What is the Operational Audit Software Market Size?

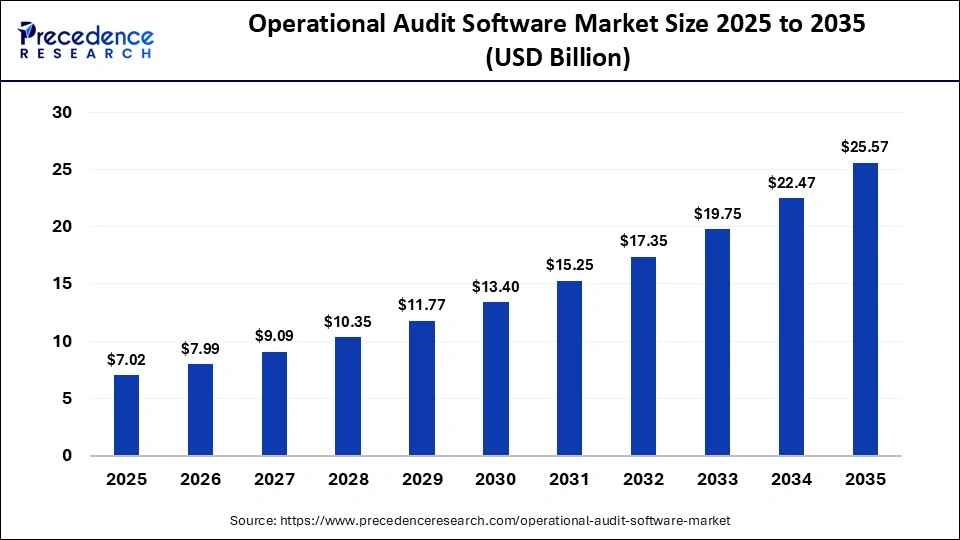

The global operational audit software market size was calculated at USD 7.02 billion in 2025 and is predicted to increase from USD 7.99 billion in 2026 to approximately USD 25.57 billion by 2035, expanding at a CAGR of 13.80% from 2026 to 2035. The market growth is attributed to rising demand for real-time operational insights, automated risk and compliance management, and AI-enabled audit analytics across enterprises.

Market Highlights

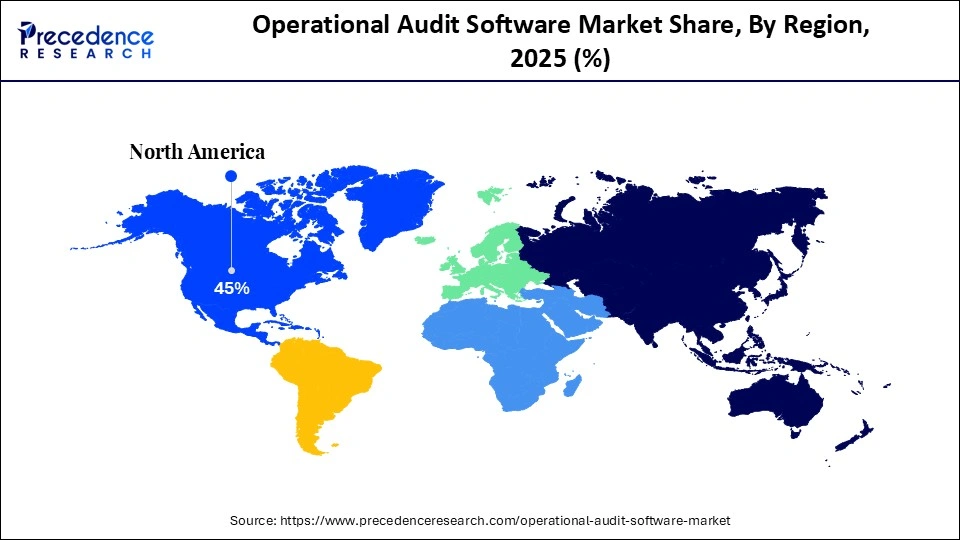

- North America dominated the market with a share of approximately 45% in 2025.

- Asia-Pacific is expected to grow at the fastest CAGR of 15.4% between 2026 and 2035.

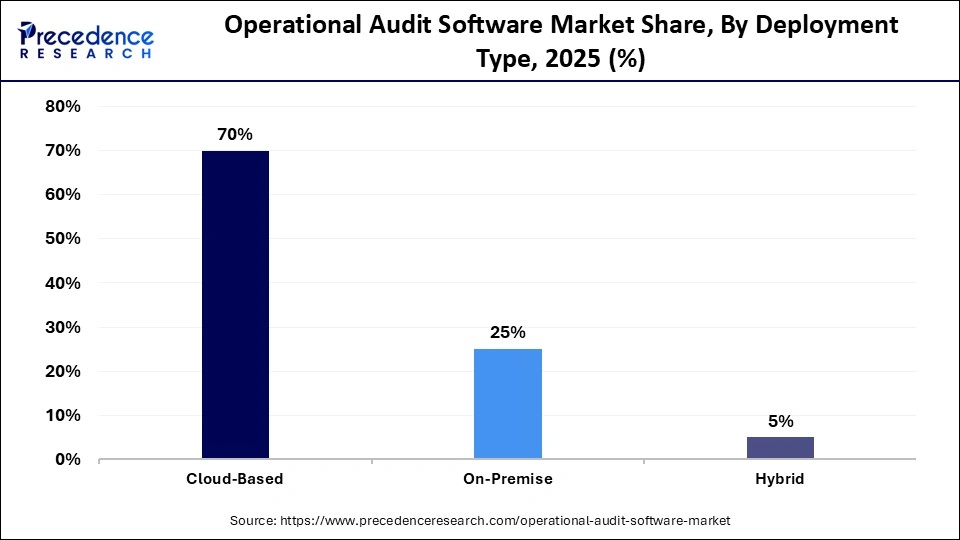

- By deployment type, the cloud-based segment contributed the highest operational audit software market share of approximately 70% in 2025.

- By deployment type, the on-premise segment is expected to grow at a strong CAGR of 13.3% between 2026 and 2035.

- By end-user/industry, the healthcare segment held a major market share of approximately 30% in 2025.

- By end-user/industry, the manufacturing segment is expected to expand at the fastest CAGR of 14% from 2026 to 2035.

- By functionality, the risk management segment captured the highest market share of approximately 35% in 2025.

- By functionality, the compliance management segment is poised to grow at a healthy CAGR of 13.5% between 2026 and 2035.

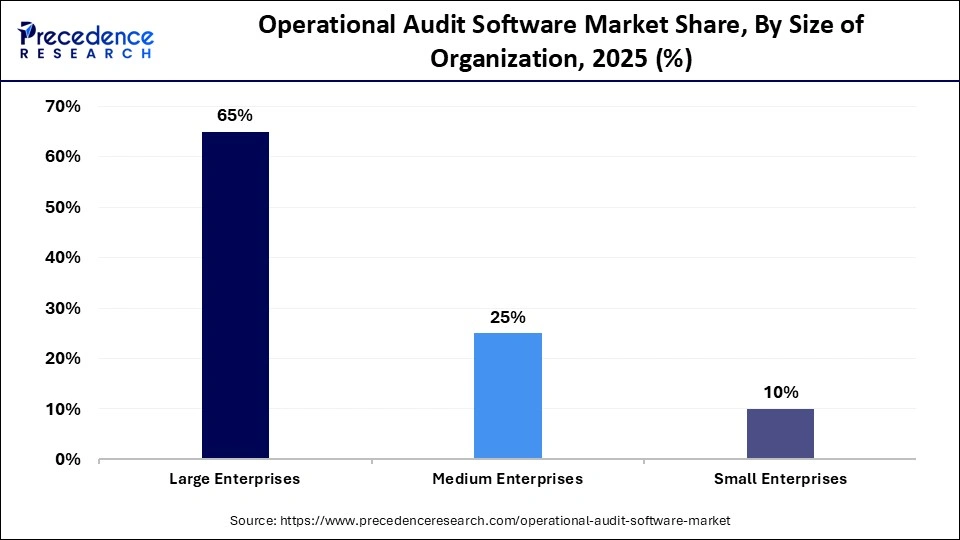

- By size of organization, the large enterprises segment generated the biggest market share of approximately 65% in 2025.

- By size of organization, the small enterprises segment is expected to expand at the fastest CAGR of 13.7% between 2026 and 2035.

What is Operational Audit Software?

The operational audit software market is driven by the rapid integration of artificial intelligence (AI) and advanced analytics into audit functions. Organizations are being driven towards technology-based assurance models by the implementation of the IIA Global Internal Audit Standards. According to Vision 2035 research from the IIA, 97% of audit practitioners expect technology to increase the complexity and volume of data available for auditing, while 93% believe technology will allow better insight generation. Furthermore, this is pushing organizations to invest in software that can process and analyze complex operational information.

Impact of AI on the Operational Audit Software Market

The market is changing with the reshaping of AI that facilitates enhanced, more intelligent, and continuous audit processes in businesses. AI-based audit systems process large amounts of operational and transactional data in real time. This enables audit teams to identify operational anomalies, control gaps, and process inefficiencies early. Additionally, advanced analytics help maintain continuous auditing with controls being monitored on a continuous basis as opposed to periodic reviews.

Market Trends

- Embedded Audit Capabilities within Core Business Applications: There have been growing operational audit tools directly embedded within ERP, EHS, and procurement systems. Enterprises favor in-workflow auditing due to reduced friction between operations and assurance teams. Such a trend reduces the issue remedial timescales and enhances the adoption of the audit at the process-owner level.

- Low-Code Audit Configuration for Business-Led Assurance: Low-code audit platforms have become popular as business units structure audit processes with these platforms. Enterprises enable decentralized audit design due to faster operational change cycles. The trend makes it less reliant on IT teams and increases the scope of audit over business functions.

- Operational Audit Software Market Growth Factors: Rising Adoption of Remote Workforce Audits: Growing reliance on distributed teams is propelling the demand for audit software that enables real-time monitoring and control across remote operations.

- Demand for Real-Time Operational Dashboards: Boosting decision-making capabilities, enterprises increasingly rely on audit tools that provide continuous visibility into key operational metrics.

- Expansion of Multi-Jurisdictional Audit Capabilities: Propelling cross-border operational oversight, audit platforms support global enterprises in managing diverse regulatory environments efficiently.

Rising Momentum of Intelligent Automation and Digital Transformation Across the Market

- In a global survey of internal audit professionals, 39% were already using AI-enabled audit technologies in 2025, and a further 41% planned to adopt such capabilities within the next 12 months, showing escalating adoption of advanced audit software across enterprises of all sizes.

- Gartner's 2026 audit technology survey found that 83% of audit departments are either piloting or actively using AI and data analytics tools within their audit workflows, which typically correlates with broader operational audit software deployment in mid-to-large organizations.

- Use of AI in internal audit activities has more than doubled recently, increasing from about 15% adoption to approximately 40% of internal audit functions actively applying generative AI and advanced analytics in audit workflows by 2025, reflecting rapid integration of AI-driven tools into audit processes.

- According to The IIA's 2025 Pulse of Internal Audit survey, 71 % of internal audit functions report using audit management or automation software as part of their core audit process, including financial reporting assurance activities, reflecting widespread operational audit tool usage in evaluating financial controls.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 7.02 Billion |

| Market Size in 2026 | USD 7.99 Billion |

| Market Size by 2035 | USD 25.57 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 13.80% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Deployment Type, End-User/Industry, Functionality, Size of Organization, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Deployment Type Insights

Which Deployment Type Segment Dominated the Operational Audit Software Market?

The cloud-based segment dominated the market in 2025, accounting for an estimated 70% market share due to the low initial costs of infrastructure and the fact that the complex on-premise systems were no longer required to be maintained. The cloud audit platform is becoming more popular among businesses in supporting remote audit, centralized data access, and expediting the audit process across geographies. Furthermore, the vendors increased certifications to ISO, SOC, and data residency, and this enhanced enterprise adoption of these technologies.

The on-premise segment is expected to grow at the fastest CAGR in the coming years, as they maintain complete control of sensitive audit and operational data. Legislation of data sovereignty and governments supporting national cybersecurity trends promote the existence of audit data in the internal networks of organizations. On-premise expansion, accompanied by cloud ecosystems, supports hybrid IT strategies. These tendencies make on-premise deployment the quickest growing segment in the imminent years due to security, compliance, and control concerns.

End-User/Industry Insights

Why Did the Healthcare Segment Dominate the Operational Audit Software Market?

The healthcare segment held the largest revenue share of approximately 30% in the market in 2025, due to increased regulatory controls and complicated operational settings. Regulations, including the HIPAA and GDPR facilitates the rising rate and intensity of internal audits, promoting the use of organized audit platforms by healthcare providers. Additionally, the use of audit software by hospitals, payers, and life sciences organizations increased with a high level of compliance required by patient safety, data privacy, and accuracy of the reimbursement.

The manufacturing segment is expected to show the fastest growth over the forecast period, owing to the accelerating digital transformation and operational complexity. Greater automation, intelligent factory implementations, and global supply chains are increasing the number of audit programs implemented by manufacturers. They create substantial amounts of operational data that need systematic audit control. Moreover, the industry 4.0 initiatives drove demand for analytics-enabled audit platforms that integrate ML and continuous auditing capabilities in the manufacturing segment.

Functionality Insights

How the Risk Management Segment Dominated the Market?

The risk management segment accounted for the highest revenue share of approximately 35% in the operational audit software market in 2025, as a result of the growing enterprise risk exposure and the increasing governance expectations. The growing volatility of operations in all supply chains, information technology systems, and third-party ecosystems enables organizations to weigh risk-based audit modules. Furthermore, the segment dominance also strengthened owing to the integration of enterprise risk management and internal audit functions

The compliance management segment is expected to expand rapidly in the market with a CAGR of 13.5% in the coming years, owing to the growing complexity and intensity of regulations. Regulatory examinations increased in scope and frequency, driving demand for structured compliance tracking and automated compliance mapping. These drivers accelerate the adoption of compliance-focused audit platforms. Moreover, the industry bodies such as IEEE, NIST, and AICPA published updated guidance in 2025 that reinforced technology-enabled compliance evaluation as a professional best practice, further driving functional growth.

Size of Organization Insights

Which Size of Organization Led the Operational Audit Software Market?

The large enterprises segment led the market with a share of approximately 65% in 2025, due to complex operating models and heightened governance expectations. The increase in the volume of data produced by ERP, cloud, and digital activities encourages investments in new analytics and continuous audit tools by enterprises. Furthermore, the need to have real-time dashboards and to track issues pushed the adoption of advanced audit technologies in this sector.

The small enterprises segment is expected to witness the fastest growth in the market with a CAGR of 13.7% over the forecast period, owing to the growing regulatory exposure and expansion of digital business. The use of audit software has increased in smaller organizations due to rising audit scrutiny by regulators, customers, and partners. The use of cloud-first strategies facilitates adoption, reducing upfront expenses and ease of implementation. Additionally, these drivers position small enterprises as the fastest-growing segment in the coming years, owing to rising accountability and operational scale.

Regional Insights

How Big is the North America Operational Audit Software Market Size?

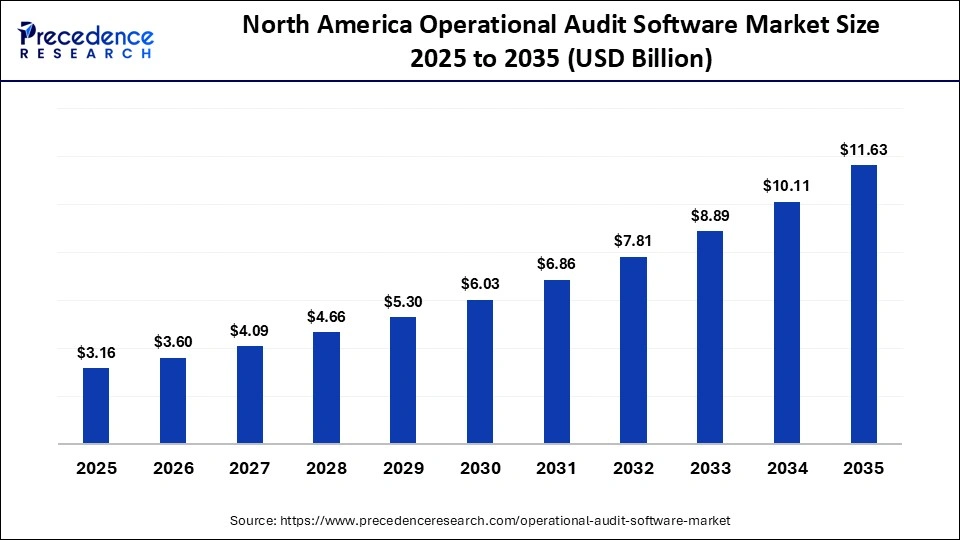

The North America operational audit software market size is estimated at USD 3.16 billion in 2025 and is projected to reach approximately USD 11.63 billion by 2035, with a 13.92% CAGR from 2026 to 2035.

Why Did North America Lead the Operational Audit Software Market?

North America led the market, capturing the largest revenue share of approximately 45% in 2025, due to mature governance frameworks and strong regulatory oversight. In 2025, the Institute of Internal Auditors (IIA) reiterated that 75% of the large organizations in the U.S.

They have fully implemented institutional audit functions in line with COSO-based internal control systems in support of the continued need to have structured audit platforms. Furthermore, the complexity of technology also increased the rate of adoption since North American enterprises had substantial ERP, cloud, and analytics penetration.

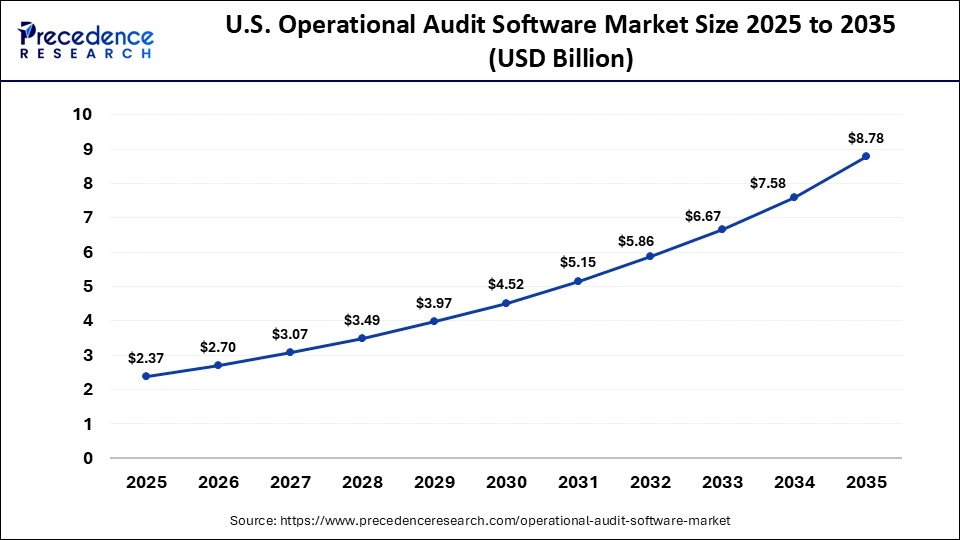

What is the Size of the U.S. Operational Audit Software Market?

The U.S. operational audit software market size is calculated at USD 2.37 billion in 2025 and is expected to reach nearly USD 8.78 billion in 2035, accelerating at a strong CAGR of 13.99% between 2026 and 2035.

U.S. Established Leader in Operational Audit Software Adoption

U.S. leads the market in North America, due to stringent regulatory frameworks, advanced digital infrastructure, and deep enterprise governance expectations. Companies in the U.S. began allocating more resources to AI-powered audit tools. This heightened demand for boards and audit committees to obtain real-time insights into the operations of the enterprise.

Why Is Asia Pacific Emerging as the Fastest-Growing Region in the Market?

Asia Pacific is expected to witness the fastest growth with a CAGR of 15.4% in the operational audit software market during the predicted timeframe, owing to the accelerated digitalization process and growing regulatory frameworks among the emerging and developed economies. The adoption of audit software also increased with the growing scale of operations, cross-border supply chains, and regional data localization regulations by enterprises. Additionally, further integration with the global value chains and multinational clients led local organizations to increase internal audit coverage.

India High-Growth Market for Operational Audit Software Expansion

India is leading the charge in the Asia-Pacific region, owing to the heightened regulatory provisions, high-speed digitalization, and the growth of enterprise functions. Indian banks invested significantly in compliance and audit technology, reflecting a strong shift toward automated audit and risk management systems across BFSI and non-bank sectors. Furthermore, the increase in digitalisation of business operations and the increase in demands for well-organized risk and compliance monitoring led to growth in the utilisation of audit platforms.

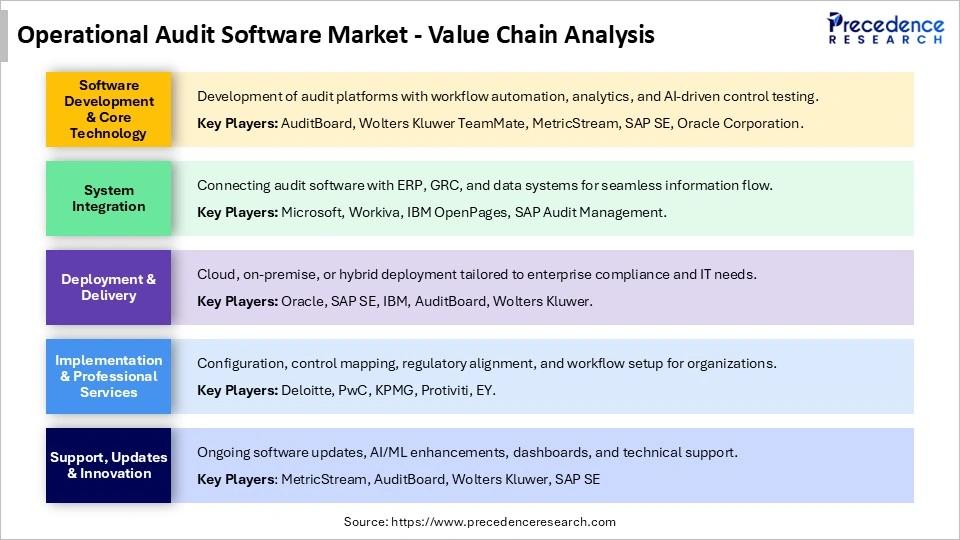

Operational Audit Software Market Value Chain Analysis

Who are the Major Players in the Global Operational Audit Software Market?

The major players in the operational audit software market include AuditBoard, CaseWare International, Galvanize (Diligent), IBM Corporation, LogicManager, MetricStream, Microsoft Corporation, Oracle Corporation, Resolver Inc., SAP SE, SAS Institute, ServiceNow, Thomson Reuters, Wolters Kluwer, and Workiva.

Recent Developments

- In October 2025, AuditBoard launched Accelerate, a cutting-edge AI solution enhancing natural-language workflows, continuous auditing, document intelligence, and agentic AI capabilities. Building on its AI-driven platform, AuditBoard empowers global risk teams with connected risk management and real-time operational oversight.(Source: https://www.prnewswire.com)

- In October 2025, Reveleer rolled out its unified RADV Audit SaaS platform for Medicare Advantage plans, streamlining audits from data retrieval to submission. The solution integrates automated enrollee data management, multi-year retrieval, provider attestation, pre-built submission packages, and real-time reporting, reflecting insights from leading health plans.(Source: https://www.reveleer.com)

- In October 2025, Wolters Kluwer enhanced its audit platform, CCH Axcess Audit Suite, with generative and agentic AI, enabling faster engagements, higher accuracy, and improved client value. The expansion addresses rising audit complexity and demand for real-time intelligence in professional services. (Source: https://www.wolterskluwer.com)

- In June 2025, Caseware launched Cloud Audit, a cloud-enabled audit platform aligned with the Institute of Singapore Chartered Accountants (ISCA) methodology. The solution supports audit transformation and compliance with Singapore's regulatory and professional standards, enhancing efficiency and reliability for local audit teams.(Source:https://www.caseware.com)

Segments Covered in the Report

By Deployment Type

- Cloud-Based

- On-Premise

- Hybrid

By End-User/Industry

- Healthcare

- Manufacturing

- Financial Services

- Retail

- Government & Others

By Functionality

- Risk Management

- Compliance Management

- Process Improvement

- Performance Management

By Size of Organization

- Large Enterprises

- Medium Enterprises

- Small Enterprises

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting