What is Non-thermal Pasteurization Market Size?

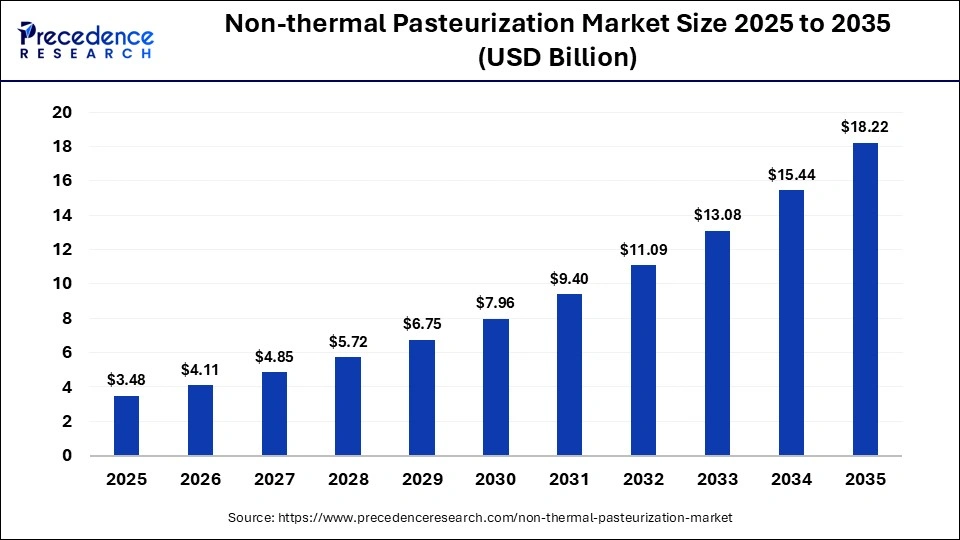

The global non-thermal pasteurization market size accounted for USD 3.48 billion in 2025 and is predicted to increase from USD 4.11 billion in 2026 to approximately USD 18.22 billion by 2035, expanding at a CAGR of 18.00% from 2026 to 2035. The main driving factor for the growth in the non-thermal pasteurization space is the rising consumer need for safer, higher-quality, and even more natural foods, coupled with the growth of the ready-to-eat and even convenience food markets. This involves a desire for "clean-label" goods with minimal additives and also preservatives and increased knowledge about food safety and the incidence of foodborne illnesses.

Market Highlights

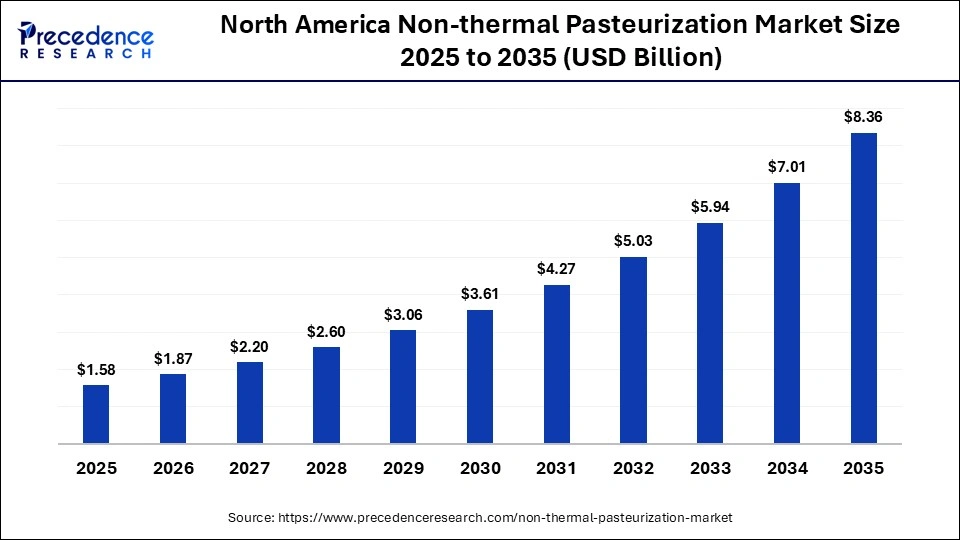

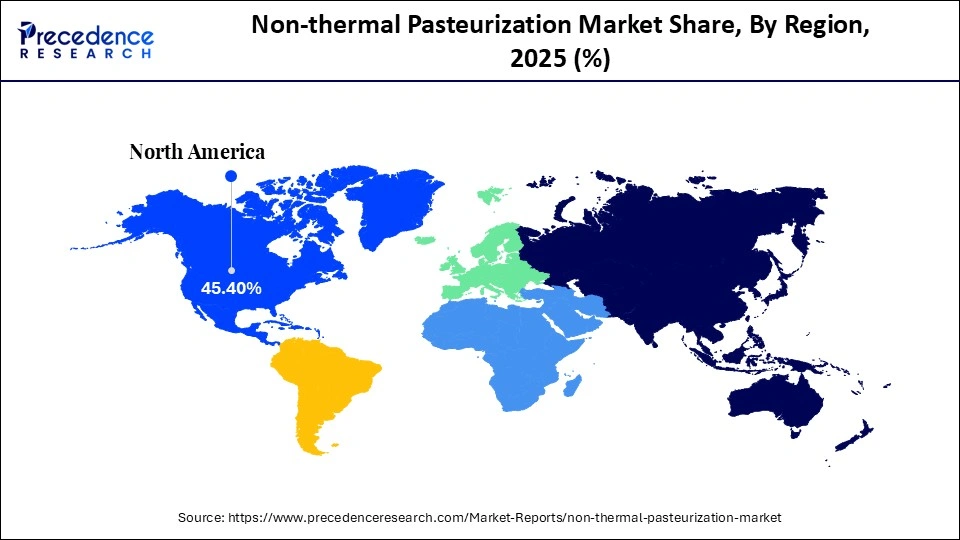

- North America dominated the non-thermal pasteurization market with a share of 45.4% in the year 2025.

- Asia Pacific is expected to be the fastest growing, with 18.8% CAGR between 2026 and 2035.

- By technology, the high-pressure processing segment held the largest share of 37.4% in 2025.

- By technology, the pulsed electric fields segment is set to grow at a remarkable 17.4% CAGR between 2026 and 2035.

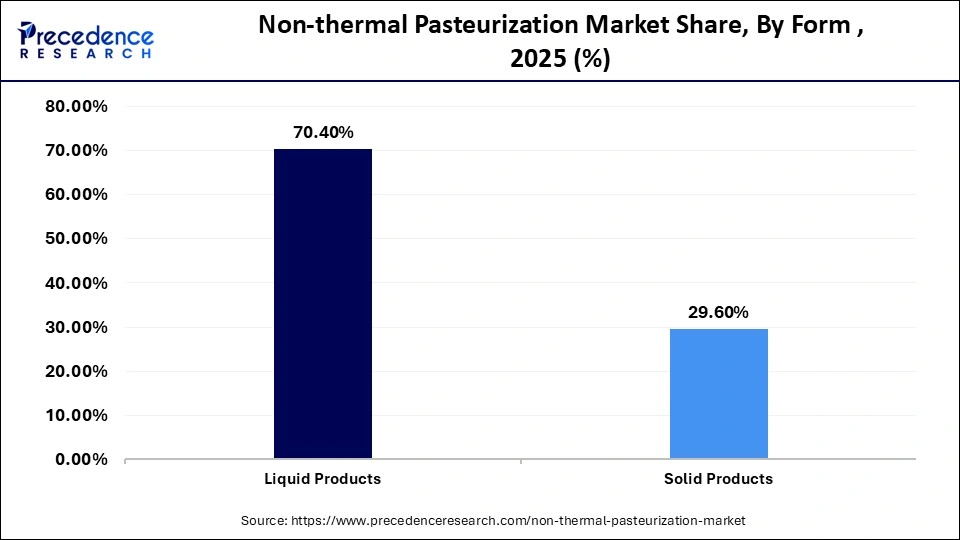

- By form, the liquid products segment contributed the biggest market share of 70.4% in 2025.

- By form, the solid products segment is growing at a strong 17.5 % CAGR between 2026 and 2035.

- By application, the dairy products segment held the major market share of 40.4% in 2025.

- By application, the meat & seafood segment is poised to grow at a healthy CAGR of 17.7% between 2026 and 2035.

- By end-user industry, the food & beverage manufacturers segment captured the largest market share of 56.5% in 2025.

- By end-user industry, the retail & foodservice segment grows at a remarkable 18% CAGR between 2026 and 2035.

What is the Non-thermal Pasteurization?

Non-thermal pasteurization is a food processing technique that utilizes physical forces such as electric fields, high pressure, or UV light to kill microorganisms even without high heat. This approach protects a food's raw nutritional value, flavor, and texture by avoiding the damage that high temperatures can cause. Meanwhile, it preserves food quality by utilizing methods such as high pressure or electric fields instead of heat, which retains nutrients, flavor, and also color. It provides extended shelf life, enhanced food safety, and even sustainability by being more energy-efficient and utilizing less water than traditional methods. This procedure can also inactivate enzymes, minimize spoilage, and permit the creation of value-added products.

In practical applications, technologies such as high-pressure processing and pulsed electric fields are increasingly adopted for juices, dairy products, ready-to-eat meals, and fresh produce. These methods enable processors to meet clean-label and minimally processed food demands while complying with stringent safety standards. As a result, non-thermal pasteurization supports product differentiation and premium positioning without compromising safety or sensory quality.

Non-thermal Pasteurization Market Outlook

- Industry Growth Overview: The non-thermal pasteurization market is witnessing steady growth as food and beverage producers increasingly prioritize food safety while preserving nutritional quality, sensory attributes, and clean-label positioning. This growth is driven by rising consumer demand for minimally processed foods, extended shelf life, and fresh-like characteristics in products such as juices, dairy alternatives, ready-to-eat meals, and functional beverages. Technologies such as high-pressure processing, pulsed electric fields, cold plasma, and ultraviolet treatment are gaining traction as they effectively inactivate pathogens and spoilage microorganisms without the detrimental effects of heat. Continuous advancements in equipment scalability, process validation, and microbial inactivation consistency are improving industrial adoption across large-scale and mid-sized food processors.

- Sustainability Trends: Sustainability considerations are playing an increasingly important role in the adoption of non-thermal pasteurization technologies. Compared to conventional thermal methods, non-thermal processes typically consume less water and energy while reducing food waste through longer shelf life. Manufacturers are investing in energy-efficient high-pressure systems, recyclable packaging compatibility, and optimized processing cycles to align with corporate sustainability goals. Regulatory emphasis on reducing environmental impact in food manufacturing is also encouraging the transition toward non-thermal solutions that support lower carbon footprints and improved resource efficiency.

- Global Expansion: Global expansion of non-thermal pasteurization technologies is accelerating as food safety regulations tighten and demand for premium food products increases. North America and Europe remain early adopters due to strong regulatory frameworks, advanced food processing infrastructure, and high consumer awareness. The Asia-Pacific region is emerging as a high-growth area, supported by urbanization, rising packaged food consumption, and investments in modern food processing facilities. Expansion into the Middle East, Africa, and Latin America is supported by growing cold-chain infrastructure, government-backed food security initiatives, and partnerships with international equipment suppliers.

- Major Investors: Strategic corporate investors, food processing conglomerates, and private equity firms are increasingly investing in non-thermal pasteurization technology providers. Investment focus is directed toward companies offering scalable high-pressure processing systems, modular pulsed electric field units, and validation services for regulatory compliance. Capital inflows reflect confidence in long-term demand for food safety solutions that balance quality preservation with operational efficiency. Mergers, acquisitions, and joint ventures are strengthening technology portfolios and accelerating global market penetration.

- Startup Ecosystem:The non-thermal pasteurization market is supported by a growing startup ecosystem focused on process innovation, compact system design, and cost reduction. Emerging companies are developing portable and small-batch systems tailored for artisanal producers, functional beverage brands, and pilot-scale operations. Startups are also advancing sensor-based process monitoring, digital validation tools, and hybrid systems that combine multiple non-thermal methods. Venture capital interest is supporting rapid prototyping, pilot deployments, and commercialization across niche food categories.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.48 Billion |

| Market Size in 2026 | USD 4.11 Billion |

| Market Size by 2035 | USD 18.22 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 18.00% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Technology, Form, Application, End-User Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Key Technological Shifts in the Non-thermal Pasteurization Market

The key technological shifts in the non-thermal pasteurization market are the development and broader adoption of established technologies such as High-Pressure Processing (HPP) along with Pulsed Electric Fields (PEF) and the emergence of the latest methods such as Ultraviolet (UV) light-LED and even Cold Plasma. These shifts are boosted by the need for scalable, more efficient, and energy-efficient systems that preserve food quality, with the latest innovations focusing on continuous-flow processing, automation, and incorporation with Internet of Things for real-time monitoring.

Equipment manufacturers are improving system throughput and uniformity to support large-scale commercial operations without compromising microbial inactivation efficacy. Advanced sensor integration and data analytics are enabling precise control over processing parameters, improving reproducibility across different food matrices. These technological improvements are helping processors reduce operating costs while meeting increasingly stringent food safety and quality requirements.

Non-thermal Pasteurization Market Key Trends

Demand for high-quality, additive-free products is one of the major drivers of growth. It aligns with user preferences for natural and also healthy foods, along with the demand for effective as well as non-chemical preservation methods. Non-thermal processes such as high-pressure processing (HPP) protect a food's natural flavor, vitamins, texture, and nutritional value while extending shelf life without utilizing preservatives or additives, which makes them an ideal solution for most of the clean-label food movement. Non-thermal processes can generally extend the shelf life of foods, which is mainly beneficial for naturally processed goods, which might otherwise spoil more quickly. Further, it reliably removes harmful pathogens, meeting user and regulatory needs for food safety.

Segmental Insights

Technology Insights

How Is High-Pressure Processing Dominating the Non-thermal Pasteurization Market?

The high-pressure processing segment dominated in the non-thermal pasteurization market during 2025, accounting for 37.4%. It efficiently inactivates microbes while protecting the fresh-like quality, flavor, and even nutritional content of foods, which users highly desire. This method helps in extending shelf life without using chemicals, heat, or additives, aligning with consumer need for "clean-label," minimally processed foods and even "fresh-tasting" products. By inactivating spoilage microorganisms and even enzymes, HPP extends the shelf life of food goods, reducing spoilage and even waste for both producers and retailers.

The pulsed electric fields segment is set to be the fastest-growing in the non-thermal pasteurization market, with an expected 17.4% CAGR, as it provides superior quality preservation by reducing changes to food's flavor, color, and texture compared to heat-derived methods. It also enhances food processing efficiency via cell membrane permeabilization, contributing to benefits such as faster extraction and shorter processing times. Modern consumers are increasingly looking for foods that are safe, natural, and even minimally processed. Pulsed electric fields technology works with these requirements by offering a non-thermal preservation method that manages a food's fresh-like characteristics and also nutritional value.

Form Insights

How Is Liquid Products Leading the Non-thermal Pasteurization Market?

Liquid products led the market for non-thermal pasteurization, accounting for a 70.4% share during 2025. This is due to their high need, mainly in the beverage and convenience food industries, and even the suitability of these technologies for such liquid processing. Non-thermal methods can now extend the shelf life of products such as juices and ready-to-eat meals remarkably without the usage of chemical preservatives, which is a huge selling point for both users and producers. These technologies assist producers in meeting stringent food safety regulations along with industry standards by effectively inactivating many harmful microorganisms.

The solid products segment is set to be the fastest-growing in the non-thermal pasteurization market, expected to reach a 17.5% CAGR, as consumers are increasingly seeking "clean-label" and natural goods. Non-thermal pasteurization offers a way to achieve this, thus extending shelf life while managing the "fresh" perception of solid food items. Moreover, non-thermal techniques effectively remove bacteria and few microorganisms, which contributes to longer shelf lives for goods such as sliced meats, prepared meals, and cheeses. This reduces food waste and enhances overall food safety, a major concern for both consumers and regulators.

Application Insights

How Are Dairy Products Leading the Non-thermal Pasteurization Market?

The dairy products segment led the non-thermal pasteurization industry with a 40.4% share, due to a a growing user preference for minimally processed foods with a few chemical preservatives. Non-thermal processing generally supports the "clean label" trend by manufacturing safe products that can retain their natural features. These technologies effectively decrease dewhilecrobial loads and even inactivate enzymes, which can extend the shelf life of products such as yogurt, milk, and cheese without even compromising their integrity.

The meat & seafood segment is expected to be the fastest-growing in the non-thermal pasteurization market during the forecast period with a 17.7% CAGR, due to consumer need for safer, minimally processed, and even high-quality options and is boosted by a requirement for longer shelf life in packaged and even ready-to-eat options and changing lifestyles and even preferences for healthy, clean-label food. Busy lifestyles are driving the need for ready-to-eat and also frozen meat and seafood products.

End-User Industry Insights

Why Are Food & Beverage Manufacturers Dominating the Non-thermal Pasteurization Market?

The food & beverage manufacturers segment is dominating the market with a 56.5% share, as manufacturers are using non-thermal methods to understand consumer need for foods with fewer additives and even preservatives. By stretching shelf life without compromising quality, producers can expand their distribution networks and even build stronger retail collaboration. minimizing spoilage and returns. Partnership between food processors, equipment manufacturers, and research institutions is speeding up the development and acceptance of these innovative techniques.

The retail & foodservice segment is expected to be the fastest-growing in the non-thermal pasteurization market with an 18% growth rate during the forecast period. There is a significant need for minimally processed products that can retain their freshness and nutritional value. These methods of pasteurization preserve these qualities better than the traditional heat treatment by making it a perfect fit for fresh juices, ready-to-eat meals, and a few ready-to-serve items. These technologies destroy many harmful microorganisms while preserving sensory qualities together with nutritional value, which is a vital factor for both food manufacturers and consumers. This is mainly important for goods that are sensitive to heat and also where taste is a major selling point.

Regional Insights

How Big is the North America Non-thermal Pasteurization Market Size?

The North America non-thermal pasteurization market size is estimated at USD 1.58 billion in 2025 and is projected to reach approximately USD 8.36 billion by 2035, with a 18.13% CAGR from 2026 to 2035.

Why Is North America Leading in the Non-thermal Pasteurization Market?

North America is leading the market for non-thermal pasteurization in 2025 with a 45.4% share. There is a high user requirement for minimally processed foods with extended shelf life that retain their nutritional value and even flavor. The rising preference for clean-label products, which are minimally processed and free of chemical preservatives, has made a remarkable market for non-thermal pasteurization. Thus, sophisticated infrastructure together with a dense network of equipment suppliers and producers supports the market's growth.

Widespread adoption by juice, ready-to-eat meal, and premium protein processors is accelerating deployment of high-pressure and pulsed electric field systems at commercial scale. Strong regulatory clarity around food safety validation is also enabling faster commercialization of non-thermal processes. In addition, contract processing service providers are lowering entry barriers for small and mid-sized brands, further expanding market penetration.

What is the Size of the U.S. Non-thermal Pasteurization Market?

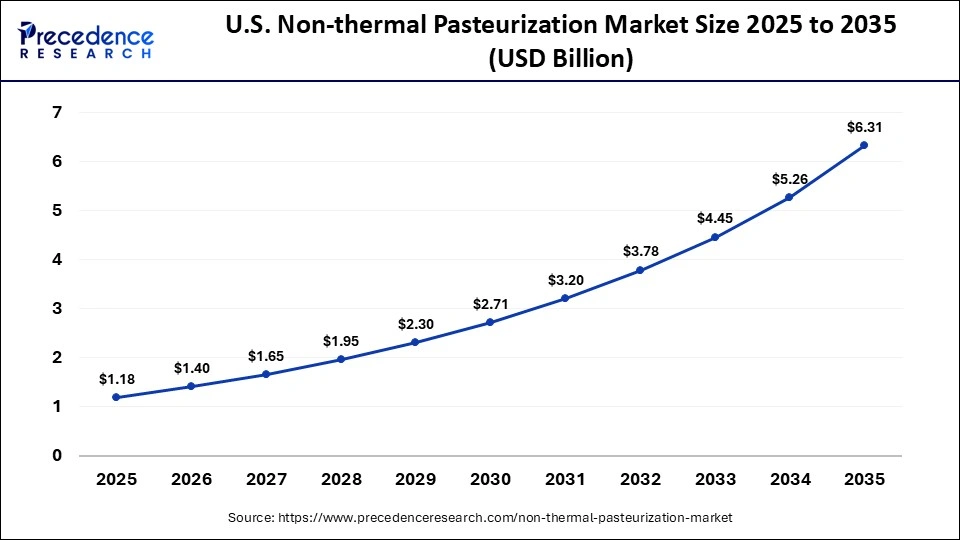

The U.S. non-thermal pasteurization market size is calculated at USD 1.18 billion in 2025 and is expected to reach nearly USD 6.31 billion in 2035, accelerating at a strong CAGR of 18.25% between 2026 and 2035.

U.S. Non-Thermal Pasteurization Market Trends

The United States non-thermal pasteurization market is driven by strong demand for clean-label foods with extended shelf life across juices, ready-to-eat meals, and premium protein products. Food processors are increasingly deploying high-pressure processing and pulsed electric field systems to meet safety requirements without compromising nutritional value or sensory quality. The presence of well-established contract processing facilities is lowering adoption barriers for small and mid-sized food brands. Clear regulatory pathways for validated non-thermal technologies are supporting faster commercialization. Ongoing investments in automation and process monitoring are improving throughput, consistency, and cost efficiency at a commercial scale.

Why is Asia Pacific Set to become the Fastest-Growing Region In The Non-thermal Pasteurization Market?

Asia Pacific has a large, rising middle class that is increasingly health-conscious and willing to pay a premium for foods and beverages recognized as fresh and natural. Non-thermal pasteurization manages the raw flavor, texture, and nutritional profile of food better than conventional heat-based methods. High-profile food safety incidents in the region and heightened consumer and media scrutiny have pushed regulators to strengthen enforcement. Adopting sophisticated non-thermal technologies assists producers in meeting stricter safety standards and avoiding costly product recalls.

In parallel, rapid expansion of packaged food, beverage, and cold-chain distribution networks is accelerating commercial adoption of advanced pasteurization systems. Government support for food processing modernization and export-oriented food manufacturing is further encouraging investment in scalable non-thermal solutions. Growing participation of multinational food brands is also driving technology transfer and standardization across the region.

China Non-Thermal Pasteurization Market Trends

The China non-thermal pasteurization market is gaining momentum as regulators tighten food safety enforcement following past contamination incidents. Large beverage, dairy, and ready-to-eat food producers are adopting high-pressure processing to extend shelf life while preserving fresh attributes. Rapid growth in cold-chain logistics is enabling wider commercialization of non-thermally processed foods across urban and tier-2 cities. Government support for food processing modernization and export compliance is further accelerating adoption. Growing demand for premium, minimally processed products among middle-income consumers is reinforcing long-term market expansion.

Why is Europe Growing Significantly in the Non-thermal Pasteurization Market?

Europe is undergoing significant growth in the non-thermal pasteurization sector. Consumers are increasingly looking for natural, fresh-tasting goods with fewer additives or preservatives. It preserves the natural features of food, working with this trend. The European Green Deal and sustainability goals are driving industries toward more energy-efficient and lower-emission procedures. Non-thermal methods are usually considered more eco-friendly than conventional high-heat pasteurization.

Strict food safety regulations and traceability requirements are encouraging processors to adopt validated non-thermal technologies with consistent microbial control. Strong appearance of premium dairy, juice, and ready-to-eat demand among consumers is supporting early commercial adoption. Investments in modern food processing equipment and automation are improving scalability across small and mid-sized producers. Collaboration between food manufacturers, research institutes, and equipment suppliers is also accelerating process optimization and regulatory acceptance across the region.

Germany Non-Thermal Pasteurization Market Trends

In Germany, non-thermal pasteurization adoption is increasing due to strong demand for clean-label and high-quality food products. Food processors are implementing high-pressure processing to meet strict national and EU food safety and sustainability standards. Germany's advanced food engineering capabilities support efficient integration of non-thermal systems into existing production lines. Growing focus on energy efficiency and waste reduction is reinforcing the shift away from high-heat pasteurization. Strong collaboration between equipment suppliers and food manufacturers is enabling consistent commercial-scale deployment.

Non-thermal Pasteurization Market Value Chain Analysis

Research and Development

Research and development form the foundation of the non-thermal pasteurization market, focusing on microbial inactivation mechanisms, process optimization, and product quality retention. R&D efforts emphasize validation studies, shelf-life testing, and compatibility with diverse food matrices.

• Key Players: Hiperbaric, Elea Technology, Avure Technologies

Equipment Manufacturing

Equipment manufacturing involves the production of high-pressure vessels, pulse generators, UV chambers, control systems, and safety enclosures designed to meet food-grade and regulatory standards. Precision engineering and durability are critical to ensure consistent performance and long equipment life.

• Key Players: Hiperbaric, Bühler Group, Multivac

System Integration and Validation

Manufacturers and solution providers integrate processing units with upstream preparation and downstream packaging lines. Validation services, microbial challenge testing, and regulatory documentation are essential components of this stage to ensure compliance with food safety standards.

• Key Players: Avure Technologies, Elea Technology, JBT Corporation

Distribution and After-Sales Support

Finished systems are distributed directly to food processors or through regional partners. After-sales services include installation, operator training, preventive maintenance, and process optimization support, which are critical for long-term customer retention.

• Key Players: Hiperbaric, JBT Corporation, Bühler Group

Who are the Major Players in the GlobalNon-thermal Pasteurization Market?

The major players in the non-thermal pasteurization market include Hiperbaric S.A., Avure Technologies (JBT Corporation), IMA Group, GEA Group AG, Ultraviolet Devices, Inc., Pulsed Electric Field Technologies (PEF Systems), Food Technology Services, JBT Avure, Bühler Group, Steriflow, Inc, Miraka Ltd., Cold Plasma Technologies GmbH, Multivac Sepp Haggenmüller GmbH & Co. KG, and APV / SPX FLOW, Inc

Recent Developments

- In June 2025, Tamarack Biotics, a food technology company developing non-thermal methods to treat milk, secured U.S. FDA acceptance for its light-based milk treatment process. Tamarack's TruActive process eliminates pathogens while preserving the enzymes, proteins, and immunity-supporting compounds often destroyed by traditional heat-based pasteurization using their UV light technology. The result is a scientifically verified, safe, raw milk equivalent, said Tamarack. The company's light-focusing treatment aims to preserve the taste and creaminess of raw milk. (Source: https://www.qualityassurancemag.com)

- In May 2025, Miraka declared an opening 2025/26 season Farmgate Milk Price forecast of $8.85–$10.85 per kgMS, with a major midpoint of $9.85 per kgMS. The low-carbon dairy processor states that its forecast reflects confidence in robust global dairy needs and reinforces Miraka's target of delivering transparent and reliable value to its suppliers. (Source:https://www.miraka.co.nz)

Segment Covered in the Report

By Technology

- High-Pressure Processing (HPP)

- Pulsed Electric Fields (PEF)

- Ultraviolet (UV) Processing

- Cold Plasma Technology

- Other Emerging Technologies

By Form

- Liquid Products

- Solid Products

By Application

- Dairy Products

- Meat & Seafood

- Beverages

- Fruits & Vegetables

- Ready-to-Eat Meals

- Sauces & Dressings

By End-User Industry

- Food & Beverage Manufacturers

- Retail & Foodservice

- Contract Manufacturing

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting