What is Offshore Mooring Systems Market Size?

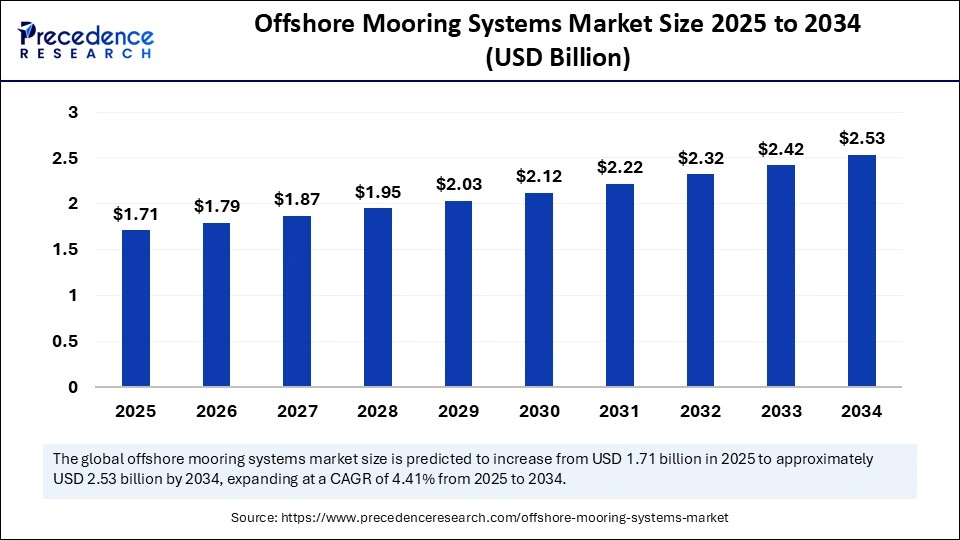

The global offshore mooring systems market size is calculated at USD 1.71 billion in 2025 and is predicted to increase from USD 1.79 billion in 2026 to approximately USD 2.53 billion by 2034, expanding at a CAGR of 4.41% from 2025 to 2034. The offshore mooring systems industry stands as a pivotal backbone of the global offshore energy infrastructure, anchoring platforms that harness the power of the ocean. With increasing offshore exploration and renewable energy ventures, these systems from the invisible yet indispensable link between technology and the tumultuous seas.

Market Highlights

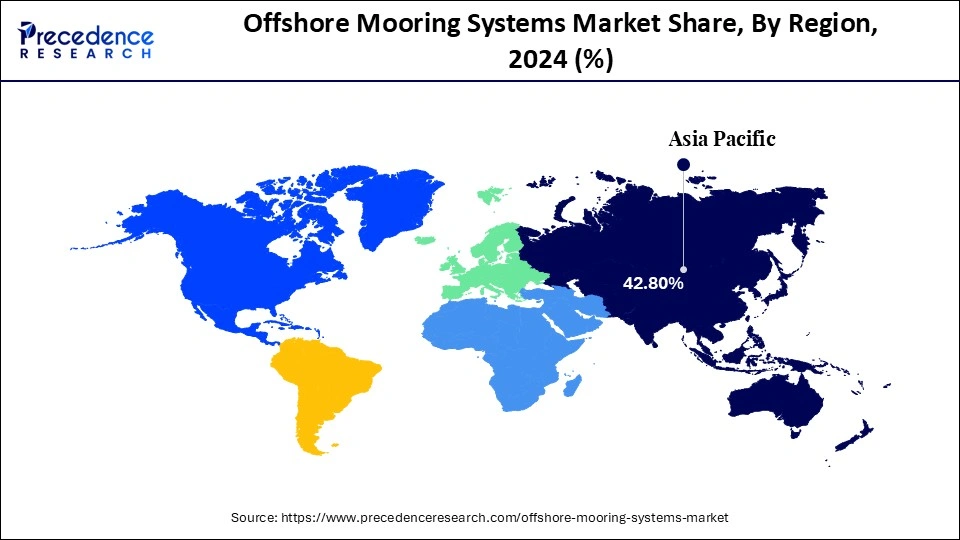

- North America dominated the market, holding largest market share of 42.8% in the year 2024.

- Asia Pacific is expected to expand at the fastest CAGR of 5.2% between 2025 and 2034.

- By mooring type, the spread mooring segment held the largest market share of 43.4% in 2024. 2024.

- By mooring type, single-point mooring is expected to grow at a CAGR of 5.0% between 2025 and 2034.

- By component, the anchors segment contributed the highest market share of 40.4% in 2024.

- By component, the chains segment is growing at a CAGR of 5.2% between 2025 and 2034.

- By anchorage type, the drag embedment anchors segment recorded the biggest market share of 48.4% in 2024.

- By anchorage type, suction anchors segment is growing at a CAGR of 5.3% CAGR between 2025 and 2034.

- By application, the floating production storage and offloading segment generated the highest market share of 36.5% in 2024.

- By application, floating platforms segment is expanding at a CAGR of 5.4% between 2025 and 2034.

- By end-user industry, the oil & gas segment contributed the highest market share pf 45.4% in 2024.

- By end-user industry, renewable energy segment is poised to grow at a CAGR of 5.6% between 2025 and 2034.

Market Size and Forecast

- Market Size in 2025: USD 1.71 Billion

- Market Size in 2026: USD 1.79 Billion

- Forecasted Market Size by 2034: USD 2.53 Billion

- CAGR (2025-2034): 4.41%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What are Offshore Mooring Systems?

The offshore mooring systems market involves equipment and technologies used to anchor floating offshore structures such as FPSOs, drilling rigs, and floating wind platforms to the seabed. These systems include mooring lines, anchors, and connectors designed to withstand harsh marine environments. Market growth is driven by increasing offshore oil & gas exploration, the rise of floating production units, and the rapid expansion of offshore renewable energy, especially floating wind farms, which demand advanced, durable, and cost-efficient mooring solutions.

Market growth has been propelled by the expanding offshore oil, gas, and renewable energy projects that demand robust and adaptable mooring solutions. The increasing exploration in deeper waters and harsher marine environments necessitates advanced mooring configurations capable of ensuring safety and stability.

Moreover, the transition towards floating wind farms has infused the market with fresh dynamism and sustainability-driven momentum. Technological advancement in synthetic materials and automated monitoring systems is redefining durability and performance standards. Companies are focusing on modular and cost-efficient mooring structures that reduce installation time and environmental footprint. As nations race to decarbonize energy generation, offshore mooring systems have emerged as a silent yet crucial enabler of the marine energy revolution.

Offshore Mooring Systems Market Outlook

- Industry Growth Overview: The industry's trajectory mirrors the broader momentum of offshore industrialization. Expanding floating production, storage, and offloading installations and wind farm deployments continue to accelerate demand. Strategic collaborations between energy corporations and engineering firms are streamlining mooring design and deployment cycles.

- Sustainability Trends:Sustainability has become the market's guiding principle. Manufacturers are embracing eco-sensitive design approaches that minimize seabed disturbance and utilize recyclable materials. Offshore wind energy expansion has catalyzed innovation in mooring design, ensuring longevity with minimal ecological disruption. Furthermore, life-cycle assessments and carbon footprint reduction strategies are shaping material choices and maintenance protocols across their sector.

- Major investors: Leading investors include global energy conglomerates, marine technology funds, and renewable infrastructure developers. They are channeling capital into research and next-generation mooring designs compatible with floating wind and wave energy platforms. This investment wave underscores a shared vision for resilient, adaptable, and sustainable marine engineering solutions.

- Startup Economy: the startup ecosystem surrounding offshore mooring technologies is thriving. Young companies are developing smart mooring systems integrated with IoT, AI-based predictive analytics, and lightweight composite materials. These startups are redefining cost structures and accelerating the digital transformation of marine anchoring systems.

Key Technological Shift in the Market

Technological transformation in the offshore mooring market is characterized by a pivot toward automation, digital monitoring, and adaptive anchoring systems. AI-powered condition assessment tools are replacing traditional manual inspections, drastically improving efficiency. Dynamic positioning technologies are being hybridized with advanced mooring lines to enable real-time control in turbulent seas. Material science breakthroughs, particularly in carbon fiber and synthetic rope composites, are enhancing durability without increasing weight. Moreover, the adoption of autonomous underwater vehicles for mooring inspection has revolutionized maintenance paradigms. Together, these shifts mark the dawn of a more intelligent, responsive, and sustainable mooring era.

Market Key Trend

- The rising convergence of sustainability and digitalization defines the sector's new normal.

- Manufacturers are prioritizing intelligent mooring systems with embedded sensors for continuous performance tracking.

- The increasing deployment of floating wind farms is shaping demand for hybrid mooring solutions adaptable to shifting sea states.

Offshore Mooring Systems Market Value Chain Analysis

- Raw material sources: High-strength steel, synthetic polymers, and advanced composites from the bedrock of mooring production. Innovations in corrosion mooring production. Innovation in corrosion-resistant alloys and recyclable materials is improving system longevity and reducing marine pollution.

- Technology Used:AI-enabled monitoring systems, automated deployment vessels, and dynamic tensioning technologies are central to modern mooring operations. Digital twins and simulation platforms facilitate predictive maintenance and structural optimization.

- Investment by investors: Venture capital and sovereign green funds are actively investing in offshore infrastructure startups. This influx of financial momentum is propelling R&D into scalable, cost-effective, and eco-conscious mooring designs.

- AI advancement: Artificial intelligence is optimizing everything from design precision to maintenance scheduling. Predictive algorithms anticipate wear patterns, enhancing safety while minimizing operational interruptions.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.71 Billion |

| Market Size in 2026 | USD 1.79 Billion |

| Market Size by 2034 | USD 2.53 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.41% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Mooring Type,Component,Anchorage Type, Application,End-User Industry and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Kongsberg Maritime vs. Gall Thomson - Offshore Mooring

|

Country |

Company |

Product |

Aim |

|

India |

Kongsberg Maritime |

Innovation Mooring |

A capable solution for offshore construction. |

|

U.K. |

Gall Thomson |

New Automatic Actuation System |

To minimize the risks associated with manual emergency. |

Segment Insights

Mooring Type Insights

Why Is Spread Mooring Dominating the Offshore Mooring Market?

The spread mooring market is dominating the offshore mooring market by holding a share of 43.4%, underscoring its reliability and versatility across diverse marine environments. Spread mooring systems, characterized by multiple anchor lines extending from a floating structure, offer superior stability and load distribution. They are widely favored for their adaptability in both shallow and deep waters, providing robust anchoring solutions for floating production and drilling units. Their capacity to minimize vessel drift and withstand extreme weather conditions further enhances their utility in offshore exploration. As the demand for secure and cost-effective mooring grows, spread mooring continues to be the backbone of offshore stability and operational safety.

Spread mooring's prevalence also stems from its simplicity of design and compatibility with a variety of vessel types, including FPSOs and semi-submersibles. Its cost efficiency compared to turret systems and low maintenance requirements make it a preferred choice for operators balancing safety and economics. With ongoing technological refinement in mooring line materials and monitoring sensors, spread mooring systems are evolving into intelligent anchoring networks. The combination of durability, scalability, and technological integration ensures this segment's continued dominance in the global market.

The single point mooring is the fastest growing in the offshore mooring market, with an expected CAGR of 5%, registering an impressive 5.0% CAGR, driven by its efficiency in offshore loading and unloading operations. These systems, which allow a vessel to weathervane around a single mooring point, offer flexibility and operational ease, particularly in deepwater oil transfer activities. Their growing adoption reflects the industry's shift toward automation and rapid deployment of offshore terminals. SPM systems provide an elegant engineering solution for fluid transfer operations, reducing downtime and ensuring maritime safety.

The increasing focus on efficient crude oil handling and energy logistics has propelled SPM installations across coastal terminals and offshore production zones. Their ability to operate independently from port infrastructure offers both economic and logistical advantages. Enhanced designs now incorporate corrosion-resistant materials and remote monitoring technologies, amplifying durability and performance. As offshore transport and trade routes expand, single-point mooring is poised to anchor the next phase of operational flexibility and innovation.

Component Insights

How Anchors is Dominating the Offshore Mooring Market?

The anchors are dominating the offshore mooring market by holding the share of 40.4%, reflecting their pivotal role as the foundation of every mooring system. These components bear the brunt of marine forces, securing floating assets against wind, wave, and current stresses. Technological advancements in anchor geometry, metallurgy, and load distribution have elevated performance reliability in complex underwater terrains. Their essential function across both oil & gas and renewable energy projects ensures continued market leadership.

Anchors' dominance also stems from the diversity of their applications, from drag embedment to suction and vertical load anchors. Their evolving design enables better penetration, improved holding capacity, and reduced installation costs. Manufacturers are increasingly focusing on sustainable alloys and corrosion-resistant coatings to enhance lifespan. As offshore operations extend into ultra-deep waters, anchor systems remain indispensable, defining the structural integrity and longevity of mooring infrastructures.

The chains are the fastest-growing in the offshore mooring market, holding a share of 5.2%, buoyed by their crucial role in connecting anchors to floating structures with flexibility and strength. The rising demand for durable, high-tensile chains in dynamic offshore environments underscores their importance. Modern chain designs leverage advanced metallurgy and heat-treatment processes, offering greater fatigue resistance and corrosion protection.

As mooring systems transition toward hybrid designs integrating synthetic fibers and steel, chains remain vital in ensuring load balance and operational safety. Their modular configuration allows for easy maintenance and adaptability to variable sea conditions. The growth trajectory of this segment mirrors the industry's pursuit of reliability, longevity, and innovation beneath the ocean surface.

Anchorage Type Insights

Why Drag Embedment Anchors are Leading the Offshore Mooring Market?

Drag embedment anchors dominate the anchorage type segment, commanding 48.4% of the market, primarily due to their proven efficiency and versatility. They are particularly favored for their ability to achieve high holding power with minimal material use, making them cost-effective and environmentally considerate. Their application across FPSOs, drilling rigs, and floating terminals reinforces their indispensability.

Their dominance also lies in the ease of installation and adaptability across varying seabed conditions. Continuous innovations have enhanced drag efficiency and reduced drag length, enabling precise anchorage even in challenging sediments. Their economic appeal, coupled with robust performance metrics, ensures their ongoing prominence in offshore engineering.

Suction anchors are gaining momentum as the fastest-growing segment, expanding at a 5.3% CAGR, driven by their high load capacity and minimal seabed disturbance. These anchors are particularly suited for deepwater applications where traditional anchoring systems struggle. The combination of superior vertical load resistance and reduced environmental impact makes them a preferred choice for modern floating systems.

Technological advancements in suction pile design, including pressure monitoring and composite material usage, are enhancing efficiency and precision during deployment. Their rising integration into renewable energy installations, particularly floating wind platforms, signals a future dominated by intelligent and eco-conscious anchoring methods.

Application Insights

How is Floating Production Storage and Offloading (FPSO) Commanding the Offshore Mooring Market?

The FPSO application segment leads the market with a commanding 36.5% share, symbolizing the synergy between offshore exploration and mooring technology. FPSOs rely heavily on stable and robust mooring systems to ensure uninterrupted hydrocarbon production, storage, and transfer. The increasing number of FPSO installations worldwide underscores the vital role mooring systems play in ensuring operational continuity and maritime safety.

This dominance also arises from FPSOs' unique ability to operate independently of seabed pipelines, necessitating highly secure mooring designs. Innovations in turret and spread mooring systems have enhanced FPSO adaptability across varying water depths. With offshore oilfield redevelopment projects gaining momentum, the FPSO segment continues to anchor the offshore mooring industry's long-term growth narrative.

Floating platforms are emerging as the fastest-growing segment, recording a 5.4% CAGR, fueled by expanding offshore renewable energy ventures and deep-sea research initiatives. These platforms require dynamic mooring systems capable of adjusting to shifting oceanic conditions while maintaining positional stability.

The rise in offshore aquaculture and wave energy projects further accentuates demand for adaptive mooring technologies. Floating platforms, integrated with AI-based control systems and modular mooring lines, epitomize the future of flexible marine engineering. Their growth trajectory is not merely industrial; it represents a paradigm shift toward sustainable utilization of oceanic resources.

End-User Industry Insights

How Oil & Gas is Dominating the Offshore Mooring Market?

The oil and gas sector continues to dominate the offshore mooring systems market, holding a 45.4% share, owing to the sector's long-standing reliance on marine exploration and extraction. The proliferation of deepwater drilling operations and subsea developments necessitates high-performance mooring structures. As global energy demand remains robust, mooring systems remain central to ensuring safety and continuity in offshore production.

The segment's dominance is further fortified by heavy investments in floating rigs, FPSOs, and offshore terminals. Technological evolution, especially the integration of monitoring sensors and remote diagnostics, has enhanced reliability. Despite a gradual shift toward renewable energy, oil and gas projects remain the market's cornerstone, sustaining demand for precision-engineered mooring solutions.

Renewable energy emerges as the fastest-growing end-user segment, expanding at a 5.6% CAGR, driven by the surging adoption of offshore wind and wave energy projects. The global transition toward decarbonization has catapulted floating wind platforms and tidal energy systems into the limelight, requiring advanced mooring technologies.

This growth is further amplified by governmental policies promoting green energy infrastructure. The use of lightweight, recyclable mooring components and AI-driven monitoring platforms aligns with the renewable sector's ethos of sustainability and innovation. As nations harness the winds and waves for energy, renewable end-users are redefining the offshore mooring industry's future with a vision anchored in ecological harmony.

Regional Insights

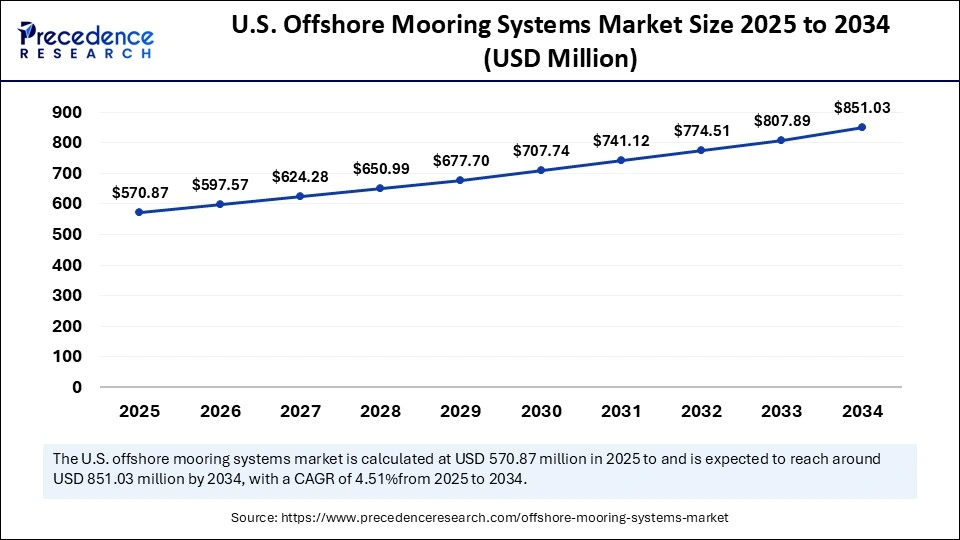

U.S. Offshore Mooring Systems Market Size and Growth 2025 to 2034

The U.S. offshore mooring systems market size is exhibited at USD 570.87 million in 2025 and is projected to be worth around USD 851.03 million by 2034, growing at a CAGR of 4.51% from 2025 to 2034.

Can North America be the undisputed maritime vanguard?

North America is dominating the offshore mooring system market by holding a share of 42.8%, driven by robust energy exploration initiatives and well-established marine infrastructure. The region's deepwater oilfields and expanding offshore wind projects sustain its leadership. Continuous innovation in smart anchoring systems and automated tension management further reinforces its dominance. Stringent regulatory frameworks ensure high safety and environmental compliance standards. The convergence of digital engineering and renewable integration has made North America the crucible of offshore technological excellence.

Will the U.S. continue steering the Offshore Revolution?

U.S. continues to spreadheads North America, boasting a strong nexus between academic marine technology and industrial investment. Federal incentives for offshore wind projects are driving demand for advanced mooring technologies. The Gulf of Mexico remains a testing ground for deepwater innovations, while Atlantic coastlines host the next wave of floating energy infrastructure. The country's holistic approach, melding sustainability, safety, and sophistication, cements its maritime supremacy.

Why is Asia Pacific Known as the Fastest Surging Nation in the Offshore Mooring Systems Market?

Asia Pacific is the fastest-growing in the nation in the offshore mooring systems market by holding a share of 5.2%, buoyed by coastal industrialization and renewable energy ambitions. Expanding offshore oil fields and new wind installations across China, Japan, and South Korea underpin this growth. The region's governments are investing heavily in clean marine technologies, fueling innovation across the mooring ecosystem. Partnerships between local engineering firms and international investors are catalyzing technological diffusion. Asia-Pacific's growth narrative is not just industrial, it's transformative, redefining how nations harness their blue economies.

China: Can the Dragon Dominate the Blue Frontier?

China leads the regional charge with aggressive offshore wind deployment and strategic deep-sea exploration programs. State-backed funding and advanced shipbuilding capabilities empower the nation's engineering edge. As the government intensifies its renewable energy commitments, demand for sophisticated mooring architectures continues to soar. China's integration of AI, automation, and indigenous innovation in marine systems signals its ascension as a global powerhouse in offshore technology.

How Europe is a Resilient Innovator in the Offshore Mooring Systems Market?

Europe is notably growing in the offshore mooring systems industry, propelled by stringent sustainability regulations and pioneering renewable initiatives. The North Sea remains a focal point for wind energy development, driving innovation in hybrid mooring designs. The region's emphasis on reducing carbon intensity has led to the creation of eco-engineered anchors and recyclable mooring lines. Collaborative R&D among EU nations fosters design standardization and accelerates green innovation.

Norway: Will the Nordic Seas Remain Europe's Innovation Bedrock?

Norway exemplifies Europe's balanced approach between traditional energy expertise and renewable foresight. Its extensive experience in offshore oil exploration has seamlessly transitioned into offshore wind innovation. Supported by strong policy frameworks and technological excellence, Norway continues to redefine sustainable marine engineering.

Top Offshore Mooring Systems Market Companies

- SBM Offshore N.V.: SBM Offshore is a global leader in offshore mooring and floating production systems, specializing in the design, supply, and installation of turret mooring and spread mooring systems. The company's expertise in floating production storage and offloading (FPSO) units enables reliable deepwater oil and gas production. SBM's focus on modular designs and renewable energy mooring solutions supports its leadership in sustainable offshore development.

- MODEC, Inc.: MODEC provides comprehensive offshore mooring and floating production solutions, including single-point mooring (SPM) and turret systems for FPSOs and FSOs. The company's advanced mooring technologies ensure stability and safety in deepwater and ultra-deepwater environments. MODEC's engineering capabilities and long-term partnerships with major oil companies reinforce its position in the global offshore energy market.

- BW Offshore Limited: BW Offshore specializes in floating production and mooring systems, offering engineering, procurement, and installation (EPCI) services for FPSO and mooring integration. Its extensive offshore experience enables customized solutions for both shallow and deepwater applications. BW Offshore is also expanding into renewable energy mooring technologies, particularly for floating wind platforms.

- NOV Inc.: NOV delivers advanced mooring components and systems, including chains, connectors, winches, and anchor handling equipment. Its solutions are widely used in offshore drilling, production, and floating platform stabilization. NOV's integrated approach to mooring and rig equipment enhances operational reliability and efficiency.

- Mampaey Offshore Industries: Mampaey designs and manufactures heavy-duty mooring, berthing, and offshore handling systems for oil, gas, and renewable installations. The company's equipment ensures safe mooring operations under dynamic offshore conditions, combining precision engineering with high durability.

- Delmar Systems, Inc.: Delmar Systems is a leading provider of offshore mooring and anchoring solutions, specializing in temporary and permanent mooring design and installation. Its patented RAR Plus technology enables quick and safe mooring release operations in deepwater projects.

- InterMoor Inc.: InterMoor, a subsidiary of Acteon Group, offers complete mooring services, including design, installation, maintenance, and decommissioning. The company's global footprint and experience with dynamic positioning systems make it a trusted partner for offshore operators.

- Bluewater Energy Services B.V.: Bluewater provides innovative mooring and fluid transfer systems, including turret mooring systems for FPSOs and CALM buoys. Its focus on reliability and low-maintenance designs makes it a key player in deepwater oil and gas infrastructure.

- Trelleborg Marine & Infrastructure: Trelleborg supplies engineered polymer-based solutions for mooring, anchoring, and offshore load transfer. Its products enhance safety, efficiency, and environmental performance in mooring operations for both oil and gas and renewable energy sectors.

- Saipem S.p.A.:Saipem delivers offshore engineering and construction services, including integrated mooring and subsea infrastructure installation. Its expertise in deepwater projects and floating production support systems underpins its strong global presence.

- TechnipFMC plc: TechnipFMC provides turnkey offshore mooring and subsea production systems, combining engineering excellence with innovative technology. Its integrated approach enables optimized floating platform performance in challenging marine environments.

- Offspring International Limited: Offspring International designs and supplies mooring and offloading systems for FPSO, FSO, and SPM terminals. Its mooring hawser and chain solutions ensure high reliability and compliance with international safety standards.

- Cavotec SA: Cavotec develops automated mooring and shore connection systems for offshore and port applications. Its innovative vacuum and hydraulic systems enhance safety and reduce manual intervention in mooring operations.

- RigNet, Inc.: RigNet provides digital connectivity and data management solutions for offshore installations, supporting remote monitoring and operational control of mooring systems. Its AI and cloud-based platforms improve communication and asset performance.

- Vryhof Anchors B.V.: Vryhof Anchors specializes in the design and supply of offshore anchoring and mooring equipment, including drag anchors and chain systems. The company's products are widely used in oil, gas, and renewable offshore installations for secure and stable anchoring.

Recent Developments

- In October 2025, China successfully completed the assembly of the world's largest single-unit floating offshore wind power system, marking a major stride in its pursuit of marine economic growth and renewable energy advancement. The 16-megawatt floating installation, assembled in Beihai within the Guangxi Zhuang Autonomous Region of southern China, signifies the nation's increasing commitment to clean energy innovation and offshore technological excellence, according to a report by Science and Technology Daily on Wednesday.

- In October 2025, Technology innovator Gazelle Wind Power partnered with Chinese manufacturing giant Titan Wind Energy to advance the large-scale industrialization of its pioneering floating wind platform. The design merges the stability of a tension leg platform with the hydrodynamic efficiency of a spar structure, aiming to deliver a next-generation solution that substantially reduces the cost of floating wind energy production. (Source: https://www.rechargenews.com)

Segments Covered in the Report

By Mooring Type

- Spread Mooring

- Single Point Mooring

- Dynamic Positioning

- Catenary Mooring

- Taut Leg Mooring

By Component

- Anchors

- Chains

- Connectors

- Polyester Ropes

- Buoys

By Anchorage Type

- Drag Embedment Anchors

- Suction Anchors

- Vertical Load Anchors

By Application

- Floating Production Storage And Offloading (FPSO)

- Floating Platforms

- Semi-Submersibles

- Spar Platforms

- TLP (Tension Leg Platforms)

- Floating Wind Turbines

By End-User Industry

- Oil & Gas

- Renewable Energy

- Marine & Defense

- Others

By Region

- North America (US, Canada)

- Europe (EU, UK, Rest)

- Asia-Pacific (China, Japan, South Korea, Australia)

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting