What is the Non-Fused Disconnect Switches Market Size?

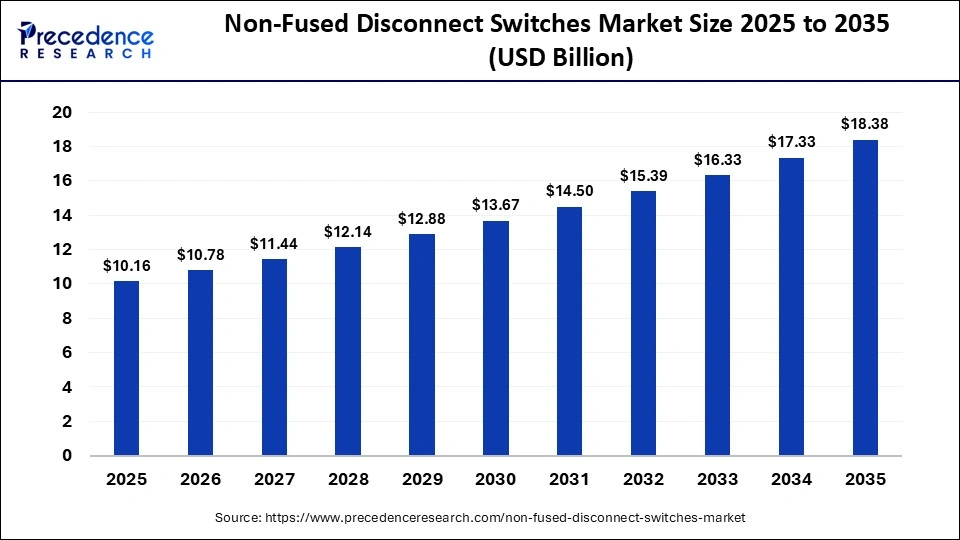

The global non-fused disconnect switches market size is calculated at USD 10.16 billion in 2025 and is predicted to increase from USD 10.78 billion in 2026 to approximately USD 18.38 billion by 2035, expanding at a CAGR of 6.11% from 2026 to 2035. The market growth is attributed to increasing investments in grid modernization, renewable energy integration, and stringent electrical safety regulations worldwide.

Market Highlights

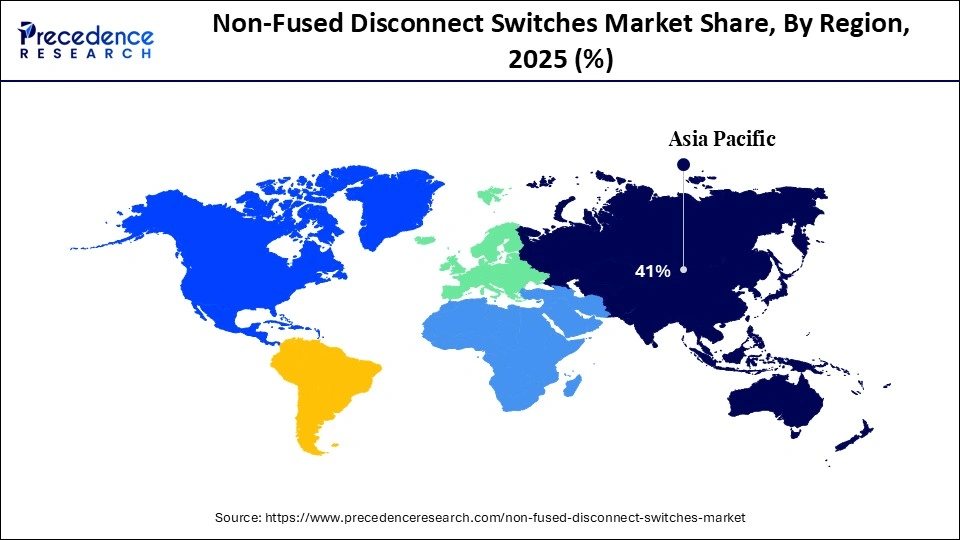

- Asia Pacific dominated the market, holding more than 41% of market share in 2025.

- North America is expected to grow at the fastest CAGR from 2026 to 2035.

- By type, the panel mounted segment accounted for a considerable share in 2025.

- By type, the DIN rail mounted segment is expected to experience the fastest growth in the market between 2026 and 2035.

- By phase, the three-phase segment led the market in 2025.

- By phase, the single-phase segment is growing at a notable CAGR from 2026 to 2035.

- By voltage, the low voltage segment registered its dominance in 2025.

- By voltage, the high voltage segment is expected to grow at the highest CAGR from 2026 to 2035.

- By application, the industrial segment dominated the market in 2025.

- By application, the commercial segment is growing at a strong CAGR from 2026 to 2035.

Market Overview

The non-fused disconnect switches market has expanded considerably due to increasing demand for dependable electrical isolation and safety in modern power systems. Non-fused disconnect switches provide a mechanical means of opening and closing electrical circuits that lack built-in overcurrent protection. This enables safe maintenance, servicing, and isolation of electrical equipment used in the industrial, commercial, and infrastructure sectors.

Governments are funding grid upgrades that indirectly support the adoption of advanced isolation devices. The U.S. Department of Energy has announced, under its GRIP Program in 2024, a total of USD 10.5 billion in support aimed at improving grid modernization. These efforts enhance reliability and flexibility, encouraging the installation of robust switchgear and isolation solutions. Additionally, ongoing regulatory focus on electrical safety and infrastructure modernization is expected to sustain strong demand for non-fused disconnect solutions.

Impact of Artificial Intelligence on the Non-Fused Disconnect Switches Market

Artificial intelligence is significantly transforming the market by improving both manufacturing processes and operational efficiency. Companies utilize AI-driven predictive maintenance tools to monitor switch performance in real time, helping to identify potential faults before they cause downtime and ensuring continuous power distribution. AI algorithms also optimize load management and switching operations in industrial and commercial settings, boosting energy efficiency and safety. Additionally, AI-powered robotics and machine vision systems enable precise assembly and thorough quality inspections.

Non-Fused Disconnect Switches MarketGrowth Factors

- Rising Industrial Automation Demands: Growing adoption of automated manufacturing and processing systems is driving the need for reliable disconnect solutions to ensure operational safety and continuity.

- Expanding Data Center Infrastructure: Increasing establishment of data centers is boosting demand for high-performance isolation devices to manage complex electrical loads and prevent downtime.

- Propelling Smart Grid Integration: Investments in smart grid technologies and digitalized power networks are fueling the deployment of non-fused disconnect switches for precise control and fault isolation.

- Growing Electrification of Transportation: Expansion of electric vehicle charging infrastructure is driving demand for robust isolation equipment in public and private charging stations.

- Boosting Adoption in Renewable Energy Projects: Rising installation of solar, wind, and microgrid systems is propelling the need for compliant disconnect switches to ensure safe operations.

Non-Fused Disconnect Switches MarketOutlook

- Industry Growth Overview: The non-fused disconnect switches market is experiencing robust growth due to the increasing demand for safety and reliability in electrical systems, especially in industrial applications and renewable energy installations. Advancements in electrical infrastructure, rising energy consumption, and the adoption of smart grid technologies, all of which require secure and efficient power management solutions, also drive the market.

- Global Expansion: The market is growing globally due to the increasing need for reliable electrical safety and efficient power management systems across industries like renewable energy, manufacturing, and commercial infrastructure. Emerging regions, particularly in Asia Pacific and Africa, present significant opportunities driven by expanding industrialization, urbanization, and the growing adoption of smart grid technologies and renewable energy projects, creating a demand for secure and cost-effective disconnect switches.

- Major Investors: Major investors in the market include electrical equipment manufacturers, such as Schneider Electric, Siemens, and Eaton, who invest in the development of advanced disconnect switch technologies for better electrical safety and power management. These companies contribute to the market by offering innovative solutions for renewable energy installations, industrial automation, and smart grid systems, driving the adoption of non-fused disconnect switches in various applications worldwide.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 10.16 Billion |

| Market Size in 2026 | USD 10.78 Billion |

| Market Size by 2035 | USD 18.38 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 6.11% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Phase, Voltage, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Type Insights

Why Did the Panel Mounted Segment Lead the Non-Fused Disconnect Switches Market?

The panel mounted segment dominated the market with the largest share in 2025. This is mainly due to the increased demand for rugged, high-capacity isolation devices that easily integrate into centralized control panels in industrial and utility applications. Engineers at large manufacturing plants and renewable energy facilities preferred panel-mounted switches for their durable mechanical operation and proven safety compliance. Additionally, ongoing grid modernization supports the rising demand for panel mounting.

The DIN rail mounted segment is expected to grow at the fastest rate in the coming years, as installers and systems integrators increasingly use these switches for their compact, scalable products that fit modular electrical designs. These switches suit dense electrical layouts where space constraints make panel-mounted solutions impractical and rely on standardized DIN-rail form factors. Moreover, the standards' alignment with IEC 60947-3 and other regional codes further bolstered installers' confidence in adopting DIN rail formats for decentralized electrical systems.

Phase Insights

What Made Three Phase the Leading Segment in the Market?

The three phase segment dominated the non-fused disconnect switches market in 2025, driven by extensive deployment of three-phase power systems across industrial, commercial, and utility sectors that require stable, high-capacity electrical distribution. Three-phase systems deliver continuous, balanced power and support larger loads. They are essential in large motors, HVAC systems, and equipment used in manufacturing, data centers, and infrastructure projects. Additionally, the risk of overheating from single phasing increases the demand for three-phase systems.

The single phase segment is expected to grow at the fastest rate in the coming years due to its increasing use in residential, light commercial, and small business electrical networks. The rise in urban and suburban electrification drives the demand for single-phase isolation equipment that is reliable and easy to install. Additionally, advances in smart home energy systems and solar PV integration in residential setups further boost interest in small, safety-approved single-phase disconnect switches.

Voltage Insights

How Does the Low Voltage Segment Dominate the Market in 2025?

The low voltage segment dominated the non-fused disconnect switches market with a major revenue share in 2025. This is mainly due to its high utilization in normal electrical distribution systems across commercial, residential, and light industrial applications. Furthermore, the electrification of equipment and retrofit of older panels continued to boost the growth of low-voltage installations in Asia-Pacific, North America, and Europe. With the rise of renewable energy systems, smart grids, and electrical infrastructure upgrades, low voltage disconnect switches are increasingly critical for ensuring safety, reliability, and maintenance of electrical systems in both emerging and developed markets.

The high voltage segment is expected to grow at the fastest CAGR in the coming years, as utilities and large industrial players invest in grid modernization, substation upgrades, and long-distance transmission networks that require robust isolation solutions above 36 kV. High-voltage disconnect switches provide the mechanical isolation needed to safely service transformers, circuit breakers, and transmission lines. These functions become increasingly important as power systems evolve to include large-scale renewable generation and distributed energy resources. Additionally, the U.S. Department of Energy's grid resilience efforts aim to enhance the safety and reliability of transmission infrastructure, creating an opportunity to adopt high-voltage switches.

Application Insights

Why Did the Industrial Segment Lead the Market in 2025?

The industrial segment led the non-fused disconnect switches market in 2025 due to the critical need for reliable electrical isolation and safety in complex industrial systems, including manufacturing facilities, automated production lines, and heavy machinery operations. As industries focus on improving energy efficiency, reducing downtime, and ensuring worker safety, non-fused disconnect switches become essential for managing electrical power, facilitating maintenance, and protecting equipment from electrical faults in demanding environments.

Operators in industries need reliable equipment that makes it easy for technicians to isolate heavy electrical systems during maintenance or fault conditions. Especially when the industry follows a high safety regime as required by NFPA 70E and IEC 60947-3 standards, which emphasize safe operating and isolation practices in industrial settings. Additionally, using non-fused disconnect switches is beneficial in heavy-duty industrial environments to meet increased electrical safety measures and operational reliability expectations.

The commercial segment is expected to grow at the fastest CAGR over the forecast period due to the increasing demand for reliable electrical systems in office buildings, retail spaces, and data centers, where continuous power supply and safety are paramount. As commercial establishments focus on energy efficiency, sustainability, and reducing operational risks, non-fused disconnect switches are becoming essential for power isolation, overload protection, and electrical system reliability, ensuring smooth operations and minimizing downtime.

Regional Insights

What is the Asia Pacific Non-Fused Disconnect Switches Market Size?

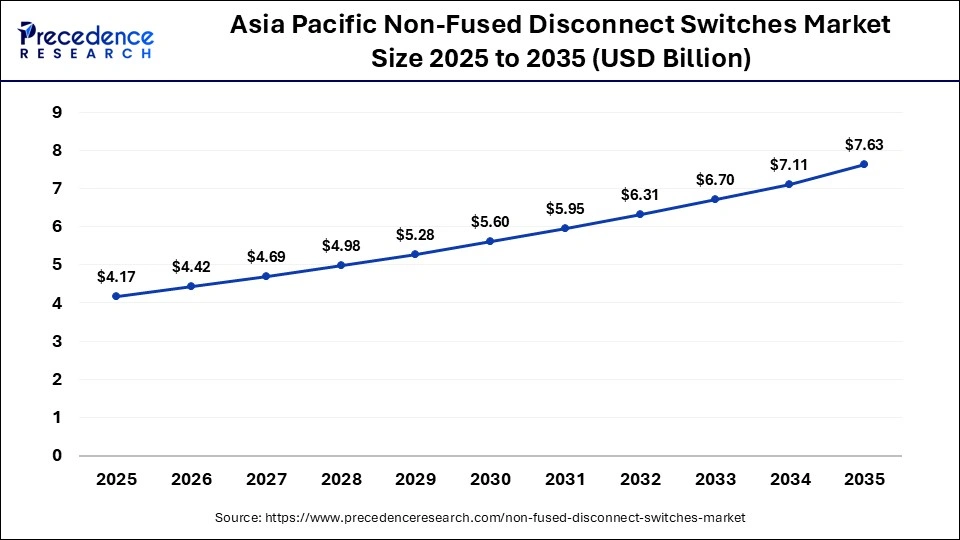

The Asia Pacific non-fused disconnect switches market size is expected to be worth USD 7.63 billion by 2035, increasing from USD 4.17 billion by 2025, growing at a CAGR of 6.23% from 2026 to 2035.

What Made Asia Pacific the Leading Region in the Non-Fused Disconnect Switches Market?

Asia Pacific dominated the non-fused disconnect switches market, capturing the largest revenue share in 2025. This is mainly due to massive investments in power infrastructure and a rapid shift toward renewable energy, especially in China, India, and the Southeast Asian economies. In 2024, Asia added over 413 GW of new renewable capacity, accounting for approximately 24.9% of the total installed renewable capacity. This significantly boosted the demand for electrical distribution and protection systems to manage variable generation and grid stability. Moreover, rapid industrialization, urbanization, and the growing demand for energy-efficient solutions across manufacturing and infrastructure sectors ensure the region's long-term dominance in the market.

China Non-Fused Disconnect Switches Market Analysis

China is leading the charge in Asia Pacific due to rapid industrialization, the development of renewable energy, and urban infrastructure. Significant renewable capacity has been built, creating demand for electrical isolation equipment in power stations, substations, and industrial facilities. Additionally, government-backed electrification programs have increased the use of both panel-mounted and DIN rail-mounted switches.

Why is North America Considered the Fastest-Growing Region in the Market?

North America is expected to grow at the fastest CAGR over the projection period. This is mainly due to the increasing focus on modernizing electrical infrastructure, high safety standards, and widespread deployment of grid automation technologies that emphasize resilience and reliability. In 2024, federal and state utility programs drove grid upgrades to enable safer, more adaptable power distribution systems, using advanced non-fused disconnect switch solutions. Additionally, stringent safety regulations, rising energy efficiency initiatives, and strong investments by manufacturers and utilities to modernize electrical infrastructure are accelerating market growth across the region.

U.S. Non-Fused Disconnect Switches Market Analysis

U.S. is a major player in the market within North America. The market in the U.S. is driven by substantial investments in grid modernization and industrial automation. The need to meet the strict safety standards of the National Electrical Code (NEC) and OSHA regulations drove demand for high-reliability non-fused disconnect switches. Moreover, the emergence of renewable power plants, microgrids, and electrification projects is fueling the U.S. market.

What Potentiates the Non-Fused Disconnect Switches Market in Europe?

The market within Europe is driven by energy transition and decarbonization plans, which are causing a significant transformation of the grid. Investments in smart grids, modernization of commercial and residential electrical infrastructure, and the adoption of energy-efficient technologies further boost demand. Additionally, the national and regional standards organizations continued to align safety standards, promoting the use of compliant electrical fittings and appliances.

Germany Non-Fused Disconnect Switches Market Analysis

Germany leads the European market in the rapid transition to renewable energy and infrastructure development. The distribution of renewable energy, especially wind and solar, demanded good electrical isolation equipment to control distributed generation and to ensure grid stability. The support for smart grids and energy-saving building systems programs increased the use of sophisticated isolation devices, such as non-fused disconnect switches.

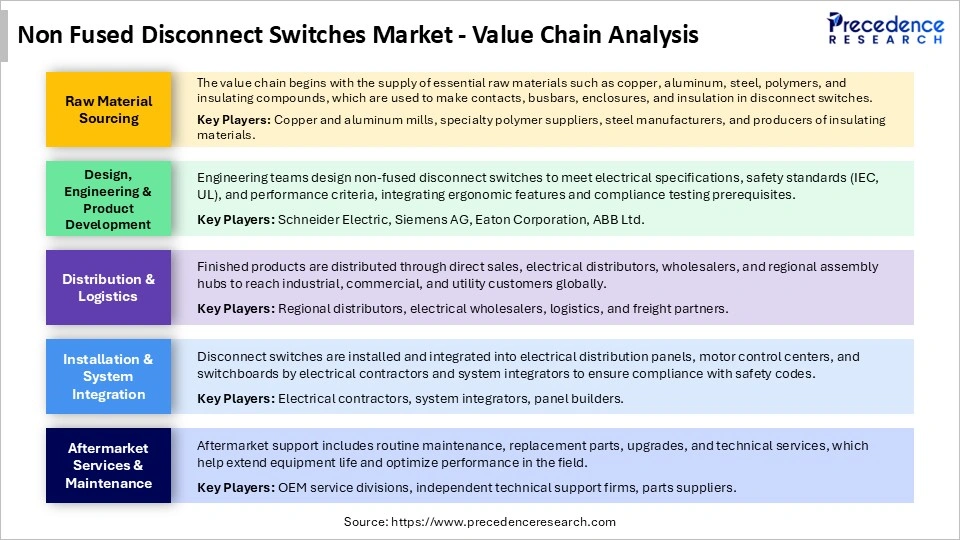

Non-Fused Disconnect Switches Market Value Chain

Top Companies in the Non-Fused Disconnect Switches Market & Their Offerings

- MK Electric (UK): MK Electric provides innovative electrical solutions, specializing in modular and high-performance disconnect switches suitable for low-voltage applications.

- Littelfuse Inc. (U.S.): Littelfuse designs and manufactures circuit protection and electrical safety devices, including robust non-fused disconnect switches for industrial and renewable energy installations.

- Mitsubishi Electric (Japan): Mitsubishi Electric delivers advanced switchgear and electrical components, including non-fused disconnect switches optimized for high-efficiency power distribution.

- ABB Ltd. (Switzerland): ABB is a global technology leader providing non-fused disconnect switches with integrated safety and automation features for industrial and utility applications.

- Legrand (France): Legrand develops electrical and digital building infrastructures, offering user-friendly non-fused disconnect switches for commercial, industrial, and residential settings.

- Altech (U.K.): Altech specializes in modular electrical solutions, supplying non-fused disconnect switches tailored for industrial automation and control panels.

- Delixi Electric Co. Ltd. (China): Delixi Electric produces a variety of electrical components, including non-fused disconnect switches for industrial, commercial, and infrastructure projects.

Other Major Companies

- Eaton Corporation

- General Electric Company

- Schneider Electric

- Siemens AG

- Socomec

Recent Developments

- In November 2025, Altech Corporation launched its dual-rated AC/DC non-fused disconnect switches under the LSF and RT Series for industrial and manufacturing applications. The switches support both DIN-rail and base mounting and are rated for 600V AC and 60V DC, eliminating the need for separate AC and DC components. The LSF Series enables extended handle operation with external interlocking to prevent enclosure access while power remains on. This design enhances electrical safety, maintenance efficiency, and installation flexibility in control panels.(Source: https://www.automation.com)

- In December 2025, Q-PAC introduced two new control panel configurations, Fan-Only and Fused Disconnect, expanding its HVAC fan system solution portfolio. These options complement the company's existing Basic and Premium control panels, providing engineers and facility managers greater customization for different airflow and power requirements. The new panels support streamlined installation and improved system compatibility across commercial and industrial HVAC projects. This expansion reflects growing demand for modular and adaptable electrical control solutions.(Source: https://www.hvacinformed.com)

- In June 2023, RS Group expanded its industrial product portfolio by adding Altech Corporation's LSF and RT Series non-fusible motor disconnect switches and accessories. These switches support safe electrical isolation during maintenance and emergency shutdowns while allowing the rest of the facility to continue operating. Manufactured to UL 60947-4-1A and UL 98 standards, the switches comply with NEC requirements for visible disconnect placement. The expansion strengthened RS Group's offering of compliant electrical safety components for industrial environments.(Source: https://www.prnewswire.com)

- In October 2023, Littelfuse, Inc. launched its Class J Fuse Disconnect Switch, integrating a manual switch and multiple fuses into a compact, single-device solution. Rated up to 600V and available in current ratings from 30A to 200A, the product provides protection against overcurrent and short circuits. The device automatically interrupts power when faults occur, protecting equipment on both upstream and downstream sides. It supports applications across HVAC/R, solar, energy storage, mining, and industrial systems.(Source:https://electricalline.com)

Segments Covered in the Report

By Type

- Panel Mounted

- DIN Rail Mounted

By Phase

- Single Phase

- Three Phase

By Voltage

- High Voltage

- Medium Voltage

- Low Voltage

By Application

- Utility

- Commercial

- Industrial

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting