What is the Opioid Use Disorder Market Size?

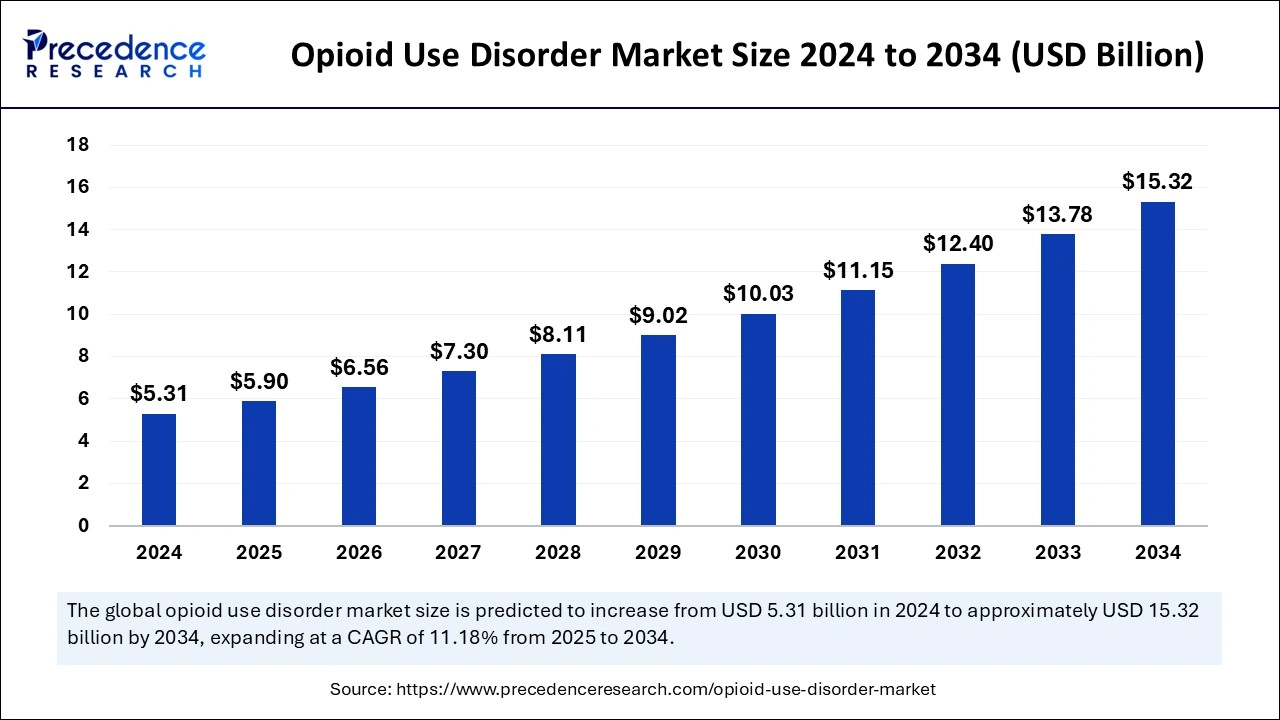

The global opioid use disorder market size is valued at USD 5.90 billion in 2025 and is predicted to increase from USD 6.56 billion in 2026 to approximately USD 15.32 billion by 2034, expanding at a CAGR of 11.18% from 2025 to 2034. The increasing rates of substance use disorders are the key factor driving the market growth. Also, rising government efforts to deal with these disorders, coupled with the increasing awareness of opioid use conditions, can fuel market growth shortly.

Opioid Use Disorder Market Key Takeaways

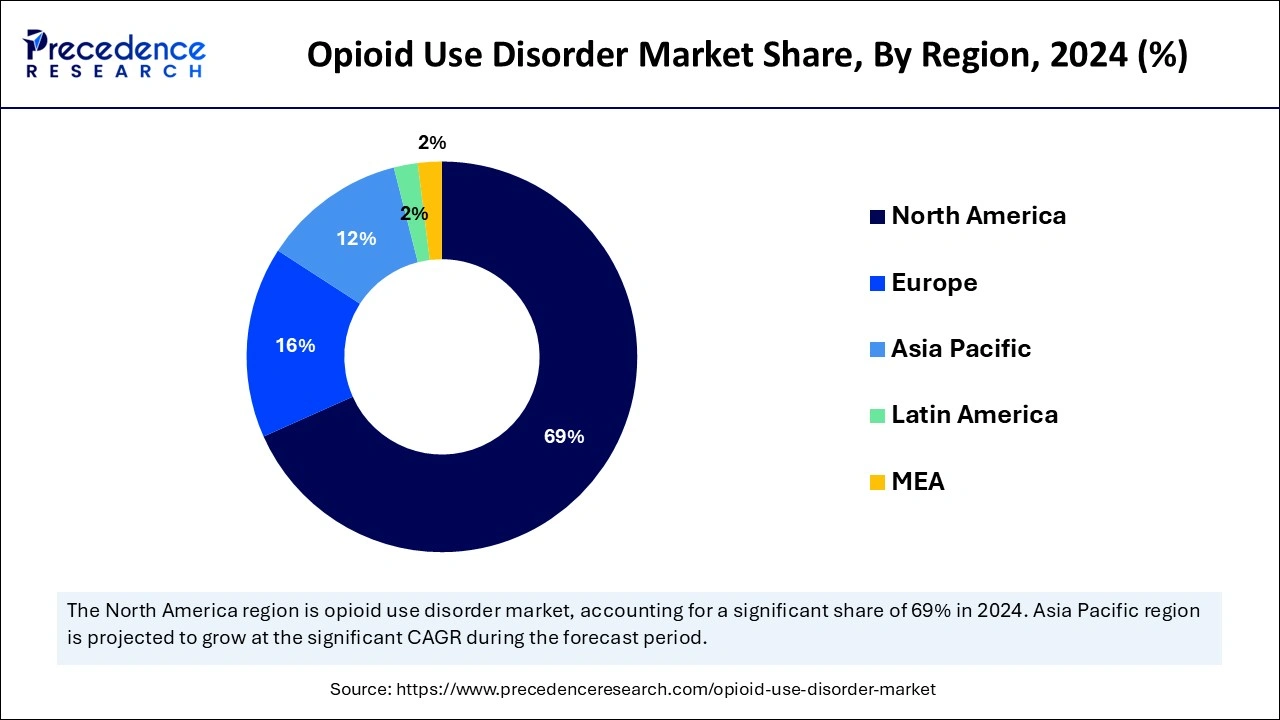

- North America dominated the global opioid use disorder market with the largest share of 69% in 2024.

- Asia Pacific is expected to grow at a double-digit CAGR of 12.5% over the studied period.

- By drug, the buprenorphine segment has held a major market share of 61% in 2024.

- By drug, the naltrexone segment is expected to grow at the fastest CAGR over the forecast period.

- By route of administration, the injectable administration segment accounted for the largest market share of 60% in 2024.

- By route of administration, the oral administration segment is anticipated to grow at the fastest rate over the forecast period.

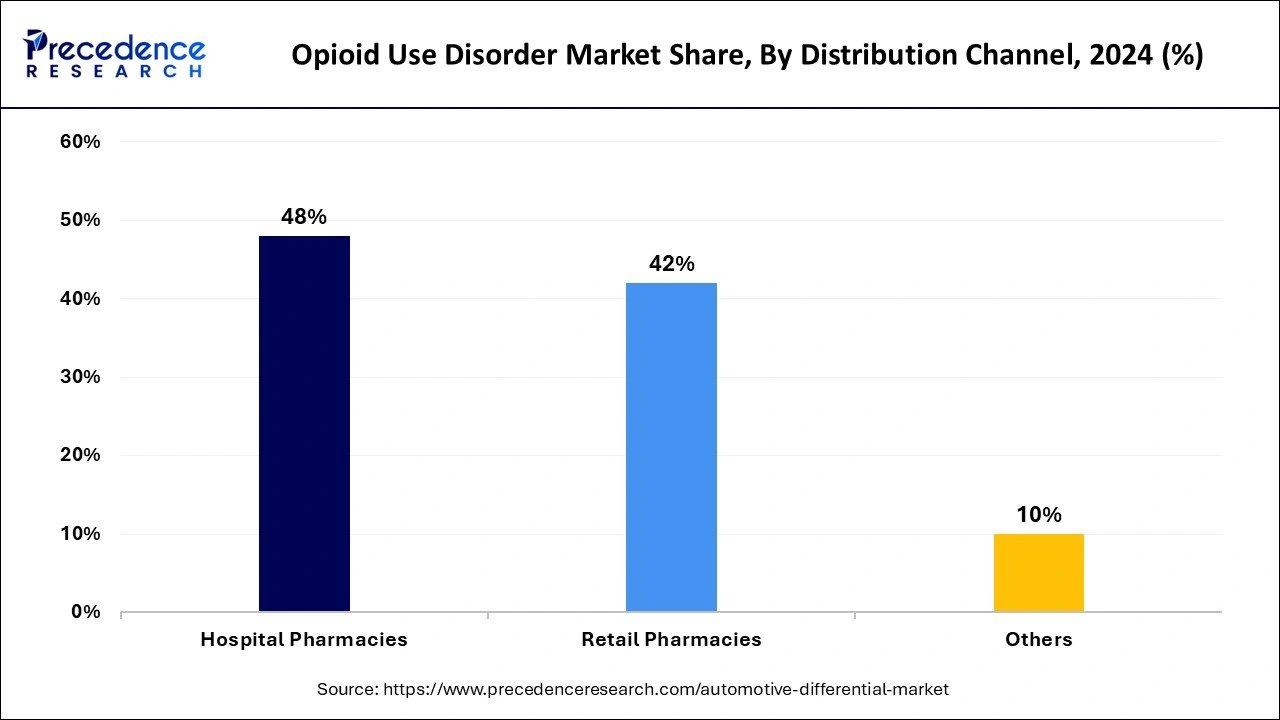

- By distribution channel, the hospital pharmacies segment contributed the highest market share of 48% in 2024.

Market Overview

Opioids are a set of painkillers that contain drugs that reduce pain, relax muscles, and relieve stress. Drugs such as oxycodone, codeine, hydrocodone, methadone, fentanyl, and other pharmaceutical medications are generally prescribed to treat severe or moderate pain. The excessive use of these drugs for pain treatment or any other purposes can lead to an illness called opioid usage disorder (OUD). Opioid drugs are mainly used to treat immediate pain after surgery. This factor can result in driving the opioid use disorder market.

Drug Abuse Statistics 2020

| Substance | First-Time Users |

| Alcohol | 4.9 million |

| Marijuana | 3.1 million |

| Pain killers | 1.9 million |

| Tobacco | 1.8 million |

| Hallucinogens | 1.1 million |

Role of Artificial Intelligence (AI) in Opioid Addiction Management

Artificial Intelligence models can help to detect the highest risk person for opioid addiction and can also implement insightful resources for the opioid use disorder market. This is useful for better management of pain among the population suffering from opioid addiction. Furthermore, GenAI can offer a more holistic approach to forecasting many outcomes based on patterns discovered from wide patient datasets.

- In February 2024, the U.S. General Services Administration (GSA) launched the Applied AI Healthcare Challenge, a prize competition seeking diverse and practical solutions to help federal agencies provide the highest level of medical care. GSA encourages large and small enterprises, women-owned, minority-owned, small disadvantaged, and service-disabled veteran-owned small businesses to participate.

Market Outlook

- Industry Growth Overview: The opioid use disorder market is expanding at a r significant rate from 2025 to 2034, driven by escalating addiction rates, increased awareness of overdoses, and expanded access to medication-assisted treatments, prompting healthcare systems to rapidly scale services and therapeutic solutions. The rising demand for effective treatment solutions, including medication-assisted therapy and counseling services, to combat the growing global opioid crisis also supports the market.

- Global Expansion:There is significant potential for market growth worldwide, as the demand for OUD treatments extends beyond North America into Europe, Asia‑Pacific, and Latin America, driven by increasing regulatory support, improved reimbursement pathways, and expanding infrastructure for addiction care globally.

- Major investors: Leading pharmaceutical and biotech companies such as Indivior PLC, Alkermes plc, and Orexo AB are heavily investing in long‑acting treatments and digital health platforms for OUD, demonstrating a strong commitment of capital to the field.

- Startup Ecosystem: Emerging digital-health ventures like Bicycle Health and virtual care platforms are developing around telemedicine, wearable monitoring, and peer-support models, providing new, scalable options for traditional OUD treatment.

Opioid Use Disorder Market Growth Factors

- An increase in product launches and product approvals for these drugs is expected to boost opioid use disorder market growth soon.

- Growing consideration of buprenorphine patches for providing effective treatment solutions can propel market growth shortly.

- The surge in the adoption of key strategies including acquisition, collaboration, and agreement will likely contribute to the market expansion further.

- Rising utilization of e-prescriptions at hospitals coupled with other healthcare facilities and a surge in internet users.

Market Concentration & Characteristics

The growth of the opioid use disorder market is primarily driven by increasing rates of substance use disorders, coupled with the surge in government initiatives to solve this crisis. Furthermore, recent developments and growing funding allocations by major market players are driving the overall market growth positively soon. The market mainly emphasizes developing comprehensive treatment solutions for opioid use disorder.

Market Scope

| Report Coverage | Details |

| Market Size in 2034 | USD 15.32 Billion |

| Market Size in 2026 | USD 6.56 Billion |

| Market Size in 2025 | USD 5.90 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 11.18% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Drug, Route Of Administration, Distribution Channel, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Market Dynamics

Drivers

Rising admiration for buprenorphine patches

Buprenorphine patches for tackling opioid addiction are increasingly becoming popular, as they are more effective in treating OUD. These patches have benefits such as decreased discomfort and enhanced drug delivery. They are the key choice for current opioid therapy, particularly for individuals who require continuous medications. In addition, the increasing prevalence of disease conditions like heart and cancer disease necessitates frequent use of opioids and other painkillers.

- In February 2024, Acadia Healthcare Company, Inc. announced the acquisition of three opioid treatment program clinics in South Carolina, which provide treatment for people seeking recovery from opioid use disorder. These facilities are the Company's first CTCs in South Carolina and offer care to all patients, including those covered by Medicaid.

Restraint

Side-effects from drug intake

The key factor that might hinder the opioid use disorder market growth is the side effects that can arise from the administration of drugs used for OUD treatment. The general side effects of these drugs are abdominal cramps, vomiting, diarrhea, respiratory complications, and constipation. Moreover, in severe cases of multiple side effects, the patient can also suffer from psychological disorders like anxiety and depression, hampering market growth further.

Opportunity

Rising R&D of novel drugs

The opioid use disorder market is witnessing substantial growth owing to the rising incidence of substance use conditions such as opioid addiction. Hence, the market players are working on developing innovative novel therapies to treat this addiction. These treatment solutions provide benefits over offering fast and strong rises in plasma levels, effectively inhibiting opioid receptors. Furthermore, digital therapeutics such as telecommuting and cognitive behavioral therapy are also gaining traction because of their effectiveness.

- In October 2023, -Netsmart announced the acquisition of Netalytics, a South Carolina-based addiction treatment software and practice management company, dedicated to developing technology for substance use disorder (SUD) providers focused on opioid addiction treatment. This acquisition will further extend the Netsmart CareFabric platform by enabling interoperable data sharing between opioid treatment program (OTP) facilities.

Drug Insights

The buprenorphine segment dominated the global opioid use disorder market in 2024. The dominance of the segment can be attributed to the effectiveness of this drug as a partial opioid agonist; this helps in increasing cravings and withdrawal symptoms while reducing euphoria and other associated risks. Additionally, the combination of naloxone and buprenorphine can deter opioid abuse further. The research also shows that raised buprenorphine doses can improve treatment results, especially in patients using fentanyl.

- In May 2023, the U.S. Food and Drug Administration approved Brixadi (buprenorphine) extended-release injection to treat moderate-to-severe opioid use disorder. The approval was based upon a randomized, double-blind, active-controlled clinical trial in 428 adults with a diagnosis of moderate-to-severe opioid use disorder.

The naltrexone segment is expected to grow at the fastest rate over the forecast period. The growth of the segment can be linked to its numerous benefits. As an opioid antagonist, it efficiently blocks opioid receptors, protecting from relapses by cutting the adverse effects of opioids. In addition, growing awareness and rising insurance coverage will likely fuel its adoption.

- In April 2024, California purchased CalRx Branded Over-the-Counter Naloxone for USD 24. Qualifying organizations in the state, including first responders, universities, and community organizations, can access the state's naloxone supply for free.

Route Of Administration Insights

The injectable administration segment led the global opioid use disorder market in 2024. The dominance of the segment can be credited to the advantages this route of administration provides. The injectable route can be used to deliver medications more rapidly and supplement calories. Furthermore, this route enables the drug to reach the bloodstream rapidly, which results in a quick onset of action. This is essential in controlling opioid withdrawal symptoms and also offers quick pain relief.

The oral administration segment is anticipated to grow at the fastest rate over the forecast period. The growth of the segment is due to the convenience it provides as it is non-invasive. Which in turn increases patient compliance and adherence. Medications like naltrexone and buprenorphine are much easier to manage and administer and require no specialized procedures or equipment. Also, oral medications can be administered at home easily.

Distribution Channel Insights

In 2024, the hospital pharmacies segment held the largest share of the opioid use disorder market. The dominance of the segment can be driven by the ability of hospital pharmacies to monitor and distribute specialized medications, like extended-release drugs and methadone. They also provide a controlled environment where drugs can be taken under stringent supervision, which is important for ensuring safety and adherence, especially for injectables.

Regional Insights

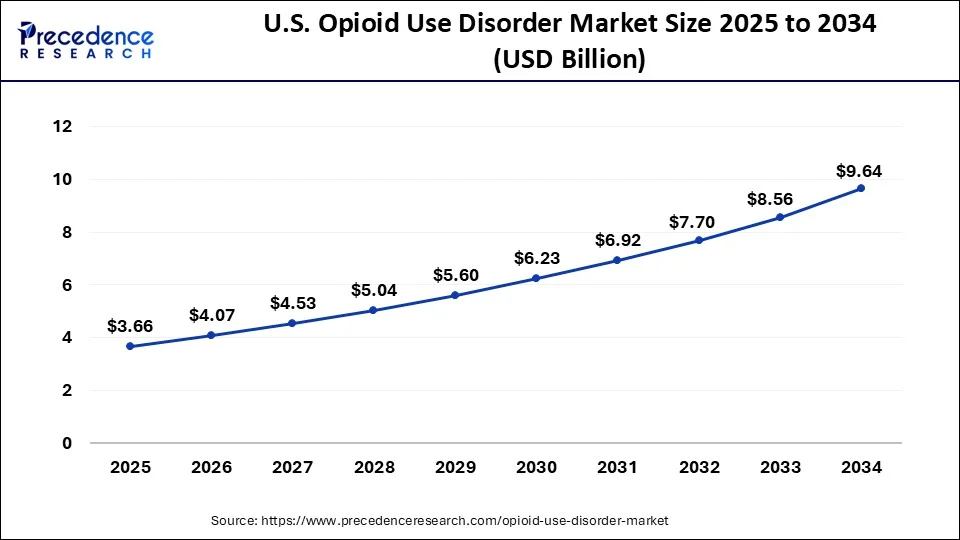

U.S. Opioid Use Disorder Market Size and Growth 2025 to 2034

The U.S. opioid use disorder market size is exhibited at USD 3.66 billion in 2025 and is projected to be worth around USD 9.64 billion by 2034, growing at a CAGR of 11.31% from 2025 to 2034.

North America dominated the global opioid use disorder market in 2024. The dominance of the region can be attributed to the increasing incidence of OUD, which fuels the substantial demand for new treatment options. The region also benefits from innovative healthcare infrastructure, development capabilities, and wide research. Furthermore, in North America, the U.S. led the market owing to the growing awareness among medical professionals regarding available treatments along with the surge in disease prevalence.

- In October 2024, Acadia Healthcare Company, Inc. announced the acquisition of three opioid treatment program clinics in South Carolina, which offer treatment for people seeking recovery from opioid use disorder. The clinics – formerly the opioid treatment programs of Recovery Concepts, Recovery Concepts of the Carolina Upstate, and Clear Skye Treatment Center.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia Pacific is expected to show the fastest growth in the opioid use disorder market over the studied period. The growth of the segment can be credited to the increasing collaborations between local and international organizations. These partnerships are boosting innovation and other management strategies. In Asia Pacific, China dominated the market due to increasing government support for enhancing healthcare facilities and increasing adoption of opioids in pain management.

- In January 2023, Hikma Pharmaceuticals PLC revealed Naloxone Hydrochloride Injection, USP, 2mg/2mL, in the prefilled syringe (PFS) form. The drug is used to treat known or suspected opioid overdose. The launch expands the portfolio of addiction therapy treatments of the company.

How Big is the Success of Europe in the Market?

Europe's growth in the opioid use disorder market is driven by increasing awareness of opioid misuse across countries like the U.S., Germany, and France, and expanded government investment in addiction treatment. Strong healthcare infrastructures and widespread adoption of medication-assisted treatment (MAT), supported by reimbursement programs, make interventions more accessible. Additionally, the region is adopting digital health tools such as telemedicine and mobile apps to reach remote areas and reduce the stigma linked to seeking help.

Germany is experiencing significant growth in the market, driven by a strong, universal health care system that incorporates medication-assisted treatments (MAT) like Buprenorphine and Methadone into routine services. Government-led harm reduction initiatives and comprehensive insurance coverage under the statutory health scheme support broad access to addiction care. Additionally, increasing public awareness and reducing stigma around substance use disorders encourages more people to seek treatment.

How Crucial is the Role of Latin America in the Opioid Use Disorder Market?

Latin America plays a crucial role in the market due to rising opioid misuse, increasing government initiatives for addiction treatment, expanded access to medication-assisted therapies, and greater awareness programs. Improving healthcare infrastructure and regional harm-reduction strategies further enhance treatment adoption and market significance. Brazil significantly contributes to the market because of its large population and the rising prevalence of opioid misuse, especially in urban areas.

How Big is the Opportunity for the Growth of the Opioid Use Disorder Market in the Middle East and Africa

The Middle East and Africa (MEA) offer substantial opportunities in the market due to rising opioid misuse, a growing focus by governments on addiction treatment programs, expanding healthcare infrastructure, and increased adoption of medication-assisted therapies. Awareness campaigns and harm-reduction initiatives further facilitate market growth throughout the region. South Africa is a major contributor to the market due to its high rates of substance abuse, including opioids, and the country's increasing focus on expanding addiction treatment services.

Value Chain Analysis

Research and Development (R&D)

This stage involves the identification of new pharmacological targets for opioid addiction treatment, including agonist, partial agonist, or antagonist therapies.

- Key Players: Alkermes, Indivior, Braeburn Pharmaceuticals, and Reckitt Benckiser.

Clinical Trial and Regulatory Approval

This stage involves conducting Phase I–III clinical trials to evaluate safety, efficacy, dosing, and long-term outcomes.

- Key Players: Contract Research Organizations (CROs), such as ICON plc, PPD, and Parexel, and regulatory bodies, including the U.S.FDA, the European Medicines Agency (EMA), Health Canada, and other national health authorities.

Patient Support and Service

This stage involves distributing approved therapies through clinics, hospitals, pharmacies, and telehealth platforms.

- Key Players: Addiction treatment centers and outpatient clinics like Hazelden Betty Ford Foundation (USA) and Priory Group (UK).

Opioid Use Disorder Market Companies

- Teva Pharmaceutical Industries, Ltd.: Teva contributes to the opioid use disorder market through its development of generic opioid agonist treatments, like methadone and buprenorphine, for managing addiction and withdrawal symptoms.

- Pfizer, Inc.: Pfizer plays a role in the opioid use disorder market by providing medication-assisted treatment options, including its opioid antagonists, to help reduce opioid dependence and prevent relapse.

- Collegium Pharmaceutical (BioDelivery Sciences International, Inc.): Collegium Pharmaceutical offers innovative formulations for opioid addiction treatment, such as buprenorphine, to improve patient compliance and reduce abuse potential.

- Alkermes, Inc.:Alkermes contributes through its long-acting opioid antagonists, like Vivitrol, which help prevent relapses in individuals recovering from opioid addiction.

- Orexo US, Inc. (a part of Orexo AB): Orexo provides treatment solutions for opioid use disorder, including Zubsolv, a combination of buprenorphine and naloxone, to support detoxification and maintenance therapy.

- Titan Pharmaceuticals, Inc.:Titan Pharmaceuticals offers Probuphine, a subdermal implant that delivers buprenorphine for long-term maintenance treatment of opioid use disorder.

- Omeros Corporation: Omeros is developing therapies targeting opioid addiction through its proprietary pipeline, including novel treatments that aim to reduce opioid cravings and withdrawal symptoms.

- Camurus AB: Camurus supports opioid use disorder treatment with its innovative long-acting formulations of buprenorphine, like CAM2038, which provide sustained release for opioid addiction management.

- Hikma Pharmaceuticals PLC: Hikma manufactures generic opioid addiction treatment drugs, including buprenorphine and naloxone, to improve access to affordable opioid use disorder therapies.

Latest Announcement by Market Leaders

- In July 2024, Teva Pharmaceuticals, a U.S. affiliate of Teva Pharmaceutical Industries Ltd. and Sanofi, announced an update to the timing for the anti-TL1A, duvakitug (formerly known as TEV-'574/SAR447189) program investigating the human IgG1-λ2 monoclonal antibody targeting TL1A for moderate-to-severe IBD. Teva and Sanofi are collaborating to co-develop and co-commercialize duvakitug for moderate-to-severe UC and CD patients.

- In January 2025, Hikma Pharmaceuticals announced an exclusive six-year commercial partnership with Emergent BioSolutions for the sale of KLOXXADO (naloxone HCl nasal spray 8 mg) in the U.S. and Canada. KLOXXADO received FDA approval in April 2021 for emergency treatment of suspected opioid overdose in adults and pediatric patients.

Recent Developments

- In April 2025, Governor Newsom announced that individual twin-packs of CalRx-branded over-the-counter (OTC) naloxone HCL (which blocks the effect of opioids) 4 mg nasal spray are now available to all Californians at a low price of USD 24 per carton, almost half the standard market price.

- In November 2024, Canadian guidelines expanded treatment options for opioid use disorder. Healthcare providers who manage patients with opioid use disorder recommend buprenorphine and methadone as first-line treatments. Canada has seen a 184% increase in opioid-related deaths over 7 years, from 2831 deaths in 2016 to 8049 deaths in 2023.

- In September 2024, West Virginia offered a free app to aid friends and families of those with opioid use disorder. As part of the ongoing commitment to solving the complex challenges of opioid use disorder, the WVU Health Affairs Institute has announced the statewide deployment of the CHESS Health Companion app.

- In October 2023, Netsmart announced the acquisition of Analytics, a South Carolina-based addiction treatment software and practice management company dedicated to developing technology for substance use disorder (SUD) providers' emphasis on opioid addiction treatment. This acquisition will further extend the Netsmart CareFabric platform.

- In July 2023, Titan Pharmaceuticals, Inc. entered into an Asset Purchase Agreement with Fedson, Inc. As part of this deal, Titan agreed to sell a portion of its ProNeura assets, including its portfolio of addiction treatment medications and other early-stage projects based on the ProNeura drug delivery technology. This portfolio included implant programs for Nalmefene and Probuphine.

- In May 2023, Indivior PLC received approval from the U.S. Food and Drug Administration for OPVEE (nalmefene) nasal spray for the treatment of opioid overdose induced by natural or synthetic opioids. OPVEE contains nalmefene, an opioid receptor that delivers fast onset and long-duration reversal of opioid-induced respiratory depression.

Segments Covered in the Report

By Drug

- Naltrexone

- Buprenorphine

- BELBUCA

- Sublocade

- Suboxone

- Zubsolv

- Methadone

- Others

By Route Of Administration

- Oral Administration

- Injectable Administration

- Others

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Others

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting