Optical Films Market Size and Forecast 2025 to 2034

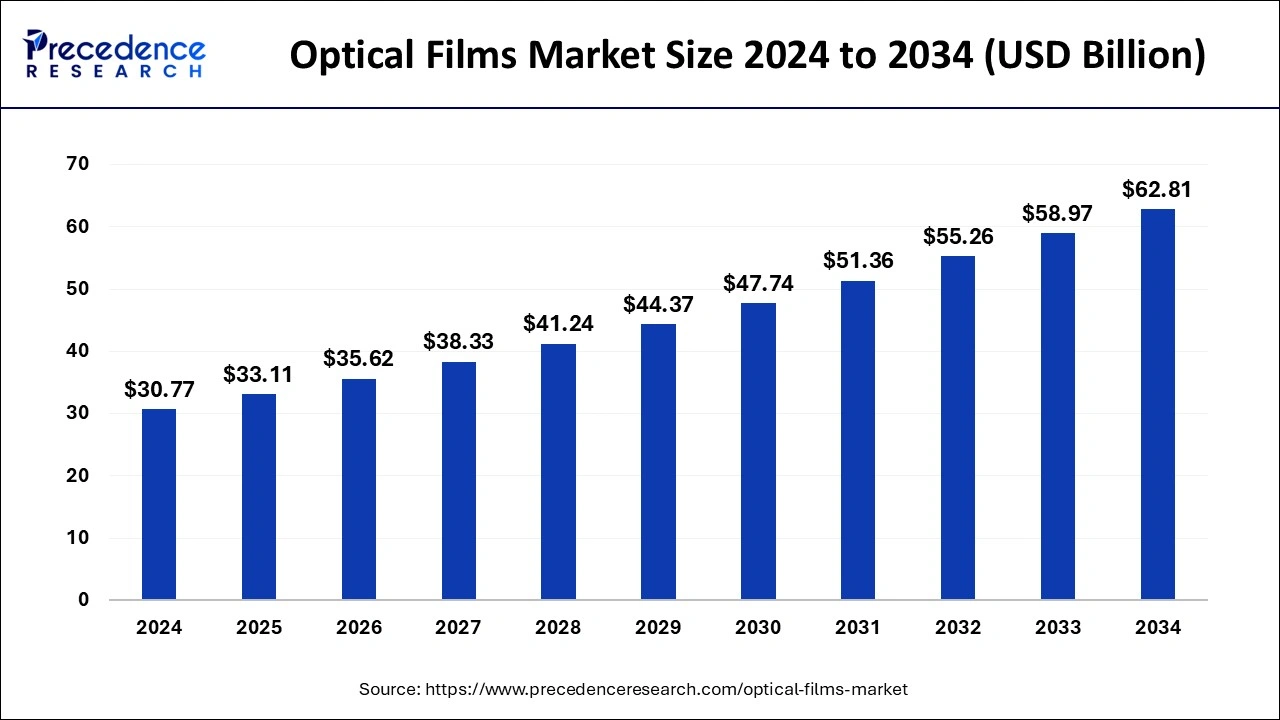

The global optical films market size accounted for USD 30.77 billion in 2024 and is expected to exceed around USD 62.81 billion by 2034, growing at a CAGR of 7.40% from 2025 to 2034.

Optical Films Market Key Takeaways

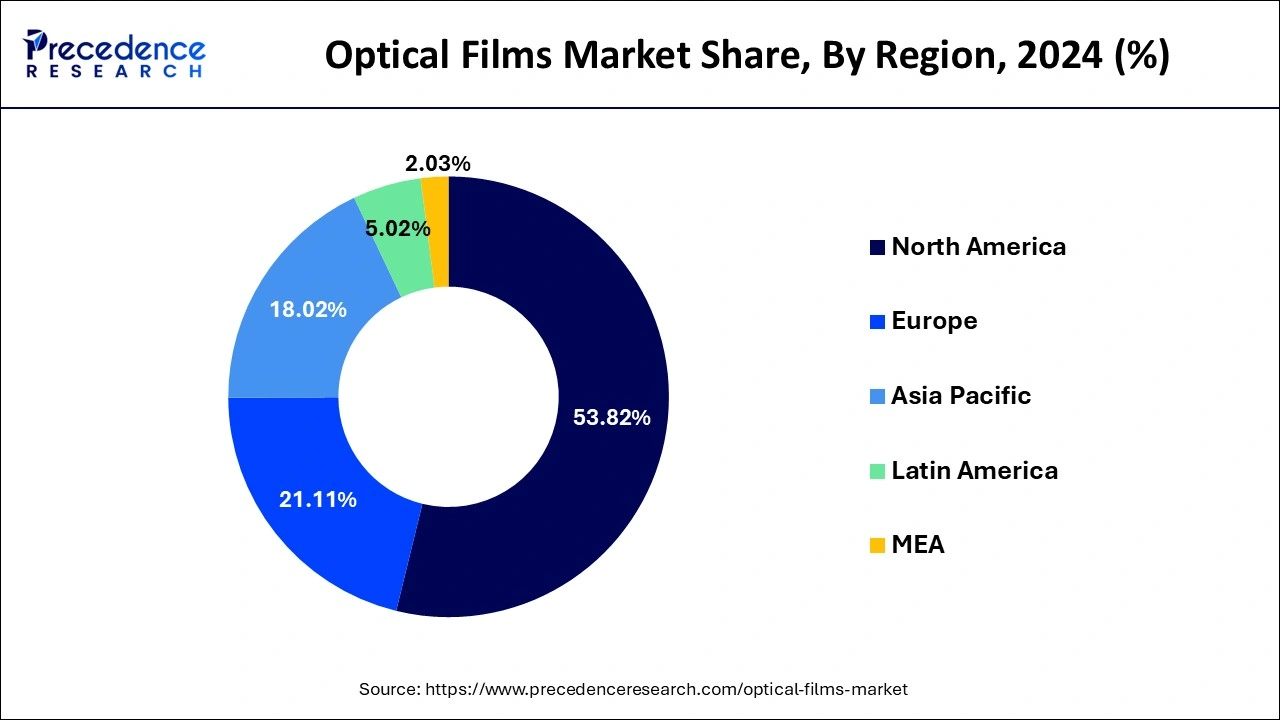

- The Asia Pacific led the market and generated more than 53.82% of total revenue in 2024.

- On the basis of film type, the polarizing film segment captured the worldwide market and generated more than 48% of the total revenue, In 2024.

- On the basis of application, the smartphone segment market held the higher spot and generated more than 36% of total revenue, In 2024.

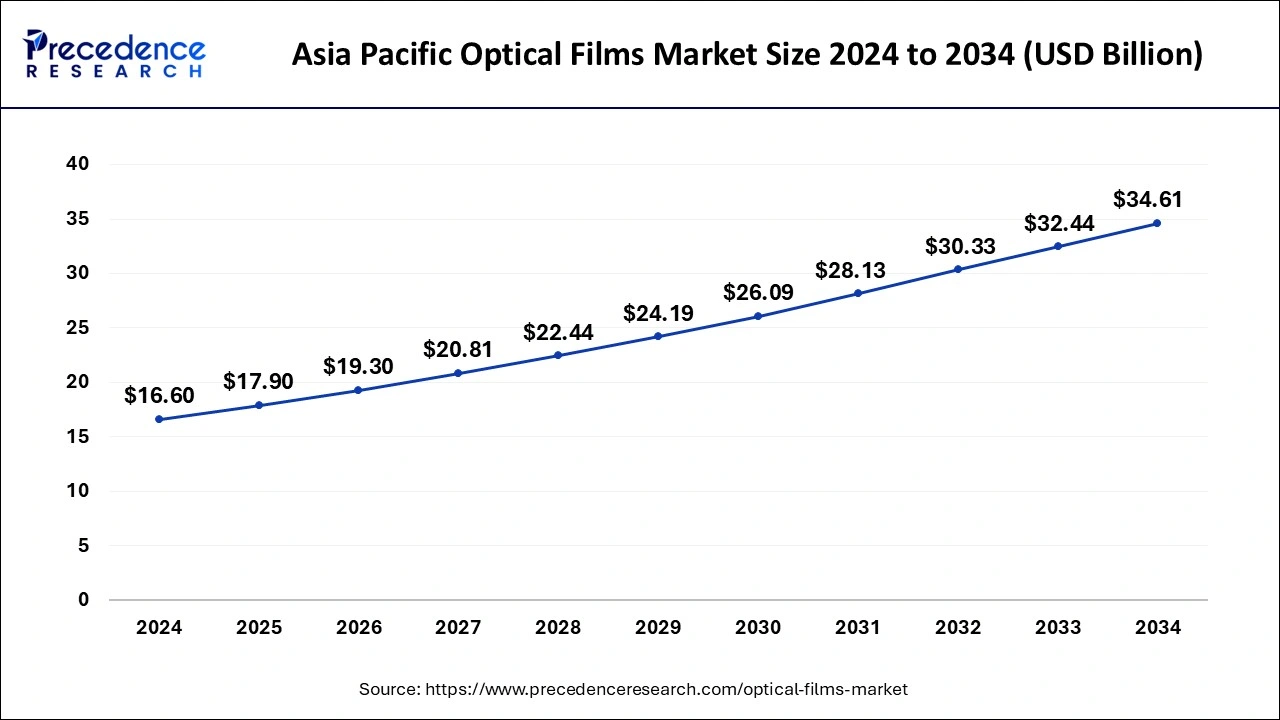

Asia Pacific Optical Films Market Size and Growth 2025 to 2034

Asia Pacific optical films market size was evaluated at USD 16.60 billion in 2024 and is projected to be worth around USD 34.61 billion by 2034, growing at a CAGR of 7.62% from 2025 to 2034.

In 2024, Asia Pacific led the market and alone generated more than 53.82% of worldwide revenue. The presence of numerous end-users, including Samsung Electronics, Sony Corp., Panasonic Corp., LG Electronics, and others, in the area, is a contributing factor to this significant proportion. Leading MNCs have been making large investments in the manufacturing sector in Asia Pacific over recent years. Companies from Northeast Asian nations, including China, India, and Japan, primarily work to stimulate economic growth in those nations' crucial manufacturing, services, and raw resource extraction sectors.

As a result, the region's demand for products is driven by the expanding consumer electronics sector. The Indian government has adopted several national reform initiatives, including Digital India, Make in India, and 100% FDI in the production of electronic gear, which has fueled the expansion of the electronic manufacturing sector. Investors are also becoming more interested in the area due to the accessibility of inexpensive labor and the proximity to raw materials suppliers. Throughout the projection period, Indonesia, China, India, South Korea, and Taiwan are anticipated to continue to drive regional market expansion.

Market Overview

Rising consumer demand for tablets, smartphones, and other digital devices will likely fuel the global optical films industry expansion. The need for technological devices is anticipated to grow due to rapid urbanization, which will change consumer lifestyles and increase product usage. In addition, technical developments in the smart and portable consumer electronics sectors, such as smart televisions and smartphones, are anticipated to drive product demand in the upcoming years. A growing number of businesses and the desire for multipurpose gadgets also propel the sector's growth.

The need for optical films is growing as more applications, including automotive displays, desktops & laptops, televisions, smartphones, and tablets, demand features like greater readability, excellent contrast, increased brightness, color consistency, and glare reduction. Additionally, developing display technologies such as micro-LED will drive the industry's growth. The rise of micro-LED display technology is anticipated to be fueled by the rising need for brighter and more energy-efficient display panels for smartwatches, televisions, and virtual reality (VR) & augmented reality (AR) devices. In turn, this would increase the demand for optical film in the field of micro-LED display technology during the forecast period.

Furthermore, the intense interest that businesses including Samsung, Apple, and Sony have in micro-LED display technology will likely spur market expansion during the upcoming time frame. However, fluctuating raw material prices may impede overall industry growth during the forthcoming years. Additionally, the outburst of the pandemic has adversely impacted the manufacturing business, which is likely to have a detrimental influence on industry growth. Short-term industrial development is expected to be negatively affected by declining discretionary spending due to rising expenditures on necessities like food and medical supplies, supply and transportation constraints, and a halt in production due to the COVID-19 epidemic.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.40% |

| Market Size in 2025 | USD 33.11 Billion |

| Market Size by 2034 | USD 62.81 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Largest Market | Asia Pacific |

| Segments Covered | Film Type, Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Covid-19 Impact

The market for optical films was among the industries that were moderately impacted by the coronavirus epidemic. A strict lockdown that disrupted the optical films' supply chain was the main factor that had a detrimental influence on the global market for optical films. Additionally, a lack of subcontractors and contract terminations for cost-control purposes slowed the demand and expansion of the optical films market.

Several businesses reduced the operational costs associated with their products to boost their profitability. The elements mentioned above suggest that the epidemic may have a minor impact on the market for optical films.

Optical Films Market Trends

The growing use of displays with large format will accelerate market growth

The demand for big format displays, which is on the rise and necessitates the continual application of technical breakthroughs, is the primary factor driving the significant expansion of the worldwide optical film market. Functional meals are becoming more popular due to the increasing use of OLED (organic light-emitting diode) technologies in displays.

The development of big format displays in healthcare, education, and advertising, among other areas, is anticipated to fuel the global optical film market. Furthermore, one of the factors that will propel the worldwide optical film industry is the expansion of online shopping for electric goods due to holiday discounts on various goods. For instance, the South Korean-based electronics manufacturer Samsung stated that it had introduced several smart TVs on Flipkart and Amazon with different promotions and discounts. It is also anticipated that these kinds of activities from industry players will fuel market expansion.

High optical film investment costs to limit market growth

Because it uses top-notch technology, the optical film business has substantial setup costs. Additionally, the price of raw materials for producing optical films is relatively high. Therefore, high prices may have a detrimental effect on the market's expansion during the forthcoming years.

Massive investment opportunities will be generated by the market's enormous need for foldable and flexible displays.

Because optical films are thin, light, flexible, and long-lasting, they are increasingly being employed in tablets, smartphones, and other electronic devices, which is driving the rapid growth of the global optical film market. Such factors have caused the need for optical films to soar. Additionally, due to the rising demand for optically coated glasses, optical films are primarily employed in electronic devices, positively impacting the market growth.

Additionally, businesses are choosing a variety of tactics, including product launches and innovation in the market for optical films. For instance, the electronic manufacturer LG Innotek stated in April 2021 that Nexlide-E, intended to generate even brilliant light in car lighting modules, had been introduced. Additionally, the Nexlide-E is made up of three components: an optical resin, an optical film, and an LED package. This business has created a new 0.2mm-thick optical film. In the following years, essential companies may benefit from lucrative market opportunities due to this kind of product development and innovation.

Film TypeInsights

Backlight and polarizing are widely used optical films. In 2024, the polarizing film segment dominated the worldwide market and generated more than 48% of the total revenue. The category is likely to maintain its leadership while growing at the quickest rate. The need for polarizing films is predicted to rise due to their high picture-quality liquid crystal display property in several applications, including television, cellphones, automobile displays, and others.

It transmits the incident beam, which absorbs all other rays and spreads in one direction, converting non-polarized light into linearly polarized light. Since the LCD panel lacks luminous properties, the backlight film is an essential component providing the LCD's backlight source. A light source must be added to the LCD panel for display. Apart from these additional components, LCD backlight film includes adhesive goods, a backlight, insulation products, an optical diaphragm, a plastic frame, and others.

ApplicationInsights

The global industry based on applications has been further segmented into televisions, automotive displays, desktops & laptops, smartphones, tablets, and signs & advertising display boards. In 2024, the smartphone application market held the top spot in the sector and generated more than 36% of total revenue. The rising popularity of consumer electronics, particularly in Asia Pacific, is driving the demand for optical films. The need for consumer electronics, such as desktops & laptops, television, tablets, and smartphones, is being considerably fueled by factors such as rising urbanization, an expanding middle class, altering expenditures, and changing consumption habits toward more significant discretionary spending.

The need for optical films in the TV application category is further being driven by growing product adoption in LCD and LED. Additionally, the television segment is expected to rise faster, fueling demand for optical films due to the rising need for large displays and the popularity of video walls. In addition, the growing popularity of laptops in corporate offices and educational institutions due to work-from-home policies and online classes is anticipated to benefit product demand for desktop and laptop applications.

Optical Films Market Companies

The presence of multiple companies that actively participate in implementing methods aimed at achieving sales execution, sustainable transition, and efficient pricing defines the industry. These market leaders provide diverse capabilities and capacities, enabling them to meet various needs that arise across several end-use sectors. The following are the top firms active in the worldwide optical film market:

- 3M

- Toray International, Inc.

- Mitsubishi Chemical Corp.

- Nitto Denko Corp.

- KOLON Industries, Inc.

- Teijin Ltd.

- Hyosung Chemical

- LG Chem

- Sumitomo Chemical Co., Ltd.

- Toyobo Co., Ltd.

Segments Covered in the Report

By Film Type

- Backlight Film

- Polarizing Film

- Others

By Application

- Televisions

- Signage & Advertising Display Boards

- Automotive Display

- Smartphones

- Desktop & Laptops

- Tablets

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting