What is the Natural Food Color Market Size?

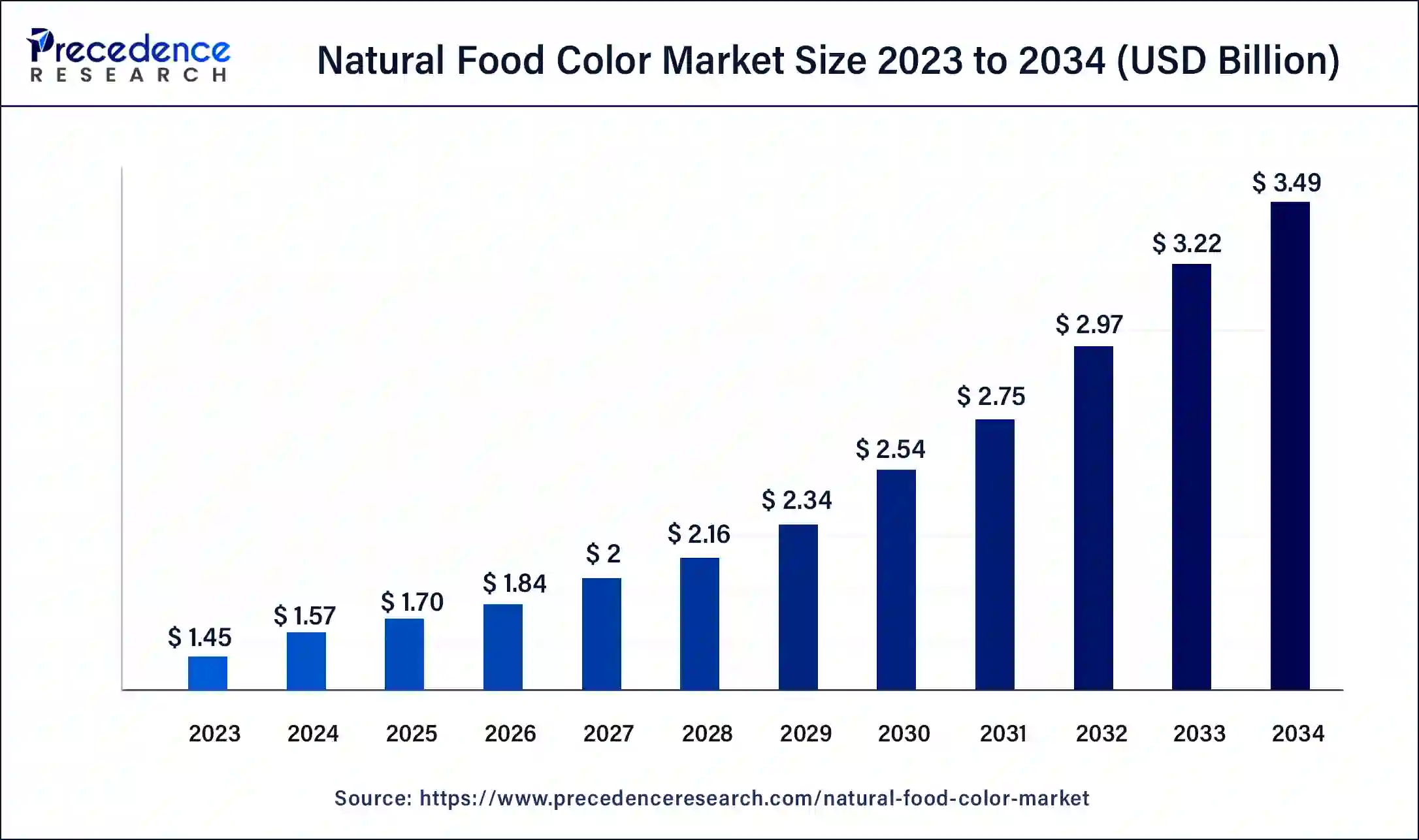

The global natural food color market size is calculated at USD 1.70 billion in 2025 and is predicted to increase from USD 1.84 billion in 2026 to approximately USD 3.75 billion by 2035, expanding at a CAGR of 8.23% from 2026 to 2035.

Natural Food Color Market Key Takeaways

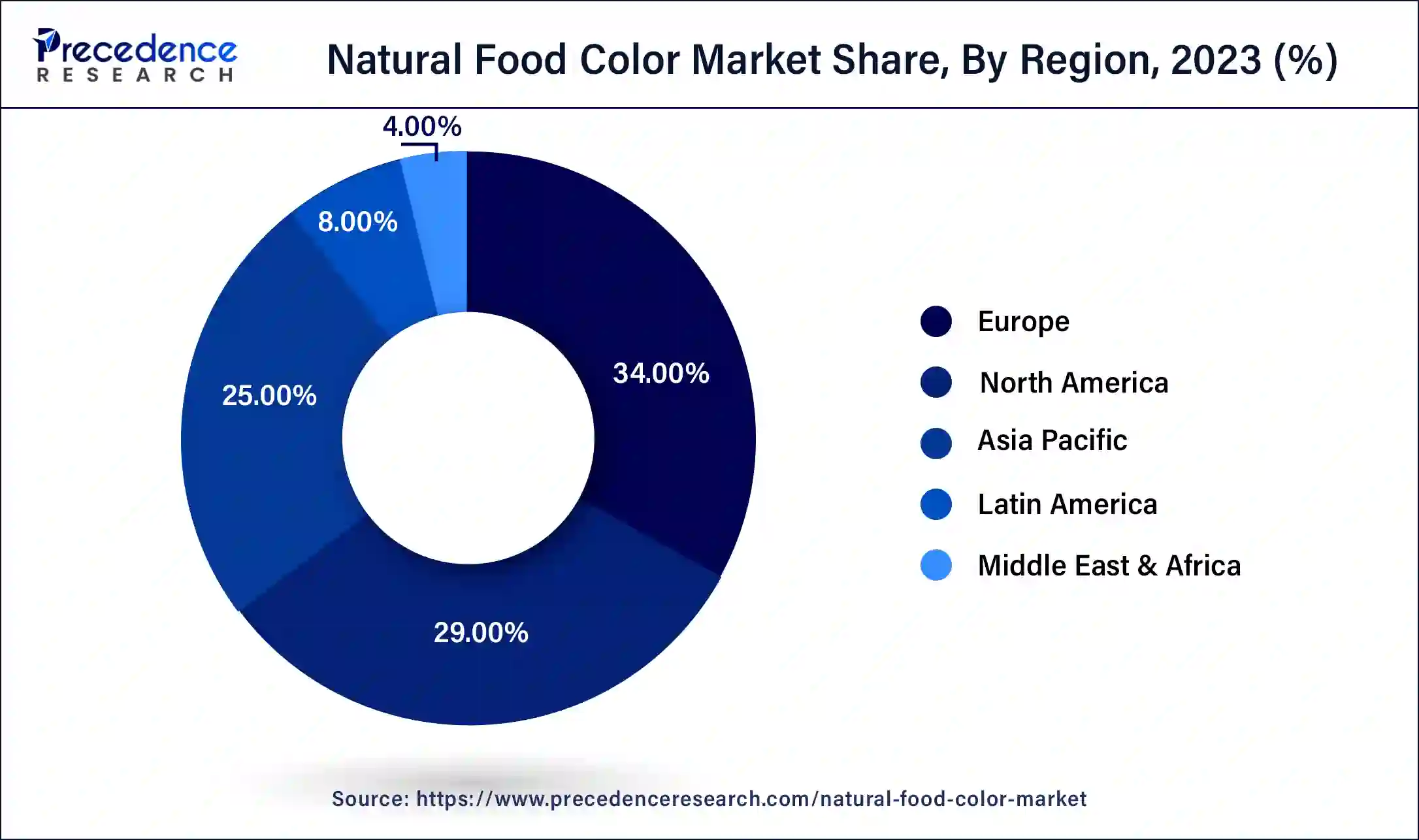

- Europe dominated the market with a major market share of 34% in 2025.

- Asia Pacific is anticipated to grow at a solid CAGR of 9.53% during the forecast period.

- By ingredient, the beta-carotene segment contributed more than 23% in 2025.

- By ingredient, the blue spirulina segment is expected to grow at a significant CAGR in the market during the forecast period.

- By application, the beverages segment recorded the biggest market share of 25% in 2025.

- By application, the dairy & frozen products segment is expected to grow at the fastest rate in the market during the forecast period 2026 to 2035.

What is the Natural Food Color?

Natural food colors refer to a pigment, dye, or any substance obtained from natural sources like animals, vegetables, or minerals to add color to any food or beverage. Some of the natural colors can naturally be obtained from some insects or algae. These colors are considered a better option than synthetic food colors as they are produced by using chemicals that can cause harm to the body and are also non-biodegradable in the environment. Colors like red, violet, and blue are derived from anthocyanins, which are water-soluble pigments found in raspberries, red cabbages, and beetroots. One of the mineral-based sources is calcium carbonate, which creates white coloring in food products.

The global natural food color market is growing significantly due to several health benefits provided by natural colors, and consumers are also turning towards these products. There are many beverages that are being made with natural colors, gaining significant importance and contributing to market growth. There are multiple food options available that contain natural food colors; some of the foods are chocolate gems by Unreal, Magic Spoon Grain Free Fruity Cereal, Tillamook Cheddar Cheese, and many more.

What is the Role of AI in Food Industry?

The emergence of artificial intelligence (AI) is helping many industries in multiple ways to increase their sales and mark significant growth. AI has the capability to analyze huge amounts of data related to natural food colors and help in studying consumer patterns. This can help monitor the quality of the product during production and enhance it according to consumer preferences. The capability to monitor various changes in consumer patterns will potentially help contribute to the growth of the natural food color market in the upcoming years.

- In July 2024, Kalamazoo Company partnered with Thimus, which will use AI to analyze people's reactions to flavors and to improve natural food ingredients.

Natural Food Color Market Growth Factors

- The increasing awareness of the benefits of natural food colors stands out as a potential growth factor for the market.

- Rising health consciousness among individuals increases the demand for natural food colors over chemical-based colors, fueling the market growth.

- The ongoing environmental campaigns by governments and organizations boost the demand for sustainable products, including natural food colors, which is fueling the growth of the natural food color market.

- Regulations towards banning synthetic colors encourage the promotion and use of natural food colors which also is a potential growth factor for the natural food color market.

Statistics:

- Between June 2024 and May 2025, the world imported 4,235 shipments of Food Color.

- These imports came from 745 different exporters and were delivered to 706 different global buyers.

- The period saw a decline of -21% in the growth rate compared to the previous twelve months.

- In May 2025, the world only imported 270 shipments of Food Color.

- Imports for May 2025 indicated a year-on-year decline of -43.9% when compared to May 2024.

- The imports for May 2025 represented a 13% increase if we consider the month of April 2025 as

- the preceding month.

(Source: https://www.volza.com )

Market Outlook

- Industry Growth Overview: The natural food color market is expanding rapidly as consumers increasingly demand clean-label, additive-free products and become more conscious of health and the environment. Manufacturers are innovating extraction and stabilization techniques to improve pigment quality and shelf-stability, expanding applications across beverages, dairy, bakery, and snacks. Regulatory pressure on synthetic dyes and favorable government policies favoring natural alternatives further accelerate adoption worldwide.

- Global Expansion:The market is expanding worldwide, driven by increasing demand for clean-label, plant-based ingredients, rising health and sustainability awareness, regulatory pressure on synthetic dyes, and wider adoption across food and beverage applications. Emerging regions such as Asia Pacific and Latin America offer immense opportunities due to the rapid expansion of the food & beverages industry.

- Major Investors: Major investors in the market include large ingredient‑specialist firms such as Archer Daniels Midland Company (ADM), Sensient Technologies Corporation, Givaudan (including its subsidiary DDW, The Colour House), and Oterra. They invest heavily in R&D, sustainable sourcing, and advanced extraction/fermentation technologies, enabling scalable production of stable, clean-label natural colorants and supplying a wide global customer base across food, beverage, and nutraceutical industries

- Startup Ecosystem: The startup ecosystem in the market is flourishing. Emerging companies are focusing on innovation using fermentation and bio-based techniques to create stable, clean-label pigments. For example, Phytolon produces natural dyes via precision fermentation for cost-effective, sustainable food color solutions. Emerging players like BM Ingredients Europe and Picta Natural Ingredients leverage fruits, vegetables, herbs or botanicals for plant-based food dyes, expanding color-source variety.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 3.75 Billion |

| Market Size in 2025 | USD 1.70 Billion |

| Market Size in 2025 | USD 1.84 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 8.23% |

| Largest Market | Europe |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Ingredient, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Increasing health consciousness

The increasing health consciousness due to the use of synthetic chemical-based food colors is increasing the health risks, which can lead to allergies, acidity, and many other risks. This brings an opportunity for natural food colors that are extracted from plants and fruits and minimize the health risks. Additionally, the rising disposable incomes in urban cities increase the affordability and preference towards these products, which are gaining significant popularity. Many kinds of research also revealed that the natural ingredients present in food colors contain several health benefits due to the antioxidants present in the natural food colors.

- An article by the Center for Science for the Public Interest shows that synthetic food dyes are found in over 36,000 American food products, which pose potential health risks.

Rising environmental concerns

The increasing global trend is leading towards the adoption of sustainable practices, which is leading to increasing demand for natural food colors. The process of extracting natural colors is sustainable as they are taken from biodegradable sources which are environmentally friendly. This factor plays an important role in attracting multiple investments and support from government bodies and organizations. On the other hand, synthetic chemical-based products are considered harmful to the environment, which increases chemical pollution. Therefore, consumers also prefer natural food colors, which have less impact on the environment and provide additional benefits to the consumers.

- A study by the University of Bath states that synthetic dyes in wastewater have health and global ecological risks.

Restraint

Higher costs

The natural food color market has been gaining significant popularity from the past year but there are still concerns that could hamper the market growth. The less availability of natural food color materials increases the overall costs and makes it expensive. This also makes the traditional food colors cheaper, which are being used widely due to less disposable incomes, especially in underdeveloped regions. Many companies should try to invest in production and R&D to make advancements in developing natural food colors.

Opportunities

Increasing focus on R&D

The natural food color market has been gaining significant importance due to the increasing health risks and environmental concerns. This makes it a sensitive topic in the interest of the public as it has the potential risks of affecting their health. As a reason, many organizations are investing heavily in coming up with alternatives for synthetic chemical-based food colors. These investments may benefit the company as it could register significant growth by standing out differently from its competitors. Technological advancements also play a vital role in these researches as they help in improving the overall procedure. The increasing investments are projected to play a vital role in the development of the natural food color market.

Increasing partnerships and collaborations

The increasing collaborations and partnerships tend to offer multiple opportunities in the natural food color market as they help in producing multiple alternatives to synthetic dyes. This is also beneficial for both companies as they can improve their brand value through PR campaigns while promoting these sustainable alternatives in the market. These multiple benefits play a vital role in attracting multiple companies to partner to find solutions in the food industry.

- In January 2024, Ginkgo Bioworks and Phytolon's partnership achieved a milestone that enabled the production of vibrant, natural food colors with the use of two producing strains. This effective partnership offers a sustainable alternative to synthetic dyes.

Segmental Insights

Ingredient Insights

The beta-carotene segment held the largest share of the natural food color market in 2025. It is a carotenoid, which is a pigment that gives veggies and fruits their yellow, orange, and red colors. The body converts this beta-carotene into vitamin A, which is essential for the body. Vitamin A helps improve the immune system, maintain healthy vision, and keep the skin healthy. These benefits stand out as a potential factor in promoting the use of natural colors. Beta-carotene is widely used in multiple food products, such as dairy products and baked goods, and is gaining popularity in variousdietary supplements. The use of beta-carotene in various food products plays a vital role in the overall growth of the natural food color market.

- In April 2024, Japanese scientists developed transgenic eggplants that contain five times more beta-carotene under lighting. This enhances the nutritional value of the product.

The blue spirulina segment is expected to grow at a significant CAGR in the natural food color market during the forecast period. Blue spirulina, also known as phycocyanin, is a pigment that is derived from algae containing various nutrients and antioxidants. It is also rich in protein, which is a good addition to foods and supplements. The blue color also makes a unique and rare appeal in the food product, which makes it different from other foods. The increasing consumer preferences towards blue spirulina. It was frequently used by NASA scientists who were on space missions. It is a sustainable option to add to food products as the process of its cultivation is eco-friendly compared to chemical-based food colors.

- In a recent study by Italian researchers, spirulina showed potential in managing the risk related to heart diseases and diabetes. It contains antioxidant and hypolipidemic properties, which help minimize the risk.

Application Insights

The beverages segment dominated the natural food color market in 2025. The growth of this segment is attributed to the rising health awareness among consumers. Individuals prefer natural food colors over synthetic chemical-based colors as they pose a potential health risk. The consumption rate of beverages is increasing day by day for multiple reasons, such as the influence of a busy work schedule. The changing lifestyle plays a key role in changing consumer preferences and adopting these sustainable options. Natural colors also provide unique colors, which is one of the important factors in attracting consumers. Many companies are using natural colors, which will help enhance the overall visual appeal of the beverages and contribute towards the growth of the natural food color market.

The dairy & frozen products segment is expected to grow at the fastest rate in the natural food color market during the forecast period 2026 to 2035. Urbanization and a busy lifestyle are key factors behind the significant increase in the production of dairy and frozen products. People prefer products with additional nutritional benefits that would complete their minimum requirement. Many companies are also coming up with new ideas, like flavored yogurt and ice creams, which contain healthy colors. The increasing demand for these products is leading to the global expansion of the natural colors market. This is also increasing the overall demand for these products, which also helps reduce the overall costs and make them affordable for people, especially in developing regions.

Regional Insights

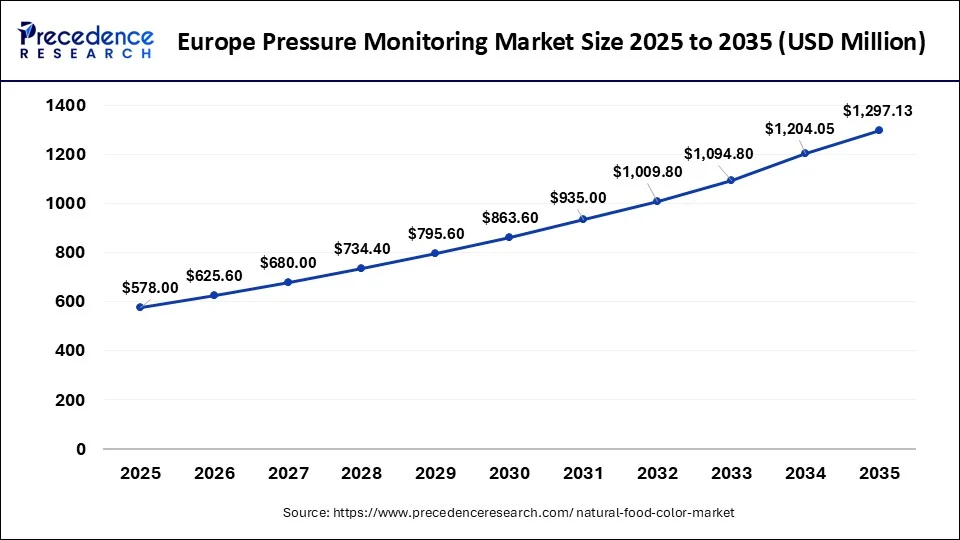

What is the Europe Natural Food Color Market Size?

The Europe natural food color market size is calculated at USD 578 million in 2025 and is predicted to surpass around USD 1,297.13 million by 2035, at a CAGR of 8.42% from 2026 to 2035.

Europe dominated the global natural food color market in 2024. The dominance is attributed to the well-established food and beverage industry in European regions like the UK, France, and Germany. The European population prefers natural food colors due to the increasing health awareness that they provide multiple nutritional benefits. Governments in this region also have a regulatory environment that focuses on sustainable production. This opens multiple opportunities for new market players to contribute towards the growth of the natural food color market.

Germany Natural Food Color Market Analysis

Germany is a major contributor to the European natural food color market. Germany leads because it has a strong food and beverage manufacturing base, including bakery, dairy, confectionery, and processed‑food industries, where demand for clean‑label, natural ingredients is high. Moreover, strict EU‑level and local regulations encourage the replacement of synthetic dyes with natural alternatives.

What Makes Asia Pacific the Fastest-Growing Region in the Natural Food Color Market?

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period. Rapid urbanization in countries like China and India is changing lifestyles, which is increasing the need for packed foods and beverages. People prefer foods containing natural colors that are environmentally friendly and provide nutritional benefits. Countries like Japan are constantly focusing on sustainable production, which gives multiple opportunities for new emerging players to contribute to the growth of the natural food coloring market.

India Natural Food Color Market Trends

The Indian market is experiencing rapid growth as consumer preferences shift towards clean-label, health-oriented products and away from synthetic additives. Rising demand from the bakery, confectionery, beverage, and dairy sectors is driving wider adoption of plant-based and minimally processed colorants. Regulatory support and food safety awareness are encouraging manufacturers to formulate with approved natural alternatives, reinforcing transparency in labeling.

China Natural Food Color Market Analysis

China is a major player in the market thanks to its enormous food processing industry, rising urban middle class, and growing consumer demand for clean-label, health-conscious food products. China's large-scale agricultural production also supports local sourcing of botanical pigments, helping scale cost-effective production.

How Big is the Success of North America in the Market?

North America is experiencing significant growth in the natural food color market due to increasing consumer demand for clean-label and plant-based products, strong regulatory pressure against synthetic dyes, and greater adoption of natural ingredients by major food and beverage companies. The rising demand for organic and functional foods, along with continuous innovation in botanical and fermentation-based color formulation technologies, also drives regional market growth. The U.S. leads the region largely because of high consumer demand for clean‑label foods, growing health and wellness awareness, and strict regulatory pressure to reduce synthetic dyes, which drives widespread adoption of natural colorants across processed foods, beverages, bakery, and dairy products.

Canada Natural Food Color Market Trends

Canada's market is growing steadily as consumers increasingly prefer clean-label, plant-based, and naturally derived ingredients over synthetic colorants. Demand is rising across food and beverage categories such as bakery, dairy, beverages, and snacks, driven by health awareness and transparency in labeling.

Regulatory oversight and food safety standards are encouraging manufacturers to reformulate products using approved natural color alternatives. Advances in extraction and formulation technologies are improving color stability and performance, supporting wider application of natural pigments.

How Crucial is the Role of Latin America in the Natural Food Color Market?

Latin America offers immense opportunities in the market due to rising consumer demand for clean-label food ingredients, increasing use of plant-derived colors like annatto and beetroot, and the expansion of the food processing and beverage sectors. Stringent regulations on food quality and safety also drive regional market growth. Brazil is leading the market. thanks to its vast agricultural base, which yields abundant plant‑derived raw materials such as annatto, turmeric, and beetroot, and to a large, growing food and beverage processing industry embracing "clean‑label" trends.

What Potentiates the Growth of the Middle East & Africa Natural Food Color Market?

The market in the Middle East & Africa (MEA) is driven by rising urbanization, increasing processed and ready-to-eat food and beverage consumption, and a growing health-conscious population, which are driving demand for clean-label, additive-free products. Growing disposable incomes and rising interest in traditional, flavor-rich cuisines using natural colorants further strengthen adoption. The UAE is the dominant country due to strong demand for processed and convenience foods, a rapid shift by consumers toward clean-label and halal-certified ingredients, high disposable incomes, advanced food and beverage manufacturing infrastructure, and active reformulation efforts by brands to replace synthetic dyes with plant-based and bio-derived color solutions.

Value Chain Analysis

- Raw Material Procurement:

Raw materials such as fruits, vegetables, algae, and spices are cultivated, harvested, and sourced for pigment extraction.

Key Players: Givaudan (Naturex), ADM, Sensient Technologies, DDW (a Givaudan brand), Dohler. - Processing and Preservation:

Pigments are extracted, filtered, standardized, blended, and stabilized to enhance solubility, heat/light resistance, and shelf life for food and beverage applications.

Key Players: Chr. Hansen, Kalsec, Roha, Symrise, Kerry Group. - Retail Sales and Marketing:

Natural food color formulations are commercialized, distributed through B2B ingredient channels, promoted to food and beverage manufacturers, and marketed on the basis of clean-label benefits.

Key Players: DSM-Firmenich, BASF Colors & Effects (now part of DIC), DDW, Sensient, ADM. - Waste Management and Recycling:

Organic residues such as fruit peels and botanical by-products are treated, recycled, or redirected to biomass, composting, or secondary ingredient streams to minimize environmental impact.

Key Players: Veolia, Suez, Clean Harbors, Waste Management Inc., Biowaste Tech.

Top Vendors in the Natural Food Color Market & Their Offerings

- Naturex (part of Givaudan) - Offers plant-derived colors, including carotenoids, anthocyanins, spirulina blue, and beet pigments for beverages, dairy, confectionery, and snack applications.

- Phytolon - Provides innovative natural food colors produced through precision fermentation technology for cost-efficient and stable replacements to synthetic dyes.

- BASF - Supplies natural-based color ingredients and pigment stabilizers used in packaged foods, beverages, and nutrition products with a focus on clean-label solutions.

- FSE (Food Supply Engineering) - Offers natural food-color formulations sourced from fruits, vegetables, and botanicals to support beverage, bakery, and culinary processing.

- ADM (Archer Daniels Midland Company) - Delivers plant-sourced natural color systems covering yellow, orange, red, purple, and blue shades for global food and beverage manufacturers.

- Sensient Technologies Corporation - Provides advanced natural color pigments and dispersion technology designed for high stability across beverages, dairy, confectionery, and bakery sectors.

- Roha Group - Offers a wide portfolio of natural color extracts from turmeric, paprika, beetroot, spirulina, and other botanicals for processed foods and beverages.

- Australian Food Ingredient Suppliers - Supplies natural food colors and plant extracts tailored for bakery, meat processing, confectionery, and beverage producers across Asia-Pacific.

- IFC Solutions - Specializes in natural colorants and custom-blended pigment systems for icing, confectionery, beverages, and dairy, including oil- and water-soluble formats.

Other Major Key Players

- Spring TopCo DK ApS (Oterra)

- Allied Biotech Corporation

- Kalsec Inc.

- Dohler GmbH

- San-Ei Gen F.F.I., Inc.

- AROMATAGROUP SRL

- Ingredion

- Vivify

- Roquette Freres

- INCOLTEC

Recent Developments

- In November 2025, Oterra and Seprify formed a strategic partnership to promote a plant-based white coloring to replace titanium dioxide (TiOâ‚‚) in food and beverages. Utilizing Seprify's cellulose technology, this clean-label alternative offers similar opacity and brightness while minimizing environmental impact. (Source: https://news.cision.com )

- In April 2025, Phytolon and Ginkgo Bioworks announced the successful completion of the second milestone in their collaboration, which began in 2022, to develop yeast strains for natural food colors. This project aims to provide vibrant, functional alternatives to synthetic dyes amid regulatory pressures. (Source: https://www.prnewswire.com )

- In January 2024,Ginkgo Bioworks and Phytolon achieved a major milestone by unlocking a full yellow-to-purple color spectrum for Phytolon's natural food colors through fermentation.

- In February 2024, Willow Biosciences secured a strategic $100,000 investment from Kalsec to advance the development and commercialization of innovative natural food ingredients.

- In July 2024, Sensient Colors Canada announced an investment of $500,000 in its Kingston facility to boost production capacity by 25% and enhance automation for natural food color products.

- In October 2023, Phytolon secured funding to launch its innovative natural food colors made through fermentation, with support from investors like Nextgen Nutrition Investment Partners, EIT Food, and Chairman Steve Dubin.

Segments Covered in the Report

By Ingredient

- Beta-carotene

- Lycopene

- Curcumin

- Anthocyanin

- Carmine

- Copper Chlorophyllin

- Paprika

- Betanin

- Riboflavin

- Blue Spirulina

- Caramel

- Annatto

- Others

By Application

- Bakery & Confectionery

- Beverages

- Dairy & Frozen Products

- Meat Products

- Oils & Fats

- Fruits & Vegetables

- Meat Alternatives/Plant-based Meat

- Pet Food

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting