What is the Fluoropolymer Films Market Size?

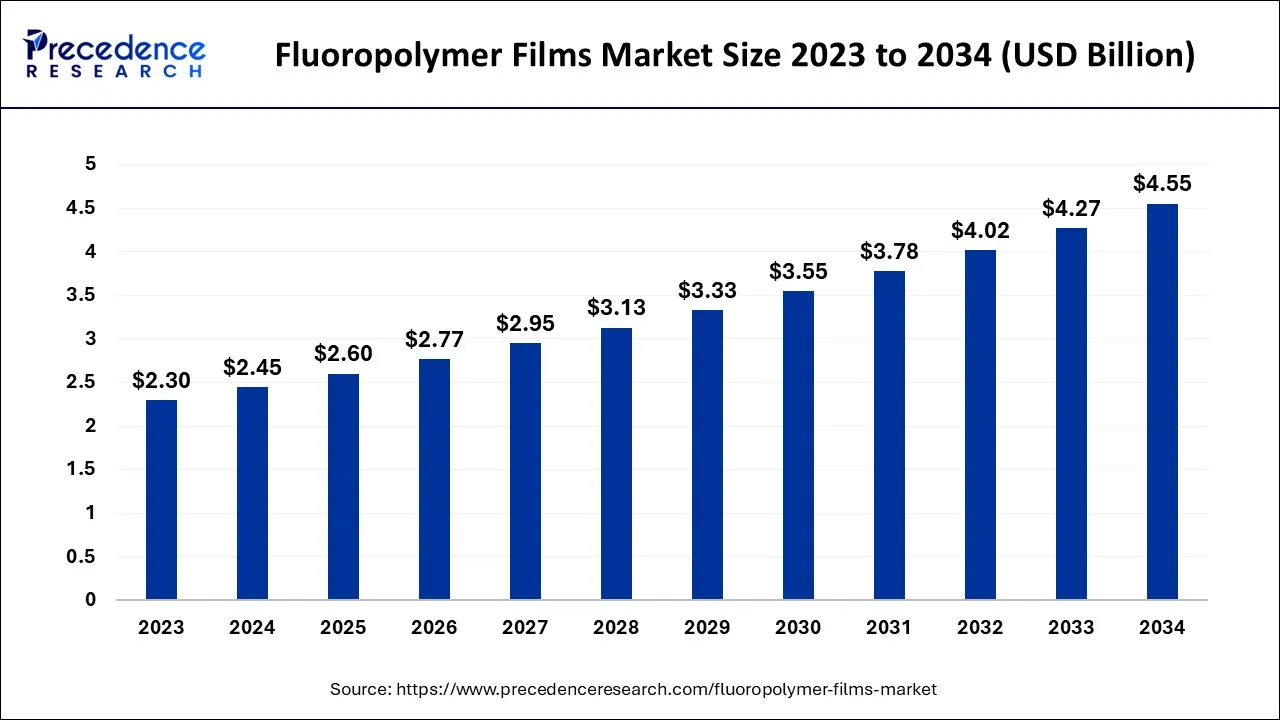

The global fluoropolymer films market size is calculated at USD 2.60 billion in 2025 and is predicted to increase from USD 2.77 billion in 2026 to approximately USD 4.81 billion by 2035, expanding at a CAGR of 6.35% from 2026 to 2035.

Fluoropolymer Films Market Key Takeaways

- In terms of revenue, the market is valued at $2.60billion in 2025.

- It is projected to reach $4.81billion by 2035.

- The market is expected to grow at a CAGR of 6.35% from 2026 to 2035.

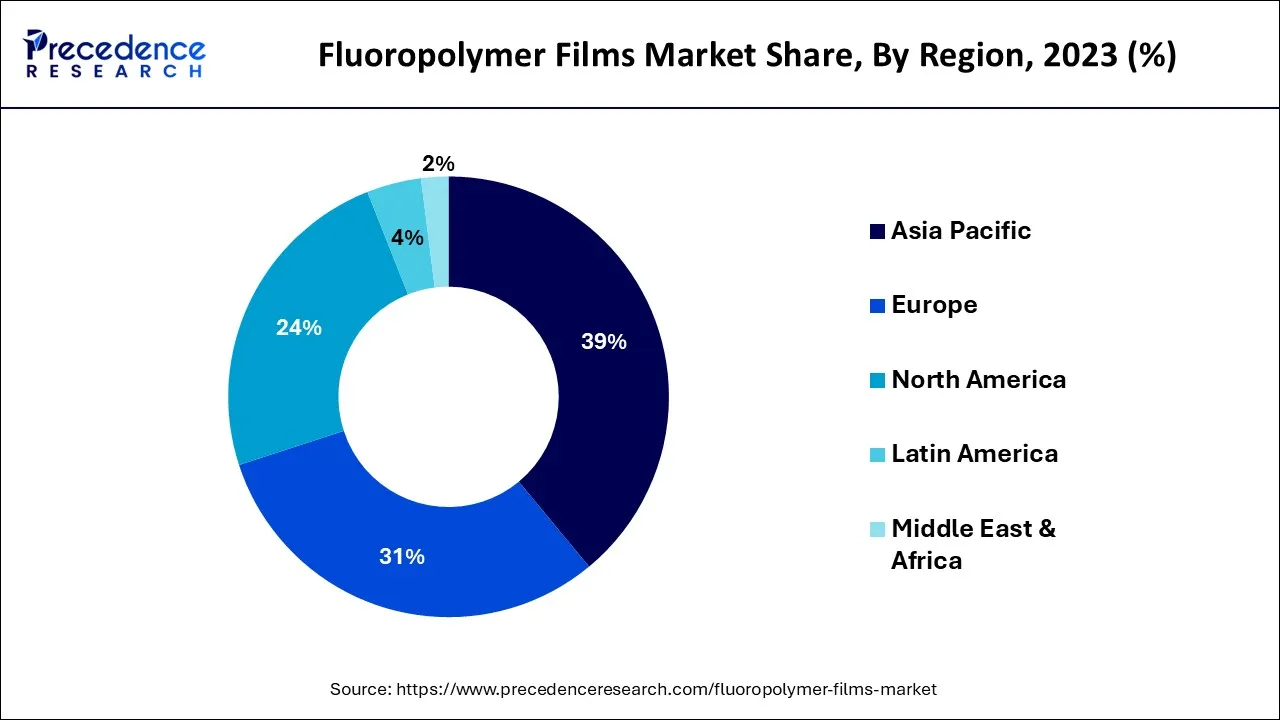

- Asia Pacific led the global market with the highest market share of 39% in 2025.

- By Type, the polytetrafluoroethylene segment is expected to expand at the fastest CAGR from 2026 to 2035.

- By Application, the automobile & aerospace segment is predicted to contribute the largest revenue share from 2026 to 2035.

Market Overview

Fluorine and carbon-based polymers are produced as fluoropolymer films by the cast film extrusion process. They are high-performance polymers that are frequently utilized in applications involving high temperatures and harsh chemical environments. They are extensively utilized in cable insulation, anticorrosive linings, solar cell glazing, and pharmaceutical cap liners. Fluoropolymer compounds and resins, which are made up of monomers including propene, chlorotrifluoroethylene, vinyl fluoride, propene hexafluoro, tetrafluoroethylene, and ethylene, are used to create fluoropolymer films. They have high transparency, weather resistance, water absorption, dielectric, and cryogenic qualities in addition to a low friction coefficient. Fluoropolymer films are consequently widely used in the automotive, medical, building, electrical, and electronics industries.

The construction industry is seeing significant expansion on a global scale, which is generating favorable prospects for the market. For safety and security reasons, fluoropolymer films are frequently utilized as a coating material in textile architecture, windows, and doors. Accordingly, the widespread use of the product due to its exceptional non-adhesive and low friction features as well as the rising consumer preference for aesthetically beautiful designs are encouraging market expansion. Additionally, market growth is being fueled by the deployment of numerous government initiatives encouraging infrastructure development. In addition, the launch of green fluoropolymer films as a result of growing environmental awareness and a quick move toward ecologically friendly products is bolstering market expansion.

- The Statista estimates that the size of the construction industry was $8.2 trillion in 2022 and that it would increase to $17 trillion by 2029 at a compound annual growth rate (CAGR) of 7.3%.

- As per International Energy Agency, solar PV generation reached 1,000 TWh in 2021 and increased by a record-breaking 179 TWh (up 22%).

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 4.81 Billion |

| Market Size in 2025 | USD 2.60 Billion |

| Market Size in 2026 | USD 2.77 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 6.35% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing adoption in the electrical and electronics industry

The increasing adoption of fluoropolymer films in the electrical and electronics industry is expected to drive market growth over the forecast period. Fluoropolymer films made of FEP, PFA, ETFE, Matte ETFE and cast PTFE combine outstanding dielectric characteristics with chemical and temperature resistance and weldability. Fluoropolymer films are used in a variety of electrical applications, such as circuit board laminates and high-temperature insulation tapes for wrapping wire and cable. Since ETFE films maintain their superior release capabilities and modest cushioning at high temperatures, they are employed as release films for electronics.

In the Film Assisted Molding (FAM) techniques used to manufacture semiconductors and integrated circuits, it is also utilized as a cushioning or releasing media. Fluoropolymer films boost productivity by eliminating the need to clean the mold in between uses, which reduces the release force required to extract the integrated circuit from the mold. Thus, these attributes drive the market growth over the forecast period.

Restraints

High cost of fluoropolymer films

The price of fluoropolymer films closely correlates with the expense associated with the development of their technology, the complexity of their production process, and the price of the raw materials required to make the films, such as PTFE, PVDF, FEP, and Others. To accommodate consumer demand, the major manufacturers in the market have created expensive technologies to generate fluoropolymer films. Small businesses find it challenging to develop this patented technology. This drives up the production costs and raises the expense of these films. Thus, the high cost of fluoropolymer films is expected to hamper the market expansion during the forecast period.

Opportunities

Growing investment in the solar industry

PVDF, ECTFE, and ETFE films are highly suited for usage in the back sheet and front sheet glazing of PV panels due to their good dielectric performance, fire resistance, and high solar transmittance. They are widely utilized as an outside component for the back sheet, providing the PV module with prolonged environmental protection. Thereby, the rising investment in solar energy is expected to provide enormous opportunities for market growth over the forecast period.

As per Solar Energy Industries Association, in 2021, more than 255,000 Americans were employed by more than 10,000 solar businesses across all 50 states. Nearly USD 33 billion in private investment was brought into the American economy by the solar industry.

Segment Insights

Type Insights

Based on the type, the global fluoropolymer films market is segmented into polyvinyl fluoride, polytetrafluoroethylene, polyvinylidene fluoride, fluorinated ethylene propylene and others. The polytetrafluoroethylene segment is expected to grow at the fastest rate over the forecast period because it has high dielectric and chemical resistance qualities and absorbs UV electromagnetic energy. Additionally, it can be utilized in both extremely cold (down to -530 K) and extremely high temperatures. These qualities are used in a wide variety of products, including semiconductors, electrical appliances, auto parts, and non-stick frying pans.

Additionally, as the price of raw materials, which are used to produce resins, pigments, and fillers, has climbed over time, the cost of PTFE has gone up. Gujarat Fluorochemical Limited, for instance, uses INOFLON PTFE Resins, an engineering plastic designed for exceptional performance under some of the most demanding conditions. They are recognized for having a wide operating temperature range, excellent weather ability, low coefficient of friction, dielectric strength, thermal stability, and flame resistance.

Application Insights

Based on the application, the global fluoropolymer films market is divided into automobile & aerospace, construction, electronics & electrical, packaging, medical & pharmaceutical and others. The automobile & aerospace segment is expected to capture a substantial revenue share over the forecast period. Fluoropolymers are essential for many applications in the aerospace industry because of their distinctive characteristics. These include internal data and power supply systems, wing design and manufacture, engine production, landing gear, fuel systems, helicopters, and fuselage design and assembly/testing.

Fluoropolymers improve aircraft safety and fuel efficiency. They extend the useful life of several components essential for performance, emission control, and safety in the aerospace sector by providing strong and efficient protection against heat, corrosive fluids and fuels, humidity, vibrations, and compressions. Additionally, fluoropolymers products are used in various application in the automotive sector which includes fluid delivery, coatings and sealings, temperature and level detection, and emission testing. Thus, the broad application of fluoropolymer films in the aerospace and automotive industry drives the market growth during the forecast period.

Regional Insights

What is the Asia Pacific Fluoropolymer Films Market Size?

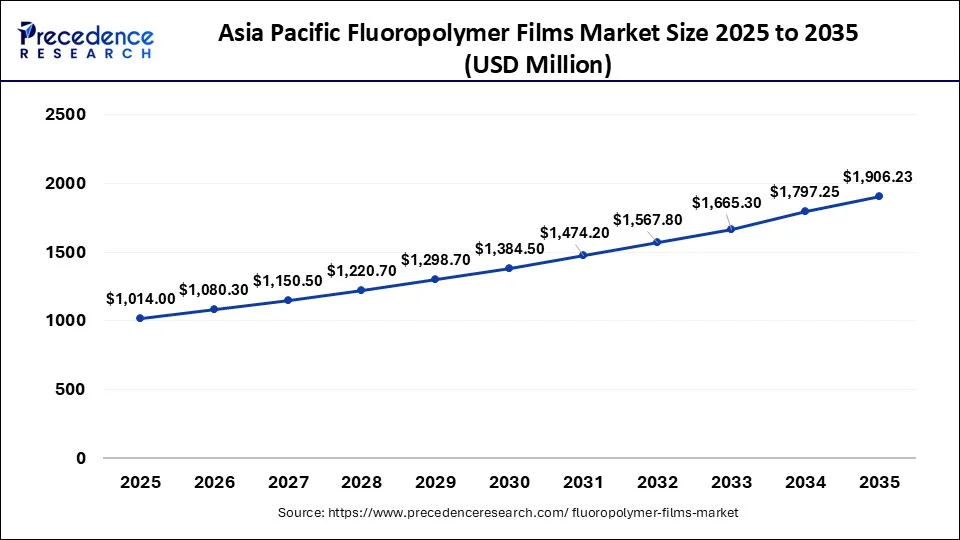

The Asia Pacific fluoropolymer films market size is exhibited at USD 1,014 million in 2025 and is projected to be worth around USD 1,906.23 million by 2035, growing at a CAGR of 6.52% from 2026 to 2035.

The Asia Pacific accounted for the largest market share in 2025. The growth in the region is attributed to the increasing solar industry coupled with the rising government initiatives, the growing chemical sector and the increasing electrical and electronics sector. In the Asia Pacific region, the growth of the fluoropolymer is mainly driven by the countries such as China, India and Japan.

- According to the International Energy Agency, as a result of the significant capacity additions in 2020 and 2021, China accounted for nearly 38% of the growth in solar PV generation in 2021. In addition, the ambitious goal of 33% of electricity output coming from renewable sources by 2025, including an 18% target for wind and solar technologies, is part of China 14th Five-Year Plan, which was unveiled in June 2022.

- As per India Brand Equity Foundation, the Indian chemicals market was worth US$ 178 billion in 2019 and is projected to grow by 9.3% annually to US$ 304 billion by 2025. The demand for chemicals is predicted to rise 9% yearly by 2025. The market for chemicals andpetrochemicalsin India is made up 22% specialized chemicals.

- Thus, the aforementioned facts are expected to rise the demand for fluoropolymers in the region during the projected timeframe.

India Fluoropolymer Films Market Analysis

The market in India is growing, as industries are increasingly adopting fluoropolymer films for high-temperature, corrosion-resistant, and lightweight applications. Growing investments in advanced manufacturing, expanding electronics and chemical processing industries, and rising demand for reliable insulation and protective materials are boosting market growth. Additionally, increasing focus on sustainable materials and domestic production capabilities is strengthening market growth momentum.

How is the Opportunistic Rise of Europe in the Market?

Europe is expected to grow significantly in the fluoropolymer films market during the forecast period. The demand for the use of fluoropolymer films in the automotive andaerospace sectors in Europe is increasing. At the same time, their use in the development of semiconductors is due to their application to enhance the thermal stability and chemical resistance is also rising. Furthermore, their use in roofing and insulation materials is growing as the fluoropolymer films show enhanced durability. This, in turn, is supported by the regulatory bodies as well as the government. Thus, these developments drive the market growth.

UK Fluoropolymer Films Market Trends

The automotive industry in the UK is focusing on the development of various electric vehicles due to their growing demand. This, in turn, increases the use of fluoropolymer films to enhance their development. At the same time, the use of fluoropolymer films in manufacturing wire insulation is also rising. Thus, the use of fluoropolymer films in the various sectors is continuously increasing. This development is further supported by the government as well.

Germany Fluoropolymer Films Market Trends

The growing adoption of new technologies in Germany is increasing the research and development of the fluoropolymer films in different fields for enhancing their sustainability as well as performance. At the same time, support by the regulatory bodies is also provided in the development of eco-friendly fluoropolymer films, which comply with the given standards.

What Potentiates the North American Fluoropolymer Films Market?

The market in North America is expected to grow at the fastest CAGR in the upcoming period due to rising demand from the automotive, electronics, and construction sectors. Increasing adoption of electric vehicles, advanced wiring and insulation, regulatory support for high-performance and sustainable materials, and technological innovations in film production are driving market expansion.

U.S. Fluoropolymer Films Market Analysis

The U.S. market is growing due to increasing demand from the aerospace, automotive, electronics, and semiconductor industries. Rising use of high-performance materials for thermal stability, chemical resistance, and electrical insulation, along with strong R&D activity, expanding clean-energy projects, and supportive regulatory frameworks, is accelerating market growth.

Value Chain Analysis

- Chemical Synthesis and Processing: Fluoropolymer films are produced by polymerizing fluorinated monomers and converting them into films via extrusion, casting, or emulsion techniques.

Key players: DuPont, 3M, Arkema Group, Daikin Industries, AGC Chemicals - Waste Management and Recycling:Fluoropolymer film waste is managed through mechanical, chemical, and advanced recycling methods to enable closed-loop reuse and sustainability.

Key players: Solvay, Chemours, Dongyue Group, Gujarat Fluorochemicals, Saint-Gobain Performance Plastics

Fluoropolymer Films Market Companies

- Arkema Group – Produces high-performance PVDF-based fluoropolymer films like Kynar, used in architecture, chemical processing, renewable energy, and industrial applications for durability, weather resistance, and chemical stability.

- American Durafilm – Distributes and fabricates specialized fluoropolymer films such as PTFE, FEP, and Kapton, known for exceptional chemical and thermal resistance for aerospace, medical, and industrial uses.

- 3M – Offers advanced Dyneon™ fluoropolymer films, including PTFE, FEP, and ETFE, providing chemical inertness, thermal stability, and low surface energy for electronics, aerospace, and specialty industrial sectors.

- DuPont – Supplies high-performance fluoropolymer films, including Teflon PTFE, PFA, and ETFE, widely used in automotive, aerospace, and electronics for heat resistance, low friction, and chemical stability.

- DAIKIN INDUSTRIES, Ltd. – Manufactures Neoflon™ PTFE films and other fluoropolymer materials, serving high-frequency electronics, industrial, and chemical processing markets with heat-resistant and durable film solutions.

- AGC Chemicals – Offers a diverse range of fluoropolymer films under brands like Fluon ETFE and PFA, providing excellent heat resistance, chemical inertness, and optical clarity for solar, electronics, and industrial applications.

Other Major Key Players

- Solvay

- Fluoro-Plastics

- Polyflon Technology Limited

- Saint-Gobain Performance Plastics

- Fluortek AB

- The Chemours Company

Recent Developments

- In April 2024, Rostec State Corporation launched Russia's first fluoropolymer film production line, branded NEVAFLON. The film replaces polycarbonate, other polymers, and glass, and is designed for diverse applications across architecture, aerospace, and advanced industrial sectors.

(Source: https://rostec.ru ) - March 2025, with the use of bio-based materials for the production of UV protection films was investigated by the researchers of the University of Turku in Finland. Furthermore, to compare the long-term changes in the variety of bio-based UV filters properties, this study is considered to be the first. Additionally, to protect solar cells from UV-induced degradation, polyvinyl fluoride (PVF) and polyethylene terephthalate (PET), which are petroleum-based films, are commonly used.

(Source: https://www.azom.com) - In March 2021, Tetrafluoroethylene (ETFE) and ethylene-based Fluon+ EM-20010 compounds were introduced by AGC Chemicals Americas.

- In July 2021, The Kashima Integrated Production Center at DAIKIN INDUSTRIES, Ltd.'s Kashima Plant in Kamisu City, Ibaraki Prefecture, Japan, has been finished. On June 10, 2021, the production of fluorochemicals for a variety of applications, including films, and others began there.

- In May 2021, Agiplast, a pioneer in the regeneration of high-performance polymers, will be acquired by Arkema. With the acquisition, Arkema is now equipped to fully serve customers' needs for materials circularity and meet the expanding demands of the market. Additionally, this acquisition will assist Arkema in completely integrating producers of high performance polymers that use recycled and biobased resources.

- In March 2020, A method to remove perfluoroalkyl substances (PFAS), such as perfluorooctanoic acid (PFOA), from fluoropolymer resins was introduced by Inhance Technologies. PFAS species are being found in common consumer goods and are widely employed in the fluoropolymers industry, although current worries about their effects on human health and the environment are growing.

Segments Covered in the Report

By Type

- Polyvinyl Fluoride

- Polytetrafluoroethylene

- Polyvinylidene Fluoride

- Fluorinated Ethylene Propylene

- Others

By Application

- Automobile & Aerospace

- Construction

- Electronics & Electrical

- Packaging

- Medical & Pharmaceutical

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting