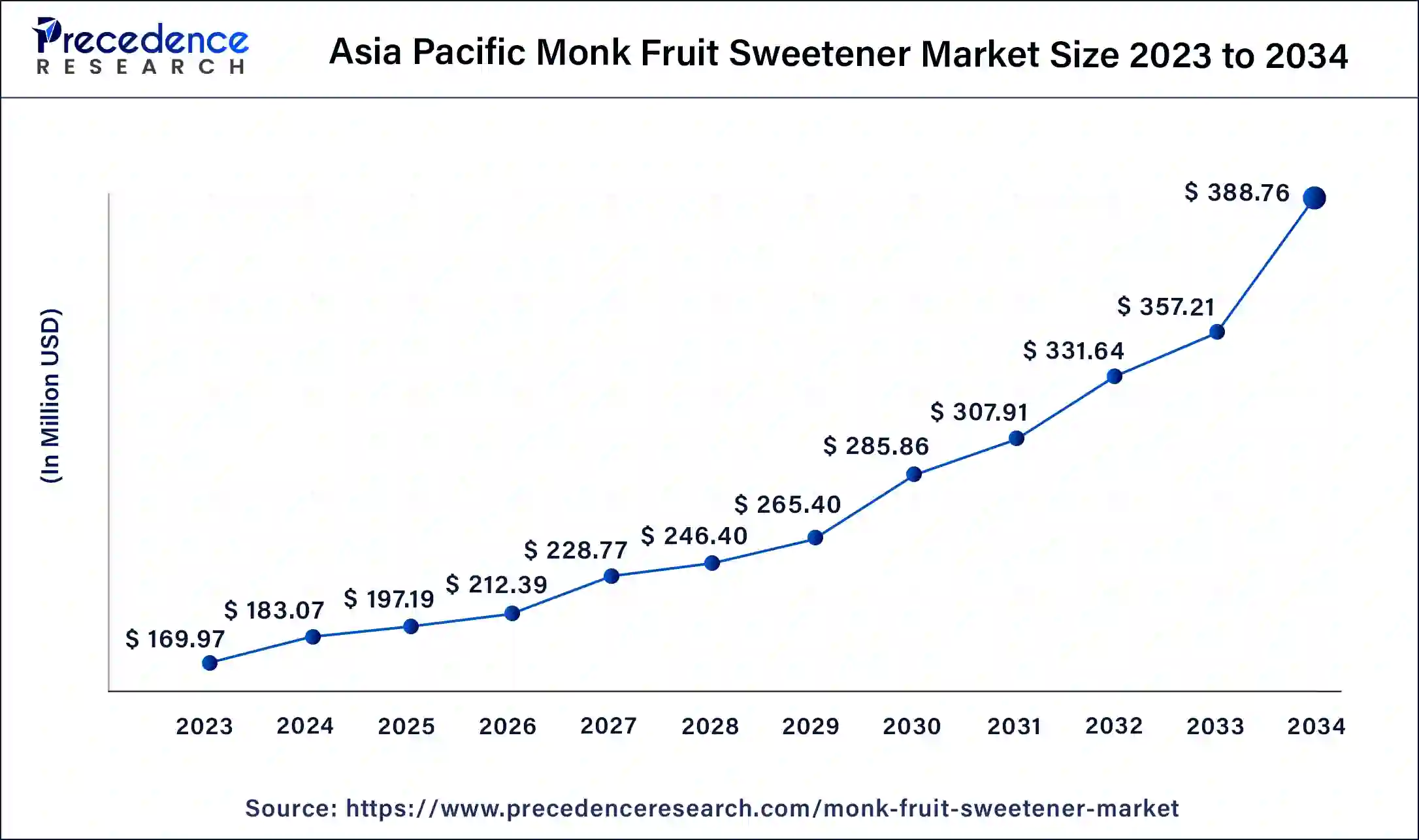

The Asia Pacific monk fruit sweetener market size was exhibited at USD 183.07 million in 2024 and is projected to be worth around USD 388.76 million by 2034, poised to grow at a CAGR of 7.82% from 2025 to 2034.

Asia Pacific held the largest share of the monk fruit sweetener market in 2024. The dominance of the region is attributed to the rising health benefits of monk fruit in countries like India and Japan. The region is also experiencing rapid urbanization, which is leading to the increasing need for on-the-go food options. Additionally, the rising disposable income and health awareness increase individuals' expenditure on healthy food products. The rapid adoption of technology, especially in China, is prevalent with the overall consumer requirement and presence of major players in the country.

North America is observed to grow at a notable rate in the global monk fruit sweetener market during the forecast period. The dominance of the region is attributed to the wide established base of the food and beverage industry in countries like the United States and Canada. People in the United States are becoming more conscious of health due to the increasing obesity rate in the country. Additionally, the governments in the region support the innovation of healthy food products, which further expands the global food market. These countries use technologies like AI on a large scale, which helps them get better results.

- According to a report by Forbes, the data from 2017 to 2020 stated that around 42% of the adults in the U.S. had obesity.

Market Overview

Monk fruit sweetener is a zero-calorie natural sugar derived from monk fruit, also known as Luo Han Guo. The round-shaped fruit comes from Southern Asia and is almost 100-250 grams sweeter from sugar but contains no calories. It is created by separating the seeds and the skin of the fruit and crushed to collect it into a juice, which is then turned into a concentrated powder.

The monk fruit sweetener market is gaining significant popularity due to the increasing prevalence of health conditions, especially among adults. This increases the demand for low-calorie beverages, which help maintain sugar intake. Additionally, the glycemic index of monk fruit sweeteners is zero, which has an impact on attracting a health-conscious audience.

Monk Fruit Sweetener Market Growth Factors

- Rapid raw material supply chain expansion stands out as a major growth factor in the monk fruit sweetener market.

- The increasing demand for monk fruit sweeteners is leading to the expanding production of the sweeteners, which is a market growth factor.

- The rising influence of health and fitness trends promotes the use of low-calorie beverages, which stands out as a potential market growth factor.

- The increasing innovation in new beverages and other sweeteners is raising the demand for monk fruit sweetener products.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 801.57 Billion |

| Market Size in 2025 | USD 410.81 Billion |

| Market Size in 2024 | USD 381.40 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.71% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, End-User, Form, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Rising health consciousness

The rising awareness of health conditions like obesity and diabetes due to excessive sugar consumption is leading to the demand for sugar alternatives. This makes monk fruit sweetener a preferable option as it contains zero calories and is sweeter than sugar. Many reports have also stated that monk fruit is a preferable alternative to sugar. Additionally, digitalization in thew monk fruit sweetener market is helping to promote the use of healthy food options.

Demand for clean labelled products

The rising concerns due to the consumption of artificial ingredients in food and beverages lead to an increasing need for organic and natural ingredients. Adding natural ingredients is attracting multiple audiences to consume these products, which has led to the growth of the monk fruit sweetener market.

Restraint

Higher production costs

The monk fruit sweetener market has shown significant demand in recent years, but the complexity of production stands as a barrier to market growth. Additionally, these fruits are found in Southeast Asia, which restricts their availability in other parts of the world. These factors make the product expensive, including transportation costs.

Opportunities

Increasing approval rates

The rising awareness regarding the health benefits of monk fruit sweeteners leads to the expansion of the product into multiple products. Governments are also taking initiatives to expand healthy products into the market by increasing the approval rates. These initiatives create many opportunities for monk fruit sweetener market players in the food and beverage industry.

Rapid product expansion

The rising health trends drive the demand for healthier products like monk fruit sweeteners, which is leading to the expansion of the monk fruit sweetener market. The product is gaining popularity in various emerging segments like functional beverages and vegan foods.

Product Insights

The conventional segment registered the largest share of the monk fruit sweetener market in 2024. Conventional monk fruit sweeteners are traditional sweeteners that are made using synthetic fertilizers and pesticides. The farming process used for making these is comparatively lower in cost which makes it more preferrable and also makes it dominant. The increasing production of these conventional monk fruit sweeteners makes them widely available and increases their use on different products. Zero-calorie sweeteners are driving the popularity of the monk fruit sweeteners market in multiple regions due to increasing health concerns like diabetes and other conditions caused by excessive sugar intake.

The organic segment is anticipated to register the fastest growth in the monk fruit sweetener market during the forecast period of 2025 to 2034. Organic monk fruit sweeteners are produced using organic farming methods, which eliminate the use of synthetic and chemical-based fertilizers as they cause soil pollution. The segment is gaining popularity due to the increasing government and organizational initiatives towards adopting organic farming. Top five organic farming countries include Denmark, Switzerland, Sweden, Austria, and Germany.

The Indian government recognizes the farmers under the National Programme for Organic Production (NPOP). These government steps encourage farmers to do organic farming, which contributes to the growth of the monk fruit sweetener market.

Form Insights

The solid segment accounted for the largest share of the monk fruit sweetener market in 2023. Solid monk fruit sweeteners are granulated or powdered sweeteners especially used for baking and cooking. The dominance of the segment is attributed to many aspects, but its versatility in various applications makes it more popular among multiple food options. These powdered sweeteners have longer shelf life compared to the others, which makes them a prior option for use in multiple food options. As these sweeteners are in granulated and powdered form, they are easy to package and transport and also require fewer costs.

The liquid segment is expected to grow at the fastest rate in the monk fruit sweetener market during the forecast period. Liquid-based monk fruit sweeteners are usually used in beverages and sauces as they dissolve easily. The reason behind the increasing growth of the segment is attributed to the well-established consumer base of tea and coffee. Adding liquid monk fruit sweeteners to these drinks helps people maintain their daily calorie intake and also control their sugar levels. Rapid urbanization has led to busy, hectic schedules of individuals, which has raised the trend for on-the-go drinks. These trends lead to many investments in product innovation.

Urban Platter offers a monk fruit juice concentrate that contains natural ingredients and also offers intense flavor in fewer calories.

End-user Insights

The B2B segment dominated the global monk fruit sweetener market in 2024. This includes businesses purchasing monk fruit sweeteners to include in their product or to process it further. The dominance of the segment is attributed to its huge demand in the food and beverage industry. Many baking or beverage companies buy these sweeteners in bulk to add them to their product. This also increases the global supply chain and helps in attracting more clients.

The B2C segment is expected to register significant growth in the monk fruit sweetener market during the forecast period. This includes individuals buying monk fruit sweeteners. The increasing awareness regarding the benefits of monk fruit sweeteners is the main reason behind the rapid growth among consumers. Additionally, the increasing growth of the e-commerce platform plays a crucial role in expanding the growth of the monk fruit sweetener market. The use of smart devices can ease product access for consumers as they provide home delivery to them. The increasing competition in the e-commerce industry has led to many innovations that enhance B2C growth.

Monk Fruit Sweetener Market Companies

- GLG Life Tech Corp.

- Steviva Brands, Inc.

- NOW Foods

- Firmenich SA

- SweetLeaf

- Lakanto

- Guilin Layn Natural Ingredients Corp.

- Archer Daniels Midland Company (ADM)

- Tate & Lyle PLC

- Monk Fruit Corp.

- Cargill, Inc.

Recent Developments

- In January 2024, Elo Life Systems raised USD 20.5 million in Series A extension funding to advance its monk fruit sweetener. The company aims for a market launch by 2026.

- In July 2021, Layn invested USD 148 million to expand infrastructure, R&D, and supply chain for plant-based sweeteners. The investment was majorly for stevia monk fruit and botanicals.

- In January 2021, India started its first monk fruit cultivation in Kullu, Himachal Pradesh, aiming to explore its potential as a non-caloric natural sweetener through field trials led by CSIR-IHBT.

Segments Covered in the Report

By Product

- Organic

- Conventional

By End-User

- B2B

- Bakery & Confectionery

- Beverages

- Dairy & Frozen Desserts

- Pharmaceuticals

- Others

- B2C

- Hypermarkets/Supermarkets

- Convenience Stores

- Online

- Others

By Form

- Solid

- Liquid

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting