Subsea and Offshore Services Market Size and Forecast 2025 to 2034

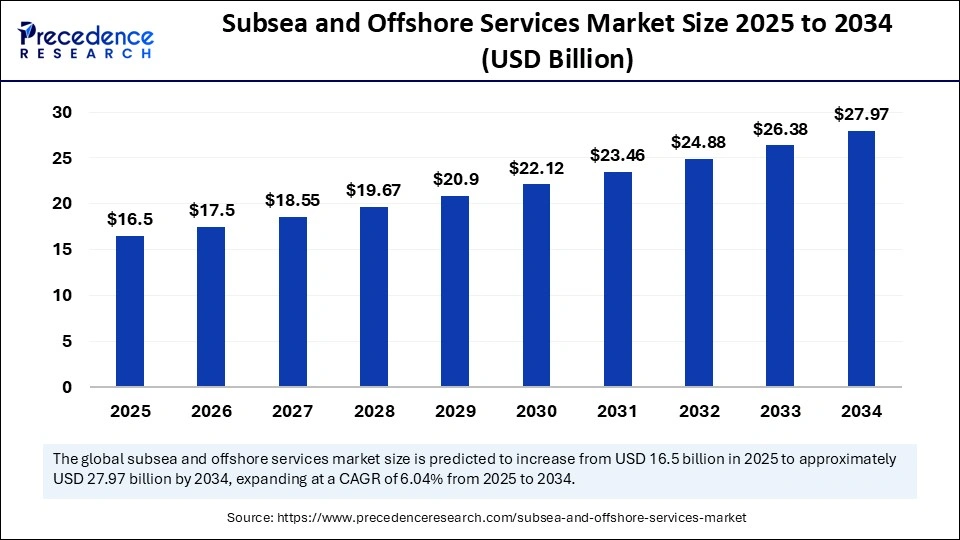

The global subsea and offshore services market size was calculated at USD 15.56 billion in 2024 and is predicted to increase from USD 16.50 billion in 2025 to approximately USD 27.97 billion by 2034, expanding at a CAGR of 6.04% from 2025 to 2034. The global energy demand continues to expand, and offshore exploration and production remain integral to meeting future needs, driving demand for subsea technologies and services.

Subsea and Offshore Services Market Key Takeaways

- In terms of revenue, the global subsea and offshore services market was valued at USD 15.56 billion in 2024.

- It is projected to reach USD 27.97 billion by 2034.

- The market is expected to grow at a CAGR of 6.04% from 2025 to 2034.

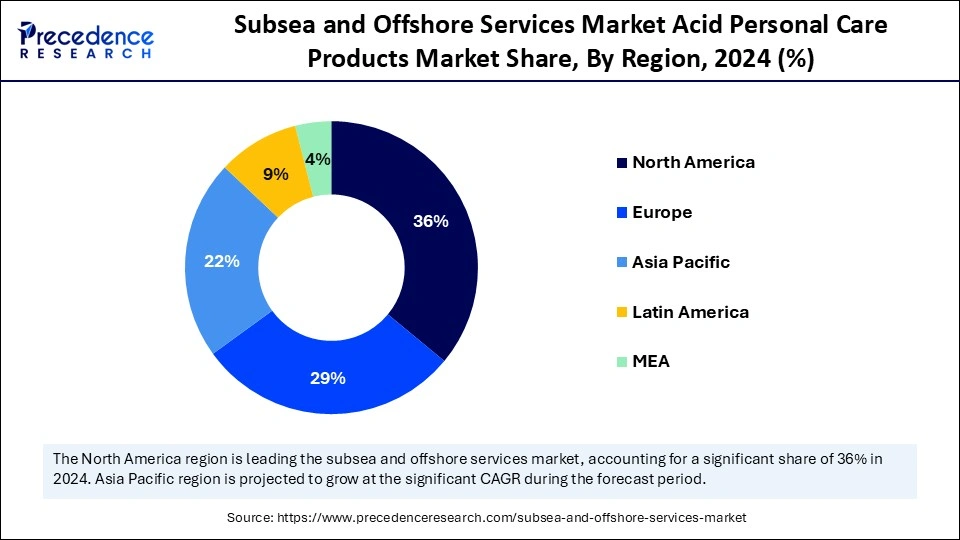

- North America dominated the chemical subsea and offshore services market with the largest market share of 36% in 2024 and is also expected to be the

- fastest-growing region in the upcoming years.

- By service type, the engineering, procurement, construction, installation & commissioning segment held the biggest market share in 2024.

- By service type, the inspection, maintenance, and repair segment is expected to grow at the fastest CAGR during the forecast period.

- By application, the offshore oil & gas segment accounted for a considerable share in 2024.

- By application, the marine infrastructure & utilities segment is projected to experience the highest growth CAGR between 2025 and 2034.

- By water depth/geography type, the shallow water services segment captured the highest market share in 2024.

- By water depth/geography type, the deepwater services segment is set to experience the fastest CAGR of market growth from 2025 to 2034.

How Is AI Transforming the Subsea and Offshore Services Market?

Artificial intelligence is revolutionizing the subsea and offshore services industry by enabling productive maintenance, operational safety, and efficiency. AI-powered analytics allow real-time monitoring of subsea equipment, which helps operators detect potential failures before they occur. Machine learning models are being deployed to optimize drilling operations, subsea robotics, and pipeline inspection, significantly reducing downtime and costs. AI-driven automation is also being used to support remotely operated vehicles and autonomous underwater vehicles, allowing them to perform complex tasks in deepwater without constant human intervention. Furthermore, artificial intelligence supports data-driven decision making by analyzing vast amounts of subsea sensor data, improving resource management, and reducing operational risks. As a result, AI is becoming an essential enabler of smart, resilient, and cost-effective subsea and offshore operations.

U.S. Subsea and Offshore Services Market Size and Growth 2025 to 2034

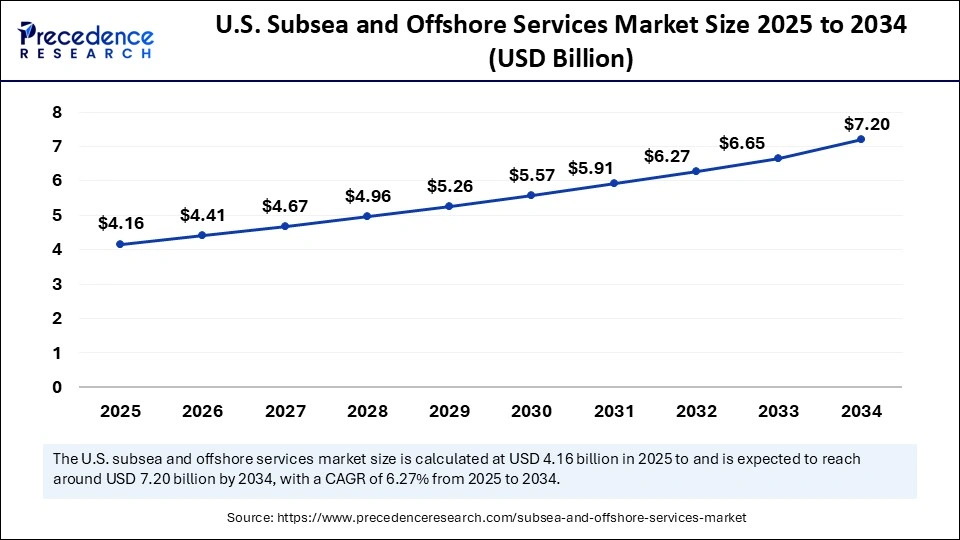

The U.S. subsea and offshore services market size was evaluated at USD 3.92 billion in 2024 and is projected to be worth around USD 7.20 billion by 2034, growing at a CAGR of 6.27% from 2025 to 2034.

Why Is North America Leading the Subsea and Offshore Services Market?

By region, North America held a significant share of the global subsea and offshore services market in 2024 and is anticipated to grow at the fastest rate in the market during the forecast period, following its extensive offshore oil and gas activities, particularly in the Gulf of Mexico. Strong investment in offshore infrastructure and the presence of leading service providers strengthen the region's market position. The U.S. is also a leader in adopting subsea robotics, automation, and artificial intelligence to enhance efficiency and safety in offshore operations. In addition, North America has accelerated investments in offshore wind energy, particularly along the Atlantic coast, expanding the scope of subsea services beyond hydrocarbons. Favourable regulatory frameworks and robust capital availability further reinforce the region's dominance. Together, these factors make North America a hub for innovation and large-scale offshore projects.

Renewable energy initiatives and increased exploration into untapped deepwater reserves. The growing momentum of offshore wind projects is expected to generate substantial demand for subsea construction, cable installation, and inspection services. Furthermore, advancements in automation and AI will allow North American operators to achieve cost savings and efficiency, encouraging higher investments. Government-backed sustainability goals and incentives are also fuelling the rapid development of offshore renewable infrastructure. This dual growth from oil, gas, and renewables positions North America as not just the leading region but also the most dynamic in terms of future expansion.

Market Overview

The subsea and offshore services market encompasses all services related to the installation, operation, maintenance, inspection, repair, decommissioning, and support of infrastructure, e.g., production platforms, pipelines, umbilicals, subsea trees, tie-backs, offshore foundations, both near-shore and deepwater, and subsea environments. This includes engineering, procurement, construction, commissioning, inspection, maintenance, repair (IMR), decommissioning (EPCIC/M), diving services, remotely operated and autonomous underwater vehicle services, subsea intervention, geophysical/geotechnical surveying, subsea construction support, and logistics and project management specifically for offshore and subsea oil & gas, offshore wind, and marine energy sectors.

The subsea offshore services industry is undergoing steady growth as offshore exploration activities expand across deepwater and ultra-deepwater regions. Increasing investments in offshore energy, particularly wind farms, are creating opportunities for service providers. The need for efficient subsea infrastructure installation, inspection, and repair has driven technological advancement in remote monitoring and automation. Additionally, the growing complexity of offshore projects has boosted demand for integrated service providers capable of managing end-to-end operations. Market expansion is also supported by government initiatives to enhance offshore energy security and reduce dependency on onshore reserves. Despite obstacles to growth such as high costs and environmental concerns, the subsea and offshore services industry continues to progress as a cornerstone of global energy infrastructure.

Market Key Trends

- Expansion of deepwater and ultra-deepwater exploration projects, especially pertaining to oil and natural gas mining.

- Growing adoption of subsea robotics and autonomous systems.

- Rising investments in offshore renewable energy, especially wind power.

- Integration of digital twin and AI for predictive maintenance and monitoring.

- Increased demand for environmentally sustainable offshore solutions.

- Growth in subsea tieback projects to maximize existing field productivity.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 27.97 Billion |

| Market Size in 2025 | USD 16.50 Billion |

| Market Size in 2024 | USD 15.56 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.04% |

| Dominating Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, Application / End-Use Sector,Water Depth / Geography Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Fueling the Depths: Energy Security and Exploration Needs

The subsea and offshore services market is primarily influenced by its rising global energy demand, pushing operators to explore and develop offshore resources, especially for oil and natural gas. With onshore reserves maturing, deepwater and ultra-deepwater projects are gaining prominence, fueling demand for specialized subsea engineering and construction services. Offshore wind energy expansion also serves as a powerful driver, aligning with global sustainability goals while diversifying energy portfolios. Governments and energy companies are increasingly investing in offshore projects to enhance energy security and reduce reliance on imports. The technical expertise required for subsea providers is indispensable as partners in global energy development. Together, these factors are propelling consistent growth in the subsea and offshore service industry.

Opportunity

Unlocking Potential Beneath the Waves

The opportunities in the subsea and offshore services market are associated with both oil and gas as well as renewable projects. Offshore wind farms, especially in Europe and North America, are creating demand for subsea cable laying, inspection, and maintenance services. In addition, digitalization opens new opportunities for service providers to differentiate through advanced data analytics, AI-enabled monitoring, and integrated offshore asset management. Emerging regions with untapped offshore reserves also present significant opportunities for market expansion. As sustainability becomes a central theme, companies focusing on low-emission subsea technologies and eco-friendly practices will benefit from favorable partnerships and funding. Collectively, these opportunities create a dynamic growth environment for both established players and new entrants.

Restraint

High Costs and Harsh Realities

One of the major restraints of the subsea and offshore services sector is the high capital and operational expenditure involved in offshore projects. Harsh marine environments make installation and maintenance costly and technically challenging, often requiring highly specialized equipment and skilled labor. Environmental risks, including oil spills and habitat disruption, lead to stringent regulations, which can delay or increase project costs. Additionally, price volatility in crude oil directly impacts offshore investment, making the market highly cyclical. The complexity of logistics and supply chain disruptions further constrains smooth offshore operations. These challenges together slow down adoption and expansion, particularly in regions with weaker financial or technological infrastructure.

Service Type Insights

Why Did Engineering, Procurement, Construction, Installation & Commissioning Dominate in the Year 2024?

The engineering, procurement, construction, installation & commissioning segment led the market subsea and offshore services market, in view of the services the sector is providing, especially with the end-to-end approach that extends all the way to the project execution. These services ensure seamless coordination from the initial design phase to final commissioning, making them an indispensable model that reduces project risk and enhances accountability, appealing to oil and gas operations. Engineering, procurement, construction, installation, and commissioning contracts are favoured for their cost efficiency and ability to streamline logistics in remote marine environments. The high demand for large-scale offshore oil, gas, and renewable projects continues to drive this sector as the leading service type. This dominance is further supported by global operators' preferences for single-point responsibility contracts that ensure timely and safe delivery.

The sector for subsea and offshore services also benefits from the growing offshore wind sector, where comprehensive installation and commissioning services are required for turbines, cables, and substations. With offshore projects becoming larger and technically more demanding, EPCIC providers are leveraging advanced technologies and digital project management to stay competitive. Their role extends beyond traditional oil and gas into emerging renewable sectors, broadening the growth potential. Governments and investors favor EPCIC partnerships due to their ability to deliver complex infrastructure under strict timelines. This makes EPCIC not only dominant but also a stable pillar of the subsea and offshore services market.

The inspection, maintenance, and repair functions are set to be the fastest-growing in the subsea and offshore services sector during the forecast period, due to operators increasingly prioritizing asset integrity and long-term performance. Offshore facilities, once installed, require continuous monitoring and servicing due to harsh marine conditions that accelerate wear and tear. IMR ensures safety, compliance with regulations, and uninterrupted production, making it a critical element of offshore operations. The rising use of remotely operated vehicles and autonomous underwater vehicles has accelerated the efficiency of inspection, maintenance, and repair services. Additionally, as offshore assets age, demand for specialized repair and life-extension services continues to expand. These factors collectively position IMR as the fastest-growing service type.

The growth of IMR is also fueled by sustainability considerations, as well-maintained infrastructure minimizes environmental risks such as leaks or spills. Operators are increasingly adopting AI-driven predictive maintenance to reduce downtime and optimize repair schedules. This digital transformation in IMR enhances precision while lowering operational costs, making it attractive to both oil and gas as well as renewable operators. As offshore projects expand globally, IMR service providers are scaling operations to meet diverse regional demands. The combination of technology adoption, regulatory pressure, and asset longevity ensures robust growth for this segment.

Application / End-Use Sector Insights

How Offshore Oil & Gas is Dominating the Subsea and Offshore Services Market?

The offshore oil & gassegment maintained a leading position in the subsea and offshore services market in 2024 owing to large-scale deepwater exploration and production projects rely heavily on subsea infrastructure, EPCIC, and IMR services to ensure efficiency and safety. Mature onshore reserves are pushing energy companies to expand into offshore basins, strengthening oil and gas as the leading application. Subsea tieback projects, which connect new wells to existing infrastructure, further drive demand for specialized offshore services. The scale and complexity of offshore oil and gas operations continue to sustain their dominant share in the subsea and offshore services market. Strong financial backing from global oil majors ensures continuous activity in this segment.

Even with the transition to renewable energy, offshore oil and gas remain vital due to their central role in meeting global energy needs. National oil companies and private operators alike are investing in ultra-deepwater projects, where advanced subsea services are indispensable. The demand for maintenance and life extension of existing offshore fields also supports the oil and gas application segment. Additionally, innovations in subsea processing and digital monitoring have boosted operational efficiency, reinforcing the importance of this sector. While diversification into renewables grows, offshore oil and gas will continue to dominate as the backbone of subsea services for decades to come.

The marine infrastructure & utilities segment is projected to expand rapidly in the market in the coming years for the subsea and offshore services sector, because the construction and maintenance of offshore renewable energy projects is accelerating worldwide. The construction and maintenance of offshore wind farms, subsea power cables, and marine utility networks are driving substantial growth in this segment. Governments across Europe, North America, and the Asia Pacific are investing heavily in offshore wind energy generation projects as part of their decarbonization goals. Subsea services are critical for laying, protecting, and inspecting the extensive cable networks that connect offshore energy to onshore grids. This rapid growth in renewable-related projects positions marine infrastructure as the fastest-growing application.

The expansion of desalination plants, undersea pipelines, and intercontinental power transmission links also contributes to the growth of this segment. Service providers are increasingly diversifying into renewable and utility projects to capitalize on this momentum. Inspection, maintenance, and repair services are especially crucial in marine infrastructure, ensuring the reliability of cables and turbines exposed to harsh oceanic environments. As offshore renewable energy capacity scales up, so does the demand for specialized subsea services. This shift highlights a long-term structural opportunity for the subsea market beyond hydrocarbons.

Water Depth / Geography Type Insights

Why Did the Shallow Water Services Segment Lead the Subsea and Offshore Services Market in 2024?

The shallow water services segment registered its dominance over the subsea and offshore services industry in 2024, resulting from the relatively lower costs and technical requirements compared to deepwater projects. These projects are easier to access, involve reduced risk, and are well-suited for smaller operators. Historically, shallow water regions such as the North Sea, the Gulf of Mexico, and Southeast Asia have driven significant activity, reinforcing their dominance. Shallow water services also benefit from stable production levels and shorter project timelines. The reduced need for advanced technologies compared to deepwater projects makes shallow water an attractive option for cost-conscious investors. As a result, shallow water continues to hold a significant share of subsea services manufacturing.

Moreover, shallow water plays remain important for both oil and gas as well as renewable projects, such as nearshore wind farms. With mature fields requiring regular IMR services, shallow water provides a steady, recurring demand for service providers. Governments in developing regions often prioritize shallow water exploration due to its cost-effectiveness and faster return on investment. Although deepwater expansion is increasing, shallow water remains critical for maintaining supply stability in global energy markets. This balance between affordability, accessibility, and ongoing demand cements shallow water as the dominant water depth segment.

The deepwater services are the fastest-growing in the subsea and offshore services sector. As a result, these projects are characterized by high complexity and the need for advanced subsea engineering, robotics, and installation services. While deepwater projects are capital-intensive, they often yield higher reserves, making them attractive for long-term energy security. Regions such as Brazil, West Africa, and the Gulf of Mexico are witnessing significant growth in deepwater exploration. This surge is driving demand for EPCIC, IMR, and subsea robotics tailored to extreme depths. As technology advances, deepwater operations are becoming more viable and economically sustainable.

The application of AI, digital twins, and predictive analytics is also accelerating deepwater adoption by improving efficiency and reducing risks. Service providers specializing in deepwater are expanding their capabilities to address the technical and environmental challenges of extreme ocean depths. Growing investment from both international oil majors and national oil companies further supports the expansion of this segment. At the same time, deepwater is compared to mature shallow waters. This positions deepwater services as the fastest-growing and most dynamic segment of the subsea and offshore services market.

Subsea and Offshore Services Market – Value Chain Analysis

- Infrastructure Development Projects

The infrastructure development includes key components such as deepwater and ultra-deepwater exploration, renewable energy projects, and the need for decommissioning aging infrastructure.

- Warehousing and Inventory Management

The warehousing and inventory management in the infrastructure development includes the strategic oversight and practical control of materials used in underwater and offshore oil and gas operations. This includes optimizing storage, tracking, and distribution of equipment and supplies to ensure efficient and cost-effective operations while minimizing risks and maximizing safety.

Subsea and Offshore Services Market Companies

- DeepOcean

- Sembcorp

- Keppel Corporation

- PT.Offshore Services Indonesia (OSI)

- Marine B.V

- ITC Global

- SBSS

- Hobeck Offshore Services

- Acteon

- Island Offshore

- SeaZip

- Goliath Offshore Services Limited

- Astro Offshore

- Havila Shipping

- EMAR Offshore Services BV

- Kreuz Subsea

- Zamil Offshore

- Rawabi Vallianz Offshore Services (RVOS)

- GulfMark

- Northe Offshore Services

- MMA Offshore

- Makamin Offshore Saudi Ltd

- Bourbon Offshore

- Calpac Maritime Services Ltd.

- Jan De Nul Group

Recent Developments

- In August 2025, Helix Energy Solutions Group, a US-based offshore energy services provides, signed a contract to deliver production enhancement and well abandonment services in the Gulf of Mexico starting in 2026. The agreement outlines a minimum vessel utilization commitment over a three-year period. The project will leverage either the company's riser-based well intervention vessel equipped with a 10K or 15K intervention riser system, along with remotely operated vehicles, while also incorporating project management and engineering support services.(Source: https://finance.yahoo.com)

- In April 2025, Mermaid Maritime Public Company Limited, a Thailand-based subsea and offshore drilling services company, announced the purchase of four work-class remotely operated vehicles from Argus Remote Systems, a Norway-based enterprise. The total cost of acquisition was approximately €11 million, to be paid in stages and funded through Mermaid's cash reserves and credit facilities. Delivery is scheduled for the third quarter of this year.

Segments Covered in the Report

By Service Type

- Engineering, Procurement, Construction, Installation & Commissioning (EPCIC)

- Survey & Feasibility

- Detailed Engineering

- Procurement & Fabrication

- Installation & Commissioning

- Inspection, Maintenance, And Repair (IMR)

- Inspection (CCTV/visual, NDT, metrology)

- Preventive Maintenance

- Corrective Repair

- Integrity Management

- Subsea Intervention & Remediation

- ROV-based Intervention

- AUV-based Intervention

- Intervention Tooling & Modules

- Diving & Manned Intervention

- Air Diving

- Mixed Gas Diving

- Saturation Diving

- Survey Services

- Geophysical Survey (Seismic)

- Geotechnical Survey (Cores, Sampling)

- Environmental & Metocean Survey

- Subsea Construction Support

- Trenching & Pipelay Support

- Foundation & Anchor Installation Assistance

- Cable-Lay Support

- Logistics & Project Management

- Marine Logistics & Support Vessels

- Project Management & Consultancy

- Decommissioning Services

- Plugging & Abandonment Support

- Platform Removal Support

- Subsea Equipment Recovery

- Subsea Power & Umbilical Services

- Umbilical Installation & Maintenance

- Subsea Power System Services

By Application / End-Use Sector

- Offshore Oil & Gas

- Exploration

- Development

- Production

- Decommissioning

- Offshore Renewable Energy

- Offshore Wind

- Tidal / Wave Energy

- Marine Infrastructure & Utilities

- Subsea Telecoms & Data Cables

- Offshore Pipelines (Oil, Gas, COâ‚‚)

- Subsea Power Cables

By Water Depth / Geography Type

- Shallow Water Services (0–200 m)

- Mid-Water Services (200–1,000 m)

- Deepwater Services (> 1,000 m)

By Region

- North America

- Latin America & Caribbean

- Europe

- Middle East & Africa

- Asia Pacific

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting