What is the Offshore Oil and Gas Equipment Market Size in 2026?

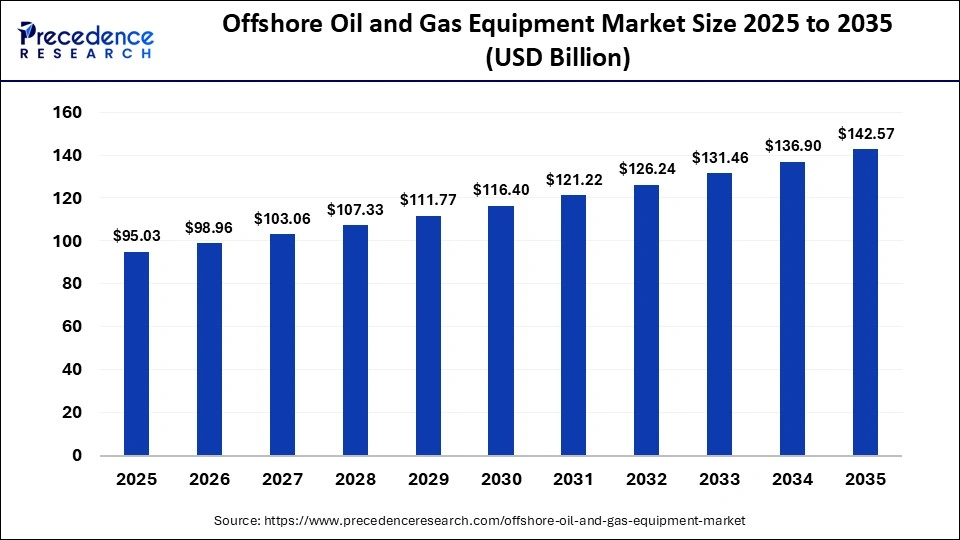

The global offshore oil and gas equipment market size was calculated at USD 95.03 billion in 2025 and is predicted to increase from USD 98.96 billion in 2026 to approximately USD 142.57 billion by 2035, expanding at a CAGR of 4.14% from 2026 to 2035.The market is driven by growing global energy demand, increased offshore exploration activities, and rising investments in deepwater and ultra-deepwater drilling technologies.

Key Takeaways

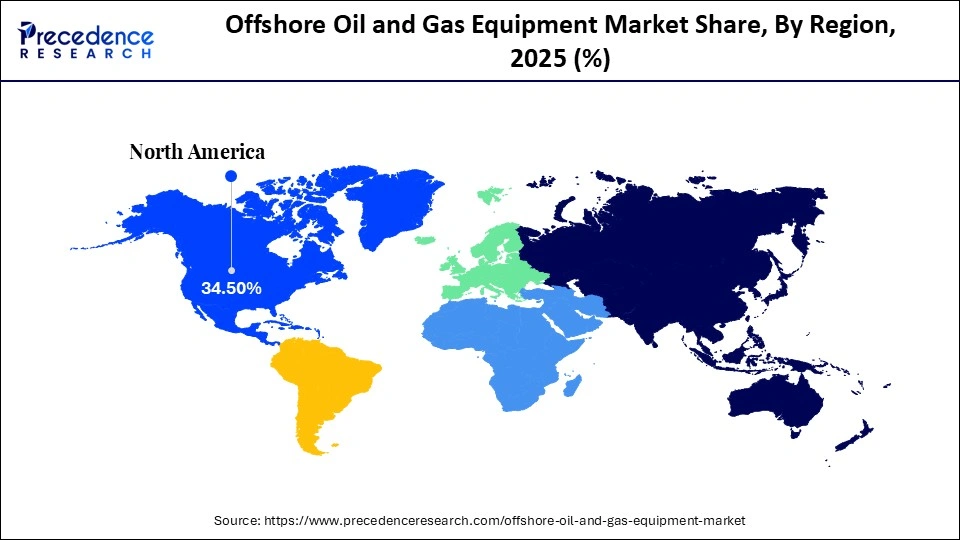

- By region, North America led the offshore oil and gas equipment market with approximately 34.5 % share in 2025.

- By region, Asia Pacific is observed to be the fastest-growing region in the forecasted period.

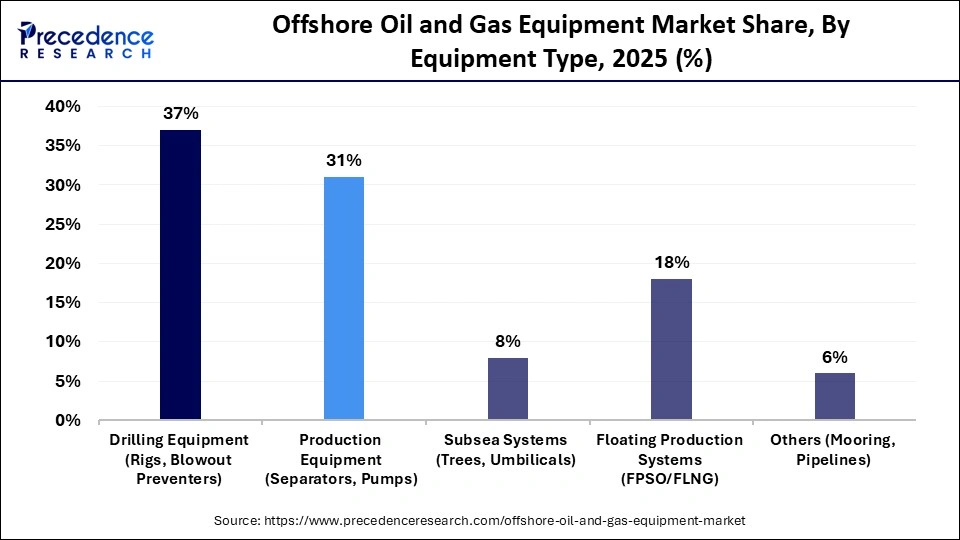

- By equipment type, the drilling equipment segment led the market with approximately 37% share in 2025.

- By equipment type, the subsea systems segment is expected to grow at a 5.8% CAGR during the forecast period.

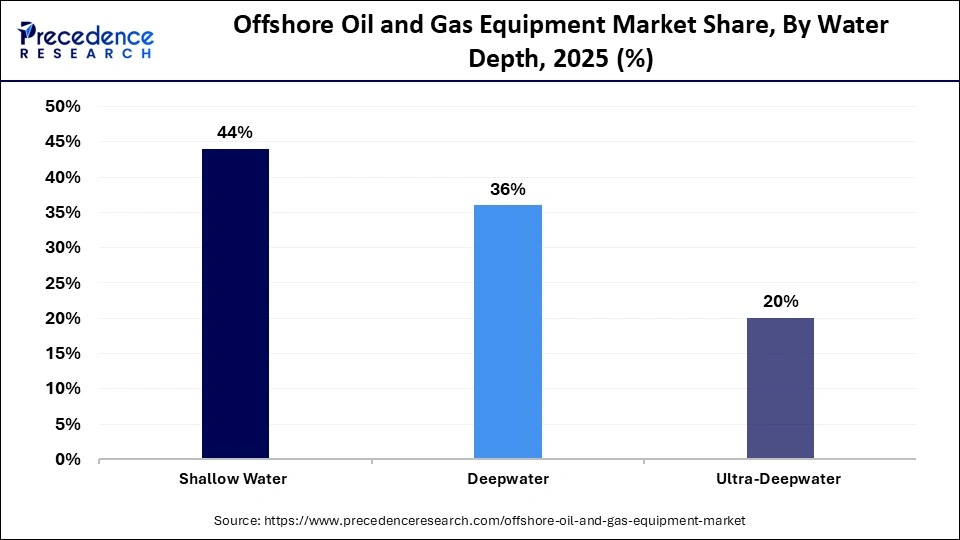

- By water depth type, the shallow water segment led the global market with approximately 44% share in 2025.

- By water depth type, the ultra-deepwater segment is observed to expand at the fastest CAGR of 7.1% in the coming years.

- By application type, the production wells segment led the market with approximately 48% share in 2025.

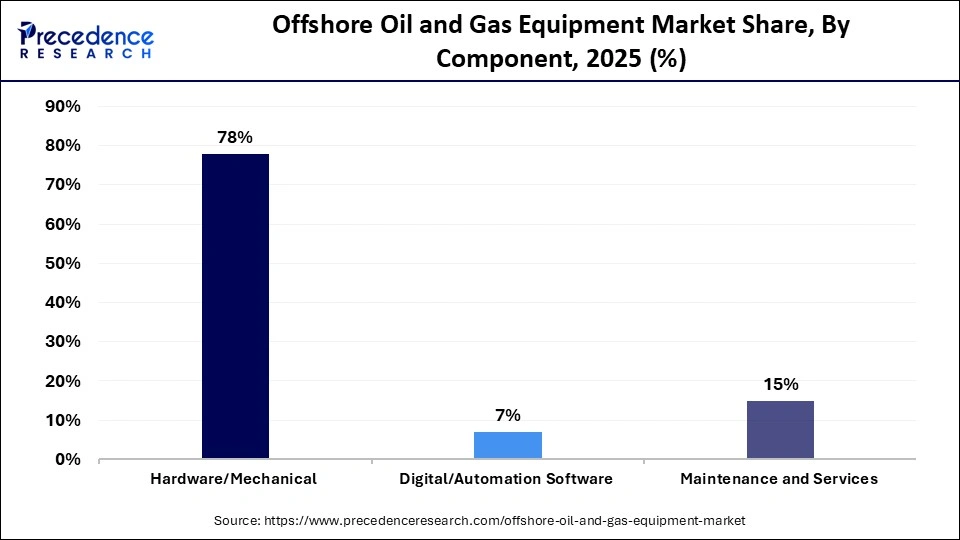

By application type, the exploration wells segment is observed to grow at the fastest CAGR of about 6.4% during the projection period. - By component type, the hardware/mechanical segment dominated the market with approximately 78% share in 2025.

- By component type, the digital/automation segment is observed to expand at the fastest CAGR of 9.2% between 2026 and 2035.

Market Overview

The offshore oil and gas equipment market encompasses the production, supply, and maintenance of machinery, tools, and systems used in offshore exploration, drilling, production, and processing of oil and gas resources. These specialized machineries are required to extract hydrocarbons from seabed environments while managing extreme pressures, corrosive saltwater, and stringent maritime safety regulations. Market growth is driven by increasing global energy demand, rising offshore exploration activities in deepwater and ultra-deepwater regions, and ongoing technological advancements in drilling, subsea, and production equipment. Additionally, favorable government policies, rising oil prices, and investments in renewable hybrid offshore infrastructure are further boosting market expansion.

Impact of Artificial Intelligence on the Offshore Oil and Gas Equipment Market

Artificial Intelligence is changing the landscape for energy resources. Artificial intelligence and machine learning provide actionable insights that support real-time decision-making. They enable the oil & gas industry to analyze real-time data from downhole tools, the wellbore, and surface systems. By predicting issues such as changes in formation pressure, equipment malfunctions, or bit wear, performance problems can be prevented.

Energy companies now use AI-powered robots equipped with thermal cameras for gas leak detection and comprehensive facility monitoring, reducing human exposure while maintaining rigorous environmental oversight. With AI analytics, maintenance strategies are shifting from reactive repairs to predictive interventions that help protect marine environments. The advantages of AI are becoming increasingly evident as the offshore oil and gas equipment market seeks to enhance safety, operational efficiency, and overall sustainability.

What are the Key Trends Shaping the Market?

- Sustainability and AI integration are becoming key trends in the offshore oil and gas equipment market, enhancing resource efficiency and supporting marine environmental protection.

- There is a rising adoption of IoT sensors and devices, enabling real-time monitoring of equipment and assets and helping operators to track performance, detect faults early, and optimize maintenance.

- Shift toward low-emission solutions, including electrified systems, Tier 4 engines, and modular platforms, is driving cleaner, more efficient, and sustainable offshore energy production.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 95.03 Billion |

| Market Size in 2026 | USD 98.96 Billion |

| Market Size by 2035 | USD 142.57 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 4.14% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Equipment Type, Water Depth, Application, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Equipment Type Insights

What Made Drilling Equipment the Dominant Segment in the market?

The drilling equipment segment dominated the offshore oil and gas equipment market in 2025, accounting for 37% share, driven by rising global oil and gas demand and increasing exploration in deeper and more remote offshore locations. Offshore drilling involves creating wells in the seabed of the continental shelf, as well as in lakes and inland seas, to enhance production. Such complex operations require specialized equipment, where floating rigs are predominantly used along with blowout preventers, leading to higher demand for drilling equipment. There is a noticeable inclination toward sustainable practices and the integration of advanced drilling techniques. The rigs market is also witnessing a growing trend toward digitalization and automation, further supporting market growth.

The subsea systems segment is expected to grow at a CAGR of approximately 5.8% over the forecast period, driven by rising demand for renewable energy sources and increasing investment in infrastructure development. Technological advancements are enhancing the efficiency and safety of subsea operations, including tress and umbilicals, while the integration of automation and digitalization is improving performance and reducing operational costs. The growing emphasis on sustainable practices within the energy sector is influencing the design and functionality of subsea equipment toward more environmentally friendly solutions. Ultra-deepwater high-pressure equipment and advanced digital technologies are further lowering inspection, maintenance, and repair costs, as well as overall capital and operating expenditures, thereby accelerating the growth of the subsea systems market.

Water Depth Insights

Why Did the Shallow Water Segment Dominate the Market in 2025?

The shallow water segment dominated the offshore oil and gas equipment market with around 44% share in 2025 due to easier installation, monitoring, and maintenance at lower water depths. Drilling operations in shallow water are less expensive and easier to execute, requiring less equipment and drilling time, which results in lower capital expenditure (CAPEX) and faster project turnaround. Moreover, lower operational complexity enables the efficient deployment of advanced technology and AI-based monitoring systems. Equipment replacement and repair in cases of corrosion or damage are also less in shallow water compared to deeper water. Additionally, shallow water projects provide valuable resources and contribute to local economies, reinforcing the segment's dominance.

The ultra-deepwater segment is expected to grow at the fastest CAGR of approximately 7.1% in the upcoming period. This is because oil and gas production companies are increasingly showing interest in ultra-deepwater drilling due to the strong production potential of these fields. In addition, estimated ultimate recovery (EUR) in ultra-deepwater averages around 12 MMboe for oil wells and 50–300 MMboe for gas wells. This advantage is expected to improve further, as future ultra-deepwater developments are projected to achieve nearly twice the average EUR of fields already on stream, strengthening long-term production prospects. Furthermore, the growing adoption of digital technologies such as automation and remote operations is enhancing efficiency, further supporting segment growth. However, high upfront investment and operating costs remain major challenges for the expansion of the ultra-deepwater segment.

Application Insights

How Does the Production Wells Segment Dominate the Market in 2025?

The production wells segment dominated the offshore oil and gas equipment market with approximately 48% share in 2025 because it focuses on established hydrocarbon fields where reservoir characteristics, production volumes, and site conditions are well defined. Production wells typically operate over an extended lifecycle, requiring sustained operational focus and equipment support, which drives higher equipment demand and utilization. This combination of field clarity, long-term production activity, and recurring operational requirements reinforces the leading position of the production wells segment.

The exploration wells segment is expected to expand at the fastest CAGR of 6.4% over the forecast period, driven by the ongoing need to discover new hydrocarbon reserves and assess unexplored offshore fields. Exploration wells provide essential data on reservoir quality, hydrocarbon volumes, and site conditions, guiding future field development and investment decisions. Technological advancements, including AI and digital monitoring, have improved efficiency in site analysis and equipment deployment, while supportive government policies and favorable regulations further boost investment and operational activity despite the higher risk and cost associated with exploration.

Component Insights

Why Did the Hardware/Mechanical Segment Lead the Market in 2025?

The hardware/mechanical segment dominated the market revenue with the highest share of 78% in 2025, primarily due to the critical role that specialized equipment plays in drilling, production, and processing operations. In drilling, offshore rigs, blowout preventers, and wellhead systems ensure safe and efficient resource extraction. During production, separators, pipelines, and pumps facilitate continuous flow and processing of hydrocarbons, while processing equipment such as refining units, heat exchangers, and boilers support treatment, storage, and transportation. Moreover, high CAPEX requirements, specialized design, ongoing offshore infrastructure expansion, and regulatory mandates for safety inspection and maintenance further strengthen the market position of this segment.

The digital/automation software segment is expected to grow at the highest CAGR of approximately 9.2% during the projection period, as these digital solutions allow operators to optimize operations while simultaneously supporting emissions reduction and broader sustainability goals. Advanced sensors and analytics enable precise monitoring of resource flows and operational performance, enhancing efficiency and reducing operating costs. The oil and gas sector, which accounts for roughly 15% of global energy-related emissions, faces mounting pressure to decarbonize in order to meet net-zero targets and mitigate climate change impacts. Digitalization is widely seen as a critical pathway to achieving net zero across industries, and its adoption is being accelerated by rising environmental concerns and increasingly stringent regulations.

Regional Insights

North America Offshore Oil and Gas Equipment Market Size and Growth 2026 to 2035

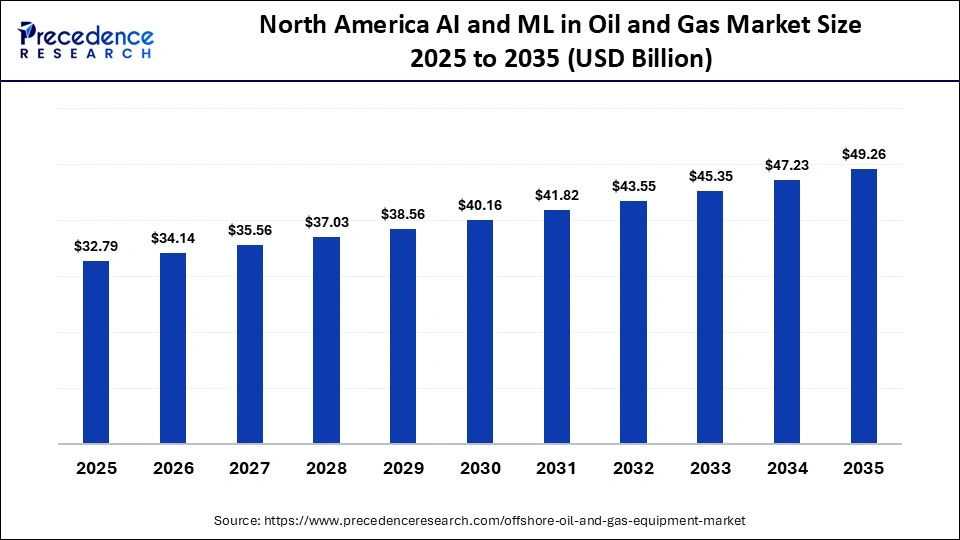

The North America offshore oil and gas equipment market size is estimated at USD 32.79 billion in 2025 and is projected to reach approximately USD 49.26 billion by 2035, with a 4.15% CAGR from 2026 to 2035.

What Made North America the Dominant Region in the Offshore Oil and Gas Equipment Market?

North America dominated the offshore oil and gas equipment market, accounting for approximately 34.5% share in 2025. This dominance is driven by high-value deepwater projects in the Gulf of Mexico and the integration of digital twin technology to extend the life of aging assets. Moreover, growth is supported by continued investments in deepwater drilling, subsea infrastructure upgrades, and enhanced recovery techniques. The region benefits from a strong regulatory framework, a well-established offshore service ecosystem, and the adoption of digital drilling solutions that improve operational efficiency and cost optimization.

Favorable geopolitical conditions and resilient oil prices continue to attract exploration and production (E&P) investments in offshore assets, reinforcing the region's dominance in the market. The U.S. and Mexico drive the regional market, supported by substantial hydrocarbon reserves, technological advancements, and strong market demand, with Mexico's growth fueled by government-backed energy sector reforms.

U.S. Offshore Oil and Gas Equipment Market Size and Growth 2026 to 2035

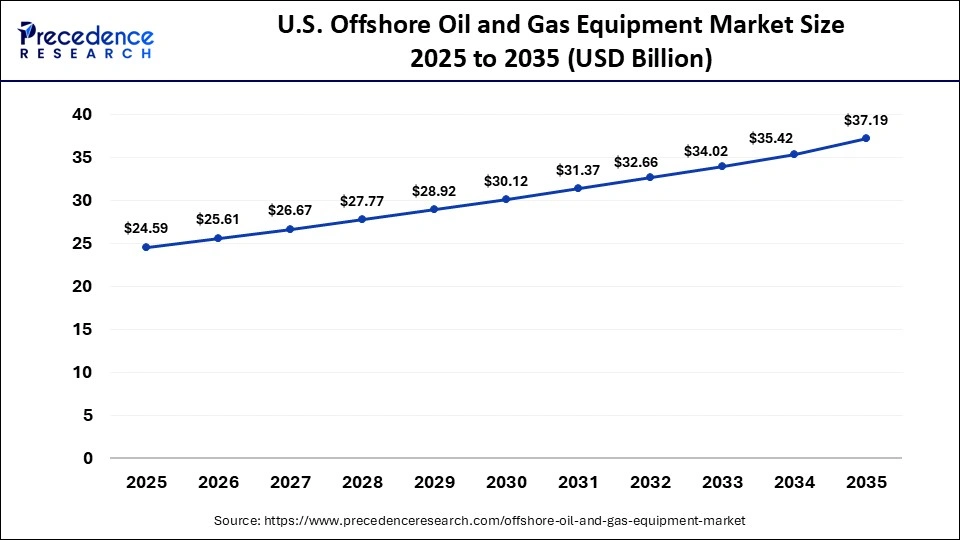

The U.S. offshore oil and gas equipment market size is calculated at USD 24.59 billion in 2025 and is expected to reach nearly USD 37.19 billion in 2035, accelerating at a strong CAGR of 4.22% between 2026 and 2035.

U.S. Market Analysis

The U.S. is the major contributor to the North American offshore oil and gas equipment market due to its extensive offshore oil and gas reserves, well-established exploration and production infrastructure, and high investment in advanced offshore drilling and production technologies. Strong government support, favorable regulatory frameworks, and substantial private-sector R&D in deepwater and ultra-deepwater operations further reinforce the U.S.'s leading position in the regional market.

How is the opportunistic Rise of Asia Pacific in the Market?

Asia Pacific is the fastest-growing region in the offshore oil and gas equipment market, fueled by rising investment in energy infrastructure. The market is increasingly shaped by automation initiatives and manufacturing transformation efforts aimed at enhancing operational efficiency. Additionally, surging energy consumption in the region, along with rapid industrialization and urbanization in countries such as India and China, is driving demand for oil and gas, thereby increasing offshore exploration activities and driving the demand for equipment.

Governments across the region are actively investing in the oil and gas sector through favorable policies and incentives. Initiatives such as “Make in India” are strengthening domestic manufacturing capabilities, while the liberalization of FDI policies in India's oil and gas equipment sector is attracting substantial foreign investment, improving infrastructure and accelerating technology transfer. In addition, technological advancements in well exploration equipment, including self-adaptive inflow control, intelligent well completion, and downhole sensors, are reducing well maintenance costs and further improving operational efficiency.

Offshore Oil and Gas Equipment Market Value Chain Analysis

- Raw Material Sourcing

Raw materials such as high-strength steel, alloys, polymers, and composites are essential for manufacturing offshore equipment, ensuring durability, corrosion resistance, and safety in extreme marine conditions.

Key Player: ArcelorMittal, Nippon Steel Corporation, Tenaris S.A.

- Component Fabrication and Machining

This stage involves designing, engineering, and producing drilling rigs, subsea equipment, blowout preventers, production platforms, and other essential offshore machinery.

Key Player: McDermott International, TechnipFMC / Technip Energies, Larsen & Toubro (L&T)

- Testing and Certification

Component testing and certification safeguard offshore assets, ensuring regulatory compliance and safety in harsh subsea conditions.

Key Players: SGS Société Générale de Surveillance SA, Bureau Veritas (BV)

- Installation and Commissioning

Installation and commissioning transform offshore assets from costly mega-projects into operational, revenue-generating energy infrastructure.

Key Players: Saipem S.p.A., Subsea 7 S.A.

- Distribution and Sales

It is carried out through Direct-to-Operator (DTO) sales, performance-based contracting, and competitive bidding and tendering.

Key Players: SLB (Schlumberger), Baker Hughes

- Maintenance and After-Sales Service

Ensuring equipment reliability and longevity in harsh offshore environments is critical. Maintenance and After-Sales Service include Preventive & Predictive Maintenance, Corrective Maintenance & Repair, Turnaround & Shutdown Support.

Key Players: Oceaneering International, Aker Solutions

Offshore Oil and Gas Equipment Market Companies

- Schlumberger (SLB) (USA)

- Baker Hughes (USA)

- Halliburton (USA)

- TechnipFMC plc (UK)

- National Oilwell Varco (NOV Inc.) (USA)

- Aker Solutions (Norway)

- Saipem S.p.A. (Italy)

- Subsea 7 S.A. (Luxembourg/UK)

- Weatherford International (USA)

- Valaris Limited (Bermuda)

- Noble Corporation (USA)

- Transocean Ltd. (Switzerland)

- China Oilfield Services Limited (COSL) (China)

- Dril-Quip, Inc. (USA)

- Odfjell Drilling (Norway)

Recent Developments

- In January 2026, MFE Inspection Solutions launched its Offshore Division, a new unit dedicated to subsea and offshore operations and built to serve offshore oil and gas, offshore wind, and other maritime operators.(Source: https://www.marinetechnologynews.com)

- In 2026, Chevron achieved first oil offshore Angola just two years after starting construction on a new production platform. Cabinda Gulf Oil Company (CABGOC), a subsidiary of the U.S.-headquartered energy giant Chevron, has brought the platform into production mode off the coast of Angola slightly more than two years after construction began.(Source: https://www.offshore-energy.biz)

- In 2025, Dajin Heavy Industry launched its first self-built heavy deck carrier, designed to transport XXL components and equipment for the offshore wind, oil, and gas industries.(Source: https://www.offshorewind.biz)

Segment Covered in the Report

By Equipment Type

- Drilling Equipment (Rigs, Blowout Preventers)

- Production Equipment (Separators, Pumps)

- Subsea Systems (Trees, Umbilicals)

- Floating Production Systems (FPSO/FLNG)

- Others (Mooring, Pipelines)

By Water Depth

- Shallow Water

- Deepwater

- Ultra-Deepwater

By Application

- Production Wells

- Development Wells

- Exploration Wells

By Component

- Hardware/Mechanical

- Digital/Automation Software

- Maintenance & Services

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting