Hyperpigmentation Disorder Treatment Market Size and Forecast 2025 to 2034

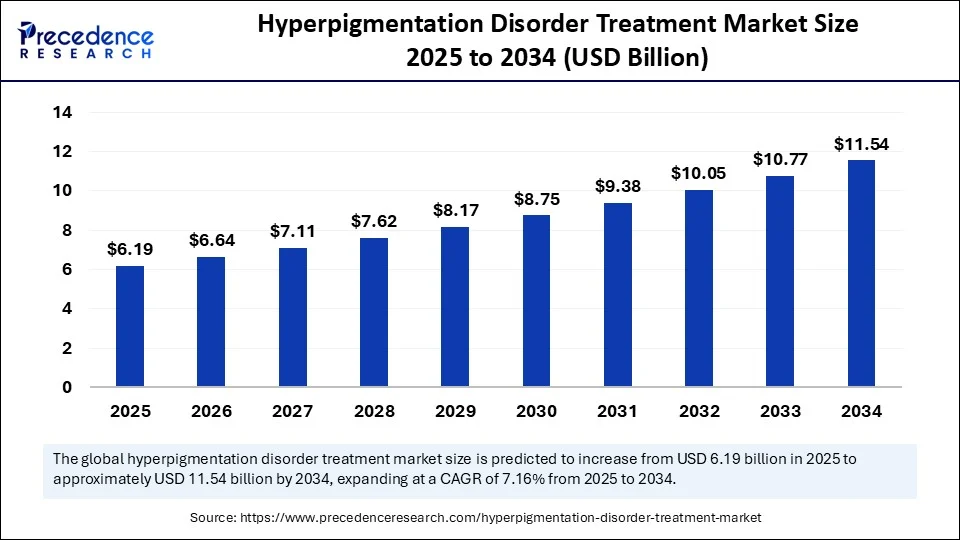

The global hyperpigmentation disorder treatment market size accounted for USD 5.78 billion in 2024 and is predicted to increase from USD 6.19 billion in 2025 to approximately USD 11.54 billion by 2034, expanding at a CAGR of 7.16% from 2025 to 2034. The growth of the market is attributed to the rising occurrence of skin pigmentation disorders such as melasma and dyschromia, increased interest in non-invasive cosmetic dermatology, and advances in laser, topical, and AI-based therapies.

Hyperpigmentation Disorder Treatment MarketKey Takeaways

- In terms of revenue, the global hyperpigmentation disorder treatment market was valued at USD 5.78 billion in 2024.

- It is projected to reach USD 11.54 billion by 2034.

- The market is expected to grow at a CAGR of 7.16% from 2025 to 2034.

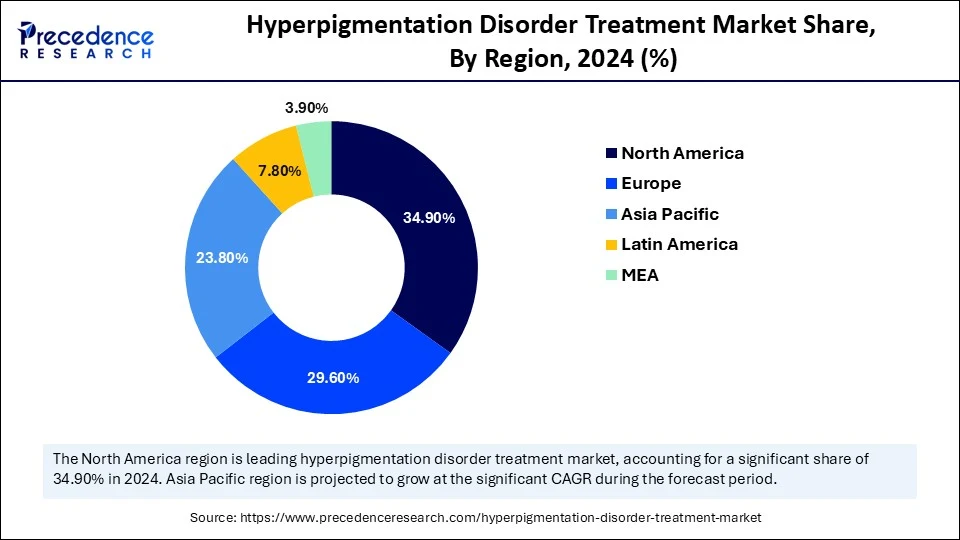

- North America dominated the hyperpigmentation disorder treatment market with the largest market share of 34.9% share in 2024.

- Asia Pacific is expected to expand at the fastest CAGR between 2025 and 2034.

- By treatment type, the topical treatment segment held the biggest market share of 27.3% in 2024.

- By treatment type, the laser therapy segment is anticipated to grow at a significant CAGR between 2025 and 2034.

- By disorder type, the melasma segment captured the highest market share of 32.1% in 2024.

- By disorder type, the post-inflammatory hyperpigmentation segment is expected to expand at a notable CAGR over the projected period.

- By end user, the dermatology clinics segment generated the major market share of 38.7% in 2024.

- By end user, the home care settings segment is expected to expand at a notable CAGR over the projected period.

- By distribution channel, the prescription-based (Rx) segment accounted for significant market share of 41.5% in 2024.

- By distribution channel, the online retail segment is expected to expand at a notable CAGR over the projected period.

How is AI Reshaping the Hyperpigmentation Disorder Treatment Market?

Artificial Intelligenceis revolutionizing the hyperpigmentation disorder treatment market by improving diagnosis, personalization, and access to treatments. Accuracy study for diagnosis of facial pigmented lesions in the artificial intelligence (AI) model DenseNet121 and InceptionResNetV2 resulted in an accuracy of 87% and 86% respectively, accurately identifying cutaneous pigmented lesions on the face and even outperformed dermatologists in detecting lentigo maligna melanoma.

(Source: https://pmc.ncbi.nlm.nih.gov)

In October 2024, Kaya Clinic launched the Klear AI platform using a dataset of over 4,000 Indian skin images that provides personalized skin care plans drawn from a real-time image analysis database for pigmented skin types.(Source: https://www.healthcareradius.in)

Meanwhile, Cosmos Scholars showed how AI could enhance treatment planning and decision support in clinical settings through predictive algorithms. However, there are still concerns about the biases present in the datasets, especially in darker skin tones, and this emphasizes the need for a more diverse training dataset. The innovations show great strides for dermatology, not only advancing precision but also decreasing long-standing disparities in equitable skin health care.

U.S. Hyperpigmentation Disorder Treatment Market Size and Growth 2025 to 2034

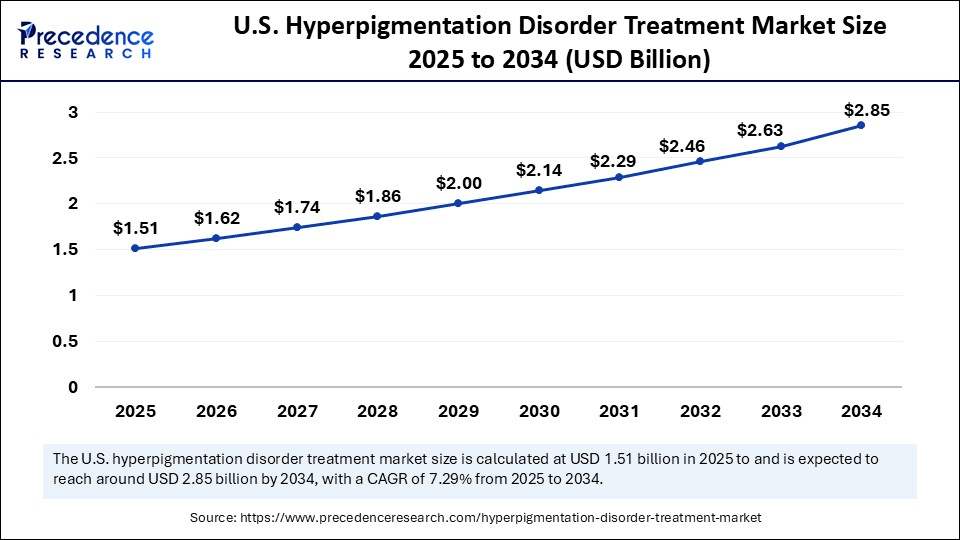

The U.S. hyperpigmentation disorder treatment market size was exhibited at USD 1.41 billion in 2024 and is projected to be worth around USD 2.85 billion by 2034, growing at a CAGR of 7.29% from 2025 to 2034.

What made North America the dominant region in the hyperpigmentation disorder treatment market in 2024?

North America dominated the market with the largest share in 2024. This is mainly due to several factors, including the presence of well-developed dermatology clinics, accessibility to advanced dermatology services, and heightened consumer awareness regarding skin health. With the growing aging population, there is a high demand for novel therapeutic approaches, as hyperpigmentation is more common with age. Increased social media influence and celebrity endorsement further bolster the market in the region. There is a high demand for treatments like laser options, chemical peel options, and topical agents in dermatology practices. The growing prevalence of skin disorders and high awareness of skin health further contribute to regional market growth.

The U.S. is a major contributor to the North America hyperpigmentation disorder treatment market. More dermatology clinics and medspas in the U.S. are providing individualized treatments for pigmentation with the convenience of teledermatology. In addition, the U.S. Energy Information Administration reported that phototherapy using energy-based devices continues to become more popular for the treatment of pigmentation. The American Academy of Dermatology reported (2024) that melasma and post-inflammatory hyperpigmentation ranked high among skin issues, resulting in the most clinic visits. Moreover, in the U.S., patients are experiencing a surge in efficacy with topical agents, particularly with new state-registered compound medications, and multi-agent combination therapies are becoming increasingly popular treatment options.

Asia Pacific Hyperpigmentation Disorder Treatment Market Trends

Asia Pacific is expected to grow at the fastest CAGR over the projection period due to the rising demand for aesthetic skincare products and rising awareness among consumers regarding pigmentation issues, such as melasma, freckles, and age spots. As urbanization and UV exposure continue to grow, there is a high desire for clear and even skin. Additionally, growing K-beauty and J-beauty trends are boosting the demand for beauty products and aesthetic procedures, supporting market growth. Governments in India and South Korea are committed to building advanced healthcare infrastructure, which can lead to increased access and availability for patients needing dermatological treatments.

India is a major player in the market. The growing demand for cosmetic dermatology treatments, combined with over a billion people affected by sun-induced pigmentation problems, will continue to drive market growth. Growth of dermatology chains into Tier 2 and Tier 3 cities in India, and the ever-growing availability of beauty-related content on social media platforms, and a lower cost and better accessibility of many popular treatments position India as a major player in the market.

In February 2025, Alkem Laboratories introduced a novel two-fold product, "Kojiglo Serum" in India, which treats facial hyperpigmentation. The multi-functional serum combines brightening agents and aims to reduce dark spots and discoloration. This product was launched in India as part of an evolution in dermatology by Alkem in response to the growing demand among dermatologists and consumers in India for effective pigmentation correction.(Source: https://in.fashionnetwork.com)

Market Overview

The hyperpigmentation disorder treatment market comprises pharmaceutical, cosmeceutical, and procedural interventions aimed at reducing or eliminating skin discoloration resulting from melanin overproduction or deposition. Hyperpigmentation disorders include conditions such as melasma, post-inflammatory hyperpigmentation (PIH), solar lentigines (age spots), and freckles. These conditions are treated through topical agents, laser therapies, chemical peels, microdermabrasion, and oral formulations that inhibit melanogenesis, accelerate cell turnover, or physically remove pigmented cells. The market is fueled by rising aesthetic awareness, increasing dermatological consultations, and advancements in combination therapies for ethnic skin types.

Hyperpigmentation Disorder Treatment MarketGrowth Factors

- Increase in skin disorders: The increasing incidence of skin disorders among young people, such as melasma, hyperpigmentation, solar lentigines, and post-acne marks, is driving demand for treatment with these indications among these populations concerned with skin tone.

- Rise in demand for cosmetic procedures: The growing interest in non-invasive cosmetic enhancements has led to the increased use of laser therapy, microdermabrasion, and chemical peels, enhancing the prevalence of these procedures in almost all areas of urban life and among consumers who are concerned with outward appearances.

- Increasing awareness via well-publicized avenues or groups: The awareness of skin health has increased via social media, and the increase in the number of dermatology and access to products OTC is increasing the consumption rate for treatments, particularly for emerging economies where solutions have been limited/or a lack of being digitally engaged or connected.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 11.54 Billion |

| Market Size in 2025 | USD 6.19 Billion |

| Market Size in 2024 | USD 5.78 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.16% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Treatment Type, Disorder Type, End User, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Prevalence of Pigmentary Disorders

A primary factor driving the growth of the hyperpigmentation disorder treatment market is the staggering prevalence of pigmentary disorders. According to a survey conducted between December 2022 and February 2023, approximately 50% of respondents (N ≈ 48,000) in 34 countries reported at least one pigmentary disorder, including solar lentigo (27%), post-inflammatory hyperpigmentation (15%), peri-orbital hyperpigmentation (15%), and melasma (11%) and vitiligo 8%, with an average age of 44yo and affecting more women (59%).(Source: https://www.lorealdermatologicalbeauty.com)

These conditions are more frequent among women and patients with darker skin types, for whom symptoms are more prevalent and visible, and cause substantial psychological harm. The ubiquity of pigmentation disorders, which have been exacerbated by the presence of UV-light exposure, hormonal influences, and inflammation, has contributed to the increased demand for effective dermal and cosmeceutical treatments. As awareness increases for both patients and clinicians, these parties are demanding greater access to personalized therapeutic measures that address common and stigmatizing skin conditions.

Restraint

Safety Issues Associated with Hydroquinone and Regulatory Restrictions Limit Market Growth

A significant limiting factor for the hyperpigmentation treatment market is the increased regulatory scrutiny and safety concerns regarding hydroquinone, the most successful topical agent historically for melasma and post-inflammatory hyperpigmentation. As of 2023, hydroquinone is no longer sold without a prescription in the U.S.. It is still prohibited in the EU, Japan, and Australia due to the risk of exogenous ochronosis, an unusual blue-black discoloration seen more in people with darker skin and potential carcinogenicity.

Clinical reviews emphasize the need for more stringent medical oversight during its use, with extensive use (even at 2%) being linked to irreversible skin damage and hypopigmentation. Physicians' access to, and willingness to prescribe, hydroquinone has been curtailed by these severe national imposts and caution publicized for its use, which slows the uptake of this essential treatment option.

Opportunity

Are Natural and Herb-Based Active Ingredients Opening New Pathways in Treating Hyperpigmentation?

A major opportunity for the global hyperpigmentation disorder treatment market lies in the growing preference for natural and plant-based skincare ingredients. Consumers continue to seek out treatments that are free from harsh chemicals like hydroquinone, and instead use botanical ingredients such as licorice root extract, kojic acid, arbutin, and niacinamide, which are all known to confer some degree of depigmenting activity. In 2024, multiple skincare brands from South Korea, India, and the U.S. launched pigment illuminating creams leveraging herbal-based solutions, while leveraging the clean across the channel and consumer preference.

- In March 2024, Givaudan launched Illuminyl™â€¯388, a biotech-derived active from green tea to mitigate pigmentation and enhance radiance in as little as weeks! Clinically tested with efficacy across many skin types, Illuminyl™â€¯388 stimulates other skin microbiota activity to provide a more even skin tone and smoother skin luminosity.(Source:https://www.givaudan.com)

As harbingers of this trend, dermatology is also now including Ayurvedic and traditional Chinese medicine-based actives into their treatment recommendations. This is a strong and growing segment of plant-based hyperpigmentation compounds that might be driving future questions and innovation.

Treatment Type Insights

Why did the topical treatment segment dominate the hyperpigmentation disorder treatment market in 2024?

Topical Treatment

The topical treatment segment dominated the market, under which the hydroquinone sub-segment held the maximum share in 2024. Hydroquinone represents a safe and effective treatment, which is why it is routinely prescribed by dermatologists globally and sold as over-the-counter and prescription formulations. It is also a popular ingredient with consumers, due to its ability to action within weeks, leading many people to use it specifically for pigment correction (which makes it the most preferred ingredient in skin-lightening creams and serums for all hyperpigmentation treatment).

The tranexamic acid sub-segment is emerging rapidly due to its rapid uptake, especially among individuals with melasma and post-inflammatory hyperpigmentation. Tranexamic acid was initially used as a hemostatic aid as it inhibits skin bleeding, leading to new evidence that it inhibits melanin synthesis by inhibiting plasminogen activation. Tranexamic acid is gaining traction, as there is a strong consumer preference for skin-friendly, efficacious products, and is developing into an active ingredient in new product launches within the pigmentation care category.

Laser Therapy

The laser therapy segment is expected to grow at the fastest CAGR during the forecast period. The Q-switched Nd:YAG laser sub-segment is leading the charge due to several reasons: Firstly, it can directly target deep pigmented lesions, including melasma and age spots. Additionally, it is capable of delivering high-intensity pulses to fragment the underlying melanin without damaging the surrounding healthy tissue, so dermatology clinics are more familiar with using it.

The picosecond laser sub-segment is expected to grow at a rapid pace because of the low risk of side effects and faster recovery associated with it compared to other laser options for pigment targeting. Notably, most Picosecond lasers feature an ultra-short pulse duration, allowing better pigment clearance with lesser skin trauma, leading to improved injury and treatment management post-procedure. As knowledge of complication management improves and the technology is used for a range of skin types, it should increase in popularity.

Chemical Peels

The glycolic acid peel is the most prevalent sub-segment in the chemical peels category due to its common usage for milder to moderate hyperpigmentation. It is a common option within dermatology practices due to its ability to exfoliate and promote cellular turnover, improving uneven tone in the skin.

Trichloroacetic acid (TCA) peel is gaining traction. TCA offers more extended penetration into the skin, therefore allowing for treatment of more different types of stubborn pigmentation disorders (i.e., melasma, post-inflammatory hyperpigmentation). TCA is gaining traction and uptake due to demand from practitioners and clients for a more aggressive treatment with visible results in fewer sessions.

Oral Treatment

Tranexamic acid (oral) sub-segment maintained its stronghold in the hyperpigmentation disorder treatment market. Tranexamic acid is widely used because it effectively reduces melanin production, which aids in the treatment of hyperpigmentation conditions such as melasma, given its activity on the plasmin pathway (anti-plasmin activity). Tranexamic acid's mechanism of action appears to be associated with the suppression of inflammatory mediators in the skin, which results in visible improvement in skin tone.

Glutathione is gaining immense popularity in oral treatment for hyperpigmentation. Glutathione helps with antioxidant defence and skin-lightening, and it appears to be a growing interest among consumers looking for internal solutions to address hyperpigmentation. In addition, glutathione's increased use in oral supplements for aesthetic dermatology further supports segmental growth.

Disorder Type Insights

How does the melasma segment dominate the hyperpigmentation disorder treatment market in 2024?

The melasma segment dominated the market in 2024, as it affects more individuals of darker skin tones and is often associated with hormonal changes, UV exposure, or inherited skin conditions. The long-term, chronic, and recurrent nature of melasma contributes to sustained demand owing to long-term management with topical creams, chemical peels, or laser treatments. The significant contribution to the segment of melasma is also due to the common occurrence among women being treated for this skin condition.

The post-inflammatory hyperpigmentation (PIH) segment is expected to grow at the fastest CAGR in the coming years, driven by the rising demand for cosmetic procedures for acne/post-inflammatory hyperpigmentation as well as skin injuries, particularly in younger patients. Skincare awareness continues to grow, and patients are seeking earlier intervention with topical and oral agents, providing a significant impetus to the market growth.

End User Insights

What made dermatology clinics the major end user?

The dermatology clinics segment dominated the hyperpigmentation disorder treatment market in 2024. Clinics provide the necessary specialized services, attracting more patients. They often equipped with advanced diagnostic and treatment solutions, including laser treatment, chemical peels, and prescription topical or systemic medications, making them the trusted point of contact for patients. The presence of trained dermatologists, along with the growing trust in clinical outcomes by patients, continues to bolster segmental growth.

On the other hand, the home care settings segment is likely to expand at the fastest rate over the projection period. The growth of the segment is attributed to the increasing awareness among people about self-care, boosting the demand for over-the-counter skincare products. The popularity of e-commerce and social media influence has empowered many people to self-manage their mild to moderate hyperpigmentation, therefore increasing the demand for products for home use.

Distribution Channel Insights

Why did the prescription-based (Rx) segment dominate the market in 2024?

The prescription-based (Rx) segment dominated the hyperpigmentation disorder treatment market while holding the largest share in 2024, largely due to the effectiveness and regulatory oversight of topical hydroquinone, oral tranexamic acid, and procedural treatments like laser therapy that require a medical provider. This channel ensures the timely availability and procurement of prescription therapeutic products in bulk quantities, increasing accessibility for patients. Patients tend to seek dermatologists for recommended treatment pathways, regardless of the product, to ensure safety and potentially better outcomes, particularly for chronic or severe hyperpigmentation. Therapeutics and products dispensed from clinics or pharmacies are also registered under guidance from the doctor.

The online retail segment is expected to grow at the fastest CAGR in the upcoming period. The increase in teledermatology and convenient access to virtually endless skincare products support the growth of this segment. As online purchasing of over-the-counter lightening creams, serums, and peels becomes more popular, consumers prefer to access these products from online retailers, rather than from in-person visits to clinics, pharmacies, or drug stores. Online platforms offer a range of products from multiple brands at competitive prices, encouraging consumers to repeat purchases.

Hyperpigmentation Disorder Treatment Market Companies

- Galderma S.A.

- L'Oréal S.A.

- Allergan (AbbVie Inc.)

- Obagi Cosmeceuticals LLC

- Johnson & Johnson (Neutrogena)

- SkinCeuticals (L'Oréal)

- The Ordinary (DECIEM)

- Beiersdorf AG (Eucerin)

- La Roche-Posay (L'Oréal)

- Pierre Fabre Dermo-Cosmétique

- ISDIN

- PCA Skin

- Uriage Dermatological Laboratories

- Epionce

- Innoaesthetics

- Procter & Gamble Co. (Olay)

- Menarini Group

- Image Skincare

- Sesderma

- Bioderma (NAOS)

Recent Developments

- In July 2025, Sonocouture released a hydration and skincare line specifically designed for melanin-rich skin while tackling hyper-pigmentation, uneven tone, and sensitivity. This product line launch speaks to next-gen consumer demands for diverse and effective skincare options in personal care, beauty, premium, and personalized beauty categories.(Source: https://www.digitaljournal.com)

- In July 2025, Kaya Clinics launch globally recognized Neo Elite Laser Treatment to its clinics in India. The Neo Elite Laser Treatment for hyperpigmentation and dermal rejuvenation is the advanced laser treatment that provides quicker and more effective results with low to no discomfort to the patient and will fully support the treatments with post care products.(Source: https://www.biospectrumindia.com)

Segments Covered in the Report

By Treatment Type

- Topical Treatment

- Hydroquinone

- Retinoids (Tretinoin, Adapalene)

- Corticosteroids

- Azelaic Acid

- Kojic Acid

- Niacinamide

- Vitamin C (Ascorbic Acid)

- Tranexamic Acid

- Botanicals (Licorice Extract, Arbutin, etc.)

- Combination Formulations

- Others

- Laser Therapy

- Q-Switched Nd:YAG Laser

- Fractional CO2 Laser

- Intense Pulsed Light (IPL)

- Picosecond Laser

- Others

- Chemical Peels

- Glycolic Acid Peel

- Salicylic Acid Peel

- Lactic Acid Peel

- Trichloroacetic Acid (TCA) Peel

- Others

- Microdermabrasion

- Oral Treatment

- Tranexamic Acid (Oral)

- Polypodium Leucotomos

- Glutathione

- Others

- Others

- Cryotherapy

- Radiofrequency-based Treatments

By Disorder Type

- Melasma

- Post-Inflammatory Hyperpigmentation (PIH)

- Solar Lentigines (Age Spots)

- Freckles

- Drug-Induced Hyperpigmentation

- Others (e.g., Acanthosis Nigricans, Addison's Disease-associated pigmentation)

By End User

- Dermatology Clinics

- Aesthetic Clinics

- Hospitals

- Home Care Settings (OTC Use)

- Others

By Distribution Channel

- Prescription-Based (Rx)

- Over-the-Counter (OTC)

- Online Retail

- Dermatology/Aesthetic Clinics

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting