What is the Oil and Gas Wastewater Recovery Systems Market Size?

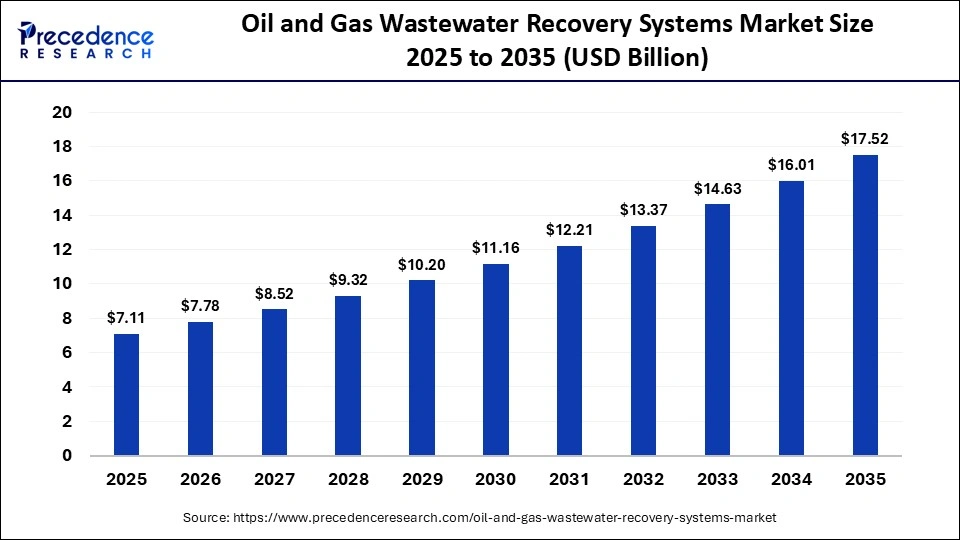

The global oil and gas wastewater recovery systems market size accounted for USD 7.11 billion in 2025 and is predicted to increase from USD 7.78 billion in 2026 to approximately USD 17.52 billion by 2035, expanding at a CAGR of 9.43% from 2026 to 2035. Market growth is driven by the rising volume of wastewater generated from upstream, midstream, and downstream oil and gas operations, along with increasing regulatory pressure to treat, reuse, or safely discharge produced water and refinery effluents.

Market Highlights

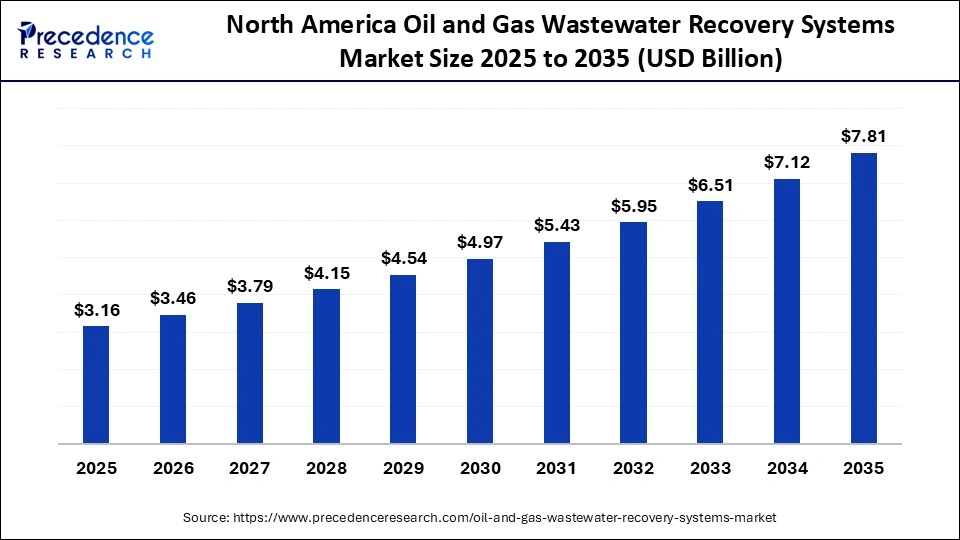

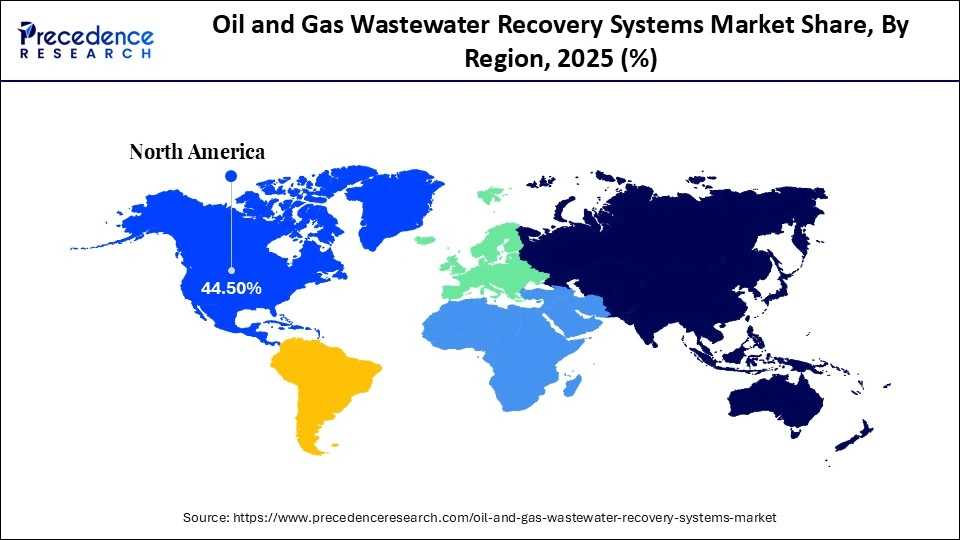

- North America accounted for the largest market share of 44.5% in 2025.

- The Middle East & North Africa is growing at the fastest CAGR of 9.8% from 2026 to 2035.

- By product/system type, the fixed/centralized treatment plants segment captured the largest market share of 47.6% in 2025.

- By product/system type, the mobile/containerized treatment units segment is expected to grow at a 8.6% CAGR from 2026 to 2035.

- By treatment technology, the physical separation segment led with 34.2% market share in 2025.

- By treatment technology, the membrane filtration (UF/NF/RO) segment is expanding at a notable CAGR of 8.7% from 2026 to 2035.

- By application/source, the produced water (PW) segment contributed the largest market share of 46.9% in 2025.

- By application/source, the flowback water treatment segment is poised to grow at the fastest CAGR of 9.0% from 2026 to 2035.

- By end-user/buyer, the E&P (upstream) segment held the major market share of 54.4% in 2025.

- By end-user/buyer, the midstream operators/water gatherers segment is expected to expand at the fastest CAGR of 9.1% from 2026 to 2035.

Understanding the Oil and Gas Wastewater Recovery Systems Market: Treatment Technologies and Field Applications

The oil and gas wastewater recovery systems market encompasses technologies and infrastructure designed to treat, recycle, and reuse wastewater generated during upstream, midstream, and downstream operations. These systems address complex effluents such as produced water, flowback water, and refinery wastewater, which contain hydrocarbons, dissolved salts, heavy metals, suspended solids, and chemical additives. Treatment technologies commonly deployed include physical separation processes, membrane filtration, thermal distillation, advanced oxidation, and biological treatment, selected based on water composition and reuse objectives.

In field applications, wastewater recovery systems are used to enable water reuse for drilling and hydraulic fracturing, reduce freshwater dependency in water-stressed regions, ensure regulatory compliance for discharge, and lower overall operating costs. Growing regulatory scrutiny, rising water management costs, and sustainability pressures are driving increased adoption of efficient and site-specific wastewater recovery solutions across oil and gas operations.

How Is AI Impacting the Oil and Gas Wastewater Recovery Systems Market?

Artificial intelligence is playing an increasingly important role in transforming the global oil and gas wastewater recovery systems market by improving operational efficiency, lowering treatment costs, and supporting sustainability objectives. Machine learning models are being applied across wastewater treatment workflows to enable predictive maintenance, process automation, and real-time optimization. These systems analyze historical and live process data to anticipate equipment failures, optimize membrane fouling management, forecast water quality variations, and autonomously adjust operating parameters such as pressure, flow rates, and chemical dosing. As a result, treatment systems operate more consistently and efficiently, reducing downtime and extending equipment life.

AI-driven platforms also support real-time decision-making by dynamically controlling treatment processes based on incoming water composition and operational conditions. For example, AI algorithms can automatically adjust filtration backwash cycles, reroute wastewater streams, or modify treatment sequences to maintain performance under fluctuating loads. This reduces reliance on manual intervention and operator oversight while improving treatment reliability. In addition, AI enables optimized scheduling of treated effluent reuse, helping operators minimize freshwater intake and manage water availability across drilling, fracturing, and production activities. By ensuring treated water consistently meets reuse and discharge standards, AI-driven systems support circular water management strategies, regulatory compliance, and long-term sustainability goals across oil and gas operations.

Oil and Gas Wastewater Recovery Systems Market Outlook

- Industry Growth Overview: The market is set for strong growth from 2026 to 2035. This expansion is primarily driven by increasingly stringent environmental regulations, growing water scarcity, and the economic benefits of water reuse and recycling in oil and gas operations, which require advanced treatment to meet regulatory discharge standards.

- Growing Demand for Advanced Treatment Technologies: This major trend includes membrane filtration & ZLD, mainly driven by stringent environmental regulations, water scarcity, and corporate sustainability goals, pushing for wastewater reuse in operations, especially for fracking & steam injection for remote sites, turning wastewater into a valuable resource.

- Global Expansion: The global market is expanding rapidly, with North America currently dominating due to stringent environmental rules and a large shale gas sector. While the Asia Pacific region is the fastest-growing market, along with Europe, Latin America and Middle East, and Africa also play an emerging role in market expansion.

- Major Investors: Many prominent companies like Veolia, SUEZ, Xylem, Ecolab, Evoqua Water Technologies, and Halliburton Company provide integrated, end-to-end water management and treatment services. Significant investment has been seen from entities such as the European Investment Bank and Bank of America in the broader water treatment industry.

- Startup Ecosystem: Various ecosystems are focusing on disruptive innovations, particularly in sustainable and energy-efficient solutions. Innovators such as Oxyle are leveraging smart, nanoporous catalysts for effective degradation of organic pollutants to treat high-BOD wastewater while recovering electricity.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 7.11 Billion |

| Market Size in 2026 | USD 7.78 Billion |

| Market Size by 2035 | USD 17.52 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 9.43% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product/System Type, Treatment Technology, Application/Source, End-user/Buyer, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segments Insights

Product/System Type Insights

How Will the Fixed/Centralized Treatment Plants Segment Dominate the Oil and Gas Wastewater Recovery Systems Market in 2025?

Fixed/Centralized Treatment Plants: The segment dominated with 47.6% market share in 2025. This is mainly due to demand for high-capacity, customized, and permanent infrastructure to manage large volumes of complex industrial wastewater. Fixed plants are engineered to handle massive, continuous volumes of produced water and other wastewater over the long operational lifespan of major oil and gas fields, ensuring consistent performance. For long-term operations, fixed installations are more cost-effective over their entire lifecycle compared with the repeated deployment and relocation costs.

Mobile/Containerized Treatment Units: The segment is anticipated to have the fastest growth with a CAGR of 8.6%. This is primarily due to the rapid deployment capabilities, operational flexibility, and cost-effectiveness these systems offer for remote and temporary oil and gas sites. Mobile containerized units can be easily transported to new drilling sites as operations shift, offering a level of portability that traditional, fixed infrastructure cannot match. These systems are built to withstand harsh environments and often feature fully automated operations, making them suitable for locations.

Treatment Technology Insights

What Made the Physical Separation Segment Lead the Oil and Gas Wastewater Recovery Systems Market in 2025?

Physical Separation (API Separators, Hydrocyclones, Decanters): The segment led with 34.2% in 2025. This is because of its simple operations and suitability for primary oil and water separation, efficiently handling large volumes from onshore plays before advanced treatment. Physical processes handle the initial, high-volume separation of oil from water, essential for all wastewater streams. They also support reuse and re-injection, with lower energy costs than thermal methods. Physical methods are less expensive to install and run compared to advanced treatments, making them a go-to for initial bulk water and oil separation.

Membrane Filtration (UF/NF/RO): The segment is expected to have the fastest growth with a CAGR of 8.7%. This is mainly stemming from strict environmental rules, water scarcity driving reuse, high efficiency in removing tough contaminants like oils, salts, and solids, lower operating costs with modern designs, and the ability to handle complex oily wastewater, often in hybrid systems, making them crucial for compliance and resource recovery. Advances in RO/NF/UF designs and forward osmosis integration are reducing energy costs, making these solutions more economically viable for large-scale treatment.

Application/Source Insights

Why Did the Produced Water (PW) Segment Lead the Oil and Gas Wastewater Recovery Systems Market in 2025?

Produced Water from Oil & Gas Wells: The segment led with 46.9% market share in 2025. This is mainly stemming from its being the largest waste stream, generated continuously in huge volumes during extraction, making treatment essential for operations, environmental compliance, and resource recovery. Treating and reusing PW reduces reliance on freshwater, lowers disposal costs, and supports sustainable operations. PW isn't just waste; it contains valuable minerals and can be treated for beneficial uses like enhanced oil recovery, irrigation, or industrial applications, creating new revenue streams and promoting water reuse.

Flowback Water (Fracking): The segment is anticipated to experience the fastest growth with a CAGR of 9%. This is mainly due to massive volumes generated, strict environmental rules demanding reuse, water scarcity in shale regions, and significant cost savings from reduced freshwater hauling. Flowback water is a huge, immediate byproduct of fracking, making its management crucial. Strict EPA and state rules force operators to treat and reuse water, boosting treatment solutions. Innovations in membranes (RO) and advanced oxidation make tertiary treatment highly effective, allowing water to be reused.

End-user/Buyer Insights

What Made the E&P (Upstream) Segment Dominate the Oil and Gas Wastewater Recovery Systems Market in 2025?

E&P Operators (Upstream): The segment held 54.4% market share in 2025. This is mainly due to the immense volume and complex nature of produced water, coupled with the direct impact of stringent environmental regulations on their operations. This phase, particularly from unconventional sources like shale gas and mature fields, generates the largest volume of wastewater, necessitating extensive recovery and treatment infrastructure. The integration of innovative, modular, and mobile wastewater treatment technologies has made on-site treatment and recovery more feasible and cost-effective for remote and temporary E&P sites.

Midstream Operators/Water Gatherers: The segment is anticipated to have the fastest growth with a CARG of 9.1%. This is primarily stemming from intense regulatory pressure for reuse, rising freshwater scarcity, massive volumes of produced water from shale, and the economic benefits of reduced transportation costs. Additionally, unconventional drilling generates huge amounts of produced water, creating a massive need for management solutions. Treating and reusing water cuts expenses related to trucking water to disposal sites and buying fresh water, improving overall economics.

Regional Insights

How Big is the North America Oil and Gas Wastewater Recovery Systems Market Size?

The North America oil and gas wastewater recovery systems market size is estimated at USD 3.16 billion in 2025 and is projected to reach approximately USD 7.81 billion by 2035, with a 9.47% CAGR from 2026 to 2035.

How Will North America Dominate the Oil and Gas Wastewater Recovery Systems Market in 2025?

North America dominated the oil and gas wastewater recovery systems market with a 44.5% share in 2025, driven largely by extensive shale oil and gas extraction activities that generate high volumes of produced water requiring treatment and reuse. Strict environmental regulations in the U.S. and Canada governing wastewater disposal, freshwater withdrawal, and discharge quality have accelerated investment in advanced recovery systems. Operators are increasingly prioritizing produced water reuse to support drilling and hydraulic fracturing operations while reducing dependence on freshwater sources.

Recent developments in the region focus on integrating AI-driven optimization, advanced membrane systems, and selective separation technologies to improve treatment efficiency and reduce operating costs. There is also growing interest in recovering high-value elements from brine streams as part of broader sustainability and resource efficiency strategies. The presence of major industry players, strong R&D capabilities, and early adoption of advanced treatment technologies continues to drive innovation. In parallel, sustained government and private-sector funding support the expansion and modernization of water management infrastructure, reinforcing North America's leadership in the global market.

What is the Size of the U.S. Oil and Gas Wastewater Recovery Systems Market?

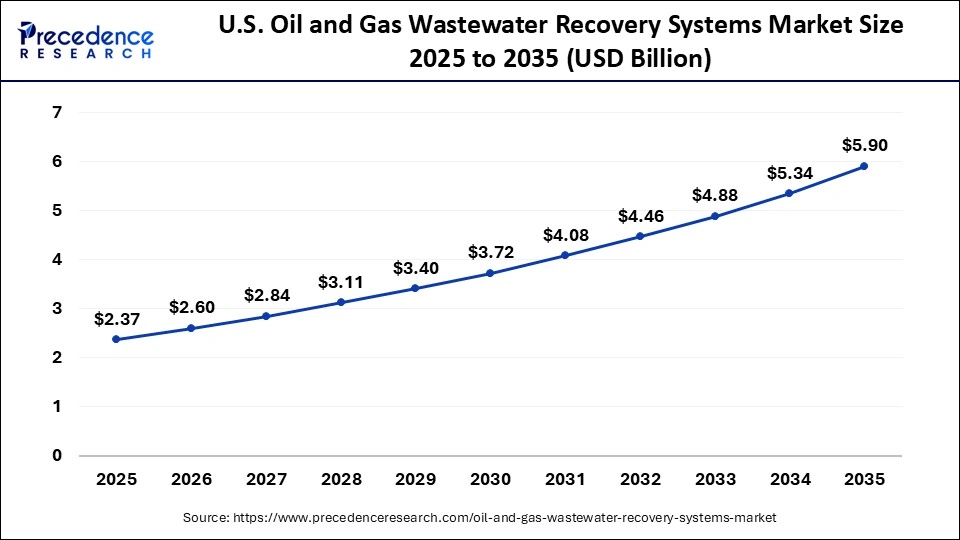

The U.S. oil and gas wastewater recovery systems market size is calculated at USD 2.37 billion in 2025 and is expected to reach nearly USD 5.90 billion in 2035, accelerating at a strong CAGR of 9.55% between 2026 and 2035.

U. S. Oil and Gas Wastewater Recovery Systems Market Trends

The U.S. is a leading market within North America, driven by high demand for advanced produced water treatment across shale oil and gas operations. Operators are increasingly required to meet strict environmental standards, which is accelerating the adoption of advanced treatment technologies such as membrane filtration, advanced oxidation, and zero liquid discharge (ZLD) systems. These solutions help comply with U.S. Environmental Protection Agency requirements while reducing environmental impact through higher water recovery rates and minimizing wastewater discharge. The market also benefits from a strong domestic ecosystem of water technology providers and large-scale field deployments. The presence of major companies such as Ecolab, Veolia, and Evoqua supports continuous innovation, pilot testing, and commercialization of advanced wastewater recovery solutions.

How Will Middle East and North Africa Contribute to the Oil and Gas Wastewater Recovery Systems Market in 2025?

The Middle East and North Africa (MENA) region is expected to experience the fastest growth in the oil and gas wastewater recovery systems market during the forecast period, driven primarily by acute water scarcity and rising oil and gas production activity. Many countries in the region face chronic freshwater shortages, making wastewater reuse a strategic necessity rather than an operational preference. As a result, oil and gas operators are increasingly required to treat and reuse produced water to reduce reliance on desalinated or groundwater resources.

Growth is further reinforced by stricter environmental regulations and discharge standards introduced by governments, particularly in Saudi Arabia and the United Arab Emirates (UAE), which mandate sustainable water management practices for industrial operations. Expansion of exploration and production activities, including offshore developments and unconventional resources, is generating large volumes of produced water with complex chemical compositions. This is driving strong demand for advanced treatment solutions such as membrane systems, thermal processes, and zero liquid discharge technologies to enable safe reuse, regulatory compliance, and long-term water security across the region's oil and gas sector.

UAE Oil and Gas Wastewater Recovery Systems Market Trends

The United Arab Emirates is a key contributor to growth in the oil and gas wastewater recovery systems market, driven by arid climatic conditions, large-scale industrial development, and strong government emphasis on sustainability and resource efficiency. Chronic water scarcity has made wastewater reuse a strategic priority, particularly for energy-intensive oil and gas operations that generate significant volumes of produced water.

The UAE's commitment to advanced water management is reinforced through national sustainability programs such as the UAE Net Zero 2050, alongside international partnerships focused on water conservation and low-carbon industrial practices. These initiatives are accelerating the adoption of advanced treatment technologies, including zero liquid discharge systems, to minimize wastewater discharge, enable high levels of water reuse, and reduce the environmental footprint of oil and gas activities.

What Has Caused the Emergence of the Asia Pacific in the Oil and Gas Wastewater Recovery Systems Market?

In the Asia-Pacific region, a combination of rising energy demand, rapid urbanization, increasing water scarcity, and tightening environmental regulations is making the region a significant contributor to the global oil and gas wastewater recovery systems market. Governments across the region are actively promoting circular water management frameworks, encouraging industrial operators to prioritize wastewater treatment, reuse, and resource recovery over freshwater withdrawal. These policy directions are particularly relevant in water-stressed basins where industrial growth is outpacing natural water availability.

Rapid industrialization and population growth in China, India, and several Southeast Asian countries are placing sustained pressure on freshwater resources, making produced water recovery a strategic necessity rather than a cost-driven choice. Expanding upstream and downstream oil and gas activities in these economies generate large volumes of produced water with complex contaminant profiles. As a result, operators are increasingly investing in advanced treatment and reuse systems to support drilling, processing, and enhanced recovery operations while reducing dependence on freshwater sources. This shift toward reclamation-driven water management is reinforcing Asia-Pacific's growing role in the global wastewater recovery market.

India Oil and Gas Wastewater Recovery Systems Market Trends

India is emerging as an important player in the global oil and gas wastewater recovery systems market, driven by severe water stress, rising energy demand, and tightening environmental oversight. Many oil refineries, petrochemical complexes, and upstream operations operate in water-scarce regions, making wastewater treatment and reuse a strategic requirement rather than an optional sustainability measure. Government emphasis on water conservation and stricter discharge norms is further reinforcing the adoption of advanced recovery systems.

Major domestic players such as IndianOil and Thermax are actively investing in water recycling, zero liquid discharge systems, and smart water management technologies to reduce freshwater intake and improve operational efficiency. In parallel, technology providers such as TRL are supplying advanced membrane solutions, including zeolite-based membranes like TRL-Zeo, designed to treat high-salinity and complex industrial effluents. These technologies enable higher water recovery rates and support reuse across refining, processing, and energy operations, strengthening India's role in the global wastewater recovery market.

How Will Europe Surge in the Oil and Gas Wastewater Recovery Systems Market in 2025?

Europe plays a critical role in the global oil and gas wastewater recovery systems market, driven by stringent environmental regulations, strong policy alignment toward sustainability, and steady technological innovation in industrial water treatment. The European Union has established a comprehensive regulatory framework, including the Water Framework Directive and the Urban Waste Water Treatment Directive, which impose strict limits on the discharge of hydrocarbons, heavy metals, and other industrial contaminants into surface and groundwater bodies. These regulations compel oil and gas operators, refineries, and petrochemical facilities to adopt advanced wastewater treatment and recovery solutions to remain compliant.

Beyond regulation, Europe places strong emphasis on water reuse, circular economy principles, and resource efficiency, which align closely with wastewater recovery objectives. Financial institutions such as the European Investment Bank are actively supporting investment in sustainable water infrastructure through funding and low-interest financing, accelerating the deployment of advanced treatment technologies. As a result, European operators increasingly invest in membrane filtration, advanced oxidation, and zero liquid discharge systems to minimize environmental impact, reduce freshwater consumption, and ensure long-term compliance with evolving environmental standards.

Germany Oil and Gas Wastewater Recovery Systems Market Trends

Germany holds a distinctive position in the oil and gas wastewater recovery systems market, driven by its strong commitment to circular economy principles and strict adherence to European environmental directives. German industrial and energy operators operate under some of the highest regulatory and technical standards in Europe, which encourages early adoption of advanced wastewater treatment and reuse solutions. Policy emphasis on resource efficiency, pollutant recovery, and minimization of industrial discharge is shaping investment decisions across refining, petrochemical, and energy-related operations.

The market is also characterized by continuous innovation in filtration and separation technologies, supported by Germany's strong engineering and industrial equipment manufacturing base. There is a growing deployment of advanced treatment processes such as ultrafiltration and reverse osmosis to achieve high-quality water recovery suitable for reuse within industrial operations. These systems are increasingly used to treat complex effluents with high salinity and contaminant loads, enabling compliance with discharge norms while reducing freshwater intake.

How Will Latin America Emerge in the Oil and Gas Wastewater Recovery Systems Market in 2025?

Latin America is emerging as an increasingly important market for oil and gas wastewater recovery systems, driven by rising hydrocarbon production, tightening environmental regulations, and growing water scarcity across key producing countries. The region holds substantial oil and gas reserves, and recent increases in upstream activity, including conventional and unconventional developments, have led to higher volumes of produced water that must be treated, reused, or safely discharged.

Governments across the region are responding to water pollution risks by enforcing stricter discharge standards and environmental compliance requirements, pushing operators to invest in modern wastewater treatment and recovery technologies. At the same time, persistent water stress in several oil-producing basins is encouraging the reuse of treated produced water for drilling, processing, and other industrial applications to reduce dependence on freshwater sources. Together, regulatory pressure, production growth, and water conservation priorities are positioning Latin America for stronger adoption of advanced oil and gas wastewater recovery systems starting in 2025.

Brazil Oil and Gas Wastewater Recovery Systems Market Trends

Brazil plays an increasingly important role in the oil and gas wastewater recovery systems market, driven by expanding offshore exploration and production activities and stricter environmental compliance requirements. Large offshore developments generate substantial volumes of produced water with complex contaminant profiles, increasing the need for effective treatment solutions to meet discharge standards and support operational continuity. Regulatory oversight related to offshore discharges and marine ecosystem protection is pushing operators to adopt more advanced wastewater treatment and monitoring technologies.

Although Brazil's market remains at an earlier stage compared with more mature regions, momentum is building as sustainability and water stewardship gain importance across the energy sector. As one of the world's significant oil producers, Brazil is placing greater emphasis on produced water management, reuse where feasible, and reduction of environmental impact from offshore operations.

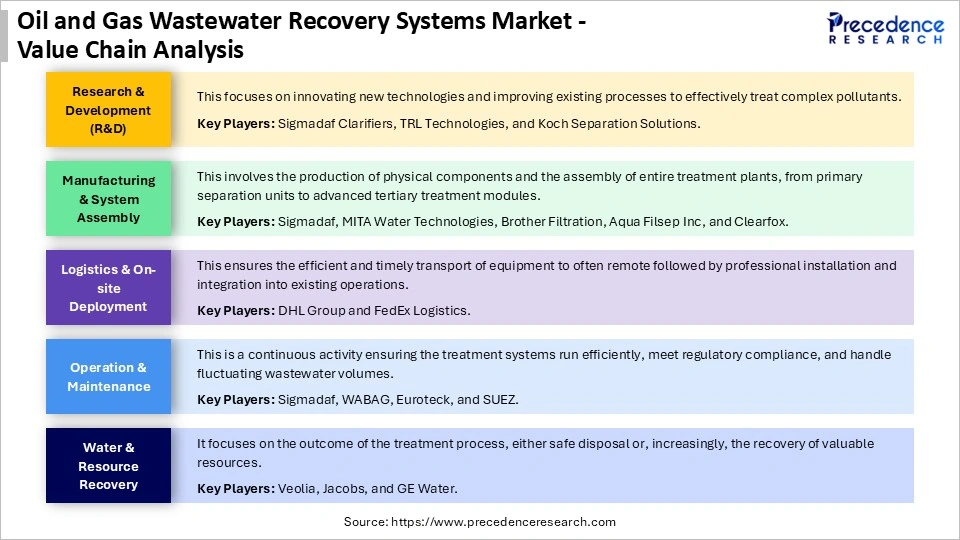

Oil and Gas Wastewater Recovery Systems Market Value Chain

Oil and Gas Wastewater Recovery Systems Market Companies

- Schlumberger (SLB)

- Halliburton

- Baker Hughes

- TechnipFMC

- Veolia

- SUEZ

- Aker Solutions

- Siemens Energy

- Xylem

- Aquatech

- Frames Group

- Ovivo

- CETCO (Minerals Technologies)

- Aris Water Solutions

- ProSep

Recent Developments

- In July 2025, Valicor Environmental Services acquired NewGen Resources, expanding its reach into Oklahoma and enhancing waste and wastewater treatment services. NewGen, located in Oklahoma City, provides non-hazardous wastewater disposal and operates a centralized treatment facility. This acquisition increases Valicor's presence to 30 facilities in 15 states, reinforcing its commitment to environmentally responsible practices.(Source: https://www.prnewswire.com)

- In February 2024, Veolia unveiled its GreenUp strategic program for 2024-2027, aiming to enhance its role in ecological transformation by accelerating the implementation of solutions for pollution reduction, decarbonization, and resource regeneration. The initiative includes 4 billion in growth investments, focusing on local energy, water technologies, and hazardous waste treatment.(Source:https://www.veolia.com)

Segment Covered in the Report

By Product/System Type

- Mobile/Containerized Treatment Units

- Packaged/Skid Systems

- Fixed/Centralized Treatment Plants

- Zero Liquid Discharge (ZLD) Trains

By Treatment Technology

- Physical Separation (API separators, hydrocyclones, decanters)

- Chemical Treatment & Coagulation/Flocculation

- Membrane Filtration (UF/NF/RO)

- Thermal Evaporation/Crystallization

- Advanced Oxidation & Biological Treatment

- Solids Dewatering & Handling

By Application/Source

- Produced Water from Oil & Gas Wells

- Flowback Water (fracking)

- Refinery & Petrochemical Process Wastewater

- Gas Processing & Midstream Effluents

By End-user/Buyer

- E&P Operators (Upstream)

- Midstream Operators/Water Gatherers

- Refiners & Petrochemical Plants (Downstream)

- OG Service Companies/Contractors

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting