Oil and Gas Infrastructure Market Size and Forecast 2025 to 2034

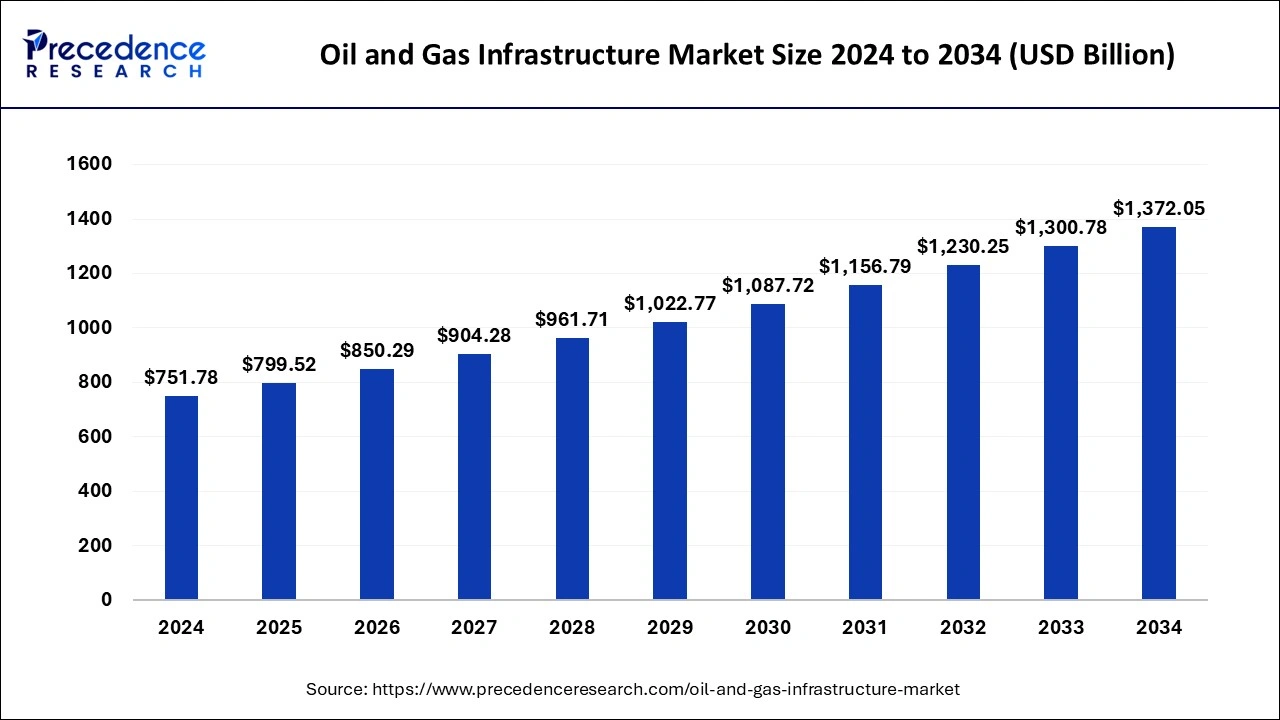

The global oil and gas infrastructure market size was accounted for USD 751.78 billion in 2024 and is anticipated to reach around USD 1372.05 billion by 2034, growing at a CAGR of 6.20% from 2025 to 2034. The increasing demand for chemicals, petrochemical and other fuel types is driving the growth for the oil and gas infrastructure market.

Oil and Gas Infrastructure Market Key Takeaways

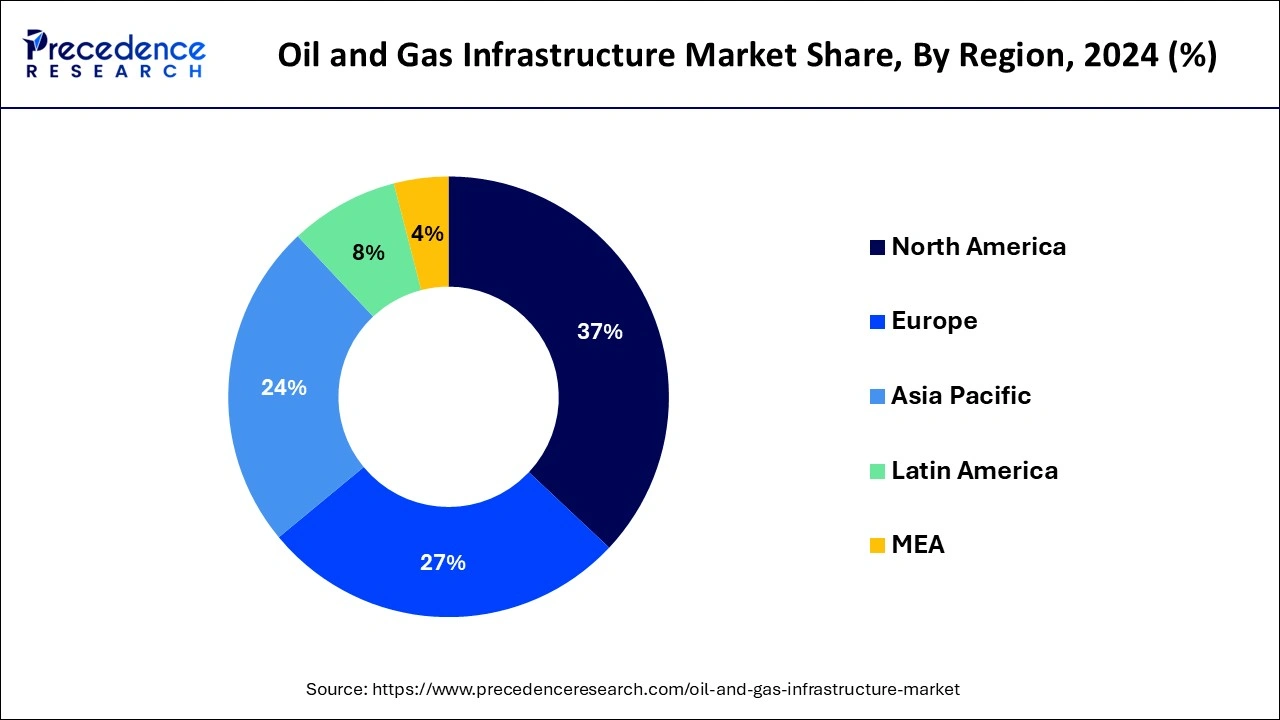

- North America dominated the global oil and gas infrastructure market with the largest market share of 37% in 2024.

- By operation, the distribution segments represented the highest market share in 2024.

How can AI impact the Oil and Gas Infrastructure Market?

The integration of AI into the oil and gas infrastructure is revolutionalize the overall operation of the industry. AI efficiently optimizes the supply chain management by offering real-time insights related to the demand forecasting, logistic planning, and inventory management. AI can predict the fluctuation in demand with the predictive analysis that allows companies to maintain the supply chain operations effectively.

For Instance,

- In July 2024, Indosat Ooredoo Hutchison with Indosat Business and its subsidiary Lintasarta, launched the suite of new AI-powered, cloud-based solutions made to support the developing Oil and Gas industry in Indonesia.

U.S. Oil and Gas Infrastructure Market Size and Growth 2025 to 2034

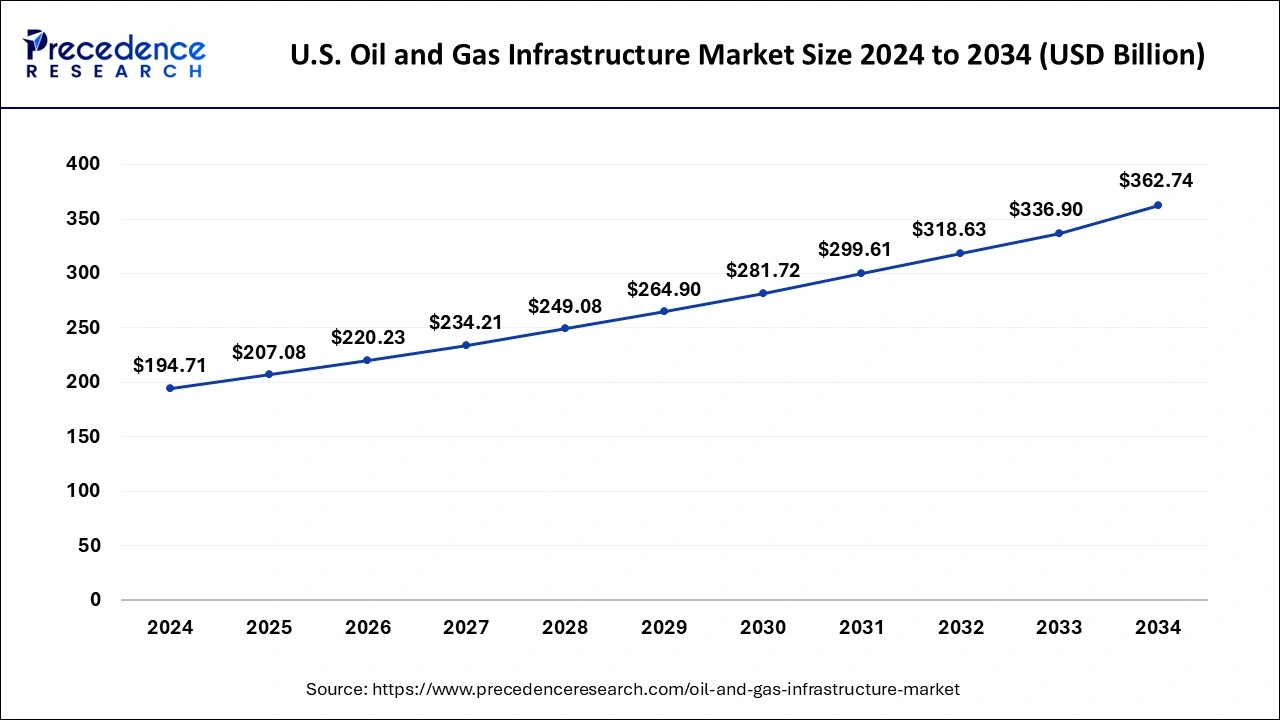

The U.S. oil and gas infrastructure market size was evaluated at USD 194.71 billion in 2024 and is predicted to be worth around USD 362.74 billion by 2034, rising at a CAGR of 6.41% from 2025 to 2034.

The International Energy Agency (IEA) projects that China will boost global energy consumption by 30% by 2025. Moreover, China's imports of natural gas have been rising steadily, reaching 162.7 bcm in 2021, in order to fulfil the rising demand. State-owned businesses in China, such as CNPC and China National Offshore Oil Company, have plans to increase output at nearby gas fields, which will increase the demand for pipelines in the area. A contract for the seventh development phase of ONGC's pipeline replacement projects was also given to L&T Hydrocarbon Engineering Limited in January 2022. Engineering, procurement, construction, installation, and commissioning of about 350 km of subsea pipes and offshore activities are included in EPCIC's contract.

Moreover, China National Offshore Oil Company and TotalEnergies reached a definitive investment decision with Uganda and Tanzania in February 2022 to start more than USD 10 billion in investments to produce and export crude oil from Uganda. The project involves building a $5 billion oil pipeline to help move crude from landlocked Uganda to international markets via a port on Tanzania's Indian Ocean coast. As a result, the expansion of pipeline infrastructure and rising demand in the Asia-Pacific region are key contributors to the growth of the oil and gas market.

Market Overview

Infrastructure for oil and gas refers to the structures, pieces of technology, and networks that energy businesses require to function. To find and utilise energy resources, upstream oil and gas companies need infrastructure. Access to the infrastructure required for processing and refining fuel is available to midstream producers. Also, downstream producers supply and sell petrol and oil to merchants by using the infrastructure.

The market for oil and gas infrastructure will continue to expand due to the increased demand for natural gas. Natural gas is the cleanest fossil fuel on earth and has neither a colour nor a smell. Four hydrocarbon atoms and one carbon atom make up its structure (CH4 or methane). Natural gas production must increase to meet the rising global demand, and infrastructure must be built. For instance, the annual production of natural gas plant liquids (NGPLs), a key component of the U.S. Federal Statistical System, reportedly hit a new high of approximately 5.40 million barrels per day in 2021. As a result, the market for oil and gas infrastructure is driven by the increasing demand for natural gas.

Oil and Gas Infrastructure Market Growth Factor

- The ongoing investment in the technological advancements on the oil and gas infrastructure is identified as the leading growth factor in the oil and gas infrastructure market.

- The increasing demand for efficient fuel infrastructure and the rising industrialization across countries are accelerating the demand for the conventional fuels for operations that contribute to the expansion of the oil and gas infrastructure market.

- The increasing population and the growing demand for automobiles in the developing countries are contributing to the growth of the oil and gas infrastructure market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 799.52 Billion |

| Market Size by 2034 | USD 1372.05 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.20% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Category, By Operation, and By Deployment |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Increase gas pipeline

In 2021, natural gas consumption reached 4037.5 billion cubic meters (bcm), mostly as a result of rising demand for fuel across a variety of sectors, including transportation and power generation. The infrastructure for gas pipelines is set to grow greatly as a result of this trend, which is predicted to last for the foreseeable future.

The demand for natural gas is anticipated to experience the largest increase of all fuel types by 2030 as a result of the advantages to the environment and the need for energy security in places like the Middle East, Africa, and Asia-Pacific. Russian shipments of LNG remained the greatest in the world in 2021, totaling 201.7 billion cubic meters. The demand for the natural gas pipeline network is anticipated to rise as a result of the expected large growth in the worldwide LNG trade.

Worldwide, 408 new gas pipelines totaling 193,400 km are being built now or in the planning stages as of 2021, while 510 renovations and capacity additions to existing infrastructure are also under way. According to the Global Energy Monitor, 16 gas pipelines totaling 3,200 kilometres (km) and EUR 6.5 billion are being built in Europe. The Baltic Pipe Project, which is anticipated to improve EU gas import capacity by 10 billion cubic meters annually, is allocated EUR 2.1 billion of this total. The discovery of new natural gas sources, including shale gas reserves, and the pressure on prices that follows are expanding the global market for natural gas. Thus, it is anticipated that during the projected period, these changes will increase demand for pipeline network growth.

Restrain

High cost of oil and gas pipeline is also restraining the market

Since major declines and increases in oil prices have a negative effect on government and consumer spending, market volatility is likely to be detrimental. In contrast, a significant increase in oil prices had led to rising inflation, a current account deficit, and a fiscal deficit in nations like India and China, which primarily import oil.

The decline in oil prices is having a negative impact on government spending in nations like Saudi Arabia, Nigeria, and the UAE (United Arab Emirates), which are heavily dependent on revenues from crude oil exports. For instance, due to a significant decline in the revenues from oil exports, which has an impact on the market, the Saudi government is expected to reduce its spending from 1.05 trillion riyals ($280 billion) in 2019 to 1.02 trillion riyals ($270 billion) in 2020 and to 955 billion riyals ($255 billion) by 2022. It is anticipated that the market will suffer as a result of the current high level of oil price volatility.

Opportunity

high demand for natural gas and crude oil across the electricity sector

Through 2030, the market for oil, gas, and NGL pipelines is expected to grow rapidly. The paradigm shift towards gas-based power plants and the rising demand for propylene, ethylene, and other natural gas liquids will be what motivates investment in infrastructure development. The prevention of oil and gas pipeline disruption along with the incorporation of cutting-edge security technologies would enhance the oil and gas infrastructure market industry statistics and make operations secure, cost-effective, and productive.

Increased market share will result from accelerating spending on the construction of LNG terminals and changing trends in natural gas pipeline networks. Also, the demand for natural gas in tandem with the quick growth of the infrastructure for gas transportation throughout growing economies will lead to the need for infrastructure. The usage of CNG and LNG as substitute fuels for petrol and diesel has been encouraged by government initiatives to minimise carbon footprints and greenhouse gas emissions, which will support the natural gas infrastructure industry. Furthermore, the United States has seen a boost in the use of LNG cryogenic applications in the industrial sector, which will foster corporate growth.

Operation Insights

The distribution segments represented the highest market share in 2024. The segment expansion is anticipated to be driven by increasing consumption in end-use categories such the expanding number of gas-fired power plants, the chemical industry, the manufacturing industry, and the residential and commercial sectors. With extensive inter-regional trade in the form of imports and exports, the segment is anticipated to have rapid expansion in nations like the United States, Russia, China, and other European countries. The category expansion, however, may be hampered by the market liberalization's sluggish progress. For example, National Oil Companies (NOCs) have access to transmission pipelines in China without having any rights to third-party lines.

Category Insights

The need for crude oil and natural gas is expected to increase exploration and production operations, which would likely propel the oilfield equipment over the forecast period. However, the erratic price of oil and gas is making oil and gas operators hesitant, which is probably going to limit the growth of oilfield equipment in the next years. Due to rising exploration and production activities, the drilling rigs segment is predicted to dominate the market throughout the forecast period. In the upcoming years, market players should benefit from advancements in deepwater and ultra-deepwater drilling activities in the area, including Brazil, Norway, and the United Kingdom.

Oil and Gas Infrastructure Market Companies

- DCP Midstream

- Gazprom

- General Electric

- MRC Global

- National Oilwell Varco

- Nippon Steel Corporation

- Redexis

- Tenaris Inc

- TMK Group

- United States Steel Corporation

Recent Developments

- In November 2024, The Prime Minister of India, Mr. Narendra Modi is announced the launch of initiatives worth ₹4,027 crore in the petroleum and natural gas industry aims to develop the cleaner fuel and Make in India initiatives.

- In August 2024, PPG launched the PPG PITT-THERM 909 spray-on insulation (SOI) coating made with silicon and designed for high-heat environments in the chemicals, oil and gas, petrochemicals, and critical infrastructure industries. These coating enhances safety, operational efficiency, and asset protection compared to traditional thermal insulative materials.

Segment Covered in the Report

By Category

- Surface And Lease Equipment

- Gathering And Processing

- Gas And NGL Pipelines

- Oil And Gas Storage

- Refining And Oil Products Transport

- Export Terminals

By Operation

- Transmission

- Distribution

By Deployment

- Onshore

- Offshore

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content