Ophthalmic Viscosurgical Devices (OVD) Market Size and Forecast 2025 to 2034

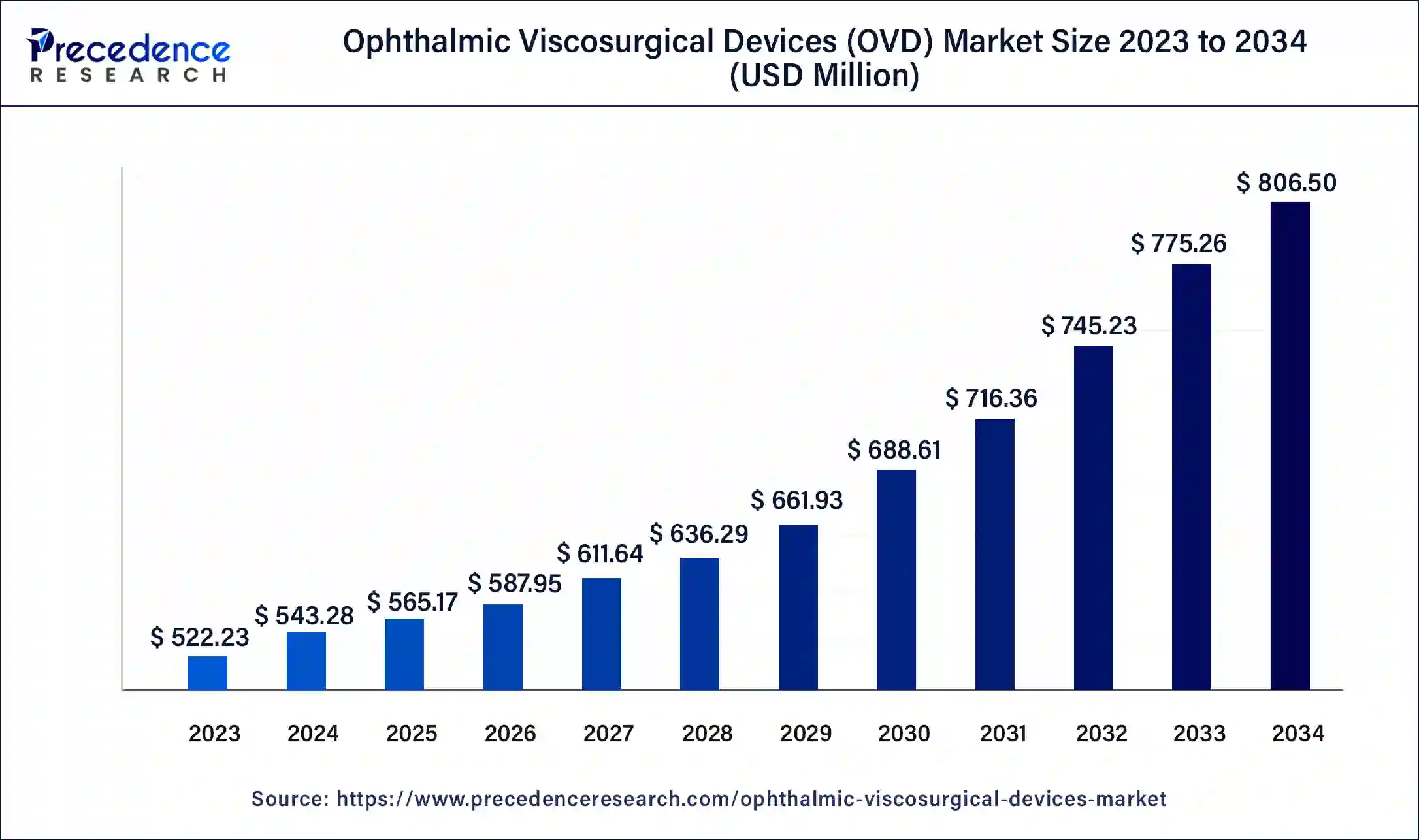

The global ophthalmic viscosurgical devices (OVD) market size was estimated at USD 543.28 million in 2024 and is predicted to increase from USD 565.17 million in 2025 to approximately USD 806.5 million by 2034, expanding at a CAGR of 4.03% from 2025 to 2034. The ophthalmic viscosurgical devices (OVD) market is driven by the advancement of cutting-edge surgical procedures, including advanced vitreoretinal surgery and femtosecond laser cataract surgery, which drives the need for OVDs with specific qualities. To ensure the best possible surgical results, these devices must be specifically designed to fulfill the demands of these specific procedures

Ophthalmic Viscosurgical Devices (OVD) Market Key Takeaways

- In terms of revenue, the global ophthalmic viscosurgical devices (OVD) market was valued at USD 543.28 million in 2024.

- It is projected to reach USD 806.5 million by 2034.

- The market is expected to grow at a CAGR of 4.03% from 2025 to 2034.

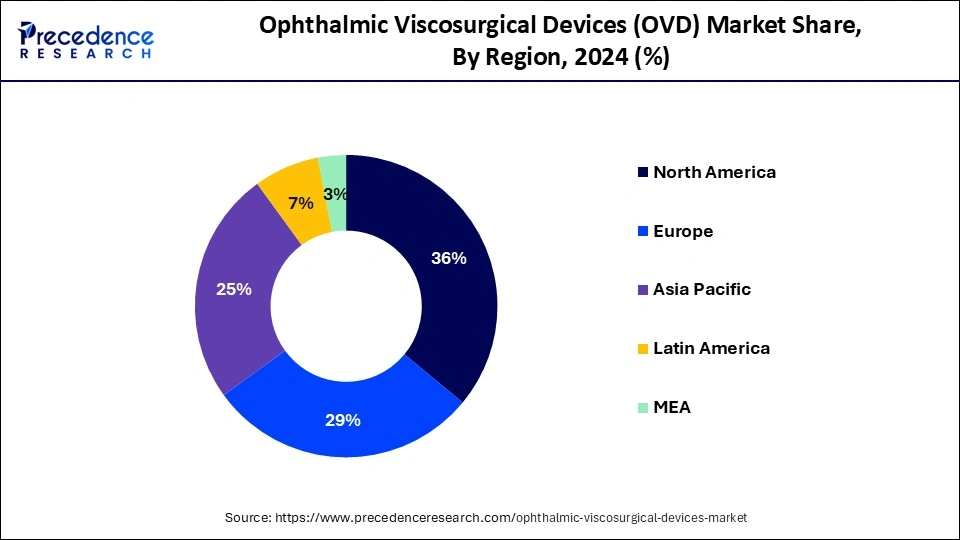

- North America dominated the ophthalmic viscosurgical devices (OVD) market with the largest market share of 36% in 2024.

- Asia- Pacific is observed to be the fastest growing in the ophthalmic viscosurgical devices (OVD) market during the forecast period.

- By type, the dispersive segment contributed the highest market share of 49% in 2024.

- By type, the viscoadaptive segment is observed to be the fastest growing in the ophthalmic viscosurgical devices (OVD) market during the forecast period.

- By source, the animal segment held a significant share in the market in 2024.

- By source, the biological segment shows a notable growth in the ophthalmic viscosurgical devices (OVD) market during the forecast period.

- By application, the cataract surgery segment dominated the market in 2024.

- By application, the glaucoma surgery segment shows a lucrative growth in the ophthalmic viscosurgical devices (OVD) market during the forecast period.

U.S. Ophthalmic Viscosurgical Devices (OVD) Market Size and Growth 2025 to 2034

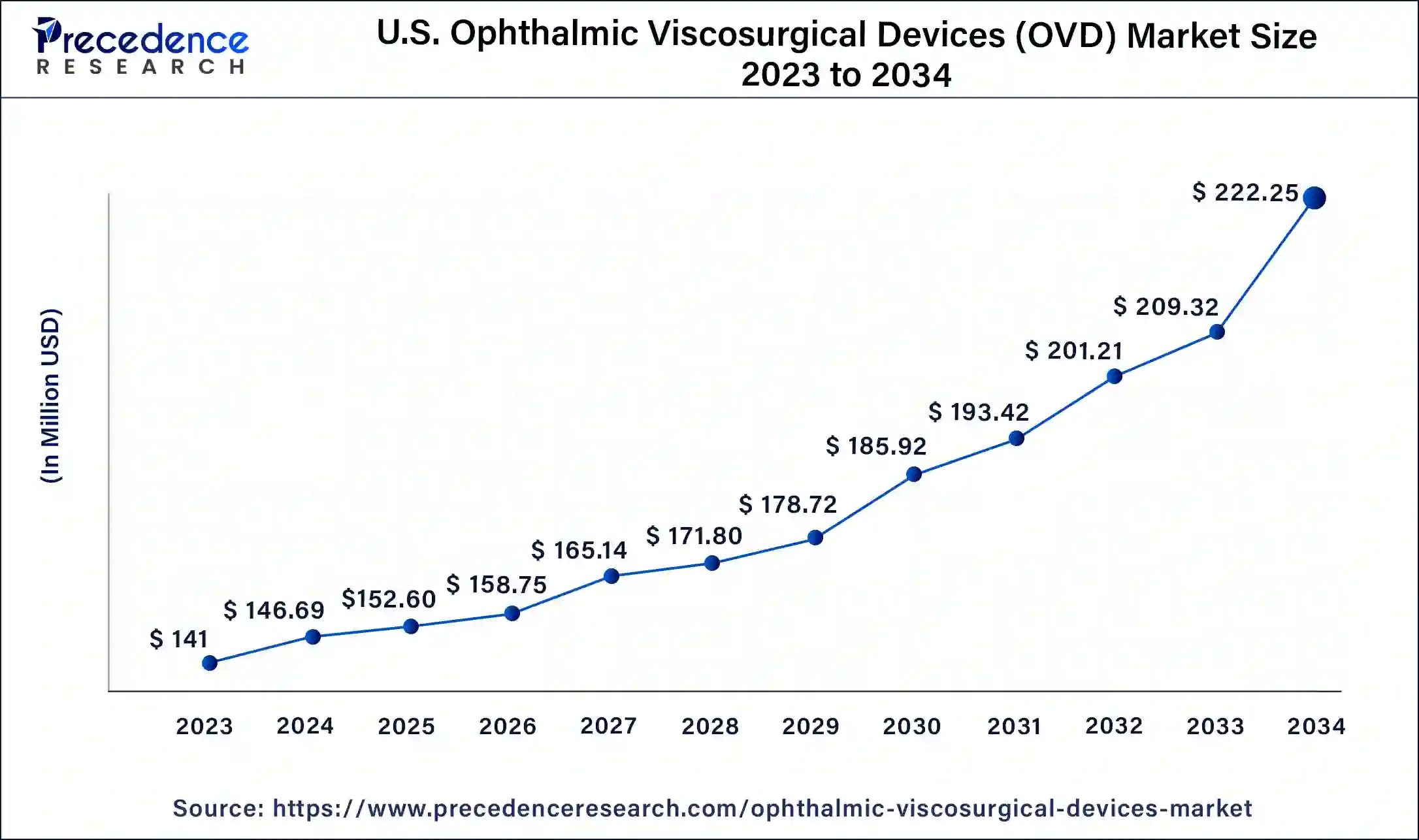

The U.S. ophthalmic viscosurgical devices (OVD) market size was accounted at USD 146.69 million in 2024 and is projected to be worth around USD 222.25 million by 2034, poised to grow at a CAGR of 4.24% from 2025 to 2034.

North America dominated the ophthalmic viscosurgical devices (OVD) market in 2024. The aging population in North America, especially in the United States, makes them increasingly vulnerable to age-related eye diseases likeglaucoma and cataracts. The need for ophthalmic procedures, particularly cataract surgeries, which significantly rely on OVDs, increases with the number of senior people. Medical devices, particularly OVDs, are subject to strict yet well-organized regulatory frameworks from the US Food and Drug Administration (FDA). An OVD product acquires a strong reputation and commercial acceptance after passing these strict standards, which promotes wider adoption.

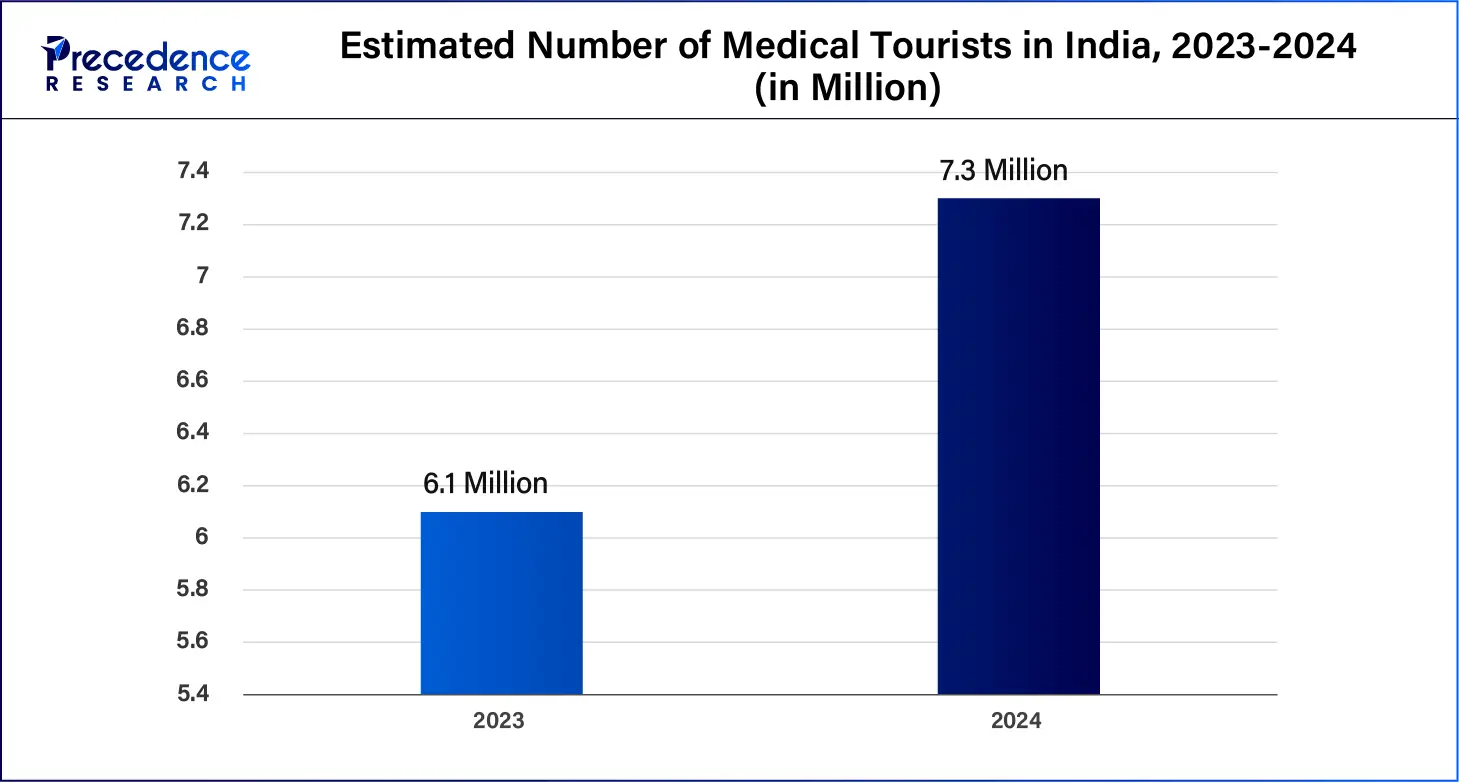

Asia-Pacific is observed to be the fastest growing in the ophthalmic viscosurgical devices (OVD) market during the forecast period. As the healthcare infrastructure improves, an increasing number of specialized ophthalmology services are available. As a result, more surgeries are carried out, which raises the need for OVDs. Asia-Pacific's economy is expanding, which has increased the number of people in the middle class with more disposable money. The demand for OVDs is driven by this demographic's higher propensity to spend on healthcare services, notably surgery related to the eyes.

Medical tourism is increasingly taking place in Thailand, Singapore, and India, especially for ophthalmic operations. The demand for OVDs is rising due to their excellent care and reduced costs compared to Western nations that draw patients from all over the world.

- In Telangana, the state government intends to create a 1,000-acre medical and health tourism center.

- Over the past ten years, Pune's medical scene has undergone a significant transformation. The focus is on developing top-notch healthcare facilities powered by cutting-edge technology. With 58 cadaver contributions in total in 2023, the city has become one of the states' and the nation's top organ donation destinations.

- superior, more reasonably priced care, the newest technologies, and well-known specialists compared to their nation.

- States like Kerala have carved out a niche as ayurveda centers because some seek alternative therapies. At the same time, many travel to Mysore and Rishikesh to study and practice yoga.

Market Overview

Specialized medical devices known as ophthalmic viscosurgical devices (OVDs) are used in ocular surgery to preserve and safeguard the corneal endothelium throughout different procedures. Typically, viscoelastic materials, that is, substances with both viscous and elastic properties, are used to make these devices. When it comes to eye surgeries like intraocular lens (IOL) implantation, corneal transplants, and cataract removals, OVDs are essential. They cushion the eye, aid in maintaining its form, and make it easier to insert and place implants and surgical equipment. OVDs can lower the risk of postoperative problems such as corneal edema or injury by shielding the fragile endothelium and other ocular tissues from mechanical harm during surgery.

- Lower wait times for cutting-edge therapies. Medical tourism is heavily influenced by the allure of privacy, a wide range of care options, government laws that facilitate it, and cultural concerns in many Indian states.

- Our nation's standard of medical care has improved to the point where it is now comparable to, and occasionally better than, that of many other nations. In comparison to its rivals, India offers far more economical medical care.

How AI is helping the ophthalmic viscosurgical devices (OVD) market

It is often acknowledged that ophthalmic surgery is a delicate and intricate microsurgery that calls for extreme precision in the small intraocular space. Artificial intelligence (AI) is very good at obtaining and modeling the large amounts of digital data that are created during surgery. This technological development eventually improves accuracy and efficiency by overcoming physicians' inherent constraints during such treatments. Lastly, AI can anticipate postoperative vision and modify the surgical plan, allowing individualized care and improving surgical accuracy.

Ophthalmic Viscosurgical Devices (OVD) Market Growth Factors

- The need for OVDs, utilized in various ophthalmic treatments, is driven by the rising prevalence of illnesses like cataracts, glaucoma, and retinal diseases.

- Creating biocompatible and long-acting OVDs fosters market expansion, among other innovations in OVD compositions and administration methods.

- The number of people who need eye surgery rises as the world's population ages, which stimulates the market for OVDs.

- The demand for OVDs is driven by the trend toward less invasive eye operations like phacoemulsification.

- Higher disposable income levels stimulate the market for OVD, making elective eye procedures more affordable for more people.

- Access to medical facilities is becoming more convenient, especially in developing nations, leading to a rise in the availability of eye procedures and the corresponding use of OVD.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 806.50 Million |

| Market Size in 2025 | USD 565.17 Million |

| Market Size in 2024 | USD 543.28 Million |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.03% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Source, Application and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Increasing awareness and access to eye care

Education initiatives and public awareness campaigns stress the value of routine eye exams and appropriate eye care. These campaigns frequently emphasize the need for early detection and treatment of eye problems. There is an increasing prevalence of age-related eye disorders that call for surgical procedures as the world's population ages. This demographic trend results from the growing need for OVDs in cataract operations and other ophthalmic treatments.

Expansion of healthcare services

Access to eye care services is improved by the growth of the healthcare infrastructure, which includes the construction of new hospitals, eye clinics, and specialty ophthalmic centers. As more facilities become available, there is an increasing need for improved ophthalmic tools, such as OVDs. Increased worldwide spending on healthcare makes modern ophthalmic surgeries and technology more accessible. Investing in high-quality OVDs becomes increasingly practical as healthcare budgets rise. The demand for OVDs is growing due to increased medical tourism for eye procedures in other nations. Patients seeking dependable and superior ophthalmic solutions who travel overseas for advanced eye treatment also contribute to the market expansion.

Restraints

Lack of awareness or understanding of the benefits of advanced OVDs

Often, patients having eye surgery are unaware of the kinds of OVDs employed in the process or how these devices affect the results. Patients might not request these more sophisticated choices if they are unaware of how advanced OVDs can improve surgical outcomes; instead, the surgeon, who could favor more conventional techniques, will make the final decision. Specialized training is frequently needed to integrate advanced OVDs into clinical practice. Adopting these cutting-edge devices may be hampered by a lack of resources or educational programs explaining their uses and advantages. Surgeons would be reluctant to employ them without sufficient training or proof of the new goods' benefits.

Economic fluctuations and downturns can impact healthcare budgets

Insurance companies and government programs may reduce the reimbursement rates for medical procedures, including those involving OVDs. This may adversely affect healthcare providers' desire to invest in cutting-edge technologies by lowering their revenue. To reduce healthcare expenditures, governments may enact new laws or lower reimbursement rates for medical devices, such as OVDs. Spending on medical devices might be examined more carefully, which could result in stricter approval procedures or greater requests for cost-effectiveness information.

Opportunities

Advances in the formulation of OVDs

As a result of recent advancements, OVDs now exhibit increased stability and viscosity, which enhances their functionality during eye procedures. By preserving a stable anterior chamber, these developments lower the possibility of problems. The usage of OVDs in complex ocular procedures, such as cataract and vitreoretinal surgeries, is growing due to the development of new types of OVDs, such as those with controlled release features or those made for specific surgical demands. Businesses that invest to create and commercialize cutting-edge OVD formulations can differentiate themselves from competitors. Gaining a competitive edge from this will help you attract more clients and increase your market share.

Development of environmentally friendly and biodegradable OVDs

Making biodegradable materials more biocompatible is possible, which could lower the possibility of adverse patient reactions. Additionally, customizing these materials to resemble actual tissues more closely may improve their efficacy during ophthalmic procedures. There is a rising need for eco-friendly and sustainable products in many industries, including healthcare, as customers and regulatory agencies become more aware of environmental challenges.

Type Insights

The dispersive segment dominated the ophthalmic viscosurgical devices (OVD) market in 2024. During surgery, invasive OVDs shield sensitive ocular tissues, like corneal endothelium. They are essential in surgical procedures because they can preserve a protective layer over these structures even when subjected to mechanical stress. Dispersive OVDs help patients achieve a crucial result: quicker recovery from surgery by shielding the corneal endothelium and preserving room in the anterior chamber.

The viscoadaptive segment is observed to be the fastest growing in the ophthalmic viscosurgical devices (OVD) market during the forecast period. Due to their unique rheological characteristics, viscoadaptive OVDs can act as cohesive and dispersive agents. These dual-purpose preserves anterior chamber space while shielding sensitive intraocular tissues, offering enhanced control during eye procedures like cataract operations. Viscoadaptive OVD use has been linked to better surgical outcomes, including fewer postoperative problems and faster patient recovery. The need for these cutting-edge tools is increasing, along with the emphasis on patient outcomes and safety.

Source Insights

The animal segment held a significant share in the ophthalmic viscosurgical devices (OVD) market in 2024. An increase in veterinaryophthalmology treatments can be attributed to the growing emphasis and understanding of animal health. Wealthy pet owners are more likely to spend money on cutting-edge animal medical procedures, such as eye surgery. OVDs have been approved by regulatory organizations in several nations, especially for veterinary usage, guaranteeing their effectiveness and safety during animal operations. This has prompted additional manufacturers to enter the veterinary sector, further accelerating the market's expansion.

The biological segment shows a notable growth in the ophthalmic viscosurgical devices (OVD) market during the forecast period. Ophthalmic procedures are in greater demand due to the rising prevalence of eye-related conditions like diabetic retinopathy, cataracts, and glaucoma. Because of their increased biocompatibility and efficacy, biological OVDs, which are utilized to preserve space in the anterior eye chamber during surgery, are becoming increasingly popular. Diabetes and other chronic illnesses affect a large number of the elderly and can cause problems like diabetic retinopathy. The expansion of the market is partly attributed to biological OVDs, which provide improved management of these disorders during ocular procedures.

Application Insights

The cataract surgery segment dominated the ophthalmic viscosurgical devices (OVD) market in 2024. Most cataract cases are age-related, and as the world's population ages quickly, more people need cataract surgery than ever before. According to estimates from the World Health Organization, cataracts afflict about 20 million people worldwide and account for 51% of all cases of blindness. Several governments and healthcare systems offer cataract surgery subsidies or reimbursements, particularly for older populations. The demand for OVDs has increased as a result of these measures, which have pushed more patients to choose surgery.

- In May 2023, Bausch + Lomb Corp. reported the launch in the U.S. of an ophthalmic viscosurgical device (OVD) designed to protect patients during cataract surgery.

The glaucoma surgery segment shows a lucrative growth in the ophthalmic viscosurgical devices (OVD) market during the forecast period. OVDs are essential instruments for glaucoma surgery. They serve a number of vital purposes, including preserving anterior chamber space, shielding the corneal endothelium, and facilitating the precise and safe manipulation of fragile ocular structures. These are critical functions in glaucoma surgery, where it is critical to manage intraocular pressure and avoid optic nerve injury. The increasing demand for OVDs in glaucoma procedures can be attributed to their capacity to improve surgical outcomes by decreasing the risk of complications and improving the precision of surgical maneuvers.

Ophthalmic Viscosurgical Devices (OVD) Market Companies

- Carl Zeiss Meditec AG

- Alcon AG

- Beaver-Visitec International, Inc.

- Amring Pharmaceutical Inc.

- Rayner Intraocular Lenses Limited

- Bohus Biotech AB

- Johnson & Johnson Services, Inc.

Recent Developments

- In April 2023, Canadian eye health company Bausch + Lomb launched the StableVisc cohesive ophthalmic viscosurgical device (OVD) and the TotalVisc Viscoelastic System in the US. The company stated that StableVisc helps maintain space in the eye's anterior chamber, allowing doctors to remove and replace the clouded natural lens.

Segments Covered in the Report

By Type

- Dispersive

- Cohesive

- Viscoadaptive

By Source

- Animal

- Biological

- Semi-synthetic

By Application

- Cataract Surgery

- Glaucoma Surgery

- Corneal Grafting

- Vitreoretinal Surgery

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting